Menlo XV Announcement Deck

- 2. 2 / © 2020 Menlo Ventures At Menlo, when we invest, we’re invested. Genuinely, actively invested. Invested in your success, but also your struggles. Your questions, your concerns, your highs, your lows. We don’t just invest our dollars, we invest our dedication, our drive. Our tested advice and trusted support. That’s because, when we find an idea we believe in, we’re all engaged. When we’re in, we’re all in. Having support from every angle means you can take on any challenge. Go further, go bolder. Not limiting yourself to what is, but courageously pursuing what could be—the game- changing ideas that reinvent life and work. Starting a business isn’t easy. You can’t do it alone. And while anyone can back you, not everyone will have your back. Menlo Ventures. All in. Our Promise to Founders

- 3. 3 / © 2020 Menlo Ventures MSFT CSCO AAPL HPQ YHOO GOOG UBER AAPL* GILD FFIV CAVM PANW* RDFN* ROKU DOCU* UBER ••••••••••••••• ••••••••••••••• •••••••••••••••••••••••••••••• ••••••••••••••• ••••••••••••••• ••••••••••••••• ••••••••••••••• •••••••••••••••••••••••••••••• mergers & acquisitions 150+ 44 years of consistent performance $280B+ value of Menlo portfolio companies† $8B+ distributed to LPs since 1977‡ •••••••••• •••••••••• •••••••••• •••••••••• •••••••••• •••••••••• ••••••••••public companies 70+ Menlo by the Numbers *Investment and board seat from previous firm. † Based on the sale price of company or its market capitalization as of 6/30/20. ‡ Net of fees and carried interest.

- 4. 4 / © 2020 Menlo Ventures We Go ALL IN. All of us. All of you. All access. All along. All about impact. When we’re in, we’re all in. From our partners to our Fuel team, we give the companies we back our full attention. We don’t stop at the top. Our partnership is deeper than board member to founder; we support the entire portfolio company. We make intros that matter. From finding new hires to new customers, we put our network to work on behalf of our companies. We’re get-to- know-it-alls. From inception to IPO, we dig deep and partner through thick and thin. We don’t just raise money, we raise the bar. We hold companies to a higher standard, ourselves included. When we invest, we’re invested.

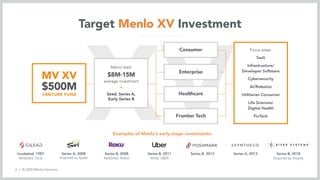

- 6. 6 / © 2020 Menlo Ventures Incubated, 1987 Series A, 2008 Series B, 2008 Series B, 2011 Series B, 2012 Series A, 2013 Series B, 2018 NASDAQ: GILD Acquired by Apple NASDAQ: ROKU NYSE: UBER Acquired by Shopify Target Menlo XV Investment Examples of Menlo’s early-stage investments:

- 7. 7 / © 2020 Menlo Ventures Early-Stage Investors Focus Areas Naomi Ionita • Departmental SaaS • Workflow automation • Data + developer tools • Remote work and productivity tooling Greg Yap • Therapeutic platforms • Digital health • Transformative health technologies Venky Ganesan • Cybersecurity • Cloud infrastructure Matt Murphy • AI-enhanced SaaS • Developer-led tools (DevOps) and infrastructure • Robotics Shawn Carolan • Utilitarian consumer (productivity, transportation, fintech) • Menlo Labs Grace Ge • Departmental SaaS • Future of work • Data tooling • Sales and CS enablement Croom Beatty • Fintech • Healthcare IT (unbundling EHRs) • DevOps Sunil Chhaya • AI-enhanced SaaS • Cloud infrastructure • Collaboration solutions

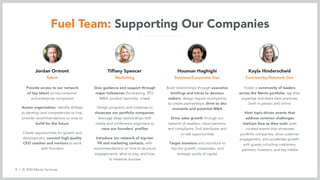

- 8. 8 / © 2020 Menlo Ventures Fuel Team: Supporting Our Companies Jordan Ormont Talent Tiffany Spencer Marketing Houman Haghighi Business/Corporate Dev Kayla Hinderscheid Community/Network Dev Provide access to our network of top talent across consumer and enterprise companies Assess organization, identify skillsets to develop and competencies to hire, provide recommendations on how to build for the future Create opportunities for growth and development, connect high-quality CEO coaches and mentors to work with founders Give guidance and support through major milestones (fundraising, IPO, M&A, product launches, crises) Design programs and initiatives to showcase our portfolio companies; leverage deep relationships with media and conference organizers to raise our founders’ profiles Introduce our network of top-tier PR and marketing contacts, with recommendations on how to structure engagements, what to pay, and how to measure success Build relationships through executive briefings and intros to decision makers; design regular touchpoints to create partnerships; drive to aha moments and potential M&A Drive sales growth through our network of resellers, cloud partners, and consultants; find distributor and co-sell opportunities Target investors and introduce to top-tier growth, corporates, and strategic pools of capital Foster a community of leaders across the Menlo portfolio; tap their expertise and share best practices, both in person and online Host topic-driven events that address common challenges startups face as they scale; plan curated events that showcase portfolio companies, drive customer engagement, and accelerate growth, with guests including customers, partners, investors, and key media

- 9. 9 / © 2020 Menlo Ventures Investment Themes Focusing on the future 1The drive to digital 2The push for automation 3Healthcare takes center stage

- 10. 10 / © 2020 Menlo Ventures The Drive to Digital • COVID has accelerated the shift to digital, making the future of work— particularly collaboration, communication, workflow automation, and productivity solutions—more relevant now than ever before. • Sectors that relied on a hybrid of physical and digital locations to conduct business have had to prioritize digital. Examples include banking and commerce, and even healthcare. Importantly, as these businesses shift, many require specialized solutions for their tech stack (e.g., security, payments). • This shift has increased the demand for better infrastructure, cloud technology, and security. • The digital transformation will be driven by developers, and we’re eager to invest in companies building better dev tools, open-source software, and APIs. Current portfolio:

- 11. 11 / © 2020 Menlo Ventures • With fewer of the workforce returning to the workplace, there is more demand for automation and robotics. This has been particularly evident in the supply chain, which was already challenged by labor shortages. The pandemic has added stress to the supply chain as consumers have increased their grocery and food delivery, as well as e-commerce, but we are excited by the potential of robotics and automation to drive new efficiencies. • Increasing efficiency requires smarter tools. That is why we are excited about the integration of artificial intelligence, particularly when dealing with large data sources, where smart AI can increase data observation and provide insights. Current portfolio: The Push for Automation

- 12. 12 / © 2020 Menlo Ventures • The pandemic has reminded us all that without good health, we have nothing. We will further invest in therapeutics—particularly companies built around platform technologies and massive data sets that can produce multiple new treatments—and transformative health technologies, including applications of genomics and synthetic biology. • Healthcare and technology continue to intersect as healthcare becomes increasingly digital. We are excited by the consumerization of healthcare and the shift from care organized around providers and hospitals to care influenced by consumers with access to data and AI-enhanced health technologies. And at the enterprise level, vertical SaaS applications are driving workflow efficiencies, reducing overall cost of care and improving patient outcomes. Current portfolio: Healthcare Takes Center Stage