CH6 ... Valuing Bonds

CH6 ... Valuing Bonds

Uploaded by

Mariam AlraeesiCopyright:

Available Formats

CH6 ... Valuing Bonds

CH6 ... Valuing Bonds

Uploaded by

Mariam AlraeesiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

CH6 ... Valuing Bonds

CH6 ... Valuing Bonds

Uploaded by

Mariam AlraeesiCopyright:

Available Formats

Chapter 6

Valuing Bonds

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-1

Chapter Outline

6.1 Bond Cash Flows, Prices, and Yields

6.2 Dynamic Behavior of Bond Prices

6.3 The Yield Curve and Bond Arbitrage

6.4 Corporate Bonds

6.5 Sovereign Bonds

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-2

6.1 Bond Cash Flows, Prices, and

Yields

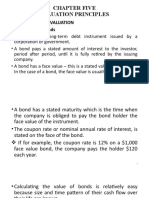

• Bond: A financial contract that typically has a stated maturity

and periodic interest payments.

• Bond Terminology

– Bond Certificate

• States the terms of the bond

– Maturity Date

• Final repayment date

– Term

• The time remaining until the repayment date

– Coupon

• Promised interest payments

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-3

6.1 Bond Cash Flows, Prices,

and Yields (cont'd)

• Bond Terminology

– Face Value

• Notional amount used to compute the interest

payments

– Coupon Rate

• Determines the amount of each coupon payment,

expressed as an APR

– Coupon Payment

Coupon Rate Face Value

CPN

Number of Coupon Payments per Year

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-4

6.2 (B) Zero-Coupon Bonds

• Known as “pure” discount bonds and sold at a

discount from face value

• Do not pay any interest over the life of the

bond.

• At maturity, the investor receives the par

value, usually $1000.

• Price of a zero-coupon bond is calculated by

merely discounting its par value at the

prevailing discount rate or yield to maturity.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-5

6.2 (C) Amortization of a Zero-

Coupon Bond

Table 6.2

Amortized

Interest on a

Zero-Coupon

Bond

• The discount on a zero-coupon bond is amortized over its life.

• Interest earned is calculated for each 6-month period.

• for example .04*790.31=$31.62

• Interest is added to price to compute ending price.

• Zero-coupon bond investors have to pay tax on annual price

appreciation even though no cash is received.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-6

Zero-Coupon Bonds

• Zero-Coupon Bond

– Does not make coupon payments

– Always sells at a discount (a price lower than

face value), so they are also called pure

discount bonds

– Treasury Bills are U.S. government zero-

coupon bonds with a maturity of up to one year.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-7

Zero-Coupon Bonds (cont'd)

• Suppose that a one-year, risk-free, zero-

coupon bond with a $100,000 face value

has an initial price of $96,618.36. The cash

flows would be

– Although the bond pays no “interest,” your

compensation is the difference between the

initial price and the face value.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-8

Zero-Coupon Bonds (cont'd)

• Yield to Maturity

– The discount rate that sets the present value of

the promised bond payments equal to the

current market price of the bond.

• Price of a Zero-Coupon bond

FV

P

(1 YTM n ) n

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-9

Zero-Coupon Bonds (cont'd)

• Yield to Maturity

– For the one-year zero coupon bond:

100,000

96,618.36

(1 YTM 1 )

100,000

1 YTM 1 1.035

96,618.36

• Thus, the YTM is 3.5%.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-10

Zero-Coupon Bonds (cont'd)

• Yield to Maturity

– Yield to Maturity of an n-Year Zero-Coupon Bond

1

FV n

YTM n 1

P

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-11

Textbook Example 6.1

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-12

Textbook Example 6.1 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-13

Alternative Example 6.1

• Problem

– Suppose that the following zero-coupon bonds

are selling at the prices shown below per $100

face value. Determine the corresponding yield

to maturity for each bond.

Maturity 1 year 2 years 3 years 4 years

Price $98.04 $95.18 $91.51 $87.14

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-14

Alternative Example 6.1 (cont'd)

• Solution

YTM (100 / 98.04) 1 0.02 2%

YTM (100 / 95.18)1/2 1 0.025 2.5%

YTM (100 / 91.51)1/3 1 0.03 3%

YTM (100 / 87.14)1/4 1 0.035 3.5%

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-15

Zero-Coupon Bonds (cont'd)

• Risk-Free Interest Rates

– A default-free zero-coupon bond that matures

on date n provides a risk-free return over the

same period. Thus, the Law of One Price

guarantees that the

risk-free interest rate equals the yield to

maturity on such a bond.

– Risk-Free Interest Rate with Maturity n

rn YTM n

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-16

Zero-Coupon Bonds (cont'd)

• Risk-Free Interest Rates

– Spot Interest Rate

• Another term for a default-free, zero-coupon yield

– Zero-Coupon Yield Curve

• A plot of the yield of risk-free zero-coupon bonds as a

function of the bond’s maturity date

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-17

Coupon Bonds

• Coupon Bonds

– Pay face value at maturity

– Pay regular coupon interest payments

• Treasury Notes

– U.S. Treasury coupon security with original

maturities of 1–10 years

• Treasury Bonds

– U.S. Treasury coupon security with original

maturities over 10 years

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-18

Textbook Example 6.2

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-19

Textbook Example 6.2 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-20

Alternative Example 6.2

• Problem

– Suppose that Proctor & Gamble has just issued a

10-year, $1000 bond with a 4% coupon and

semi-annual coupon payments. What cash flows

will you receive if you hold the bond until

maturity?

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-21

Alternative Example 6.2 (cont'd)

• Solution:

– Here is the timeline, based on a six-month

period:

– Note that the last payment is composed of both

a coupon payment of $20 and the face value

payment of $1000.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-22

Coupon Bonds (cont'd)

• Yield to Maturity

– The YTM is the single discount rate that equates

the present value of the bond’s remaining cash

flows to its current price.

– Yield to Maturity of a Coupon Bond

1 1 FV

P CPN 1 N

y (1 y ) (1 y ) N

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-23

Formula for Bond Yield

• Weighted average is used to get the average

investment over 15 year holding period.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-24

Yield to Maturity

• YTM is the average rate of return earned on

a bond if it is held to maturity

Annual Accrued

Approximate interest capital gains

yield to maturity Average value of bond

M - Vd

INT

N

2 Vd M

3

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-25

Textbook Example 6.3

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-26

Textbook Example 6.3 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-27

Alternative Example 6.3

• Problem

– Consider the following semi-annual bond:

• $1000 par value

• 7 years until maturity

• 9% coupon rate

• Price is $1,080.55

– What is the bond’s yield to maturity?

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-28

Textbook Example 6.4

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-29

Textbook Example 6.4 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-30

6.2 Dynamic Behavior of Bond

Prices

• Discount

– A bond is selling at a discount if the price is

less than the face value.

• Par

– A bond is selling at par if the price is equal to

the face value.

• Premium

– A bond is selling at a premium if the price is

greater than the face value.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-31

Discounts and Premiums

• If a coupon bond trades at a discount, an

investor will earn a return both from

receiving the coupons and from receiving a

face value that exceeds the price paid for

the bond.

– If a bond trades at a discount, its yield to

maturity will exceed its coupon rate.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-32

Discounts and Premiums (cont'd)

• If a coupon bond trades at a premium, it will earn

a return from receiving the coupons, but this

return will be diminished by receiving a face value

less than the price paid for the bond.

• Most coupon bonds have a coupon rate so that the

bonds will initially trade at, or very close to, par.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-33

Discounts and Premiums (cont'd)

Table 6.1 Bond Prices Immediately After a Coupon

Payment

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-34

Relationship of Yield to Maturity and

Coupon Rate

Table 6.2 Premium Bonds, Discount Bonds, and

Par Value Bonds

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-35

Textbook Example 6.5

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-36

Textbook Example 6.5 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-37

Alternative Example 6.5

• Problem

– Suppose that Proctor & Gamble issued a bond

that has seven years remaining until maturity, a

$1000 face value, and a 4% coupon rate with

annual coupon payments. If the current market

interest rate is 3%, what is bond’s premium or

discount? What if the current market rate is

6%?

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-38

Alternative Example 6.5 (cont'd)

• Solution:

– At a market rate of 6%, the price of the bond will

be

– So the discount is $1000 – $888.35 = $111.65.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-39

Time and Bond Prices

• Holding all other things constant, a bond’s

yield to maturity will not change over time.

• Holding all other things constant, the price

of discount or premium bond will move

toward par value over time.

• If a bond’s yield to maturity has not

changed, then the IRR of an investment in

the bond equals its yield to maturity even if

you sell the bond early.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-40

Textbook Example 6.6

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-41

Textbook Example 6.6 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-42

Textbook Example 6.6 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-43

Figure 6.1 The Effect of Time on

Bond Prices

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-44

Interest Rate Changes and Bond

Prices

• There is an inverse relationship between

interest rates and bond prices.

– As interest rates and bond yields rise, bond

prices fall.

– As interest rates and bond yields fall, bond

prices rise.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-45

Interest Rate Changes

and Bond Prices (cont'd)

• The sensitivity of a bond’s price to changes

in interest rates is measured by the bond’s

duration.

– Bonds with high durations are highly sensitive to

interest rate changes.

– Bonds with low durations are less sensitive to

interest rate changes.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-46

Textbook Example 6.7

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-47

Textbook Example 6.7 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-48

Alternative Example 6.7

• Problem

– The University of Pennsylvania sold $300 million

of 100-year bonds with a yield to maturity of

4.67%. Assuming the bonds were sold at par

and pay an annual coupon, by what percentage

will the price of the bond change if its yield to

maturity decreases by 1%? Increases by 2%?

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-49

Valuing a Coupon Bond

Using Zero-Coupon Yields

• The price of a coupon bond must equal the

present value of its coupon payments and face

value.

– Price of a Coupon Bond

PV PV (Bond Cash Flows)

CPN CPN CPN FV

1 YTM 1 (1 YTM 2 ) 2

(1 YTM n ) n

100 100 100 1000

P 2

3

$1153

1.035 1.04 1.045

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-50

Coupon Bond Yields

• Given the yields for zero-coupon bonds, we

can price a coupon bond.

100 100 100 1000

P 1153

(1 y ) (1 y ) 2

(1 y )3

100 100 100 1000

P 2

3

$1153

1.0444 1.0444 1.0444

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-51

Textbook Example 6.8

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-52

Textbook Example 6.8 (cont'd)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-53

Treasury Yield Curves

• Treasury Coupon-Paying Yield Curve

– Often referred to as “the yield curve”

• On-the-Run Bonds

– Most recently issued bonds

– The yield curve is often a plot of the yields on

these bonds.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-54

6.4 Corporate Bonds

• Corporate Bonds

– Issued by corporations

• Credit Risk

– Risk of default

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-55

Corporate Bond Yields

• Investors pay less for bonds with credit risk

than they would for an otherwise identical

default-free bond.

• The yield of bonds with credit risk will be

higher than that of otherwise identical

default-free bonds.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-56

Corporate Bond Yields (cont'd)

• Certain Default

– The yield to maturity of a certain default bond is

not equal to the expected return of investing in

the bond. The yield to maturity will always be

higher than the expected return of investing in

the bond.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-57

Corporate Bond Yields (cont'd)

• Risk of Default

– Consider a one-year, $1000, zero-coupon bond

issued. Assume that the bond payoffs are

uncertain.

• There is a 50% chance that the bond will repay its face

value in full and a 50% chance that the bond will

default and you will receive $900. Thus, you would

expect to receive $950.

• Because of the uncertainty, the discount rate is 5.1%.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-58

Corporate Bond Yields (cont'd)

• Risk of Default

– The price of the bond will be

950

P $903.90

1.051

– The yield to maturity will be

FV 1000

YTM 1 1 .1063

P 903.90

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-59

Corporate Bond Yields (cont'd)

• Risk of Default

– A bond’s expected return will be less than the

yield to maturity if there is a risk of default.

– A higher yield to maturity does not necessarily

imply that a bond’s expected return is higher.

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-60

Corporate Bond Yields (cont'd)

Table 6.3 Price, Expected Return, and Yield to Maturity of

a One-Year, Zero-Coupon Avant Bond with Different

Likelihoods of Default

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-61

Bond Ratings

• Investment Grade Bonds

• Speculative Bonds

– Also known as Junk Bonds or High-Yield Bonds

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-62

Table 6.4 Bond Ratings

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-63

Table 6.4 Bond Ratings (cont’d)

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-64

Corporate Yield Curves

• Default Spread

– Also known as Credit Spread

– The difference between the yield on corporate

bonds and Treasury yields

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-65

Figure 6.3 Corporate Yield Curves

for Various Ratings, August 2015

Source: Yahoo! Finance

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-66

Figure 6.4 Yield Spreads and the

Financial Crisis

Source:

Bloomberg.com

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-67

6.5 Sovereign Bonds

• Bonds issued by national governments

– U.S. Treasury securities are generally considered

to be default free.

– All sovereign bonds are not default free,

• e.g. Greece defaulted on its outstanding debt in 2012.

– Importance of inflation expectations

• Potential to “inflate away” the debt

– European sovereign debt, the EMU, and the ECB

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-68

Chapter Quiz

1. What is the relationship between a bond’s price and

its yield to maturity?

2. If a bond’s yield to maturity does not change, how

does its cash price change between coupon

payments?

3. How does a bond’s coupon rate affect its duration –

the bond price’s sensitivity to interest rate changes?

4. Explain why two coupon bonds with the same

maturity may each have a different yield to maturity.

5. There are two reasons the yield of a defaultable bond

exceeds the yield of an otherwise identical default-

free bond. What are they?

Copyright ©2017 Pearson Education, Ltd. All rights reserved. 6-69

You might also like

- 2009 Valuation Handbook A UBS GuideDocument112 pages2009 Valuation Handbook A UBS Guidealmasy99100% (5)

- How Compulsive WeChat Use & Information Overload Affect Social Media FatigueDocument11 pagesHow Compulsive WeChat Use & Information Overload Affect Social Media FatigueMariam AlraeesiNo ratings yet

- Chapter 4 - Case #4 (Answers)Document3 pagesChapter 4 - Case #4 (Answers)Mariam AlraeesiNo ratings yet

- Solutions Balancing Process Capacity Simulation Challenge 1 and Challange 2Document29 pagesSolutions Balancing Process Capacity Simulation Challenge 1 and Challange 2Mariam AlraeesiNo ratings yet

- Moulton Corporation Engaged in The Following Seven Transactions During DecemberDocument1 pageMoulton Corporation Engaged in The Following Seven Transactions During Decembertrilocksp SinghNo ratings yet

- DocumentDocument80 pagesDocumentzohaib bilgramiNo ratings yet

- Bond CapmDocument158 pagesBond CapmQuỳnh Anh TrầnNo ratings yet

- C11 - Bond Valuation - UpdatedDocument34 pagesC11 - Bond Valuation - UpdatedmieumahmieumahNo ratings yet

- Corporate Finance - CH 6, 7 8Document156 pagesCorporate Finance - CH 6, 7 8JoanWang100% (1)

- Im Module4Document82 pagesIm Module4lokiknNo ratings yet

- The Valuation and Characteristics of BondsDocument56 pagesThe Valuation and Characteristics of BondsErlangga100% (1)

- Chapter 06Document44 pagesChapter 06蔡彤旻No ratings yet

- Interest Rates and Bond Valuation: Mcgraw-Hill/IrwinDocument29 pagesInterest Rates and Bond Valuation: Mcgraw-Hill/IrwinsueernNo ratings yet

- Cecchetti 6e Chapter 06updatedDocument53 pagesCecchetti 6e Chapter 06updatedmithatfurkananlarNo ratings yet

- Chap 6aDocument45 pagesChap 6a何健珩No ratings yet

- Unit 57 - Introduction To The Valuation of Debt Securities - 2013Document25 pagesUnit 57 - Introduction To The Valuation of Debt Securities - 2013amish ganatraNo ratings yet

- Chapter 7 (Spring 2017)Document37 pagesChapter 7 (Spring 2017)Eugene M. BijeNo ratings yet

- Fin254 Chapter 6Document18 pagesFin254 Chapter 6Wasif KhanNo ratings yet

- THREEBond and Stock Valuation - BondDocument22 pagesTHREEBond and Stock Valuation - BondRaasu KuttyNo ratings yet

- RWJ FCF11e Chap 07 PDFDocument49 pagesRWJ FCF11e Chap 07 PDFJeanette JenaNo ratings yet

- 5-Valuation of BondsDocument52 pages5-Valuation of BondsAkansh NuwalNo ratings yet

- LN01 Smart3075419 13 FI C10 EditedDocument58 pagesLN01 Smart3075419 13 FI C10 EditedNgọcNo ratings yet

- Week 4 (Lecture 4) : The Time Value of Money: Effective Annual Rate, Annuities & PerpetuitiesDocument39 pagesWeek 4 (Lecture 4) : The Time Value of Money: Effective Annual Rate, Annuities & PerpetuitiesIsaac NahNo ratings yet

- RWJ FCF2e Chap 07Document51 pagesRWJ FCF2e Chap 07مممم ههنNo ratings yet

- Bonds Valuation (Part Two)Document16 pagesBonds Valuation (Part Two)rrrrokayaaashrafNo ratings yet

- Bond Market 2019Document57 pagesBond Market 2019GBMS gorakhnagarNo ratings yet

- Lecture 4 PostDocument29 pagesLecture 4 PostSamantha YuNo ratings yet

- Chapter 5Document35 pagesChapter 5Ahmed El KhateebNo ratings yet

- Bond ValuationDocument15 pagesBond ValuationR.D. PiyumalNo ratings yet

- AE 18 - Bonds and Their ValuationDocument6 pagesAE 18 - Bonds and Their ValuationNephtaly TorralbaNo ratings yet

- 5 BondDocument9 pages5 BondSurya ChourasiaNo ratings yet

- Bond Valuation 2018Document40 pagesBond Valuation 2018KeeganNo ratings yet

- Chapter Five Valuation Principles: Bond and Stock Valuation 1. Valuation of BondsDocument32 pagesChapter Five Valuation Principles: Bond and Stock Valuation 1. Valuation of BondsIvecy ChilalaNo ratings yet

- Review Session# 2 #17 July 2021Document23 pagesReview Session# 2 #17 July 2021Diff EnderNo ratings yet

- Chapter 6Document18 pagesChapter 6eee “eezzyy” zzzNo ratings yet

- Debt ValuationDocument30 pagesDebt ValuationSiddharth BirjeNo ratings yet

- How To Value Bonds?: Application of Time Value of MoneyDocument36 pagesHow To Value Bonds?: Application of Time Value of Moneyabhishek dharNo ratings yet

- Bond ValuationDocument57 pagesBond ValuationRajib BurmanNo ratings yet

- Ecture OND Aluation: Ming Liu International University of JapanDocument38 pagesEcture OND Aluation: Ming Liu International University of JapanPabitra DangolNo ratings yet

- BondsDocument58 pagesBondsKunal ChoudharyNo ratings yet

- Chapter 7Document38 pagesChapter 7AnsleyNo ratings yet

- Bond Valuation A Mini Case and Solution OutlineDocument7 pagesBond Valuation A Mini Case and Solution OutlinegeorgeNo ratings yet

- Module 3 Valuing Securities - Tagged (1)Document49 pagesModule 3 Valuing Securities - Tagged (1)tylerlemieuxbusinessNo ratings yet

- CH5 ... Interest RatesDocument40 pagesCH5 ... Interest RatesMariam AlraeesiNo ratings yet

- Chapter 4Document26 pagesChapter 4KarimBekdashNo ratings yet

- Bond Portfolio MGMTDocument43 pagesBond Portfolio MGMTpranav nalawadeNo ratings yet

- Bond ValuationDocument78 pagesBond ValuationSarikaNo ratings yet

- The Debt MarketDocument79 pagesThe Debt MarketFernanda HrnNo ratings yet

- CH 05Document40 pagesCH 05bodyelkasabyNo ratings yet

- FINA2010 Financial Management: Lecture 6: Bond and Stock ValuationDocument61 pagesFINA2010 Financial Management: Lecture 6: Bond and Stock ValuationmoonNo ratings yet

- Interest Rates and Bond ValuationDocument79 pagesInterest Rates and Bond ValuationNina ElbenniNo ratings yet

- Brooks FM PPT Ch06 BBDocument33 pagesBrooks FM PPT Ch06 BBghj9818No ratings yet

- Valuation of Financial AssetDocument39 pagesValuation of Financial AssetEyael ShimleasNo ratings yet

- Chapter 5 BondDocument30 pagesChapter 5 BondHang NguyenNo ratings yet

- Valuation of Securities-Bonds StocksDocument50 pagesValuation of Securities-Bonds StocksMega capitalmarketNo ratings yet

- WK 7.1 - Bonds and Bond ValuationDocument18 pagesWK 7.1 - Bonds and Bond Valuationhfmansour.phdNo ratings yet

- Session 3 Interest Rate and BondsDocument32 pagesSession 3 Interest Rate and BondsRoshanNo ratings yet

- Bond ValuatioDocument66 pagesBond ValuatioKanishka SinghNo ratings yet

- Lecture 4 Debt Valuation 2Document25 pagesLecture 4 Debt Valuation 211219221nguyen.viNo ratings yet

- Chapter 7 - 18may 2022Document51 pagesChapter 7 - 18may 2022Hazlina HusseinNo ratings yet

- FM - CH 4 Security Valuation 2024Document66 pagesFM - CH 4 Security Valuation 2024felpitmomNo ratings yet

- Chapter+4 +time+value+of+moneyDocument109 pagesChapter+4 +time+value+of+moneyThảo Nhi LêNo ratings yet

- Valuation of Bonds and SharesDocument36 pagesValuation of Bonds and SharesnidhiNo ratings yet

- FMP IiDocument87 pagesFMP IiAbhijeet PatilNo ratings yet

- Chapter 4 Interest RatesDocument31 pagesChapter 4 Interest Ratesashutoshusa20No ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- A Communication Study of Young AdultsDocument24 pagesA Communication Study of Young AdultsMariam AlraeesiNo ratings yet

- Studying Social Media Burnout & Problematic Social Media UseDocument13 pagesStudying Social Media Burnout & Problematic Social Media UseMariam AlraeesiNo ratings yet

- COVID-19 Information Overload & Generation Z's Social MediaDocument13 pagesCOVID-19 Information Overload & Generation Z's Social MediaMariam AlraeesiNo ratings yet

- IFRSadoptioncorporategovernanceandfaithfulrepresentationoffinancialreportingqualityinNigeriasdevelopmentbanks PDFDocument15 pagesIFRSadoptioncorporategovernanceandfaithfulrepresentationoffinancialreportingqualityinNigeriasdevelopmentbanks PDFMariam AlraeesiNo ratings yet

- Implementing Canva in A Flipped Classroom A ChalleDocument17 pagesImplementing Canva in A Flipped Classroom A ChalleMariam AlraeesiNo ratings yet

- Trait Anxiety and Social Media Fatigue - Fear of Missing Out As A MediatorDocument10 pagesTrait Anxiety and Social Media Fatigue - Fear of Missing Out As A MediatorMariam AlraeesiNo ratings yet

- Extended Implementation of IFRS 15 Integrated ModeDocument16 pagesExtended Implementation of IFRS 15 Integrated ModeMariam AlraeesiNo ratings yet

- Board Characteristicsand International Financial Reporting Standards IFRSComplianceDocument18 pagesBoard Characteristicsand International Financial Reporting Standards IFRSComplianceMariam AlraeesiNo ratings yet

- Examination of Compliance With Disclosure RequiremDocument13 pagesExamination of Compliance With Disclosure RequiremMariam AlraeesiNo ratings yet

- The Determinants and Effects of The Early Adoption of IFRS 15:evidence From A Developing CountryDocument24 pagesThe Determinants and Effects of The Early Adoption of IFRS 15:evidence From A Developing CountryMariam AlraeesiNo ratings yet

- Joint ArrangementDocument7 pagesJoint ArrangementMariam AlraeesiNo ratings yet

- Week 5 Balancing Process Capacity Simulation Slides Challenge1 and Challenge 2 HHv2Document23 pagesWeek 5 Balancing Process Capacity Simulation Slides Challenge1 and Challenge 2 HHv2Mariam AlraeesiNo ratings yet

- IFRS Adoption Cost of Equity and Firm Value EvidenDocument14 pagesIFRS Adoption Cost of Equity and Firm Value EvidenMariam AlraeesiNo ratings yet

- If Rs Exploring Financial Evidence From Listed Companies in The UsDocument27 pagesIf Rs Exploring Financial Evidence From Listed Companies in The UsMariam AlraeesiNo ratings yet

- Effect of IFRS On The Value Relevance of Accounting Information in The Nigerian Stock MarketDocument12 pagesEffect of IFRS On The Value Relevance of Accounting Information in The Nigerian Stock MarketMariam AlraeesiNo ratings yet

- Balancing Process Capacity Report C14Document6 pagesBalancing Process Capacity Report C14Mariam AlraeesiNo ratings yet

- Published JIABR 2022Document24 pagesPublished JIABR 2022Mariam AlraeesiNo ratings yet

- Value Relevance of Financial Reporting in Pre IFRSDocument25 pagesValue Relevance of Financial Reporting in Pre IFRSMariam AlraeesiNo ratings yet

- 2018v13 2 SantoshDocument13 pages2018v13 2 SantoshMariam AlraeesiNo ratings yet

- BPR HLBDocument31 pagesBPR HLBMariam AlraeesiNo ratings yet

- Business Process Reengineering BPRDocument9 pagesBusiness Process Reengineering BPRMariam AlraeesiNo ratings yet

- BPC PDFDocument4 pagesBPC PDFMariam AlraeesiNo ratings yet

- 2021 Ijsom-27044 PPVDocument33 pages2021 Ijsom-27044 PPVMariam AlraeesiNo ratings yet

- Reengineering HistoryDocument25 pagesReengineering HistoryMariam AlraeesiNo ratings yet

- 5784 14518 1 PBDocument10 pages5784 14518 1 PBMariam AlraeesiNo ratings yet

- Cash Flow and Equivalence PDFDocument6 pagesCash Flow and Equivalence PDFIscandar Pacasum DisamburunNo ratings yet

- Session 7 - 25.02.2024 - Time Value of MoneyDocument31 pagesSession 7 - 25.02.2024 - Time Value of Moneysiranjivikumar.m1No ratings yet

- Financial Management-Lecture 7Document26 pagesFinancial Management-Lecture 7TinoManhangaNo ratings yet

- IFRS vs. IFRS For SMEsDocument33 pagesIFRS vs. IFRS For SMEsLohraine DyNo ratings yet

- Mishkin FMI9ge TIF 2Document13 pagesMishkin FMI9ge TIF 2joviaahurraNo ratings yet

- Accounting Manual Federal Reserve BanksDocument222 pagesAccounting Manual Federal Reserve Banksuser31415100% (2)

- Valuation Report DCF Power CompanyDocument34 pagesValuation Report DCF Power CompanySid EliNo ratings yet

- Ross Chapter 9 NotesDocument11 pagesRoss Chapter 9 NotesYuk Sim100% (1)

- Chapter 4Document34 pagesChapter 4goutian211No ratings yet

- How To Use The Sven Carlin Stocks Comparative TableDocument6 pagesHow To Use The Sven Carlin Stocks Comparative TablezparNo ratings yet

- Tybms Sem 6 SyllabusDocument9 pagesTybms Sem 6 SyllabusRavi KrishnanNo ratings yet

- Chapter 15Document8 pagesChapter 15Mychie Lynne MayugaNo ratings yet

- Compounding and DiscountingDocument20 pagesCompounding and DiscountingShivansh Dwivedi100% (1)

- Compound Market Risk AssessmentDocument45 pagesCompound Market Risk AssessmentMichaelPatrickMcSweeneyNo ratings yet

- 1d 5 Learning Module Week 5 Financial AccountingDocument11 pages1d 5 Learning Module Week 5 Financial AccountingLJNo ratings yet

- ch18 Kieso IFRS4 PPTDocument147 pagesch18 Kieso IFRS4 PPTNaylaNo ratings yet

- Line50ii Fields AdvancedDocument3 pagesLine50ii Fields AdvancedrobertNo ratings yet

- Bills Discounting, Factoring & ForfaitingDocument23 pagesBills Discounting, Factoring & ForfaitingVineet HaritNo ratings yet

- CF Classwrok 1 TVMDocument2 pagesCF Classwrok 1 TVMfalconsgroupNo ratings yet

- FIN3702 MayJune2022Document21 pagesFIN3702 MayJune2022kevinedgarjacobsNo ratings yet

- Mgt201 Midterm Solved Mcqs by Junaid MalikDocument18 pagesMgt201 Midterm Solved Mcqs by Junaid MalikAZEEM SAMSONNo ratings yet

- Bcom Sem 1 Financial Accounting 1 EMQuestion BankDocument29 pagesBcom Sem 1 Financial Accounting 1 EMQuestion BankGames OnlineNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- Lecture08 09 FutursForwardsDocument42 pagesLecture08 09 FutursForwardsPino De PinisNo ratings yet

- ch15 AccountingDocument49 pagesch15 AccountingYAHIA ADELNo ratings yet

- Personal Finance Math (Part 2) - Varsity by ZerodhaDocument9 pagesPersonal Finance Math (Part 2) - Varsity by Zerodhadeveloper devNo ratings yet

- FMS QBDocument57 pagesFMS QBkrishna chaitanyaNo ratings yet