Q3 2008 Comcast Corporation Earnings Conference Call

- 1. 3rd Quarter Results October 29, 2008 1

- 2. Safe Harbor Caution Concerning Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify those so-called “forward-looking statements” by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of those words and other comparable words. We wish to take advantage of the “safe harbor” provided for by the Private Securities Litigation Reform Act of 1995 and we caution you that actual events or results may differ materially from the expectations we express in our forward- looking statements as a result of various risks and uncertainties, many of which are beyond our control. Factors that could cause our actual results to differ materially from these forward-looking statements include: (1) changes in the competitive environment, (2) changes in business and economic conditions, (3) changes in our programming costs, (4) changes in laws and regulations, (5) changes in technology, (6) adverse decisions in litigation matters, (7) risks associated with acquisitions and other strategic transactions, (8) changes in assumptions underlying our critical accounting policies, and (9) other risks described from time to time in reports and other documents we file with the Securities and Exchange Commission. We undertake no obligation to update any forward-looking statements. The amount and timing of share repurchases and dividends is subject to business, economic and other relevant factors. Non-GAAP Financial Measures Our presentation may also contain non-GAAP financial measures, as defined in Regulation G, adopted by the SEC. We provide a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure in our quarterly earnings releases, which can be found on the Financial Information page of our web site at www.cmcsa.com or www.cmcsk.com. 2

- 3. 2008: Focused on Execution • Solid results in a challenging environment • Strong competitive position • Proactive management of expenses and disciplined capital investment • Significant Free Cash Flow growth • Solid balance sheet 3

- 4. 3nd Quarter 2008 - Consolidated Results 3Q08 Consolidated Revenue, OCF(1), Free Cash Flow(2), Adjusted EPS(3) and FCF/Share (in millions except per share amounts) 3Q08 +10% YTD +11% 00.0 $8,549 3Q08 +88% YTD +124% $7,781 00.0 3Q08 +33% YTD +19% $0.32 0.3 00.0 $0.24 3Q08 +10% YTD +12% $0.18 0.2 $0.17 00.0 $3,237 $2,929 3Q08 +77% YTD +109% 0.1 00.0 $928 $524 3Q07 3Q08 3Q07 3Q08 3Q07 3Q08 3Q07 3Q08 3Q07 3Q08 0.0 0.0 Revenue OCF Free Cash Flow Adjusted EPS FCF/Share 4 See detailed notes on Slide 13.

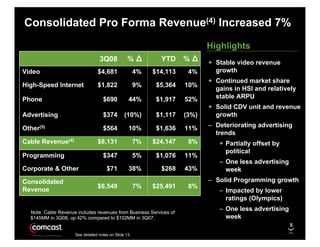

- 5. Consolidated Pro Forma Revenue(4) Increased 7% Highlights %∆ %∆ 3Q08 YTD + Stable video revenue growth Video $4,681 4% $14,113 4% + Continued market share High-Speed Internet $1,822 9% $5,364 10% gains in HSI and relatively stable ARPU Phone $690 44% $1,917 52% + Solid CDV unit and revenue growth Advertising $374 (10%) $1,117 (3%) – Deteriorating advertising Other(5) $564 10% $1,636 11% trends Cable Revenue(4) $8,131 7% $24,147 8% + Partially offset by political Programming $347 5% $1,076 11% – One less advertising Corporate & Other $71 38% $268 43% week – Solid Programming growth Consolidated $8,549 7% $25,491 8% Revenue – Impacted by lower ratings (Olympics) – One less advertising Note: Cable Revenue includes revenues from Business Services of week $145MM in 3Q08, up 42% compared to $102MM in 3Q07. 5 See detailed notes on Slide 13.

- 6. Consolidated Pro Forma Operating Cash Flow Increased 8% %∆ %∆ 3Q08 YTD Cable OCF $3,251 7% $9,755 8% Cable OCF Margin 40.0% (20 bps) 40.4% (10 bps) Programming OCF $105 9% $307 30% ($119) 16% ($300) 9% Corp & Other OCF Consolidated OCF $3,237 8% $9,762 9% Consol. OCF Margin 37.9% +20 bps 38.3% +20 bps Highlights + Controlling expenses + CDV and HSI costs decreased 9% + Employee expense reductions – $39MM expenses related to employee reductions – $20MM impact from 2 major hurricanes 6 See detailed notes on Slide 13.

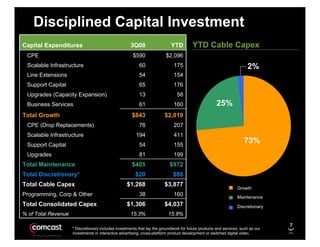

- 7. Disciplined Capital Investment YTD Cable Capex Capital Expenditures 3Q08 YTD CPE $590 $2,096 Scalable Infrastructure 60 175 2% Line Extensions 54 154 Support Capital 65 176 Upgrades (Capacity Expansion) 13 58 25% Business Services 61 160 Total Growth $843 $2,819 CPE (Drop Replacements) 76 207 Scalable Infrastructure 194 411 73% Support Capital 54 155 Upgrades 81 199 Total Maintenance $405 $972 Total Discretionary* $20 $86 Total Cable Capex $1,268 $3,877 Growth Programming, Corp & Other 38 160 Maintenance Total Consolidated Capex $1,306 $4,037 Discretionary % of Total Revenue 15.3% 15.8% 7 * Discretionary includes investments that lay the groundwork for future products and services, such as our investments in interactive advertising, cross-platform product development or switched digital video. 7

- 8. Financial Priorities Balanced and Disciplined Financial Strategy • Focus on Free Cash Flow Generation • Disciplined Capital Allocation • Returning Capital to Shareholders 113% FCF 106% FCF $367MM $2.8Bn $2.8Bn $182MM $0.94/Share $928MM $800MM $0.32/Share $1.3Bn $1.0Bn $0.42/Share $524MM $0.17/Share 3Q07 3Q08 YTD 07 YTD 08 Free Cash Flow Share Repurchases 8 Dividends Paid

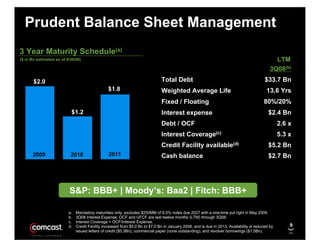

- 9. Prudent Balance Sheet Management 3 Year Maturity Schedule(a) .0 LTM ($ in Bn estimated as of 9/30/08) 3Q08(b) Total Debt $33.7 Bn $2.0 .0 $1.8 13.6 Yrs Weighted Average Life 80%/20% Fixed / Floating $1.2 $2.4 Bn Interest expense .0 Debt / OCF 2.6 x Interest Coverage(c) 5.3 x Credit Facility available(d) $5.2 Bn 2011 2009 2010 Cash balance $2.7 Bn .0 2009 2010 2011 S&P: BBB+ | Moody’s: Baa2 | Fitch: BBB+ a. Mandatory maturities only, excludes $250MM of 8.5% notes due 2027 with a one-time put right in May 2009. b. 3Q08 Interest Expense, OCF and UFCF are last twelve months (LTM) through 3Q08. c. Interest Coverage = OCF/Interest Expense. 9 d. Credit Facility increased from $5.0 Bn to $7.0 Bn in January 2008, and is due in 2013. Availability is reduced by issued letters of credit ($0.3Bn), commercial paper (none outstanding), and revolver borrowings ($1.5Bn).

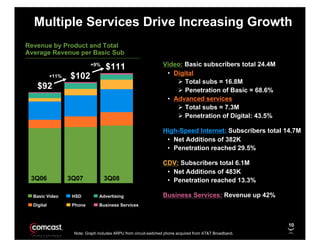

- 10. Multiple Services Drive Increasing Growth Revenue by Product and Total Average Revenue per Basic Sub Video: Basic subscribers total 24.4M +9% $111 • Digital $102 10 +11% Total subs = 16.8M 00 $92 Penetration of Basic = 68.6% 90 • Advanced services 80 Total subs = 7.3M 70 Penetration of Digital: 43.5% 60 High-Speed Internet: Subscribers total 14.7M 50 • Net Additions of 382K 40 • Penetration reached 29.5% 30 CDV: Subscribers total 6.1M 20 • Net Additions of 483K 10 3Q06 3Q07 3Q08 • Penetration reached 13.3% 0 Business Services: Revenue up 42% Basic Video HSD Advertising Digital Phone Business Services 10 Note: Graph includes ARPU from circuit-switched phone acquired from AT&T Broadband.

- 11. Product Evolution • New product offerings to meet changing marketplace • Revised bundles, economy tiers and retention offers • Targeted promotions by geographic area • More HD product bundles • Continued focus on product superiority • Expanding VOD offerings • Roll-out of DOCSIS 3.0 (“Wideband”) • Conversion to digital delivery (“All-Digital”) 11

- 12. Expense Management • Reacted quickly to a changing environment • Activity levels decline • Productivity increases • Unit costs in CDV decline • Headcount carefully managed • Significant capital cost reduction • YTD capital spending declined ~$650MM vs. last year • Broad reductions in many line items 12

- 13. Notes 1 Operating Cash Flow is defined as operating income before depreciation and amortization, excluding impairment charges related to fixed and intangible assets and gains or losses on sale of assets, if any. 2 Free Cash Flow, which is a non-GAAP financial measure, is defined as ”Net Cash Provided by Operating Activities” (as stated in our Consolidated Statement of Cash Flows) reduced by capital expenditures and cash paid for intangible assets and adjusted for any payments related to certain non-operating items, net of estimated tax benefits (such as income taxes on investment sales, and non-recurring payments related to income tax and litigation contingencies of acquired companies). Please refer to Table 4 in our 3Q08 earnings release for further details. Free Cash Flow per Share is calculated by taking Free Cash Flow (as described above) divided by diluted weighted-average number of common shares outstanding used in the calculation of earnings per share. 3 Net income and earnings per share are adjusted for gains, net of tax, related to the dissolution of the Texas/Kansas City Cable Partnership in 2007, the dissolution of the Insight Midwest Partnership in 2008, and gains related to the settlement of an uncertain tax position of an acquired entity and certain state tax law changes in 2008. Please refer to Table 7-B in our 3Q08 earnings release for a reconciliation of adjusted net income and earnings per share. Earnings per share amounts are presented on a diluted basis. 4 Pro forma results adjust for certain cable segment acquisitions and dispositions, including the acquisitions of Comcast SportsNet Bay Area/Comcast SportsNet New England (June 2007), the cable system acquired from Patriot Media (August 2007), and the dissolution of the Insight Midwest Partnership (January 2008). Consolidated and cable pro forma results are presented as if the transactions noted above were effective on January 1, 2007. The net impact of these transactions increased the number of basic cable subscribers by 765,000. Please refer to Table 7-A in our 3Q08 earnings release for a reconciliation of pro forma financial data. 5 Other revenues include franchise fees, regional sports programming networks, residential video installation revenues, guide revenues, commissions from electronic retailing, other product offerings and revenues of our digital media center. For more detailed information please refer to our quarterly earnings release. 13