2Q07 Presentation

- 1. 2Q07 EARNINGS RELEASE PRESENTATION AUGUST 09, 2007 April 20071

- 2. The Bank's financial statements and consolidated financial statements herein are presented on a pro forma basis, encompassing the financial statements of the Bank, its subsidiaries, the Credit Receivables Investment Funds (FIDC) and insurer J. Malucelli Seguradora. They were prepared based on the accounting practices pursuant to Brazilian Corporate Law, and associated with the regulations and instructions issued by the National Monetary Council (“CMN”), the Brazilian Central Bank (“BACEN”) and the Brazilian securities and exchange commission Comissão de Valores Mobiliários ("CVM") (“BR GAAP”). 2

- 3. Summary Paraná Banco Overview 3 Operational Highlights 4 Origination Evolution 5 Franchise: an innovative sales channel 6 Total Assets and Equity 7 Period Result Composition 8 Financial Highlights 9 Credit Portfolio 10 Credit Portfolio Quality 11 Funding Structure 12 Operating Income and Expenses 13 J. Malucelli Seguradora – Performance 14 Ratings 15 IPO 16 Share Price Evolution 17 3

- 4. Paraná Banco Overview Niche Bank, specialized in payroll deductible loans Focus in profitability and a low-risk customer base (civil servants, private-sector employees and retirement beneficiaries, and pensioners under the INSS social security system) Deductible loans agreements with more than 560 state and private entities 3 sales channels: brokers, call center and franchises Repurchase of 85% of J. Malucelli Seguradora, coming to 100% ownership, after SUSEP approval 4

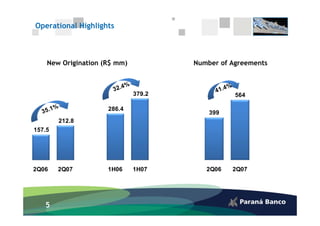

- 5. Operational Highlights New Origination (R$ mm) Number of Agreements 379.2 564 286.4 399 212.8 157.5 2Q06 2Q07 1H06 1H07 2Q06 2Q07 5

- 6. Origination Evolution (R$ x 1,000) 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 2006 2007 6

- 7. Franchise: an innovative sales channel Exclusivity and long term agreements Low initial investment and low operating costs Initial activities in march 2007 Original target of 30 franchisees at end of 2007 27 franchises in operation today, with 27 more in the pipeline 7

- 8. Total Assets and Equity Total Assets Shareholders’ Equity 746,582 1,656,882 678,835 192,556 2Q06 2Q07 2Q06 2Q07 Note: the deferred comission adjustment initiated in 2007 resulted in na increase of R$ 25,505 thousand in the Sahreholders’ Equity and right to dividends of 25% on this sum. 8

- 9. Period Result Composition (1H07) (R$ x 1,000) 60000 50000 24,505 40000 30000 12,541 56,341 20000 31,836 10000 19,295 0 Net Income Non-Recurring Net Adjusted Deferred Period Result IPO expenses Income Comissions Adjustment 9

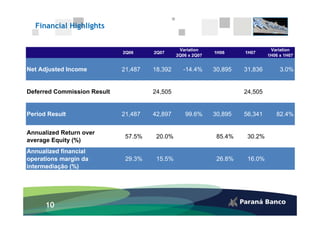

- 10. Financial Highlights Variation Variation 2Q06 2Q07 1H06 1H07 2Q06 x 2Q07 1H06 x 1H07 Net Adjusted Income 21,487 18,392 -14.4% 30,895 31,836 3.0% Deferred Commission Result 24,505 24,505 Period Result 21,487 42,897 99.6% 30,895 56,341 82.4% Annualized Return over 57.5% 20.0% 85.4% 30.2% average Equity (%) Annualized financial operations margin da 29.3% 15.5% 26.8% 16.0% intermediação (%) 10

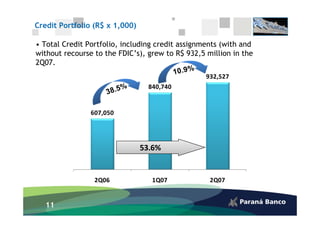

- 11. Credit Portfolio (R$ x 1,000) • Total Credit Portfolio, including credit assignments (with and without recourse to the FDIC’s), grew to R$ 932,5 million in the 2Q07. 932,527 840,740 607,050 53.6% 2Q06 1Q07 2Q07 11

- 12. Credit Portfolio Quality High Quality and Stability 2Q06 D‐H 2Q07 D‐H 6% 6% AA‐C AA‐C 94% 94% 12

- 13. Funding Structure (R$ x 1,000) 849.409 0 89,229 71,508 33,918 540.242 0 147,385 54,791 21,282 654,754 316,784 2Q06 2Q07 Total Deposits Open market Medium term notes Credit Assignments 13

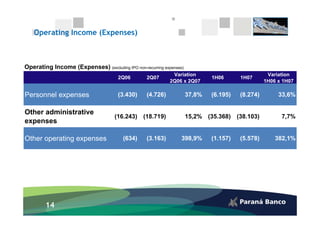

- 14. Operating Income (Expenses) Operating Income (Expenses) (excluding IPO non-recurring expenses) Variation Variation 2Q06 2Q07 1H06 1H07 2Q06 x 2Q07 1H06 x 1H07 Personnel expenses (3.430) (4.726) 37,8% (6.195) (8.274) 33,6% Other administrative (16.243) (18.719) 15,2% (35.368) (38.103) 7,7% expenses Other operating expenses (634) (3.163) 398,9% (1.157) (5.578) 382,1% 14

- 15. J. Malucelli Seguradora - Performance Premiums Written Shareholders’ Equity 66.5 81.90 56.80 47.9 57.6 25.3 2Q06 2Q07 1H06 1H07 2Q06 2Q07 15

- 16. Ratings Rating Rating / Ranking Rating / Ranking Rating / Ranking brBBB+/B+ 9,94 A- A- Low Credit Risk Low Risk –Medium Term Low Credit Risk Low Credit Risk June 2007 March 2007 June 2007 June 2007 16

- 17. IPO IPO in June 14th, 2007 100% primary issue R$529,2 million total proceedings Corporate Governance Adherence to BOVESPA Level 1 corporate governance practices. Bank intends to migrate to Level 2 All shares issued with 100% Tag-along 17

- 18. Share Price Evolution (R$) PRBC4 X IBOV X IGC 15,0 14,5 14,0 13,5 13,0 12,5 12,0 11,5 PRBC4 IBOV IGC 18

- 19. IR Contacts Luis César Miara CFO and Investor Relations Officer Maurício N. G. Fanganiello IR Coordinator Phone: (55 41) 3351-9907 / 3351-9961 e-mail: ir@paranabanco.com.br IR Website: www.paranabanco.com.br/ir “This document may include estimates and forward-looking statements. These estimates and forward-looking statements are to a large extent based on current expectations and projections about future events and financial trends that affect or may come to affect our business. Many important factors may adversely affect the results of Paraná Banco as described in our estimates and forward-looking statements. These factors include, but are not limited to, the following: the Brazilian and international economic conjunctures, fiscal, foreign-exchange and monetary policies, higher competition in the payroll deductible loan segment, the ability of Paraná Banco obtain funding for its operations, and amendments to Central Bank regulations. The words “believe”, “may”, “could”, “seek”, “estimate”, “continued”, “anticipate”, “plan”, “expect” and other similar words have the objective of identifying estimates and projections. The considerations involving estimates and forward-looking statements include information related to results and projections, strategies, competitive positioning, the environment in the industry, growth opportunities, the effects of future regulations, and the impacts from competitors. Said estimates and projections refer only to the date on which they were expressed, and we do not assume any obligation to publicly update or revise any of these estimates arising from the occurrence of new information, future events, or any other factors. In view of the risks and uncertainties described above, the estimates and forward-looking statements contained herein may not materialize. Given these limitations, shareholders and investors should not make any decisions based on the estimates, projections and forward-looking statements contained in this report 19