Exercises - Chapter 3

Exercises - Chapter 3

Uploaded by

Galang, Princess T.Copyright:

Available Formats

Exercises - Chapter 3

Exercises - Chapter 3

Uploaded by

Galang, Princess T.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Exercises - Chapter 3

Exercises - Chapter 3

Uploaded by

Galang, Princess T.Copyright:

Available Formats

EXERCISE 1

(TRUE or FALSE)

Name: Year and Section:

Date: Score:

Write TRUE if the statement is correct or FALSE if it is incorrect.

_________________1. Decrease in assets may also result in decrease in liabilities

_________________2. Liabilities is said to be as a residual claim against asset

_________________3. Accounts Receivable represents claims for payment of debts collectible from other

person

_________________4. Loss from operations will be having no effect on owner’s equity

_________________5. No liability is to be reported as current if payable beyond one year from the

Statement of Financial Position date

_________________6. Unsold Inventories are current assets

_________________7. A personal drawing of the owner is a reduction of the owner’s equity in the

business

_________________8. The used up portion of a prepayment is an expense while the unused portion is an

asset

_________________9. The used portion of supplies bought during the period is called Prepaid Supplies

_________________10. The terms receivable and prepaid connote an asset, while the terms payable and

unearned connote a liability

_________________11. If a receivable is collected, there will be an increase in total assets

_________________12. Increases in asset mean increases in liabilities and/or increases in capital

_________________13. Creditors have priority of claims against the business assets

_________________14. Bad debts are considered uncollectible receivables

_________________ 15. Allowance for Bad Debts and Accumulated Depreciation are considered contra

asset accounts

ACCTG 101- FINANCIAL ACCOUNTING AND REPORTING (FUNDAMENTALS) 1|P age

EXERCISE 2

Preparation of Financial Statements of a Service Business

Name: Year and Section:

Date: Score:

The following are the ledger balances of “MUKBANG SERVICES” as of October 31, 2020

ACCOUNT TITLE DEBIT CREDIT

Foodie, Capital 3,014,130

Notes Payable 751,521

Building 1,219,668

Accounts Payable 410,669

Allowance for Bad Debts 63,910

Prepaid Rent 774,811

Cash 2,690,551

Income from Services 1,941,900

Promotional Expense 211,800

Accounts Receivable 689,441

Land 813, 800

SSS Payable 89,445

Bonds Payable 158,119

Salaries Expense 154,889

Office Supplies 68,390

Equipment 180,552

Interest Payable 256,894

Accumulated Depreciation- 21,731

Equipment

Mortgage Payable 731,865

Accumulated Depreciation- 451,821

Building

Miscellaneous Expense 361,885

Bad Debts Expense 90,775

Notes Receivable 190,338

Salaries Payable 450,885

Loans Payable ( Non- Current) 331,900

Foodie, Personal 1,227,890

ACCTG 101- FINANCIAL ACCOUNTING AND REPORTING (FUNDAMENTALS) 2|P age

Required:

Prepare the following Statements:

1. Income Statement

2. Statement of Owners’ Equity

3. Statement of Financial Position

ACCTG 101- FINANCIAL ACCOUNTING AND REPORTING (FUNDAMENTALS) 3|P age

EXERCISE 3

Preparation of Financial Statements of a Merchandising Business

Name: Year and Section:

Date: Score:

Account No. Account Title Debit Credit

10 Cash 1,441,800

11 Accounts Receivable 450,221

21 Furniture & Fixtures 54,988

30 Accounts Payable 845,005

50 Corona, Capital 1,545,056

51 Corona, Withdrawal 210,773

60 Sales 989,559

61 Sales Discount 54,500

62 Sales Returns and 88,900

Allowances

71 Purchases 645,009

72 Freight In 14,800

73 Purchase Discount 40,764

74 Purchase Returns and 34,890

Allowances

75 Salaries Expense 190,400

76 Utilities Expense 56,500

77 Advertising Expense 90,300

78 Freight Out 71,774

ACCTG 101- FINANCIAL ACCOUNTING AND REPORTING (FUNDAMENTALS) 4|P age

79 Office Supplies Expense 85,309

TOTAL 3,455,274 3,455,274

Required:

Prepare the following Statements of Corona Merchandising Company as of January 2021

4. Statement of Cost of Goods Sold

5. Income Statement

6. Statement of Owners’ Equity

7. Statement of Financial Position

“Life is not about finding yourself; life is about creating yourself- George Bernard

Shaw.

ACCTG 101- FINANCIAL ACCOUNTING AND REPORTING (FUNDAMENTALS) 5|P age

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5978)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1111)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (898)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (932)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (619)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (546)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (356)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (831)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (476)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (275)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (424)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2272)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (99)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (270)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (125)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (235)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (232)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (75)

- Descriptive Accounting Ifrs Focus (19th Ed) - Z R Koppeschaar Lexis-NexisDocument1,067 pagesDescriptive Accounting Ifrs Focus (19th Ed) - Z R Koppeschaar Lexis-Nexism100% (1)

- AuditingDocument30 pagesAuditingMary Rose Mendoza91% (11)

- 3 - Cost-Volume-Profit AnalysisDocument83 pages3 - Cost-Volume-Profit AnalysisBəhmən OrucovNo ratings yet

- Shamily VisualCV Jun2022Document2 pagesShamily VisualCV Jun2022Vijay SamuelNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quiz - Periodic Acctg CycleDocument7 pagesQuiz - Periodic Acctg CycleGalang, Princess T.No ratings yet

- BrochDocument5 pagesBrochGalang, Princess T.No ratings yet

- Chapter 3 Exercises Answer Key Part 2Document10 pagesChapter 3 Exercises Answer Key Part 2Galang, Princess T.No ratings yet

- Acctg Quiz MerchDocument7 pagesAcctg Quiz MerchGalang, Princess T.No ratings yet

- Photo Editing SoftwareDocument24 pagesPhoto Editing SoftwareGalang, Princess T.No ratings yet

- Quiz Trial BalanceDocument1 pageQuiz Trial BalanceGalang, Princess T.No ratings yet

- PrE4 Module 1Document8 pagesPrE4 Module 1Galang, Princess T.No ratings yet

- VI. Decision AnalysisDocument5 pagesVI. Decision AnalysisGalang, Princess T.No ratings yet

- Accounting For ConsignmentDocument7 pagesAccounting For ConsignmentGalang, Princess T.No ratings yet

- Acctg For LTCC - IllustrationsDocument13 pagesAcctg For LTCC - IllustrationsGalang, Princess T.No ratings yet

- Essay in EthicsDocument1 pageEssay in EthicsGalang, Princess T.No ratings yet

- Intoduction To Business TaxationDocument6 pagesIntoduction To Business TaxationGalang, Princess T.No ratings yet

- Exempt SalesDocument4 pagesExempt SalesGalang, Princess T.No ratings yet

- Percentage Tax Part 3Document2 pagesPercentage Tax Part 3Galang, Princess T.No ratings yet

- Percentage Tax Part 2Document2 pagesPercentage Tax Part 2Galang, Princess T.No ratings yet

- Percentage Tax Part 1Document2 pagesPercentage Tax Part 1Galang, Princess T.No ratings yet

- Financial Management by Uttarakhand Open UniversityDocument479 pagesFinancial Management by Uttarakhand Open UniversityCrack360No ratings yet

- PANEER CHICKEN - Merged (AJMER SATABDI 15.12.22)Document11 pagesPANEER CHICKEN - Merged (AJMER SATABDI 15.12.22)pradeep kumarNo ratings yet

- Self Assessment Report - MBA (General)Document25 pagesSelf Assessment Report - MBA (General)Ambreen ZainebNo ratings yet

- Slides No.1Document35 pagesSlides No.1Ramez AhmedNo ratings yet

- Background KnowledgeDocument7 pagesBackground Knowledgeanamsaeed1No ratings yet

- 2023 Accounting Grade 12 Baseline Assessment - QP-1Document12 pages2023 Accounting Grade 12 Baseline Assessment - QP-1Ryno de BeerNo ratings yet

- BP OP ENTPR 2023 Prerequisites Matrix EN USDocument253 pagesBP OP ENTPR 2023 Prerequisites Matrix EN USwaqar anwarNo ratings yet

- What Are The Golden Rules For AccountingDocument28 pagesWhat Are The Golden Rules For AccountingWong KianTatNo ratings yet

- AccountingDocument95 pagesAccountingSimran KaurNo ratings yet

- HeheDocument20 pagesHeheMary Grace NaragNo ratings yet

- CRT Learning Module: Course Code Course Title Units Module TitleDocument29 pagesCRT Learning Module: Course Code Course Title Units Module TitleJudea Sevilla DizonNo ratings yet

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Document6 pagesCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Analysis of Business CombinationsDocument58 pagesAnalysis of Business Combinationstehsin123No ratings yet

- Rogimille E. Deogracias: 176 Macopa St. San Isidro Balanti Cainta, Rizal Mobile No. 09451491874 Email AddDocument2 pagesRogimille E. Deogracias: 176 Macopa St. San Isidro Balanti Cainta, Rizal Mobile No. 09451491874 Email AddGrace SambranoNo ratings yet

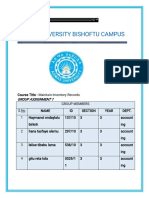

- Admas University Bishoftu Campus: Group Assignment 1Document3 pagesAdmas University Bishoftu Campus: Group Assignment 1Tilahun GirmaNo ratings yet

- Asset AccountingDocument18 pagesAsset Accountinglavanlavanya810No ratings yet

- Accounting in Business: © 2019 Mcgraw-Hill EducationDocument81 pagesAccounting in Business: © 2019 Mcgraw-Hill Educationkikad10038No ratings yet

- RTP June 2018 AnsDocument29 pagesRTP June 2018 AnsbinuNo ratings yet

- Chapter9 - FinalDocument17 pagesChapter9 - FinalbraveusmanNo ratings yet

- AccDocument123 pagesAccNguyen Thi Lan Anh (K17 HCM)No ratings yet

- Elements of Cost Variable Cost Portion Fixed CostDocument65 pagesElements of Cost Variable Cost Portion Fixed CostDipen AdhikariNo ratings yet

- Article On AI in AccountingDocument5 pagesArticle On AI in AccountingTshepiso OganneNo ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- Accounting Information Systems: An Overview: Suggested Answers To Discussion QuestionsDocument18 pagesAccounting Information Systems: An Overview: Suggested Answers To Discussion QuestionsMichelle BabaNo ratings yet

- Sample Accounting Thesis Title in The PhilippinesDocument8 pagesSample Accounting Thesis Title in The Philippinesbsqbdfe7100% (2)

- Invoice: Jl. Teuku Umar No.85 Cibitung, Kabupaten Bekasi Phone: 021 8830349 - 021 88336439 - WA 08118255532 EmailDocument1 pageInvoice: Jl. Teuku Umar No.85 Cibitung, Kabupaten Bekasi Phone: 021 8830349 - 021 88336439 - WA 08118255532 EmailWahyu AdjiNo ratings yet