Webcast - 4th Quarter 2012 (IFRS)

- 1. Results Announcement 4th Quarter and 2012 Year End Results Conference Call / Webcast February 5th, 2013

- 2. DISCLAIMER FORWARD-LOOKING STATEMENTS: DISCLAIMER The presentation may contain forward-looking statements about future We undertake no obligation to publicly update or revise any events within the meaning of Section 27A of the Securities Act of 1933, as forward-looking statements, whether as a result of new amended, and Section 21E of the Securities Exchange Act of 1934, as information or future events or for any other reason. Figures for amended, that are not based on historical facts and are not assurances of 2013 on are estimates or targets. future results. Such forward-looking statements merely reflect the Company’s current views and estimates of future economic circumstances, industry conditions, company performance and financial All forward-looking statements are expressly qualified in their results. Such terms as "anticipate", "believe", "expect", "forecast", "intend", entirety by this cautionary statement, and you should not place "plan", "project", "seek", "should", along with similar or analogous reliance on any forward-looking statement contained in this expressions, are used to identify such forward-looking statements. presentation. Readers are cautioned that these statements are only projections and may differ materially from actual future results or events. Readers are referred to the documents filed by the Company with the SEC, specifically the NON-SEC COMPLIANT OIL AND GAS RESERVES: Company’s most recent Annual Report on Form 20-F, which identify CAUTIONARY STATEMENT FOR US INVESTORS important risk factors that could cause actual results to differ from those contained in the forward-looking statements, including, among other We present certain data in this presentation, such as oil and gas things, risks relating to general economic and business conditions, resources, that we are not permitted to present in documents filed including crude oil and other commodity prices, refining margins and with the United States Securities and Exchange Commission prevailing exchange rates, uncertainties inherent in making estimates of (SEC) under new Subpart 1200 to Regulation S-K because such our oil and gas reserves including recently discovered oil and gas terms do not qualify as proved, probable or possible reserves reserves, international and Brazilian political, economic and social under Rule 4-10(a) of Regulation S-X. developments, receipt of governmental approvals and licenses and our ability to obtain financing. 2

- 3. 2012 Highlights • Operating Income: R$ 32,397 million Results • Net Income: R$ 21,182 million • Improvement in planning through the accomplishment of the 2012 target (2,022 kbpd ± 2%): 1,980 kbpd • Start up of FPSO Cid. Anchieta (Baleia Azul) in September: 78 kbpd production in December • Postponement of the start up of FPSO Cid. Itajaí (Baúna and Piracaba): Feb/2013 • Petrobras Pre-salt production’s share: from 5% in 2011 (100.3 kbpd) to 6.9% in 2012 (136.4 kbpd) Exploration & • Pre-salt daily production record: 213.9 kbpd in Dec /27 (Petrobras) Production 245.6 kbpd in Dec /31 (Petrobras & partners) • Arrival of 15 deepwater rigs, total ultra deep fleet now 40 units • Proven Reserves (Brazil and International): 16.44 billion boe (SPE/ANP criterion) • Reserve Replacement Ratio (Brazil and International): 103.3% • Reserves/Production (Brazil and International): 18.6 years • Three price increases in diesel and two in gasoline over the last eight months: increase of 10.2% in diesel and 7.8% in gasoline in 2012 and new increase of 5.4% in diesel and 6.6% in gasoline in Jan/30/13 Downstream • Oil products output: 1,997 kbpd (+5% compared to 2011) • Oil products sales in Brazil: 2,285 kbpd (+7% compared to 2011) • Daily throughput record: 2,101 kbpd (in the Aug/09-12 period) • Natural gas demand: 74.5 million m³/d (89.4 million m³/d in 4Q12) Gas & Power • Electric generation daily record: 5,883MW in Nov/26 • Natural gas delivery daily record: 49.6 million m3 /d in Oct/11 • PROEF: operational efficiency increase in Campos Basin (UO-BC and UO-RIO) • PROCOP: cost reduction target of R$ 32 billion between 2013 and 2016 Management • PRODESIN: restructured divestiture unit. Execution of the 1st transaction (BS-4: Atlanta and Oliva) • Investment Projects: achievement of 104.8% of the physical targets forecasted in the S-Curves Performance 3

- 4. 2012 Brazil Production: Target achieved according to 2012-16 BMP • Decrease of 2% in oil and LNG production due to: Frade field interruption due to seepage (-14 kbpd), longer than expected scheduled maintenance (-6 kbpd) and unexpected operational interruptions (-68 kbpd). • Increase of 5.6% in natural gas production with new wells (Canapu and Lula) and beginning of NG exports from the FPSO Cid. de Anchieta. 2700 2011 Average 2,377 kboed 2012 2600 Average 2,355 kboed 2,491 2500 2,456 NG = from 355 kboed to 375 kboed 2,441 2400 2,346 2,350 2,359 2,339 2,333 2,305 2,315 2,306 2011 2012 kboed 2300 355 kboed 2,222 375 kboed of Natural Gas of Natural Gas 2200 2,110 2,098 2100 2,032 1,993 1,989 2000 1,961 1,960 1,968 1,940 1,928 1,940 2011 1900 Average 2,022 kbpd 2012 1,843 Average 1,980 kbpd 1800 jan-12 feb-12 mar-12 apr-12 may-12 june-12 july-12 aug-12 sep-12 oct-12 nov-12 dec-12 Oil and LNG Production Total Production (Oil, LNG and Natural Gas) Non operated production of Petrobras: 46 kbpd in 2011 vs 23 kbpd in 2012 Operated production of Petrobras on behalf of third parties: 26 kbpd in 2011 vs 38 kbpd in 2012 4

- 5. PROEF UO-BC: Program to Recover Operational Efficiency In 2012 UO-BC’s average production was improved by 25 kbpd through PROEF, reaching 459 kbpd. The average operational efficiency increased 11 p.p., from 67% in April to 78% in December. Cost to date US$ 831 million and NPV of US$ 519 million. Production Units: 29 without PROEF 550 Production in 2012: 459 kbpd with PROEF Oil and LNG Production (kbpd) PROEF avoided a decrease of 47 kbpd 499 495 PROEF start-up +25 kbpd 500 at UO-BC Oil Production in 2012 (kbpd) 469 468 465 461 459 454 448 445 450 + 31 mbpd 437 434 434 + 50 + 29 + 57 + 34 437 437 + 32 + 22 + 47 425 400 414 411 408 412 Without PROEF the decrease would reach 101 kbpd 405 398 350 jan/12 feb/12 mar/12 apr/12 may/12 june/12 july/12 aug/12 sep/12 oct/12 nov/12 dec/12 Without With PROEF PROEF Operational Efficiency in 2012 (%) PROEF start-up Operational Efficiency (%) at UO-BC +11p.p. 80 75 +1.9 p.p. 70 65 69.8 71.7 75 76 78 73 74 71 71 74 60 67 70 69 67 55 50 jan/12 feb/12 mar/12 apr/12 may/12 june/12 july/12 aug/12 sep/12 oct/12 nov/12 dec/12 Without With PROEF PROEF 5

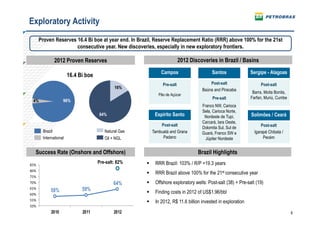

- 6. Exploratory Activity Proven Reserves 16.4 Bi boe at year end. In Brazil, Reserve Replacement Ratio (RRR) above 100% for the 21st consecutive year. New discoveries, especially in new exploratory frontiers. 2012 Proven Reserves 2012 Discoveries in Brazil / Basins Campos Santos Sergipe - Alagoas 16.4 Bi boe Pre-salt Post-salt Post-salt 16% Baúna and Piracaba Barra, Moita Bonita, Pão de Açúcar Pre-salt Farfan, Muriú, Cumbe 4% 96% Franco NW, Carioca Sela, Carioca Norte, 84% Espírito Santo Nordeste de Tupi, Solimões / Ceará Carcará, Iara Oeste, Post-salt Post-salt Dolomita Sul, Sul de Brazil Natural Gas Tambuatá and Grana Guará, Franco SW e Igarapé Chibata / International Oil + NGL Padano Júpiter Nordeste Pecém Success Rate (Onshore and Offshore) Brazil Highlights 85% Pre-salt: 82% RRR Brazil: 103% / R/P =19.3 years 80% RRR Brazil above 100% for the 21st consecutive year 75% 70% 64% Offshore exploratory wells: Post-salt (38) + Pre-salt (19) 65% 58% 59% Finding costs in 2012 of US$1.96/bbl 60% 55% In 2012, R$ 11.6 billion invested in exploration 50% 2010 2011 2012 6

- 7. Domestic Output of Oil Products: Focus on Diesel and Gasoline Increase of 82 kbpd in throughput using more domestic crude oil while improving the production profile. Increases in diesel and gasoline production minimized import needs. Oil Products Output Throughput 2012 Start up of Major Units and Utilization (Refineries / Units) 2.500 96% 100 RECAP – Cracked naphtha HDS +5% 92% 90 REPAR – Diesel HDT 1,997 1,896 2.000 1,944 80 196 1,862 RLAM – Diesel HDT Others 183 238 351 70 Fuel Oil 340 234 93 REPAR – Coke Naphtha HDT Throughput (kbpd) Jet Fuel 93 1.500 60 Utilization (%) kbpd Naphtha 106 109 143 50 REVAP – Cracked naphtha HDS LPG 137 Gasoline 395 +11% 438 1.000 40 REFAP – Cracked naphtha HDS +5% 1,527 1,523 1,594 1,594 1.594 1.527 30 REPAR – Reform 500 20 Diesel 745 +5% 782 REPAR – Coke 10 REPAR – Cracked naphtha HDS 0 0 2011 2012 2011 2012 REPLAN – Cracked naphtha HDS Utilization(%) Imported Oil Domestic Oil 7

- 8. Oil Products Sales in Brazil Increase of 81 kbpd in gasoline sales and 57 kbpd in diesel sales due to economic growth, especially retail. Oil Products Sales in Brazil +7% 2,285 Oil products sales in Brazil were 7% higher compared to 2,131 199 2011: Others 84 188 Fuel Oil 82 106 Jet Fuel 101 165 Gasoline (+17%): increase in the flex-fuel automotive Naphtha 167 224 fleet along with price advantage relative to ethanol; LPG 224 kbpd +17% 570 Diesel (+6%): increase in the retail sector, along with Gasoline 489 higher thermoelectric consumption in the northern region of Brazil; +6% Jet fuel (+5%): higher demand in the aviation sector. Diesel 880 937 2011 2012 8

- 9. Oil Products Price - Brazil vs International • Price adjustments were not enough to close the gap between domestic and international prices due to the increase in the oil price and, especially, FX rate fluctuation. • Petrobras continues to pursue price parity, which is an assumption of the Business and Management Plan. ARP in Brazil* x ARP in USGC** 2011 2012 2013 ∆ FX Rate: 14% ∆ Brent: 6% 260 FX Rate: R$ 1.99/US$ Brent: US$ 115.94/bbl 240 FX Rate: R$ 1.75/US$ 220 ARP in USGC Brent: US$ 108.91/bbl Prices (R$/bbl) 200 180 Jan/30 Jul/16 Adjustment: Jun/25 160 Adjustment: Adjustment: Gasoline: 6.6% Nov/01 Adjustment: Gasoline: 7.83% Diesel: 6% Diesel: 5.4% 140 ARP in Brazil Diesel: 3.94% Gasoline: 10% Diesel: 2% 120 100 may/11 may/12 mar/11 apr/11 aug//11 mar/12 apr/12 aug//12 jan/11 feb/11 june//11 july/11 Sep/11 oct/11 nov/11 jan/12 Dec/11 feb/12 june//12 july/12 Sep/12 oct/12 nov/12 Dec/12 * jan/13 feb/13 * * Forecast * Weighted Average Realization Price of Diesel, Gasoline, Naphtha, LPG, Jet Fuel and Fuel Oil ** Average Realization Price in United States Gulf Coast, considering the same volumes and products sold in Brazil 9

- 10. Trade Balance of Oil and Oil Products Market growth exceeded production, leading to higher gasoline and diesel imports. Increase in domestic feedstock and lower crude oil production reduced oil exports in 2012. Exports Imports Balance +4% 749 779 -13% 631 548 346 362 428 364 +16% kbpd 164 190 43 87 +96% 160 153 +102% 43 31 180 156 66 18 -184 -249 Oil Fuel Oil Other Oil Products Diesel Gasoline Oil Products -118 -231 2011 2012 2011 2012 2011 2012 10

- 11. Natural Gas Demand and Supply Increase of 22% in natural gas demand in 2012 (74.5 MM m³/d), largely due to higher thermal power generation (+119%). Demand was met through higher domestic supply and LNG imports. The increase in domestic natural gas production reduced the need for LNG imports. DEMAND 2011 vs 2012 3Q12 vs 4Q12 +26% +22% 89.4 74.5 million m³/d 61.1 71.0 Non Thermal 38.3 39.3 39.9 Thermal 40.3 23.0 Refineries / E&P 38.6 10.5 18.7 12.1 Fertllizer plants 10.8 12.1 12.4 2011 2012 3Q12 4Q12 SUPPLY 2011 vs 2012 3Q12 vs 4Q12 +26% +22% 74.9 90.1 71.6 million m³/d 61.2 Domestic 43.5 39.5 39.6 33.5 Bolivia 30.8 27.0 24.6 1.6 26.1 8.4 LNG 7.4 16.0 2011 2012 4Q12 3Q12 11

- 12. 2012 Investments Investments of R$ 84 billion, 16% above 2011. Annual Investment Investment by Segment Main Projects 1.6% 2% 0.4% +16% 5% E&P: Production Development Projects of Baleia 84.1 6% Azul (Cid. de Anchieta), Sapinhoá (Cid. de São 72.5 Paulo), Roncador Modules 3 and 4 (P-55 and P-62) 51% and Papa-Terra (P-61 and P-63). R$ billion 34% Downstream: Abreu e Lima Refinery and Comperj. G&P: UFN-3, Bahia Regasification Terminal and UPGN Cabiúnas. International: Production Development Projects of E&P Corporate Cascade and Saint-Malo. 2011 2012 Downstream Distribution International Biofuel G&P Physical and financial monitoring of 174 individualized projects (S-Curves): average physical realization of 104.8% and financial realization of 110.6%. 12

- 13. Net Result by Segment - 2011 vs 2012 Exploration and Production Downstream R$ 40.6 Bi vs R$ 45.4 Bi - R$ 9.9 Bi vs - R$ 22.9 Bi ↑ g Higher realization prices due to the FX devaluation (17%). rate. ↑ Increase in7,8% no preço da utilizationefrom10,2%to 96%. Reajuste de refining capacity gasolina de 92% no el. ↑ Increase of 7.8% in gasoline and 10.2% in diesel prices. Ddddddddddddd fflfdldljfdjdfjlkfjfjgjfg dsfkjldfldfjdlkfjdflj ↓ d Increase in Government Take (+15%). dslfkdfjldfjj ↓ 1 Higher lifting cost (+28%). Higher oil products sales (+7%). ↑ Depreciação cambial ampliou a defasagem em relação a ↓ H Higher dry hole expenses. ↓ Crescimento das vendasthede derivados em international FX devaluation increased differential versus +7%. dfdgffdglkfdgl prices. ↓ Higher imports of gasoline (+102%)(+102%) e (+16%). Maiores importações de gasolina and diesel de diesel (+16%). ↓ Crescimento dos custos de aquisição Reais (+21%). Higher crude oil acquisition costs in do óleo em Reais em +21%.Aumento do Gas & Power International R$ 3.1 Bi vs R$ 1.6 Bi rate. R$ 1.9 Bi vs R$ 1.3 Bi ↓ d Impairment generated losses of R$ 487 milliion in 2012. Increase in domestic natural gas supply (+18%). ↑ Aumento da oferta de gás nacional em +18%. Increase thermoelectric dispatch associated with higher ↓ 1 ↔Aumento doofdespacho termelétrico, associado ao aumento Scheduled maintenance in Akpo field (Nigeria). dopreço da prices (‘PLD’) accompanied by higher LNG and ↓ H Start up of Cascade and Chinook fields, in deepwater GoM, energy energia (PLD), atendido pela Bolivian gas imports. NL e gás boliviano. with higher lifting costs due to initial production costs. In 2011, recognition of tax fiscais no the net amount of 928 ↓ Reconhecimento de créditos credits in valor líquido de R$ R$ 928 million (non recuring gain). milhões em 2011 13

- 14. 2011 vs 2012 Operating Income (R$ million) 37,203 45,403 (43,533) 32,397 (1,849) (4,827) 2011 Sales COGS SG&A Other 2012 Operating Revenues Expenses Operating Income Income Higher sales revenues reflecting growth in domestic demand, as well as higher prices for domestic products and exports. Increase in COGS due to higher sales volumes supplied by imports, and effect of FX devaluation on imports and production taxes. Increase in SG&A expenses primarily reflecting higher personnel costs. Other operating expenses increased due to higher dry hole expense. 14

- 15. 2011 vs 2012 Net Income (R$ million) 33,313 4,447 20 21,182 (13,006) 555 (3,845) (302) 2011 Operating Financial Equity in Profit Income Tax / Minority 2012 Net Income Income Result earnings of Sharing Social Interest Net Income investments Contribution Lower operating income due to higher demand largely supplied by imports, and domestic prices below international levels. Financial results decreased primarily due to the devaluation of the Real and higher net liabilities denominated in dollars. Decrease in taxes as a result of reduced taxable income. 15

- 16. 3Q12 vs 4Q12 Operating Income (R$ million) 8,864 (388) 6,120 (1,136) (98) (1,318) 3Q12 Sales COGS SG&A Other 4Q12 Operating Revenue Expenses Operating Income Income Revenue: higher demand and prices offset by reduced exports (income from exports in transit not yet recognized). Increase in COGS as higher sales volumes were broadly supplied by imports. Increase in Other Expenses due to higher dry hole expense and impairments of international assets. 16

- 17. 3Q12 vs 4Q12 Net Income (R$ million) 1,646 48 7,747 3,357 5,567 (10) (117) (2,744) 3Q12 Operating Financial Equity Profit Income Tax / Minority 4Q12 Net Income Income Results Income Sharing Social Interest Net Income Contribution Higher net financial results from the sale of Government securities (NTN-B) and income from deposits for legal provisions. Income tax reduction due to fiscal benefit related to provisions of interest on own capital. 17

- 18. Capital Structure Net Debt/EBITDA Net Debt/Net Capitalization1 5 40% 28% 28% 30% 4 24% 24% 30% 20% 3 10% 2.77 2 2 2.46 2.42 0% 1 1.66 1.61 -10% 0 -20% 4Q11 1Q12 2Q12 3Q12 4Q12 R$ Billion 12/31/12 12/31/11 Short-term Debt 15.3 19.0 Lower operating cash flow and higher capex Long-term Debt 181.0 136.6 resulted in net debt increase. Total Debt 196.3 155.6 (-) Cash and Cash Equivalents 3 48.5 52.5 The devaluation of the Real (9%4) also increased net debt. = Net Debt 147.8 103.0 US$ Billion Net Debt 72.3 54.9 1) Net Debt / (Net Debt + Shareholder’s Equity) 2) Refers to the adjusted EBITDA which excludes equity income and impairment. 3) Includes tradable securities maturing in more than 90 days 4) Period-end commercial selling rate for U.S. dollar 18

- 19. Dividends Proposed Dividends PN = R$ 0.96 / share and R$ 1.92 / ADR ON = R$ 0.47 / share and R$ 0.94 / ADR Note: 1 ADR = 2 shares General Rules Companies with two classes of shares must pay a minimum amount of dividends Minimum amount to be distributed (common + prefs): 25% of Adjusted Net Income Priority to preferred shareholders, who will receive the higher of: 25% of Adjusted Net Income 3% of the PN’s proportional book value of shareholder’s equity 5% of the PN’s proportional paid-in capital 19

- 20. 2013 Outlook Management Oil Production in Brazil PROCOP: program implementation to achieve first Average production flat as compared to 2012. results in 2013. Lower production in 1H13 due to higher concentration of scheduled stoppages and the smaller contribution from new PROEF: continuing activities to recover operational systems. On the other hand, in 2H13 the ramp-up of efficiency. Sapinhoá, Baúna e Piracaba, Lula NE, Papa-Terra P-63 and Roncador P-55 will support the production increase PRODESIN: intensification of the Divestment Program. forecasted for 2014. Total Capacity/ 6 News Production Units Investments in 2013 Start-Up Petrobras Interest (kbpd) Sapinhoá Pilot Capital budget: R$ 97.7 billion, of which 53% to E&P and FPSO Cid. São Paulo Jan-13 120 / 54 33% to Downstream. Baúna and Piracaba Feb-13 80 / 80 FPSO Cid. Itajaí Downstream and Oil Products Market Lula NE Pilot May-13 120 / 78 FPSO Cid. Paraty Oil products market’s growth of 4%, lower than 2012 Papa Terra July-13 140 / 87,5* (8%). P-63 Flat refining output despite higher scheduled Roncador Mod. III maintenance. Sep-13 180 / 180 P-55 Increase in diesel production (5%), to the detriment of Papa Terra * processing capacity of other products. Dec-13 P-61 P-63 Higher participation of domestic oil in throughput (84% vs 82% in 2012). Franco’s EWT Start-up (Transfer of Rights). Sapinhoá North’s EWT Start-up. 20

- 21. Announcement of the Results END 4th Quarter and Year End 2012 Results Conference Call / Webcast February 5th, 2013