Airport Operation Market In Opportunity Nitin

- 1. Airport Operation Market Opportunity in India By: Nitin Rajan 1

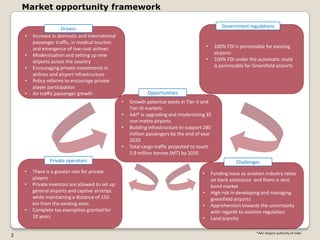

- 2. Market opportunity framework Government regulations Drivers • Increase in domestic and international passenger traffic, in medical tourism and emergence of low-cost airlines • 100% FDI is permissible for existing • Modernization and setting up new airports airports across the country • 100% FDI under the automatic route • Encouraging private investments in is permissible for Greenfield airports airlines and airport infrastructure • Policy reforms to encourage private player participation • Air traffic passenger growth Opportunities • Growth potential exists in Tier-II and Tier-III markets • AAI* is upgrading and modernizing 35 non-metro airports • Building infrastructure to support 280 million passengers by the end of year 2020 • Total cargo traffic projected to touch 5.9 million tonnes (MT) by 2020 Private operators Challenges • There is a greater role for private • Funding issue as aviation industry relies players on bank assistance and there is zero • Private investors are allowed to set up bond market general airports and captive airstrips • High risk in developing and managing while maintaining a distance of 150 greenfield airports km from the existing ones. • Apprehension towards the uncertainty • Complete tax exemption granted for with regards to aviation regulation 10 years • Land scarcity *AAI: Airport authority of India 2

- 3. Rising passenger traffic, changed mindset, positive government policies fuelled the industry growth Current state of aviation industry • The Civil Aviation Sector in India has undergone a huge transformation over the last few years and is on the verge of taking another quantum leap in the years to come. • Airport Sector has witnessed a growth of 35% on an average per year for the last six years compared to the global growth of about 9% per annum. The growth is fuelled by the robust economy and infrastructure development which lead to economic growth. It is estimated that : Had the infrastructural gap not been there, India's GDP would have been 2% higher per annum – and would have been at about par with the phenomenal growth China has achieved. • The Indian Airports are not prepared to handle the huge increase in the number of passengers and hence up- gradation of the airports and construction of new airports are the only alternatives left with the regulatory authorities in India. Current state of Airports in India Indian Airports Passenger Traffic: 2005-06 to 2011-12 • At present, India has 136 airports, of which 128 are Passenger Traffic in Million Passenger Traffic Growth Y-o-Y in % owned by the AAI. Year International Domestic Total International Domestic Total • The Government of India has recognized the need 2005-06 22.37 50.98 73.35 15.15 27.94 23.75 to involve private players in developing world-class 2006-07 25.87 70.62 96.49 15.66 38.52 31.55 airport infrastructure 2007-08 29.81 87.06 116.87 15.23 23.28 21.12 • Until recently, the AAI was the only major player 2008-09 31.58 77.30 108.88 5.90 -11.22 -6.85 involved in developing and upgrading airports in the 2009-10 34.37 89.39 123.76 8.96 15.54 13.63 country. However, private sector players are now 2010-11 37.91 105.52 143.43 10.17 18.14 15.90 becoming increasingly involved after sniffing the 2011-12 40.80 121.51 162.30 7.63 15.18 13.18 lucrative opportunity in this sector. • Some major private sector players include GMR Source: APAO India Infrastructure Ltd, GVK Power and Infrastructure Ltd, Siemens, Larsen & Toubro (L&T), Unique Zurich and Maytas Infrastructure Limited, etc Indian airports passenger growth increased at an average rate of 16% since • Airports which are operated through PPP* model in 2005-06. Except year 2008-09, when the global economy was facing India are Delhi, Mumbai, Bangalore, Hyderabad and recession, Indian passenger traffic recoded a negative growth (in-line with Cochin the market trends) *PPP: Public private partnership 3 Source: AERO, APAO India

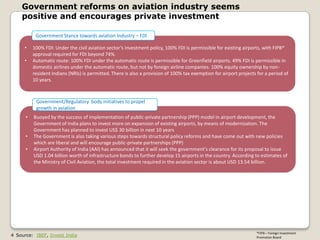

- 4. Government reforms on aviation industry seems positive and encourages private investment Government Stance towards aviation Industry – FDI • 100% FDI: Under the civil aviation sector’s investment policy, 100% FDI is permissible for existing airports, with FIPB* approval required for FDI beyond 74%. • Automatic route: 100% FDI under the automatic route is permissible for Greenfield airports. 49% FDI is permissible in domestic airlines under the automatic route, but not by foreign airline companies. 100% equity ownership by non- resident Indians (NRIs) is permitted. There is also a provision of 100% tax exemption for airport projects for a period of 10 years. Government/Regulatory body initiatives to propel growth in aviation • Buoyed by the success of implementation of public-private partnership (PPP) model in airport development, the Government of India plans to invest more on expansion of existing airports, by means of modernization. The Government has planned to invest US$ 30 billion in next 10 years • The Government is also taking various steps towards structural policy reforms and have come out with new policies which are liberal and will encourage public-private partnerships (PPP) • Airport Authority of India (AAI) has announced that it will seek the government's clearance for its proposal to issue USD 1.04 billion worth of infrastructure bonds to further develop 15 airports in the country. According to estimates of the Ministry of Civil Aviation, the total investment required in the aviation sector is about USD 13.54 billion. *FIPB – Foreign Investment 4 Source: IBEF, Invest India Promotion Board

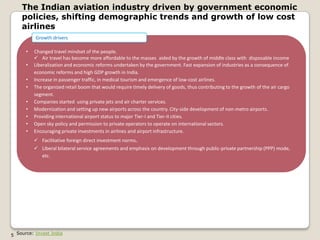

- 5. The Indian aviation industry driven by government economic policies, shifting demographic trends and growth of low cost airlines Growth drivers • Changed travel mindset of the people. Air travel has become more affordable to the masses aided by the growth of middle class with disposable income • Liberalization and economic reforms undertaken by the government. Fast expansion of industries as a consequence of economic reforms and high GDP growth in India. • Increase in passenger traffic, in medical tourism and emergence of low-cost airlines. • The organized retail boom that would require timely delivery of goods, thus contributing to the growth of the air cargo segment. • Companies started using private jets and air charter services. • Modernization and setting up new airports across the country. City-side development of non-metro airports. • Providing international airport status to major Tier-I and Tier-II cities. • Open sky policy and permission to private operators to operate on international sectors. • Encouraging private investments in airlines and airport infrastructure. Facilitative foreign direct investment norms. Liberal bilateral service agreements and emphasis on development through public-private partnership (PPP) mode, etc. 5 Source: Invest India

- 6. There is a huge opportunity for private players as government plans airport up-gradation across India and growing passenger traffic Opportunities • Immense growth potential exists in Tier-II and Tier-III markets with airlines on an expansion spree in these markets. The AAI is upgrading and modernizing 35 non-metro airports in the country at an estimated cost of around USD 1 billion, as well as modernizing the Chennai and Kolkata airports • The Indian commercial aerospace market is estimated to absorb about 1,100 commercial jets worth USD 130 billion over the next 20 years, making it one of the most lucrative markets for global aviation majors • India will be the fourth biggest market in terms of value for all new aircraft deliveries during the next 20 years Air Traffic • According to the CAPA India 2011-12 aviation industry outlook, by the end of this decade, in 2020, air traffic in India is projected to grow 3.5 times from today's level, making it the third-largest market in the world, behind the US and China Passenger Growth • The Vision 2020 announced by the Ministry of Civil Aviation conceives of building infrastructure to support 280 million customers by the end of year 2020 Airport Cargo • The 12th Five Year Plan (2012-17) estimates the domestic and international cargo to grow at the rate of 12% and 10%, respectively, with the total traffic projected to touch 5.9 million tonnes (MT) by 2020. Thus, a significant potential lies for the Indian airports to become tran-shipment hubs. • Foreign airlines carry 82% of India’s air cargo traffic, which is projected to grow at 10-12% rate over the next five years 6 Source: Invest India

- 7. Foreign airport players can play a bigger role as there is a huge capital expenditure gap and government encourages private participation Foreign airport operators in India • Germany’s Fraport AG. owns 10% in Delhi International Airport Ltd and is currently in negotiations with its promoter GMR Group to sell its stake. • Flughafen Zurich AG holds 5% in Bangalore International Airport Ltd, now controlled by GVK group. Earlier, Zurich Airport sold a 12% stake in Bangalore International Airport to GVK Group However it would be looking at the proposed airport projects in Navi Mumbai and Goa if the prjoject seem to be lucrative • The US-based airport operator ADC and HAS Airports Worldwide are also interested in Navi Mumbai and Goa airport projects Role of Private Players • Over the last few years, the government has been proactive in building and modernizing Indian airports under the PPP mode to encourage the private sector’s participation. Prominent projects undertaken for airports under the PPP mode are at Hyderabad, Delhi, Bangalore, Cochin, Kannur and Mumbai. These projects have been undertaken through the PPP mode with a total investment of INR 20,041 crore. • Private investors are allowed to set up general airports and captive airstrips while maintaining a distance of 150 kms from the existing ones. Complete tax exemption is also granted for 10 years 7 Source: Live Mint, Invest India

- 8. Although there is a growth potential, but the industry is plagued by issues such as high risk, land scarcity among others Challenges • The Indian aviation market relies a lot on banks’ assistance and has zero bond market available for developing infrastructure. Besides, the risk in developing and managing greenfield airports is really high • There is an apprehension towards the uncertainty with regards to aviation regulation. Foreign operators are expecting master plan for airports with lot more stability and better framework. They need a clear picture about the policy and clear government support The apprehension has cropped in after the government decided to abolished the Airport Development Fee (ADF) with effect from January 01, 2013 for Mumbai and Delhi airports. • Industry experts believe that foreign airport operators would stay out of India because of the lack of stability in the Indian regulatory framework. There are several country-specific issues where foreign investors were not treated well. • Land scarcity will be the major challenge for airport development in India in the coming years. India is already facing a shortage of land, particularly in the larger towns and cities, and this issue will only intensify with the increase in urbanization. McKinsey estimates that India’s urban population will grow from 20% of the total in 1991 to 37% by 2025. By 2030 India is expected to have 55 cities with a population of more than 1 million. 8 Source: Travel Biz Monitor, Live Mint

- 9. The private operators are recommended to plunge in but need to be cautious Recommendations • Indian aviation industry is offering a huge growth opportunities for foreign airport operators. • Government regulatory framework is positive with its investment policies. • There is a huge requirement for airport development across India even in tier 1 and tier 2 cities with plans to develop airports in 35 cities • Although the Indian government has positive policies towards role of private players in airport development , there could be a future uncertainly with regards to regulatory framework as in the case of abolition of Airport Development Fees which had no provision initially 9