2Q06 Results

- 1. 1H06 Earnings Result – Conference Call July, 2006 António Martins da Costa CEO Antonio José Sellare CFO and Vice President of Investor Relations Vasco Barcellos Investor Relations Officer

- 2. Disclaimer This presentation may include forward-looking statements of future events or results according to regulations of the Brazilian and international securities and exchange commissions. These statements are based on certain assumptions and analysis by the company that reflect its experience, the economic environment and future market conditions and expected events, many of which are beyond the control of the company. Important factors that may lead to significant differences between the actual results and the statements of expectations about future events or results include the company’s business strategy, Brazilian and international economic conditions, technology, financial strategy, public service industry developments, hydrological conditions, financial market conditions, uncertainty of the results of future operations, plans, objectives, expectations and intentions, among others. Considering these factors, the actual results of the company may be significantly different from those shown or implicit in the statement of expectations about future events or results. The information and opinions contained in this presentation should not be understood as a recommendation to potential investors and no investment decision is to be based on the veracity, current events or completeness of this information or these opinions. No advisors to the company or parties related to them or their representatives shall have any responsibility for whatever losses that may result from the use or contents of this presentation. This material includes forward-looking statements subject to risks and uncertainties, which are based on current expectations and projections about future events and trends that may affect the company’s business. These statements include projections of economic growth and energy demand and supply, as well as information about the competitive position, the regulatory environment, potential opportunities for growth and other matters. Several factors may adversely affect the estimates and assumptions on which these statements are based. 2

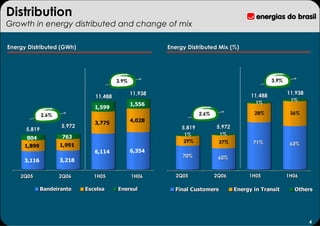

- 4. Distribution Growth in energy distributed and change of mix Energy Distributed (GWh) Energy Distributed Mix (%) 3.9% 3.9% 11,938 11,938 11,488 11,488 1% 1,556 1% 1,599 2.6% 2.6% 28% 36% 3,775 4,028 5,972 5,819 5,972 5,819 1% 1% 804 763 29% 37% 71% 1,899 1,991 63% 6,114 6,354 70% 62% 3,116 3,218 2Q05 2Q06 1H05 1H06 2Q05 2Q06 1H05 1H06 Bandeirante Escelsa Enersul Final Customers Energy in Transit Others 4

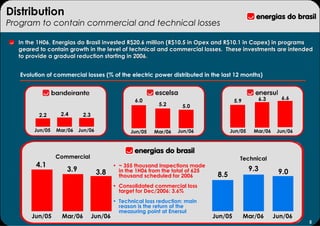

- 5. Distribution Program to contain commercial and technical losses In the 1H06, Energias do Brasil invested R$20.6 million (R$10.5 in Opex and R$10.1 in Capex) in programs geared to contain growth in the level of technical and commercial losses. These investments are intended to provide a gradual reduction starting in 2006. Evolution of commercial losses (% of the electric power distributed in the last 12 months) 6.0 6.3 6.6 5.9 5.2 5.0 2.2 2.4 2.3 Jun/05 Mar/06 Jun/06 Jun/05 Mar/06 Jun/06 Jun/05 Mar/06 Jun/06 Commercial Technical 4.1 • ~ 355 thousand inspections made 3.9 3.8 in the 1H06 from the total of 625 9.3 9.0 thousand scheduled for 2006 8.5 • Consolidated commercial loss target for Dec/2006: 3.6% • Technical loss reduction: main reason is the return of the measuring point at Enersul Jun/05 Mar/06 Jun/06 Jun/05 Mar/06 Jun/06 5

- 6. Generation Peixe Angical Starts the Operation of the 1st Turbine 100% of contracted 100% contracted energy through PPA in auctions – Location: Rio Tocantins – Installed Capacity: 452 MW (Installed Capacity MW) 50 1,043 1 – Assured annual power supply: 2,374 GWh 25 2006 – Reservoir area: 294 Km2 2006 – Investment: R$1.6 Bi (96% expended) 452 527 2006 516 Current Current AHE Peixe AHE Peixe PCH São João PCH São João 4th 4th Total Total Capacity Capacity Angical Angical Mascarenhas Mascarenhas engine engine – 99% of the construction concluded New Project in Generation – June 06 – start of the 1st turbine - Santa Fé Small Power Plant (ES) – Start-up in 2009 – July 06 – start of the 2nd turbine - Installed Capacity: 30 MW – October 06 – start of the 3rd turbine - Assured Energy: 16 MW (R$124.99 / MWh) 6

- 7. Commercialization Reduction of self-dealing offset by the increase of customers Energy Commercialized (GWh) Enertrade – Number of Customers 10.2% 63 75.0% 3,503 3,179 17.2% 749 36 1,846 1,398 1,575 446 2,754 715 54.6% 1,781 62.8% 1,400 860 2Q05 2Q06 1H05 1H06 2Q05 2Q06 Others Energias do Brasil's Discos 7

- 8. Vanguard Project Redundancy Plan (RP) concluded Savings from RP (R$ million/year) * Productivity (Client/Employee) 1,143 1,071 68.4 957 890 838 776 762 654 40.8 585 456 502 28.8 60.0 462 17.2 35.6 151% 91% 24.8 81% 14.8 2.4 4.0 5.2 8.4 Jun/06 Dec/06 Jun/07 Dec/07 Bandeirante Escelsa Enersul Indirect Personnel Cost Direct Personnel Cost 1998 2001 2005 2Q06 * Current currency Redundancy Plan - Recognized cost in june/06: R$ 52 million - Acceptance of 651 employees - 19% of the current number of employees 8

- 10. Net Revenues (R$ million) Decrease reflects 2005 events and new market profile Net Revenues (R$MM) Main Impacts: -0.1% - Tariff Readjustment of -8,86% at Bandeirante in 2,182 2,179 Oct/05; 9% 11% - Migration of free customers at Escelsa in 1Q06 2% 5% -2.6% - R$ 75 million recognized in 1Q05 at Enersul 1,087 (R$ 65 million prior of 2005); 1,059 89% 84% 9% 12% 2% 5% 89% Excluding Enersul impact, net operating revenue 83% would have risen around 3.0% between the periods 2Q05 2Q06 1H05 1H06 Distribution Generation Commercialization 10

- 11. Costs and Expenses (R$ million) Impacted by Efficiency Programs in Course Costs and Expenses Breakdown1 – 1H06 Costs and Manageable Expenses Breakdown – 1H06 R$ Million 1H06 1H05 Var.% Personnel 197 134 47.3% Material 20 19 5.6% Non- Non- Manageable costs manageable Third-part Services 136 106 28.8% costs R$430 million R$1,304million R$1,304million (25%) Provisions 37 43 -13.9% (75%) Others 40 53 -23.8% Total 430 354 21.5% R$1,734 million Third party Services (Corporate Programs) - Program to Contain Losses: R$ 8.7 million - Consultancy: R$ 5.5 million - RP: R$ 51.6 million Note: 1 Excludes depreciation and amortization 11

- 12. EBITDA 1H06 x 1H05 (R$ million) Variation mainly reflects 2005 events and RP EBITDA Variation and Analysis (R$ million) Excluding Enersul’s contribution and the RP provision, 1H06 EBITDA would have recorded a 518 year-on-year increase of about 10%. Enersul’s Tariff Revision 65 Effect -10 -4 -52 +54 -14 +45 -18 453 444 June/05 RP Efficiency R&D* Distribu- Gene- Commer- Others June/06 Program tor Market ration cialization EBITDA Margin: EBITDA Margin: 23.7% 20.4% 12

- 13. Financial Result (R$ million) Exchange rate was favorable in 1H05 Exchange rate variation was 12.9% in 1H05 Financial Result – R$ million Accumulated 1H06 1H05 Var.% Financial Revenues 119 134 -10.9% Financial Expenses (180) (230) -21.9% Net Foreign Exchange Result (26) 109 n.a. SWAP - net result (73) (81) -9.1% Foreign exchange gains (losses) 48 190 -74.8% TOTAL (86) 13 n.a. 13

- 14. Net Profit (R$ million) Non-recurring and exchange rate variation explain decrease Net profit before the participation of minority shareholders (R$ million ) Net Profit (R$ million ) 231 229 198 128 138 -86.8% 125 -73.5% -40.3% -45.4% 34 26 2Q05 2Q06 1H05 1H06 2Q05 2Q06 1H05 1H06 14

- 15. Indebtedness Low leverage level and low currency exposure Capital structure was strengthened, creating financial capacity for the company’s growth Indebtedness – 1H06 (R$ million) Gross Debt – Index Breakdown (Jun/06) RP, CAPEX e 3% (447) Dividends/JSCP (752) 31% 2.3x* 2.3x 1.9x* 3,122 61% 5% 1,923 1,731 US$ TJLP ** Fixed rate Floating rates Gross Debt (-) Cash & (-) Regulatory Net Debt Jun.06 Net Debt Mar.06 Jun.06 Marketable Assets ** Includes Selic, CDI, IGP-M and INPC IGP- Securities * Ratio: Net Debt / EBITDA 12 months Ratio: 15

- 16. Indebtedness Extending maturities at lower costs Debt Amortization Schedule – Jun/06 (R$ million) Concluded transactions Benefits from the operations: – Issuance of debentures: - Reduction of short-term debt short- – Bandeirante (R$250 Million, April/2006) – Enersul (R$337.5 Million, June/2006) - Extension of the average maturity - Reduction of the debt average cost – Escelsa (R$264 Million, July/06) 883 692 552 447 372 351 28% 22% 272 18% 12% 11% 9% Cash & Jul-Dec/06 2007 2008 2009 2010 After 2010 Marketable Securities 16

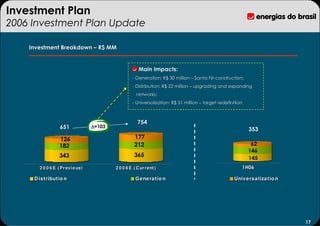

- 17. Investment Plan 2006 Investment Plan Update Investment Breakdown – R$ MM Main Impacts: - Generation: R$ 30 million – Santa Fé construction; - Distribution: R$ 22 million – upgrading and expanding networks; - Universalization: R$ 51 million – target redefinition Universalization: 754 651 ∆=103 353 126 177 182 212 62 146 343 365 145 2 0 0 6 E ( Pr evio us) 2 0 0 6 E ( C ur r ent ) 1H06 D is t ribut io n G e ne ra t io n Univ e rs a liza t io n 17

- 18. ENBR3 Performance Important recognitions in 1H06 IR Recognitions 2005 Best Listed Company Honorable Mention Volume R$th R$th 230 70,000 210 60,000 190 50,000 170 40,000 +53% 150 30,000 +48% 130 20,000 +48% 110 10,000 +42% 90 0 7/12/2005 8/10/2005 9/9/2005 10/10/2005 11/10/2005 12/12/2005 1/11/2006 2/10/2006 3/15/2006 4/13/2006 5/17/2006 6/16/2006 7/17/2006 Volume R$ ENBR3 ENBR3 Ibovespa IEE IBX Updated until July 24, 2006 18

- 19. Conclusion: Important Achievements in 1H06 Total Loss Reduction Redudancy Program Concluded Peixe Angical Start-up and New Project in Generation Business Market Recognition Debentures Issuance Concluded 19

- 20. 1H06 Earnings Result – Conference Call July, 2006 For further information: www.energiasdobrasil.com.br