2013-05-05 ACR Fundamentals of Financial Planning

- 1. Money. Grow it for Good ® American College of Radiology Fundamentals of Financial Planning Dennis Gogarty, CFP®, AIF® President Chase Deters, CFP®, ChFC® Portfolio Manager May 5, 2013

- 2. Fundamentals of Financial Planning / Page Money. Grow it for Good.® WELCOME 2 Raffa Wealth Management (RWM) •Founded in 2005 by principals with over 25 years of financial services experience •Clients are mid-sized institutions, high net- worth investors, and qualified retirement plans •Assets under management exceed $250 million •Affiliated with accounting, tax, estate and financial planning professionals.

- 3. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 3 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 4. Fundamentals of Financial Planning / Page Money. Grow it for Good.® CASH FLOW & SAVINGS STRATEGIES 4 Save First, Spend Second •Prioritize your financial goals •Calculate the monthly savings required •Invest savings based on amount of time until goal date Find Ways to Increase Savings •Get a raise or bonus? •Done paying down a debt? •Capture a portion of increase in surplus cash flow – part savings, part increase in lifestyle

- 5. Fundamentals of Financial Planning / Page Money. Grow it for Good.® CASH FLOW & SAVINGS STRATEGIES 5 Where to Save? Open a Vanguard/Fidelity/Schwab Investment Account •Set up ACH link to checking account (overnight transfers) •Begin monthly deposits from your checking account Ultra Short Term Goals < 1 Year •ING Savings Account •DFA One-Year Fixed Income Fund Short Term Goals > 1 Year •Vanguard Short Term Bond Index Fund •Vanguard Limited Term Tax Exempt Fund

- 6. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 6 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 7. Fundamentals of Financial Planning / Page Money. Grow it for Good.® INSURANCE PLANNING 7 Types of Insurance Life Insurance •Term, Variable Life, Universal Life, Whole Life Disability Insurance •Short and Long Term Disability Long Term Care Insurance •Home and Facility Care Property and Casualty •Home, Auto, Liability

- 8. Fundamentals of Financial Planning / Page Money. Grow it for Good.® INSURANCE PLANNING 8 Term Insurance •Covers needs for the least expense •Layer policies to cover needs over various time periods Permanent Insurance •More expensive •Protects long term needs $500,000 $1,500,000 $2,500,000 $3,500,000 $4,500,000 $5,500,000 Income Replacement Children's Education Debt Coverage Estate Taxes Life Insurance Needs Change Over Time

- 9. Fundamentals of Financial Planning / Page Money. Grow it for Good.® INSURANCE PLANNING 9 Permanent Life Insurance – As Savings Vehicle? •Permanent Insurance will be pitched to you as a way to supplement your retirement income –In order for this approach to work, you must over fund the policy being purchased as much as possible –Distributions are then "borrowed" out of the policy free of tax – but not free of expenses –Loans are paid back when the policy pays out the death benefit •Insurance company sets the lowest premium you can pay (Term), the government sets the highest (MEC) •Most insurance salesmen are not acting as fiduciaries, they are selling a product Potential Pitfalls of Permanent Life Insurance

- 10. Fundamentals of Financial Planning / Page Money. Grow it for Good.® INSURANCE PLANNING 10 What to Look Out For in an Salesmen's Illustration •Front loaded Premiums (higher in start years) –Feeds the Salesmen a higher commission, at your expense •Premiums that are below the maximum allowable premium based on the policy you are looking for –The same premium dollars in policies with larger death benefits result in larger commisions, at your expense •Unreasonable Rate of Return Illustrated –Policies will fall apart if those returns are not met •Rate of Return does not change during illustrated distributions during retirement –Rate of Return expectations should be reduced when distributions are being made Red Flags in Permanent Life Insurance Illustrations

- 11. Fundamentals of Financial Planning / Page Money. Grow it for Good.® INSURANCE PLANNING 11 Your Ideal Permanent Life Insurance Policy •Quotes from MORE THAN ONE Insurance Company –Identical illustrations from more than one company allow you to more easily identify superior products •MAXIMIZE the premium dollars that fit into the smallest possible death benefit •Inexpensive Investment Options – Fees Matter •Low Spread between Loan Rate and Loan Credit Rate –Less than 2% is ideal, some as low as 0.50% or less, are avaiable •Hire an independent third party for an assessment of what people are showing you! Life Insurance is a Complex and Expensive Product to Purchase

- 12. Fundamentals of Financial Planning / Page Money. Grow it for Good.® INSURANCE PLANNING 12 Disability Insurance Planning Group Short & Long Term Disability •Inexpensive coverage •Benefits can be taxable, depending on how premiums are paid •Potentially low monthly cap on benefits paid Supplemental Long Term Disability •Covers gaps in some group DI plans •Can provide more specific definitions of disability that will protect specialized skill sets Short Term Group DI Long Term Group DI Supp. Long Term DI

- 13. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 13 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 14. Fundamentals of Financial Planning / Page Money. Grow it for Good.® COLLEGE SAVINGS STRATEGIES 14 529 Savings Plans •Can be used for college expenses at any college or university •Potential for state tax deductions •Account grows tax deferred •Distributions for college expenses are tax free •Ideal for long term accumulation needs Education Savings Trusts •Prepay tuition semesters for certain state public schools •Lock in tuition at today’s rates (deposits earn a rate of return equal to tuition inflation rate) •Ideal for older children with less time for growth before college •Cannot be used for other college expenses (but can be paired with a 529 account for other expenses)

- 15. Fundamentals of Financial Planning / Page Money. Grow it for Good.® COLLEGE SAVINGS STRATEGIES 15 Supplimental Sources for College Expenses 401k Plans •Most plans allow for an in-service loan up to 50% (up to $50k) of your account value to be taken out, usually at a low net interest rate •5 year payback period. •Potential tax liability if you leave your job before paying back the loan Student Loans •Deferred payment student loans can provide you and your child time to get on better financial footing before payments are due •Help pay back loans without sacrificing your own financial goals

- 16. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 16 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 17. Fundamentals of Financial Planning / Page Money. Grow it for Good.® ASSET ALLOCATION TECHNIQUES 17

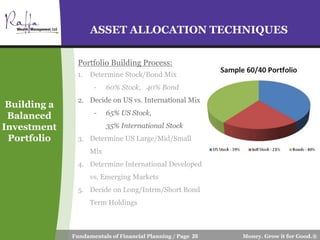

- 18. Fundamentals of Financial Planning / Page Money. Grow it for Good.® ASSET ALLOCATION TECHNIQUES 18 Building a Balanced Investment Portfolio Portfolio Building Process: 1. Determine Stock/Bond Mix - 60 Stock, 40% Bond 2. Decide on US vs. International Mix 3. Determine US Large/Mid/Small Mix 4. Determine International Developed vs. Emerging Markets 5. Decide on Long/Intrm/Short Term Bond Holdings

- 19. Fundamentals of Financial Planning / Page Money. Grow it for Good.® ASSET ALLOCATION TECHNIQUES 19 US Stocks vs. International Stocks Global Market Breakdown July 31, 2011 Location Total Value ($mm) Weight Securities United States 15,078,889 43.94% 3599 International 14,713,323 42.87% 3720 Emerging 4,526,117 13.19% 2811 Global 34,318,329 100% 10,130

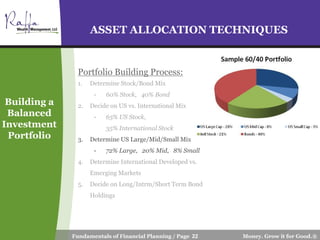

- 20. Fundamentals of Financial Planning / Page Money. Grow it for Good.®20 Portfolio Building Process: 1. Determine Stock/Bond Mix - 60% Stock, 40% Bond 2. Decide on US vs. International Mix - 65% US Stock, 35% International Stock 3. Determine US Large/Mid/Small Mix 4. Determine International Developed vs. Emerging Markets 5. Decide on Long/Intrm/Short Bond Term Holdings ASSET ALLOCATION TECHNIQUES Building a Balanced Investment Portfolio

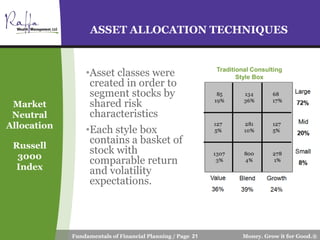

- 21. Fundamentals of Financial Planning / Page Money. Grow it for Good.® ASSET ALLOCATION TECHNIQUES 21 Market Neutral Allocation Russell 3000 Index •Asset classes were created in order to segment stocks by shared risk characteristics •Each style box contains a basket of stock with comparable return and volatility expectations. Traditional Consulting Style Box

- 22. Fundamentals of Financial Planning / Page Money. Grow it for Good.®22 Portfolio Building Process: 1. Determine Stock/Bond Mix - 60% Stock, 40% Bond 2. Decide on US vs. International Mix - 65% US Stock, 35% International Stock 3. Determine US Large/Mid/Small Mix - 72% Large, 20% Mid, 8% Small 4. Determine International Developed vs. Emerging Markets 5. Decide on Long/Intrm/Short Term Bond Holdings ASSET ALLOCATION TECHNIQUES Building a Balanced Investment Portfolio

- 23. Fundamentals of Financial Planning / Page Money. Grow it for Good.® ASSET ALLOCATION TECHNIQUES 23 Developed Intl Stock vs. Emerging Markets International Market Breakdown July 31, 2011 Location Total Value ($mm) Weight Securities International 14,713,323 76.47% 3720 Emerging 4,526,117 23.53% 2811 Intl Total 19,239,440 6,531

- 24. Fundamentals of Financial Planning / Page Money. Grow it for Good.®24 ASSET ALLOCATION TECHNIQUES Portfolio Building Process: 1. Determine Stock/Bond Mix - 60% Stock, 40% Bond 2. Decide on US vs. International Mix - 65% US Stock, 35% International Stock 3. Determine US Large/Mid/Small Mix - 72% Large, 20% Mid, 8% Small 4. Determine International Developed vs. Emerging Markets - 75% Developed Intl Stock, 25% Emerging Markets Stock 5. Decide on Long/Interm/Short Term Bond Holdings Building a Balanced Investment Portfolio

- 25. Fundamentals of Financial Planning / Page Money. Grow it for Good.® ASSET ALLOCATION TECHNIQUES 25 Fixed Income Allocation

- 26. Fundamentals of Financial Planning / Page Money. Grow it for Good.®26 4. Determine International Developed vs. Emerging Markets - 75% Developed Intl Stock, 25% Emerging Markets Stock 5. Decide on Long/Interm/Short Term Bond Holdings - 0% Long Term, 70% Intermediate, 30% Short Term Portfolio Building Process: 1. Determine Stock/Bond - 60% Stock, 40% Bond 2. Decide on US vs. International - 65% US Stock 35% International Stock 3. Determine US Large/Mid/Small - 72% Large, 20% Mid, 8% Small ASSET ALLOCATION TECHNIQUES Building a Balanced Investment Portfolio

- 27. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 27 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 28. Fundamentals of Financial Planning / Page Money. Grow it for Good.® RETIREMENT SAVINGS STRATEGIES 28 Three Types of Accounts Tax Deferred Assets Tax Free Assets Taxable Assets •Traditional IRA’s, 401k, SEP, SIMPLE, KEOGH, 457, 403b, etc. •Money goes in pre-tax, comes out as Taxable Income •Pay no taxes on earnings •Roth IRA, Roth 401k •Money goes in after tax, comes out Tax Free •Pay no taxes on earnings •Pay taxes on interest and realized capital gains each year

- 29. Fundamentals of Financial Planning / Page Money. Grow it for Good.®29 Employer-sponsored Retirement Plans •2013 limit: $17,500 –+$5500 catch-up for those over 5o •Maximize Employer Match – 100% return on investment Traditional IRA •Likely your largest asset during retirement •All retirement plans you accumulate during working years will roll into this account •Ideal if tax rates decrease in the future Tax Deferred Assets RETIREMENT SAVINGS STRATEGIES

- 30. Fundamentals of Financial Planning / Page Money. Grow it for Good.®30 Employer-sponsored Roth 401k Plans •2013 limit: $17,500 +$5500 catch-up for those over 5o •Money goes in after-tax, comes out tax free Roth IRA •Maximum income of $112k single / $178k married for 2013 •Roth(k)’s will roll into Roth IRA •Ideal if tax rates increase in the future Tax Free Assets RETIREMENT SAVINGS STRATEGIES

- 31. Fundamentals of Financial Planning / Page Money. Grow it for Good.®31 Investment Accounts •Money goes in after tax, basis comes out tax free •Pay tax on 1099 income each year •Surplus account for savings when all other savings options are max funded •Pay capital gains tax rate on long term gains and qualified dividends •Pay income tax rate on short term gains and ordinary dividends •Balance of muni-bonds and tax managed equity funds makes this a perfectly viable savings opportunity Taxable Assets RETIREMENT SAVINGS STRATEGIES

- 32. Fundamentals of Financial Planning / Page Money. Grow it for Good.®32 Control Your Tax Rate During Retirement •Balance Savings between Taxable, Tax Free, and Tax Deferred accounts •Allow for strategic distributions during retirement •Maximize tax bracket distributions Tax Deferred Assets Tax Free Assets Taxable Assets RETIREMENT SAVINGS STRATEGIES

- 33. Fundamentals of Financial Planning / Page Money. Grow it for Good.®33 Ima Client (age 72): needs $225,000/yr •Has Rental Property income of $18,000/yr •Social Security income of $36,000/yr •Pension income of $16,000/yr •RMD for 2013 of $31,500 • Total Taxable Income of $101,500/yr •Pull $44,900 more from Tax Deferred Assets - Maximize 25% Tax Bracket •Pull remaining $78,600 from Tax Free Assets and Taxable Assets Tax Rate Income Bracket 10% Up to $17,850 15% $17,851 - $72,500 25% $72,501 - $146,400 28% $146,401 - $223,050 33% $223,051 - $398,350 35% $398,351 - $450,000 39.6% $450,001 + Control Your Tax Rate During Retirement RETIREMENT SAVINGS STRATEGIES

- 34. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 34 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 35. Fundamentals of Financial Planning / Page Money. Grow it for Good.®35 Will & Advanced Directives •Written document that outlines your final wishes, including: • Designating a Guardian for your children • Bequest assets and valuables to your heirs • Make charitable donations •Advanced Directives also specify what type of medical treatment you desire, should you become incapacitated Durable Power of Attorney •An advance directive, you provide another individual the power of attorney to allow them to make bank transactions, sign checks, apply for disability, etc., in the case of an incapacitating medical condition BASIC ESTATE PLANNING Make the Decisions Now -Or- The State Will Decide for You

- 36. Fundamentals of Financial Planning / Page Money. Grow it for Good.® AGENDA 36 •Cash Flow Tracking & Savings Techniques •Insurance Planning •College Savings Strategies •Asset Allocation Techniques •Retirement Savings Strategies •Basic Estate Planning •What to Look For in a Financial Planner

- 37. Fundamentals of Financial Planning / Page Money. Grow it for Good.® WHAT TO LOOK FOR IN A FINANCIAL PLANNER 37 Look for a Certified Financial Planner - CFP® • Held to higher level of fiduciary care by the CFP Board of Standards • Search for a CFP in your area at www.cfp.net Broker/Dealer (BD) vs. Registered Investment Advisor (RIA) • BD’s charge commissions for products, leaving room for a potential conflict of interest • RIA’s charge an asset based management fee, aligning your interests with theirs • RIA’s are held to a 3(21) or 3(38) fiduciary standard to put your interests ahead of their own Review their Client Service History • Check for a history of past client complaints at www.brightscope.com

- 38. Fundamentals of Financial Planning / Page Money. Grow it for Good.® HELPFUL PLANNING TOOLS 38 Visit www.raffawealth.com •Click on the “Resources” tab •Click on “Calculators” –Retirement Nestegg Calculator –How Long Will My Money Last? Contact RWM •Email: chase@raffawealth.com or dennis@raffawealth.com •Phone: (202) 955-7217

- 39. Fundamentals of Financial Planning / Page Money. Grow it for Good.® DISCLOSURE 39 The performance data presented represent past performance. Past performance is not a guarantee of future results and there is always a risk that an investor may lose money. Information contained has been gathered from sources we believe to be reliable, but we do not guarantee the accuracy or completeness of such information. Current performance may be lower or higher than the performance quoted. An investment in a sub- account will fluctuate in value to reflect the value of the underlying portfolio and, when redeemed, may be worth more or less than original cost. Performance current to the most recent month end is available at www.jhpensions.com. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Returns are shown net of fund expenses and gross of RWM’s advisory fee.