0 ratings0% found this document useful (0 votes)

3 viewsInternalll

Internalll

Uploaded by

Dev kumar ShawCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Internalll

Internalll

Uploaded by

Dev kumar Shaw0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesInternalll

Internalll

Uploaded by

Dev kumar ShawCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

INTERNAL Q&A OF MANAGEMENT

INTERNAL Q&A OF TAXATION -1

ACCOUNTING

1. Flexible Budget: A flexible budget is a budget that changes based on the

level of activity. It is typically used for costs that are directly related to the

level of activity, such as variable costs such as raw materials, direct labor, and

commissions.

2. Zero-based budgeting (ZBB): Zero-based budgeting is a budgeting method

where each budget item is evaluated from a "zero base," meaning that every

expense must be justified and approved for each budgeting period, with no

assumption of previous budgets carrying over.

3. Management Accounting: Management accounting, also known as

managerial accounting, is a branch of accounting that focuses on providing

financial and non-financial information to the management of an

organization to support decision-making, planning, and control activities.

4. Cash flow statement: A cash flow statement is a financial statement that

provides a summary of the cash inflows and outflows from a company's

operating, investing, and financing activities during a specific period.

5. Balance Sheet Ratios: In case both variables are from the balance sheet, it is

classified as balance sheet ratios. These ratios are used to assess a

company's liquidity, solvency, and overall financial health. For example,

ratio of current assets to current liabilities known as current ratio. It is

calculated using both figures from balance sheet.

6. Features of Management accounting:

a) Internal focus: Management accounting is focused on providing

information and analysis for internal decision-making and planning

within an organization

b) Decision-making support: Management accounting provides data and

analysis to support strategic and operational decision-making, such as

pricing, product mix, and investment decisions

c) Cost control and efficiency: Management accounting focuses on cost

analysis and control to improve efficiency and reduce waste in business

operations

d) Timeliness: Management accounting provides timely and relevant

information to support decision-making and planning processes

7. Standard Costing: Standard costing is a technique which is used in many

industries, where production is of repetitive nature. It is a system of

accounting that uses predetermined standard costs for direct material,

direct labour, and factory overheads.

8. Distinguish between Management Accounting and Financial Accounting:

Basis Management Accounting Financial Accounting

Application Management accounting Financial accounting is

helps management to prepared to reflect true

take meaningful steps and fair picture of financial

and strategize affairs.

Scope The scope is much The scope is pervasive, but

border. not as much as the

management accounting.

Nature It records both qualitative It records quantitative

and quantitative aspect. aspect only.

Dependence Management accounting Financial accounting is not

is dependent on both cost dependent management

& financial accounting for accounting for successful

successful implementation.

implementation.

You might also like

- Compendium For Civic The EconomyDocument203 pagesCompendium For Civic The EconomyNesta86% (7)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Module 1 Introduction To Cost AccountingDocument21 pagesModule 1 Introduction To Cost AccountingLeslie100% (1)

- Cost AccountingDocument19 pagesCost AccountingJoseph Anbarasu89% (9)

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Solution of Case StudiesDocument9 pagesSolution of Case StudiesRose DolsonNo ratings yet

- Prominence Bank Custodian Agreement DfcuDocument14 pagesProminence Bank Custodian Agreement DfcuMutumba ShafikNo ratings yet

- Price Action ScalperDocument16 pagesPrice Action ScalperDwi CahyoNo ratings yet

- Indian Kidswear Market Presentation - FinalDocument20 pagesIndian Kidswear Market Presentation - FinalMukund SinghNo ratings yet

- L2 Management AccountingDocument23 pagesL2 Management Accountingvidisha sharmaNo ratings yet

- Ch01 Introduction To Cost AccountingDocument5 pagesCh01 Introduction To Cost AccountingRenelyn FiloteoNo ratings yet

- MGMT ACC (UNIT - 1) Bhagiya MamDocument10 pagesMGMT ACC (UNIT - 1) Bhagiya MamDineshNo ratings yet

- Ica Afm 2022Document64 pagesIca Afm 2022Muhammed FayisNo ratings yet

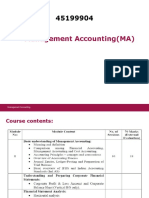

- Management Accounting (MA)Document114 pagesManagement Accounting (MA)Shivangi Patel100% (1)

- Accounting I UnitDocument28 pagesAccounting I UnitBalasaranyasiddhuNo ratings yet

- MGT 404Document407 pagesMGT 404Rimsha Tariq100% (1)

- Management Accounting- Meaning, Definition, Scope, Objectives-Management Accounting as distinct from Cost Accounting and Financial Accounting- Budgetary Control- Classification of Budgets(Emphasis on theory).Document14 pagesManagement Accounting- Meaning, Definition, Scope, Objectives-Management Accounting as distinct from Cost Accounting and Financial Accounting- Budgetary Control- Classification of Budgets(Emphasis on theory).RAJESH MGNo ratings yet

- Unit - 1 - Introduction Management AccountingDocument18 pagesUnit - 1 - Introduction Management AccountingKetan GuptaNo ratings yet

- Management AccountingDocument108 pagesManagement AccountingBATUL ABBAS DEVASWALANo ratings yet

- Intro in Management AccountingDocument10 pagesIntro in Management AccountingGilvi Anne MaghopoyNo ratings yet

- Module 5 PDFDocument47 pagesModule 5 PDFJerin MathewNo ratings yet

- Budget EtcDocument27 pagesBudget EtcMuzaFarNo ratings yet

- Management Accounting MergeDocument36 pagesManagement Accounting Mergearunpradeep795No ratings yet

- Unit 4 Cost Concept and ClassificationDocument90 pagesUnit 4 Cost Concept and ClassificationHibret100% (2)

- M.ac B.com Vi SemDocument41 pagesM.ac B.com Vi Semgankitrauniyar123No ratings yet

- Manaement and Cost AccoutinDocument368 pagesManaement and Cost AccoutinPinky Pinky100% (1)

- Introduction To Managerial Accounting Printed MaterialsDocument6 pagesIntroduction To Managerial Accounting Printed Materialsmiralouaujuaniza10No ratings yet

- Fin. Acct.-review-Lesson 1Document6 pagesFin. Acct.-review-Lesson 1SALENE WHYTENo ratings yet

- Introduction To AccountingDocument7 pagesIntroduction To Accountingcarolaaquino27No ratings yet

- 01 Fundamentals of Managerial Accounting and Ethical StandardsDocument10 pages01 Fundamentals of Managerial Accounting and Ethical StandardsXtian AmahanNo ratings yet

- Management AccountingDocument14 pagesManagement AccountingBristi SonowalNo ratings yet

- Overview of Management AccountingDocument6 pagesOverview of Management AccountingRenz Francis LimNo ratings yet

- Cost IntroductionDocument75 pagesCost Introductionkumaramit04052000No ratings yet

- Ans.1) (Chapter 1) : Management Accounting Is The Process of Identification, Measurement, Accumulation, AnalysisDocument27 pagesAns.1) (Chapter 1) : Management Accounting Is The Process of Identification, Measurement, Accumulation, AnalysisAnshuNo ratings yet

- Chapter OneDocument15 pagesChapter OnefiraolmosisabonkeNo ratings yet

- Cost AccountingDocument19 pagesCost AccountingAysayah JeanNo ratings yet

- Textual Learning Material - Module 5Document47 pagesTextual Learning Material - Module 5victor victorNo ratings yet

- Management Accounting Unit No 1st BBA 5th SemesterDocument4 pagesManagement Accounting Unit No 1st BBA 5th SemesterDrVivek SansonNo ratings yet

- Financial and Managerial AccountingDocument4 pagesFinancial and Managerial Accountingsonam agrawalNo ratings yet

- Managerial AccountingDocument5 pagesManagerial Accountingjaninemaeserpa14No ratings yet

- Cost Accounting IDocument60 pagesCost Accounting Isamuel debebe50% (2)

- Module 1Document11 pagesModule 1Rasha rubeenaNo ratings yet

- Management AccountingDocument358 pagesManagement AccountingLeojelaineIgcoy100% (1)

- Chapter 1Document16 pagesChapter 1dominiczek123No ratings yet

- UNIT 4 Management AccountingDocument16 pagesUNIT 4 Management Accountingashlesha.hangargekarNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingnileshkambleNo ratings yet

- BBA M&CA 301A UNIT I NotesDocument11 pagesBBA M&CA 301A UNIT I Notesrahmanakhtar28No ratings yet

- 7 E's in Management AccountingDocument18 pages7 E's in Management AccountingLabib Shah100% (2)

- Chapetr1-Overview of Cost and Management AccountingDocument12 pagesChapetr1-Overview of Cost and Management AccountingNetsanet BelayNo ratings yet

- Cost and Management Accounting Chapter 2Document48 pagesCost and Management Accounting Chapter 2shegaw114No ratings yet

- Management Accounting - Unit1Document15 pagesManagement Accounting - Unit1anil gondNo ratings yet

- Bca Unit Iii Mgt. AcoountingDocument13 pagesBca Unit Iii Mgt. AcoountingGautham SajuNo ratings yet

- MGT Accounting: Unit - 1 Nature and Scope of Management AccountingDocument32 pagesMGT Accounting: Unit - 1 Nature and Scope of Management AccountingFRANCISCA AKOTHNo ratings yet

- Management Accounting (Bba32) Unit - IDocument42 pagesManagement Accounting (Bba32) Unit - IT S Kumar KumarNo ratings yet

- Management AccountingDocument17 pagesManagement Accountingpikalucky202No ratings yet

- 1 Chapter 1&2 Cost & MGT AccountingDocument12 pages1 Chapter 1&2 Cost & MGT AccountingMinaw BelayNo ratings yet

- Introduction To Management Accounting: Asst Prof. Jonlen DesaDocument22 pagesIntroduction To Management Accounting: Asst Prof. Jonlen DesaAryanSainiNo ratings yet

- Managerial Accounting: Mon Raval Sevilla, CPADocument27 pagesManagerial Accounting: Mon Raval Sevilla, CPAminus oneNo ratings yet

- Managerial Accounting IBPDocument58 pagesManagerial Accounting IBPSaadat Ali100% (1)

- Chapter 1 IntroductionDocument40 pagesChapter 1 IntroductionSoka PokaNo ratings yet

- Accountancy Bbs 1st Year - Oweisme PDFDocument21 pagesAccountancy Bbs 1st Year - Oweisme PDFPratima Upreti100% (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Technical Analysis: The Basic AssumptionsDocument30 pagesTechnical Analysis: The Basic AssumptionsDevdutt RainaNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- IRT Bus Tender - Merged - 328850 IRT 450 Chassis Type IDocument81 pagesIRT Bus Tender - Merged - 328850 IRT 450 Chassis Type IDisability Rights AllianceNo ratings yet

- PAN Card ApplicationDocument2 pagesPAN Card ApplicationKishore PotnuruNo ratings yet

- ISEM 500 Project 1 TasksDocument11 pagesISEM 500 Project 1 TasksPaola OrtegaNo ratings yet

- Invoice: PT - Karya Jayadi MandiriDocument1 pageInvoice: PT - Karya Jayadi MandiriRhaniiNo ratings yet

- Ishchenko AnastasiiaDocument1 pageIshchenko AnastasiiaСергей АлексеевичNo ratings yet

- Finman Bobadilla PDFDocument49 pagesFinman Bobadilla PDFChristopher Vicente100% (1)

- An Empirical Study On Audit Expectation Gap Role of Auditing Education in BangladeshDocument17 pagesAn Empirical Study On Audit Expectation Gap Role of Auditing Education in Bangladeshrajeshaisdu009100% (1)

- SBI Clerk 2014 GA QuestionsDocument8 pagesSBI Clerk 2014 GA QuestionsnehaNo ratings yet

- VedicDocument2 pagesVedicmaddy_i5No ratings yet

- IDX LQ45 August 2014Document188 pagesIDX LQ45 August 2014Richie NirmansyahNo ratings yet

- Swift Code Obligor Bank RiskpartDocument12 pagesSwift Code Obligor Bank RiskpartDee AZNo ratings yet

- Fourmula 1Document9 pagesFourmula 1Jamil Lorca100% (3)

- Series eDocument34 pagesSeries eYamil EzequielNo ratings yet

- Muhammad NaseemKhan WP, PDFDocument2 pagesMuhammad NaseemKhan WP, PDFnaseem00No ratings yet

- Chapter 12 Ia2Document18 pagesChapter 12 Ia2JM Valonda Villena, CPA, MBA0% (1)

- International Machine Euro Disney VDocument6 pagesInternational Machine Euro Disney VZaid Diaz0% (2)

- Car Buying Project XLS 95 Excel Version 1Document13 pagesCar Buying Project XLS 95 Excel Version 1rolfwillNo ratings yet

- Vidya Bhawan: Secured DISTINCTION (Second Highest Attainable Grade) in CRIMINAL LAW-I and CRIMINALDocument3 pagesVidya Bhawan: Secured DISTINCTION (Second Highest Attainable Grade) in CRIMINAL LAW-I and CRIMINALSAURABH SUNNYNo ratings yet

- Peer To Peer Lending: Innovation and Fall Out: Presented by Group 8Document15 pagesPeer To Peer Lending: Innovation and Fall Out: Presented by Group 8Ritesh SahuNo ratings yet

- Chapter 7 The Value of Common StocksDocument48 pagesChapter 7 The Value of Common StocksPrajval Somani100% (2)

- Project Summary: Came Upon The Suggestion of Professor Patriarca As It Appeals More To The Target AudienceDocument33 pagesProject Summary: Came Upon The Suggestion of Professor Patriarca As It Appeals More To The Target AudienceJj Villaflores100% (1)

- Accounts Payable ProceduresDocument9 pagesAccounts Payable ProceduresSuhas YadavNo ratings yet

- Answer Key - CK-12 PreCalculus ConceptsDocument171 pagesAnswer Key - CK-12 PreCalculus ConceptsFrederichNietszche100% (2)