Amazon Goes Global - Ivey Publishing 2015

- 2. About the Company • Founded by Jeff Bezos on July 5, 1994 • American electronic commerce and cloud computing company based in Seattle, Washington • Largest Internet retailer in the world (Revenue and market capitalization) • amazon.com started as an online bookstore and later diversified to other categories • Amazon has separate retail websites for the US, UK, France, Canada, Germany, Italy, Spain, Netherlands, Australia, Brazil, Japan, China, India, Mexico, Singapore, and Turkey • Amazon is the second most valuable public company in the world (behind Apple), the largest Internet company by revenue in the world, and after Walmart, the second largest employer in the United States

- 3. KSF – Amazon • Direct to consumer online model • Low inventory risk – Strategic location, Optimum level • Huge economies of scale – Virtual barrier for new entrants • Presence around the world – 15+ country specific websites • Entry through strategic acquisitions • Diversified product mix (Retailing, AWS, Alexa, Kindle, Fire, ATS, Prime Video, Prime Music) • High customer retention – Customer centric approach • Local language (amazon.in is also available in Hindi) • First mover advantage – Online Retailing

- 4. SWOT Analysis - Amazon S • Powerful global brand • Diversified portfolio (Products & Services) • Customer Support (Earth’s most customer centric company) • Presence in global landscape T W O • Third party sellers on website (Lesser Control) • Dependence on third party logistics • Huge Capital being wiped off due to competition (Sale) • Stock piling (Slow moving and Non moving goods) • Backward Integration (Amazon Basics products) • Strategic acquisition of local players (eg. Walmart-Flipkart) • In-house payment service Amazon pay (Developing Nations) • Opportunities in Middle East and Africa • Intense competition in China, a major market. Competitors such as Alibaba, JD already have the first mover advantage. • Low entry barriers means tough competition, price wars, shrinking margins & losses

- 5. Potential New Entrants Threat of Substitutes Porters Five Forces – Online Retailing Industry Suppliers Power Buyers Power Industry Rivalry • No Switching cost of customer • Well informed customers • High cost of customer acquisition • Between major players • Deep-discounts for gaining market • Low entry barriers • Innovation in order delivery - Drones • Retail stores selling online • Intra-City based retail chains • Lot of potential market untapped • Lot of funding option available • Low capital requirement • Rules set by brands, suppliers follow • Set code of conduct for suppliers • Limited options for suppliers Relatively High Moderately Low Moderately High Moderately Low Relatively High With intense competition within the industry, no entry barriers posing threat of new entrants, no product differentiation posing huge threat from substitute products, huge possibility for suppliers to forward integrate and huge bargaining power of customers makes the current E-Commerce industry unattractive.

- 6. Revenue vs Net Income -500 0 500 1000 1500 2000 2500 3000 3500 0 20000 40000 60000 80000 100000 120000 140000 160000 180000 200000 NetIncomeMillion$ 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 RevenueMillion$ Revenue vs Net Income Revenues Net Income Doubled spending on Purchases of property and equipment, including internal-use software and website development

- 7. Net Sales vs Cost of Sales 0 20000 40000 60000 80000 100000 120000 140000 160000 180000 2010 2011 2012 2013 2014 2015 2016 2017 Million$ Axis Title Net Sales vs Cost of Sales Net Sales Cost of Sales

- 8. 0 5 10 15 20 25 Asia Pacific Australasia Eastern Europe Latin America Middle East & Africa North America Western Europe CAGR 2012-17 CAGR - Online Retailing Industry

- 9. Amazon in China • Entry through acquisition of joyo.com – largest online retailer of books, music and videos in China at that time • Renamed amazon.cn, increased product offering by 32 fold, still didn’t have profits • Cultural, Administrative, Economic distance – customers not willing to pay for e-books, sparse use of card payment • Did not launch Kindle in China, leading to dominance of local brand, low cost e-readers • Failed to understand that no company has built a profitable business in china around e-books • Regulatory barriers and complications in cloud services

- 10. Case Questions Why did Amazon consider international expansion in the first place? Is international expansion a key success factor in Online Retail industry? • Intense competition & saturated home markets • Internet growth, computer & smartphone outreach in developing nations • Strong competition from stores like WALMART in home country • Negligible product differentiation in retailing, hence they followed ‘Market Development’ strategy • Mostly unorganized players (small players, mostly limited category) in developing nations • CAGR of Online retailing industry 20+ % in Asia, Middle East

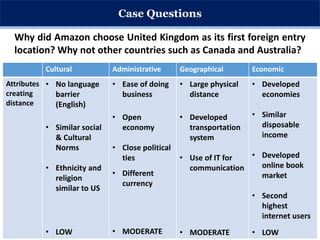

- 11. Case Questions Why did Amazon choose United Kingdom as its first foreign entry location? Why not other countries such as Canada and Australia? Cultural Administrative Geographical Economic Attributes creating distance • No language barrier (English) • Similar social & Cultural Norms • Ethnicity and religion similar to US • LOW • Ease of doing business • Open economy • Close political ties • Different currency • MODERATE • Large physical distance • Developed transportation system • Use of IT for communication • MODERATE • Developed economies • Similar disposable income • Developed online book market • Second highest internet users • LOW

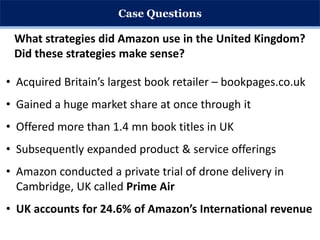

- 12. Case Questions What strategies did Amazon use in the United Kingdom? Did these strategies make sense? • Acquired Britain’s largest book retailer – bookpages.co.uk • Gained a huge market share at once through it • Offered more than 1.4 mn book titles in UK • Subsequently expanded product & service offerings • Amazon conducted a private trial of drone delivery in Cambridge, UK called Prime Air • UK accounts for 24.6% of Amazon’s International revenue

- 13. Case Questions Why did Amazon choose to enter Japan after the United Kingdom and Germany? Cultural Administrative Geographical Economic Attributes creating distance • Different social and cultural norms • Different language • Ethnicity and religion dissimilar • HIGH • Legal constraint on discounts • Regulated market • Fluctuating exchange rates • Different currency • LOW • Large physical distance • Developed transportation system • Use of IT for communication • MODERATE • Per capita online spend second to US • Similar disposable income • Shared market information • Similar financial resource • LOW

- 14. Case Questions What strategies did Amazon use in Japan? Did these strategies make sense? • Amazon.co.jp – First website in Asian language • Japanese books were already sold at low prices • Legal restrictions prohibited deep discounts • Japanese consumers hesitated in using Cards Online (POD) • Launch country specific websites (99% of population fully comprehend website content in Japanese • Teamed up with Red Cross for relief efforts (Tsunami-2011)

- 15. Case Questions Was there any pattern across Amazon’s international entries? • Test Market (Export Based) • Target countries with rapidly rising internet users • Firstly enter as an online book retailer (Safe Bet) • Acquire one/major retailers • Launch country specific websites • Generally wholly owned subsidiary

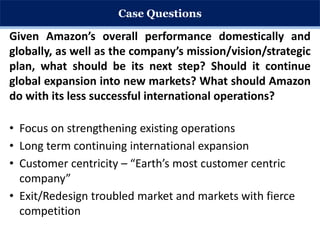

- 16. Case Questions Given Amazon’s overall performance domestically and globally, as well as the company’s mission/vision/strategic plan, what should be its next step? Should it continue global expansion into new markets? What should Amazon do with its less successful international operations? • Focus on strengthening existing operations • Long term continuing international expansion • Customer centricity – “Earth’s most customer centric company” • Exit/Redesign troubled market and markets with fierce competition