Kordia Interim Report 2012

Kordia Interim Report 2012

Uploaded by

kordiaNZCopyright:

Available Formats

Kordia Interim Report 2012

Kordia Interim Report 2012

Uploaded by

kordiaNZCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Kordia Interim Report 2012

Kordia Interim Report 2012

Uploaded by

kordiaNZCopyright:

Available Formats

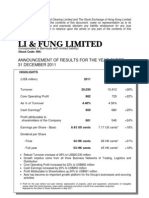

2012

HALF YEAR RESULTS

INTERIM REPORT

KORDIA GROUP LIMITED

P.2 INTERIM REPORT

P.1

KORDIA GROUP LIMITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS (UNAUDITED) FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

02 HALF YEAR RESULTS 2012 04 CONSOLIDATED INTERIM FINANCIAL STATEMENTS 16 DIRECTORY

P.2 INTERIM REPORT

P.3

HALF YEAR RESULTS 2012

Kordia has delivered a strong first half result with all four subsidiary businesses trading above their first half profit budgets. Compared to the December 2010 half year, revenue at $196.7m is up 45%. Net Profit After Tax at $7.3m compares to the December 2010 after tax loss of $(18.0)m. Despite the growth-driven funding requirements net debt has been further reduced, from $80.6m to $70.8m. The five year broadcast to broadband transformation was designed to establish new future growth paths for Kordia Group. Its success is evident as 60% of current revenue is in services which were non- existent five years ago. KORDIA NETWORKS A marketing campaign has been aimed at establishing Kordia Networks as the only Telco dedicated to business. This is a successful campaign achieving 72% prompted awareness from the target audience. Strong growth has continued for OnKor, the wide area network product and the associated ecosystem of services. Broadcast has performed ahead of expectations with solid demand for digital TV transmission services. ORCON The current business plan assumed that Telecom would provide widespread availability of sub-loop extension service (SLES). When this did not eventuate Orcon had an alternative its Genius product which is also ultra-fast broadband ready. This product was offered nationally and the full year sales budget was achieved in the first two months. Orcon was party to a settlement between Telecom and the Commerce Commission in 2011. KORDIA SOLUTIONS AUSTRALIA The last six months has seen a dramatic growth with staff count increasing by 28% from over 570 to 731 personnel. Strong business development efforts have culminated in new business in the telco and mining sectors. Growth is also attributed to customers shifting more business to Kordia due to its record of delivering complex network design and build projects on time and within budget. Geoff Hunt CEO - KORDIA GROUP 28 February 2012 David Clarke CHAIRMAN - KORDIA GROUP KORDIA SOLUTIONS NZ Kordia Solutions NZ has been steadily diversifying its customer base outside of the broadcast and telco sectors. It routinely undertakes assignments in difficult locations in Papua New Guinea, Fiji and the Solomon Islands. DIVIDEND Consistent with the disclosure in the Statement of Corporate Intent (SCI) the Group has declared an interim dividend of $1m. A total dividend of $2m is forecast for FY12. CONCLUSION Kordia Group is already exceeding targets stated in the SCI and is well positioned for a strong result this year. The focus is now on delivering benchmark financial performance.

P.4 INTERIM REPORT

P.5

KORDIA GROUP LIMITED

CONSOLIDATED INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

INCOME STATEMENT

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

Audited 30/6/11 In thousands of New Zealand dollars 294,541 Revenue 408 Finance income 294,949 Unaudited Note 31/12/11 31/12/10 3 196,643 136,028 59 292 196,702 136,320 98,662 67,162 16,447 3,737 10,694 3,423 7,271 60,415 50,821 15,933 4,208 116 29,043 (24,216) (6,212) (18,004)

CONTENTS

05 06 07 09 10 12 INCOME STATEMENT STATEMENT OF COMPREHENSIVE INCOME STATEMENT OF CHANGES IN EQUITY STATEMENT OF FINANCIAL POSITION STATEMENT OF CASH FLOWS NOTES TO THE INTERIM FINANCIAL STATEMENTS

134,896 108,147 31,692 8,409 173 1,348 29,054

Direct costs and overheads Employee and contractor expenses Depreciation and amortisation expense Finance costs Impairment of advances to associate Impairment of assets Impairment of a cash-generating unit

(18,770) Profit/(loss) before income tax (4,050) Income tax expense/(benefit) (14,720) Profit/(loss) for the period attributable to the equity holder

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

P.6 INTERIM REPORT

P.7

STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

Audited 30/6/11 In thousands of New Zealand dollars (14,720) Profit/(loss) for the period attributable to the equity holder 175 Foreign currency translation differences 289 Effective portion of changes in fair value of cashflow hedges (84) Tax effect of the effective portion of changes in the fair value of cashflow hedges 380 Other comprehensive income for the period (14,340) Total comprehensive income for the period Unaudited 31/12/11 31/12/10 7,271 (18,004) 240 (1,015) 302 (473) 6,798 738 642 (193) 1,187 (16,817)

STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011 (UNAUDITED)

Share Capital 87,696 Retained Earnings (4,522) 7,271 Foreign Currency Translation Reserve 1,240 Cashflow Hedge Reserve (2,783) -

In thousands of New Zealand dollars Balance 1 July 2011 Net profit for the period Other comprehensive income Foreign currency translation differences Effective portion of changes in fair value of cashflow hedges, net of tax Fair value of cashflow hedges transferred to income statement, net of tax Total other comprehensive income Total comprehensive income for the period Balance 31 December 2011

Total 81,631 7,271

240 -

(515) (198)

240 (515) (198)

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

7,271

240 240

(713) (713)

(473) 6,798

87,696

2,749

1,480

(3,496)

88,429

FOR THE SIX MONTHS ENDED 31 DECEMBER 2010 (UNAUDITED)

Foreign Currency Retained Translation Earnings Reserve 10,198 1,065 (18,004) Cashflow Hedge Reserve (2,988)

In thousands of New Zealand dollars Balance 1 July 2010 Net loss for the period Other comprehensive income Foreign currency translation differences Effective portion of changes in fair value of cashflow hedges, net of tax Fair value of cashflow hedges transferred to income statement, net of tax Total other comprehensive income Total comprehensive income for the period Balance 31 December 2010

Share Capital 87,696 -

Total 95,971

- (18,004)

738 -

466 (17)

738 466 (17)

(18,004)

738 738

449

1,187

449 (16,817)

87,696

(7,806)

1,803

(2,539)

79,154

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

P.8 INTERIM REPORT

P.9

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 30 JUNE 2011 (AUDITED)

Share Capital 87,696 Retained Earnings 10,198 (14,720) Foreign Currency Translation Reserve 1,065 Cashflow Hedge Reserve (2,988) -

CONTINUED

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2011

Audited 30/6/11 In thousands of New Zealand dollars Assets 109,277 Property, plant and equipment 57,955 Intangible assets 60 Derivative assets 4,111 Deferred tax assets - Loan to associate 171,403 Total non-current assets 5,559 Cash 60,109 Trade and other receivables and contract work in progress 328 Taxation receivables 5 Derivative assets 1,177 Inventories 67,178 Total current assets 238,581 Total assets Note Unaudited 31/12/11 31/12/10 111,713 57,029 5,940 174,682 2,295 73,414 8 2,095 77,812 252,494 113,803 59,879 151 3,821 721 178,375 5,746 44,226 415 15 1,397 51,799 230,174

In thousands of New Zealand dollars Balance 1 July 2010 Net loss for the year Other comprehensive income Foreign currency translation differences Effective portion of changes in fair value of cashflow hedges, net of tax Fair value of cashflow hedges transferred to income statement, net of tax Total other comprehensive income Total comprehensive income for the year Balance 30 June 2011

Total 95,971 (14,720)

175 -

222 (17)

175 222 (17)

(14,720)

175 175

205

380

205 (14,340)

87,696

(4,522)

1,240

(2,783)

81,631 Equity and Liabilities Share capital Foreign currency translation reserve Cashflow hedge reserve Retained earnings Total equity attributable to the equity holder Payables and deferred income Derivative liabilities Provisions Finance lease liability Loans and advances Deferred taxation Total non-current liabilities Payables and deferred income Taxation payable Derivative liabilities Provisions Finance lease liability Loans and advances Total current liabilities

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

87,696 1,240 (2,783) (4,522) 81,631 3,777 3,884 5,484 167 69,020 446 82,778 60,810 1,065 288 1,806 203 10,000 74,172

87,696 1,480 (3,496) 2,749 88,429 3,984 4,968 5,747 105 52,797 67,601 70,420 4,087 178 1,625 154 20,000 96,464 164,065 252,494

87,696 1,803 (2,539) (7,806) 79,154 3,992 3,486 7,484 270 70,466 85,698 47,937 450 1,306 629 15,000 65,322 151,020 230,174

156,950 Total liabilities 238,581 Total equity and liabilities

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

P.10 INTERIM REPORT

P.11

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

Audited 30/6/11 In thousands of New Zealand dollars Cash flows from operating activities 279,832 Receipts from customers (229,936) Payments to suppliers and employees 49,896 3 405 (7,881) (38) (2,705) 39,680 Dividends received Interest received Interest paid - other Interest paid - finance lease Taxes (paid) Net cash from/(used in) operating activities Cash flows from investing activities Proceeds from sale of property, plant and equipment Acquisition of property, plant and equipment Acquisition of intangibles and frequency licences Acquisition of assets of a company, net of cash acquired Proceeds from a government grant Loan to associate Net cash from/(used in) investing activities Unaudited 31/12/11 31/12/10 187,317 139,539 (160,829) (111,401) 26,488 28,138 2 59 (3,567) (12) (1,975) 20,995 4 288 (3,771) (22) (1,887) 22,750

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

Audited 30/6/11 In thousands of New Zealand dollars Reconciliation of net surplus for the period with cash flows from operating activities (14,720) Net surplus/(deficit) as per income statement Add/(deduct) non cash items: Depreciation Amortisation and write off of licences and intangibles Unrealised foreign currency losses/(gains) Change in deferred tax/(future income tax benefit) Movement in provision for doubtful and bad debts Unwind/change in make good Impairment of advance to associate Impairment of assets Movement in other provisions Impairment of a cash-generating unit Note Unaudited 31/12/11 31/12/10

CONTINUED

7,271

(18,004)

128 (15,112) (7,069) (2,376) 775 183 (23,471)

66 (15,997) (1,755) (17,686)

98 (8,501) (1,843) (2,509) (324) (13,079)

26,889 4,803 (145) (7,391) 388 269 173 1,348 (1,909) 29,054 38,759

13,571 2,876 49 (1,902) 503 137 (100) 22,405

15,291 642 45 (7,462) 89 116 129 29,043 19,889

Cash flows from financing activities (13,726) Proceeds from/(repayment of) loans and advances (1,033) Repayment of finance lease liabilities (14,759) Net cash from/(used in) financing activities 1,450 3,942 167 5,559 Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at beginning of the period Effect of exchange rate fluctuations on cash Cash and cash equivalents at end of the period

(6,530) (111) (6,641) (3,332) 5,559 68 2,295

(7,612) (504) (8,116) 1,555 3,942 249 5,746

Items classified as investing activities: 135 Loss/(gain) on disposal of property, plant and equipment 740 Working capital acquired on the acquisition of assets of a company 875 Movements in working capital: (17,178) Receivables and prepayments 458 Inventories 16,766 Payables 46 39,680 Net cash flows from operating activities

54 54

88 873 961

(13,385) (918) 12,839 (1,464) 20,995

(1,382) 238 3,044 1,900 22,750

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

The notes set out on pages 12 to 14, form part of, and should be read in conjunction with, the Interim Financial Statements.

P.12 INTERIM REPORT

P.13

NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011 1. REPORTING ENTITY

Kordia Group Limited (the Company) is a limited liability company incorporated and domiciled in New Zealand under the Companies Act 1993 and is wholly owned by the Crown. The registered office of the Company is Level 4, Fidelity House, 81 Carlton Gore Road, Newmarket, Auckland, New Zealand. The consolidated financial statements presented here are for the reporting entity Kordia Group Limited comprising the Company, its subsidiaries and the Groups interest in associates. The financial statements of the Group have been prepared in accordance with the requirements of the Companies Act 1993, the Financial Reporting Act 1993 and the State Owned Enterprises Act 1986.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011 4. LOANS AND ADVANCES

Audited 30/6/11 In thousands of New Zealand dollars 79,020 Bank loans (unsecured) Loan facilities are repayable as follows: 10,000 Within one year 69,020 One to two years - Two to four years 79,020 Weighted average interest rates: 4.5% Bank loans 8.9% Bank loans amended for derivatives, line fees and margin 4.5% 8.9% 5.0% 9.0% 20,000 52,797 72,797 15,000 70,466 85,466 Unaudited 31/12/11 72,797 31/12/10 85,466

CONTINUED

STATEMENT OF COMPLIANCE

The Interim Financial Statements have been prepared in accordance with NZ IAS 34, Interim Financial Statements. The consolidated financial statements do not include all of the information required for full annual financial statements and should be read in conjunction with the consolidated financial statements of the Group as at and for the year ended 30 June 2011. The financial statements were authorised for issue by the directors on 28 February 2012. The financial statements have been prepared on the basis of historical cost unless otherwise noted within the specific accounting policies. These financial statements are presented in New Zealand dollars ($), which is the Companys functional currency. All financial information presented in New Zealand dollars has been rounded to the nearest thousand.

ESTIMATES AND JUDGEMENTS

The preparation of financial statements requires management to make judgements, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised and in any future periods affected. In the opinion of management, all adjustments necessary for a fair presentation of the results of operations, financial position and cash flows have been reflected.

The loan facilities comprise a syndicated revolving cash advance facility, dated 29 June 2009 and amended and restated on 29 June 2010, and amended by a letter dated 20 December 2010, committed to a maximum amount of $110 million (2010: $120 million). The loans drawn and facility available is analysed as follows:

31/12/11 Balance Drawn Current Noncurrent 55,397 (2,600) 52,797 Available Facility Current 20,000 20,000 Noncurrent 80,000 10,000 90,000 15,000 Current 15,000

31/12/10 Balance Drawn Noncurrent 70,466 70,466 Available Facility Current 20,000 10,000 30,000 Noncurrent 80,000 10,000 90,000

2. STATEMENT OF ACCOUNTING POLICIES

The Interim Financial Statements presented here are the consolidated financial statements of the Group comprising Kordia Group Limited and its subsidiaries, for the six months ended 31 December 2011 and 2010. Both periods are unaudited. The audited annual results for the year ended 30 June 2011 are also presented. The accounting policies used in the preparation of the Interim Financial Statements are consistent with those used for the year ended 30 June 2011 and the six months ended 31 December 2010. The Group has not applied any standards, amendments to standards and interpretations that are not yet effective.

Tranche A Tranche B Tranche C

20,000 20,000

3. REVENUE

Audited 30/6/11 In thousands of New Zealand dollars 221,669 Transmission services 72,372 Internet services 500 Other 294,541 Total Revenue Unaudited 31/12/11 146,373 41,008 9,262 196,643 136,028 31/12/10 101,419 34,609

Tranche C is a working capital facility which enables the Group to manage its cashflow on a daily basis. At 31 December 2011, the facility was in credit as excess funds were available in the Groups bank account thereby enabling a credit to the working capital facility, this credit is interest bearing. Tranche A is renewable by agreement between Kordia and the members of the syndicate annually and has a lower fee and margin structure than the three year Tranche B and C facilities. Tranche A was due to expire on 30 June 2011 however this was renewed on 10 May 2011 for a further period of one year. Tranche B and C were committed to $100m to 31 May 2011 and this reduced by $10m on 31 May 2011 to $90m for the remainder of the term to June 2013. As $20m was drawn as current under Tranche A, current liabilities exceed current assets by $18.6m (2010: $13.5m). Net debt, as defined in the syndicated revolving cash advance facility, as at 31 December 2011 was $70.8m (2010: $80.6m) with the majority of the debt under a facility which expires in June 2013. Consistent with improved profitability and further debt reduction, the Group is currently in negotiations to renew and extend its facilities to include a tranche of the facility to September 2015.

Other revenue includes various resolutions and settlements reached with a supplier and insurance settlements relating to the loss on damaged assets as a result of the Christchurch earthquake.

P.14 INTERIM REPORT

P.15

NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2011

The Board is of the opinion, there is minimal liquidity risk because: The split of funding between current and non-current was a conscious decision to be in line with the Groups treasury policy which stipulates progressive expiry/renewal dates for debt facilities. The facility has a portion of one year debt to take advantage of lower bank margins and commitment fees. During the 12 months ended 31 December 2011, the Group paid back net debt of $9.8m. The Board forecasts a further debt reduction in the 2012 financial year and the group continues to trade with strong EBITDAs. The facility is supported by a negative pledge by the Company and its guaranteeing subsidiaries over their assets and undertakings. The negative pledge restricts the disposal of assets other than in the ordinary course of business or within certain materiality thresholds. Under the negative pledge, each guaranteeing subsidiary may be liable for indebtedness incurred by the Company and other guaranteeing subsidiaries. The facility is subject to various covenants such as limitations on gearing, interest cover, minimum shareholders; funds and coverage (the proportion of the consolidated group that forms the guaranteeing group under the negative pledge). The Group was in compliance with all covenants for the interim periods ended 31 December 2011 and 2010 and the year ended 30 June 2011.

CONTINUED

NOTES

5. COMMITMENTS

Audited 30/6/11 In thousands of New Zealand dollars 96,897 Operating lease commitments 5,156 Capital commitments Unaudited 31/12/11 31/12/10 102,976 5,327 83,366 3,734

6. CONTINGENT LIABILITIES

As part of its contractual obligations with clients, the Group has an undertaking to provide services at a certain level and should this not be achieved, the Group may be liable for contract penalties. It is not possible to quantify what these may be until an event has occurred. The Directors do not expect any liabilities to occur as a result of these contractual obligations. The Company makes advances to its subsidiary companies. The Companys loan facility comprises a syndicated revolving cash advance facility committed to a maximum amount of $110 million (2010: $120 million). The facility is supported by a negative pledge by the Company and its guaranteeing subsidiaries over their assets and undertakings. Under the negative pledge, each guaranteeing subsidiary may be liable for indebtedness incurred by the Company and other guaranteeing subsidiaries. The Company considers the negative pledge in the individual subsidiaries financial statements to be an insurance contract. Such contracts and cross guarantees are treated as a contingent liability and only recognised as a liability if a payment becomes probable.

7. EVENTS SUBSEQUENT TO BALANCE DATE

On 28 February 2012 the Board of Directors declared an interim dividend of $1 million (2011: nil). There are no other events subsequent to balance date which have a significant effect on the financial statements.

P.16 INTERIM REPORT

P.17

DIRECTORY

Kordia has harmonised its business to deliver what customers want. With a wealth of experience in broadcast and telecommunications solutions, and specialised networks, we are poised to leverage that experience, and deliver what people want from technology. Our products and our infrastructure are a valuable asset but not as precious to us as our people. Our people are who we are, what we stand for and how we deliver. You can contact us online at www.kordia.co.nz or at any of the following locations:

NEW ZEALAND Auckland Level 4, Fidelity House 81 Carlton Gore Road Newmarket P O Box 2495 Auckland 1023 P. +64 9 551 7000 F. 0800 KORFAX Christchurch Unit 12, Cavendish Business Park 150 Cavendish Road Casebrook 8051 P O Box 5320 Papanui 8542 P. +64 3 550 1015 F. 0800 KORFAX Dunedin 182 Albany Street North Dunedin 9016 P O Box 6080 Dunedin 9059 P. +64 3 550 1032 F. 0800 KORFAX Hamilton 14 Aztec Place Frankton Hamilton 3204 P. +64 7 562 1015 F. 0800 KORFAX Wellington Level 12, Kordia House 109-125 Willis Street P O Box 98 Wellington 6040 P. +64 4 914 8000 F. 0800 KORFAX Level 6 Avalon Business Centre Percy Cameron Street P O Box 31642 Lower Hutt 5040 P. +64 4 914 8335 F. +64 4 914 8377 AUSTRALIA ACT Level 2 82 Northbourne Avenue Braddon ACT 2612 P. +61 2 9856 2600 F. +61 2 6230 7462 New South Wales Level 2 4 Drake Avenue Macquarie Park NSW 2113 P. +61 2 9856 2600 F. +61 2 9856 2695 Unit 6, 21 Kangoo Road Somersby NSW 2250 P. +61 2 9856 2600 F. +61 2 4340 1426 THAILAND 23 Uhrig Road Homebush NSW 2140 P. +61 2 9856 2600 F. +61 2 9648 3170 Queensland 11 Ashtan Place Banyo QLD 4014 P. +61 2 9856 2600 F. +61 7 3267 7321 South Australia 29 Walsh Street Thebarton SA 5031 P. +61 2 9856 2600 F. +61 8 8234 2227 ORCON NEW ZEALAND Auckland Building B 28 The Warehouse Way Akoranga Business Park Northcote Auckland Tel: 0800 55 2000 Fax: 0800 19 99 99 Thailand 60/1 Monririn Building (Room A105) Soi Phaholyothin 8 Phaholyothin Road Samsennai Phayathai Bangkok 10400 Tel: +66 2 270 1520 Fax: +66 2 271 2225 Victoria Unit 11 181 Rooks Road Vermont VIC 3133 P. +61 2 9856 2600 F. +61 3 9873 5012 Unit 1B 4 Rocklea Drive Port Melbourne VIC 3207 P. +61 2 9856 2600 F. +61 3 8359 0350 Western Australia 1/21 Tulloch Way Canning Vale WA 6155 P. +61 2 9856 2600 F. +61 8 9456 2130

BANKERS Bank of New Zealand / National Australia Bank Commonwealth Bank of Australia Australia New Zealand Banking Group

AUDITORS KPMG on behalf of the Auditor-General SOLICITORS Simpson Grierson (New Zealand) Blake Dawson (Australia)

WWW.KORDIASOLUTIONS.COM

You might also like

- 2015 - AFS - Steel Asia Manufacturing CorpDocument58 pages2015 - AFS - Steel Asia Manufacturing CorpMarius Angara100% (2)

- ISO 27001:2022 - ISO 27002:2022: Annex A Clause 5.16 Identity ManagementDocument2 pagesISO 27001:2022 - ISO 27002:2022: Annex A Clause 5.16 Identity Managementfadwa turkiNo ratings yet

- Handbook Security For Security OfficialsDocument87 pagesHandbook Security For Security OfficialsIoan COMANNo ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- FY 2012 Audited Financial StatementsDocument0 pagesFY 2012 Audited Financial StatementsmontalvoartsNo ratings yet

- GMH 2011 Depot - 14 - 154891Document50 pagesGMH 2011 Depot - 14 - 154891LuxembourgAtaGlanceNo ratings yet

- DYE110831 - Appendix 4E - Preliminary Final ReportDocument13 pagesDYE110831 - Appendix 4E - Preliminary Final ReportMattNo ratings yet

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- NIF 2010 Financial Staterments (Final)Document32 pagesNIF 2010 Financial Staterments (Final)WeAreNIF100% (1)

- Ch02 - Financial ManagmentDocument9 pagesCh02 - Financial ManagmentAhmed SallamNo ratings yet

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDocument23 pagesFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlNo ratings yet

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300No ratings yet

- Negros Navigation Co., Inc. and SubsidiariesDocument48 pagesNegros Navigation Co., Inc. and SubsidiarieskgaviolaNo ratings yet

- SGXQAF2011 AnnouncementDocument18 pagesSGXQAF2011 AnnouncementJennifer JohnsonNo ratings yet

- 2012 Annual Financial ReportDocument76 pages2012 Annual Financial ReportNguyễn Tiến HưngNo ratings yet

- MSC-Audited FS With Notes - 2014 - CaseDocument12 pagesMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorNo ratings yet

- ACC1006 EOY Essay DrillDocument13 pagesACC1006 EOY Essay DrillTiffany Tan Suet YiNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Hannans Half Year Financial Report 2010Document18 pagesHannans Half Year Financial Report 2010Hannans Reward LtdNo ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- TSL Audited Results For FY Ended 31 Oct 13Document2 pagesTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- CH 02Document30 pagesCH 02Awais KarneNo ratings yet

- Hannans Half Year Financial Report 2011Document18 pagesHannans Half Year Financial Report 2011Hannans Reward LtdNo ratings yet

- NIF 2011 Financial StatermentsDocument33 pagesNIF 2011 Financial StatermentsWeAreNIFNo ratings yet

- STERLUBE AFRICA LTD 2021 (1)Document12 pagesSTERLUBE AFRICA LTD 2021 (1)Christopher Mwithi MbithiNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Qbe 10-KDocument183 pagesQbe 10-Kftsmall0% (1)

- Interim Report 1 April - 30 September 2024: Second Quarter (1 July - 30 September 2024)Document22 pagesInterim Report 1 April - 30 September 2024: Second Quarter (1 July - 30 September 2024)Desmond WeeNo ratings yet

- Half Yearly Dec09-10 PDFDocument15 pagesHalf Yearly Dec09-10 PDFSalman S. ZiaNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument43 pagesFinancial Statements, Cash Flow, and TaxesshimulNo ratings yet

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- IRRI AR 2011 - Audited Financial StatementsDocument45 pagesIRRI AR 2011 - Audited Financial StatementsIRRI_resourcesNo ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2012Document6 pagesProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNo ratings yet

- First Quarter Ended March 31 2012Document24 pagesFirst Quarter Ended March 31 2012Wai HOngNo ratings yet

- NSSF Emphasis On The Financial StatementsDocument16 pagesNSSF Emphasis On The Financial StatementsAtukwatse AmbroseNo ratings yet

- Appendix 5 Consolidated Cash Flow Statement: For The Year Ended 31 December 2008Document15 pagesAppendix 5 Consolidated Cash Flow Statement: For The Year Ended 31 December 2008Architecture ArtNo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakFerry JohNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Document40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425No ratings yet

- PD 2013 Fin StatementsDocument4 pagesPD 2013 Fin StatementsdignitykitchenNo ratings yet

- DATEDocument10 pagesDATEbiancaftw90No ratings yet

- Chapter 02Document19 pagesChapter 02armanchowdhury651No ratings yet

- IRRI AR 2013 Audited Financial StatementsDocument62 pagesIRRI AR 2013 Audited Financial StatementsIRRI_resourcesNo ratings yet

- CH 02Document68 pagesCH 02Daniel BalchaNo ratings yet

- FXCM Q3 Slide DeckDocument20 pagesFXCM Q3 Slide DeckRon FinbergNo ratings yet

- San Miguel CorporationDocument1 pageSan Miguel CorporationHUPGUIDAN, GAUDENCIANo ratings yet

- Financial Statement SampleDocument172 pagesFinancial Statement SampleJennybabe PetaNo ratings yet

- FIDL Audited Results For FY Ended 31 Dec 13Document1 pageFIDL Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Hyundai Motor - Ir Presentation 2012 - 1Q - EngDocument20 pagesHyundai Motor - Ir Presentation 2012 - 1Q - EngSam_Ha_No ratings yet

- 3Q12 Financial StatementsDocument50 pages3Q12 Financial StatementsFibriaRINo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakpurnamaNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasNo ratings yet

- MMH SGXnet 03 12 FinalDocument16 pagesMMH SGXnet 03 12 FinalJosephine ChewNo ratings yet

- Royale Furniture Holdings Limited: Annual Results For The Year Ended 31 December 2012Document18 pagesRoyale Furniture Holdings Limited: Annual Results For The Year Ended 31 December 2012alan888No ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Understanding The Basics of BCPDocument10 pagesUnderstanding The Basics of BCPManmua UrbanusNo ratings yet

- Boston Consulting Group ReportDocument29 pagesBoston Consulting Group ReportSupratim NaskarNo ratings yet

- ST TH TH TH TH TH ST THDocument4 pagesST TH TH TH TH TH ST THapi-127658921No ratings yet

- Footsteps of SatanDocument5 pagesFootsteps of SatanRaif AhmedNo ratings yet

- Poverty Term PaperDocument8 pagesPoverty Term Paperfuzkxnwgf100% (1)

- Social Infrastructure Why It Matters and How Urban Geographers Might Study ItDocument11 pagesSocial Infrastructure Why It Matters and How Urban Geographers Might Study Itplanetaleconomia2No ratings yet

- 01) PCI LEASING AND FINANCE v. TROJAN METALDocument2 pages01) PCI LEASING AND FINANCE v. TROJAN METALJay EmNo ratings yet

- Mosaic Hong KongDocument15 pagesMosaic Hong KongAlex ChanNo ratings yet

- Open Auditions Information Pack: Royal Opera Extra ChorusDocument8 pagesOpen Auditions Information Pack: Royal Opera Extra ChorusSTANISLAVNo ratings yet

- BangladeshDocument49 pagesBangladeshS M Zillur RahamanNo ratings yet

- Metropolitan ManilaDocument20 pagesMetropolitan ManilaKciroj ArellanoNo ratings yet

- Kalyani Plastic Industries QT No 454 DT 12.10 PDFDocument4 pagesKalyani Plastic Industries QT No 454 DT 12.10 PDFMd AkramNo ratings yet

- Mar 8 OGDocument3 pagesMar 8 OGAjaratanNo ratings yet

- Types of Foundation and Their Uses in Building ConstructionDocument4 pagesTypes of Foundation and Their Uses in Building ConstructionCraig MNo ratings yet

- The Noble Nature Poem - 4Document5 pagesThe Noble Nature Poem - 4Nidhi AnanthamNo ratings yet

- WinningTradingRules Aaron TanDocument41 pagesWinningTradingRules Aaron TanKuru GovindNo ratings yet

- Haryana Govt. Gaz., Sept. 13, 2016 (Bhdr. 22, 1938 Saka) (Part IDocument88 pagesHaryana Govt. Gaz., Sept. 13, 2016 (Bhdr. 22, 1938 Saka) (Part IRajbir SinghNo ratings yet

- 02 08 PPE CapEx Depreciation BeforeDocument6 pages02 08 PPE CapEx Depreciation BeforeShaheer AhmedNo ratings yet

- AcknowlegementDocument2 pagesAcknowlegementVenkys Overseas EducationNo ratings yet

- PUI JV Project Manager 2021Document3 pagesPUI JV Project Manager 2021Moe NyanNo ratings yet

- Basic Organizational DesignDocument31 pagesBasic Organizational DesignSahar Hayat AwanNo ratings yet

- Scriptures On ThirumularDocument9 pagesScriptures On ThirumularVaaniV2No ratings yet

- Maple Leaf AssignmentDocument2 pagesMaple Leaf AssignmentSudan KhadgiNo ratings yet

- Indian Healthcare Onthecuspofa Digital Transformation: WWW - Pwc.inDocument20 pagesIndian Healthcare Onthecuspofa Digital Transformation: WWW - Pwc.inswarnaNo ratings yet

- Interpretation of StatuteDocument16 pagesInterpretation of Statuteakshy vyasNo ratings yet

- API 851 RefGuide 2011-09-12Document695 pagesAPI 851 RefGuide 2011-09-12Hækæn ÆkdægNo ratings yet

- Another GospelDocument3 pagesAnother GospelJim Patrick CastilloNo ratings yet

- Arun Updated2Document4 pagesArun Updated2Navaneethan RamasamyNo ratings yet