Adma Mobile Marketing Course 2009 For Printing

- 1. ADMA Mobile Marketing Course June 11th 2009 Sydney Lecturer: Emily Freeman Director, Mobilista Organiser, Mobile Monday Melbourne ADMA Mobile Marketing Course

- 2. Past & Future – Mobile Technology Why is this important? Networks & Handsets 1G 2G / 2.5G 3G / 3.5G 4G WiFi Bluetooth Data Charges

- 3. To understand The mobile customer experience – past issues and future expectations what devices people are using and why not everyone can see your campaign why data speed makes a big difference to the mobile web and app experience. how to use video and pictures appropriately the various companies involved in mobile marketing Because carriers use different technologies which limit what their customers can so Premium SMS Walled Gardens So you know that Australia has world class networks & devices! Why is this important?

- 4. 1G Analogue Mobile Phone Service 2G Digital (SMS & WAP) 2.5G General Packet Radio Service 3G Fast mobile data and multi channel 3.5G Yep, even faster!! 4G Long Term evolution – sooooper fast! WiFi Bluetooth Overview of Networks & Handsets

- 5. Analogue Mobile Phone Service (AMPS) Phone calls only Basic handsets Networks & Handsets: 1G

- 6. Digital transmission Better signal More secure SMS - meant as an engineer comms tool WAP (Wireless Applications Protocol) meant that people could access specially built content on their mobile phone GPRS (General Packet Radio Service) was 2.5G and allowed faster data speeds for WAP 2.5G also enabled MMS Handsets got colour screens for pics & video Networks & Handsets: 2G/2.5G

- 7. All about the mobile data Data + voice at the same time Faster data speeds 3.6/7.2/14.4/21Mbps + (up to 100Mbps?) Video finally looks decent and plays OK Handsets advancing bigger screens to see more content and at decent size higher resolution screens to make content clearer different interaction methods (stylus, QWERTY, touch) Networks & Handsets: 3G/3.5G

- 8. Long Term Evolution (LTE) Due in around 2012 (?) Super fast!! 50-70Mbps Networks & Handsets: 4G

- 9. Smaller (usually private) network Not through telco but used to extend current internet connection, therefore no additional cost Faster speeds 54Mbps High-end handsets have WiFi (Nokia N95/97, iPhone, G1 etc) Some devices e.g. iPhone will only allow some content to download/play when on WiFi to prevent poor experience and bill shock WiFi makes it faster to download big apps and large content Can be hard to get onto closed networks Networks & Handsets: WiFi

- 10. Smaller network area Need to have Bluetooth turned on Generally easier to connect to a Bluetooth No cost to use the network Good for sending larger files to each other Handsets Most handsets have Bluetooth these days Most default to off, so need to have clear instructions for people to turn on. Networks & Handsets: Bluetooth

- 11. For using the carrier network/infrastructure (Telstra, Three, Vodafone, Optus) Usually customer buys a data pack for data use on top of their mobile phone call plan (some call plans include data) Content “can” be zero-rated Some markets offer wholesale data campaigns that need more bandwidth (e.g. video or music) Data rates are coming down over time Data Charges

- 12. Carriers Aggregators Developers Handset manufactures Publishers Search Companies Advertising networks Industry bodies The Mobile Industry

- 13. What they do Build the mobile phone networks Allow calls & data Invoice the customer Example Carriers Telstra (9m) Optus (7m) Vodafone (4.1m) Three (1.9m) MVNOs (Virgin, B, RSL, etc) Carriers / Telcos

- 14. What they do Collate content to re-sell e.g. ringtones, wallpapers, games, SMS competitions Example companies 5th Finger Be Interactive Communicator Most of these companies have opt-in lists e.g. BlueSkyFrog Aggregators

- 15. What they do Design & develop mobile web sites and applications Example companies Tigerspike Mogeneration Digital Glu WAPFly m.Net Corporation MIA Icon Mobile Developers

- 16. What they do Create mobile web sites & campaigns Deal with brands and advertisers (their clients) Sometimes work with mobile development company to implement Example companies Hyperfactory Group M Saatchi & Saatchi Hothouse Agencies

- 17. What they do Design & manufacture mobile phones Example companies Nokia Sony Ericsson Apple LG None are based in in Australia Australia is a small market and therefore few manufacturers customise phones for our market Handset Manufacturers

- 18. What they do Create and publish content (news, weather & sport information) Example companies ABC ninemsn Yahoo!7 News Digital Media Sensis Fairfax Digital The Publishers

- 19. What they do Provide mobile search engines and results Example companies Google Yahoo!7 Sensis Search Companies

- 20. What they do Create ads Serve ads into mobile websites & applications Example companies AdMob Sensis Advertising Networks

- 21. What they do Support the industry Deal with regulators Create guidelines (e.g. Mobile Advertising Guidelines) to improve consistency Examples ADMA AIMIA Mobile Industry Group ACMA Industry Bodies

- 22. The Mobile Audience – Your Customers Globally In Australia How many 3G Handsets Research & Data Handset usage (AdMob & Nielsen) iPhone app store AIMIA traffic trends m.Net WMDS Nielsen Internet & Technology Report Australian Mobile Phone Lifestyle Index (AMPLI) The Mobile Experience

- 23. More than 4 billion mobile subscribers (60% of ALL people) There are more mobiles than PCs on Earth From now on more people will connect to the Internet via mobile than by PC 1 trillion SMS sent in 2008 in the US alone (CTIA) Globally

- 24. Australia Australian population = 21.5m Mobile phone usage = 20m Surpassed natural saturation Mobile internet capable handsets = 8.5m (43%) Mobile web users = 4.65m (30%)^ Handsets usage (at end 2008) ^ Nokia 38% iPhone 13% Blackberry 11% Handset replacement cycles 12 – 18 mths (^ Source: Nielsen. The Australian Internet and Technology Report 2008-2009)

- 25. How many 3G handsets in Australia? Courtesy of Myne Blog http:// myneblog.typepad.com/myne / 43% 100% 31% 29% 47% 3G as % 22,500 2,000 4,100 7,100 9,300 Total 12,800 0 2,800 5,000 4,900 Other handsets 9,800 2,000 1,200 2,100 4,400 3G Handsets Total 3 Vodafone Optus Telstra

- 26. 3G Handsets vs Mobile Internet users Courtesy of Myne Blog http:// myneblog.typepad.com/myne / Source: Nielsen. The Australian Internet and Technology Report Edition 11, 2008-2009 (Feb 2009) 31% of Australian with a mobile phone have used the Mobile Internet and specified which was their mobile carrier (source: Nielsen) ^ remaining 9% specified ‘other’ as carrier ^91% 10% 16% 27% 38% Mobile Internet Usage 100% 21% 12% 22% 45% % of 3G Market 9,800 2,000 1,200 2,100 4,400 3G Handsets Total 3 Vodafone Optus Telstra

- 27. Statistics only show those sites serving mobile ads by admob Top handsets: Research: admob ads served AdMob Stats for Q1 2009 www.admob.com

- 28. Research: AdMob Australian Handset Data (Jan 09 – Mar 09) Of all handsets hitting AdMob publisher sites and seeing an Ad: Apple iPhone 37.7% Apple iPod Touch 15.4% Nokia 6120 4.4% LG TU500 2.8% Samsung A411 2.6% Nokia N95 2.5% AdMob Mobile Metrics for Q1 2009 www.admob.com

- 29. Handset Consideration (Source: Nielsen. The Australian Internet and Technology Report 2008-2009)

- 30. iPhone – 1 Billion Apps in 9 months 35k applications in store Average 33 apps per iPhone 1000 new apps released each week No.1 device for mobile internet browsing today in Australia Estimated 500k – 600k Australian iPhone users Predominantly 25 – 35 year olds

- 31. AIMIA Mobile Measurement Committee measures growth in Australian mobile traffic (page views) Quarter 4 - 2008 Australian Mobile Traffic grew by 17.3% Quarter 1 - 2009 Australian Mobile Traffic grew by 20% Compound Annual Growth Rate (CAGR) of 89.3% (NOTE Sensis announced mobile sites page views grew 62% in Q4 08) Australian Traffic Trends

- 32. More than 70% of Australians use mobile for more than voice & sms 41% visited a website 30% used mobile search 15% used social networking sites 61% accessed information 57% accessed entertainment 31% used mobile to make purchase Mobile search increased to 30% Mobile web usage increased to 49% Access methods - URL entry dropped from 54% to 29% Research: WMDS Australian Results of Worldwide Mobile Data Service Study 2008 www.mnetcorporation.com/worldwide-mobile-data-services-study/

- 33. 34% have a 2nd mobile phone and/or SIM card 48% purchased content for their mobile from PC & 17% carrier portal Top 3 Content types Games (43%) Trutones (42%) Wallpapers (33%) Top 3 Info types News (53%) Weather (50%) Sport (34%) Future content types maps (31%) news (29%) weather (28%) Research: AMPLI Australian Mobile Phone Lifestyle Index 2008 www.aimia.com.au/mobile

- 34. Research: Nielsen Internet Report 43% of Australians have internet capable mobile devices 31% of Australians have used the Mobile Internet 68% between 16 – 29 years 42% between 30 – 49 years 37% of High Income earners ($95k+) Of those who have used the mobile internet 41% have accessed News & Weather 38% have used Email 38% have used General Search 33% have used Local Business / Directories Search 32% have accessed Maps & Directions 30% have used Mobile Web Search Source: Nielsen. The Australian Internet and Technology Report Edition 11, 2008-2009 (Feb 2009)

- 35. Research: Nielsen Internet Report Of those aged between 16 – 29 years 81% say they have access to the internet from their mobile 68% they have used a mobile device to access the internet 51% say they use the mobile internet regularly 32% say they have a touch screen phone Source: Nielsen. The Australian Internet and Technology Report Edition 11, 2008-2009 (Feb 2009)

- 36. Online Communities Australian Mobile Phone Lifestyle Index 2008 www.aimia.com.au/mobile PC Mobile 83% used at least one online community 16% stated they used online communities on their mobile Most popular: MSN Messenger (57%) You Tube (46%) Facebook (45%) MySpace (28%) Y! Messenger (23%) Most popular: MSN Messenger (8%) Facebook (5%) MySpace (3%) Y! Messenger (2%) You Tube (2%)

- 37. Creation of Content for the Mobile 33% created content to share with others Type of content shared (as a % of those that shared content) Australian Mobile Phone Lifestyle Index 2008 www.aimia.com.au/mobile

- 38. Sharing of Content for the Mobile How content is shared (as a % of those that shared content) Australian Mobile Phone Lifestyle Index 2008 www.aimia.com.au/mobile

- 39. Use More Content if Free? Australian Mobile Phone Lifestyle Index 2008 www.aimia.com.au/mobile

- 40. Approach to Mobile Advertising Australian Mobile Phone Lifestyle Index 2008 www.aimia.com.au/mobile

- 41. Approach to Mobile Advertising

- 42. Choice between Ads and No Ads

- 43. For Mobile Customers complexity & cost of call & data plans low awareness / understanding / need separation of hardware, OS, applications, content & online services too much irrelevant functionality hidden & difficult customisation For Mobile Content Creators handset range for intended audience screen size/s interaction type/s internal developer skills understanding of all aspects of mobile is complex The Mobile Experience: Bad (historically)

- 44. For Customers Data costs are coming down Wide range of content Greater awareness/engagement of mobile content and marketing campaigns Handsets are getting more user friendly Better methods of discovery & access to mobile content Integrated with multiple channels, online, outdoor For Creators Range of campaign tools to use Easier to reach more users, discoverability choices Better options for developing and implementing for mobile The main mobile browsers are starting to standardise (WebKit) The Mobile Experience: Good (the future!)

- 45. Killing time Want something to do while waiting for the bus Entertainment while family watches something on the main TV Goal directed Want to get in and out quickly After a specific piece of information Gen Y use multiple channels simultaneously With new touch screen, advanced handsets Normal internet behaviours Convenience, contextual, relevant, location Mobile Behaviours

- 46. The (r)evolution of mobile 2006 (past) Mobile as another channel Limited audience Restricted capability 2009 (now) Content is being integrated cross channel Audience growth, building fast Opportunities being discovered Convenience & context 2013 (future) Mobile reaches critical mass Not just another channel - seamless extension of your internet experience Integrated with social, contextual, location, identity

- 47. Your Marketing Message Mobile Marketing Tools What are your marketing goals? There are only 4 ways to deliver mobile content SMS MMS Mobile Site Mobile application Really!

- 48. All the Mobile Buzz “ driving traffic to mobile adsites “ QR codes can leverage print media: “ bluetooth for ambient distribution” “ iPhone apps as a branding tool” “ mobile is all about location based services” “ mobilise your content” “ push SMS for mainstream reach” “ branded content on the carrier portals” “ reaching users off deck” “ mobile CPMs are too high” “ it’s too early for mobile SEO” “ not worth targeting low end devices” “ multiple ad formats in mobile”

- 49. What is “Mobile Content” then? It’s just stuff on your mobile! Cartoons that you send by MMS Pages on a carrier portal Off deck mobile sites Custom made mobisodes & shortform content Mobile TV shows and videos Applications & downloads Personalisation content like ringtones & wallpapers Mobile music Mobile games

- 50. Mobile Marketing Tools Mobile content Mobile landing pages / campaign pages Click to call Mobile site & content sponsorship Mobile banner ads Mobile SEO and Search Engine Marketing (SEM) Off-deck mobile ad networks Mobile social networks SMS & MMS, shortcodes, voting Mobile Barcodes QR Codes, eCoupons Location based services Bluetooth

- 51. What is your marketing goal? Forget about mobile!! What is the goal of the campaign? Build a database Generate competition entries Awareness / branding Calls to a call centre A specific response or action Think about Conversations Interactions Start with traditional DM!

- 52. Classic Mistakes and things to avoid Starting from a list of mobile marketing tools! What to avoid: My client wants to do mobile this year We booked mobile media – now what? We had $5k left so we got Vodafone to give us a quote No mobile content? Just run the TV ad / online banners Why would you use mobile? If your audience is there – and you can reach them If it’s the right channel to deliver your campaign goals

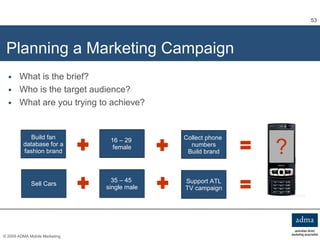

- 53. Planning a Marketing Campaign What is the brief? Who is the target audience? What are you trying to achieve? Build fan database for a fashion brand 16 – 29 female Collect phone numbers Build brand Sell Cars 35 – 45 single male Support ATL TV campaign ?

- 54. Other things to consider Consider mobile at the beginning – not the end Can a mobile component be core to the ENTIRE campaign Not an afterthought BMW snow tyres example Can you support existing channels? Extend DM execution to mobile Build database via mobile as well Create a mobile version of the web site Push iPhone users to web site Use click to call to generate call centre activity Redemption at POS

- 55. It all boils down to only 4 options! SMS MMS Mobile Site Mobile application Mobile TV (emerging opportunity)

- 56. SMS Text based messages Alerts and updates News Short form information Immediate response Voting

- 57. MMS Visual or more detailed One or more images Video & Audio Slide show

- 58. Mobile Site Web Content Detailed information Lasting content Images, video & audio Interaction Forms & data collection Competitions Branding

- 59. Mobile Application Interaction Games Functionality Permanence Utility

- 60. “ Advertising” Your Mobile Message How to: Send an SMS / MMS Drive visits to a mobile site Telcos Mobile Media Ad Networks & Mobile Search Traditional methods Web to mobile Mobile Codes / Blutooth Distribute a mobile application

- 61. Advertise your message OR How to get people to see the mobile stuff you created…

- 62. Send an SMS or MMS? Collect their phone number Send an SMS mailout (push SMS) Advertise a number Ask your audience to request the SMS Shortcode eg 19 1234 Longcode 0418 123 456

- 63. Messaging Campaign Considerations Database acquisition Your own customers Telco database Opt-in database Choosing suppliers Manage your campaign Handle opt-ins an opt-out Maintain database Billing across all carriers SPAM Act and opt-ins SMS Shortcodes Using MMS

- 64. Visitors to a Mobile Site Buy mobile media Banners Sponsorship Social media sites Do a deal with a Telco Advertise the URL Outdoor Print Send them from your website Send an SMS with a link in it Get them to photograph a QR code Push it to them while they’re in a bluetooth zone Buy mobile search keywords (SEM)

- 65. Buy Mobile Media CPM Traditional Media Buyers often uninformed Bundling From Telcos Banners & Sponsorship From Publishers NineMSN News Digital Fairfax From Ad Networks AdMob / Global networks Social Media sites

- 66. Telco Portals – On Deck Buy Mobile Media from a Carrier Telstra Vodafone Three Optus CPM based media buy Sponsorship deal Pros includes zero rating landing page development Cons limited reach blocked to other carrier customers

- 67. AdMob Global publisher network of mobile sites Targeting by Country Australian visitors to AdMob publisher sites Targeting by Carrier, Telstra / Optus / Vodafone / 3 Mobile Targeting by Handset Specific Device iPhone custom Ad units Large network of ‘unidentified’ sites CPC bidding Competition for Australian traffic pushes bids up In 2008/09 average CPC = $0.35

- 68. AdMob new iPhone ad units (3.0) Mobile Social Networking lets consumers access advertisers' social content from an ad, including their Twitter feed, Facebook page, Digg, MySpace account, Flickr photos, and Linkedin. Search users can run searches within an advertiser's mobile site straight from an ad unit. Multi-Panel Banner delivers multiple calls to action in one rich media ad unit. Scrolling Canvas lets audiences access more information about a product or service without clicking away from the application they're on.

- 69. Mobile Search Target customers using Google Mobile Other mobile search engines Low usage in Australia Growth area globally Buy mobile search keywords (SEM) Click thru to mobile site Very targeted traffic, high conversions

- 70. Google Mobile Mobile Search Mobile Content Network Device Targeting

- 71. Google Mobile SEM CPC bid for relevant keywords in Google Mobile Search User searches for keywords on Google Mobile Results vary depending on device Ad appears within results based on relevancy, CTR, CPC bid In 2008/09 average CPC = $0.15

- 72. Traditional Advertising Integrate mobile destination (URL) in traditional advertising Advertise the URL On a billboard In a magazine On the side of a tram In a press ad Include SMS shortcode as alternative to URL

- 73. Web to Mobile Suits Brands & Publishers with existing website Promote mobile version of your content Direct customers to visit the mobile site Enter your mobile number and receive an SMS Type in URL Low cost option where online channel exists already

- 74. Enter your mobile no. to receive a link

- 75. Mobile Codes Integrate a QR Code in traditional and online advertising: on a billboard in a magazine on a website at Point of Sale in direct marketing materials Customers scan and click through to your mobile site SMS back-up is essential Since July 08 Telstra reported 42.5k Code Scans 1.2M+ handsets now capable of scanning mobile codes. 25% of Telstra’s Next G handsets

- 76. Where can a QR Code go? Takashi Murakami & Louis Vuitton “designer QR” Jacket Patches Tattoos Business Cards Invitations Posters T-Shirts

- 77. Bluetooth Location specific Events Festivals Contained area such as an office building, university campus etc Customers with bluetooth enabled receive alert Choose whether or not to receive the content

- 78. Mobile Application Downloads Promote in an app store iPhone app store Other app stores are growing market Send an SMS with a link to download Send to a mobile site where they can download Pre-installed onto a phone Carriers Handset manufacturers Strong brands only

- 79. App stores, the iPhone and others iPhone Australian app store launched July 08 500 – 750k Australian users Android (Google) Australian app store launched March 09 2.3k applications No. 4 Handset in U.S. in March (after iPhone, Blackberry) Blackberry Launched App store April 09 (not in Aus yet) Nokia (Ovi store) Australian app store launched Predicted 20k applications on launch

Editor's Notes

- Moto Phone: http://www.eightiesonline.com/wp-content/uploads/2008/10/cellphone_full.jpg

- Nokia 7110

- Number est: International Telecommunication Union. (2009). Measuring the Information Society: The ICT Development Index . International Telecommunication Union. pp. 108. ISBN 9261128319 .

- Case Study

- Case Study

- Case Study

- Case Study

- How’s this for a QR barcode! Produced by Tokyo-based creative agency SET, it was put together to promote the ongoing collaborations between LV and Takashi Murakami. I’m pretty sure it’s the first time I see a stylized code like this, and I’m quite surprised that it actually works.