Copenhagen 2010 ITS "Community owned fibre optic networks in Croatia"

- 1. Community owned fibre optic networks – a sustainable broadband future for rural areas in Croatia? 2010 European Regional ITS Conference in Copenhagen ć Igor Brusić, Martin Lundborg, Wolfgang Reichl SBR Juconomy Consulting AG 14.09.2010 1

- 2. Content 1 Introduction and Background 2 Analysis / Business Models 3 Analysis / Business Case 4 Main results 5 Next Steps and Conclusions Brusic, 9/15/2010 2

- 3. Croatia / General • 4,5 mio. inhabitans; 56.500 km2; 1,5 mio. households • Croatian telecommunication market dominated by the Incumbent operator Hrvatski Telekom (T-HT) – 89% of the broadband access market (January 2009) – Since 1999 owned by DT (Deutsche Telekom) • ANOs like Optima, Metronet, H1 telekom, Amis telekom and B.net only 11% of the BB market • Broaband penetration rate: 11,83% (July 2008) • Fiber Access Lines: ca. 100.000 (homes passed) and ca. 12.000 homes connected Brusic, 9/15/2010 3

- 4. Municipality optical network 1. Why municipality? 2. Why optical? 3. Why network? No operators will do it It has the best charakteristics It is one of the very few The municipality can build it concerning: investments in infrastructure together with other capacity which is fincially attractive infrastructure (streets, canal, electricity consumption It will be the basic etc.) infrastructure for future insensibillity development of the town and Independent of network operaters durability the island environmental impact Because the windows of The last decades most opportunity is open operators are using fibre optics in fixed networks Brusic, 9/15/2010 4

- 5. Croatia / Island Krk / Town of Krk Town of Krk with 6.000 inhabitants and 2.200 houses (5.000 households) Tourism as main source of revenues At the town council decidion in September 2009: Collecting information about existing infrastructure (database) Future civil work, obligation to collocate empty duct Elaboration of a cost/benefit analysis The study can be downloaded at http://www.sbr-net.de/fileadmin/sbr- group/pdf/juconomy/veroeffentlichungen/Cost- Benefit_Analysis_Town_of_Krk_Draft10_Final_ Version.pdf Brusic, 9/15/2010 5

- 6. Content 1 Introduction and Background 2 Analysis / Business Models 3 Analysis / Business Case 4 Main results 5 Next Steps and Conclusions Brusic, 9/15/2010 6

- 7. Verticaly Integrated Services Classical Network Operator owns the infrastructure administers / operates the Distribution network Vertical Integration provides services to end users Company Revenue from products / services contribute to financing the O&M infrastructure and the operation Wholesale offers possible on different levels Network Investors require short term ROI Different regulatory remedies Brusic, 9/15/2010 7

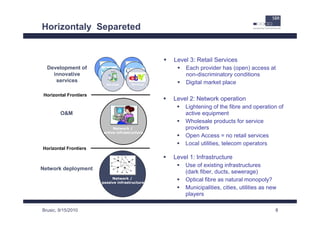

- 8. Horizontaly Separeted Level 3: Retail Services Development of Each provider has (open) access at innovative Dienste Dienste non-discriminatory conditions Dienste Dienste services Digital market place Services Services Horizontal Frontiers Level 2: Network operation Lightening of the fibre and operation of O&M active equipment Wholesale products for service Network / providers active infrastructure Open Access = no retail services Local utilities, telecom operators Horizontal Frontiers Level 1: Infrastructure Use of existing infrastructures Network deployment (dark fiber, ducts, sewerage) Network / passive infrastructure Optical fibre as natural monopoly? Municipalities, cities, utilities as new players Brusic, 9/15/2010 8

- 9. Possible Business Models for Municipalities Source: Benoit Felten, Exploring Open Access Models, 2008 Brusic, 9/15/2010 9

- 10. Content 1 Introduction and Background 2 Analysis / Business Models 3 Analysis / Business Case 4 Main results 5 Next Steps and Conclusions Brusic, 9/15/2010 10

- 11. Calculation Input parameters Cost and revenue estimation path Brusic, 9/15/2010 11

- 12. Cumulated Cash Flow with WACC of 6% Brusic, 9/15/2010 12

- 13. Content 1 Introduction and Background 2 Analysis / Business Models 3 Analysis / Business Case 4 Main results 5 Next Steps and Conclusions Brusic, 9/15/2010 13

- 14. Main Results of the Analysis Calculation confirmed that Krk is not attractive for classical network operators For the realisation of 2.000 connections investments of 1,99 mio. Euro 968 Euro per household 9 km of empty ducts are installed in the city and the town is owning a cable TV network with 1.000 homes connected (70% of the cabeles are in ducts) Parameters positively influencing the project Higher income per subscriber Lower cost of Backhaula (Krk-Zagreb) Lower cost of capital (WACC) Lower OPEX Necessary to optimize the input parameters or changing the business model Brusic, 9/15/2010 14

- 15. Content 1 Introduction and Background 2 Analysis / Business Models 3 Analysis / Business Case 4 Main results 5 Next Steps and Conclusions Brusic, 9/15/2010 15

- 16. Next Steps Elaboration of an master plan Marketing/educating/convince local companies and inhabitants Checking posibilities of financing Checking posibilities of cooperation with (local) private partners Brusic, 9/15/2010 16

- 17. Conclusions Business case for municipalities is different than for classical network operators Externalities can/have to be added Each municipality has to be analized separately City owned ducts and cable TV network - better starting position than other comparable cities in Croatia On site support as a key factor! Public private partnership and open access are highly relevant in future elaborations Brusic, 9/15/2010 17

- 18. Contact SBR Juconomy Consulting AG Nordstrasse 116 Parkring 10/1/10 40477 Düsseldorf 1010 Wien Germany Austria Tel: + 49 211 68 78 88 0 Tel: + 43 1 513 514 0 15 Fax: + 43 1 513 514 0 95 Fax: + 49 211 68 78 88 33 URL: www.sbr-net.com URL: www.sbr-net.com E-mail: brusic@sbr-net.com Brusic, 9/15/2010 18