Income Tax Challan

Income Tax Challan

Uploaded by

SHRI RAMAYANICopyright:

Available Formats

Income Tax Challan

Income Tax Challan

Uploaded by

SHRI RAMAYANIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Income Tax Challan

Income Tax Challan

Uploaded by

SHRI RAMAYANICopyright:

Available Formats

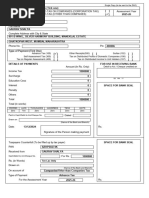

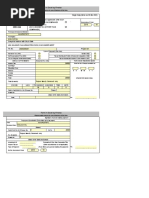

* Important : Please see notes overleaf before Single Copy (to be sent to the ZAO)

filling up the challan

Tax Applicable (Tick One)*

CHALLAN (0020) INCOME-TAX ON COMPANIES Assessment Year

NO./ (CORPORATION TAX)

2024-25

ITNS 280 (0021) INCOME TAX (OTHER THAN ü

COMPANIES)

Permanent Account Number

AEDPC4529D

Full Name

RAKESH CHOPRA

Complete Address with City & State

236C Regent Suncity, Shipra Suncity Indrapuram Ghaziabad UTTAR PRADESH

Tel. No.. 0 Pin 201014

Type of Payment (Tick One)

Advance Tax (100) Surtax (102)

Self Assessment Tax (300) ü Tax on Distributed Profits of Domestic Companies (106)

Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107)

DETAILS OF PAYMENTS Amount (in Rs. Only) FOR USE IN RECEIVING BANK

Income Tax 50390

Debit to A/c / Cheque credited on

Surcharge 0

Education Cess 0

Interest 0

D D M M Y Y

Penalty 0

Others 0

Total 50390

Total (in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS SPACE FOR BANK SEAL

FIFTY THREE NINE ZERO

Paid in Cash/Debit to A/c /Cheque No. . Dated 24-06-2024

Drawn On HDFC Bank Ltd

(Name of the Bank and Branch)

Dated 24-06-2024

Signature of person making payment

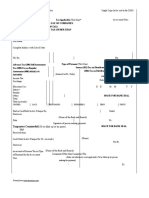

Taxpayers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL

PAN AEDPC4529D

Received from RAKESH CHOPRA

(Name)

Cash/ Debit to A/c /Cheque No. . For Rs. 50390

Rs. (in words) Fifty Thousand Three Hundred Ninety

Drawn on HDFC Bank Ltd

(Name of the Bank and Branch)

on account of ü

Companies/Other than Companies/Tax

Income Tax on (Strike out whichever is not applicable)

Type of Payment Self Assessment Tax

for the Assessment Year 2024-25

You might also like

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- CHALLANDocument1 pageCHALLANSrinubabu MaddukuriNo ratings yet

- GAURAV SHALYA Advance taxDocument1 pageGAURAV SHALYA Advance taxCA RamNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- ChallanDocument1 pageChallanShilesh GargNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Advance Tax ChallanDocument1 pageAdvance Tax ChallanakalidiNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- Challan Income TaxDocument1 pageChallan Income Taxkjservices108No ratings yet

- ChallanDocument1 pageChallanabhi7991No ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- T.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneDocument5 pagesT.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneSachin KumarNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- BZVPK1481J: (0020) Income Tax On Companies (Corporation Tax) (0021) Income TaxDocument1 pageBZVPK1481J: (0020) Income Tax On Companies (Corporation Tax) (0021) Income TaxBhandari AdvNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseDocument10 pagesT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARNo ratings yet

- CHALLAN NO. ITNS 281 Tax Deduction AccountDocument1 pageCHALLAN NO. ITNS 281 Tax Deduction AccountAnand_Gupta_6499No ratings yet

- ChallanFormDocument1 pageChallanFormiemjalaalNo ratings yet

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- GST FormatDocument3 pagesGST FormatAnmol GoyalNo ratings yet

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- 24122500039353_ChallanFormDocument1 page24122500039353_ChallanFormkipakurgoNo ratings yet

- challanDocument1 pagechallanRajendra LaddaNo ratings yet

- Direct Tax Challan Report: Save PrintDocument2 pagesDirect Tax Challan Report: Save PrintRavi JujjavarapuNo ratings yet

- AADCO7831R 24091300213914ICIC DTAX 13092024 TaxPayerDocument1 pageAADCO7831R 24091300213914ICIC DTAX 13092024 TaxPayermedimart.admNo ratings yet

- C/O Ross Brothers PVT LTD Flat No 2-A Lda Apart - Lawrenc Imran RossDocument4 pagesC/O Ross Brothers PVT LTD Flat No 2-A Lda Apart - Lawrenc Imran Rosssehedid178No ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- Declaration 3840321246075Document7 pagesDeclaration 3840321246075Qais NasirNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- ChallanFormDocument1 pageChallanFormvelanvasanth31No ratings yet

- 24070100091158_ChallanFormDocument1 page24070100091158_ChallanFormIGU AccountsNo ratings yet

- 24111400079882_ChallanFormDocument2 pages24111400079882_ChallanFormvijay.dixit.988No ratings yet

- ChallanFormDocument1 pageChallanFormrmzmuhammedNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Zeeshan H. JawadiNo ratings yet

- Direct Tax Challan ReportDocument2 pagesDirect Tax Challan ReportVivek MurtadakNo ratings yet

- ChallanFormDocument1 pageChallanFormasinghas72No ratings yet

- 24070500218785_ChallanFormDocument1 page24070500218785_ChallanFormIGU AccountsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- Fizod IncomeDocument1 pageFizod IncomeSHRI RAMAYANINo ratings yet

- Sujit Kumar IncomeDocument1 pageSujit Kumar IncomeSHRI RAMAYANINo ratings yet

- Acknowledgement SlipDocument1 pageAcknowledgement SlipSHRI RAMAYANINo ratings yet

- Asl Term 1Document3 pagesAsl Term 1SHRI RAMAYANINo ratings yet

- Liberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationDocument3 pagesLiberty General Insurance Limited: Insured Motor Vehicle Details and Premium ComputationSHRI RAMAYANINo ratings yet

- CLWM4100 T2 2020 Assessment 3Document9 pagesCLWM4100 T2 2020 Assessment 3Aritra ChakrabortyNo ratings yet

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinNo ratings yet

- FPDocument20 pagesFPRadhika ParekhNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Taxation BookDocument490 pagesTaxation BookMukund PatelNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsAshly MateoNo ratings yet

- Mr. Atsilla Grade 9 Mathematics For HSS Christmas Term Mid-Term Examinations 2024Document3 pagesMr. Atsilla Grade 9 Mathematics For HSS Christmas Term Mid-Term Examinations 2024FRANCIS HORLALI ATSILLANo ratings yet

- Percentage by Prof. Kavita DhullDocument18 pagesPercentage by Prof. Kavita DhullSarthakNo ratings yet

- Tax 301 Income Taxation Module 4 Co Ownership, Estates and TrustDocument6 pagesTax 301 Income Taxation Module 4 Co Ownership, Estates and TrustKristine hazzel ReynoNo ratings yet

- TaxationDocument82 pagesTaxationRiah M. De ChavezNo ratings yet

- 2015 03 Dec LibrettoDocument24 pages2015 03 Dec LibrettomebittleNo ratings yet

- Tax 1 Notes 2Document20 pagesTax 1 Notes 2Kate CalansinginNo ratings yet

- Take Home Quiz On Taxation Law Prepared By: Prof. AGN Concepts To StudyDocument3 pagesTake Home Quiz On Taxation Law Prepared By: Prof. AGN Concepts To StudyJImlan Sahipa IsmaelNo ratings yet

- BSOA 4A and 4B Income TaxationDocument2 pagesBSOA 4A and 4B Income Taxationtomasnielkevin433No ratings yet

- Projects Topics - Law of Taxation - 1Document6 pagesProjects Topics - Law of Taxation - 1AnshuSinghNo ratings yet

- ACCT 3050 Group Assignment S2 2023-2024Document2 pagesACCT 3050 Group Assignment S2 2023-2024Princess DouglasNo ratings yet

- Excel New Assignment PDFDocument20 pagesExcel New Assignment PDFHimanshi VohraNo ratings yet

- PRINCIPLES - OF - TAXATION - LAW - Delhi University LLBDocument62 pagesPRINCIPLES - OF - TAXATION - LAW - Delhi University LLBhasna140No ratings yet

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

- (Final) Acco 20133 - Income TaxationDocument13 pages(Final) Acco 20133 - Income TaxationRyramel Em CaisipNo ratings yet

- SCRC 3 CorporationDocument18 pagesSCRC 3 CorporationChristine Yedda Marie AlbaNo ratings yet

- TAX - LEAD BATCH 3 - Preweek 1 PDFDocument28 pagesTAX - LEAD BATCH 3 - Preweek 1 PDFMay Litt0% (1)

- Taxation Final Preboard 91 SolutionsDocument23 pagesTaxation Final Preboard 91 SolutionsJean TatsadoNo ratings yet

- 480 (2013) Expenses and Benefits A Tax Guide - 480-2013Document136 pages480 (2013) Expenses and Benefits A Tax Guide - 480-2013hester.kevinNo ratings yet

- China Rail Cons - 2012 Annual Results Announcement PDFDocument359 pagesChina Rail Cons - 2012 Annual Results Announcement PDFalan888No ratings yet

- 2017 Bar Exams Questions in Mercantile LawDocument29 pages2017 Bar Exams Questions in Mercantile LawGeeAgayamPastorNo ratings yet

- Cir Vs St. LukesDocument15 pagesCir Vs St. LukesLalaine FelixNo ratings yet

- Chartered ClubDocument3 pagesChartered ClubkajshdiNo ratings yet

- Module2 AE26 ITDocument7 pagesModule2 AE26 ITJemalyn PiliNo ratings yet

- Principles of MarketingM-MODULE-15Document17 pagesPrinciples of MarketingM-MODULE-15catajannicolinNo ratings yet