Chapter 3: Principles and Practices of Health Care Accounting

- 1. Principles and Practices of Health Care Accounting Chapter 3

- 2. Learning Objectives • Record financial transactions • Understand the basics of accrual accounting • Summarize transactions info financial statements

- 3. Analyzing and Recording External Transactions occur between the organization and an outside party. Internal Transactions occur within the organization. Process Exchanges of economic consideration between two parties. C 1 2-3

- 4. The “Book” • As transactions occur, they are recorded chronologically in a journal • Periodically the transactions are summarized by account into a ledger • The journal and ledger make up the chronological listing of transactions and the current balance in each account • Totals for each account in the ledger are used to prepare the four financial statements

- 5. Analyzing and Recording Process Analyze each transaction and event from source documents Record relevant transactions and events in a journal Post journal information to ledger Prepare and analyze accounts the trial balance C 1 2-5

- 6. Purchase Orders Bank Statements Source Documents Sales Tickets Checks Bills from Suppliers C 1 Employee Earnings Records 2-6

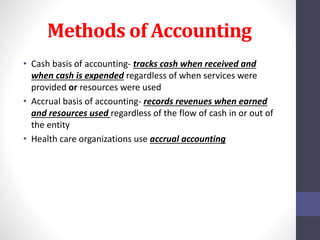

- 7. Methods of Accounting • Cash basis of accounting- tracks cash when received and when cash is expended regardless of when services were provided or resources were used • Accrual basis of accounting- records revenues when earned and resources used regardless of the flow of cash in or out of the entity • Health care organizations use accrual accounting

- 8. Recording Transactions 2 rules under accrual accounting • At least two accounts must be used to record a transaction a) Increase(decrease) an asset account whenever assets are acquired (used) b) Increase (decrease) a liability account whenever obligations are incurred (paid for) c) Increase a revenues, gains, or other support account when it occurs d) Increase an expense account when an asset is used

- 9. 2nd Rule Recording Transactions • After each transaction, the fundamental accounting equation must be in balance: Assets=Liabilities +Net Assets

- 12. Developing the Financial Statements • Once the transactions have been analyzed and recorded, the organization can develop the four financial statements: • Balance Sheet • Statement of Operations • Statement of Changes in Net Assets • Statement of Cash Flows

- 13. Question11 (from textbook) • List and record each transaction for the Claymont Outpatient Clinic, under the accrual basis of accounting, at Dec 31 20X1. Then develop a balance sheet, statement of operations for the year ended Dec 31 20X1. 1. 1. the clinic received a $10,000,000 unrestricted cash contribution from the community. 2. The clinic purchased $4,500,000 of equipment. The clinic paid cash for the equipment. 3. The clinic borrowed $2,000,000 from the bank on a long term basis. 4. The clinic purchased $550,000 of supplies on a long term basis. 5. The clinic provided $8,400,000 of services on credit 6. In the provision of these services, the clinic used $420,000 of supplies 7. The clinic received $800,000 in advance to care for capitated patients.

- 14. 8. the clinic incurred $4,500,000 in labor expenses and paid cash for them 9.The clinic incurred $2,230,000 in general expenses and paid cash for them 10. The clinic received $6,000,000 from patients and their third parties in payments of outstanding accounts 11. The clinic met $440,000 of its obligations to capitated patients (transaction 7) 12. The clinic made a $400,000 cash payment on the long term loan 13. The clinic also made a cash interest payment of $40,000 14. A donor made a temporarily restricted donation of $370,000, which is set aside in temporary investments 15. The clinic recognized $400,000 in depreciation for the year. 16. The clinic estimated that $850,000 of patient accounts would not be received and established a provision for bad debt.

- 15. Solution: General ledger for Claymont Outpatient Clinic Assets Transacti ons Cash & temporar y investme nts Accounts receivabl es Allowanc es for bad debt Supplies Plant, property & equipme nt Accumula ted depreciat ion Beginning balance

- 16. Summary • One of the major roles of accounting is to record the transactions in a standardized format and report the results. • These transactions are the basis for the financial statements • Accrual accounting is used by health care organizations • Financial statements are a foundation for decision making in health care organizations