Certificate of Insurance - Indiafirst Life Group Loan Protect Plan

Certificate of Insurance - Indiafirst Life Group Loan Protect Plan

Uploaded by

Yoko BhaiCopyright:

Available Formats

Certificate of Insurance - Indiafirst Life Group Loan Protect Plan

Certificate of Insurance - Indiafirst Life Group Loan Protect Plan

Uploaded by

Yoko BhaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Certificate of Insurance - Indiafirst Life Group Loan Protect Plan

Certificate of Insurance - Indiafirst Life Group Loan Protect Plan

Uploaded by

Yoko BhaiCopyright:

Available Formats

Certificate of Insurance - IndiaFirst Life Group Loan Protect Plan

A Non-linked, Non-Participating Group Credit Linked Insurance Plan UIN No. 143N055V01

S Soorya ..

Co M Sivaraman No 501 1st

Main Road Cross M S Nagar

Yelahanka Bengaluru

Karnataka

KARN

560064

9880628521

Master Policyholder Name : Union Bank of India

Master Policy No.: G0001656

Loan Type: Education Loan

Loan No. : 300806550005963

Name of the Primary Borrower: S Soorya ..

Date of Birth: 28/11/2001

Gender: M

Member Id: 05255-00

Nominee Name Percentage Age of Relationship Appointee Name (if Relationship of

Share Nominee of Nominee applicable) Appointee

S Sumathi .. 100.00 51 Mother

Installment Premium (including GST): 40518.84

Sum Assured: 2910000.00 Plan Option: Life Cover

Cover Type: Reducing

Payment Mode: Direct Billing (Cash) Cover Term: 216

Premium Payment Term: Single Pay Frequency: Single

Cover Commencement Date: 18/05/2024 Cover Ceasing Date: 17/05/2042

Premium Due Date: Last Premium Due Date:

Moratorium Period 36

Joint Life Sum Assured (%): Life 1 100.00 Life 2 0.00 Life 3 Life 4 Or 100% for both life

Joint Life Sum Assured: Life 1 2910000.00 Life 2 Life 3 Life 4 Or 100% for both life

Joint Borrower Sum Assured:

Life 1

S.No. Rider Options Rider Sum Assured Rider Premium (Rs.)

(Rs.)

I Group Critical Illness Rider (UIN: 143B002V01) 0

XXXXXXXX (Mention the option as chosen))

II Group Disability Rider (UIN: 143B004V01 )

XXXXXXXX (Mention the option as chosen)

III Group Additional Benefit Rider (UIN: 143B018V01 )

a. Term Rider Benefit 0

b. Spouse Cover Benefit 0

IV. Group Protection Rider (UIN: 143B003V01 )

a. Accidental Death Benefit (ADB)

b. Terminal Illness Benefit (TI)

A. Total Rider(s) Premium 0.0

B. Total Premium (Base + Rider(s)) 40518.84

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 1

Note:Premiums paid are currently eligible for tax benefits under section 80c of Income Tax Act, 1961 as amended from time to time.

IMPORTANT TERMS & CONDITIONS

Free Look Period

You will have the right to return the COI to us stating reasons thereof, within first 15 days except Distance Marketing or electronic mode, if

applicable, where it is 30 days from the date of receipt of the COI. Once we receive your written notice of cancellation together with the original

COI, we will refund the premium paid after deducting expenses incurred by us on pro rata risk premium for the period on cover, medical

examination, if any and stamp duty charges.

Distance Marketing includes every activity of solicitation (including lead generation) and sale of insurance products through the following modes: (i)

Voice mode, which includes telephone-calling; (ii) Short Messaging service (SMS); (iii) Electronic mode which includes e-mail, internet and

interactive television (DTH); (iv) Physical mode which includes direct postal mail and newspaper & magazine inserts; and, (v) Solicitation through

any means of communication other than in person

Benefits

The plan offers the following benefit options: -

Benefit Options Level Cover Decreasing Cover

Life Cover In case of death of the Member; Original Sum In case of death of the Member; outstanding cover amount as

Assured as opted at the inception is payable and the per the initial cover schedule mentioned in the COI as at

cover ceases. monthiversary immediately preceding the date of death of

Member is payable if fixed rate option is chosen or as per the

COI at the time of claim if floating rate option is chosen and

cover ceases.

The death benefit can be taken either as lumpsum or in instalments over a period of 1 to 5 years as chosen at inception.

The benefit shall be payable as under:

• In case of Regulated Entities, under Lender- Borrower scheme, the Outstanding Loan amount, if any shall be payable to the Master

Policyholder subject to prior authorization from the Member taken at the inception of policy. Any residual benefit shall be paid to the Nominee.

• In case of Other Entities, the Benefit shall be payable to the Nominee.

Please Note -

Regulated Entities shall mean to include - Reserve Bank of India (“RBI”) regulated Scheduled Banks (including co-operative Banks), NBFCs

having Certificate of Registration from RBI, National Housing Bank (“NHB”) regulated Housing Finance Companies, National Minority Development

Finance Corporation (NMDFC) and it’s States Channelizing Agencies or Small Finance Banks regulated by RBI, Mutually aided cooperative

societies formed and registered under the applicable state Act concerning such Societies, Microfinance companies registered under section 8 of

Companies Act, 2013 and any other category as approved by Insurance Regulatory and Development Authority of India (IRDAI).

Other Entities shall mean the entities other than Regulated Entities as mentioned above.

The Life Insurer may audit or cause an audit into the accuracy of the Credit Account Statement(s) of the insured member in respect of which claim

was settled.

Cover Types

• Decreasing cover

The decreasing cover (at the member level) will be the cover outstanding as at monthly anniversary immediately preceding the date of

death/date of Accidental total permanent disability/date of Critical illness of the Member based on a cover schedule calculated at the inception

of cover. Under this there are following two types:-

1) Fixed Rate: Under this cover type, Sum Assured decreases over the term as per initial cover schedule mentioned in certificate of

insurance (COI). The COI will be generated at loan interest rate for which premium is charged and cover amount will not fall below

Rs.5,000. Single and limited premium payment options are available under this cover.

2) Floating Rate: Under this cover type, Sum Assured decreases over the cover term as per the cover schedule mentioned in COI as per the

loan interest rate at inception of policy. However, when interest rate changes the loan outstanding will be recalculated with the revised

interest rate keeping the EMI as at time of inception constant and revised COI will be generated at the time of claim. For the purpose of

cover, fluctuations of upto +/- 500 bps from interest rate at inception is allowed and cover amount will not fall below Rs. 5000/-. Increase in

loan outstanding due to EMI default would not be covered. Single and limited premium payment options for cover term greater than or

equal to 5 years are available under this cover.

• Level cover

Under this cover type, Sum Assured remains level throughout the term of the cover as per certificate of insurance. Single, Limited and Regular

premium payment options are available under this cover.

Maturity - No maturity benefit under this plan

Rider Benefits

Please refer to the annexures for rider benefits, terms and conditions, claim documents and exclusions as per the riders opted for.

Points to note

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 2

1. Benefit amount to the member/ nominee/ appointee/ legal heir which is over and above the actual loan outstanding will be paid either as lump

sum or as a level monthly instalment and instalment period of over 1 to 5 years as chosen by the member at inception of the cover.

For level cover, in case of monthly instalment payouts, the benefit amount will be calculated as dividing lump sum amount (say, S) by annuity

factor (i.e. a(n)(12)) i.e. S/a(n)(12) where n is the instalment period of 1 to 5 years and S is the benefit payable to the nominee which is

calculated as sum assured as per COI less amount payable to the master policyholder.

The prevailing SBI savings bank interest rate will be used to calculate the annuity factor. Once the monthly instalment payment starts, this

payment remains level throughout the instalment period. The interest rate used to calculate annuity factor is subject to review at the end of

every financial year and will be changed in case of change in SBI savings bank interest rate

2. Top-up or any additional enhancement amount of same loan account will be considered after paying additional premium for extra cover

amount and outstanding term and modification of revised COI.

3. ATPD/ CI are accelerated benefits. ADB is an additional benefit.

4. First Diagnosis means the diagnosis of the first Critical Illness in the lifetime of the member (or second member, if applicable in case of joint

life).

5. The member who has already contracted any Critical Illness shall not be offered cover option which includes CI benefit.

6. Applicable tax charge will be levied on the premium. The level of this charge will be as per the rate of Applicable Tax on premium, declared by

the Government from time to time.

7. In case of Accidental Total Permanent Disability occurring within 180 days of accident, provided date of accident is within the cover term, we

will pay the applicable benefit on the date of accident plus any premiums, if any, paid from date of accident to date of disability.

Joint Life Cover

First claim basis - Sum Assured for each Member is equal to 100% of the outstanding loan amount. The benefit is payable on first claim basis as

per loan schedule and in respect of the other Member, the membership terminates and his cover shall cease immediately. The sum assured is

payable only once even if both Members die or there is occurrence of any other covered event at the same time.

Loan share percentage - Sum Assured for each Member is equal to his/her share of the loan. The benefit is payable in case of unfortunate

demise or any other covered event as per benefit opted of either one or more than one or all of the borrower/s. In case of death or any other

covered event as per benefit opted of one of the borrower the cover for the surviving borrowers continue.

Grace Period

A period of one month but not less than 30 (Thirty) days from the due date for payment of Premium for yearly, half yearly and quarterly Premium

payment mode,15 (Fifteen) days for monthly Premium payment mode. During this period the policy will be considered to be in-force as per terms

and conditions of the policy.

Payment of Premium:

In case, the Master Policyholder(MPH) has collected the premium from the member before the completion of grace period and has not remitted

the same to us (due to any reason), we will continue to provide coverage to that member if the member can prove that he/she had paid the

premium and secured a proper receipt leading the member to believe that he/she was duly insured.

Revival of policy (for Limited /Regular Pay policies)

A lapsed policy can be revived by paying all the outstanding premiums without any interest/late fees through the Master Policyholder within 5

years from due date of 1st unpaid premium but before the completion of cover term and fulfilling all medical (DGH) & financial underwriting

requirements as per board approved Underwriting policy.

Under limited payment option, if member/master policyholder has not revived the policy within revival period of 5 years, then on completion of

revival period surrender value will be paid to the member/master policyholder and policy or contract terminates for that member.

Under regular payment option, if member/master policyholder has not revived the policy within revival period of five years, then on completion of

revival period the policy or contract terminates for that member.

Moratorium Period

If the date of the loan disbursement and the start of loan repayment (EMI) are different, you can avail of a ‘Moratorium Period’. This allows for the

risk cover to start even before the actual loan repayment schedule begins. A moratorium period is a time during the coverage term when the

member does not make any payment towards the principal component of the loan.

Risk cover during the

moratorium period

▪ The moratorium period allows for the risk cover to start even before the actual loan repayment schedule

begins

▪ For example: In case of education loan, the repayment instalments start only after study period has been

completed. However, the member/borrower (student) is covered during this period as well

Payment of interest during the

moratorium period

▪ Level cover during moratorium period: The member can choose to pay interest during this period. In this

case the sum assured will remain constant till the start of the loan repayment

▪ Increasing cover during moratorium period: If the interest is not paid, the outstanding loan amount hence the

cover amount will increase every month to the extent of the unpaid interest till the repayment starts

Moratorium Period Minimum: 3 months

Maximum: 7 Years

Surrender

You may surrender the policy /cover at any time during the policy term. The insurance cover on your life shall cease immediately. On surrender of

the plan by the Master Policyholder or foreclosure of loan by you, you have the option to continue the life cover till the end of the policy term. You

can also surrender the cover before the end of loan term. There is no surrender value under regular premium option.

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 3

Surrender benefit under Single Premium is calculated as mentioned below:-

Level Term Cover - 70% X Single Premium X {1 – M / P}

Decreasing Term Cover ** - 70% X Single Premium X {1 – M / P} X {Current SA / Original SA}

Where M = Elapsed months since inception, P = Cover term in months

** Decreasing Term Cover is equal to the outstanding loan amount, as on the monthly plan anniversary immediately prior to the date of surrender/

lapse and as specified in the Certificate of Insurance.

Under limited premium payment, in the event of Member’s demise after expiry of the grace period and before completion of the revival period of 5

years the death benefit will be the surrender value, if any

Foreclosure of loan

In case you wish to foreclose the loan before end of the policy term or the Master Policyholder surrenders the Plan then you have the option to

continue the cover till the end of the policy term. You also have the flexibility to surrender / terminate the policy/cover before the end of policy term.

Termination of Coverage

The Cover in respect of any Member under this policy will terminate on the earliest of the following:

1. Member attaining age 76 years or on death or ATPD/CI (if customer avails this benefit) whichever is earlier

2. Non-payment of premium under limited/regular premium during the grace period.

3. The end of cover term

4. Surrender of the contract by the member

5. Death of the first life in case of joint life coverage on first claim basis

6. On the date of payment of free look cancellation amount

Claims

The master policyholder or the nominee/legal heir/appointee, as the case may be, will give us a written notice of the claim on the member’s

demise / total permanent disability. They need to give us all the relevant information in writing to enable us to process the claim as specified in the

plan. The claim documents needs to be submitted to us directly at the address mentioned in this COI or to the Master Policyholder who then sends

the same to us.

In case of authorization provided by the Member to the Master Policyholder, at the time of Claim, the Master Policyholder will need to:

• Provide Member Form & Loan Account Statement in respect of the insured Member to whom/whose nominee or beneficiary the claim money are

payable.

• Provide a confirmation that the Insured Member / Nominee / Beneficiary who had submitted the Claim discharge form is the same person who

has been registered by Master Policyholder as the Insured Member / Nominee / Beneficiary under the Group Master Policy.

The Life Insurer shall audit or cause an audit into the accuracy of the Credit Account Statement(s) of the insured Member in respect of which

claim was settled on the completion of every financial year.

Documents required at the time of making a claim are:

Natural Death

• Completely filled & signed Claim Intimation form (available on our website)

• Copy of Death Certificate

• Loan Application form & Loan a/c statement

• Certificate of Insurance (Inforced, issued at the inception / renewal whichever is applicable).

• ID proof and address proof of Nominee

• Copy of Bank Passbook or cancelled cheque of nominee / claimant

Unnatural Death – Following additional documents are required apart from the documents listed above

• Copies of Medico Legal Certificate, First Information Report, Panchnama, Inquest report and post mortem report, duly attested by the police

(only in case of Accident leading to unnatural death or Permanent Disability of the Life Assured)

• Hospitalization documents (discharge summary, all investigation reports) in case the Member was treated for any illness related to the cause

of death

Documents required for Accidental Total Permanent Disability Claim:

• Completely filled & signed claim intimation form

• Disability certificate signed & issued by the civil surgeon

• Discharge Card / Indoor consultation paper from the hospital along with the investigation report.

• In case disability due to accident, copy of First Information Report & Post Mortem Report, duly attested by police officials, in case of unnatural

deaths including accidents, murder, suicide etc.

• Member’s photo, current address proof & photo ID proof

• Member’s copy of bank passbook / statement with bank account details

Documents required for Critical Illness Claims:

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 4

• Completely filled & signed claim intimation form

• Medical Certificate confirming the diagnosis of Critical Illness

• A certificate from an attending Medical Practitioner confirming that the claim does not relate to any Pre-existing disease or Injury or any Illness or

Injury which was diagnosed within the first 90 days of the inception of the Policy.

• Discharge Card / Indoor consultation paper from the hospital along with the investigation report.

• First Consultation letter and subsequent prescriptions

• In the case critical illness arises due to an accident, copy First Information Report & Post Mortem Report, duly attested by police officials or

medico-legal certificate.

• Member’s photo, current address proof & photo ID proof

• Member’s copy of bank passbook / statement with bank account details

• Specific documents listed under the respective critical illness

Any other document or information that we may need to process the claim depending on the cause or nature of the claim. All copies to be self-

attested by the Master Policy Holder

Exclusions

• Suicide

In case of death due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival under the

policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death

or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Nomination shall be governed as per section 39 of the Insurance Act, 1938 as amended from time to time.

(1) The holder of a policy of life insurance on his own life may, when effecting the policy or at any time before the policy matures for payment,

nominatethe person or persons to whom the money secured by the policy shall be paid in the event of his death:

Provided that, where any nominee is a minor, it shall be lawful for the policyholder to appoint any person in the manner laid down by the insurer, to

receive the money secured by the policy in the event of his death during the minority of the nominee.

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 5

(2) Any such nomination in order to be effectual shall, unless it is incorporated in the text of the policy itself, be made by an endorsement on the

policy communicated to the insurer and registered by him in the records relating to the policy and any such nomination may at any time before the

policy matures for payment be cancelled or changed by an endorsement or a further endorsement or a will, as the case may be, but unless notice

in writing of any such cancellation or change has been delivered to the insurer, the insurer shall not be liable for any payment under the policy

made bona fide by him to a nominee mentioned in the text of the policy or registered in records of the insurer.

(3) The insurer shall furnish to the policyholder a written acknowledgement of having registered a nomination or a cancellation or change thereof,

and may charge such fee as may be specified by regulations for registering such cancellation or change.

(4) A transfer or assignment of a policy made in accordance with section 38 shall automatically cancel a nomination:

Provided that the assignment of a policy to the insurer who bears the risk on the policy at the time of the assignment, in consideration of a loan

granted by that insurer on the security of the policy within its surrender value, or its reassignment on repayment of the loan shall not cancel a

nomination, but shall affect the rights of the nominee only to the extent of the insurer's interest in the policy:

Provided further that the transfer or assignment of a policy, whether wholly or in part, in consideration of a loan advanced by the transferee or

assignee to the policyholder, shall not cancel the nomination but shall affect the rights of the nominee only to the extent of the interest of the

transferee or assignee, as the case may be, in the policy:

Provided also that the nomination, which has been automatically cancelled consequent upon the transfer or assignment, the same nomination

shall stand automatically revived when the policy is reassigned by the assignee or retransferred by the transferee in favour of the policyholder on

repayment of loan other than on a security of policy to the insurer.

(5) Where the policy matures for payment during the lifetime of the person whose life is insured or where the nominee or, if there are more

nominees than one, all the nominees die before the policy matures for payment, the amount secured by the policy shall be payable to the

policyholder or his heirs or legal representatives or the

holder of a succession certificate, as the case may be.

(6) Where the nominee or if there are more nominees than one, a nominee or nominees survive the person whose life is insured, the amount

secured by the policy shall be payable to such survivor or survivors.

(7) Subject to the other provisions of this section, where the holder of a policy of insurance on his own life nominates his parents, or his spouse, or

his children, or his spouse and children, or any of them, the nominee or nominees shall be beneficially entitled to the amount payable by the

insurer to him or them under sub-section (6)

unless it is proved that the holder of the policy, having regard to the nature of his title to the policy, could not have conferred any such beneficial

title on the nominee.

(8) Subject as aforesaid, where the nominee, or if there are more nominees than one, a nominee or nominees, to whom sub-section (7) applies,

die after the person whose life is insured but before the amount secured by the policy is paid, the amount secured by the policy, or so much of the

amount secured by the policy as represents

the share of the nominee or nominees so dying (as the case may be), shall be payable to the heirs or legal representatives of the nominee or

nominees or the holder of a succession certificate, as the case may be, and they shall be beneficially entitled to such amount.

(9) Nothing in sub-sections (7) and (8) shall operate to destroy or impede the right of any creditor to be paid out of the proceeds of any policy of life

insurance.

(10) The provisions of sub-sections (7) and (8) shall apply to all policies of life insurance maturing for payment after the commencement of the

Insurance Laws (Amendment) Act, 2015.

(11) Where a policyholder dies after the maturity of the policy but the proceeds and benefit of his policy has not been made to him because of his

death, in such a case, his nominee shall be entitled to the proceeds and benefit of his policy.

(12) The provisions of this section shall not apply to any policy of life insurance to which section 6 of the Married Women's Property Act, 1874,

applies or has at any time applied:

Provided that where a nomination made whether before or after the commencement of the Insurance Laws (Amendment) Act, 2015, in favour of

the wife of the person who has insured his life or of his wife and children or any of them is expressed, whether or not on the face of the policy, as

being made under this section, the said section 6 shall be deemed not to apply or not to have applied to the policy.

15. Assignment shall be governed as per section 38 of the Insurance Act, 1938 as amended from time to time.

1) A transfer or assignment of a policy of insurance, wholly or in part,

whether with or without consideration, may be made only by an endorsement upon the policy itself or by a separate instrument, signed in either

case by the transferor or by the assignor or his duly authorised agent and attested by at least one witness, specifically setting forth the fact of

transfer or assignment and the reasons thereof, the antecedents of the assignee and the terms on which the assignment is made.

(2) An insurer may, accept the transfer or assignment, or decline to act upon any endorsement made under sub-section (1), where it has sufficient

reason to believe that such transfer or assignment is not bona fide or is not in the interest of the policyholder or in public interest or is for the

purpose of trading of insurance policy.

(3) The insurer shall, before refusing to act upon the endorsement, record in writing the reasons for such refusal and communicate the same to the

policyholder not later than thirty days from the date of the policyholder giving notice of such transfer or assignment.

(4) Any person aggrieved by the decision of an insurer to decline to act upon such transfer or assignment may within a period of thirty days from

the date of receipt of the communication from the insurer containing reasons for such refusal, prefer a claim to the Authority.

(5) Subject to the provisions in sub-section (2), the transfer or assignment shall be complete and effectual upon the execution of such

endorsement or instrument duly attested but except, where the transfer or assignment is in favour of the insurer, shall not be operative as against

an insurer, and shall not confer upon the transferee or assignee, or his legal representative, any right to sue for the amount of such policy or the

moneys secured thereby until a notice in writing of the transfer or assignment and either the said endorsement or instrument itself or a copy

thereof certified to be correct by both transferor and transferee or their duly authorised agents have been delivered to the insurer:

Provided that where the insurer maintains one or more places of business in India, such notice shall be delivered only at the place where the policy

is being serviced.

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 6

(6) The date on which the notice referred to in sub-section (5) is delivered to the insurer shall regulate the priority of all claims under a transfer or

assignment as between persons interested in the policy; and where there is more than one instrument of transfer or assignment the priority of the

claims under such instruments shall be

governed by the order in which the notices referred to in sub-section (5) are delivered:

Provided that if any dispute as to priority of payment arises as between assignees, the dispute shall be referred to the Authority.

(7) Upon the receipt of the notice referred to in sub-section (5), the insurer shall record the fact of such transfer or assignment together with the

date thereof and the name of the transferee or the assignee and shall, on the request of the person by whom the notice was given, or of the

transferee or assignee, on payment of such fee as may

be specified by the regulations, grant a written acknowledgement of the receipt of such notice; and any such acknowledgement shall be

conclusive evidence against the insurer that he has duly received the notice to which such acknowledgement relates.

(8) Subject to the terms and conditions of the transfer or assignment, the insurer shall, from the date of the receipt of the notice referred to in sub-

section (5), recognize the transferee or assignee named in the notice as the absolute transferee or assignee entitled to benefit under the policy,

and such person shall be subject to all liabilities and equities to which the transferor or assignor was subject at the date of the transfer or

assignment and may institute any proceedings in relation to the policy, obtain a loan under the policy or surrender the policy without obtaining the

consent of the transferor or assignor or making him a party to such proceedings.

Explanation- Except where the endorsement referred to in sub-section (1) expressly indicates that the assignment or transfer is conditional in

terms of subsection (10) hereunder, every assignment or transfer shall be deemed to be an absolute assignment or transfer and the assignee or

transferee, as the case may be, shall be

deemed to be the absolute assignee or transferee respectively.

(9) Any rights and remedies of an assignee or transferee of a policy of life insurance under an assignment or transfer effected prior to the

commencement of the Insurance Laws (Amendment) Act, 2015 shall not be affected by the provisions of this section.

(10) Notwithstanding any law or custom having the force of law to the contrary, an assignment in favour of a person made upon the condition

that—

(a) the proceeds under the policy shall become payable to the policyholder or the nominee or nominees in the event of either the assignee or

transferee predeceasing the insured; or

(b) the insured surviving the term of the policy, shall be valid:

Provided that a conditional assignee shall not be entitled to obtain a loan on the policy or surrender a policy.

(11) In the case of the partial assignment or transfer of a policy of insurance under sub-section (1), the liability of the insurer shall be limited to

the amount secured by partial assignment or transfer and such policyholder shall not be entitled to further assign or transfer the residual amount

payable under the same policy.

Disclosures

Misrepresentation/Fraudulent Disclosures: shall be governed as per Section 45 of Insurance Act, 1938 as amended from time to time.

Extract of Section 45 of the Insurance Act 1938, as amended from time to time states

1) No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy, i.e.,

from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the

policy, whichever is later.

2) A policy of life insurance may be called in question at any time within three years from the date of issuance of the policy or the date of

commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground of fraud:

Provided that the insurer shall have to communicate in writing to the insured or the legal representatives or nominees or assignees of the

insured the grounds and materials on which such decision is based.

3) Notwithstanding anything contained in sub-section (2), no insurer shall repudiate a life insurance policy on the ground of fraud if the insured

can prove that the mis-statement of or suppression of a material fact was true to the best of his knowledge and belief or that there was no

deliberate intention to suppress the fact or that such mis-statement of or suppression of a material fact are within the knowledge of the insurer:

Provided that in case of fraud, the onus of disproving lies upon the beneficiaries, in case the policyholder is not alive.

4) A policy of life insurance may be called in question at any time within three years from the date of issuance of the policy or the date of

commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground that any

statement of or suppression of a fact material to the expectancy of the life of the insured was incorrectly made in the proposal or other

document on the basis of which the policy was issued or revived or rider issued: Provided that the insurer shall have to communicate in writing

to the insured or the legal representatives or nominees or assignees of the insured the grounds and materials on which such decision to

repudiate the policy of life insurance is based: Provided further that in case of repudiation of the policy on the ground of misstatement or

suppression of a material fact, and not on the ground of fraud, the premiums collected on the policy till the date of repudiation shall be paid to

the insured or the legal representatives or nominees or assignees of the insured within a period of ninety days from the date of such

repudiation.

5) Nothing in this section shall prevent the insurer from calling for proof of age at any time if he is entitled to do so, and no policy shall be deemed

to be called in question merely because the terms of the policy are adjusted on subsequent proof that the age of the Life Insured was

incorrectly stated in the proposal.

Grievance Redressal Procedure

Any grievance/complaint pertaining to this Plan should be addressed to Us directly or may be addressed to the Master Policyholder who shall in

turn write to Us.

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 7

a. A written communication giving reasons of either redressing or rejecting the grievance/ complaint will be sent to you within 14 (Fourteen) days

from the date of receipt of the grievance/ complaint. In case We don’t receive a revert from You within 8 weeks from the date of Your receipt

of Our response, We will treat the complaint as closed.

However, if You are not satisfied with our resolution provided or have not received any response within 14 (Fourteen) days, then You may

b. email Us at grievance.redressal@indiafirstlife.com or write to Our ‘Grievance Officer’ at the above mentioned address.

c. An acknowledgment to all grievances/ complaints received will be sent within 3 (Three) working days of receipt of the complaint/grievance.

If You are not satisfied with the response or do not receive a response from us within 15 days, you may approach the Grievance Cell of the

Insurance Regulatory and Development Authority of India (IRDAI) on the following contact details:

IRDAI Grievance Call Centre (IGCC) TOLL FREE NO: 155255

Email ID: complaints@irda.gov.in

You can also register your complaint online at

http://www.igms.irda.gov.in/

Address for communication for complaints by fax/paper:

Consumer Affairs Department,

Insurance Regulatory and Development Authority of India

Sy. No. 115/1, Financial District, Nanakramguda, Gachibowli

Hyderabad, Telangana – 500032

IRDAI TOLL FREE NO: 18004254732, Fax No: 91- 40 – 6678 9768

Insurance Ombudsman

In case you are dissatisfied with the decision/resolution of the company, you may approach the Insurance Ombudsman located nearest to you

(refer to our website www.indiafirstlife.com) *For detailed definitions and benefits on Accidental Death Benefit, Accidental Total Permanent

Disability Benefit and Critical Illness Benefit, please refer to our website www.indiafirstlife.com

Please note that this certificate is issued for the purpose of information only and is merely a summary of the major features of the scheme. The benefits payable by

IndiaFirst Life will be based on the terms and conditions stated in the Master Policy. You can get in touch with the Master Policyholder or visit our website

www.indiafirstlife.com for the terms and conditions of this plan.

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 8

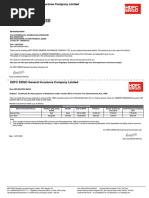

Cover Schedule

Loan Amount 300806550005963 Outstanding Loan Term 2910000.00

Loan term in Outstanding Loan Loan term in Outstanding Loan Loan term in Outstanding Loan

Months Amount Months Amount Months Amount

1 2910000.00 32 3558574.24 63 3371084.60

2 2928948.91 33 3581746.45 64 3358300.21

3 2948021.21 34 3605069.54 65 3345432.58

4 2967217.71 35 3628544.51 66 3332481.15

5 2986539.20 36 3652172.33 67 3319445.39

6 3005986.51 37 3675954.02 68 3306324.74

7 3025560.46 38 3665154.83 69 3293118.66

8 3045261.86 39 3654285.33 70 3279826.58

9 3065091.55 40 3643345.04 71 3266447.96

10 3085050.37 41 3632333.52 72 3252982.21

11 3105139.15 42 3621250.29 73 3239428.78

12 3125358.74 43 3610094.90 74 3225787.09

13 3145709.99 44 3598866.86 75 3212056.58

14 3166193.77 45 3587565.71 76 3198236.65

15 3186810.93 46 3576190.97 77 3184326.74

16 3207562.34 47 3564742.16 78 3170326.25

17 3228448.88 48 3553218.81 79 3156234.59

18 3249471.42 49 3541620.41 80 3142051.17

19 3270630.85 50 3529946.49 81 3127775.39

20 3291928.07 51 3518196.56 82 3113406.66

21 3313363.97 52 3506370.11 83 3098944.36

22 3334939.45 53 3494466.66 84 3084387.89

23 3356655.42 54 3482485.69 85 3069736.63

24 3378512.80 55 3470426.70 86 3054989.97

25 3400512.50 56 3458289.20 87 3040147.28

26 3422655.46 57 3446072.65 88 3025207.94

27 3444942.61 58 3433776.56 89 3010171.32

28 3467374.89 59 3421400.40 90 2995036.79

29 3489953.23 60 3408943.65 91 2979803.71

30 3512678.60 61 3396405.79 92 2964471.44

31 3535551.95 62 3383786.28 93 2949039.32

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 9

Cover Schedule

Loan Amount 300806550005963 Outstanding Loan Term 2910000.00

Loan term in Outstanding Loan Loan term in Outstanding Loan Loan term in Outstanding Loan

Months Amount Months Amount Months Amount

94 2933506.72 125 2398402.47 156 1744035.38

95 2917872.98 126 2379284.31 157 1720656.21

96 2902137.43 127 2360041.66 158 1697124.81

97 2886299.42 128 2340673.71 159 1673440.17

98 2870358.28 129 2321179.64 160 1649601.31

99 2854313.33 130 2301558.63 161 1625607.22

100 2838163.91 131 2281809.86 162 1601456.88

101 2821909.32 132 2261932.49 163 1577149.29

102 2805548.90 133 2241925.69 164 1552683.41

103 2789081.93 134 2221788.61 165 1528058.23

104 2772507.74 135 2201520.40 166 1503272.69

105 2755825.63 136 2181120.22 167 1478325.75

106 2739034.89 137 2160587.19 168 1453216.37

107 2722134.81 138 2139920.46 169 1427943.49

108 2705124.68 139 2119119.16 170 1402506.04

109 2688003.79 140 2098182.40 171 1376902.95

110 2670771.42 141 2077109.31 172 1351133.14

111 2653426.83 142 2055899.01 173 1325195.52

112 2635969.31 143 2034550.58 174 1299089.01

113 2618398.10 144 2013063.15 175 1272812.50

114 2600712.48 145 1991435.79 176 1246364.89

115 2582911.69 146 1969667.61 177 1219745.06

116 2564994.99 147 1947757.68 178 1192951.90

117 2546961.63 148 1925705.08 179 1165984.26

118 2528810.84 149 1903508.87 180 1138841.02

119 2510541.85 150 1881168.14 181 1111521.03

120 2492153.91 151 1858681.93 182 1084023.15

121 2473646.22 152 1836049.30 183 1056346.21

122 2455018.03 153 1813269.29 184 1028489.04

123 2436268.53 154 1790340.95 185 1000450.48

124 2417396.94 155 1767263.30 186 972229.34

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 10

Cover Schedule

Loan Amount 300806550005963 Outstanding Loan Term 2910000.00

Loan term in Outstanding Loan Loan term in Outstanding Loan Loan term in Outstanding Loan

Months Amount Months Amount Months Amount

187 943824.44

188 915234.57

189 886458.54

190 857495.12

191 828343.11

192 799001.27

193 769468.36

194 739743.15

195 709824.37

196 679710.78

197 649401.09

198 618894.04

199 588188.34

200 557282.69

201 526175.80

202 494866.35

203 463353.02

204 431634.49

205 399709.42

206 367576.46

207 335234.27

208 302681.47

209 269916.70

210 236938.58

211 203745.72

212 170336.71

213 136710.16

214 102864.65

215 68798.74

216 34511.01

IndiaFirst Life Insurance Company Limited

Registered Office: 12 and 13th floor, North [C] wing, Tower 4, Nesco IT Park, Nesco Center, Western Express Highway,

Goregaon (East), Mumbai – 400 063 Customer Care: 1800-209-8700 www.indiafirstlife.com

CIN: U66010MH2008PLC183679 Registration Number: 143

Page : 11

You might also like

- Insurance 1685500628960Document2 pagesInsurance 1685500628960subhaniNo ratings yet

- FWD Producst: Products For AllDocument44 pagesFWD Producst: Products For AllCharish DanaoNo ratings yet

- Certificate of Insurance - Indiafirst Life Group Loan Protect PlanDocument10 pagesCertificate of Insurance - Indiafirst Life Group Loan Protect PlanChandrahas KumarNo ratings yet

- GTL 49340100008832Document5 pagesGTL 49340100008832Aniket KashyapNo ratings yet

- PP000208 0FR9G CertificateOfInsDocument2 pagesPP000208 0FR9G CertificateOfInsAbhijeetPawarNo ratings yet

- Ga000027 Karimnagar 1052400 65600418 CmkgajlDocument2 pagesGa000027 Karimnagar 1052400 65600418 CmkgajlVasu AmmuluNo ratings yet

- MN230823064415795Document7 pagesMN230823064415795Dare KarNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaRai BrijNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaRajnish SinghNo ratings yet

- HDFC Life Premium - UnlockedDocument7 pagesHDFC Life Premium - UnlockedHemant SinghNo ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- MN240617070711864Document4 pagesMN240617070711864eshwarj002No ratings yet

- Bajaj IllustratiionDocument4 pagesBajaj IllustratiionvasuNo ratings yet

- 10 Pay With Return of Premium of MR SrinivasDocument4 pages10 Pay With Return of Premium of MR SrinivasvasuNo ratings yet

- Future Generali New Assure Plus Policy-Document 133n065v01Document45 pagesFuture Generali New Assure Plus Policy-Document 133n065v01testNo ratings yet

- Scheme DetailsDocument1 pageScheme DetailsSubhadip MaitiNo ratings yet

- Generate COIDocument2 pagesGenerate COIsaumitra ghogaleNo ratings yet

- InsurancekitDocument11 pagesInsurancekitmr.360clickzNo ratings yet

- 825 E-Term 288V01 SLDocument5 pages825 E-Term 288V01 SLIncredible MediaNo ratings yet

- 25580864Document6 pages25580864ktr.kdlNo ratings yet

- Life Insurance Corporation of India Central Office: LIC's Amritbaal (Plan No: 874) ofDocument21 pagesLife Insurance Corporation of India Central Office: LIC's Amritbaal (Plan No: 874) ofdineshmani01No ratings yet

- LIC - Single Premium Endowment Plan - Sales Brochure - 4 Inch X 9 Inch - EngDocument11 pagesLIC - Single Premium Endowment Plan - Sales Brochure - 4 Inch X 9 Inch - Engmeet2kaurjasvinderNo ratings yet

- LIC - Single Premium Endowment Plan - Sales Brochure - 4 Inch X 9 Inch - EngDocument14 pagesLIC - Single Premium Endowment Plan - Sales Brochure - 4 Inch X 9 Inch - EngSonu KumarNo ratings yet

- Sample Policy Document LIC S Dhan SanchayDocument19 pagesSample Policy Document LIC S Dhan SanchayChandra ShekarNo ratings yet

- Jeevan Kiran BrochureDocument24 pagesJeevan Kiran BrochureIsmailYusufAscJrcollegeNo ratings yet

- MN240617070695810Document4 pagesMN240617070695810eshwarj002No ratings yet

- UBI Loan InsuranceDocument13 pagesUBI Loan InsuranceSuraj Pratap PhalkeNo ratings yet

- Sampoorn Suraksha Non - Employer - Employee Brochure - BRDocument8 pagesSampoorn Suraksha Non - Employer - Employee Brochure - BRpraveen kumarNo ratings yet

- Benefit Illustration For SUD Life New Aashiana Suraksha (UIN: 142N055V02)Document3 pagesBenefit Illustration For SUD Life New Aashiana Suraksha (UIN: 142N055V02)Pandit Katti NarahariNo ratings yet

- 70015610793Document7 pages70015610793Gump ForestNo ratings yet

- 933 Sales Brochure Jeevan LakshyaDocument16 pages933 Sales Brochure Jeevan LakshyaPREM MURUGANNo ratings yet

- SBI+Life +Smart+Bachat+Plus+V01 BrochureDocument20 pagesSBI+Life +Smart+Bachat+Plus+V01 Brochurechanti.singamNo ratings yet

- SampoornaDocument1 pageSampoornaimam janiNo ratings yet

- Certificate of Insurance - 20!06!59Document3 pagesCertificate of Insurance - 20!06!59Patel SunilkumarNo ratings yet

- Tata Capital Financial Services LTD TCFPL0631000011147040 Fort Mumbai Rahul Vishwanath Mayee 42Document6 pagesTata Capital Financial Services LTD TCFPL0631000011147040 Fort Mumbai Rahul Vishwanath Mayee 42Rahul MayeeNo ratings yet

- Et Uch: Key Feature DocumentDocument4 pagesEt Uch: Key Feature Documentabdulk1432No ratings yet

- Policy-Document LIC-s New-Jeevan AmarDocument15 pagesPolicy-Document LIC-s New-Jeevan AmarprabhatzmauryaNo ratings yet

- E-Term Policy DocumentDocument23 pagesE-Term Policy DocumentpraveenNo ratings yet

- Metlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Document4 pagesMetlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Amit PrasadNo ratings yet

- Final Policy Doc - LIC S Jeevan UmangDocument20 pagesFinal Policy Doc - LIC S Jeevan UmangdemoNo ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- Part A Welcome To Max Life Insurance: Page 1 of 21Document21 pagesPart A Welcome To Max Life Insurance: Page 1 of 21ZafarNo ratings yet

- Ola OlaolaDocument3 pagesOla Olaolabhanu rajawatNo ratings yet

- Certificate of Insurance - 1711814142865Document6 pagesCertificate of Insurance - 1711814142865Ashok KumarNo ratings yet

- Sales Brochure LIC S Saral PensionDocument10 pagesSales Brochure LIC S Saral PensionKshitij KumarNo ratings yet

- Sampoorna Raksha Plus 110N130V06Document30 pagesSampoorna Raksha Plus 110N130V06p0303rNo ratings yet

- Critical Illness Insurance Policy WordingsDocument78 pagesCritical Illness Insurance Policy Wordingsblancaliliaortegamedina85No ratings yet

- Sales Brochure LIC-s E-Term Rev PDFDocument3 pagesSales Brochure LIC-s E-Term Rev PDFRamesh ThumburuNo ratings yet

- Lai-121596463 TNC DocumentDocument4 pagesLai-121596463 TNC Documentwajid08.awNo ratings yet

- Insurance 1718847255488Document7 pagesInsurance 1718847255488Vaishak VijayanNo ratings yet

- Sales Brochure LIC S Jeevan Lakshya PDFDocument11 pagesSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10No ratings yet

- Lic English Leaflet Jeevan Saral4x9 Inches WXHDocument12 pagesLic English Leaflet Jeevan Saral4x9 Inches WXHEkta SinhaNo ratings yet

- Lic NEW Jeevan Anand 2024 4x9 inches wxh single page - FINAL - 24.10.24Document22 pagesLic NEW Jeevan Anand 2024 4x9 inches wxh single page - FINAL - 24.10.24Akshata KulkarniNo ratings yet

- New PdsDocument5 pagesNew PdsnadiaNo ratings yet

- 93 111N035V01 Dhanaraksha Plus LPPTDocument9 pages93 111N035V01 Dhanaraksha Plus LPPTanshfeaturesNo ratings yet

- Final Policy Doc - LIC S SP Endwoment PlanDocument17 pagesFinal Policy Doc - LIC S SP Endwoment Plansantosh kumarNo ratings yet

- Jeevan Labh 736 BrochureDocument17 pagesJeevan Labh 736 Brochureksdborewells2020No ratings yet

- LIC - Jeevan Labh - Sales Brochure - 4 Inch X 9 Inch - EngDocument16 pagesLIC - Jeevan Labh - Sales Brochure - 4 Inch X 9 Inch - Engtakmash69No ratings yet

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Document23 pagesYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?gkNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Chapter 2 UnderwritingDocument6 pagesChapter 2 UnderwritingYoko BhaiNo ratings yet

- Micro OB Session 1 SDocument22 pagesMicro OB Session 1 SYoko BhaiNo ratings yet

- DocScanner 31-Jan-2022 2.26 PMDocument106 pagesDocScanner 31-Jan-2022 2.26 PMYoko BhaiNo ratings yet

- DocScanner 14-Feb-2022 12.06 PMDocument26 pagesDocScanner 14-Feb-2022 12.06 PMYoko BhaiNo ratings yet

- Sapm NewDocument58 pagesSapm NewYoko BhaiNo ratings yet

- Upload ZDFDFGDocument5 pagesUpload ZDFDFGYoko BhaiNo ratings yet

- HDFC Click2protectlife BrochureDocument25 pagesHDFC Click2protectlife BrochureaaaNo ratings yet

- Allianz eAZy Health Agency Digital Brochure 20200212Document4 pagesAllianz eAZy Health Agency Digital Brochure 20200212chrismsawiNo ratings yet

- My: Optima SecureDocument4 pagesMy: Optima Secureaparna singhNo ratings yet

- Beginning of Examination : P P P P P PDocument35 pagesBeginning of Examination : P P P P P Pcui yueNo ratings yet

- Prospectus New India Floater Mediclaim 21012020 - 1Document20 pagesProspectus New India Floater Mediclaim 21012020 - 1mail2sranjanNo ratings yet

- Creditshield Gold Information SheetDocument2 pagesCreditshield Gold Information SheetAhmad NurdinNo ratings yet

- Edelweiss Tokio Life - Income Builder: An Individual, Non-Linked, Non-Par, Savings, Life Insurance ProductDocument16 pagesEdelweiss Tokio Life - Income Builder: An Individual, Non-Linked, Non-Par, Savings, Life Insurance ProductsoumyakantNo ratings yet

- SRS Vitality Protect LeafletDocument4 pagesSRS Vitality Protect LeafletPraveen KumarNo ratings yet

- TD Insurance Product GuideDocument39 pagesTD Insurance Product Guidetake.a.chance123456No ratings yet

- Pro-Fit - Internal Booklet (Print)Document24 pagesPro-Fit - Internal Booklet (Print)Meet GohilNo ratings yet

- CCP&CCM PDFDocument4 pagesCCP&CCM PDFjOHN rEMEDYNo ratings yet

- Smart Protection Goal: Bajaj Allianz LifeDocument5 pagesSmart Protection Goal: Bajaj Allianz LifevasuNo ratings yet

- Royal Sundaram General Insurance Co. Limited: September 05, 2019Document6 pagesRoyal Sundaram General Insurance Co. Limited: September 05, 20191stabhishekNo ratings yet

- Critical IllnessDocument1 pageCritical IllnessStar HealthNo ratings yet

- DOM0000514000103Document7 pagesDOM0000514000103harshNo ratings yet

- Downlaod BrochureDocument13 pagesDownlaod BrochureAkshay SaxenaNo ratings yet

- Black Book Project 2Document51 pagesBlack Book Project 2Pragya SinghNo ratings yet

- Manonmaniam Sundaranar University: Insurance and Risk ManagementDocument190 pagesManonmaniam Sundaranar University: Insurance and Risk ManagementDevanshu JulkaNo ratings yet

- CeMap 2 - Sample PaperDocument36 pagesCeMap 2 - Sample PaperJason ChengNo ratings yet

- 2856205176904600000Document4 pages2856205176904600000sanskritikatyaynimishraNo ratings yet

- Mrs. Nagma Aejaz Mujawar Kadamwak Wasti, Loni Kalbhor, Taluka Haveli, Loni Kalbhor, Near Pyasa Hotel, Haveli, Pune, Maharashtra, 41 2201 7620063293Document33 pagesMrs. Nagma Aejaz Mujawar Kadamwak Wasti, Loni Kalbhor, Taluka Haveli, Loni Kalbhor, Near Pyasa Hotel, Haveli, Pune, Maharashtra, 41 2201 7620063293Aejaz MujawarNo ratings yet

- Max Life Smart Total Elite Protection Plan - PolicyBrochureDocument31 pagesMax Life Smart Total Elite Protection Plan - PolicyBrochureBahubali PrithvirajNo ratings yet

- SequiseZ 70000ON210156 2022 11 11Document19 pagesSequiseZ 70000ON210156 2022 11 11Vipul SinghNo ratings yet

- Product Disclosure SheetDocument3 pagesProduct Disclosure SheetshamsulNo ratings yet

- Marketing Share of TATA AIG Life Insurance NewDocument81 pagesMarketing Share of TATA AIG Life Insurance NewDeepak SinghalNo ratings yet

- HDFC Life Sanchay Par Advantage Retail BrochureDocument18 pagesHDFC Life Sanchay Par Advantage Retail BrochureDilshad ViraniNo ratings yet

- Quality Coverage When You Need It Most: Critical Illness InsuranceDocument8 pagesQuality Coverage When You Need It Most: Critical Illness InsuranceVin BitzNo ratings yet

- 4225i_ELVT_371855076_00_000_unlockedDocument24 pages4225i_ELVT_371855076_00_000_unlockedbhavin5386No ratings yet

- Policy BreakdownDocument4 pagesPolicy BreakdownSparsh Panwar 067 F2No ratings yet