Atlantic computer case analysis

- 1. ATLANTIC COMPUTER PGPM912 – Div B – Group 3 Sandeep Bharihoke M. Farhan Khan Munish Kumar Piyush Audichya Madhuparna Das Ritesh Ranjan Vijay Aggarwal Atlantic Computer Analysis-Group3 MARKETING -1 CASE ANALYSIS

- 2. Case Analysis • Atlantic Computer is a manufacturer of servers and high-tech products. • Currently there 2 market segments: Traditional and Basic server markets. • Atlantic is a market leader in traditional market with its product Radia, which is a premier product. • Basic market is a new market and is a fast growing one. • For basic market, Atlantic has developed a server Tronn. Also Atlantic has developed a software tool PESA, Performance Enhancing Server Accelerator. Atlantic Computer Analysis- Group3

- 3. Case Analysis. Contd… • PESA enhances the Tronn server’s speed by 4 times from its normal speed. • Atlantic’s main competitor in basic market segment is Ontario, which commands 50% market share with its product Zinc. Atlantic Computer Analysis- Group3

- 4. Objective • The pricing strategy for the Atlantic bundle, which is Tronn server with PESA tool, need to be determined. • There are 4 options available. 1. Atlantic Computers can stay with the status quo and provide PESA as free with Tronn server. 2. It can choose competitive based pricing, which is charging customer to 4 times Ontario Zinc servers. 3. Arrive at price by cost-plus pricing. 4. Arrive at price based on value-in use pricing. • Also other questions regarding product’s target market, competitor’s and customer’s reaction need to be answered. Atlantic Computer Analysis- Group3

- 5. Option-1 • This option include charging for Tronn server only and give PESA tool for free. • Cost Of Atlantic bundle = $2,000 • Atlantic will have to forego the amount of R&D investments done in PESA software here. This amounts to $20,00,000. Atlantic Computer Analysis-Group3

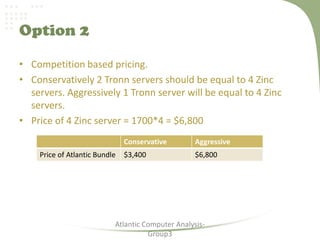

- 6. Option 2 • Competition based pricing. • Conservatively 2 Tronn servers should be equal to 4 Zinc servers. Aggressively 1 Tronn server will be equal to 4 Zinc servers. • Price of 4 Zinc server = 1700*4 = $6,800 Atlantic Computer Analysis- Group3 Conservative Aggressive Price of Atlantic Bundle $3,400 $6,800

- 7. Option 3 • Cost-plus pricing. • Expected sales in 3 years=(4*50000+9*70000+14*92000)/100 • Cost of Tronn server = $1,538 Atlantic Computer Analysis- Group3 Value Remarks Expected sales for Tronn servers(units) 21180 Expected number of PESA installations 10590 (50% of 21180) Cost of PESA per installation 189 (2,000,000/10590) Total cost of Atlantic bundle 1727 1538+189 30% mark-up 518.1 0.3*1727 Final cost 2245.1 1727+518.1

- 8. Option 4 • Value-in use pricing. • Conservatively 2 Tronn servers + PESA is equivalent to 4 Zinc servers. Atlantic Computer Analysis- Group3 2 Tronn Server 4 Zinc server Remarks Price of Servers 4000 6800 Electricity 500 1000 $250 per server S/w licenses cost 1500 3000 $750 per server Total cost 6000 10800 Savings by Tronn 4800 0 10800-6000 50% of saving 2400 0 50-50 cost sharing Final cost for Atlantic bundle 6400 10800 4000+2400

- 9. Pricing - Recommendation • Though the most profitable option looks to be option2(competition-based pricing), we recommend Atlantic to go for option 4(value-in pricing). • Reasons to opt for value-in pricing are listed below. 1. Atlantic computer can show more value to customers by showing them the monetary benefits. 2. If sales increase then Atlantic will also gain by 50-50 profit sharing. 3. Also opting for price-war may not be an good option for Atlantic because the cost of Tronn itself is $1538 while Ontario sells the Zinc at $1700. Atlantic need to factor the cost of PESA as well. So if Ontario lowers the price then it will be difficult for Atlantic to survive. Atlantic Computer Analysis- Group3

- 10. Pricing-Recommendation. Contd… • Though the value-in pricing looks to be most beneficial to both customers and Atlantic, there are certain challenges. – Salespeople need to be convinced about this because their 30% of pay comes from sales and value-in pricing is lower priced than other parts. – Sales people need to be trained to describe the value to customers properly. Atlantic Computer Analysis- Group3 Pricing Method Expected Sale Revenues($) Costs Profit Status-Quo 21,180 $18,287,420 $2,416,030 $2,416,030 Comp-Based 21,180 $36,006,000 $18,287,420 $17,242,030 Cost-Plus 21,180 $23,785,140 $18,287,420 $5,021,170 Value-In 21,180 $33,888,000 $18,287,420 $15,124,030

- 11. Other Questions • Which market should be targeted? – Atlantic should target market that do web hosting and file sharing. These companies can achieve the maximum benefit from PESA software. Showing the pricing benefit to these customers will be most beneficial for Atlantic as well and these companies can become attractive customers. • How will Ontario’s top management likely to respond? – In the short run they may not respond as the market share of Atlantic will be very small 4%. But as the market share for Atlantic grows, Ontario may react by lowering prices. Atlantic may need to compromise on the 50-50 profit sharing to show the pricing difference if needed. Atlantic Computer Analysis- Group3