March 2024 Pay Slip

March 2024 Pay Slip

Uploaded by

mohiniaggarwal22Copyright:

Available Formats

March 2024 Pay Slip

March 2024 Pay Slip

Uploaded by

mohiniaggarwal22Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

March 2024 Pay Slip

March 2024 Pay Slip

Uploaded by

mohiniaggarwal22Copyright:

Available Formats

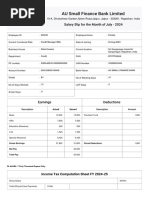

MMI Online Limited

Noida , Uttar Pradesh, India

Salary Slip for the Month of March - 2024

Employee ID : KO0277 Employee Name : Mohini Diinesh Aggarwal

Current Designation : HR Business Partner Account Number : 922010030725692

Department : HR Operations Bank Name : AXIS BANK

Date of Joining : 05-Aug-2022 Swift/IFSC code : UTIB0000296

PF number : DSNHP09406320000011172 UAN Number : 101617279314

No of Working Days : 31 No of Days Worked : 29

LOP Days : 2 Arrear Days : 0

Earnings Deductions

Description Amount Description Amount

Basic 17,540 Provident Fund 2,105

HRA 8,770

NP,Books & Periodicals. 1,871

Entertainment Allowance 4,677

Conveyance Allowance 8,053

Mobile 1,029

Gross Earnings 41,940 Gross Deductions 2,105

Net Pay 39,835

Total Pay 39,835

In words : Thirty Nine Thousand Eight Hundred And Thirty Five Rupees Only.

Income Tax Computation Sheet FY 2023-24

Gross Salary 475619

Total Gross Salary (Current

475619

Employer)

Total Gross Salary 475619

Less CTC Reimbursements

Total Reimbursments 0

Gross Income after Deduction

475619

and Reimbursements

Less exemption under Section 10

Total Section 10 Exemptions 0

Total amount of Salary received after Section 10 475619

Less: Deductions under section 16

Standard deduction under section

50000

16(ia)

Total amount of deductions under

50000

section 16

Income chargeable under the head "Salaries" 425619

Add: Income from Other Sources

A. Income/Loss from house

property

Total for Income/Loss from house

0

property

B. Other Sources

Total from Other Sources 0

Gross Total Income 425619

Total Chapter-VIA Declared value Qualified Value Deductible Value

Section 80C,80CCC,80CCD

Section 80TT

Total Chapter-VIA Total 0 0

Net Taxable Income 425619

Net Taxable Income (Rounded to Next 10) 425620

Income Tax on Net Taxable Income (Before Rebate U/s 87A) 6281

Rebate (U/s 87A) 6281

Income Tax After Rebate (u/s 87A)/Marginal Relief under New Tax Regime 0

Raw Surcharge 0

Marginal Relief 0

Add Edn Cess + Health Cess @ 4% 0

Net Tax Payable (A) 0

Previous Employer TDS (B) 0

Outside Tax / Advance Tax (C) 0

Tax Deducted till Date by Current Employer (D) 0

Remaining Tax (A - B - C - D) 0

** This is a system generated payslip, hence signature not required.

You might also like

- Lead Detail Report-1980Document4 pagesLead Detail Report-1980Shashikumar100% (1)

- Taskus India Private LimitedDocument1 pageTaskus India Private LimitedPranjal AgrawalNo ratings yet

- Banking Operations ManagementDocument2 pagesBanking Operations ManagementPrabhav GrohNo ratings yet

- 07-Forensic Audit Report - Key Findings of KPMGDocument1 page07-Forensic Audit Report - Key Findings of KPMGSanjeev Agrawal100% (2)

- Indemnity FormatsDocument3 pagesIndemnity FormatsWeb Spring100% (1)

- Jan 2024 Pay SlipDocument3 pagesJan 2024 Pay Slipmohiniaggarwal22No ratings yet

- April Pay SlipDocument3 pagesApril Pay Slipmohiniaggarwal22No ratings yet

- PayslipDocument3 pagesPayslipbibhutisahu23No ratings yet

- Payslip_a66f947c02cb31_2024-09 (1)Document3 pagesPayslip_a66f947c02cb31_2024-09 (1)kkt274514No ratings yet

- pay slipDocument3 pagespay slipkkt274514No ratings yet

- Payslip_a6566e807010cd_2023-11Document3 pagesPayslip_a6566e807010cd_2023-11jkfinancialservicesjitenderpalNo ratings yet

- Payslip A667fc5ede1c71 2024-06Document3 pagesPayslip A667fc5ede1c71 2024-06kkt274514No ratings yet

- Payslip_a66838bd285c4d_2024-06Document3 pagesPayslip_a66838bd285c4d_2024-06Chandan DubeyNo ratings yet

- PayslipDocument3 pagesPayslipvenkataratnacharyNo ratings yet

- PRATIK 2024-11 (1)Document3 pagesPRATIK 2024-11 (1)jitendrabadgujar1989No ratings yet

- Payslip A66a904489d9ca 2024-07Document3 pagesPayslip A66a904489d9ca 2024-07Pankaj Singh PalNo ratings yet

- Payslip A662ffaf8007ae 2024-04Document3 pagesPayslip A662ffaf8007ae 2024-04ramchena552No ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Payslip Null 2024-05Document3 pagesPayslip Null 2024-05ramchena552No ratings yet

- CmputationDocument2 pagesCmputationk83716671No ratings yet

- Payslip_a6722334b849af_2024-10Document1 pagePayslip_a6722334b849af_2024-10rnitin701No ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- VBRViewer (6)Document1 pageVBRViewer (6)mukeshsahoo32No ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Salary Slip 1700531238397241Document1 pageSalary Slip 1700531238397241nirasahu7894No ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- ITProjectionDocument1 pageITProjectiondeepakjain2kNo ratings yet

- COMPDocument2 pagesCOMPAaryaa KhatriNo ratings yet

- Computation of Total Income (As Per 115BAC)Document2 pagesComputation of Total Income (As Per 115BAC)N PrabhurajanNo ratings yet

- July 2024Document1 pageJuly 2024Tushar Kumar MishraNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Doc-20230725-Wa0011. (2)Document1 pageDoc-20230725-Wa0011. (2)s0026637No ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Pay SlipDocument1 pagePay SlipSourabhNo ratings yet

- RAHUL 2024-11Document3 pagesRAHUL 2024-11jitendrabadgujar1989No ratings yet

- Aqvpa7118e 2024Document2 pagesAqvpa7118e 2024mohitji08112000No ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Viridian Development Managers Pvt. Limited: Pay Slip For The Month of August 2018Document1 pageViridian Development Managers Pvt. Limited: Pay Slip For The Month of August 2018userabazNo ratings yet

- Vijay More Pay Slip_3Document1 pageVijay More Pay Slip_3emekarkpNo ratings yet

- VISAI_V2404010_August_2024Document3 pagesVISAI_V2404010_August_2024ravishsomNo ratings yet

- VISAI_V2404010_November_2024 (2)Document3 pagesVISAI_V2404010_November_2024 (2)ravishsomNo ratings yet

- HTMLReports (2)Document1 pageHTMLReports (2)Jyoti SharmaNo ratings yet

- Sep 2024Document1 pageSep 2024tomaraditya720No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountsakthivelNo ratings yet

- HTMLReports (7)Document1 pageHTMLReports (7)Jyoti SharmaNo ratings yet

- HTMLReports (24)Document1 pageHTMLReports (24)Prasanta AgastiNo ratings yet

- T-Systems ICT India Pvt. LTD: Salary Slip For The Month of July - 2021Document3 pagesT-Systems ICT India Pvt. LTD: Salary Slip For The Month of July - 2021Anurag PradhanNo ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- Earnings Entitled Amt. Earned Amt. Arrears Deductions AmountDocument5 pagesEarnings Entitled Amt. Earned Amt. Arrears Deductions AmountAditya PLNo ratings yet

- GG1933 2024Document1 pageGG1933 2024vishalgarasiya53No ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- MediaAgility 2019 Form16Document1 pageMediaAgility 2019 Form16SiddharthNo ratings yet

- Salary DecemberDocument1 pageSalary Decemberapi-3846919No ratings yet

- Final Computation Fy 2022-23Document3 pagesFinal Computation Fy 2022-23mohammadshahina82No ratings yet

- Salary Slip JulyDocument1 pageSalary Slip Julyapi-3846919No ratings yet

- SalaryDocument1 pageSalaryNet Xpress HubNo ratings yet

- Payslip MAY 2024: Employee Details Payment & Leave Details Location DetailsDocument1 pagePayslip MAY 2024: Employee Details Payment & Leave Details Location DetailsPavan YoyoNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- SBL 1 AssignmentDocument5 pagesSBL 1 AssignmentAvinash AcharyaNo ratings yet

- International ParityDocument5 pagesInternational ParitySumit GuptaNo ratings yet

- Role of Self Help Groups Through Micro FDocument11 pagesRole of Self Help Groups Through Micro Fঅবাকঅমিয়No ratings yet

- Term Paper On Insurance CompanyDocument4 pagesTerm Paper On Insurance Companyea68afje100% (1)

- Chapter 5. Accounting For Merchandising OperationsDocument5 pagesChapter 5. Accounting For Merchandising OperationsÁlvaro Vacas González de EchávarriNo ratings yet

- Commercial Law Notes (Sundiang and Aquino) 1Document21 pagesCommercial Law Notes (Sundiang and Aquino) 1FernandoNo ratings yet

- Wa0466.Document196 pagesWa0466.hilopilloNo ratings yet

- Corporation ProblemsDocument5 pagesCorporation ProblemsKathleenNo ratings yet

- bài tập unit 4Document5 pagesbài tập unit 4Hiền PhạmNo ratings yet

- Portfolio Recovery Associates Comments To The FTC Debt Collection Roundtable 2007Document4 pagesPortfolio Recovery Associates Comments To The FTC Debt Collection Roundtable 2007Jillian Sheridan100% (1)

- Kittle Mae PabloDocument2 pagesKittle Mae Pablorealjosh21No ratings yet

- Can You Claim Both HRA and Deduction On Home Loan InterestDocument6 pagesCan You Claim Both HRA and Deduction On Home Loan Interestvishwajeetkumar44No ratings yet

- Jay Project - UpdatedDocument27 pagesJay Project - UpdatedDevesh BalkoteNo ratings yet

- SHE Exercise 1Document6 pagesSHE Exercise 1Gems Marriah Wayne King100% (1)

- Exercise 1 Investment in AssociatesDocument7 pagesExercise 1 Investment in AssociatesJoefrey Pujadas BalumaNo ratings yet

- BOI ZO Ludhiana - 51Document1 pageBOI ZO Ludhiana - 51Yogesh SinghNo ratings yet

- DepreciationDocument18 pagesDepreciationManuthi HewawasamNo ratings yet

- Learning Journal Unit 1Document2 pagesLearning Journal Unit 1Daniel AdaneNo ratings yet

- Foreign Exchange Market EfficiencyDocument9 pagesForeign Exchange Market EfficiencySeth Therizwhiz RockerfellaNo ratings yet

- Bancassurance - A Global Breakdown:: Review of LiteratureDocument9 pagesBancassurance - A Global Breakdown:: Review of LiteratureSathya PriyaNo ratings yet

- LEISURE ON JULY 31STDocument4 pagesLEISURE ON JULY 31STMaryNo ratings yet

- International Arbitration and Project Finance inDocument30 pagesInternational Arbitration and Project Finance inTheodoor KoenenNo ratings yet

- Ey Cost of Capital India Survey 2017Document16 pagesEy Cost of Capital India Survey 2017Rahul KmrNo ratings yet

- Financial Statement Analysis Tesco TargetDocument6 pagesFinancial Statement Analysis Tesco Targetnormalty100% (3)

- Ar2012 - 13 SVC BankDocument52 pagesAr2012 - 13 SVC Bankarya30111991No ratings yet

- Sahrudaya Health Care Private LimitedDocument1 pageSahrudaya Health Care Private LimitedBabu MallelaNo ratings yet