Ratio Analysis

Ratio Analysis

Uploaded by

Ramiz RajaCopyright:

Available Formats

Ratio Analysis

Ratio Analysis

Uploaded by

Ramiz RajaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ratio Analysis

Ratio Analysis

Uploaded by

Ramiz RajaCopyright:

Available Formats

Ratio analysis

The r ratio analysis is made under six broad categories as follows:

1) Long term Solvency ratios

2) Short term solvency ratios

3) Profitability ratios

4) Activity ratios

5) Operating ratios

6) Market ratios

Long term Solvency Ratios

The long-term financial stability of the firm may be considered as independent upon its

ability to meet all its liability including including those not currently payable. The ratios

which are important in measuring the long-term solvency is as follows;

i) Debt -Equity Ratio

ii) Shareholders Equity Ratio

iii) Debt to net worth Ratio

iv) Capital gearing Ratio

v) Fixed Assets to Long Term fonds Ratio

vi) Propriety Ratio

vii)Dividend coverage Ratio

Viii) Interest Coverage Ratio

Short term Solvency Ratios

i) Current Ratio

ii) Quick Ratio or Liquid Ratio

iii) Absolute Liquid Ratio

Profitability Ratios

i) Return on Capital Employed or Return on Investment

ii) Earnings per share (EPS)

iii) Cash earning per share

iv) Gross Profit Margin

v) Net Profit Margin

vi) Cash Profit Ratio

vii) Return on Assets

viii) Return on Net Worth (Return on Shareholders’ Equity

Activity Ratios or Turnover Ratios

i) Inventory turn over Ratios

ii) Inventory Ratio

iii) Debtors Turnover Ratio

iv) Average Collection Period

v) Bad Debts to Sales Ratio

vi) Creditors Turnover Ratio

vii) Creditors Turnover Period

viii) Assets Turnover Ratio

ix) Fixed Assets Turnover Ratio

x) Total Assets Turnover Ration

xi) Working Capital Turnover Ratio

xii) Sales to Capital Employed Ratio

Operating Ratios

i) Material Cost Ratio

ii) Labour cost Ratio

iii) Factory overhead Ratio

iv) Administrative expenses Ratio

v) Selling and distribution expenses Ratio

Market Test Ratio

i) Dividend Payout Ratio

ii) Divined yield ratio

iii) Book Value Ratio

iv) Price/Earnings Ratio.

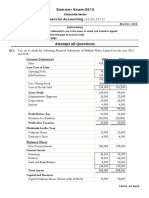

Exer. 1From the given Balance Sheets. Calculate:

(a) Debt- equity ratio

(b) Liquid ratio

(c) Fixed assets to current assets ratio

(d) Fixed assets to Net worth ratio.

Balance Sheet

Liabilities Rs. Assets Rs,

Share Capital 1,00,000 Goodwill 60,000

Reserve 20,000 Fixed assets (Cost) 1,40,000

Profit and loss a/c 30,000 Stock 30,000

Secured Loans 80,000 Debtors 30,000

Creditors 50,000 Advances 10,000

Provision for taxation 20,000 Cash 30,000

3,00,000 3,00,000

Exer.2 From the following data, Calculate:

(a) Current Ratio

(b) Quick Ratio

(c) Stock turnover Ratio

(d) Operating Ratio

(e) Rate of return on equity capital.

Balance Sheet as on Dec.31.2023

Liabilities Rs. Assets Rs.

Equity Share Capital (Rs.10.per 10,00,000 Plant and Machinery 6,40,000

share

Profit and Loss account 3,68,000 Land and buildings 80,000

Creditors 1,04,000 Cash 1,60,000

Bills Payable 2.00.000 Debtors 3,60,000 3,20,000

Less: Provision for bad debts

40.000

Other Current Liabilities 20,000 Stock 4,80,000

Prepaid Insurance 12,000

16.92.000 16,92,000

Income Statement for the year ending 31st Dec.2023

Sales 40,00,000

Less; Cost of goods sold 30,80,000

9,20,000

Less: Operating Expenses 6,80,000

Net Profit 2,40,000

Less: Income tax paid 50% 1,20,000

Net Profit after tax 1,20,000

Balances at the beginning of the year Debtors 3,00,000

Stock 4,00,000

Exer. 3 The Zurich Ltd financial statements contain the following information

Particulars 31st March,2023 31st March,2024

Cash 2,00,000 1,60,000

Sundry debtors 3.20,000 4,00,000

Temporary Investments 2,00,000 3,20,000

Stock 18,40,000 21,60,000

Prepaid expenses 28,000 12,000

Total current assets 25,88,000 30,52,000

Total Assets 56,00,000 64.00,000

Current liabilities 6,40,000 8,00,000

10% Debentures 16,00,000 16,00,000

Equity share capital 20,00,000 20,00,000

Retained earnings 4,68,000 8,12,000

Statement of profit for the year ended 31st March,2023

sales 40,00,000

Less: Cost of goods sold 28,00,000

Less: Interest 1,60,000 29,60,000

Net Profit for 2023 10,40,000

Less: Taxes @50% 5,20.000

Net Profit 5,20,000

Dividend declared on equity shares Rs. 2,20,000

From the above figures, appraise the financial position of the company from the points of view of (i)

liquidity (ii) Solvency (iii) profitability and activity.

You might also like

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3Xiena67% (3)

- Answer Key Chapters 1 7Document40 pagesAnswer Key Chapters 1 7Sheila Mae Guerta Lacerona74% (38)

- Financial Management - 1 PDFDocument85 pagesFinancial Management - 1 PDFKingNo ratings yet

- SWIFT Messages: Each Block Is Composed of The Following ElementsDocument10 pagesSWIFT Messages: Each Block Is Composed of The Following ElementsMAdhuNo ratings yet

- Assignment No. 1 Audit of CashDocument5 pagesAssignment No. 1 Audit of CashMa Tiffany Gura RobleNo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis ProblemsNavya SreeNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Solution 18preparation of Financial Statements Company Final AccDocument2 pagesSolution 18preparation of Financial Statements Company Final AccKajal BindalNo ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Management Accounting 2022 QPDocument4 pagesManagement Accounting 2022 QPsharanubalekai794No ratings yet

- Quiz in Safe Payment and Cash Priority Program With Answer Keys Part 2Document4 pagesQuiz in Safe Payment and Cash Priority Program With Answer Keys Part 2caraaatbongNo ratings yet

- Cash Flow Statement Test 1Document3 pagesCash Flow Statement Test 1beniwaljay465No ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- AS Book 1Document3 pagesAS Book 1Vashu ShrivastavNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- Important QuestionsDocument3 pagesImportant QuestionsNayan JainNo ratings yet

- Acc425 Tutorial Sheet 1Document4 pagesAcc425 Tutorial Sheet 1motiaeposiNo ratings yet

- Cash Flow Statement (BBA-H)Document5 pagesCash Flow Statement (BBA-H)asiharry037No ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- CMA Inter FMDA Importent QuestionsDocument43 pagesCMA Inter FMDA Importent QuestionsJesmina MajeedNo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis Problemssasirekha02758No ratings yet

- Accountancy TestDocument5 pagesAccountancy Testrafiaparveen2020No ratings yet

- Accounting Process ExtensionDocument24 pagesAccounting Process ExtensionVarad AngleNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Cash FLDocument4 pagesCash FLyash dNo ratings yet

- Ratio Analysis NumericalDocument3 pagesRatio Analysis NumericaldakukhuniNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- test bank 3Document12 pagestest bank 3susonken526No ratings yet

- Buyback of Shares Practice QuestionsDocument20 pagesBuyback of Shares Practice Questionsaryan.patel048No ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Q8Document2 pagesQ8Liam ChanningNo ratings yet

- Worksheet Tools of Financial Statements of A FirmDocument9 pagesWorksheet Tools of Financial Statements of A FirmpuxvashuklaNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFAnirban BiswasNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Ac QuestionsDocument7 pagesAc QuestionssamsherbdtamangNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- 3060_Part-III_COMMERCE_3H2_L_4Document4 pages3060_Part-III_COMMERCE_3H2_L_4anusha.adfamindiaNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Abhinav CA pptDocument7 pagesAbhinav CA pptAbhinav BhardwajNo ratings yet

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocument3 pagesFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNo ratings yet

- Cash Flow_Class Work Question_3.12.24Document2 pagesCash Flow_Class Work Question_3.12.24Oswal ChhajedNo ratings yet

- Introduction to finance & accountingDocument5 pagesIntroduction to finance & accountingmansisalweNo ratings yet

- Acc Practical QuestionsDocument6 pagesAcc Practical QuestionsyogochkeNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Account Chap 3 Tools for Financial AnalysisDocument3 pagesAccount Chap 3 Tools for Financial Analysisanjalirawlani4907No ratings yet

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- CFS Practice SheetDocument4 pagesCFS Practice Sheetdevgyanchandani19No ratings yet

- Basic ExerciseDocument5 pagesBasic Exercise23b4epgp142No ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Coins of India: Mughal Gold From The Skanda CollectionDocument15 pagesCoins of India: Mughal Gold From The Skanda CollectiontlananthuNo ratings yet

- Cost of CapitalDocument56 pagesCost of CapitalAndayani SalisNo ratings yet

- AirtelPaymentsBank_XXXXXX0395Document3 pagesAirtelPaymentsBank_XXXXXX0395sravslucky42No ratings yet

- Negotiable Instruments ActDocument49 pagesNegotiable Instruments ActJasMeetEdenNo ratings yet

- Macro Group Quiz1Document7 pagesMacro Group Quiz1votodex924No ratings yet

- Vsi Jaipur Ca Final ABC Analysis For May 2022 FRDocument4 pagesVsi Jaipur Ca Final ABC Analysis For May 2022 FRKeerthan GowdaNo ratings yet

- English For Banking - VocabularyDocument33 pagesEnglish For Banking - VocabularyÝ Duyên Nguyễn ThịNo ratings yet

- Rules & Regulations and Application FormatDocument9 pagesRules & Regulations and Application FormatJustin Jose PNo ratings yet

- Valuation-Income ApproachDocument38 pagesValuation-Income Approachhart kevinNo ratings yet

- 03 Zutter Smart MFBrief 15e ch03Document85 pages03 Zutter Smart MFBrief 15e ch03Komang MulianaNo ratings yet

- 2014 DDA Housing Scheme Delhi Application Form, Loan DetailsDocument13 pages2014 DDA Housing Scheme Delhi Application Form, Loan DetailsSantosh RajNo ratings yet

- Account STMT XX3368 11052024Document5 pagesAccount STMT XX3368 11052024abhaysawan123No ratings yet

- Your Current Account Terms 1Document28 pagesYour Current Account Terms 1sinisa simicNo ratings yet

- On The Scam of The Federal Reserve System PDFDocument5 pagesOn The Scam of The Federal Reserve System PDFMichael Drew PriorNo ratings yet

- Fabm Module 6Document4 pagesFabm Module 6Ruvie Mae Paglinawan100% (1)

- Problem 11&17Document12 pagesProblem 11&17Kaira GoNo ratings yet

- What's Your Investing IQDocument256 pagesWhat's Your Investing IQAmir O. OshoNo ratings yet

- FWDS Detailed ExampleDocument4 pagesFWDS Detailed ExampleZacks MchenyenyaNo ratings yet

- Answers To Questions Chapter 1Document5 pagesAnswers To Questions Chapter 1samah.fathi3No ratings yet

- Complete Download Financial Markets and Institutions 8th Edition Frederic S. Mishkin PDF All ChaptersDocument55 pagesComplete Download Financial Markets and Institutions 8th Edition Frederic S. Mishkin PDF All ChapterspayquehasynNo ratings yet

- Bill of Supply For Electricity Due Date: - : BSES Yamuna Power LTDDocument1 pageBill of Supply For Electricity Due Date: - : BSES Yamuna Power LTDShrishti Negi0% (1)

- What Is The Meaning of The Term Reinsurance?Document3 pagesWhat Is The Meaning of The Term Reinsurance?Shipra Singh0% (1)

- To Print JournalDocument5 pagesTo Print JournalDiana Grace SierraNo ratings yet

- Banking & Finance: Transfer Pricing of Interest Rates in The post-LIBOR EraDocument5 pagesBanking & Finance: Transfer Pricing of Interest Rates in The post-LIBOR Eraankur taunkNo ratings yet

- Reserve Bank of India भारतीय रिरज़र्व बैंकDocument14 pagesReserve Bank of India भारतीय रिरज़र्व बैंकRahul MittalNo ratings yet

- 103 400mDocument2 pages103 400mismail saltan100% (1)

- ADIT Prospectus (2024) - Report Format - Good For UseDocument28 pagesADIT Prospectus (2024) - Report Format - Good For UseRavi KumarNo ratings yet