0 ratings0% found this document useful (0 votes)

Aakash Bhill

Uploaded by

viveksarvaiya921ok

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

Aakash Bhill

Uploaded by

viveksarvaiya9210 ratings0% found this document useful (0 votes)

ok

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

ok

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

Aakash Bhill

Uploaded by

viveksarvaiya921ok

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1/ 1

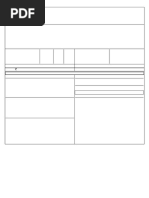

GO FOR TRANSFORMATION PRIVATE LIMITED

Payslip for the month of May 2024

Employee Code 43457 Employee Code 43457

Employee name Akash Bhill Employee name Akash Bhill

Bank Name HDFC BANK Bank Name HDFC BANK

Bank Account Number 50100263356998 Bank Account Number 50100263356998

Date of Joining 22 Jun 2022 Date of Joining 22 Jun 2022

Date of Birth 5 Jun 1997 Date of Birth 5 Jun 1994

Days Worked 30 Days Worked 30

Permanent Account CHOPP9219F Permanent Account CHOPP9219F

Number Number

PF Account Number GJAHD20477340000023787 PF Account Number GJAHD20477340000023787

Esic Account Number 3713876843 Esic Account Number 3713876843

LWP 0 LWP 0

Arrears Days 0 Arrears Days 0

IFSC Code HDFC0000069 IFSC Code HDFC000006

9

UAN Number 101286813837 UAN Number 1012868138

37

Department Network Services Department Network Services

Designation Executive Designation Executive

Grade S 04 Grade S 04

Tax Regime New Tax Regime Tax Regime New Tax Regime

Earnings Monthly Rate Current Month Arrears Total Deductions Amount

Incentives 0.00 2700.00 0.00 2700.00 Profession Tax 200.00

Incentives 0.00 2700.00 0.00 2700.00 Profession Tax 200.00

Basic Salary 12870.00 12870.00 0.00 12870.00 Provident Fund 1,400.00

Basic Salary 12870.00 12870.00 0.00 12870.00 Provident Fund 1,400.00

House Rent Allowance 4000.00 4000.00 0.00 4000.00 ESIC 200.00

House Rent Allowance 4000.00 4000.00 0.00 4000.00 ESIC 200.00

Petrol 1250.00 1250.00 0.00 1250.00

Petrol 1250.00 1250.00 0.00 1250.00

Mobile Allowance 200.00 200.00 0.00 200.00

Mobile Allowance 200.00 200.00 0.00 200.00

Gross Earnings 24,354.00 Total Deductions 1854.00

In words ( ) : Seventeen Thousand Four Hundred Seventy Six Only Net Salary : 22500.00

Income Tax Calculation for the financial Year 2024-2025

Particular Cumulative Projected Current Annual Details Of Exemption U/S 10

Incentives 0.00 0.00 2700.00 2700.00 Conveyance Exemption 0

Basic Salary 0.00 141570.00 12870.00 154440.00

House Rent 0.00 36000.00 4000.00 48000.00

Allowance

Petrol 0.00 13750.00 1250.00 15000.00

Mobile Allowance 0.00 2200.00 200.00 2400.00

Salary For The Year 222548.00

Gross Salary 316248.00

Gross Taxable Income 280248.00

Less : Standard Deduction 50000.00

Net Taxable Income (Rounded Off) 281712.00

Income Tax Deduction

87A 0.00

Income Tax Payable 0.00

Surcharge 0.00

Education Cess 0.00

Total Income Tax & Surcharge Payable 0.00

Esop Tax to be Recovered in this Month 0.00

Esop Tax Already Deducted 0.00

Less Tax Deducted at source till current month 0.00

Less Tax Deducted by Previous Employer 0.00

Balance Tax Payable/Refundable 0.00

Average Tax Payable per Month 0.00

You might also like

- Payslip For The Month of January 2023: CRM Services India Private LimitedNo ratings yetPayslip For The Month of January 2023: CRM Services India Private Limited1 page

- Payslip 2023 2024 5 200000000029454 IGSLNo ratings yetPayslip 2023 2024 5 200000000029454 IGSL2 pages

- Payslip 2023 2024 5 100000000546055 IGSL PDFNo ratings yetPayslip 2023 2024 5 100000000546055 IGSL PDF1 page

- Tax Invoice: Janse Van Rensburg, Pieter Adriaan Po Box 506 Polokwane 070050% (2)Tax Invoice: Janse Van Rensburg, Pieter Adriaan Po Box 506 Polokwane 07001 page

- Teleperformance Global Services Private Limited: Payslip For The Month of December 2021No ratings yetTeleperformance Global Services Private Limited: Payslip For The Month of December 20211 page

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021100% (2)Teleperformance Global Services Private Limited: Payslip For The Month of November 20211 page

- Abhinesh Khawar Payslip-2024-2025!4!29150-GTPLHL Khawar AbhineshNo ratings yetAbhinesh Khawar Payslip-2024-2025!4!29150-GTPLHL Khawar Abhinesh1 page

- Teleperformance Global Services Private Limited: Payslip For The Month of July 2023No ratings yetTeleperformance Global Services Private Limited: Payslip For The Month of July 20231 page

- payslip-2024-2025-10-100000000751055-TGBPLNo ratings yetpayslip-2024-2025-10-100000000751055-TGBPL1 page

- Payslip 2024 2025 10 300000000129493 TGBPLNo ratings yetPayslip 2024 2025 10 300000000129493 TGBPL1 page

- KMBL345775c1791673-9092-4c89-ac64-f786e188ef8aNo ratings yetKMBL345775c1791673-9092-4c89-ac64-f786e188ef8a1 page

- Payslip 2023 2024 5 100000000546055 IGSL PDFNo ratings yetPayslip 2023 2024 5 100000000546055 IGSL PDF1 page

- KS320659573d711-6bd5-440e-a338-cb0348f54efcNo ratings yetKS320659573d711-6bd5-440e-a338-cb0348f54efc1 page

- Payslip 2020 2021 12 300000000004232 CRMSIPLNo ratings yetPayslip 2020 2021 12 300000000004232 CRMSIPL1 page

- KS320656a5e6a50-b53b-4da9-9b39-f9cf0b2ba018No ratings yetKS320656a5e6a50-b53b-4da9-9b39-f9cf0b2ba0181 page

- payslip-2024-2025-11-kmbl317592-KTKBANKTNo ratings yetpayslip-2024-2025-11-kmbl317592-KTKBANKT1 page

- payslip-2024-2025-9-100000000751055-TGBPLNo ratings yetpayslip-2024-2025-9-100000000751055-TGBPL1 page

- 20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipNo ratings yet20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - Payslip1 page

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113No ratings yetSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-6001131 page

- 7-payslip-2022-2023-7-inf0070694-ISSINDIANo ratings yet7-payslip-2022-2023-7-inf0070694-ISSINDIA1 page

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Reliance Retail Limited: Total Amount (In Words) One Thousand Rupees OnlyNo ratings yetReliance Retail Limited: Total Amount (In Words) One Thousand Rupees Only2 pages

- About BMR Advisors BMR in News BMR Insights Events Contact Us FeedbackNo ratings yetAbout BMR Advisors BMR in News BMR Insights Events Contact Us Feedback22 pages

- Income Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisNo ratings yetIncome Statement Balance Sheet Latest Quarterly/Halfyearly Ratio Analysis1 page

- Chapter 1 - Principles of Taxation: Solutions Manual-Income Taxation (2016 Edition) by Tabag & Garcia50% (2)Chapter 1 - Principles of Taxation: Solutions Manual-Income Taxation (2016 Edition) by Tabag & Garcia40 pages

- All-Employee-Itax-Calculator-For-DDO-F.Y.2024-25-By-Ummed-Tarad-Copy-1No ratings yetAll-Employee-Itax-Calculator-For-DDO-F.Y.2024-25-By-Ummed-Tarad-Copy-17 pages

- Republic of The Philippines VS Parañaque, GR No. 191908, July 18, 2012No ratings yetRepublic of The Philippines VS Parañaque, GR No. 191908, July 18, 20123 pages

- 2018-10-23 12 - 48 - 35balochistan-Sales-Tax-Act-2015No ratings yet2018-10-23 12 - 48 - 35balochistan-Sales-Tax-Act-201574 pages

- Venture Capital Advantages and DisadvantagesNo ratings yetVenture Capital Advantages and Disadvantages24 pages