HGC 7 K 65 CBC

HGC 7 K 65 CBC

Uploaded by

Kottarathil RahulCopyright:

Available Formats

HGC 7 K 65 CBC

HGC 7 K 65 CBC

Uploaded by

Kottarathil RahulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

HGC 7 K 65 CBC

HGC 7 K 65 CBC

Uploaded by

Kottarathil RahulCopyright:

Available Formats

PSRL225024022029

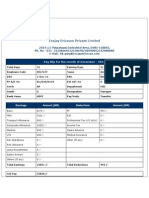

CANA | Annual Premium Statement

19/02/2024

Rahul K G

KOTTARATHIL HOUSE

ELLATHUPADI CHERUKAVU

AYIKKARAPPADI PO

Malappuram

Kerala-673637

India

: 9745069543

: speak2rahulk@gmail.com

Dear Rahul K G,

We certify that the premium(s) mentioned below have been received towards your insurance policy(s) held with us. The

Annual Premium Statement for your policy(s) as on 19/02/2024 is detailed below.

SUMMARY - Client ID: IC719665

Tax benefit

Benefit Opted available

Payment For and Premium under the

Policy No. Plan Name Product UIN Life Assured Name Policy Status Frequency Paid (INR)

Tax Details Income-tax

Act, 1961

Life Option 69311.00 Section 80C

23764324 HDFC Life Click2 Protect Life 101N139V01 RAHUL K G In Force Monthly

Taxes and

Levies as applicable 1562.00 -

NOTE:

n As per section 10(10D) of the Income-tax Act, 1961, any sum received under a Life Insurance Policy will be exempt subject to conditions

specified therein.

n Tax benefit under Section 80C and 80 CCC of the Income-tax Act, 1961 is available to an individual or HUF for premium paid towards Life

Insurance or Pension Policy, subject to the conditions / limits specified therein.

n Tax benefit is available to an individual or HUF under Section 80D of the Income-tax Act, 1961 for Health Insurance Premium (including CI

rider premium) paid subject to the conditions / limits specified therein.

n A significant part of the benefits is not available as a lump sum but would need to be mandatorily taken as Annuity from HDFC Life.

n Tax will be deducted at the applicable rate from the payments made under the Policy, as per the prevailing provisions of the Income-tax Act,

1961.

n Taxes and Levies for ULIP Plans are deducted through cancellation of units.

n The above mentioned tax benefits are subject to changes in the tax laws. Please consult your tax advisors to confirm the applicability of the

tax benefits at your end. Taxes and levies will be applicable as per prevailing tax laws.

********This is an electronically generated statement and does not require a signature.********

You might also like

- Max Bupa Premium Reeipt - Parents PDFDocument1 pageMax Bupa Premium Reeipt - Parents PDFAnand29% (7)

- Life Insurance Premium Certificate: (Financial Year 2018-2019)Document1 pageLife Insurance Premium Certificate: (Financial Year 2018-2019)Barnali ChakrabortyNo ratings yet

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- HDFC Life Premium Receipts Nov 2022Document1 pageHDFC Life Premium Receipts Nov 2022kapsekunalNo ratings yet

- Premium Paid Certificate For The Year 2022-2023Document1 pagePremium Paid Certificate For The Year 2022-2023yogesh bafnaNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Annual Premium StatementsDocument1 pageAnnual Premium Statementsnanivenkat459No ratings yet

- Annual Premium Statement: Nagarajan KDocument1 pageAnnual Premium Statement: Nagarajan KRajanNo ratings yet

- Annual PremiumDocument1 pageAnnual PremiumAnand K. MouryaNo ratings yet

- Annual Premium Statement: Naresh KumarDocument1 pageAnnual Premium Statement: Naresh Kumarnaresh29122No ratings yet

- 47p5ginte7Document1 page47p5ginte7Abhijit KumarNo ratings yet

- Annual Premium Statement: Bhupesh GuptaDocument1 pageAnnual Premium Statement: Bhupesh GuptaBhupesh GuptaNo ratings yet

- U200586078 New PDFDocument1 pageU200586078 New PDFKoushik DuttaNo ratings yet

- KFD New10082024135250000 T51Document5 pagesKFD New10082024135250000 T51Bandhan RoyNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- KFD New06012024143830079 T51Document5 pagesKFD New06012024143830079 T51Mayur NagdiveNo ratings yet

- Premium Paid Certificate: Date: 25-MAR-2011Document2 pagesPremium Paid Certificate: Date: 25-MAR-2011sivasivaniNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- Premium Paid Certificate For The Year 2020-2021Document1 pagePremium Paid Certificate For The Year 2020-2021Prince GoelNo ratings yet

- Premium Paid Certificate: Service tax/GST & Other Applicable SurchargesDocument1 pagePremium Paid Certificate: Service tax/GST & Other Applicable Surchargeshimmatbanna93No ratings yet

- Aditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04Document4 pagesAditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04kunjal mistryNo ratings yet

- 15 Pay 1cr Cover Till 70Document5 pages15 Pay 1cr Cover Till 70venkyNo ratings yet

- Null 15Document5 pagesNull 15Rajat PradhanNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptm00162372No ratings yet

- Tax Cerificate 009375579 - 01 04 2024 04 09 2024Document2 pagesTax Cerificate 009375579 - 01 04 2024 04 09 2024Satheesh BachuNo ratings yet

- Life Insurance Premium Certificate: This Is To Certify The Following Details: Policy Number Basic PlanDocument1 pageLife Insurance Premium Certificate: This Is To Certify The Following Details: Policy Number Basic PlanKDR DDNo ratings yet

- Amardeep Icici Term Plan 11390Document6 pagesAmardeep Icici Term Plan 11390meet15062024No ratings yet

- TATA AIA Tax CertificateDocument1 pageTATA AIA Tax Certificateaakashkmr3103No ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghNo ratings yet

- Tax Cerificate 001891074 - 01 04 2023 25 02 2024Document2 pagesTax Cerificate 001891074 - 01 04 2023 25 02 2024kabirpremchandaniNo ratings yet

- U155508088-Jayaprakash Reddy RanabotuDocument1 pageU155508088-Jayaprakash Reddy Ranabotujpreddy17No ratings yet

- DocumentDocument1 pageDocumentPingala SoftNo ratings yet

- Aditya Birla Sun Life Insurance Secureplus Plan: Dear MR Kunjal Uin - 109N102V02Document7 pagesAditya Birla Sun Life Insurance Secureplus Plan: Dear MR Kunjal Uin - 109N102V02kunjal mistryNo ratings yet

- PPC 02478962 1642074905Document1 pagePPC 02478962 1642074905karun009640No ratings yet

- Niv A RecieptDocument2 pagesNiv A Recieptjobandeep58No ratings yet

- Duplicate Receipt Dear Sandip KamaniDocument2 pagesDuplicate Receipt Dear Sandip KamaniSandip PatelNo ratings yet

- Benefit IllustrationDocument12 pagesBenefit IllustrationSANDEEP MISHRANo ratings yet

- Life Insurance Premium CertificateDocument1 pageLife Insurance Premium CertificateNirantar SenNo ratings yet

- MedicalimDocument1 pageMedicalimsaurabhNo ratings yet

- PremiumReceiptDocument1 pagePremiumReceiptshaindratiwari71No ratings yet

- IllustrationDocument3 pagesIllustrationsaishankersaimrutunjayNo ratings yet

- Illustration Qbuh70x89xxnnDocument2 pagesIllustration Qbuh70x89xxnnKiran JohnNo ratings yet

- Compensation LetterDocument6 pagesCompensation LetterRashmikant RautNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaNo ratings yet

- This Is An Electronically Generated Premium Receipt and Does Not Require Any SignatureDocument2 pagesThis Is An Electronically Generated Premium Receipt and Does Not Require Any Signaturediptee0% (1)

- 12 19 56 PM PDFDocument1 page12 19 56 PM PDFJagpreet Singh BediNo ratings yet

- Tax Rebate Claim Form-2019Document2 pagesTax Rebate Claim Form-2019Muhammad Hanif SuchwaniNo ratings yet

- Mr. Vitlesh PanditaDocument5 pagesMr. Vitlesh PanditaVitlesh PanditaNo ratings yet

- LetterDocument5 pagesLetterJyotirmay SahuNo ratings yet

- IllustrationDocument3 pagesIllustrationNoone AboveNo ratings yet

- Bharat RNWL PDFDocument1 pageBharat RNWL PDFmandalNo ratings yet

- Bharat RNWL PDFDocument1 pageBharat RNWL PDFmandalNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byKannanRamakrishnanNo ratings yet

- Zprmnotc 23280183 15838155Document1 pageZprmnotc 23280183 15838155devabhutada111coolNo ratings yet

- Illustration 4 PDFDocument2 pagesIllustration 4 PDFsusman paulNo ratings yet

- Policy Contract - 009049662 - 113959Document1 pagePolicy Contract - 009049662 - 113959ayushigoon1234No ratings yet

- Receipt OT045428874Document2 pagesReceipt OT045428874Narinder SinghNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- CCA Notice - December 2022Document1 pageCCA Notice - December 2022Wews WebStaffNo ratings yet

- Public Finance Management Act 2022Document78 pagesPublic Finance Management Act 2022gerald.nkhalambaNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalNelly HNo ratings yet

- Public Finance ASA Profession: by Girard MillerDocument7 pagesPublic Finance ASA Profession: by Girard MillerMutare ZimbabweNo ratings yet

- Jio MartDocument1 pageJio Martkbhattacharyya441No ratings yet

- Delinquent Taxpayers BusinessesDocument56 pagesDelinquent Taxpayers BusinessesCara MatthewsNo ratings yet

- 2018 TJX Companies Inc Prescreening NoticeDocument1 page2018 TJX Companies Inc Prescreening NoticeJls23 L DNo ratings yet

- Determination of Tax Code in PO CreationDocument3 pagesDetermination of Tax Code in PO CreationArinah Adila Abd HalimNo ratings yet

- 2022 Calderon C Form 1040 Individual Tax Return - RecordsDocument46 pages2022 Calderon C Form 1040 Individual Tax Return - RecordsSali Cali100% (1)

- Japan-IMF Scholarship 4 Asian StudentsDocument44 pagesJapan-IMF Scholarship 4 Asian StudentsThowhidul IslamNo ratings yet

- Bank of America Vs CADocument2 pagesBank of America Vs CAPretzel TsangNo ratings yet

- Prof Tax Challan ViiiDocument1 pageProf Tax Challan ViiiRahul ManalNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDMittal GalaxyNo ratings yet

- 1099 G 2018documentdownloadDocument1 page1099 G 2018documentdownloadKristine McVeigh100% (1)

- Monthly Return For Value Added Tax: 1% Rate PurchasesDocument3 pagesMonthly Return For Value Added Tax: 1% Rate PurchasesHasan Babu KothaNo ratings yet

- Ilovepdf MergedDocument84 pagesIlovepdf MergedVinay DugarNo ratings yet

- CAPE Mission Concurrence and Visa Request - 30 Sep 2014Document83 pagesCAPE Mission Concurrence and Visa Request - 30 Sep 2014PRC CAPENo ratings yet

- Stocktaking Study of PFM Diagnostic Instruments: Volume II - Annexes Final Draft November 2010Document53 pagesStocktaking Study of PFM Diagnostic Instruments: Volume II - Annexes Final Draft November 2010JahnaviBudurNo ratings yet

- Income Statement - FacebookDocument6 pagesIncome Statement - FacebookFábia RodriguesNo ratings yet

- Invoice Dec 1st - Dec 31st 2023 (Version 1)Document4 pagesInvoice Dec 1st - Dec 31st 2023 (Version 1)Amarnath MalliahyagariNo ratings yet

- CBIC Civil List As On 01.01.2016Document433 pagesCBIC Civil List As On 01.01.2016रुद्र प्रताप सिंह ८२No ratings yet

- MCQ - Unit 2Document15 pagesMCQ - Unit 2Niraj PandeyNo ratings yet

- C000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584Document2 pagesC000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584BrianNo ratings yet

- Invoice 18 EmiratesDocument1 pageInvoice 18 Emiratessiva manikandanNo ratings yet

- Guyana's: Tax GuideDocument9 pagesGuyana's: Tax GuideKris NauthNo ratings yet

- Statutory Due Date For F y 15 16Document1 pageStatutory Due Date For F y 15 16rajdeeppawarNo ratings yet

- Tax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortDocument17 pagesTax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortMohammad Shah Alam ChowdhuryNo ratings yet

- Withholding Tax (Eng)Document10 pagesWithholding Tax (Eng)WN TV programsNo ratings yet

- Essjay Ericssson Pay SlieadddsdsdsdpDocument2 pagesEssjay Ericssson Pay SlieadddsdsdsdpArun Kumar MohantyNo ratings yet

- 10th Lecture Taxation and GSTDocument57 pages10th Lecture Taxation and GSTPramod SuryawanshiNo ratings yet