100%(1)100% found this document useful (1 vote)

596 viewsMultiple Choice Questions. F6. CLC.2020. PIT and CIT. 12 Feb 2020

Multiple Choice Questions. F6. CLC.2020. PIT and CIT. 12 Feb 2020

Uploaded by

MinhDuongThe document contains 12 multiple choice questions related to personal income tax (PIT) and corporate income tax (CIT) in Vietnam. The questions cover a range of topics including determining taxable income, allowable deductions, tax rates, and family deductions for PIT.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Multiple Choice Questions. F6. CLC.2020. PIT and CIT. 12 Feb 2020

Multiple Choice Questions. F6. CLC.2020. PIT and CIT. 12 Feb 2020

Uploaded by

MinhDuong100%(1)100% found this document useful (1 vote)

596 views19 pagesThe document contains 12 multiple choice questions related to personal income tax (PIT) and corporate income tax (CIT) in Vietnam. The questions cover a range of topics including determining taxable income, allowable deductions, tax rates, and family deductions for PIT.

Original Description:

ddđ

Original Title

Multiple-choice-questions.-F6.-CLC.2020.-PIT-and-CIT.-12-Feb-2020

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document contains 12 multiple choice questions related to personal income tax (PIT) and corporate income tax (CIT) in Vietnam. The questions cover a range of topics including determining taxable income, allowable deductions, tax rates, and family deductions for PIT.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

100%(1)100% found this document useful (1 vote)

596 views19 pagesMultiple Choice Questions. F6. CLC.2020. PIT and CIT. 12 Feb 2020

Multiple Choice Questions. F6. CLC.2020. PIT and CIT. 12 Feb 2020

Uploaded by

MinhDuongThe document contains 12 multiple choice questions related to personal income tax (PIT) and corporate income tax (CIT) in Vietnam. The questions cover a range of topics including determining taxable income, allowable deductions, tax rates, and family deductions for PIT.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 19

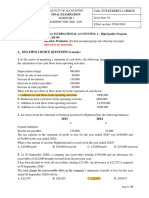

PIT MULTIPLE CHOICE QUESTIONS

1. In a statement of income of a tax payer, there are the following incomes

and remuneration in kind: (a) House allowance in cash; (b) Leadership

allowance; (c) The excessive salaries for overtime work; (d) Occupational

allowance as stipulated by law. What items above are subject to PIT?

A. (a) and (b) C. (a) and (b) and (c)

B. (a) and (c) D. (a) and (b) and (c) and (d)

2. In a statement of income of a tax payer, there are the following incomes

and remuneration in kind: (a) Salaries; (b) Toxicity allowance as stipulated by

law; (c) Bonus for performance; (d) One-off relocation allowance as

stipulated by law. What items above are subject to PIT?

A. (a) and (b) C. (a) and (b) and (c)

B. (a) and (c) D. (a) and (b) and (c) and (d)

3. We have a list of the following incomes and remuneration in kind: (a) The

payment of employer for cars rent to carry their employees from home to

work and vice versa; (b) Danger allowance as stipulated by law; (c) Bonus on

the occasion of National day; (d) Wages.

What items above are not subject to PIT?

A. (a) and (b) C. (a) and (b) and (c)

B. (a) and (c) D. (a) and (b) and (c) and (d)

4. We have a list of the following incomes and remuneration in kind: (a)

Children’s university tuition fee paid by an employer for Vietnamese

employees who work overseas; (b) Pension; (c) Rewards by an employer

named “Engineer of the Year”; (d) National defense allowance as stipulated

by law. What items above are subject to PIT?

A. (a) and (b) C. (b) and (c)

B. (a) and (c) D. (a) and (b) and (c)

5. Which of the following incomes that only the excessive amount of

VND10 million are subject to PIT?

(a) Royalty; (b) Capital Investment; (c) Capital transfer; (d) Winning prizes

A. (a) and (b) C. (a) and (d)

B. (a) and (c) D. (b) and (c)

6. In May 2019, Mrs. Hong, a Vietnamese tax resident won a lottery worth

VND181 million (net of PIT).

The amount of PIT deducted at source by the lottery company for Hong’s

PIT liability is (VND million):

A. 20 C. 18,1

B. 19 D. 21

7. Mr. John, a non-resident taxpayer in Vietnam, won a prize in a game show

on TV of VND60 million (gross income).

The income tax amount payable by Mr. John for this income is (VND

million):

A. 6 B. 5 C. 3 D. 2.5

8. Ms. Duyen Ly is a Vietnamese citizen. During 2019, she received a gross

monthly salary of VND100 million, plus a bonus equal to two months’ salary

in April 2019, relating to her work performance in 2018. Her employer also

paid rent for an apartment for her family at an annual cost of VND240

million.

What is Ms. Duyen Ly’s taxable income tax (PIT) in the year 2019 (VND

million)?

A. 1,200 B. 1,400 C. 1,610 D. 1,640

9. In March 2019, Ms. Huyen paid VND4,000 million to buy a house in Hanoi.

In May 2019, Ms. Huyen sold this house to Mr. Long at VND6,000 million.

What is the amount of PIT that Ms. Huyen has to pay related to the sale of

the above house (VND million)?

A. 120 B. 60 C. 500 D. 400

10. In January 2019, Mr. Lee Tan Hong, a 40-year-old Malaysian citizen, started

his employment in Vietnam for VFC Co, a Vietnamese company. In March

2019, his wife Allan, a 35-year-old Malaysian citizen, suffered an accident in

Malaysia. She was not handicapped, but had to move to Vietnam to live with

Lee from April 2019 to the end of the 2019 year. She had no income in 2019.

VFC Co provided Lee with cash support of VND120 million towards medical

care expenses for Allan in Vietnam during 2019.

What is the total family deduction (in VND millions) Mr. Lee Tan Hong can

claim in the year 2019 relating to his personal income tax (PIT)?

A. 108 B. 140 C. 228 D. 260

11. Mr. Minh is a Vietnamese tax resident. He has two children, a 20-year-

old son who is a undergraduate student in Taichinh University and a 9-year-

old daughter. His mother, 75 year old, has retired with monthly pension of

VND4 million, lives with him. His son doesn’t have any income in 2019. Mr.

Minh declared for 3 dependants when filing PIT return of the year 2019

with sufficient documents as stipulated by law.

What is the total family deduction (in VND millions) Mr. Minh can claim in

the year 2019 relating to his personal income tax (PIT)?

A. 237.6 B. 194.4 C. 151.2 D. 108

12. Ms. Duyen Le, a Vietnamese citizen, works for PMN Co. During 2019, she

received a gross monthly salary of VND30 million, plus a monthly leadership

allowance of VND5 million. In November 2019 PMN gave her a gift in cash

worth VND20 million on the occasion of her wedding. Duyen has no

dependants.

What is Ms. Duyen Le’s amount of PIT payable in the year 2019 (VND

million)? Given that the Duyen Le’s income above is net of compulsory

contributions.

A. 30.6 B. 34.6 C. 42.6 D. 46.6

CIT MULTIPLE CHOICE QUESTIONS

1. TSC is a production company. On 1 January 2019 TSC purchased a five-seat

car with price exclusive of VAT at VND2.4 billion. The purchase is supported

with legitimate invoice and bank payment note. Under the Ministry of

Finance’s stipulation, the time for depreciation this type of car ranges from 6

years to 10 years. TSC decided to depreciate this car in 6 years.

The amount of depreciation expense deductible for determining taxable

income in 2019 by TSC is (nearest Vietnam dong):

A. 440,000,000

B. 400,000,000

C. 293,333,333

D. 266,666,667

2. TMC is a garment company. In 2019, TMC decided to pay life

insurance for 100 employees with a monthly fee of VND5 million per

employee. This payment is stipulated in TMC’s financial regulation and

supported with legitimate invoices. Bank payment was done for this

payment. TMC has been compliant with all compulsory insurances.

The amount of life insurance expense deductible for determining

taxable income in 2019 by TMC is (VND million):

A. 1,200

B. 3,600

C. 4,800

D. 6,000

3. GM is a trading company. In 2019, GM incurred an interest expense

for loans from GM’s employees at VND14,000 million at the rate of

14% per annum. This expense is supported with legitimate vouchers

and documents. GM’s charter capital had been fully contributed by

December 2018. The base interest rate announced by the State Bank of

Vietnam is 8% per annum.

The amount of interest expense deductible for determining taxable

income in 2019 by GM is (VND million):

A. 14,000

B. 12,000

C. 10,000

D. 8,000

4. GMS is a production company. In 2019, GMS incurred an interest

expense for loans from GMS’s employees at VND15,000 million at the

rate of 15% per annum. This expense is supported with legitimate

vouchers and documents. During 2019, GMS’s lack of charter capital

was VND120,000 million. The base interest rate announced by the

State Bank of Vietnam is 8% per annum.

The amount of interest expense deductible for determining taxable

income in 2019 by GMS is (VND million):

A. 15,000

B. 12,000

C. 10,000

D. 0

5. Duc Thanh Co. ltd (Long Thanh) is a Vietnamese company. All of its

products are subject to VAT. All of its purchases in 2019 were used for the

goods sold and supported with legitimate invoices and vouchers. Bank

payment were done for all purchases of Duc Thanh. Among Duc Thanh’s

total expenses declared for CIT purpose in 2019, there are some as follows:

(a) Wages to employees; (b) Forein contractor’s income tax deduction at

source with gross price; (c) Donation to build the Academy of Finance; (d)

Donation to Hanoi’s Youth Union.

Expenses which are not deductible for CIT purpose are:

A. (b) and (c) and (d)

B. (c) and (d)

C. (b) and (d)

D. (b) and (c)

6. A company paying VAT under credit method rents 10

apartments for 5 years. The price exclusive of VAT for 5 year of

renting is VND 1,000 million and paid all in advance. VAT rate for

this service is 10%. This company chooses to book the cost of the

apartments annually.

The base turnover for CIT is (million dongs):

A. 1,100 B.1,000 C.220 D.200

7. Total expenses declared by a company for a tax year is

VND5,000 million of which:

- Fines for late payment of VAT: VND50 million

- Donation to build a state hospital: VND100 million

- House rent expenses for the year: VND200 million

The rest expenses are deductible. All of the expenses are

supported with legitimate invoices and vouchers and paid

through banks.

The total deductible expenses of the company for the tax year

is (million dongs):

A. 5,000 B. 4,950 C. 4,850 D. 4,750

8. Total expenses declared by a company engaged in production for a

tax year is VND6,000 million of which:

- Life insurance premiums of employees which is silent in the labor

contracts and other documents: VND200 million;

- Non credited input VAT because of late declaration: VND100 million;

- Donation to build houses to the poor as stipulated by law: VND50

million.

All of the expenses are supported with legitimate invoices and

vouchers and paid through banks. The rest expenses are deductible.

The total deductible expenses of the company for the tax year is

(million dongs):

A. 6,000 B. 5,800 C. 5,500 D. 5,450

9. Data on incomes and expenses of a company is as follows:

- Total turnover: VND100,000 million

- Total deductible expenses: VND90,000 million

- Income received from an domestic joint venture (before income tax):

VND600 million

- Net income received from an domestic joint venture (After income

tax): VND400 million

The taxable income for income tax of the company for the tax year

is (million dongs):

A. 11,000 B. 10,600 C. 10,400 D. 10,000

10. Data on incomes and expenses of a company is as follows:

- Total turnover: VND100 billion

- Total deductible expenses: VND90 billion

- Net income received from an domestic joint venture (After income

tax): VND2 billion

- Losses carried forward: VND6 billion

The assessable income for income tax of the company for the tax

year is (billion dongs):

A. 12 B. 10 C. 6 D. 4

11. ABC Co engaging in production has the following data in 2019:

- Base turnover: 100 billion dongs

- Total expenses declared: 80 billion dongs of which:

+ Interest expense corresponding to the lack of charter capital: 2 billion

dongs;

+ Support for the ABC’s Youth Union in organizing its activities: 1 billion

dongs;

The rest expenses are deductible. All the expenses are supported with

sufficient legitimate invoices or vouchers. Bank payments are applicable

to all purchases. Standard CIT rate is applicable to this corporation.

CIT payable amount by this corporation for the tax year 2019 is (billion

dongs):

A. 4.0 B. 4.2 C. 4.4 D. 4.6

12. AC Co engaging in production has the following data in 2019:

- Base turnover: VND120 billion

- Total expenses declared: VND110 billion of which:

+ Office rent paid in advance of 4 years exclusive of VAT: VND4 billion;

+ Donation as scholarship to Ton Duc Thang University: VND1 billion;

The rest expenses are deductible. All the expenses are supported with

sufficient legitimate invoices or vouchers. Bank payments are applicable

to all purchases. Standard CIT rate is applicable to this corporation.

CIT payable amount by this corporation for the tax year 2019 is (VND

billion):

A. 2.8 B. 2.6 C. 2.2 D. 2.0

You might also like

- BISC - FR.F7 - Past Exam - Sep - Dec 2023Document8 pagesBISC - FR.F7 - Past Exam - Sep - Dec 2023lihubruhNo ratings yet

- OSX FinancialAccounting ISM Ch09Document57 pagesOSX FinancialAccounting ISM Ch09Jan Mark CastilloNo ratings yet

- Cleaning Service Marketing PlanDocument15 pagesCleaning Service Marketing PlanLia Elisa100% (3)

- Bài kiểm tra trắc nghiệm tổng hợp các chủ đề - Xem lại bài làmDocument22 pagesBài kiểm tra trắc nghiệm tổng hợp các chủ đề - Xem lại bài làmAh TuanNo ratings yet

- CFAB - Accounting - QB - Chapter 11Document15 pagesCFAB - Accounting - QB - Chapter 11Huy NguyenNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- Mock Test 2Document9 pagesMock Test 2Toàn ĐứcNo ratings yet

- ACW366 - Tutorial Exercises 6 PDFDocument7 pagesACW366 - Tutorial Exercises 6 PDFMERINANo ratings yet

- Digital Transformation BCG PDFDocument1 pageDigital Transformation BCG PDFMinhDuongNo ratings yet

- Hospitality Industry Chart of AccountsDocument12 pagesHospitality Industry Chart of AccountsGladEddy CyberNo ratings yet

- On October 5 2014 Diamond in The Rough Recruiting Group PDFDocument1 pageOn October 5 2014 Diamond in The Rough Recruiting Group PDFFreelance WorkerNo ratings yet

- F6 PIT-AnswersDocument21 pagesF6 PIT-AnswersChippu Anh100% (1)

- Week 1 Practice SolutionsDocument7 pagesWeek 1 Practice SolutionsalexandraNo ratings yet

- Tổng Hợp Trắc Nghiệm (252 Trang)Document252 pagesTổng Hợp Trắc Nghiệm (252 Trang)Thương TrầnNo ratings yet

- Tax 5Document88 pagesTax 5Thái Minh ChâuNo ratings yet

- Review Questions - Corporate Finance 58.51Document17 pagesReview Questions - Corporate Finance 58.51Đỗ Tuấn An100% (2)

- Bản sao của Câu hỏi trắc nghiệm (bản đánh sẵn đáp án)Document30 pagesBản sao của Câu hỏi trắc nghiệm (bản đánh sẵn đáp án)HẬU TRẦN TOÀN XUÂNNo ratings yet

- F6 PIT AnswersDocument18 pagesF6 PIT AnswersHuỳnh TrungNo ratings yet

- 17 F F6 Vietnam Tax FCT Answers For Multiple Choice Questions 2015 Exam enDocument15 pages17 F F6 Vietnam Tax FCT Answers For Multiple Choice Questions 2015 Exam endomNo ratings yet

- IAS 16 - ExerciseDocument4 pagesIAS 16 - ExerciseQuỳnh AnhNo ratings yet

- Quiz 1 2Document9 pagesQuiz 1 2Hồng ThơmNo ratings yet

- Bài tập nhóm chương 3 - nhóm 4-k24kt02Document18 pagesBài tập nhóm chương 3 - nhóm 4-k24kt02Lúa PhạmNo ratings yet

- Bài kiểm tra trắc nghiệm chủ đề - Công cụ tài chính - - Xem lại bài làmDocument11 pagesBài kiểm tra trắc nghiệm chủ đề - Công cụ tài chính - - Xem lại bài làmAh TuanNo ratings yet

- f3 Mock TestDocument11 pagesf3 Mock TestSai SandhyaNo ratings yet

- CIT ExerciseDocument3 pagesCIT ExerciseThu Phương NguyễnNo ratings yet

- General (Taxation - Summer 2023) - Microsoft TeamsDocument13 pagesGeneral (Taxation - Summer 2023) - Microsoft TeamsThảo LêNo ratings yet

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209No ratings yet

- Answer Guidance For c6Document13 pagesAnswer Guidance For c6thicknhinmaykhoc100% (1)

- Answer: B: Cf-Multiple Choice Questions (1) - Thuhien-UehDocument5 pagesAnswer: B: Cf-Multiple Choice Questions (1) - Thuhien-UehMinh Phạm100% (1)

- Corporate Income Tax: Section A - Multiple Choice QuestionsDocument24 pagesCorporate Income Tax: Section A - Multiple Choice QuestionsWanda NguyenNo ratings yet

- 2024 - AAA2 - Lecture Note& Question Bank - Sent To STUDENTSDocument64 pages2024 - AAA2 - Lecture Note& Question Bank - Sent To STUDENTSendoh1810No ratings yet

- Quizz 1-2Document3 pagesQuizz 1-2DOAN NGUYEN TRAN THUCNo ratings yet

- Tasks Group AccountingDocument11 pagesTasks Group Accountingduchieu2k32k3100% (1)

- Exercises IAS 8 SolutionDocument5 pagesExercises IAS 8 SolutionLê Xuân HồNo ratings yet

- Midterm 1+ 2 (T NG H P)Document13 pagesMidterm 1+ 2 (T NG H P)Shen NPTDNo ratings yet

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- Cfs Direct Method - IaDocument35 pagesCfs Direct Method - IaCanny TrầnNo ratings yet

- Ifrs Test 2Document6 pagesIfrs Test 2Ngọc LêNo ratings yet

- Tasks For c3Document10 pagesTasks For c3thicknhinmaykhocNo ratings yet

- PDF - Revenue From Contract With Customers (IFRS 15)Document27 pagesPDF - Revenue From Contract With Customers (IFRS 15)Tram NguyenNo ratings yet

- MQ - Ifrs 9Document11 pagesMQ - Ifrs 9Huỳnh Minh Gia HàoNo ratings yet

- Chuẩn mực KTQTDocument24 pagesChuẩn mực KTQTChi PhươngNo ratings yet

- 3-Pit ExercisesDocument5 pages3-Pit ExercisesNguyen Hoang Tram AnhNo ratings yet

- Bài Kiểm Tra LMS Lần 1 Xem Lại Bài LàmDocument14 pagesBài Kiểm Tra LMS Lần 1 Xem Lại Bài Làm12B-42- Nguyễn Mạnh TuấnNo ratings yet

- Đề Bài Đáp Án: Which of the following are examples of non-financial performance indicators? Select ALL that may applyDocument11 pagesĐề Bài Đáp Án: Which of the following are examples of non-financial performance indicators? Select ALL that may applyDANH LÊ VĂNNo ratings yet

- NLKTDocument25 pagesNLKTBá Thiên Kim NguyễnNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument48 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsHồ Đan ThụcNo ratings yet

- MA1 Past Exam QuestionsDocument14 pagesMA1 Past Exam Questionssramnarine1991No ratings yet

- BaitapnhomF2 Phan2 Chapter2 Nhom4 K24KT2Document9 pagesBaitapnhomF2 Phan2 Chapter2 Nhom4 K24KT2Lúa PhạmNo ratings yet

- Kế toán quản trị ngày 9 - 5Document6 pagesKế toán quản trị ngày 9 - 5Ly BùiNo ratings yet

- ExercisesDocument4 pagesExercisesLuân Nguyễn Đình ThànhNo ratings yet

- c12 - T3-Key Bai Tap Sach Ias 33 - Gui SVDocument4 pagesc12 - T3-Key Bai Tap Sach Ias 33 - Gui SVDuongHaNo ratings yet

- Tutorial 7Document4 pagesTutorial 7kien tranNo ratings yet

- Ias 16-Property, Plant and Equipment AccaDocument3 pagesIas 16-Property, Plant and Equipment AccakaviyapriyaNo ratings yet

- PaDocument9 pagesPaGotta Patti HouseNo ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- Bai Tap Chuong 4 - Tinh Thue Thu Nhap Doanh Nghiep 2Document3 pagesBai Tap Chuong 4 - Tinh Thue Thu Nhap Doanh Nghiep 2Ngọc MinhNo ratings yet

- kttc1 IcaewDocument10 pageskttc1 Icaewthành trầnNo ratings yet

- So Sánh S Khác Nhau Gi A IFRS 15 Và VAS 14Document2 pagesSo Sánh S Khác Nhau Gi A IFRS 15 Và VAS 14Châu KhánhNo ratings yet

- GK Cmbctcqt2 Nhóm 8 Dhktkt16bDocument9 pagesGK Cmbctcqt2 Nhóm 8 Dhktkt16bPhan Thị Mỹ DuyênNo ratings yet

- Test SamplesDocument18 pagesTest SamplesDen NgNo ratings yet

- Baitap C1 HVDocument8 pagesBaitap C1 HVThanh ThảoNo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- Ifrs 3Document14 pagesIfrs 3Ngọc LêNo ratings yet

- txvnm-2022-dec-qDocument15 pagestxvnm-2022-dec-qjennifertranlinhchiNo ratings yet

- Principles - Life and Work (PDFDrive) (1) - 235-239Document5 pagesPrinciples - Life and Work (PDFDrive) (1) - 235-239MinhDuongNo ratings yet

- Học Phân Tích Kỹ Thuật Cơ BảnDocument1 pageHọc Phân Tích Kỹ Thuật Cơ BảnMinhDuongNo ratings yet

- Ichimoku Trịnh Phát: List học Phân tích kỹ thuâtDocument2 pagesIchimoku Trịnh Phát: List học Phân tích kỹ thuâtMinhDuongNo ratings yet

- DefinitiveGuideToTheMcKinseyProblemSolvingTest2 PDFDocument14 pagesDefinitiveGuideToTheMcKinseyProblemSolvingTest2 PDFMinhDuongNo ratings yet

- Tally Practical QuestionDocument18 pagesTally Practical QuestionBarani Dharan78% (327)

- Audit 2, AUDIT - OF - INVESTMENT - Problem - 2Document2 pagesAudit 2, AUDIT - OF - INVESTMENT - Problem - 2Shaz NagaNo ratings yet

- Fabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosDocument23 pagesFabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosMaria Nikka GarciaNo ratings yet

- Lesson 2 Fiscal AdministrationDocument10 pagesLesson 2 Fiscal Administrationmitzi samsonNo ratings yet

- BBM 410 Final FM EXAMDocument4 pagesBBM 410 Final FM EXAMcyrusNo ratings yet

- Balance Sheet: As at 31st December, 2018Document22 pagesBalance Sheet: As at 31st December, 2018Ashutosh BiswalNo ratings yet

- TTS - Acquisition Comps PrimerDocument5 pagesTTS - Acquisition Comps PrimerKrystleNo ratings yet

- 2018 City of Vancouver Financial StatementsDocument114 pages2018 City of Vancouver Financial StatementsCTV VancouverNo ratings yet

- Chapter 8 Advanced Accounting Chapter 8 Advanced AccountingDocument22 pagesChapter 8 Advanced Accounting Chapter 8 Advanced AccountingNur AmaliyahNo ratings yet

- Tragedy of The Commons Reflection PaperDocument2 pagesTragedy of The Commons Reflection PaperAshley100% (1)

- 401 (K) Plan Fee Disclosures in 2011Document4 pages401 (K) Plan Fee Disclosures in 2011David GratkeNo ratings yet

- Assignment (PGPM 24) Finance Management and Cost AccountingDocument20 pagesAssignment (PGPM 24) Finance Management and Cost AccountingMohammad Irshad AlamNo ratings yet

- Triple A Final Analysis Rangel Maribel, DisscussionDocument7 pagesTriple A Final Analysis Rangel Maribel, DisscussionZahid UsmanNo ratings yet

- Module 2 Intro To Business TaxationDocument33 pagesModule 2 Intro To Business TaxationHeart Lissie SantosNo ratings yet

- Punjab Rozgar Scheme: Project Business PlanDocument2 pagesPunjab Rozgar Scheme: Project Business PlanShafqat Sobhey100% (1)

- A Project ProposalDocument8 pagesA Project ProposalPasang TamangNo ratings yet

- FIN42030 Topic 2aDocument11 pagesFIN42030 Topic 2aYamini KhannaNo ratings yet

- Ex2 1 - Ex2 2 - Ch. 2Document2 pagesEx2 1 - Ex2 2 - Ch. 2tikegNo ratings yet

- Income Statement - The Coca-Cola Company (KO)Document1 pageIncome Statement - The Coca-Cola Company (KO)vijayNo ratings yet

- 2022 Accounting ExamDocument8 pages2022 Accounting ExamCaleigh OrtmannNo ratings yet

- Amul Cs FINALDocument2 pagesAmul Cs FINALAnjali KajariaNo ratings yet

- Audit of Liabilities-KeyDocument5 pagesAudit of Liabilities-KeyAegyo AshieNo ratings yet

- Adjusting Entries FR UTB Fill in The Blanks N Effects of OmissionsDocument31 pagesAdjusting Entries FR UTB Fill in The Blanks N Effects of Omissionsjadetablan30No ratings yet

- LK - Laporan KeuanganDocument17 pagesLK - Laporan KeuanganrandyoceuNo ratings yet

- Accounting For ManagementDocument5 pagesAccounting For ManagementZahid HassanNo ratings yet

- Part 3333Document2 pagesPart 3333Rhoiz100% (2)