2 q08 earnings call presentation

- 1. 2Q08 Results August, 2008

- 2. Highlights 2Q08 – Generation 28% above Assured Energy – EBITDA of R$ 288.9 million in 2Q08, an increase of 24.2% when compared to same period of 2007 (R$ 232.6 million) – Net income of R$ 134.1 million in 2Q08, 5.6% lower than that in 2Q07 (R$ 142.1 million) – On May 29th, 2008, the company paid R$ 172.8 million as Dividends regarding 1Q08 results Subsequent Events – Proposed dividends of R$ 134.1 million, corresponding to 100% of net income on 2Q08: - R$ 0.34 per Common Share - R$ 0.37 per Preferred Share 2

- 3. Energy Balance Generation – MW Average Billed Energy – GWh 7,239 7,292 738 461 121% 128% 115% 914 1,234 109% 107% 112% 1,635 5,587 5,597 1,543 1,363 1,467 1,424 1,392 2003 2004 2005 2006 2007 1H08 1H07 1H08 Generation - MW Average Generation / Assured Energy Eletropaulo MRE CCEE/Losses Increase of 29.4% on Generated Energy Bilateral Contract with Eletropaulo: (2Q08 x 2Q07) – Price until 07/03/2008 – R$ 131.98/MWh – Prices from July, 2008 – R$ 149.72/MWh Generation 28% above Assured Energy (1,275 MW average) MRE Tariff – R$ 7.77/MWh Average price of 2Q08 billed energy at CCEE – R$ 59.72/MWh (R$ 68.82/MWh in 2Q07) 3

- 4. Investments Capex – 2Q08: R$ 12.9 million 1H08 Capex – 1H08: R$ 18.5 million Equipment – Equipment restoration and upgrade of operating plants - 45.4% R$ 6.0 million Environment 32.3% – Upgrade of the SHPP – R$ 1.7 million IT – Environmental Projects – R$ 3.3 million SHPP – Investments on IT – R$ 0.8 million 17.7% – SHPPs “São José” and “São Joaquim”, at São Paulo (total 4.5% capacity 7MW) – R$ 5.2 million – 3 SHPPs at Rio de Janeiro: Investments – R$ million • Installed Capacity of 52MW 85.9 • The installation license was granted in October 2007 17.7 • Until 06/30/2008 R$ 21.0 million were invested, of SHPPs - RJ which R$ 1.0 million in 1H08 68.2 50.7 • Waiting for the Vegetation Suppression License 46.5 authorization in order to start the construction 27.5 18.5 Capex 2008 – Estimate revised to R$ 85.9 million 2005 2006 2007 2008 (E) 1H08 4

- 5. Expansion Requirement Requirement: increase installed capacity, by at least, 15% (400 MW), until December 2007: – Increase the installed capacity in São Paulo State; or – Purchase energy from new plants, located in São Paulo, through long term agreements (at least 5 years) Restrictions to accomplish the requirement: – São Paulo State – insufficient hydro resources and environmental restrictions to install Thermo plants; – Insufficiency of gas supply; – “New Model of Electric Sector” (Law # 10,848/04) On February 2008, AES Tietê received a report prepared by a consulting company, regarding the evaluation of possibilities of expanding its generation capacity in São Paulo State. The Company has been developing discussions with different members of the São Paulo State Government, regarding opportunities related to: – Hydroelectric potential – Opportunities for joint generation – Alternative energies 5

- 6. Gross Revenue – R$ Million Gross Revenue Without Non-recurring Effects +33.1% 809 786 809 608 +2.9% 34 74 74 34 34 (132) 775 775 775 712 712 +86.8% 740 +1.3% +4.6% 395 390 395 211 +8.8% 16 16 16 37 (170) -0.6% +7.4% 381 378 352 352 378 378 1H07 1H08 2Q07 2Q08 1H07 1H08 2Q07 2Q08 Net Revenue Deductions Reversion of Deductions Stable net revenue comparing to 2Q07 – Change in PIS/Cofins Tax from Cumulative to Non-cumulative generated extraordinary impacts in 2Q07: • Gross Revenue - decrease of R$ 178.2 million • Deductions – reversion of R$ 206.7 million • Net Revenue – increase of R$ 28.5 million 6

- 7. Costs and Operational Expenses R$ Million Costs and Operational Expenses Without Non-recurring Effects 253 + 4.9 % -19.0% 205 205 195 164 175 112 -35.6% 83 102 112 + 9.3 % 106 106 97 132 58 50 40 58 60 60 45 60 60 16 31 31 31 33 33 16 16 33 33 16 16 16 1H07 1H08 2Q07 2Q08 1H07 1H08 2Q07 2Q08 Power Purchase and Sector Charges Other Operational Expenses Depreciation TUSDg Costs: – Extraordinary impact in 2Q07’s expenses, R$ 92.5 million, retroactively of 07/01/2004 – Tariff Cycle 2007/2008, R$ 44.3 million (R$ 11 million / quarter) Reversal of R$ 15.3 million provision in 2Q07 due to the change of PIS/COFINS tax, from cumulative, to non-cumulative 7

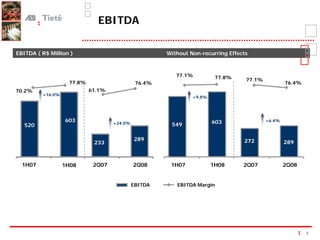

- 8. EBITDA EBITDA ( R$ Million ) Without Non-recurring Effects 77.1% 77.8% 77.1% 77.8% 76.4% 76.4% 70.2% 61.1% +16.0% +9.8% 603 +24.0% 603 +6.4% 520 520 549 289 289 272 233 289 1H07 1H08 2Q07 2Q08 1H07 1H08 2Q07 2Q08 EBITDA EBITDA Margin 8

- 9. Financial Results – R$ Million Financial Results - R$ Million Without Non-recurring Effects 1H07 1H08 2Q07 2Q08 1H07 1H08 2Q07 2Q08 10 (19) (21) - 431.6 % - 215.8 % (50) (65) (65) - 103.0 % (101) (101) Increase of the average IGP-M (4.34% in 2Q08 x 0.35% in 2Q07), which accrues the Company’s debt – amount of R$ 1.3 billion Positive effect in 2Q07 due to the change of PIS/COFINS taxation system, totaling R$ 30.8 million 9

- 10. Results Net Income - R$ Million Without Non-recurring Effects 42.3% 41.9% 40.9% 39.6% 39.6% 37.3% 35.4% +1.4% 35.4% +1.8% - 5.6 % 303 307 301 307 - 9.1% 142 154 134 134 134 1H07 1H08 2Q07 2Q08 1H07 1H08 2Q07 2Q08 Net Income Net Margin Proposed Dividends of 100% of 2Q08’s Ex-Dividend date 08/14/2008 Net Income: – Dividends: R$ 134.1 million; Payment date 08/28/2008 – Total payment by share: - R$ 0.34 / common share - R$ 0.37 / preferred share 10

- 11. Consolidated Debt in R$ million Amount Creditor Maturity Cost Collateral 1,287.1 Eletrobrás May, 2013 IGP-M + 10% p.a. Receivables 0.0 FunCesp III Sep, 2027 IGP-DI + 6% p.a. Receivables Net Debt - R$ Million 2.0x 1.4x 1,253.5 0.7x 0.6x 0.6x 0.5x 1,096.3 676.5 681.9 660.9 606.8 2003 2004 2005 2006 2007 2Q08 Net Debt (R$ million) Net Debt / EBITDA Cash Availability 06/30/2008 = R$ 680.3 million – Marketable securities with maturities lower than 90 days – Average rates around 100% of CDI 11

- 12. Managerial Cash Flow R$ Million 2Q07 3Q07 4Q07 1Q08 2Q08 INITIAL CASH 683.5 571.2 589.0 633.7 814.6 Operating Cash Flow 307.9 248.9 271.2 261.5 279.3 Investments (12.0) (9.3) (15.0) (4.1) (11.6) Net Financial Expenses (18.0) (19.3) (18.4) (15.3) (14.1) Net Amortization (48.3) (50.8) (52.0) (46.2) (45.6) Income Tax (16.6) (9.8) - (15.1) (16.0) Dividends and IoE (325.4) (141.9) (141.0) - (334.1) Free Cash Flow (112.3) 17.8 44.7 180.9 (142.1) FINAL CASH OF PARENT COMPANY 571.2 589.0 633.7 814.6 672.5 Final Cash of Subsidiaries and Associated Companies 28.3 4.2 4.6 6.5 7.8 Final Cash 599.4 593.2 638.3 821.0 680.3 Investments – construction of the SHPP’s at São Paulo (R$ 4.2 million) and upgrade of the SHPP’s of AES PCH Minas subsidiary (R$ 1.7 million) Payment of dividends regarding 4Q07 and 1Q08 12

- 13. Conclusion Generation was 28% above Assured Energy in 2Q08 EBITDA of R$ 288.9 million in 2Q08, representing an increase of 24.2% when compared to 2Q07 (R$ 232.6 million) Net income of R$ 134.1 million in 2Q08, represents a decrease of 5.6% when compared to 2Q07 (R$ 142.1 million) Proposed dividends corresponding to 100% of 2Q08 net income 13

- 14. 2Q08 Results The statements contained in this document with regard to the business prospects, projected operating and financial results, and growth potential are merely forecasts based on the expectations of the Company’s Management in relation to its future performance. Such estimates are highly dependent on market behavior and on the conditions affecting Brazil’s macroeconomic performance as well as the electric sector and international market, and they are therefore subject to changes.