FIR 4770 Midterm Review Questions: Student

FIR 4770 Midterm Review Questions: Student

Uploaded by

manish7836Copyright:

Available Formats

FIR 4770 Midterm Review Questions: Student

FIR 4770 Midterm Review Questions: Student

Uploaded by

manish7836Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FIR 4770 Midterm Review Questions: Student

FIR 4770 Midterm Review Questions: Student

Uploaded by

manish7836Copyright:

Available Formats

FIR 4770 Midterm Review Questions

Student: ___________________________________________________________________________ 1. The expected return of a portfolio of risky securities A. is a weighted average of the securities' returns. B. is the sum of the securities' returns. C. is the weighted sum of the securities' variances and covariances. D. A and C. E. none of the above.

2. Other things equal, diversification is most effective when A. securities' returns are uncorrelated. B. securities' returns are positively correlated. C. securities' returns are high. D. securities' returns are negatively correlated. E. B and C.

3. The efficient frontier of risky assets is A. the portion of the investment opportunity set that lies above the global minimum variance portfolio. B. the portion of the investment opportunity set that represents the highest standard deviations. C. the portion of the investment opportunity set which includes the portfolios with the lowest standard deviation. D. the set of portfolios that have zero standard deviation. E. both A and B are true.

4. The Capital Allocation Line provided by a risk-free security and N risky securities is A. the line that connects the risk-free rate and the global minimum-variance portfolio of the risky securities. B. the line that connects the risk-free rate and the portfolio of the risky securities that has the highest expected return on the efficient frontier. C. the line tangent to the efficient frontier of risky securities drawn from the risk-free rate. D. the horizontal line drawn from the risk-free rate. E. none of the above.

5. Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line? A. Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors. B. More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors. C. Investors choose the portfolio that maximizes their expected utility. D. A and C. E. B and C.

6. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz?

A. Only portfolio X cannot lie on the efficient frontier. B. Only portfolio Z cannot lie on the efficient frontier. C. Cannot tell from the information given. D. Only portfolio Y cannot lie on the efficient frontier. E. Only portfolio W cannot lie on the efficient frontier.

7. If a 6% coupon bond is trading for $950.00, it has a current yield of ____________ percent. A. 6.0 B. 6.5 C. 6.3 D. 6.1 E. 6.6

8. To earn a high rating from the bond rating agencies, a firm should have A. a low times interest earned ratio B. a low debt to equity ratio C. a high quick ratio D. B and C E. A and C

9. An 8% coupon U. S. Treasury note pays interest on May 30 and November 30 and is traded for settlement on August 15. The accrued interest on the $100,000 face value of this note is _________. A. $491.80 B. $800.00 C. $983.61 D. $1,661.20 E. none of the above

10. The _________ gives the number of shares for which each convertible bond can be exchanged. A. convertible floor B. conversion premium C. P/E ratio D. current ratio E. conversion ratio

11. A Treasury bond due in one year has a yield of 6.2%; a Treasury bond due in 5 years has a yield of 6.7%. A bond issued by Xerox due in 5 years has a yield of 7.9%; a bond issued by Exxon due in one year has a yield of 7.2%. The default risk premiums on the bonds issued by Exxon and Xerox, respectively, are A. 1.0% and 1.2% B. 0.5% and .7% C. 1.2% and 1.0% D. 0.7% and 0.5% E. none of the above

12. A coupon bond that pays interest semi-annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10%. The intrinsic value of the bond today will be __________ if the coupon rate is 8%. A. $922.78 B. $924.16 C. $1,075.80 D. $1,077.20 E. none of the above

13. The term structure of interest rates is: A. The relationship between the rates of interest on all securities. B. The relationship between the interest rate on a security and its time to maturity. C. The relationship between the yield on a bond and its default rate. D. All of the above. E. None of the above.

14. An inverted yield curve implies that: A. Long-term interest rates are lower than short-term interest rates. B. Long-term interest rates are higher than short-term interest rates. C. Long-term interest rates are the same as short-term interest rates. D. Intermediate term interest rates are higher than either short- or long-term interest rates. E. none of the above.

15. The expectations theory of the term structure of interest rates states that A. forward rates are determined by investors' expectations of future interest rates. B. forward rates exceed the expected future interest rates. C. yields on long- and short-maturity bonds are determined by the supply and demand for the securities. D. all of the above. E. none of the above.

16. According to the "liquidity preference" theory of the term structure of interest rates, the yield curve usually should be: A. inverted. B. normal. C. upward sloping D. A and B. E. B and C.

Suppose that all investors expect that interest rates for the 4 years will be as follows:

17. If you have just purchased a 4-year zero coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000) A. 5% B. 7% C. 9% D. 10% E. none of the above

The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000.

18. What is the yield to maturity on a 3-year zero coupon bond? A. 6.37% B. 9.00% C. 7.33% D. 10.00% E. none of the above

19. The duration of a bond is a function of the bond's A. coupon rate. B. yield to maturity. C. time to maturity. D. all of the above. E. none of the above.

20. Given the time to maturity, the duration of a zero-coupon bond is higher when the discount rate is A. higher. B. lower. C. equal to the risk free rate. D. The bond's duration is independent of the discount rate. E. none of the above.

21. Holding other factors constant, which one of the following bonds has the smallest price volatility? A. 5 year, 14% coupon bond B. 5-year, 10% coupon bond C. 5-year, 0% coupon bond D. 5-year, 12% coupon bond E. Cannot tell from the information given.

22. The duration of a par value bond with a coupon rate of 8% and a remaining time to maturity of 5 years is A. 5 years. B. 5.4 years. C. 4.17 years. D. 4.31 years. E. none of the above.

23. The two components of interest-rate risk are A. price risk and default risk. B. reinvestment risk and systematic risk. C. call risk and price risk. D. price risk and reinvestment risk. E. none of the above.

24. Indexing of bond portfolios is difficult because A. the number of bonds included in the major indexes is so large that it would be difficult to purchase them in the proper proportions. B. many bonds are thinly traded so it is difficult to purchase them at a fair market price. C. the composition of bond indexes is constantly changing. D. all of the above are true. E. both A and B are true.

25. An 8%, 30-year corporate bond was recently being priced to yield 10%. The Macaulay duration for the bond is 10.20 years. Given this information, the bond's modified duration would be________. A. 8.05 B. 9.44 C. 9.27 D. 11.22 E. none of the above

4770 mid Key

1. The expected return of a portfolio of risky securities A. is a weighted average of the securities' returns. b. is the sum of the securities' returns. c. is the weighted sum of the securities' variances and covariances. d. A and C. e. none of the above.

Bodie - Chapter 07 #4 Difficulty: Easy

2. Other things equal, diversification is most effective when a. securities' returns are uncorrelated. b. securities' returns are positively correlated. c. securities' returns are high. D. securities' returns are negatively correlated. e. B and C. Negative correlation among securities results in the greatest reduction of portfolio risk, which is the goal of diversification.

Bodie - Chapter 07 #5 Difficulty: Moderate

3. The efficient frontier of risky assets is A. the portion of the investment opportunity set that lies above the global minimum variance portfolio. b. the portion of the investment opportunity set that represents the highest standard deviations. c. the portion of the investment opportunity set which includes the portfolios with the lowest standard deviation. d. the set of portfolios that have zero standard deviation. e. both A and B are true. Portfolios on the efficient frontier are those providing the greatest expected return for a given amount of risk. Only those portfolios above the global minimum variance portfolio meet this criterion.

Bodie - Chapter 07 #6 Difficulty: Moderate

4. The Capital Allocation Line provided by a risk-free security and N risky securities is a. the line that connects the risk-free rate and the global minimum-variance portfolio of the risky securities. b. the line that connects the risk-free rate and the portfolio of the risky securities that has the highest expected return on the efficient frontier. C. the line tangent to the efficient frontier of risky securities drawn from the risk-free rate. d. the horizontal line drawn from the risk-free rate. e. none of the above. The Capital Allocation Line represents the most efficient combinations of the risk-free asset and risky securities. Only C meets that definition.

Bodie - Chapter 07 #7 Difficulty: Moderate

5. Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line? a. Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors. b. More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors. c. Investors choose the portfolio that maximizes their expected utility. d. A and C. E. B and C. All rational investors select the portfolio that maximizes their expected utility; for investors who are relatively more risk-averse, doing so means investing less in the optimal risky portfolio and more in the risk-free asset.

Bodie - Chapter 07 #11 Difficulty: Moderate

6. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz?

a. Only portfolio X cannot lie on the efficient frontier. b. Only portfolio Z cannot lie on the efficient frontier. c. Cannot tell from the information given. d. Only portfolio Y cannot lie on the efficient frontier. E. Only portfolio W cannot lie on the efficient frontier. When plotting the above portfolios, only W lies below the efficient frontier as described by Markowitz. It has a higher standard deviation than Z with a lower expected return.

Bodie - Chapter 07 #23 Difficulty: Moderate

7. If a 6% coupon bond is trading for $950.00, it has a current yield of ____________ percent. a. 6.0 b. 6.5 C. 6.3 d. 6.1 e. 6.6 60/950 = 6.3.

Bodie - Chapter 14 #3 Difficulty: Easy

8. To earn a high rating from the bond rating agencies, a firm should have a. a low times interest earned ratio b. a low debt to equity ratio c. a high quick ratio D. B and C e. A and C High values for the times interest and quick ratios and a low debt to equity ratio are desirable indicators of safety.

Bodie - Chapter 14 #9 Difficulty: Easy

9. An 8% coupon U. S. Treasury note pays interest on May 30 and November 30 and is traded for settlement on August 15. The accrued interest on the $100,000 face value of this note is _________. a. $491.80 b. $800.00 c. $983.61 D. $1,661.20 e. none of the above 76/183($4,000) = $1,661.20. Approximation: .08/12*100,000=666.67 per month. 666.67/month * 2.5 months = 1.666.67.

Bodie - Chapter 14 #13 Difficulty: Moderate

10. The _________ gives the number of shares for which each convertible bond can be exchanged. a. convertible floor b. conversion premium c. P/E ratio d. current ratio E. conversion ratio The conversion premium is the amount for which the bond sells above conversion value; the price of bond as a straight bond provides the floor. The other terms are not specifically relevant to convertible bonds.

Bodie - Chapter 14 #19 Difficulty: Easy

11. A Treasury bond due in one year has a yield of 6.2%; a Treasury bond due in 5 years has a yield of 6.7%. A bond issued by Xerox due in 5 years has a yield of 7.9%; a bond issued by Exxon due in one year has a yield of 7.2%. The default risk premiums on the bonds issued by Exxon and Xerox, respectively, are A. 1.0% and 1.2% b. 0.5% and .7% c. 1.2% and 1.0% d. 0.7% and 0.5% e. none of the above Exxon: 7.2% - 6.2% = 1.0%; Xerox: 7. 9% - 6.7% = 1.2%.

Bodie - Chapter 14 #25 Difficulty: Moderate

12. A coupon bond that pays interest semi-annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10%. The intrinsic value of the bond today will be __________ if the coupon rate is 8%. A. $922.78 b. $924.16 c. $1,075.80 d. $1,077.20 e. none of the above FV = 1000, PMT = 40, n = 10, i = 5, PV = 922.78

Bodie - Chapter 14 #30 Difficulty: Moderate

13. The term structure of interest rates is: a. The relationship between the rates of interest on all securities. B. The relationship between the interest rate on a security and its time to maturity. c. The relationship between the yield on a bond and its default rate. d. All of the above. e. None of the above. The term structure of interest rates is the relationship between two variables, years and yield to maturity (holding all else constant).

Bodie - Chapter 15 #1 Difficulty: Easy

14. An inverted yield curve implies that: A. Long-term interest rates are lower than short-term interest rates. b. Long-term interest rates are higher than short-term interest rates. c. Long-term interest rates are the same as short-term interest rates. d. Intermediate term interest rates are higher than either short- or long-term interest rates. e. none of the above. The inverted, or downward sloping, yield curve is one in which short-term rates are higher than long-term rates. The inverted yield curve has been observed frequently, although not as frequently as the upward sloping, or normal, yield curve.

Bodie - Chapter 15 #3 Difficulty: Easy

15. The expectations theory of the term structure of interest rates states that A. forward rates are determined by investors' expectations of future interest rates. b. forward rates exceed the expected future interest rates. c. yields on long- and short-maturity bonds are determined by the supply and demand for the securities. d. all of the above. e. none of the above. The forward rate equals the market consensus expectation of future short interest rates.

Bodie - Chapter 15 #7 Difficulty: Easy

16. According to the "liquidity preference" theory of the term structure of interest rates, the yield curve usually should be: a. inverted. b. normal. c. upward sloping d. A and B. E. B and C. According to the liquidity preference theory, investors would prefer to be liquid rather than illiquid. In order to accept a more illiquid investment, investors require a liquidity premium and the normal, or upward sloping, yield curve results.

Bodie - Chapter 15 #9 Difficulty: Easy

Suppose that all investors expect that interest rates for the 4 years will be as follows:

Bodie - Chapter 15

17. If you have just purchased a 4-year zero coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000) A. 5% b. 7% c. 9% d. 10% e. none of the above The forward interest rate given for the first year of the investment is given as 5% (see table above).

Bodie - Chapter 15 #11 Difficulty: Moderate

The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000.

Bodie - Chapter 15

18. What is the yield to maturity on a 3-year zero coupon bond? a. 6.37% b. 9.00% C. 7.33% d. 10.00% e. none of the above (1000 / 808.81)1/3 -1 = 7.33%

Bodie - Chapter 15 #15 Difficulty: Moderate

19. The duration of a bond is a function of the bond's a. coupon rate. b. yield to maturity. c. time to maturity. D. all of the above. e. none of the above. Duration is calculated by discounting the bond's cash flows at the bond's yield to maturity and, except for zerocoupon bonds, is always less than time to maturity.

Bodie - Chapter 16 #1 Difficulty: Easy

20. Given the time to maturity, the duration of a zero-coupon bond is higher when the discount rate is a. higher. b. lower. c. equal to the risk free rate. D. The bond's duration is independent of the discount rate. e. none of the above. The duration of a zero-coupon bond is equal to the maturity of the bond.

Bodie - Chapter 16 #5 Difficulty: Moderate

21. Holding other factors constant, which one of the following bonds has the smallest price volatility? A. 5 year, 14% coupon bond b. 5-year, 10% coupon bond c. 5-year, 0% coupon bond d. 5-year, 12% coupon bond e. Cannot tell from the information given. Duration (and thus price volatility) is lower when the coupon rates are higher.

Bodie - Chapter 16 #8 Difficulty: Moderate

22. The duration of a par value bond with a coupon rate of 8% and a remaining time to maturity of 5 years is a. 5 years. b. 5.4 years. c. 4.17 years. D. 4.31 years. e. none of the above.

Bodie - Chapter 16 #12 Difficulty: Moderate

23. The two components of interest-rate risk are a. price risk and default risk. b. reinvestment risk and systematic risk. c. call risk and price risk. D. price risk and reinvestment risk. e. none of the above. Default, systematic, and call risks are not part of interest-rate risk. Only price and reinvestment risks are part of interest-rate risk.

Bodie - Chapter 16 #19 Difficulty: Easy

24. Indexing of bond portfolios is difficult because a. the number of bonds included in the major indexes is so large that it would be difficult to purchase them in the proper proportions. b. many bonds are thinly traded so it is difficult to purchase them at a fair market price. c. the composition of bond indexes is constantly changing. D. all of the above are true. e. both A and B are true. All of the above are true statements about bond indexes.

Bodie - Chapter 16 #21 Difficulty: Moderate

25. An 8%, 30-year corporate bond was recently being priced to yield 10%. The Macaulay duration for the bond is 10.20 years. Given this information, the bond's modified duration would be________. a. 8.05 b. 9.44 C. 9.27 d. 11.22 e. none of the above D* = D/(1 + y); D* = 10.2/(1.1) = 9.27

Bodie - Chapter 16 #27 Difficulty: Easy

4770 mid Summary

Category Bodie - Chapter 07 Bodie - Chapter 14 Bodie - Chapter 15 Bodie - Chapter 16 Difficulty: Easy Difficulty: Moderate # of Questions 6 6 8 7 11 14

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- EC3333 Midterm Fall 2014.questionsDocument7 pagesEC3333 Midterm Fall 2014.questionsChiew Jun SiewNo ratings yet

- QuizDocument6 pagesQuizchitu1992No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2019 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2019 Edition)Rating: 5 out of 5 stars5/5 (1)

- Miss Samantha D Erlston Doreen 56 B High RD Edenvale 1609: Transactions in RAND (ZAR) Accrued Bank ChargesDocument2 pagesMiss Samantha D Erlston Doreen 56 B High RD Edenvale 1609: Transactions in RAND (ZAR) Accrued Bank ChargesSamantha Erlston100% (2)

- Understanding Fixed-Income Risk and ReturnDocument19 pagesUnderstanding Fixed-Income Risk and ReturnHassan100% (1)

- R55 Understanding Fixed-Income Risk and Return Q BankDocument20 pagesR55 Understanding Fixed-Income Risk and Return Q BankAhmedNo ratings yet

- Loan StatementDocument3 pagesLoan StatementNityananda SahuNo ratings yet

- Midterm Practice (Solution)Document7 pagesMidterm Practice (Solution)kaetie.yuan04No ratings yet

- Quiz 15 (443C) : StudentDocument6 pagesQuiz 15 (443C) : StudentCeleste YuNo ratings yet

- 70 32301805Document54 pages70 32301805Mar Conesa OtónNo ratings yet

- Test Bank Chapter 15 Investment BodieDocument42 pagesTest Bank Chapter 15 Investment BodieTami DoanNo ratings yet

- CH 7Document45 pagesCH 7yawnzz89100% (3)

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- Financial Economics - Model 2 - Solutions - LastDocument6 pagesFinancial Economics - Model 2 - Solutions - Lastalicia.serrano01No ratings yet

- RRR MCQDocument18 pagesRRR MCQRezzan Joy MejiaNo ratings yet

- 4412 2024B SampleMTDocument5 pages4412 2024B SampleMTemirdurmaz200131No ratings yet

- Financial Economics - Model 1 - Solutions - LastDocument6 pagesFinancial Economics - Model 1 - Solutions - Lastalicia.serrano01No ratings yet

- QuestionsDocument72 pagesQuestionsmudassar saeedNo ratings yet

- 4412 2024B SampleMT KeyDocument5 pages4412 2024B SampleMT Keyemirdurmaz200131No ratings yet

- Investment Quiz Test QNST and AnswerDocument9 pagesInvestment Quiz Test QNST and AnswerPrimrose Chisunga100% (1)

- File 20220531 173746 Thị Trường Tài ChínhDocument11 pagesFile 20220531 173746 Thị Trường Tài ChínhNguyễn Trâm AnhNo ratings yet

- ExamDocument18 pagesExamLiza Roshchina100% (1)

- Choice Multiple Questions - Docx.u1conflictDocument4 pagesChoice Multiple Questions - Docx.u1conflictAbdulaziz S.mNo ratings yet

- Weekly Quiz 2Document30 pagesWeekly Quiz 2Emmmanuel ArthurNo ratings yet

- Fa 06 Ex 3Document7 pagesFa 06 Ex 3MuhammadIjazAslamNo ratings yet

- FIN. 4828 CH. 18: CreateDocument22 pagesFIN. 4828 CH. 18: CreateSwati VermaNo ratings yet

- UntitledDocument4 pagesUntitledMuhammad AbdullahNo ratings yet

- Chap007 Test Bank (1) SolutionDocument11 pagesChap007 Test Bank (1) SolutionMinji Michelle J100% (1)

- TB Chapter20Document25 pagesTB Chapter20Viola HuynhNo ratings yet

- Mockterm FINS2624 S1 2013Document12 pagesMockterm FINS2624 S1 2013sagarox7No ratings yet

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 25: Credit Derivatives Multiple Choice Test BankDocument4 pagesHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 25: Credit Derivatives Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- Prelim Exam - For PrintingDocument4 pagesPrelim Exam - For PrintingThat's FHEVulousNo ratings yet

- QuizDocument6 pagesQuizchitu1992No ratings yet

- 재무관리 기말고사 족보Document14 pages재무관리 기말고사 족보yanghyunjun72No ratings yet

- 8230 Sample Final 1Document8 pages8230 Sample Final 1lilbouyinNo ratings yet

- Bank 1,2,3,4-Portfolios IiDocument11 pagesBank 1,2,3,4-Portfolios IimileNo ratings yet

- Quiz 1Document8 pagesQuiz 1HUANG WENCHENNo ratings yet

- Valuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers BelowDocument7 pagesValuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers Belowevivanco1899No ratings yet

- ĐTTC Duy LinhDocument21 pagesĐTTC Duy LinhThảo LêNo ratings yet

- 7 November 2020 - Question - Book 5-UnlockedDocument6 pages7 November 2020 - Question - Book 5-UnlockedAditya NugrohoNo ratings yet

- Fin 3013 Chapter 10Document56 pagesFin 3013 Chapter 10spectrum_48No ratings yet

- Chap 14Document27 pagesChap 14Thu YếnNo ratings yet

- Investment and Portoflio MGT QuestionsDocument6 pagesInvestment and Portoflio MGT QuestionsnathnaelNo ratings yet

- Fixed IncomeDocument19 pagesFixed IncomeNgọc ThảoNo ratings yet

- TB Chapter07Document83 pagesTB Chapter07dan_joel069968No ratings yet

- 97fi MasterDocument12 pages97fi MasterHamid UllahNo ratings yet

- QLDMDTDocument35 pagesQLDMDThang25040107No ratings yet

- Fin333 Secondmt04w Sample QuestionsDocument10 pagesFin333 Secondmt04w Sample QuestionsSara NasNo ratings yet

- Possible Mid-Term QuestionsDocument10 pagesPossible Mid-Term QuestionsZobia JavaidNo ratings yet

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 5: Determination of Forward and Futures Prices Multiple Choice Test BankDocument4 pagesHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 5: Determination of Forward and Futures Prices Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- Test 092403Document10 pagesTest 092403Janice ChanNo ratings yet

- Section 04Document97 pagesSection 04HarshNo ratings yet

- TT ĐCTCDocument7 pagesTT ĐCTCthuyvanscNo ratings yet

- Chap 005Document90 pagesChap 005조서현50% (2)

- Fin 072 Midterm ExamDocument10 pagesFin 072 Midterm ExamGargaritanoNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- CFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- Summary of William J. Bernstein's The Intelligent Asset AllocatorFrom EverandSummary of William J. Bernstein's The Intelligent Asset AllocatorNo ratings yet

- Security Analysis & Portfolio Management: Mba 3 SemesterDocument6 pagesSecurity Analysis & Portfolio Management: Mba 3 SemesterDERAJUDDIN AHMRDNo ratings yet

- Pages 55 Capital Market Operation FinalDocument38 pagesPages 55 Capital Market Operation FinalAakash SharmaNo ratings yet

- MBA666 - Decision - Trees Examples PDFDocument10 pagesMBA666 - Decision - Trees Examples PDFrajNo ratings yet

- Chap 2 - Management AccountingDocument13 pagesChap 2 - Management AccountingEmmanuel TeoNo ratings yet

- Chief Financial Officer in San Francisco Bay CA Kevin BerryDocument2 pagesChief Financial Officer in San Francisco Bay CA Kevin BerryKevinBerry1No ratings yet

- Month-To-Month Lease Agreement: FollowingDocument8 pagesMonth-To-Month Lease Agreement: FollowingyomexNo ratings yet

- Fixed Exchange Rates and Foreign Exchange Intervention (Lecture 8, Chapter 18)Document9 pagesFixed Exchange Rates and Foreign Exchange Intervention (Lecture 8, Chapter 18)nihadsamir2002No ratings yet

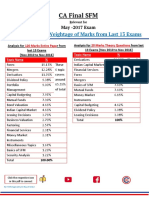

- CA Final SFM Chapter Wise Weightage Applicable For May 2017 NFUH6CATDocument1 pageCA Final SFM Chapter Wise Weightage Applicable For May 2017 NFUH6CATvignesh_vikiNo ratings yet

- FinanceDocument48 pagesFinanceMimi Adriatico JaranillaNo ratings yet

- Property Management Business ProposalDocument10 pagesProperty Management Business ProposalNicole LamNo ratings yet

- Simple InterestDocument58 pagesSimple InterestCleofeNo ratings yet

- Tutorial Letter 103/3/2016: Group Financial ReportingDocument52 pagesTutorial Letter 103/3/2016: Group Financial ReportingTINOTENDA MUCHEMWANo ratings yet

- Chapter 4 The Viability of A Business IdeaDocument28 pagesChapter 4 The Viability of A Business IdeaLawrence MosizaNo ratings yet

- Takeover FullDocument92 pagesTakeover Fullswatigupta8850% (2)

- ReportDocument12 pagesReportVishala GudageriNo ratings yet

- Portfolio Optimization in Electricity Markets: Min Liu, Felix F. WuDocument10 pagesPortfolio Optimization in Electricity Markets: Min Liu, Felix F. Wujorge jorgeNo ratings yet

- Robo Advisory 2Document8 pagesRobo Advisory 2Ankur Pandey0% (1)

- Comparative Analysis of Sbi Bank and Icici BankDocument74 pagesComparative Analysis of Sbi Bank and Icici BankRanju Chauhan80% (5)

- 58 - A - Shekhar - DPC Ii JournalDocument69 pages58 - A - Shekhar - DPC Ii JournalShekhar PanseNo ratings yet

- What Is Investment Definition?Document6 pagesWhat Is Investment Definition?Simohamed BennaniNo ratings yet

- Cersai GhigheDocument2 pagesCersai Ghighechandan bhatiNo ratings yet

- Information Sheet - BKKPG-8 - Preparing Financial StatementsDocument10 pagesInformation Sheet - BKKPG-8 - Preparing Financial StatementsEron Roi Centina-gacutanNo ratings yet

- PDF September Ict Notespdf - CompressDocument14 pagesPDF September Ict Notespdf - CompressSagar BhandariNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Ajmain Abdullah Utshow100% (1)

- Business Development Plan ON: Adaa Ethnic Wears and DressesDocument34 pagesBusiness Development Plan ON: Adaa Ethnic Wears and DressesNishedh AdhikariNo ratings yet

- C. Worksheet 1 - Liquidation - B List of ContributoriesDocument7 pagesC. Worksheet 1 - Liquidation - B List of ContributoriesSnigdha RohillaNo ratings yet

- 10%DP12mos-BF W/ BANK CHARGES Amaia Land Corp. Amaia Scapes CabanatuanDocument1 page10%DP12mos-BF W/ BANK CHARGES Amaia Land Corp. Amaia Scapes CabanatuanMao WatanabeNo ratings yet

- Payments Standardss-InitiationDocument349 pagesPayments Standardss-InitiationpurushotamsaNo ratings yet