2 q14 arezzo_apresentacao_call eng

- 1. | Apresentação do Roadshow 1 Conference Call 2Q14

- 2. 2 Important Disclaimer Information contained in this document may include forward-looking statements and reflect Management’s current view and estimates of the evolution of the macroeconomic environment, industry conditions, Company’s performance and financial results. Any statements, expectations, capabilities, plans and assumptions contained in this document, which do not describe historical facts, such as information about declaration of dividend payment, future direction of operations, implementation of relevant operating and financial strategies, investment program and factors or trends affecting the financial condition, liquidity or results of operations, are forward-looking statements, as set forth in the “U.S. Private Securities Litigation Reform Act of 1995”, and involve several risks and uncertainties. There is no guarantee that these results will occur. Forward-looking statements are based on several factors and expectations, including economic and market conditions, industry competitiveness and operational factors. Any changes in such expectations and factors may cause actual results to differ from current expectations. The Company’s consolidated financial statements presented herein are in accordance with the International Financial Reporting Standards - IFRS, issued by the International Accounting Standards Board - IASB, based on the audited financial statements. Non-financial information and other operating information have not been subject to an audit by independent auditors.

- 3. 3 Gross revenue reached R$327.5 million in the 2Q14, an increase of 7.2% against 2Q13. Gross Revenue In 2Q14, gross profit was R$112.9 million, a growth of 6.5% over 2Q13.Gross Profit EBITDA for 2Q14 amounted to R$42.3 million, a growth of 4.5% in relation to 2Q13, with a margin of 16.7%. EBITDA In this quarter, Arezzo&Co opened nine stores and expanded six stores, with a growth of 15.7% in sales area over the last 12 months. Sales Area Expansion In 2Q14, net income reached R$31.6 million, with net margin of 12.5%, and an increase of 8.9% in comparison with 2Q13. Net Profit 2Q14 Highlights

- 4. 293.9 310.8 535.4 577.1 11.6 16.7 27.5 26.2 305.5 327.5 562.9 603.4 2Q13 2Q14 1H13 1H14 Domestic Market External Market 4 Gross revenue reached R$327.5 million in the 2Q14, an increase of 7.2% against 2Q13. Company Growth Gross Revenues – Domestic and Export Market (R$ million) 5.8% 44.1% 7.2% 7.8% -4.6% 7.2%

- 5. 171.5 175.0 322.3 339.6 110.6 117.2 189.6 205.4 9.1 16.5 17.0 28.3 2.7 2.1 6.6 3.8 293.9 310.8 535.4 577.1 2Q13 2Q14 1H13 1H14 Arezzo Schutz Anacapri Others¹ 5 Growth of 5.8% from the domestic market gross revenues in 2Q14, namely the growth of 82.3% for the Anacapri brand, leveraged by the opening of 26 stores in the last twelve months. 1) Others: Reduction of 21.5% in the 2Q14 and 42.1% in the 1H14. Gross Revenues by brand – Domestic Market (R$ million) Gross Revenue Breakdown by Brand – Domestic Market 2.0% 82.3% 5.8% 5.4% 66.6% 7.8% 8.4% 6.0%

- 6. 134.5 151.1 251.4 297.0 69.8 74.9 131.3 138.8 87.6 83.6 147.6 139.2 1.9 1.2 5.2 2.1 293.9 310.8 535.4 577.1 2Q13 2Q14 1H13 1H14 Franchise Owned Stores Multi-brand Others¹ In 2Q14, monobrand stores (Franchises and Owned Stores) increased sales, namely a 12.3% growth in Franchise channel, leveraged by the opening of 58 stores and expansion of 14 in the last twelve months. Gross Revenue Breakdown by Channel – Domestic Market 6 SSS Sell-out (owned stores + franchises) SSS Sell-in (franchises) 1) Others: Decreasing 38.7% in 2Q14 and 60.2% in 1H14. Gross Revenue by channel – Domestic Market (R$ million) SSS Sell-out (owned stores + web + franchises) 1.2% 5.5% 6.7% 1.1% 2.5% 7.7% 3.7% 6.7% 5.3 % 5.1% 4.7% 5.9 % 18.1% 5.8% 7.8% 12.3% 7.3% 5.8% -4.5% -5.7%

- 7. 276 309 361 417 31 50 56 51 18.4 23.1 28.0 32.4 2Q11 2Q12 2Q13 2Q14 Franchises Owned Stores Area The sales area increased 15.7% in the 2Q14 due to the opening of 51 stores and expansion of 17 stores in the last 12 months. Distribution Channel Expansion 7 Owned Stores and Franchises Expansion 1) Includes 6 outlets with total area of 2,217 sqm The numbers of Multi Brand stores refers to the domestic market 21.1% 15.7% 25.6% +45 +50 +51 Franchises Multi Brands Owned Stores 43 26 1.383 Multi Brands Owned Stores 2 9 Franchises 26 Multi Brands Owned Stores 6 987 Franchises Multi Brands Owned Stores 348 17 1.040 307 359 417 468 1

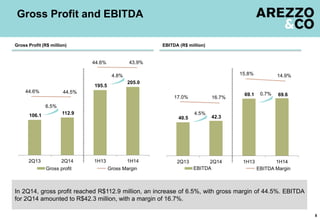

- 8. 106.1 112.9 195.5 205.0 2Q13 2Q14 1H13 1H14 40.5 42.3 69.1 69.6 2Q13 2Q14 1H13 1H14 In 2Q14, gross profit reached R$112.9 million, an increase of 6.5%, with gross margin of 44.5%. EBITDA for 2Q14 amounted to R$42.3 million, with a margin of 16.7%. Gross Profit and EBITDA 8 Gross Profit (R$ million) EBITDA (R$ million) Gross profit Gross Margin EBITDA EBITDA Margin 6.5% 4.5% 44.6% 44.5% 4.8% 44.6% 43.9% 17.0% 16.7% 15.8% 14.9% 0.7%

- 9. 29.1 31.6 48.4 49.1 2Q13 2Q14 1H13 1H14 The Company’s net income totaled R$31.6 million in 2Q14, a growth of 8.9% in the quarter with a 12.5% net margin. Net Income and Net Margin 9 Net Income (R$ million) Net MarginNet Income 8.9% 12.2% 12.5% 1.3% 11.0% 10.5%

- 10. Cash Flow 10 Arezzo&Co generated R$8.8 million of net cash flow in 2Q14, in line with the generation of operating cash of the same period last year. Operating Cash Flow (R$ thousand) 2Q13 2Q14 Change in R$ Change in % 1H13 1H14 Change in R$ Change in % 38,759 43,033 4,274 11.0% 66,850 70,030 3,180 4.8% 2,385 3,097 712 29.9% 4,970 6,306 1,336 26.9% 973 1,754 781 80.3% (286) (1,430) (1,144) 400.0% (19,522) (20,855) (1,333) 6.8% (11,285) (11,653) (368) 3.3% 11,471 9,189 (2,282) -19.9% 9,097 11,692 2,595 28.5% (2,716) (18,161) (15,445) 568.7% (14,190) (35,935) (21,745) 153.2% (25,464) (17,130) 8,334 -32.7% 8,049 22,270 14,221 176.7% (2,813) 5,247 8,060 n/a (14,241) (9,680) 4,561 -32.0% (13,935) (18,200) (4,265) 30.6% (17,598) (20,542) (2,944) 16.7% 8,660 8,829 169 2.0% 42,651 42,711 60 0.1% Operating Cash Flow Income before income tax and social contribution Depreciações e amortizações Change in other noncurrent and current assets and liabilities Payment of income tax and social contribution Net cash flow generated by operational activities Other Decrease (increase) in current assets / liabilities Trade accounts receivables Inventories Suppliers

- 11. 4.2 2.5 6.5 5.7 4.0 10.0 12.0 16.1 0.8 1.8 1.6 2.3 8.9 14.3 20.2 24.2 2Q13 2Q14 1H13 1H14 Stores Corporate Others¹ In 2Q14, the Company invested R$14.3 million, mainly due to corporate investment in infrastructure technology. Indebtedness policy remained conservative. Capital Expenditure (CAPEX) and Indebtedness 11 CAPEX (R$ million) Indebtedness (R$ million) 1) Others: increasing of 114.2% in 2Q14 and 44.2 in 1H14. -12.6% 34.2% 19.8% -39.0% 152.3% 60.1% 2Q13 1Q14 2Q14 Cash 214,411 207,553 159,196 Total debt 107,862 96,652 80,853 Short term 60,763 59,680 49,753 % total debt 56.3% 61.7% 61.5% Long-term 47,099 36,972 31,100 % total debt 43.7% 38.3% 38.5% Net debt (106,549) (110,901) (78,343) EBITDA LTM 155,575 158,113 159,916 Net Debt/EBITDA LTM -0.7X -0.7x -0.5X Cash position and Indebtedness

- 12. Contacts Thiago Borges Leonardo Pontes, CFA Telephone: +55 11 2132-4300 ri@arezzoco.com.br www.arezzoco.com.br CFO and Investor Relations Officer IR Manager Vanessa Sorechio Leandro Vieira IR Specialist IR Analyst