Tutorial 5 Questions

Tutorial 5 Questions

Uploaded by

JKFCopyright:

Available Formats

Tutorial 5 Questions

Tutorial 5 Questions

Uploaded by

JKFCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Tutorial 5 Questions

Tutorial 5 Questions

Uploaded by

JKFCopyright:

Available Formats

2022 EF209 - Tutorial 5 (week 8)

Questions

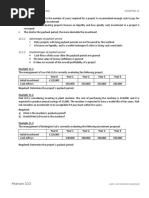

1. A project has an outlay of $40 million, with the following cashflows for the next 5

years. If the company’s minimum required rate is 10% appraise this investment by

calculating:

a. NPV

b. IRR

c. Discounted payback on the basis that the company has a target payback of

Year 1 2 3 4 5

Cashflows 20 million 15 million 10 million 5 million 5 million

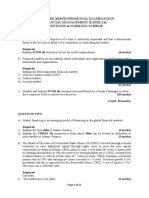

2. The directors of Spices Ltd are evaluating two investment projects (both with a

four year life) which involve the purchase of new machinery. The following data

is available:

Project Saffron Tumeric

Cost (immediate outlay) (120,000) (200,000)

Estimated Cash inflow/outflow

Year 1 63,000 106,000

Year 2 24,000 45,000

Year 3 35,000 50,000

Year 4. 38,000 60,000

Cost of capital is 10%.

Requirement

a) Calculate the payback period for each project.

b) Calculate the net present value of each project.

c) Calculate the approximate Internal Rate of Return (IRR) of each project.

d) Critically analyse which project should be undertaken based on your calculations

above.

e) Critically analyse the relative merits of NPV, IRR and payback as methods of

investment appraisal.

3. Calculate the yield of a bond that pays 5% interest and currently trading at €998 with 5

years remaining to maturity.

You might also like

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Capital Budgeting Practice QuestionsDocument5 pagesCapital Budgeting Practice QuestionsMujtaba A. Siddiqui100% (5)

- Seminar 2 - Investment AppraisalDocument3 pagesSeminar 2 - Investment AppraisalRukshani RefaiNo ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- Tutorial 3 SheetDocument2 pagesTutorial 3 Sheetnourkhaled1218No ratings yet

- Notes On Capital BudgetingDocument3 pagesNotes On Capital BudgetingCheshta Suri100% (1)

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- HCPM Tutorial 6 Project Finance and AppraisalDocument3 pagesHCPM Tutorial 6 Project Finance and AppraisalAjay MeenaNo ratings yet

- Tutorials Fin 310 2023Document3 pagesTutorials Fin 310 2023SimonNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Inter FMSM MTP2Document16 pagesInter FMSM MTP2renudevi06081973No ratings yet

- Tutorial 6 QuestionsDocument3 pagesTutorial 6 Questionsk63.2412580003No ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Investment Appraisal-PQDocument6 pagesInvestment Appraisal-PQRomail QaziNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Capital Budgeting Investment DecisionDocument10 pagesCapital Budgeting Investment Decisionkrishjainnnnn7No ratings yet

- Ba Fin430finalDocument4 pagesBa Fin430finalIzzy BbyNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- First Mock Exam FM -AnswersDocument3 pagesFirst Mock Exam FM -AnswershapfyNo ratings yet

- ETE Topics2024&Model QuesDocument8 pagesETE Topics2024&Model Quesarnavgupta1702No ratings yet

- Capital Investment Decisions: 1: Question IM 13.1 AdvancedDocument7 pagesCapital Investment Decisions: 1: Question IM 13.1 AdvancedrahimNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Practice 6 - QuestionsDocument4 pagesPractice 6 - QuestionsantialonsoNo ratings yet

- CAPITAL BUDGETING TECHNIQUES-TRIAL QUESTIONS - NsDocument3 pagesCAPITAL BUDGETING TECHNIQUES-TRIAL QUESTIONS - NsPrince AgyeiNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- FM & SM-QuestionsDocument12 pagesFM & SM-QuestionsHITESH RAMNANINo ratings yet

- Chap11 Quiz5 MI2Document15 pagesChap11 Quiz5 MI2lynvuong101299No ratings yet

- Problems of Capital BudgetingDocument4 pagesProblems of Capital Budgetingm agarwalNo ratings yet

- Exercise N PV and Irr 2024Document2 pagesExercise N PV and Irr 2024dinalias2147No ratings yet

- Questions - Investment AppraisalDocument2 pagesQuestions - Investment Appraisalpercy mapetere100% (1)

- Dba 302 Financial Management Supplementary TestDocument3 pagesDba 302 Financial Management Supplementary Testmulenga lubembaNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- Section 2Document1 pageSection 2Hello WorldNo ratings yet

- Theoretical and Conceptual Questions: (See Notes or Textbook)Document4 pagesTheoretical and Conceptual Questions: (See Notes or Textbook)raymondNo ratings yet

- Management_Information_Additional_Section_3Document10 pagesManagement_Information_Additional_Section_3ngochuongotuonNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- Chap11 Long Term Decision MakingDocument3 pagesChap11 Long Term Decision MakingSaiful AliNo ratings yet

- Problems On Capital BudgetingDocument2 pagesProblems On Capital BudgetingDeepakNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Take Home AssignmentDocument6 pagesTake Home AssignmentAmaniNo ratings yet

- ACCA F9 Revision Question Bank-49-51Document3 pagesACCA F9 Revision Question Bank-49-51rbaamba100% (1)

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Heriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsDocument7 pagesHeriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsAmy FitzpatrickNo ratings yet

- FINANCIAL MANAGEMENT PAPER 2.4 Nov 2018Document17 pagesFINANCIAL MANAGEMENT PAPER 2.4 Nov 2018Nana DespiteNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- BASTRCSX Learning Activity 9 and 10_students copy (1)Document4 pagesBASTRCSX Learning Activity 9 and 10_students copy (1)pamplonaa14No ratings yet

- AS Business AnalysisDocument4 pagesAS Business AnalysisLaskar REAZNo ratings yet

- FM CAT (AutoRecovered)Document4 pagesFM CAT (AutoRecovered)joseph mbuguaNo ratings yet

- Investment Appraisal BBADocument25 pagesInvestment Appraisal BBAreubensimone4No ratings yet

- Capital Budgeting SumsDocument6 pagesCapital Budgeting SumsDeep DebnathNo ratings yet

- Management Accountant Paper 2.2 Dec 2023Document19 pagesManagement Accountant Paper 2.2 Dec 2023MEYVIELYKERNo ratings yet

- Capital Budgeting NPV & IRRDocument4 pagesCapital Budgeting NPV & IRRKarrolu Kavya sriNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)