21st century quant

- 1. Location: QuantUniversity Meetup 6/22/2017 Boston MA The 21st Century Quant 2017 Copyright QuantUniversity LLC. Presented By: Sri Krishnamurthy, CFA, CAP sri@quantuniversity.com www.analyticscertificate.com

- 2. 2 Slides will be available at: https://www.slideshare.net/QuantUniversity

- 3. • Founder of QuantUniversity LLC. and www.analyticscertificate.com • Advisory and Consultancy for Financial Analytics • Prior Experience at MathWorks, Citigroup and Endeca and 25+ financial services and energy customers. • Regular Columnist for the Wilmott Magazine • Author of forthcoming book “Financial Modeling: A case study approach” published by Wiley • Charted Financial Analyst and Certified Analytics Professional • Teaches Analytics in the Babson College MBA program and at Northeastern University, Boston Sri Krishnamurthy Founder and CEO 3

- 4. 4 Quantitative Analytics and Big Data Analytics Onboarding • Trained more than 1000 students in Quantitative methods, Data Science and Big Data Technologies using MATLAB, Python and R • Launching ▫ Analytics Certificate Program (August 2017) ▫ Fintech Certification program (October 2017)

- 6. Late Summer 2017: http://www.analyticscertificate.com

- 7. 7

- 8. 8 • Boston • New York • Chicago • Washington DC • San Francisco QuantUniversity meetups

- 9. 9 • Big Data : Opportunities for the financial industry • Cloud computing : Are we there yet? • Retooling the Quant: The Programming Language Wars • Machine learning, AI, Deep Learning: Sifting the hype from reality • Fintech: Bringing Silicon Valley to Wall Street • Regulation and Risk : Accept, Optimize, Innovate Topic for today’s talk

- 10. 10

- 11. 11 The 1980s and 1990s - Ronald Kahn, Blackrock, Barclays, Barra

- 12. 12 The 1980s and 1990s - Peter Carr, Morgan Stanley, NYU

- 13. 13 The 1980s and 1990s - Neil Chris, Morgan Stanley, Goldman Sachs

- 14. 14 The 1980s and 1990s - Andrew Lo, MIT, Alpha Simplex

- 15. 15 The 1980s and 1990s

- 16. 16 Financial engineering and Math Finance Programs

- 17. 17 Financial engineering and Math Finance Programs

- 18. 18

- 19. 19

- 20. 20 As per Wikipedia.. “It focuses on, among other things, the 2007 subprime mortgage crisis and how it helped trigger a sudden and massive unwind of complex, highly leveraged quantitative strategies. ”

- 21. 21 The Demise of the Quant Role?

- 22. 22 • Front office quant roles • Risk management • Model Validation The transitionary quant roles http://www.investopedia.com/articles/professionals/121615/q uantitative-analyst-job-description-average-salary.asp

- 23. 23 The rise of the quants?

- 24. 24

- 25. 25

- 26. 26

- 27. 27

- 28. 28 • Up ▫ R, Python ▫ Big Data ▫ Data Science, Machine Learning, AI ▫ Ability to work with large datasets ▫ Optimization skills, Distributed and parallel computing paradigms ▫ Understanding of stress testing, model validation etc. ▫ Ability to glue multiple, disparate systems ▫ Quantamental roles • Down ▫ Great with ideation but little implementation experience ▫ Pure Mathematical finance grads with little programming experience ▫ Quant Operations and Quant IT roles ▫ Engineers, Economists, Applied Mathematicians, Physicists without domain experience ▫ Fundamental analysts without Quant skills Quant Job profiles are changing

- 30. 30

- 31. 31 1. Big Data : Opportunities for the financial industry 2. Cloud computing : Are we there yet? 3. Retooling the Quant: The Programming Language Wars 4. Machine learning, AI, Deep Learning: Sifting the hype from reality 5. Fintech: Bringing Silicon Valley to Wall Street 6. Regulation and Risk : Accept, Optimize, Innovate Six areas every quant should know about

- 33. 33 • Apache Spark enterprise adoption of HDFS based architectures • Alternate data and going beyond traditional factors • Incorporating Text and Sentiment analysis ▫ https://www.ravenpack.com/research/jp-morgan-big-data-ai-machine- learning-alternative-data/ • More realistic use-cases ▫ Large data sets for anomaly detection ▫ Credit risk modeling Freddie mac dataset http://www.freddiemac.com/research/datasets/sf_loanlevel_dataset.html Lending club dataset : https://www.lendingclub.com/info/download-data.action Big Data trends and opportunities

- 35. 35

- 36. 36 • Scaling stress and scenario tests • Model calibration and parameter tuning • More frequent model updates • Scraping datasets for proprietary data sources • Dynamic sandboxes for environment and product testing • Shorten the Quant Research -> Quant Deployment cycle • Microservices and Docker to enable dynamic environments • GPUs in the Cloud makes massive computing possible! Cloud computing trends and opportunities

- 37. 37 The programming language wars

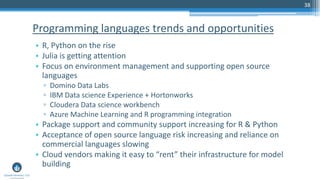

- 38. 38 • R, Python on the rise • Julia is getting attention • Focus on environment management and supporting open source languages ▫ Domino Data Labs ▫ IBM Data science Experience + Hortonworks ▫ Cloudera Data science workbench ▫ Azure Machine Learning and R programming integration • Package support and community support increasing for R & Python • Acceptance of open source language risk increasing and reliance on commercial languages slowing • Cloud vendors making it easy to “rent” their infrastructure for model building Programming languages trends and opportunities

- 39. 39 AI and Machine learning

- 40. 40 Some concepts are not new ; But interest in ML and AI re-emerging

- 41. 41 Lots of books, conferences, demos and vendor-driven seminars

- 42. 42 • Silicon valley leading the way • Lots of interest but few proven use-cases • Many organizations intrigued and are prototyping applications • Many niche solutions that offer promise ( no generic solutions out there yet) • Companies like J. P. Morgan heavily investing in Machine Learning and AI • May not replace traditional Quant Finance but could complement it in applications like Anomaly Detection, segmentation, scoring, classification etc. • Lots of Snake oil vendors • Knowledge is power : Understand before applying and use at your own risk Machine Learning and AI : Trends and opportunities

- 43. 43 • CFA Survey 2016 Fintech in the news https://www.cfainstitute.org/Survey/fintech_survey.PDF

- 44. 44 • CFA Survey 2016 Fintech in the news https://www.cfainstitute.org/Survey/fintech_survey.PDF

- 45. 45 Bitcoin

- 46. 46

- 48. 48 Fintech education becomes serious

- 53. 53 Lots of interesting problems for Quants to engage in • Equity crowdfunding platforms intermediate share placements • Peer-to-peer lending platforms intermediate or sell loans • Robo-advisers provide automated investment advice • Social trading platforms offer brokerage and investing services • Just in time insurance purchases • Longevity risk and insurance • Health care costs and engaging millennials through gamification • Domain expertise, risk and regulatory insights • Potential to model interesting scenarios and innovate! Fintech: Opportunities and trends Ref: https://www.iosco.org/library/pubdocs/pdf/IOSCOPD554.pdf

- 54. 54 • Post 2008 crisis, multiple regulations in effect ▫ CCAR, DFAST ▫ Model Validation ▫ BASEL • SR 11-7 attachment: Supervisory Guidance on Model Risk Management • Most banks now approaching and addressing model risk in a systematic way Regulation

- 55. 55 Fintech being noticed by Regulators

- 56. 56 • https://www.americanbanker.com/opinion/banks-should-see- stress-tests-as-an-opportunity-not-a-chore • Blackbox models viewed with skepticism. Transparency and explain ability as more machine learning models enter decision making • Newer frameworks to optimize model tests and model governance • Automation of stress and scenario tests • Hardware to accelerate Model validation • New opportunities in addressing risk in Fintech enterprises Regulation: Opportunities and trends

- 57. 57

- 58. 58

- 59. 59

- 60. Thank you! Checkout our programs at: www.analyticscertificate.com Sri Krishnamurthy, CFA, CAP Founder and CEO QuantUniversity LLC. srikrishnamurthy www.QuantUniversity.com Information, data and drawings embodied in this presentation are strictly a property of QuantUniversity LLC. and shall not be distributed or used in any other publication without the prior written consent of QuantUniversity LLC. 60