Aegean marine petroleum q4 2012 results presentation

- 2. Cautionary Statement This presentation contains forward-looking statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements and we desire to take advantage of such safe harbor legislation. The forward-looking statements in this report are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in our records and other data available from third parties. Important assumptions relating to the forward-looking statements include, among other things, assumptions regarding demand for our products, the cost and availability of refined marine fuel from suppliers, pricing levels, the timing and cost of capital expenditures, competitive conditions, and general economic conditions. These assumptions could prove inaccurate. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. For a more comprehensive discussion of the risk factors affecting our business please see our Annual Report on Form 20-F and other reports filed with the U.S. Securities and Exchange Commission, a copy of which can be found on our website www.ampni.com. Unless required by law, we disclaim any obligation to update any forward-looking statements contained in this presentation, whether as a result of new information, future events, a change in our views or expatiations, to conform them to actual results or otherwise. In addition, this presentation contains unaudited financial information related to our financial statements. The information provided is for indicative purposes only. Unless required by law, we undertake no obligation to update or revise any such information. Non-GAAP Financial Measures Within this presentation, the Company makes reference to certain non-GAAP financial measures, which have directly comparable GAAP financial measures as identified in this presentation. These non-GAAP measures are provided because they are used as standard metrics by the investment community. We believe these measures will assist the investment community in properly assessing the underlying performance of the Company. AEGEAN MARINE PETROLEUM NETWORK INC. 2

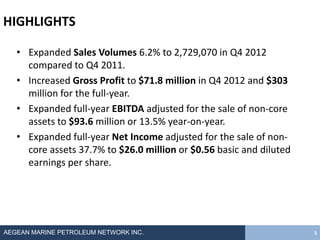

- 3. HIGHLIGHTS • Expanded Sales Volumes 6.2% to 2,729,070 in Q4 2012 compared to Q4 2011. • Increased Gross Profit to $71.8 million in Q4 2012 and $303 million for the full-year. • Expanded full-year EBITDA adjusted for the sale of non-core assets to $93.6 million or 13.5% year-on-year. • Expanded full-year Net Income adjusted for the sale of non- core assets 37.7% to $26.0 million or $0.56 basic and diluted earnings per share. AEGEAN MARINE PETROLEUM NETWORK INC. 3

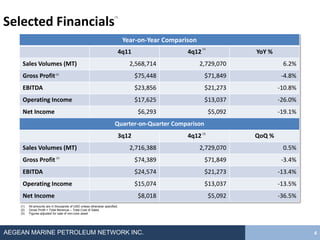

- 4. Selected Financials (1) Year-on-Year Comparison (3) 4q11 4q12 YoY % Sales Volumes (MT) 2,568,714 2,729,070 6.2% Gross Profit (2) $75,448 $71,849 -4.8% EBITDA $23,856 $21,273 -10.8% Operating Income $17,625 $13,037 -26.0% Net Income $6,293 $5,092 -19.1% Quarter-on-Quarter Comparison 3q12 4q12 (3) QoQ % Sales Volumes (MT) 2,716,388 2,729,070 0.5% Gross Profit (2) $74,389 $71,849 -3.4% EBITDA $24,574 $21,273 -13.4% Operating Income $15,074 $13,037 -13.5% Net Income $8,018 $5,092 -36.5% (1) All amounts are in thousands of USD unless otherwise specified. (2) Gross Profit = Total Revenue – Total Cost of Sales (3) Figures adjusted for sale of non-core asset AEGEAN MARINE PETROLEUM NETWORK INC. 4

- 5. Substantial EBITDA Growth 100,000 90,000 80,000 70,000 $,000 60,000 50,000 40,000 30,000 20,000 10,000 - 2005 2006 2007 2008 2009 2010 2011 2012 Note: Figures are adjusted to exclude one-time loss on sale of vessels AEGEAN MARINE PETROLEUM NETWORK INC. 5

- 6. Built-in Fleet Capacity to Further Scale Business • Modern fleet consisting of 67 (58 owned and 9 Fleet Size and Hull Type chartered) bunkering vessels including a specialty 80 tanker and 3 owned floating storage vessels 60 • Average age of fleet is 10 years, with 32 vessels less 40 than 5 years old 20 • Modern vessels equipped with: – Segregated cargo tanks allowing for 0 2006 2007 2008 2009 2010 2011 2012 transportation of multiple grades of fuel Double Hull Single Hull – High-capacity fuel pumps Aegean Fleet Current Average Size Average Age % Double Hull Number of Vessels/Barges 67 5,000 dwt 10 years 87% AEGEAN MARINE PETROLEUM NETWORK INC. 6

- 7. Continued Progress Marketing & Distributing Marine Lubricants • ALFA marine lubricants part of a comprehensive solution for Aegean customers • Product availability in more that 550 ports worldwide • Estimated annual global market size of 2mm metric tons Lubricant Volume (mt) 30,000 25,000 20,000 15,000 10,000 5,000 - 2007 2008 2009 2010 2011 2012 AEGEAN MARINE PETROLEUM NETWORK INC. 7

- 8. Gross Profit Drivers $35 3,000,000 $30 2,500,000 Gross Spread per Metric Ton $25 Sales Volume (mt) 2,000,000 $20 1,500,000 $15 1,000,000 $10 500,000 $5 - $- Volumes Gross Spread AEGEAN MARINE PETROLEUM NETWORK INC. 8

- 9. Utilization (1) (metric tons delivered per vessel per day) 700 50 600 45 500 40 (3) Fleet Size 400 Volume 35 300 30 200 100 25 0 20 1q09 2q09 3q09 4q09 1q10 2q10 3q10 4q10 1q11 2q11 3q11 4q11 1q12 2q12 3q12 4q12 (2) Gross Adjusted Fleet Volume Sensitivity Analysis (4) MT Delivered per Vessel per Day Total Annual Sales Volume (mt) (1) Utilization is measured as volume (in metric tons) delivered per average number of ocean-going bunkering vessel per day. Utilization data does not include inland and estuary barge utilization figures 400 9,700,000 (2) Adjusted figure excludes non-operating (off-hire) days caused by both scheduled and unscheduled maintenance requirements and charter hire days (3) Fleet size for utilization calculation refers to ocean-going bunkering tankers 500 11,250,000 exclusively (4) Assumes 360 operating work days per vessel per year, 41.1 ocean-going bunkering vessels and a flat utilization run-rate basis 2012 on non-ocean going inland and 600 12,800,000 estuary barge vessels 700 14,400,000 800 15,900,000 AEGEAN MARINE PETROLEUM NETWORK INC. 9

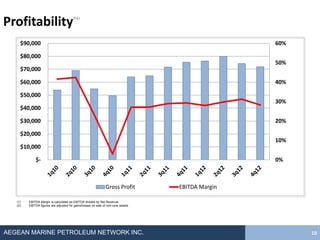

- 10. Profitability (1,2,) $90,000 60% $80,000 50% $70,000 $60,000 40% $50,000 30% $40,000 $30,000 20% $20,000 10% $10,000 $- 0% Gross Profit EBITDA Margin (1) EBITDA Margin is calculated as EBITDA divided by Net Revenue. (2) EBITDA figures are adjusted for gains/losses on sale of non-core assets AEGEAN MARINE PETROLEUM NETWORK INC. 10

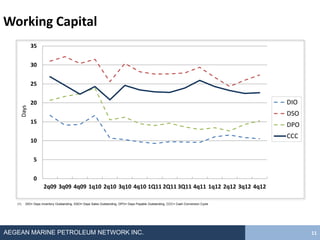

- 11. Working Capital 35 30 25 20 DIO Days DSO 15 DPO CCC 10 5 0 2q09 3q09 4q09 1q10 2q10 3q10 4q10 1Q11 2Q11 3Q11 4q11 1q12 2q12 3q12 4q12 (1) DIO= Days Inventory Outstanding, DSO= Days Sales Outstanding, DPO= Days Payable Outstanding, CCC= Cash Conversion Cycle AEGEAN MARINE PETROLEUM NETWORK INC. 11

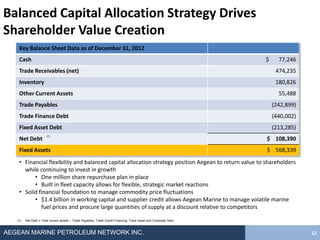

- 12. Balanced Capital Allocation Strategy Drives Shareholder Value Creation Key Balance Sheet Data as of December 31, 2012 Cash $ 77,246 Trade Receivables (net) 474,235 Inventory 180,826 Other Current Assets 55,488 Trade Payables (242,899) Trade Finance Debt (440,002) Fixed Asset Debt (213,285) (1) Net Debt $ 108,390 Fixed Assets $ 568,339 • Financial flexibility and balanced capital allocation strategy position Aegean to return value to shareholders while continuing to invest in growth • One million share repurchase plan in place • Built in fleet capacity allows for flexible, strategic market reactions • Solid financial foundation to manage commodity price fluctuations • $1.4 billion in working capital and supplier credit allows Aegean Marine to manage volatile marine fuel prices and procure large quantities of supply at a discount relative to competitors (1) Net Debt = Total current assets – Trade Payables, Trade Credit Financing, Fixed Asset and Corporate Debt AEGEAN MARINE PETROLEUM NETWORK INC. 12

- 13. Financial Flexibility to Invest in Growth and Return Capital to Shareholders • Significant Financial Liquidity with Working Capital Facilities (,000) over $1 Billion in Available Credit $1,200 – Ability to better manage commodity price fluctuations 968 $1,000 943 – Bulk purchases provide pricing power relative to competitors $800 706 • Superior Financing Terms on Newbuild Vessels $600 – Reduces cost of capital and improves 420 profitability $400 320 300 • Strong Capital Structure $200 – Net Debt of $108 million 75 – Fixed asset debt to ttm EBITDA of 2.4x $- At IPO 2007 2008 2009 2010 2011 2012 AEGEAN MARINE PETROLEUM NETWORK INC. 13

- 14. Creating Long Term Value by Entering New Markets, Diversifying Revenue and Enhancing Flexibility • Strategically expanding global footprint, driving business revenues and increasing global market share • Scalable global network allows for increased asset utilization and flexibility as macro conditions improve • Strategically located storage capacity diversifies business by providing opportunities to generate substantial income from leasing storage space to third parties • Strengthening integrated marine fuel logistics chain via strategic expansion and disposition of older non-core assets – 10 vessels sold to date yielding a savings of approximately $20m in annual operating expense AEGEAN MARINE PETROLEUM NETWORK INC. 14

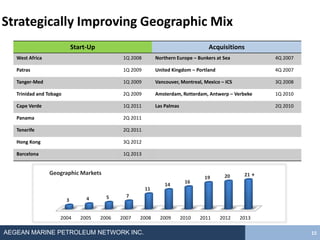

- 15. Strategically Improving Geographic Mix Start-Up Acquisitions West Africa 1Q 2008 Northern Europe – Bunkers at Sea 4Q 2007 Patras 1Q 2009 United Kingdom – Portland 4Q 2007 Tanger-Med 1Q 2009 Vancouver, Montreal, Mexico – ICS 3Q 2008 Trinidad and Tobago 2Q 2009 Amsterdam, Rotterdam, Antwerp – Verbeke 1Q 2010 Cape Verde 1Q 2011 Las Palmas 2Q 2010 Panama 2Q 2011 Tenerife 2Q 2011 Hong Kong 3Q 2012 Barcelona 1Q 2013 Geographic Markets 20 21 + 19 16 14 11 5 7 3 4 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 AEGEAN MARINE PETROLEUM NETWORK INC. 15

- 16. Unique Offerings with Global Reach and Diverse Customer Base • Aegean’s customers include commercial shipping companies, cruise lines, marine fuel traders and brokers as well as oil majors • Strong, diverse customer base, sophisticated credit management systems and a global footprint mitigate counterparty and market risk and provide top-line predictability • No customer accounts for more than 10% of total revenues Sales by Client Sector 4Q12 Volume by Market Chemical Reefers LPG/LNG Canary Other Piraeus / Tankers Islands Tankers Panama Patras Cruise Ships Gibraltar U.A.E. N.W.E. Car Carriers Singapore Bulkers Jamaica Containers Morocco U.K. West Africa Trinidad Vancouver Kong Hong AEGEAN MARINE PETROLEUM NETWORK INC. 16

- 17. Streamlining Cost Structure and Leveraging Fixed Costs • Successfully reduced operating expenses in three consecutive quarters • Sale of ten older, non-core vessels yields approximately $20m in annual operating savings • Movement from floating to land based storage capacity mitigates costly ongoing operating and maintenance expense while enhancing purchasing power and providing additional revenue streams AEGEAN MARINE PETROLEUM NETWORK INC. 17

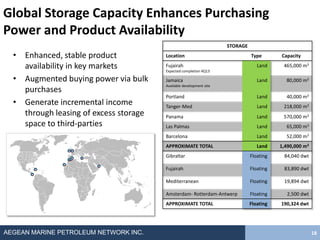

- 18. Global Storage Capacity Enhances Purchasing Power and Product Availability STORAGE • Enhanced, stable product Location Type Capacity availability in key markets Fujairah Expected completion 4Q13 Land 465,000 m3 • Augmented buying power via bulk Jamaica Land 80,000 m3 Available development site purchases Portland Land 40,000 m3 • Generate incremental income Tanger-Med Land 218,000 m3 through leasing of excess storage Panama Land 570,000 m3 space to third-parties Las Palmas Land 65,000 m3 Barcelona Land 52,000 m3 APPROXIMATE TOTAL Land 1,490,000 m3 Gibraltar Floating 84,040 dwt Fujairah Floating 83,890 dwt Mediterranean Floating 19,894 dwt Amsterdam- Rotterdam-Antwerp Floating 2,500 dwt APPROXIMATE TOTAL Floating 190,324 dwt AEGEAN MARINE PETROLEUM NETWORK INC. 18

- 19. Well-Positioned to Benefit from Positive Macro Trends • Global GDP growth forecast of 3.5% and 4.1% in 2013 and 2014 respectively (1) • Global marine market to expand 5% to (2) 6% annually through 2015 • Chinese PMI for January 2013 highest reading in 24 months (3) World GDP and Bunker Demand Bunker Demand (,000 mt/ year) • Continued expansion of world 120,000 350,000 Global GDP (USD Trillions) 100,000 300,000 250,000 seaborne trade and world fleet driving 80,000 200,000 60,000 demand for all grades of marine fuel 40,000 150,000 100,000 20,000 50,000 - 0 World GDP Bunker Demand Source: IEA, EPA, Company Estimates (1) IMF “World Economic Update” January 2013 (2) IHS Global Insight (3) HSBC AEGEAN MARINE PETROLEUM NETWORK INC. 19

- 20. Uniquely Positioned to Drive Profitability • Well-positioned to capitalize on emerging trends • Poised for long-term, sustainable growth; immune to many headwinds facing shipping industry • Diversified revenue streams, market leadership and operational infrastructure create significant barriers to entry • Track record of strong financial results • Capital allocation strategy focused on driving shareholder value • Creating long term value by entering new markets and further diversifying revenue AEGEAN MARINE PETROLEUM NETWORK INC. 20