Estate Planning with Cross Border Implications

- 1. Estate Planning Overview Estate Planning with Cross Border Implications Swiss American Chamber of Commerce Meeting at Borel Private Bank & Trust in San Mateo, California February 17, 2011 Richard S. Kinyon Morrison Foerster 425 Market Street San Francisco, California 94105- 2482 Direct Dial: (415) 268-7035 E-Mail: rkinyon@mofo.com

- 2. Estate Planning with Cross Border Implications A. U.S. Gift and Estate Taxes (effective during 2011 and 2012) 1. U.S. Citizens & Residents (Domiciliaries) a. Gratuitous Transfers of Money or Other Property, Wherever Located or Situated, are Subject to Gift or Estate Tax b. Gift Tax is Imposed on Lifetime Transfers and Estate Tax is Imposed on Testamentary Transfers; Based on Fair Market Value of Property Transferred c. Unlimited Marital and Charitable Deductions — Generally d. $13,000 Gift Tax Annual Exclusion (Indexed for Inflation) and Medical/Tuition Gift Tax Exclusion for Lifetime Transfers

- 3. e. Gift-Splitting By Spouses for Lifetime Gifts (But Only If Both Spouses are U.S. Citizens or Residents f. Cumulative Lifetime Gift Tax Exemption Amount — $5,000,000 (Indexed for Inflation After 2011) g. Gift Tax Determined by Tax-exclusive Calculation (Based on net amount given to donee) h. Gift Tax Imposed on Donor i. Annual Gift Tax Returns – Generally Filed with Income Tax Returns — Tax Due 3-1/2 Months After End of Year (Generally on April 15 of the Following Year) Estate Planning with Cross Border Implications (Cont’d)

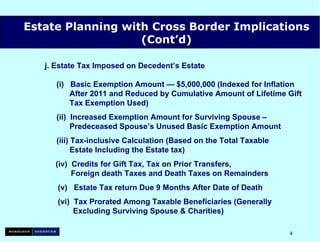

- 4. j. Estate Tax Imposed on Decedent’s Estate (i) Basic Exemption Amount — $5,000,000 (Indexed for Inflation After 2011 and Reduced by Cumulative Amount of Lifetime Gift Tax Exemption Used) (ii) Increased Exemption Amount for Surviving Spouse – Predeceased Spouse’s Unused Basic Exemption Amount (iii) Tax-inclusive Calculation (Based on the Total Taxable Estate Including the Estate tax) (iv) Credits for Gift Tax, Tax on Prior Transfers, Foreign death Taxes and Death Taxes on Remainders (v) Estate Tax return Due 9 Months After Date of Death (vi) Tax Prorated Among Taxable Beneficiaries (Generally Excluding Surviving Spouse & Charities) Estate Planning with Cross Border Implications (Cont’d)

- 5. k. Graduated Unified Estate and Gift Tax Rate Schedule Applicable to Taxable Gifts and Estates (See Appendix A) l. Transfers to Non-U.S.-Citizen Spouses (i) $136,000 Gift Tax Annual and Medical/Tuition Exclusions (Indexed for Inflation), but No Gift Tax Marital Deduction (ii) Qualified Domestic Trust — Estate Tax Marital Deduction (A) Net Income Must Be Payable Annually to Surviving Spouse (B) Principal Must Not Be Payable to Anyone Other Than Surviving Spouse During His or Her Lifetime (C) Trustee Must Be U.S. Citizen or Corporation (D) Incremental Estate Tax on Principal Paid to Surviving Spouse and Upon Spouse’s Death Estate Planning with Cross Border Implications (Cont’d)

- 6. 2. Non-Resident/Non-Citizen Donors and Decedents a. Determination of Residence (Domicile) of Donor or Decedent b. Only Transfers of Property Situated in the U.S. are Taxable c. Unlimited Marital and Charitable Deductions - Generally d. Lifetime Transfers — Gift Tax — Limited Application (i) Real and Tangible Personal Property (Including Money) Situated in the U.S. (ii) Not Applicable to Intangible Personal Property (Stock, Bonds, Partnership Interests, Promissory Notes, Etc.) (iii) $13,000 Annual and Medical/Tuition Gift Tax Exclusions (iv) No Gift-Splitting Between Spouses (v) No Lifetime Exemption Amount Estate Planning with Cross Border Implications (Cont’d)

- 7. e. Testamentary Transfers — Estate Tax — Broader Application (i) Real and Tangible Personal Property (Including Money) Situated in the U.S. (ii) Stock of U.S. Corporations (iii) Debt Obligations of U.S. Persons (But Not Bank Accounts or “Portfolio” Debt Obligations, the Interest on Which Is Not Subject to U.S. Income Taxation) (iv) Only $60,000 Estate Tax exemption Amount B. U.S. Generation-Skipping Transfer (“GST”) Tax 1. Applies Only to Transfers Subject to U.S. Gift or Estate Tax Estate Planning with Cross Border Implications (Cont’d)

- 8. 2. Applies Only to Transfers to or in Trust for the Benefit of Grandchildren or Other Beneficiaries in Generations More than One Generation Below the Transferor’s Generation (“Skip Persons”) 3. $13,000 GST Tax Annual and Medical/Tuition Exclusions (Indexed for Inflation) 4. $5,000,000 Cumulative GST Exemption Amount a. GST Exemption Allocated to ‘Direct Skips” or to Generation- Skipping Trusts (Actual or Potential) b. GST Trusts Generally Are Fully Exempt or Fully Subject to the GST Tax 5. GST Tax Rate — Highest Gift and Estate Tax Rate — (35%) 6. Transfers Otherwise Subject to GST Tax Are Generally Subjected Instead to Gift or Estate Tax Estate Planning with Cross Border Implications (Cont’d)

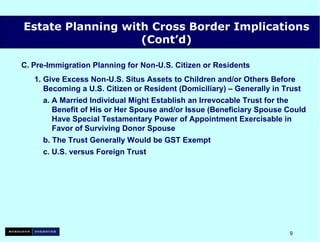

- 9. C. Pre-Immigration Planning for Non-U.S. Citizen or Residents 1. Give Excess Non-U.S. Situs Assets to Children and/or Others Before Becoming a U.S. Citizen or Resident (Domiciliary) – Generally in Trust a. A Married Individual Might Establish an Irrevocable Trust for the Benefit of His or Her Spouse and/or Issue (Beneficiary Spouse Could Have Special Testamentary Power of Appointment Exercisable in Favor of Surviving Donor Spouse b. The Trust Generally Would be GST Exempt c. U.S. versus Foreign Trust Estate Planning with Cross Border Implications (Cont’d)

- 10. D. Planning for Permanent Non-U.S. Citizens or Residents 1. U.S. Situs Assets Generally Should be Owned Through a Foreign Holding Company (e.g., a BVI Corp.) 2. A Revocable Trust Might be Established for the Benefit of a U.S. Citizen or Resident Child and His or Her Issue, with the Child as Trustee a. U.S. Situs Assets Should be Owned by, e.g., a BVI Corp. or Other Foreign Holding Company b. Non U.S. Situs Assets Could Be Owned Directly by the Trust 3. Income (Including Capital Gains) Would Not Be Subject to Current U.S. Income Taxes 4. Assets Would Not Be Subject to U.S. Gift, Estate or GST Transfer Taxes on Death of the Non-U.S. Citizen or Resident Owner or Settlor Estate Planning with Cross Border Implications (Cont’d)

- 11. 5. Establish U.S. or Foreign Dynasty Trusts for the Benefit of U.S. Citizen or Resident Children and Their Issue a. A Child Could Be Trustee of U.S. Trust for the Benefit of Himself or Herself and His or Her Issue, with Appropriate Limitations on His or Her Rights and Powers as Trustee and Beneficiary b. Foreign Trusts Could Avoid U.S. and CA Income Tax Throwback Rule If Accumulated Income Is Not Distributed to U.S. Beneficiaries c. Trusts Would Be GST Exempt If Transfers Not Subject to U.S. Gift or Estate Taxes d. Foreign Personal Holding Company (“FPHC”) Assets Should Be Sold Periodically Before the Settlor’s Death to Avoid Large FPHC Tax on Liquidation of Corp.,and the Corp. Should Be Liquidated Within 30 Days After Death to Avoid Future FPHC Taxes Estate Planning with Cross Border Implications (Cont’d)

- 12. E. Departure Planning — U.S. Citizens and Long-Term Permanent Residents (HEART Act) 1. Special Taxes Apply with Respect to “Covered Expatriates” who surrender their U.S. citizenship or long-term permanent residence status after June 16, 2008. 2. Exit Tax – based on a deemed sale of all assets for their fair market values as of the day before the expatriation occurred. 3. 2011 exemption for total net gain below $636,000. 4. Deferral of tax with respect to certain deferred compensation items and interests in non-grantor trusts. 5. Unless the expatriate elects otherwise, IRC §877A(f) provides for an automatic deferral of income tax on the value of the expatriate’s “interest in a non-grantor trust,” whether the trust is a domestic trust or a foreign trust, and §877A(f)(4)(A) provides that rules similar to payments of “eligible deferred compensation” shall apply. Estate Planning with Cross Border Implications (Cont’d)

- 13. Thus, the trustee must withhold 30% of the gross amount of the distribution, but §877A(f)(2) appears to limit the withholding to the amount of distributable net income attributable to the distribution. See IRS Notice 2009-85 (2009-45 IRS 598), §7.D). 6. The expatriate‘s ongoing U.S. income tax liability with regard to future distributions from a domestic trust is not limited to what the expatriate’s tax would have been based on if the value of the expatriate’s interest in the trust had been taxed at the time of expatriation. 7. There are no provisions for a foreign trust to “elect” to be treated as a U.S. trust for withholding tax purposes (in contrast with the rules on how the tax on the deferred tax on deferred compensation will be paid by a non-U.S. person). Thus, there is no mechanism for the IRS to directly enforce the requirement that the expatriate must report any tax due with regard to future distributions from a foreign trust. Estate Planning with Cross Border Implications (Cont’d)

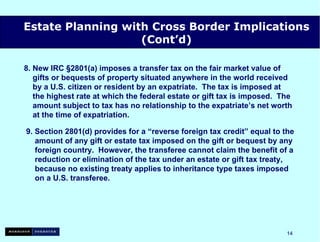

- 14. 8. New IRC §2801(a) imposes a transfer tax on the fair market value of gifts or bequests of property situated anywhere in the world received by a U.S. citizen or resident by an expatriate. The tax is imposed at the highest rate at which the federal estate or gift tax is imposed. The amount subject to tax has no relationship to the expatriate’s net worth at the time of expatriation. 9. Section 2801(d) provides for a “reverse foreign tax credit” equal to the amount of any gift or estate tax imposed on the gift or bequest by any foreign country. However, the transferee cannot claim the benefit of a reduction or elimination of the tax under an estate or gift tax treaty, because no existing treaty applies to inheritance type taxes imposed on a U.S. transferee. Estate Planning with Cross Border Implications (Cont’d)

- 15. 10. The tax does not apply to property subject to U.S. gift or estate taxes shown on timely filed gift and estate tax returns, or to gifts that are excluded under IRC §2503(b) (and probably under IRC §2503(e), too). It also does not apply to qualifying transfers to a spouse or charitable organization. 11. The tax also is imposed on a gift or bequest by an expatriate to a domestic trust. A gift or bequest to a foreign trust is deferred until distribution is made from the trust to the U.S. citizen or resident beneficiary, and an income tax deduction is allowed under IRS §164 for the §2801 tax attributable to the portion of the distribution included in gross income. A foreign trust may elect to be treated as a domestic trust for purposes of §2801. Estate Planning with Cross Border Implications (Cont’d)

- 16. Appendix A 2011 FEDERAL UNIFIED ESTATE AND GIFT TAX RATE SCHEDULE * The applicable credit amount available as an offset to the estate and gift tax is $1,730,880, which is equivalent to the tax on a taxable estate and/or cumulative lifetime gifts of $5,000,000 Estate Planning with Cross Border Implications (Cont’d)

- 17. Morrison Foerster Richard Kinyon designs and implements complex estate plans for high-net-worth individuals, including the establishment of various sophisticated irrevocable trusts and family investment companies, and he represents fiduciaries and beneficiaries in connection with the administration of estates and trusts, including litigation. Mr. Kinyon advises closely held business owner clients on how to pass interests in their businesses to younger-generation family members and others in a tax-advantaged and creditor-protected manner. He also advises wealthy individuals on how to transfer their real estate, and other assets to the objects of their bounty. Mr. Kinyon has lectured for numerous educational institutions, various local estate planning councils, and other organizations. He has authored chapters in California CEB treatises on drafting business buyout agreements, tax planning for the prospective retiree, using family partnerships as an estate planning tool, the income tax aspects of estates and trusts, "Dynasty Trusts" (in Drafting California Irrevocable Trusts ), and "Overview of Estate Planning Practice" (in California Estate Planning ). He also has written a number of articles for the CEB Estate Planning & California Probate Reporter , for which he also has served as guest editor, Estate Planning, Trust & Probate NEWS , and other professional journals. Mr. Kinyon has been active in a number of professional organizations for which he has served as Chairman, including: the Committee on Tax Legislation & Regulations: Income Taxation of Trusts and Estates, of the Real Property, Probate & Trust Law Section of the American Bar Association; the Subcommittee on State Inheritance and Gift Taxes of the Estate Planning Committee of the Estate Planning, Probate, and Trust Law Section of the State Bar of California; and the Estate Planning, Trust, and Probate Law Section of the San Francisco Bar Association. Mr. Kinyon has been recognized for his expertise in Trusts and Estate Planning by San Francisco Magazine as one of Northern California's "Super Lawyers." He has been a certified Specialist in Taxation Law by the California Board of Legal Specialization since 1973. Mr. Kinyon attended Dartmouth College from 1957 to 1959, and received his B.A., cum laude , in 1961 and his LL.B., cum laude , in 1965 from the University of Minnesota. He served as Editor of the Minnesota Law Review from 1964 to 1965.