aon 2Q 08 Earnings Release

0 likes152 views

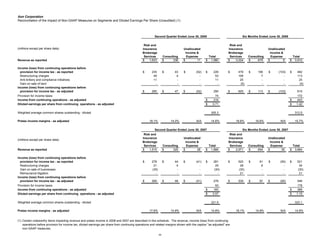

- Aon reported a 6% increase in total revenue and 2% organic revenue growth for Q2 2008. EPS from continuing operations was $0.55. - Adjusted EPS excluding certain items increased 25% to $0.71, driven by 2% organic revenue growth and margin expansion in brokerage. - Aon completed sales of CICA and Sterling, generating $2.7B in after-tax proceeds and a $1.4B pretax gain.

1 of 13

Download to read offline

Recommended

aon 1Q 08 Earnings Release

aon 1Q 08 Earnings Releasefinance27 Aon reported first quarter 2008 results with total revenue growing 7% to $1.9 billion and EPS from continuing operations increasing 10% to $0.56. Key highlights included adjusted EPS excluding items increasing 25% to $0.71, adjusted pretax margins increasing in both brokerage up 100 bps to 19.5% and consulting up 430 bps to 19.2%, and the company repurchasing $860 million of shares year-to-date. Segment reviews showed brokerage organic revenue up 2% and consulting up 4% while pretax income rose in both segments.

viacom FINAL%20Q108%20Web%20Deck

viacom FINAL%20Q108%20Web%20Deckfinance20 Viacom reported financial results for the first quarter of 2008 that showed increases in revenue, operating income, and earnings per share compared to the first quarter of 2007. Revenue grew 15% to $3.117 billion. Operating income increased 29% to $567 million. Diluted earnings per share from continuing operations rose 45% to $0.42. Media Networks and Filmed Entertainment, Viacom's two business segments, both saw revenue growth for the quarter despite lower theatrical revenues at Filmed Entertainment. Viacom also provided guidance for 2008-2010 of low double-digit annual growth in diluted earnings per share from continuing operations.

Fourth Quarter 2005 Earnings Presentation

Fourth Quarter 2005 Earnings PresentationQuarterlyEarningsReports3 Bank of America reported record earnings of $16.9 billion for 2005, up 19% from 2004. Revenue grew 9% to $57.6 billion driven by a 19% increase in noninterest income. Earnings were driven by strong consumer growth and commercial lending recovery, despite higher provision costs and fewer securities gains. For the fourth quarter of 2005, earnings were $3.8 billion, down 9% from the previous quarter due to an 8% decline in noninterest income and a 21% rise in provision for credit losses.

viacom Q208%20Web%20Deck%20FINAL%207.29

viacom Q208%20Web%20Deck%20FINAL%207.29finance20 This document summarizes Viacom's financial results for the second quarter and first half of 2008. Key highlights include:

- Revenues for Q2 2008 increased 21% to $3.9 billion and increased 18% to $7 billion for the first half.

- Operating income for Q2 2008 increased 13% to $792 million and increased 19% to $1.4 billion for the first half.

- Earnings per share from continuing operations for Q2 2008 increased 2% to $0.64 and increased 15% to $1.06 for the first half.

- Media Networks revenues increased 11% in Q2 2008 and 14% for the first half, driven by increases in affiliate fees

Fourth Quarter 2006 Earnings Presentation

Fourth Quarter 2006 Earnings PresentationQuarterlyEarningsReports3 Bank of America reported fourth quarter 2006 results. Key highlights include:

- Net income of $5.26 billion, up 34% from fourth quarter 2005. Excluding merger charges, net income was $5.41 billion, up 37%.

- Global Consumer & Small Business Banking earnings grew 8% over fourth quarter 2005 to $10.63 billion in revenue, driven by increases in net interest income and noninterest income.

- Credit quality remained stable, with the provision for credit losses down 7% from fourth quarter 2005.

- The company achieved earnings growth while completing two large acquisitions, focusing on expense management and maintaining a strong capital position.

Third Quarter 2006 Earnings Presentation

Third Quarter 2006 Earnings PresentationQuarterlyEarningsReports3 - Bank of America reported third quarter 2006 results with total revenue of $18.961 billion, an 11% increase from third quarter 2005, and net income of $5.416 billion, a 20% increase.

- Net interest income was $8.894 billion, a 1% increase, impacted by the sale of Brazilian operations and prior year FAS 133 impact. Noninterest income increased 20% to $10.067 billion.

- Global Consumer & Small Business Banking reported net income of $2.889 billion, a 13% increase, driven by increases in cards, deposits, and debit purchase volume.

Third Quarter 2007 Earnings Presentation

Third Quarter 2007 Earnings PresentationQuarterlyEarningsReports3 - Bank of America reported third quarter 2007 results with net income of $3.7 billion, down 32% from the third quarter of 2006. Earnings per share were $0.82.

- Revenues declined 12% due to a 24% drop in noninterest income driven by losses in Global Corporate and Investment Banking from market turbulence.

- The provision for credit losses increased 74% to $2.03 billion reflecting increased consumer loan loss rates and impacts from the weakened housing market.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 This document summarizes Raytheon's financial results for the fourth quarter and full year of 2008. Key points include: Raytheon reported solid financial results for Q4 and full year 2008, with record backlog of $38.9 billion; Q4 sales were $6.1 billion and adjusted EPS was $1.13; Full year sales grew 9% to $23.2 billion and adjusted EPS grew 23% to $4.06; Raytheon reaffirmed its financial guidance for 2009 and expects continued growth.

citigroup April 16, 2007 - First Quarter Press Release

citigroup April 16, 2007 - First Quarter Press ReleaseQuarterlyEarningsReports Citi reported record quarterly revenues of $25.5 billion, up 15%, and net income of $5.01 billion, down 10% from the prior year. Net income was reduced by an $871 million after-tax charge related to a structural expense review. Excluding this charge, net income was $5.88 billion, down 9% due to higher credit costs and a lower tax benefit. Revenues grew across most business segments, led by a 23% increase in Markets & Banking revenues. Credit costs increased $1.26 billion due to higher net losses and increases to loan loss reserves.

ameriprise 2Q06_Release

ameriprise 2Q06_Releasefinance43 - Ameriprise Financial reported net income of $141 million for Q2 2006, down from $149 million in Q2 2005. Adjusted earnings, which exclude certain one-time costs, increased 22% to $195 million.

- Revenue grew 8% to $2.1 billion, driven by a 13% increase in adjusted revenues. Adjusted revenues grew due to increases in management fees, distribution fees, and premiums from strong business performance.

- Adjusted return on equity increased to 10.7% from 10.4% in the previous quarter, reflecting continued improvement in business results and financial targets.

Citigroup 2007 Financial Services Conference

Citigroup 2007 Financial Services Conference QuarterlyEarningsReports3 Ken Lewis, Chairman, President and CEO of Bank of America, presented at the Citigroup Financial Services Conference on January 31, 2007. The presentation highlighted opportunities for growth at Bank of America and summarized key financial metrics for 2006, including 10% revenue growth and 16% growth in net income compared to the previous year. Lewis also outlined the company's short-term outlook and strategies to continue achieving attractive earnings growth in a challenging environment.

Angel Ron presenta los resultados del tercer trimestre 2012

Angel Ron presenta los resultados del tercer trimestre 2012Banco Popular The 9 months results were as planned. Recurrent revenues were up 31.4% driven by strong growth in net interest income and fees. Active liquidity management improved the loans to deposits ratio. Significant reinforcements were made to provisions to strengthen coverage ratios and allow the bank to face severe scenarios. The announced capital increase is well on track and expected to be completed in early December subject to shareholder and regulatory approval.

Resultados bancopopular

Resultados bancopopularWEB FINANCIAL GROUP INTERNATIONAL SL The 9 months results were as planned. Recurrent revenues were up 31.4% driven by strong growth in net interest income and fees. Active liquidity management improved the loans to deposits ratio. Significant reinforcements were made to provisions to allow the bank to face extreme scenarios. The announced capital increase is well on track and expected to be completed in early December subject to approvals.

omnicom group Q1 2008 Investor Presentation

omnicom group Q1 2008 Investor Presentationfinance22 The document provides an overview of Omnicom Group's financial results for the first quarter of 2008. It includes a summary of revenue and earnings growth compared to the first quarter of 2007. The document also discusses Omnicom's cash flow, credit profile, liquidity, acquisitions, and provides brief profiles of four agencies acquired during the first quarter.

first energy 4Q 06 Consolidated Report to the Financial_Community

first energy 4Q 06 Consolidated Report to the Financial_Communityfinance21 This document is Consolidated Energy's quarterly report for Q4 2006. It provides an analysis of changes in EPS from Q4 2005 to Q4 2006. Normalized non-GAAP EPS increased from $0.77 to $0.84 primarily due to regulatory changes in Ohio that increased earnings. However, lower distribution deliveries and generation revenues, along with higher fuel and purchase power costs reduced earnings. Guidance for 2007 normalized non-GAAP EPS is $4.05 to $4.25.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for the first quarter of 2008. Sales increased 11% to $5.4 billion compared to the first quarter of 2007, driven by growth across all business segments. Operating income rose 17% to $608 million due to increased volume and lower expenses. Earnings per share from continuing operations increased 31% to $0.93. The company also achieved record backlog of $37.7 billion and solid bookings of $6.5 billion during the quarter. Raytheon reaffirmed its full-year 2008 guidance and expects continued growth.

fannie mae Investor Summary

fannie mae Investor Summaryfinance6 This document provides a summary of Fannie Mae's financial results for the first quarter of 2008. Some key points:

- Fannie Mae reported a net loss of $2.2 billion for the quarter, an improvement from a $3.6 billion loss in the previous quarter. Revenues grew but losses on investments and derivatives also increased.

- Credit losses rose to $3.2 billion due to higher mortgage defaults and loss severities from falling home prices and economic weakness.

- Fannie Mae plans to raise $6 billion in new capital through stock offerings to maintain a strong balance sheet and provide stability in the mortgage market.

- Management is focusing on tightening lending standards and mitigating

First Quarter 2007 Earnings Presentation

First Quarter 2007 Earnings PresentationQuarterlyEarningsReports3 Bank of America reported first quarter 2007 results with key highlights as follows:

- Earnings of $5.3 billion and diluted EPS of $1.16, up 8% from first quarter 2006.

- Total revenue grew 3% to $18.4 billion compared to first quarter 2006, driven by a 10% increase in noninterest income, though net interest income declined 5%.

- Credit quality remained sound though provision expenses increased 23% compared to first quarter 2006 as credit costs trend toward more normal levels.

- Global Wealth and Investment Management saw client assets reach new highs of $547 billion and added over 500 premier banking sales associates over the past year.

progress energy Q2 2005 earnings release

progress energy Q2 2005 earnings releasefinance25 Progress Energy reported quarterly ongoing earnings of $0.63 per share and GAAP net loss of $0.01 per share for Q2 2005. Key highlights included milder weather negatively impacting earnings, writing off unrecoverable 2004 storm costs, and one less planned nuclear outage. Year-to-date ongoing earnings were $1.14 per share and GAAP earnings were $0.37 per share. Progress Energy reaffirmed its 2005 ongoing earnings guidance of $2.90-$3.20 per share.

Pfizer Quarterly Corporate Performance

Pfizer Quarterly Corporate Performancefinance5 In the third quarter 2008 earnings teleconference, Pfizer reported increased revenues and earnings compared to the previous year. Adjusted revenues increased 2% to $12.2 billion while adjusted income and EPS grew 5% and 7% respectively. Key products such as Lyrica, Celebrex and Viagra performed well. Pfizer also exceeded its cost reduction target, achieving $1.7 billion in savings through the third quarter with a goal of $2 billion for 2008 versus 2006. Pfizer narrowed its full-year revenue and EPS guidance ranges.

first energy 4Q 07

first energy 4Q 07finance21 This document provides a consolidated report and financial highlights for FirstEnergy Corp for the 4th quarter of 2007. Some key points:

- Normalized non-GAAP earnings per share for Q4 2007 were $0.90 compared to $0.84 in Q4 2006.

- GAAP earnings per share for Q4 2007 were $0.88 compared to $0.85 in Q4 2006.

- Normalized non-GAAP earnings for 2007 were $4.23 per share, near the top of guidance range.

- 2008 earnings guidance range is $4.15 to $4.35 per share.

hsbc Cover of 2008 Interim Results slide presentation Download 2008 Interi...

hsbc Cover of 2008 Interim Results slide presentation Download 2008 Interi...QuarterlyEarningsReports2 HSBC reported financial results for the first half of 2008. Profit before tax was $10.2 billion, down 28% from the first half of 2007. Earnings per share were $0.65, down 32% from the previous year. Loan impairment charges increased 58% to $10.1 billion due to deterioration in credit quality, particularly in North America. However, the bank remained profitable in all regions except North America and maintained a strong capital position with a Tier 1 capital ratio of 8.8%. Global Banking and Markets wrote down $3.9 billion related to subprime and credit market exposures.

danaher 05-2q-rel

danaher 05-2q-relfinance24 Danaher Corporation announced record results for the second quarter and first half of 2005. Net earnings for the second quarter increased 25.5% compared to 2004, and sales increased 19%. For the first six months, net earnings increased 27.5% and sales increased 19%. The company's president stated that growth from existing businesses accounted for 5.5% sales growth in the quarter and that the company saw broad-based strength across its businesses.

unum group 1Q 08_Statistical_Supplement_Notes

unum group 1Q 08_Statistical_Supplement_Notesfinance26 The document is Unum Group's statistical supplement for the first quarter of 2008. It includes financial highlights showing metrics such as premium income, revenues, income, assets and equity. It also includes segment operating results, quarterly historical results by segment, financial results and statistics by business segment (Unum US, Unum UK, Colonial Life, etc.), reserves data, investment information and statutory basis financial information. The supplement provides detailed quarterly and annual financial information about Unum Group to analyze performance by business segment.

aon Press Release 3Q 08

aon Press Release 3Q 08finance27 Aon reported financial results for the third quarter of 2008. Total revenue grew 6% to $1.8 billion with organic revenue growth of 2%. Earnings per share from continuing operations increased 27% to $0.52. Key highlights included a 33% increase in adjusted EPS to $0.69, a 140 basis point increase in adjusted pretax margin to 15.1%, and 6% organic revenue growth in commissions, fees and other. The company also repurchased $426 million of shares and increased projected annual savings from restructuring programs.

caterpillar Quarterly Releases1Q08 Cat Financial Results

caterpillar Quarterly Releases1Q08 Cat Financial Resultsfinance5 Caterpillar Financial Services Corporation (Cat Financial) reported record first quarter revenues of $779 million, a 9% increase over the previous year. Profits after tax were $124 million, a 1% decrease. New retail financing reached a record $3.47 billion, a 27% increase due to growth in Asia-Pacific, Diversified Services and Europe. While performance was strong, past dues and write-offs increased due to the softening U.S. housing industry. Cat Financial remains focused on providing reliable financing to customers and dealers.

caterpillar Cat Financial Services Corp. Q1 2008

caterpillar Cat Financial Services Corp. Q1 2008finance5 Caterpillar Financial Services Corporation (Cat Financial) reported record first quarter revenues of $779 million, a 9% increase over the previous year. Profits after tax were $124 million, a 1% decrease. New retail financing reached a record $3.47 billion, a 27% increase due to growth in Asia-Pacific, Diversified Services and Europe. While performance was strong, past dues and write-offs increased due to the softening U.S. housing industry. Cat Financial remains focused on providing reliable financing to customers and dealers.

aon 4Q 2008_Earnings Release Final

aon 4Q 2008_Earnings Release Finalfinance27 Aon reported financial results for the 4th quarter and full year of 2008. 4th quarter revenue was $1.9 billion, with organic growth in commissions and fees of 2%. EPS from continuing operations was $0.43. For the quarter, adjusted pretax margin increased 150 basis points to 19.9% in brokerage and 180 basis points to 19% in consulting. Full year 2008 revenue increased 4% to $7.6 billion with organic growth of 2%, and net income increased 71% to $1.5 billion compared to the prior year.

Pfizer Quarterly Corporate Performance

Pfizer Quarterly Corporate Performance finance5 The document summarizes Pfizer's second quarter 2008 earnings teleconference. Key highlights include:

- Revenues increased 9% year-over-year to $12.1 billion, and net income increased 119% to $2.8 billion. Adjusted diluted EPS grew 31% to $0.55.

- Cost-reduction initiatives have achieved $1.2 billion in savings to date against a target of $1.5-2 billion for 2008.

- Several major products performed well including Lipitor, Lyrica, Celebrex, and Viagra. Sutent and Chantix revenue also grew.

- Guidance for 2008 was reaffirmed for revenue of $

Pfizer Quarterly Corporate Performance - Second Quarter 2008

Pfizer Quarterly Corporate Performance - Second Quarter 2008finance5 This document summarizes Pfizer's second quarter 2008 earnings teleconference. It provides financial details such as a 9% increase in reported revenues and a 119% increase in reported net income compared to the previous year. Adjusted income increased 26% and adjusted diluted EPS grew 31%. Cost-reduction initiatives declined due to lower workforce costs. Several drugs were highlighted as top sellers, such as Lipitor, Lyrica, and Celebrex. Pfizer is on track to achieve its target of reducing costs by $1.5-2 billion through cost-cutting initiatives.

More Related Content

What's hot (16)

citigroup April 16, 2007 - First Quarter Press Release

citigroup April 16, 2007 - First Quarter Press ReleaseQuarterlyEarningsReports Citi reported record quarterly revenues of $25.5 billion, up 15%, and net income of $5.01 billion, down 10% from the prior year. Net income was reduced by an $871 million after-tax charge related to a structural expense review. Excluding this charge, net income was $5.88 billion, down 9% due to higher credit costs and a lower tax benefit. Revenues grew across most business segments, led by a 23% increase in Markets & Banking revenues. Credit costs increased $1.26 billion due to higher net losses and increases to loan loss reserves.

ameriprise 2Q06_Release

ameriprise 2Q06_Releasefinance43 - Ameriprise Financial reported net income of $141 million for Q2 2006, down from $149 million in Q2 2005. Adjusted earnings, which exclude certain one-time costs, increased 22% to $195 million.

- Revenue grew 8% to $2.1 billion, driven by a 13% increase in adjusted revenues. Adjusted revenues grew due to increases in management fees, distribution fees, and premiums from strong business performance.

- Adjusted return on equity increased to 10.7% from 10.4% in the previous quarter, reflecting continued improvement in business results and financial targets.

Citigroup 2007 Financial Services Conference

Citigroup 2007 Financial Services Conference QuarterlyEarningsReports3 Ken Lewis, Chairman, President and CEO of Bank of America, presented at the Citigroup Financial Services Conference on January 31, 2007. The presentation highlighted opportunities for growth at Bank of America and summarized key financial metrics for 2006, including 10% revenue growth and 16% growth in net income compared to the previous year. Lewis also outlined the company's short-term outlook and strategies to continue achieving attractive earnings growth in a challenging environment.

Angel Ron presenta los resultados del tercer trimestre 2012

Angel Ron presenta los resultados del tercer trimestre 2012Banco Popular The 9 months results were as planned. Recurrent revenues were up 31.4% driven by strong growth in net interest income and fees. Active liquidity management improved the loans to deposits ratio. Significant reinforcements were made to provisions to strengthen coverage ratios and allow the bank to face severe scenarios. The announced capital increase is well on track and expected to be completed in early December subject to shareholder and regulatory approval.

Resultados bancopopular

Resultados bancopopularWEB FINANCIAL GROUP INTERNATIONAL SL The 9 months results were as planned. Recurrent revenues were up 31.4% driven by strong growth in net interest income and fees. Active liquidity management improved the loans to deposits ratio. Significant reinforcements were made to provisions to allow the bank to face extreme scenarios. The announced capital increase is well on track and expected to be completed in early December subject to approvals.

omnicom group Q1 2008 Investor Presentation

omnicom group Q1 2008 Investor Presentationfinance22 The document provides an overview of Omnicom Group's financial results for the first quarter of 2008. It includes a summary of revenue and earnings growth compared to the first quarter of 2007. The document also discusses Omnicom's cash flow, credit profile, liquidity, acquisitions, and provides brief profiles of four agencies acquired during the first quarter.

first energy 4Q 06 Consolidated Report to the Financial_Community

first energy 4Q 06 Consolidated Report to the Financial_Communityfinance21 This document is Consolidated Energy's quarterly report for Q4 2006. It provides an analysis of changes in EPS from Q4 2005 to Q4 2006. Normalized non-GAAP EPS increased from $0.77 to $0.84 primarily due to regulatory changes in Ohio that increased earnings. However, lower distribution deliveries and generation revenues, along with higher fuel and purchase power costs reduced earnings. Guidance for 2007 normalized non-GAAP EPS is $4.05 to $4.25.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for the first quarter of 2008. Sales increased 11% to $5.4 billion compared to the first quarter of 2007, driven by growth across all business segments. Operating income rose 17% to $608 million due to increased volume and lower expenses. Earnings per share from continuing operations increased 31% to $0.93. The company also achieved record backlog of $37.7 billion and solid bookings of $6.5 billion during the quarter. Raytheon reaffirmed its full-year 2008 guidance and expects continued growth.

fannie mae Investor Summary

fannie mae Investor Summaryfinance6 This document provides a summary of Fannie Mae's financial results for the first quarter of 2008. Some key points:

- Fannie Mae reported a net loss of $2.2 billion for the quarter, an improvement from a $3.6 billion loss in the previous quarter. Revenues grew but losses on investments and derivatives also increased.

- Credit losses rose to $3.2 billion due to higher mortgage defaults and loss severities from falling home prices and economic weakness.

- Fannie Mae plans to raise $6 billion in new capital through stock offerings to maintain a strong balance sheet and provide stability in the mortgage market.

- Management is focusing on tightening lending standards and mitigating

First Quarter 2007 Earnings Presentation

First Quarter 2007 Earnings PresentationQuarterlyEarningsReports3 Bank of America reported first quarter 2007 results with key highlights as follows:

- Earnings of $5.3 billion and diluted EPS of $1.16, up 8% from first quarter 2006.

- Total revenue grew 3% to $18.4 billion compared to first quarter 2006, driven by a 10% increase in noninterest income, though net interest income declined 5%.

- Credit quality remained sound though provision expenses increased 23% compared to first quarter 2006 as credit costs trend toward more normal levels.

- Global Wealth and Investment Management saw client assets reach new highs of $547 billion and added over 500 premier banking sales associates over the past year.

progress energy Q2 2005 earnings release

progress energy Q2 2005 earnings releasefinance25 Progress Energy reported quarterly ongoing earnings of $0.63 per share and GAAP net loss of $0.01 per share for Q2 2005. Key highlights included milder weather negatively impacting earnings, writing off unrecoverable 2004 storm costs, and one less planned nuclear outage. Year-to-date ongoing earnings were $1.14 per share and GAAP earnings were $0.37 per share. Progress Energy reaffirmed its 2005 ongoing earnings guidance of $2.90-$3.20 per share.

Pfizer Quarterly Corporate Performance

Pfizer Quarterly Corporate Performancefinance5 In the third quarter 2008 earnings teleconference, Pfizer reported increased revenues and earnings compared to the previous year. Adjusted revenues increased 2% to $12.2 billion while adjusted income and EPS grew 5% and 7% respectively. Key products such as Lyrica, Celebrex and Viagra performed well. Pfizer also exceeded its cost reduction target, achieving $1.7 billion in savings through the third quarter with a goal of $2 billion for 2008 versus 2006. Pfizer narrowed its full-year revenue and EPS guidance ranges.

first energy 4Q 07

first energy 4Q 07finance21 This document provides a consolidated report and financial highlights for FirstEnergy Corp for the 4th quarter of 2007. Some key points:

- Normalized non-GAAP earnings per share for Q4 2007 were $0.90 compared to $0.84 in Q4 2006.

- GAAP earnings per share for Q4 2007 were $0.88 compared to $0.85 in Q4 2006.

- Normalized non-GAAP earnings for 2007 were $4.23 per share, near the top of guidance range.

- 2008 earnings guidance range is $4.15 to $4.35 per share.

hsbc Cover of 2008 Interim Results slide presentation Download 2008 Interi...

hsbc Cover of 2008 Interim Results slide presentation Download 2008 Interi...QuarterlyEarningsReports2 HSBC reported financial results for the first half of 2008. Profit before tax was $10.2 billion, down 28% from the first half of 2007. Earnings per share were $0.65, down 32% from the previous year. Loan impairment charges increased 58% to $10.1 billion due to deterioration in credit quality, particularly in North America. However, the bank remained profitable in all regions except North America and maintained a strong capital position with a Tier 1 capital ratio of 8.8%. Global Banking and Markets wrote down $3.9 billion related to subprime and credit market exposures.

danaher 05-2q-rel

danaher 05-2q-relfinance24 Danaher Corporation announced record results for the second quarter and first half of 2005. Net earnings for the second quarter increased 25.5% compared to 2004, and sales increased 19%. For the first six months, net earnings increased 27.5% and sales increased 19%. The company's president stated that growth from existing businesses accounted for 5.5% sales growth in the quarter and that the company saw broad-based strength across its businesses.

unum group 1Q 08_Statistical_Supplement_Notes

unum group 1Q 08_Statistical_Supplement_Notesfinance26 The document is Unum Group's statistical supplement for the first quarter of 2008. It includes financial highlights showing metrics such as premium income, revenues, income, assets and equity. It also includes segment operating results, quarterly historical results by segment, financial results and statistics by business segment (Unum US, Unum UK, Colonial Life, etc.), reserves data, investment information and statutory basis financial information. The supplement provides detailed quarterly and annual financial information about Unum Group to analyze performance by business segment.

hsbc Cover of 2008 Interim Results slide presentation Download 2008 Interi...

hsbc Cover of 2008 Interim Results slide presentation Download 2008 Interi...QuarterlyEarningsReports2

Similar to aon 2Q 08 Earnings Release (20)

aon Press Release 3Q 08

aon Press Release 3Q 08finance27 Aon reported financial results for the third quarter of 2008. Total revenue grew 6% to $1.8 billion with organic revenue growth of 2%. Earnings per share from continuing operations increased 27% to $0.52. Key highlights included a 33% increase in adjusted EPS to $0.69, a 140 basis point increase in adjusted pretax margin to 15.1%, and 6% organic revenue growth in commissions, fees and other. The company also repurchased $426 million of shares and increased projected annual savings from restructuring programs.

caterpillar Quarterly Releases1Q08 Cat Financial Results

caterpillar Quarterly Releases1Q08 Cat Financial Resultsfinance5 Caterpillar Financial Services Corporation (Cat Financial) reported record first quarter revenues of $779 million, a 9% increase over the previous year. Profits after tax were $124 million, a 1% decrease. New retail financing reached a record $3.47 billion, a 27% increase due to growth in Asia-Pacific, Diversified Services and Europe. While performance was strong, past dues and write-offs increased due to the softening U.S. housing industry. Cat Financial remains focused on providing reliable financing to customers and dealers.

caterpillar Cat Financial Services Corp. Q1 2008

caterpillar Cat Financial Services Corp. Q1 2008finance5 Caterpillar Financial Services Corporation (Cat Financial) reported record first quarter revenues of $779 million, a 9% increase over the previous year. Profits after tax were $124 million, a 1% decrease. New retail financing reached a record $3.47 billion, a 27% increase due to growth in Asia-Pacific, Diversified Services and Europe. While performance was strong, past dues and write-offs increased due to the softening U.S. housing industry. Cat Financial remains focused on providing reliable financing to customers and dealers.

aon 4Q 2008_Earnings Release Final

aon 4Q 2008_Earnings Release Finalfinance27 Aon reported financial results for the 4th quarter and full year of 2008. 4th quarter revenue was $1.9 billion, with organic growth in commissions and fees of 2%. EPS from continuing operations was $0.43. For the quarter, adjusted pretax margin increased 150 basis points to 19.9% in brokerage and 180 basis points to 19% in consulting. Full year 2008 revenue increased 4% to $7.6 billion with organic growth of 2%, and net income increased 71% to $1.5 billion compared to the prior year.

Pfizer Quarterly Corporate Performance

Pfizer Quarterly Corporate Performance finance5 The document summarizes Pfizer's second quarter 2008 earnings teleconference. Key highlights include:

- Revenues increased 9% year-over-year to $12.1 billion, and net income increased 119% to $2.8 billion. Adjusted diluted EPS grew 31% to $0.55.

- Cost-reduction initiatives have achieved $1.2 billion in savings to date against a target of $1.5-2 billion for 2008.

- Several major products performed well including Lipitor, Lyrica, Celebrex, and Viagra. Sutent and Chantix revenue also grew.

- Guidance for 2008 was reaffirmed for revenue of $

Pfizer Quarterly Corporate Performance - Second Quarter 2008

Pfizer Quarterly Corporate Performance - Second Quarter 2008finance5 This document summarizes Pfizer's second quarter 2008 earnings teleconference. It provides financial details such as a 9% increase in reported revenues and a 119% increase in reported net income compared to the previous year. Adjusted income increased 26% and adjusted diluted EPS grew 31%. Cost-reduction initiatives declined due to lower workforce costs. Several drugs were highlighted as top sellers, such as Lipitor, Lyrica, and Celebrex. Pfizer is on track to achieve its target of reducing costs by $1.5-2 billion through cost-cutting initiatives.

ameriprise 2Q07_Release

ameriprise 2Q07_Releasefinance43 - Ameriprise Financial reported increased earnings for the second quarter of 2007, with net income per share up 42% and adjusted earnings per share up 24%.

- Revenues grew 6% to $2.2 billion, driven by strong growth in fee-based businesses. Expenses rose 5% while income before taxes grew 14%.

- Net income was $196 million, up 39% from the prior year, while adjusted earnings rose 22% to $237 million, reflecting expense controls.

cardinal health 2008 Earnings Presentation

cardinal health 2008 Earnings Presentationfinance2 The document summarizes Cardinal Health's Q4 FY2008 earnings call with investors and analysts. It discusses financial results for Q4 and full year FY2008, with revenue growth of 3% and 5% respectively. It provides segment results for Healthcare Supply Chain Services and Clinical & Medical Products. The document also outlines financial goals and assumptions for FY2009, with total revenue growth forecast at 6-7% and non-GAAP EPS of $3.80-$3.95. Key priorities for FY2009 are also mentioned.

u.s.bancorp2Q 2008 Earnings Release

u.s.bancorp2Q 2008 Earnings Release finance13 U.S. Bancorp reported net income of $950 million for Q2 2008, down 17.8% from Q2 2007. Diluted earnings per share were $0.53, down 18.5% from the prior year. The decline was due to higher credit costs as the provision for credit losses increased $405 million over Q2 2007. Net interest income rose 15.6% to $1.908 billion from strong earning asset growth and an improved net interest margin. However, revenue growth was offset by a larger provision given stress in the housing and commercial real estate markets and the economic slowdown.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for Q2 2008, with sales up 11% and EPS up 27%. All business segments saw sales growth. Raytheon increased full-year guidance for sales, EPS, operating cash flow and return on invested capital. The company also reported solid bookings of $6 billion for Q2 and a backlog of $37.5 billion.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for the fourth quarter and full year of 2007. Quarterly sales increased 8% to $6 billion and income from continuing operations was up 84% to $634 million. For the full year, sales rose 8% to $21.3 billion while income from continuing operations grew 43% to $1.7 billion. Raytheon also increased its bookings guidance for 2008 based on record backlog of $36.6 billion in the fourth quarter.

clearchannel 318

clearchannel 318finance31 CC Media Holdings reported financial results for Q4 and full year 2008. Q4 revenue was $1.6 billion, down 14% year-over-year, and full year revenue was $6.7 billion, down 3%. Operating expenses grew 3% in Q4 and 5% for the full year. The company reported a large net loss of $4.99 billion in Q4 and $4.6 billion for the full year, primarily due to a $5.3 billion impairment charge. OIBDAN (operating income before depreciation and amortization) declined 50% in Q4 to $309 million and 21% for the full year to $1.8 billion. The company also announced

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for the third quarter of 2008, with sales up 12% and earnings per share up 17%. The company increased its full-year earnings guidance and announced a new $2 billion share repurchase plan. All of Raytheon's business segments experienced sales growth in the quarter.

Caterpillar Financial Services Corp. Q3 2008

Caterpillar Financial Services Corp. Q3 2008earningsreport Cat Financial reported third quarter 2008 revenues of $774 million, up 2% from the previous year. Profits were down 11% to $118 million due to decreased net yields on assets and higher expenses. New retail financing increased 22% to $4.38 billion, driven by growth in Asia-Pacific and diversified services. While past dues rose and write-offs increased, performance remained solid compared to previous recessions. Cat Financial maintained access to funding to support ongoing operations.

caterpillar Cat Financial Services Corp. Q3 2008

caterpillar Cat Financial Services Corp. Q3 2008finance5 Cat Financial reported third quarter 2008 revenues of $774 million, up 2% from the previous year. Profits were down 11% to $118 million due to decreased net yields on assets and higher expenses. New retail financing increased 22% to $4.38 billion, driven by growth in Asia-Pacific and diversified services. While past dues rose and write-offs increased, performance remained solid compared to previous recessions. Cat Financial maintained access to funding to support ongoing operations.

caterpillar Quarterly Releases » • 3Q08 Cat Financial Results

caterpillar Quarterly Releases » • 3Q08 Cat Financial Resultsfinance5 Cat Financial reported third quarter 2008 revenues of $774 million, up 2% from the previous year. Profits were down 11% to $118 million due to decreased yields on assets and higher expenses. New retail financing increased 22% to $4.38 billion, driven by growth in Asia and diversified services. While past dues rose and write-offs increased, the company said its portfolio performance remained solid compared to previous recessions.

cardinal health Q2 2008 Earnings Presentation

cardinal health Q2 2008 Earnings Presentationfinance2 The document summarizes Cardinal Health's Q2 FY2008 earnings call. It provides an overview of the company's financial results for Q2, including revenue growth of 7% but flat operating earnings growth of 1%. It reviews results and highlights for each of the company's business segments. The document also discusses Cardinal Health's FY2008 financial targets, goals and outlook, noting lowered EPS guidance of $3.75-3.85 due to challenges in the pharmaceutical supply chain business.

ameriprise NR_042208_1

ameriprise NR_042208_1finance43 - Ameriprise Financial reported financial results for Q1 2008 with net income of $191 million, up 16% from $165 million in Q1 2007. Earnings per share increased 21% to $0.82.

- Revenues increased 3% to $2.1 billion due to 10% growth in management fees, partially offset by lower investment income. Expenses rose 10% due to higher benefits costs from variable annuities.

- The company repurchased $270 million of stock in Q1 2008 and authorized an additional $1.5 billion repurchase program over the next two years. Challenging markets negatively impacted results but the company maintained a strong balance sheet.

Pfizer Quarterly Corporate Performance - Third Quarter 2008

Pfizer Quarterly Corporate Performance - Third Quarter 2008finance5 This document summarizes Pfizer's third quarter 2008 earnings teleconference. It discusses Pfizer's financial results for the third quarter and year-to-date, including adjusted revenues increasing 2% for both periods. It also reviews significant items that impacted results, progress on Pfizer's cost reduction target, and select product highlights for the quarter.

air products & chemicals Q3 fy 08 earnings release

air products & chemicals Q3 fy 08 earnings releasefinance26 - Air Products reported fiscal Q3 EPS from continuing operations of $1.32, an 18% increase over the prior year. Total revenues increased 16% to $2.8 billion due to higher volumes and pricing.

- Operating income increased 9% to $382 million, excluding a $237 million impairment charge for its U.S. Healthcare business. Several business segments saw increased sales and operating income.

- For Q4, the company anticipates EPS growth of 19-23% over the prior year, reflecting continued strong performance.

More from finance27 (20)

commercial metals Overview_03/08

commercial metals Overview_03/08finance27 CMC is a global steel and metals company with over 14,000 employees worldwide. It manufactures, recycles, markets, and distributes steel and metal products through a network of over 200 locations globally. CMC operates steel minimills, fabrication plants, service centers, and recycling facilities. It aims to be vertically integrated and diversified in its product offerings and geographic reach.

commercial metals 2Q 08_Presentation

commercial metals 2Q 08_Presentationfinance27 The document provides an overview of CMC's business model which focuses on vertical integration, product diversification, and global geographic dispersion. It then discusses CMC's current market conditions and outlook across different geographic regions and product lines, including details on earnings expectations, capital investment projects, and quarterly financial statistics. The document also reviews factors influencing costs and selling prices for CMC's various steel manufacturing operations in North America.

commercial metals BofA_05/08

commercial metals BofA_05/08finance27 The document provides an overview of CMC, a global steel and metals company. It discusses CMC's business model which focuses on vertical integration, product diversification, and global geographic dispersion. It also summarizes CMC's track record of conservative management and 30 consecutive years of profitability. Finally, it outlines CMC's five operating segments and overall strategy of achieving a global reach through regional focus and growth in key markets.

commercial metals Overview_06/08_2

commercial metals Overview_06/08_2finance27 CMC is a global steel and metals company with over 14,000 employees worldwide. It manufactures, recycles, markets, and distributes steel and metal products through a network of over 200 locations globally. CMC operates steel minimills, fabrication plants, service centers, and recycling facilities. It aims to vertically integrate its operations from scrap processing to steel fabrication to provide a hedge against steel and metal price fluctuations.

commercial metals Q3 08_Presentation

commercial metals Q3 08_Presentationfinance27 The document provides an overview of CMC's business model, current market conditions, earnings results, and operational metrics for the third quarter of 2008. It discusses CMC's strategy of vertical integration, product diversification, and global geographic dispersion. It also reviews earnings, sales, margins, capital investments, and performance across CMC's different business segments.

commercial metals Q3 08_Presentation

commercial metals Q3 08_Presentationfinance27 The document provides an overview of CMC's business model, current market conditions, earnings results, and operational metrics for the third quarter of 2008. It discusses CMC's strategy of vertical integration, product diversification, and global geographic dispersion. It also reviews demand trends, input costs, earnings, investments, segment performance, and operational details.

commercial metals Hodges_09/08

commercial metals Hodges_09/08finance27 This document provides an overview of Commercial Metals Company (CMC) and its quarterly performance. It discusses CMC's business model, including its vertical integration and product and geographic diversification. It also summarizes CMC's financial performance from 2003-2007, highlighting increasing sales, earnings, and shareholder returns over that period. Current market conditions and CMC's outlook are briefly addressed.

commercial metals 4thQ 2008

commercial metals 4thQ 2008finance27 The document provides an overview of CMC's business model and current market conditions for the 4th quarter of 2008. It summarizes CMC's key business segments, product lines, capital projects, financial statistics, and discusses challenges in the global steel market including falling prices, reduced demand, and excess inventory. It analyzes factors such as raw material costs, sales prices, margins, and operating profits across CMC's divisions.

commercial metals 4thQ 2008

commercial metals 4thQ 2008finance27 The document provides an overview of CMC's business model and current market conditions for the 4th quarter of 2008. It summarizes CMC's key business segments, current projects, liquidity position, financial statistics, and discusses challenges in the global steel market including falling prices, reduced demand, and excess inventory. It analyzes performance and outlook for CMC's Americas and international operations.

commercial metals GoldmanSachs_12/04/08

commercial metals GoldmanSachs_12/04/08finance27 This document summarizes notes from the 4th Annual Global Steel CEO Forum held by Goldman Sachs on December 4, 2008. It discusses the current challenging market conditions for the steel industry due to the global liquidity crisis, including falling prices, production cutbacks, and declining demand. Updates are provided on conditions and outlook for different markets, including further price declines and inventory reductions in North America, continued cutbacks and oversupply in Europe and the Middle East, and China's efforts to stimulate domestic demand and infrastructure spending to boost its economy and steel demand. Breaking the negative cycle depends on the effectiveness of global government intervention programs and restoration of confidence.

commercial metals 12/02/05TwinsBroch

commercial metals 12/02/05TwinsBrochfinance27 The document discusses how Commercial Metals Company (CMC) is different from other steel companies. It notes that CMC focuses on long steel products, has diversified its business across five segments including steel mills, fabrication, recycling, and marketing, and has a track record of consistent profitability and financial strength over 26 years. The document aims to show investors that CMC's strategy and performance set it apart from other steel industry firms.

commercial metals 12/02/05TwinsBroch

commercial metals 12/02/05TwinsBrochfinance27 The document discusses how Commercial Metals Company (CMC) is different from other steel companies. It notes that CMC focuses on long steel products, has diversified its business across five segments including steel mills, fabrication, recycling, and marketing, and has a track record of consistent profitability and financial strength over 26 years. The document aims to show investors that CMC's strategy and performance set it apart from other steel industry firms.

commercial metals 12/02/05TwinsBroch

commercial metals 12/02/05TwinsBrochfinance27 The document discusses how Commercial Metals Company (CMC) is different from other steel companies. It notes that CMC focuses on long steel products, has diversified its business across five segments including steel mills, fabrication plants, recycling, and marketing/distribution, and has a track record of consistent profitability and financial strength over 26 years. The document aims to show shareholders that CMC's business strategy and performance set it apart from other steel industry firms.

commercial metals 2005AR

commercial metals 2005ARfinance27 This document is Commercial Metals Company's 2005 Annual Report. It summarizes the company's financial performance for fiscal year 2005, including record net earnings of $286 million on net sales of $6.6 billion, up from $132 million on $4.8 billion the previous year. It discusses positive results across the company's business segments, including Domestic Mills, Domestic Fabrication, Recycling, and Marketing & Distribution. The annual report also provides an overview of the company's operations, strategic focus on vertical integration, and capital expenditure plans.

commercial metals 2005AR

commercial metals 2005ARfinance27 This document is the 2005 annual report for Commercial Metals Company. It summarizes the company's financial performance for fiscal year 2005, which saw record net earnings of $286 million on net sales of $6.6 billion, up from $132 million on $4.8 billion the previous year. The company's domestic mills and fabrication segments significantly outperformed the prior year due to higher steel prices and strong end-user demand. While operations in Poland saw a decline from the prior year, performance improved in the fourth quarter. Overall, the company benefited from favorable market conditions across most of its businesses.

commercial metals 2005AR

commercial metals 2005ARfinance27 This document is Commercial Metals Company's 2005 Annual Report which summarizes the company's financial performance for fiscal year 2005. Some key points:

- The company achieved record net earnings of $286 million on record net sales of $6.6 billion in fiscal year 2005, up from $132 million in net earnings on $4.8 billion in net sales in fiscal year 2004.

- All of the company's business segments - Domestic Mills, Domestic Fabrication, Recycling, and Marketing & Distribution - experienced strong financial performance and profitability in 2005.

- The company continued its strategy of vertical integration and diversification which has helped it perform well in changing market conditions.

- For

commercial metals AR_2006

commercial metals AR_2006finance27 This annual report summarizes Commercial Metals Company's financial performance in fiscal year 2006. Some key points:

- Record net earnings of $356 million on $7.6 billion in net sales, up from $286 million on $6.6 billion the prior year.

- All five business segments (domestic mills, CMCZ, domestic fabrication, recycling, and marketing/distribution) performed well due to favorable market conditions and the company's vertical integration strategy.

- Domestic mills set new records for sales, production, and shipments as metal spreads increased. The copper tube mill's operating profit increased significantly year-over-year.

commercial metals AR_2006

commercial metals AR_2006finance27 This annual report summarizes Commercial Metals Company's financial performance in fiscal year 2006. Some key points:

- Record net earnings of $356 million on $7.6 billion in net sales, up from $286 million on $6.6 billion the prior year.

- All five business segments (domestic mills, CMCZ, domestic fabrication, recycling, and marketing/distribution) performed well due to favorable market conditions and the company's vertical integration strategy.

- Domestic mills set production and shipment records while benefiting from high metal spreads. CMCZ also improved significantly through organizational changes and new investments.

commercial metals AR_2006

commercial metals AR_2006finance27 Commercial Metals Company reported record financial results for fiscal year 2006 with net sales of $7.6 billion, net earnings of $356 million, and diluted earnings per share of $2.89. All five of CMC's business segments performed well, with domestic steel mills, CMCZ (the Polish steel operation), and recycling being especially strong. Market conditions were favorable, especially for non-residential construction, and CMC executed well. The company also invested in new facilities, acquisitions, and branding initiatives. CMC has high confidence in its future due to the continued expected strength of its end markets and its vertically integrated business model.

commercial metals 2007_AR

commercial metals 2007_ARfinance27 Commercial Metals Company had a profitable year in 2007, approaching the record profits of 2006. The company made several strategic acquisitions, announced plans to build a new micro mill, and reorganized internally to take advantage of growth opportunities. All five of the company's business segments performed well. Safety remains a major focus.

Recently uploaded (20)

The Economic History of the United States 15

The Economic History of the United States 15Gale Pooley The Economic History of the United States 15

Paper: The World Game (s) Great Redesign.pdf

Paper: The World Game (s) Great Redesign.pdfSteven McGee Paper: The Great Redesign of The World Game (s): Equitable, Ethical, Eco Economic Epochs for programmable money, economy, big data, artificial intelligence , quantum computing.. federation, federated liquidity e.g., the "JP Morgan - Knickerbocker protocol" / global unified value unit

India’s Strategic Blueprint for Economic Growth.pdf

India’s Strategic Blueprint for Economic Growth.pdfRaj Kumble This presentation highlights the key elements of India’s Union Budget for 2025, which aims to set the country on a path of sustainable economic growth. The budget's major areas of focus include tax relief for the middle class, substantial investments in infrastructure, job creation, and significant support for research and development. The budget also introduces targeted measures to strengthen India’s maritime and MRO sectors, ensuring long-term global competitiveness. Abhay Bhutada’s endorsement underscores the transformative potential of these initiatives, particularly in promoting inclusive growth.

_Offshore Banking and Compliance Requirements.pptx

_Offshore Banking and Compliance Requirements.pptxLDM Global Offshore banking allows individuals and businesses to hold accounts in foreign jurisdictions, offering benefits like privacy, asset protection, and potential tax advantages. However, strict compliance regulations govern these banks to prevent financial crimes. Key requirements include Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, along with international regulations like FATCA (for U.S. taxpayers) and CRS (for global tax transparency).

THSYU Launches Innovative Cryptocurrency Platform: A New Era of Secure and Ef...

THSYU Launches Innovative Cryptocurrency Platform: A New Era of Secure and Ef...Google THSYU, a trailblazer in the global cryptocurrency trading landscape, is thrilled to announce the launch of its cutting-edge trading platform. This innovative platform is meticulously designed to provide secure, efficient, and user-friendly trading solutions. With this development, THSYU solidifies its position in the competitive cryptocurrency market while demonstrating its commitment to leveraging advanced technology for the protection of user assets.

NITI AAYOG: INDIA'S POLICY THINK TANK

NITI AAYOG: INDIA'S POLICY THINK TANKSunita C This PowerPoint presentation provides a comprehensive overview of NITI Aayog, covering its structure, objectives, key functions, major initiatives, and future outlook. It also compares NITI Aayog with the Planning Commission, discusses challenges, and highlights its role in India's policy-making landscape. Ideal for academic, research, and policy discussions.

AP Automation: The Competitive Advantage Your Business Needs

AP Automation: The Competitive Advantage Your Business NeedsAggregage https://www.accountantadvocate.com/frs/27799174/building-a-business-case-for-finance-automation

Struggling to get buy-in for finance automation? Learn how to build a compelling business case and streamline your purchase-to-pay process to drive efficiency, reduce costs, and stay ahead of the competition.

Slides: Eco Economic Epochs for The World Game .pdf

Slides: Eco Economic Epochs for The World Game .pdfSteven McGee Paper: The Great Redesign of The World Game (s): Equitable, Ethical, Eco Economic Epochs for programmable money, economy, big data, artificial intelligence , quantum computing.. federation, federated liquidity e.g., the "JP Morgan - Knickerbocker protocol" / global unified value unit

INDUSTRIAL ESTATES IN TAMIL NADU by Dr. S. Malini

INDUSTRIAL ESTATES IN TAMIL NADU by Dr. S. MaliniMaliniHariraj Tamil Nadu is a leading industrial hub in India, attracting foreign investment due to its strong infrastructure, logistics, and diverse manufacturing sector, including automobiles, aerospace, pharmaceuticals, textiles, electronics, and chemicals. The state has the second-highest GDP in India and houses the largest number of factory units (37,220), contributing 20% of India’s electronics production. It has a high concentration of Special Economic Zones (SEZs), accounting for one-third of the state’s exports, with key industrial estates like **Ambattur, Sriperumbudur, and Oragadam**. The **Tamil Nadu Small Industries Development Corporation (TANSIDCO)**, established in 1970, supports **MSMEs** by maintaining **41 Government Industrial Estates and 87 TANSIDCO Industrial Estates**, offering developed plots (5 cents to 1 acre) and various support services such as cluster development, technical guidance, and raw material assistance. Notable industrial estates include **Ambattur (one of Asia’s largest MSME hubs), Guindy (India’s first industrial estate), Sriperumbudur (home to Hyundai, Foxconn, and Samsung), Oragadam (major automotive hub), Irungattukottai (Renault-Nissan, BMW), and Vallam Vadagal (aerospace and defense industries).** These estates provide world-class infrastructure, including **reliable power, developed plots, common facility centers, strong connectivity (highways, ports, airports), 24/7 security, water supply, stormwater drains, sewage systems, green belts, and parks**, fostering a robust environment for industrial growth.

Monopoly Market: Features, Analysis and Impact

Monopoly Market: Features, Analysis and ImpactSunita C This PowerPoint presentation provides a detailed analysis of monopoly as a market structure, covering its key features, pricing strategies, barriers to entry, advantages, disadvantages, and real-world examples. It explores the impact of monopolies on consumers, market efficiency, and economic growth, along with government regulations and anti-trust policies to control monopolistic practices. The presentation also includes case studies of major monopolies and their influence on industries.

Gender board diversity and firm performance

Gender board diversity and firm performanceGRAPE We study the effects of gender board diversity on firm performance. We use novel and rich firm-level data covering over seven million private and public firms spanning the years 1995-2020 in Europe. We augment a standard TFP estimation with a shift-share instrument for gender board diversity. We find that increasing the share of women in the boardroom is conducive to better economic performance. The results prove robust in a variety of subsamples, and to a variety of sensitivity analyses. This outcome is driven primarily by firms from the service sector. The positive impact was stronger during the more recent years of our sample that is a period with relatively more board diversity.

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdf

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdfMatiasMendoza46 Libro de Varoufakis sobre la evolución del sistema capitalista.

SSON Report Webinar Recap - Auxis Webinar

SSON Report Webinar Recap - Auxis WebinarAuxis Consulting & Outsourcing SSON Report Webinar Recap.pdf