New gold announcement presentation - v final

- 1. to acquire May 31, 2013

- 2. Cautionary statement 2 All monetary amounts in Canadian dollars unless otherwise stated U.S. SHAREHOLDERS New Gold will be filing with the United States Securities and Exchange Commission a registration statement on Form F-10 in connection with the Offer which will include the formal offer and take-over bid circular. New Gold encourages shareholders of Rainy River to read the formal offer and take-over bid circular which contain the full terms and conditions of the Offer and other important information. The offer and take-over bid circular may be obtained free of charge through the Securities and Exchange Commission’s website at www.sec.gov or by directing a request to the Investor Relations department of New Gold. CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain information contained in this presentation constitutes “forward looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward looking information under the provisions of Canadian securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", “projects”, “potential”, "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", “should”, "might" or "will be taken", "occur" or "be achieved" or the negative connotation. Such statements and information include, without limitation, statements regarding expectations as to the anticipated timing of the mailing of the offer materials, the estimated mineral resources and mineral reserves at Rainy River’s property, the expected further growth in gold reserves and ongoing cash flows and other benefits of the transaction containing forward- looking information. This forward looking information is subject to numerous risks, uncertainties and assumptions, certain of which are beyond the control of Rainy River and/or New Gold, including risks relating to acquisitions, including, without limitation, the parties may be unable to complete the acquisition or completing the acquisition may be more costly than expected because, among other reasons, conditions to the closing of the acquisition may not be satisfied; problems may arise with the ability to successfully integrate the businesses of New Gold and Rainy River, the parties may be unable to obtain regulatory approvals required for the acquisition, New Gold may not be able to achieve the benefits from the acquisition or it may take longer than expected to achieve those benefits; and the acquisition may involve unexpected costs or unexpected liabilities. Other risks include the impact of general economic conditions; industry conditions; volatility of metals prices; volatility of commodity prices; currency fluctuations; mining risks; risks associated with foreign operations; governmental and environmental regulation; competition from other industry participants; the lack of availability of qualified personnel or management; stock market volatility; the ability of New Gold to complete or successfully integrate an announced acquisition proposal; unexpected costs or unexpected liabilities related to the acquisition. Readers are cautioned that the material assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise. Actual results, performance or achievement could differ materially from those expressed in, or implied by, this forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits that Rainy River and/or New Gold will derive therefrom. New Gold and Rainy River disclaim any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise except as required by applicable securities laws. The issuance of New Gold shares under the transaction is subject to TSX acceptance or approval. CAUTIONARY NOTE TO U.S. READERS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES Information concerning the properties and operations discussed in this presentation has been prepared in accordance with Canadian standards under applicable Canadian securities laws, and may not be comparable to similar information for United States companies. The terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" used in this presentation are Canadian mining terms as defined in accordance with NI 43-101 under guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council on November 27, 2010. While the terms "Mineral Resource", "Measured Mineral Resource" and "Indicated Mineral Resource" are recognized and required by Canadian regulations, they are not defined terms under standards of the United States Securities and Exchange Commission. Under United States standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve calculation is made. As such, certain information contained in this presentation concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the United States Securities and Exchange Commission. An "Inferred Mineral Resource" has a great amount of uncertainty as to its existence and as to its economic and legal feasibility. It cannot be assumed that all or any part of an "Inferred Mineral Resource" will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated resources will ever be converted into Mineral Reserves. Readers are also cautioned not to assume that all or any part of an "Inferred Mineral Resource" exists, or is economically or legally mineable. In addition, the definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" under CIM standards differ in certain respects from the standards of the United States Securities and Exchange Commission.

- 3. Cautionary statement (cont’d) 3 TECHNICAL INFORMATION New Gold The scientific and technical information, as it relates to New Gold, in this presentation has been reviewed and approved by Mark Petersen (AIPG CPG #10563), a Qualified Person under National Instrument 43-101 and employee of New Gold. Rainy River The scientific and technical information, as it relates to Rainy River, in this presentation has been reviewed and approved by Garett Macdonald, P.Eng. (PEO #90475344) and Kerry Sparkes, P.Geo. (APEGBC #25261), both Qualified Persons under National Instrument 43-101 and employees of Rainy River. Rainy River's exploration program in Richardson Township is being supervised by Kerry Sparkes, P.Geo. (APEGBC #25261), a Qualified Person under National Instrument 43-101 and employee of Rainy River. Rainy River Mineral Reserves Open pit mineral reserves have been estimated using a cut-off grade of 0.30 g/t gold-equivalent, and underground reserves have been estimated using a cut-off grade of 3.5 g/t gold- equivalent. Open pit reserves have been estimated using a dilution of 9.7% at 0.22 g/t Au and 1.31 g/t Ag, and underground reserves have been estimated using a CAF dilution of 9% at 0.61 g/t Au and 4.16 g/t Ag and LH dilution of 10% at 1.56 g/t Au and 1.28 g/t Ag. Open pit reserves have been estimated using a mine recovery of 95%, and underground reserves have been estimated using a mine recovery of 95%. Additional details regarding the Mineral Reserve estimate and related Feasibility Study are provided in the May 23, 2013 NI 43-101 Technical Report available on SEDAR. Rainy River Mineral Resources Mineral resources are not mineral reserves and do not have demonstrated economic viability. Mineral resources are reported relative to conceptual open pit shells. On average, the conceptual open pit extends to an elevation of 500 metres below surface. Material above this elevation offers reasonable prospects for economic extraction from an open pit because drilling results suggest that the zone of gold mineralization is broader than currently modeled and that new drilling information should positively impact future mineral resources. Material below this elevation is potentially mineable by underground mining methods. Mineral resources that are potentially mineable by open pit methods are reported at a cut-off grade of 0.35 g/t gold; underground mineral resources are reported at a cut-off grade of 2.5 g/t gold. All mineral resources are based on a gold price of US$1,100 per ounce, a silver price of US$22.50 per ounce, a foreign exchange rate of 1.10 Canadian dollars to 1.0 US dollar. Metallurgical recoveries include 88% for gold in open pit resources and 90% for gold in underground resources, with a silver recovery of 75% in both cases. All figures are rounded to reflect the relative accuracy of the estimate. Figures may not add due to rounding. Additional details on the Mineral Resource estimate are provided in the Rainy River news release dated October 10, 2012. Mineral Resources were estimated by SRK Consulting (Canada) Inc. (“SRK”) and are reported in accordance with Canadian Securities Administrators National Instrument 43-101. (1) TOTAL CASH COSTS “Total cash costs” per ounce figures are calculated in accordance with a standard developed by The Gold Institute, which was a worldwide association of suppliers of gold and gold products and included leading North American gold producers. The Gold Institute ceased operations in 2002, but the standard is widely accepted as the standard of reporting cash costs of production in North America. Adoption of the standard is voluntary and the cost measures presented may not be comparable to other similarly titled measures of other companies. Each of New Gold and Rainy River reports total cash costs on a sales basis. Total cash costs include mine site operating costs such as mining, processing, administration, royalties and production taxes, but are exclusive of amortization, reclamation, capital and exploration costs. Total cash costs are reduced by any by-product revenue and is then divided by ounces sold to arrive at the total by- product cash cost of sales. The measure, along with sales, is considered to be a key indicator of a company’s ability to generate operating earnings and cash flow from its mining operations. This data is furnished to provide additional information and is a non-IFRS measure. Total cash costs presented do not have a standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS and is not necessarily indicative of operating costs presented under IFRS. A reconciliation is provided in the respective MD&A and accompanying the quarterly financial statements of each of Rainy River and New Gold.

- 4. Compelling acquisition opportunity 4 ESTABLISHING THE LEADING INTERMEDIATE GOLD COMPANY Accretive on All Key ‘Per Share’ Metrics Enhances Production Pipeline at Below Industry Average Cash Costs Further Builds on Canadian Presence Further Strengthens New Gold Technical Development Team Adds Significant Gold Reserves and Resources Modest Transaction Size – Minimal Equity Dilution

- 5. Transaction overview 5 Offer • C$3.83 per Rainy River share (including rights attached under shareholder rights plan) • Each Rainy River shareholder will have the option to receive consideration per Rainy River share of: - C$3.83 in cash or 0.5 of a New Gold share - Aggregate consideration mix of ~50% cash / ~50% shares subject to - Maximum cash consideration of approximately $198 million - Maximum number of New Gold shares issuable under the offer of approximately 25.8 million (Rainy River proforma ownership of 5.1%) Premium • Offer represents a premium of: - 42% to closing price on the Toronto Stock Exchange on May 30, 2013 - 67% premium to the 20-day volume weighted average trading price Key Conditions • Minimum 662/3% of Rainy River shareholders to validly deposit their shares under the bid • Typical regulatory approvals Structure • Friendly combination via formal take-over bid Other Terms • Unanimous New Gold and Rainy River Board approval • Non-solicitation provision and 5 business day right to match Superior Proposal • Lock-up agreements signed by Rainy River’s management and Board • Termination fee of ~$14 million (~3.5% of transaction equity value) payable to New Gold under certain circumstances • Seek lockups from significant institutional shareholders Indicative timeline • Bid circular mailed to Rainy River shareholders: Week of June 10, 2013 • Initial expiry time: Mid-July 2013

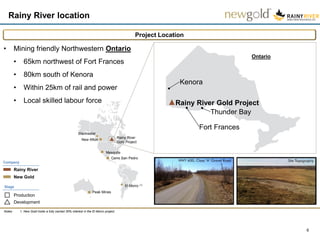

- 6. Rainy River location 6 Project Location Notes: 1. New Gold holds a fully carried 30% interest in the El Morro project. El Morro (1) Mesquite Cerro San Pedro Ontario Kenora Fort Frances Thunder Bay Rainy River Gold Project Peak Mines Rainy River New Gold Company Development Stage Production Rainy River Gold Project New Afton Blackwater • Mining friendly Northwestern Ontario • 65km northwest of Fort Frances • 80km south of Kenora • Within 25km of rail and power • Local skilled labour force

- 7. Rainy River mineral reserves and resources 7 Mineral Resource Summary(1) Exploration Potential Notes: 1. Refer to Cautionary Statement regarding Rainy River Mineral Resources. 2. Measured and Indicated resources inclusive of reserves. • Relatively underexplored region of Northwestern Ontario • Current resource situated on a trend measuring 6 kilometres along strike • Near-term exploration upside at newly discovered Intrepid Zone • Located approximately 2 kilometres east of current pit and open at depth • Zone hosts multiple high grade shoots • Potential for underground development Tonnes (Mt) Au (g/t) Ag (g/t) Au (Koz) Ag (Koz) Proven 27.7 1.14 1.94 1,015 1,728 Probable 88.6 1.06 3.01 3,017 8,587 Total Reserves 116.3 1.08 2.76 4,032 10,315 Measured 27.6 1.33 1.90 1,182 1,689 Indicated 130.9 1.18 2.77 4,985 11,649 Total M&I(2) 158.5 1.21 2.62 6,167 13,338 Inferred 93.8 0.76 2.32 2,280 6,983 Rainy River Mineral Reserve and Resource Estimate Contained metalMetal grade

- 8. Canada US Chile Mexico Australia New Gold Pro Forma Adding gold reserves/resources in Canada 8 Gold Reserves (Moz) Gold M&I Resources (Moz)(1)(2) 7.8 11.8 29.2 +44% per share +20% per share New Gold Pro Forma Gold M&I Resources (Moz)(1) Canada +62% 23.1 18.05.7 2.9 1.7 0.9 New Gold Pro Forma Notes: 1. Refer to Cautionary Statement. 2. Measured and Indicated resources inclusive of reserves.

- 9. Transaction highlights for Rainy River shareholders 9 Significant and immediate premium - 67% to 20-day VWAP; 42% to current share price Flexibility to elect form of consideration Opportunity to gain exposure to New Gold’s cash flow and attractive growth portfolio Access to New Gold’s strong balance sheet and current and future operating cash flow to develop project Ability to partner with New Gold’s experienced management and operating teams

- 10. Conclusion 10 Rainy River is an ideal fit for New Gold New Gold and Rainy River teams looking forward to the continued development of the Rainy River gold project New Gold to continue to build upon strong relationships established by Rainy River