Apresentação call tiete 2 q11_final

- 2. 2Q11 Highlights Energy generation 41% higher than physical guarantee Operational Operational R$ 34 million invested, mainly, in the modernization of the Nova Avanhandava (347 MW), Ibitinga (132 MW) and Caconde (80 MW) power plants Net revenue of R$ 409 million, 2% higher than 2Q10 2% increase in costs and operational expenses, below inflation1 Finance Finance Ebitda reached R$ 304 million, with margin of 74% Net income of R$ 161 million, increased 6% comparing to 2Q10 AES Eletropaulo bilateral contract adjusted from R$ 159,85/MWh to R$ 173,68/MWh Dividends distribution on 22th September 2011, corresponding to 112% of net income Subsequent Subsequent Went into commercial operation on July 20th, 2011, the PCH São Joaquim, with 3 MW of installed Events Events capacity, located in São João da Boa Vista (SP); the operation of PCH São José, with 4 MW of installed capacity, will take place in 2H11 Winner of 4th Abrasca Value Creation Award - Sector Highlight 2011 – Energy, as the best model for creating value between 2008 and 2010 1 – IGP-M, 8,6% for the 12 months ended in 06/30/2011 2

- 3. High level of AES Tietê’s reservoirs reflects the good rainfall level during 2Q11 Reservoirs level of AES Tietê’s power plants1 97% 95% 98% 92% 94% 89% 87% 85% 82% 84% 85% 85% Caconde Água Barra Bonita Promissão Caconde HPP Vermelha 1Q09 1Q10 1Q11 1 – As of 06/30/2011 3

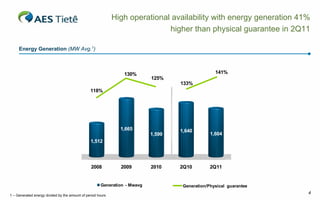

- 4. High operational availability with energy generation 41% higher than physical guarantee in 2Q11 Energy Generation (MW Avg.1) 130% 141% 125% 133% 118% 1,665 1,640 1,599 1,604 1,512 2008 2009 2010 2Q10 2Q11 Generation - Mwavg Generation/Physical guarantee 1 – Generated energy divided by the amount of period hours 4

- 5. Energy generated by AES Tietê’s power plants offset the 44% reduction in generation of Nova Avanhandava Energy Generation (GWh) 2Q10 2Q11 4% Agua Vermelha 5% 3% 4%4% 5% Promissão 5% 5% Ibitinga 6% 10% Nova Avanhandava 6% Bariri 5% 60% 62% Barra Bonita A 9% * Euclides da Cunha 9% Other Power Plants* 3,582 GWh 3,503 GWh * Caconde, Limoeiro, Mogi, SHPPs 5

- 6. Investments in the modernization of Nova Avanhandava, Ibitinga and Caconde power plants Investments (R$ million) 2Q11 Investments 78% 169 13 82 12 156 18% 57 4% 13 34 70 16 6 43 1 15 28 2009 2010 2011 (e) 2Q10 2Q11 Equipment and Modernization New SHPPs* Investments New SHPPs* * Small Hydro Power Plants IT projects 6

- 7. Brazil needs to add 25 GW2 up to 2020 Installed Capacity – GW 1 Growth by source – new auctions CAGR Total = 25 GW 2 + 5% 166 171 156 163 149 136 142 14 19 133 8 11 2 124 3 5 Thermal 116 2 42 42 42 6 GW2 Hydro 23 24 29 34 38 8 GW 6 14 110 110 110 110 110 110 110 110 110 110 Wind/ Renewable 11 GW 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Current installed capacity Auctioned Upcoming auctions 2 1 – Source: EPE (Ten-year Energy Plan – 2011 - in Public Hearing) 2 – Amount related to thermal power plant is an estimate of the Company 2 110 42 38 34 29 24 19 23 11 14 8 5 3 6 7

- 8. Opportunity to develop a gas-fired power plant project Thermal power plant project - Thermo SP • Project features • Next events - Combined cycle using natural gas - 18th august 2011: Public hearing in the - Estimated investment of R$ 1.1 billion municipality of Lorena - Natural gas consumption: 2.5 million m3/day - 2nd half of 2011: Power Auction realization A -5 (expected) • Opportunities Gas production - 10³ boe/day1 - Increased natural gas production due to the activities of the pre-salt - New Run-of-the-river (ROR) power plants create opportunities for thermal power plants 1,109 623 321 316 384 274 277 273 2005 2006 2007 2008 2009 2010 2014 2020 1 – Source: Petrobras (Estrategic Petrobras 2020 Plan) 8

- 9. Higher 2Q11 volume of billed energy through CCEE and other bilateral contracts Billed Energy (GWh) - 5% 7,881 7,507 132 201 949 847 1,146 + 7% 1,425 3,862 3,605 93 80 306 423 5,653 580 838 5,034 2,639 2,508 1H10 1H11 2Q10 2Q11 AES Eletropaulo Energy Reallocation Mechanism Spot Market Other Bilateral Contracts 9

- 10. Growth in net revenue, reflecting sales volume of CCEE and other bilateral contracts Net revenue (R$ million) - 4% 863 826 17 26 26 32 + 2% 403 409 10 12 820 768 10 15 383 382 1Q10 1Q11 2Q10 2Q11 AES Eletropaulo Spot/Energy Reallocation Mechanism Other bilateral contracts 10

- 11. Increased costs with PMSO2 below inflation Costs and operational expenses1 (R$ million) 9 8 1 1 102 105 2Q10 Personnel, Financ. Comp. Energy Operational 2Q11 Material and for Use of Water Purchased for Provisions Outsourced Res. and Resale and Other Services Transmission Operating Exp and Connection 1 – Do not include depreciation and amortization 2 – PMS = Personnel, Material and Outsourced Services 11

- 12. 2Q11 Ebitda margin stable in 74% Ebitda (R$ million) 79% 78% 75% 74% 678 643 300 304 1H10 1H11 2Q10 2Q11 EBITDA EBITDA Margin 12

- 13. Financial result benefited by exchange of debt in May, 2010 Financial Results (R$ million) 1H10 1H11 2Q10 2Q11 - (13) (28)* (24) (28) - 53% -15% * Excluding non-recurring effect of R$ 42.6 million related to FURNAS, the financial results would be R$ 71.0 million 13

- 14. Net income favored by revenue growth and good performance of the financial result Net Income (R$ million) 111% 111% 6% 4% Distribution of R$ 179.5 million in dividends 114% 112% related to 2Q11: - R$0.45 per common share 2% 2% - R$0.49 per preferred share 371 354 - Ex-dividends: August 12th, 2011 - Date of payment: September 22nd, 2011 151 161 1 1 1H10 1H11 2Q10 2Q11 Pay-out Yield Preferred Shares Net income 371 354 151 161 1 – Pay-out referred to dividends paid in the 2Q10 in relation to the net income adjusted by the IFRS 14

- 15. Final cash balance reflects the bilateral contract’s seasonality and increase in investment program Operating Cash Flow (R$ million) Final Cash Balance (R$ million) -14% - 37% 344 455 297 286 2Q10 2Q11 2Q10 2Q11 15

- 16. Stable debt, debentures maturing at the end of 2015 and nominal cost of CDI + 1.20% per year Net Debt (R$ billion) Average Cost and Average Term (Principal) 0,8 3.8 0,7 0,6 2.8 0.5x 0,5 0,4 0.4x 0,3 0,2 0,1 ‐ 111.9% 112.8% 0.6 0.5 2Q10 2Q11 2Q10 2Q11 13.9% Effective rate 14.3% Net debt Net debt / EBITDA 1 Average Term - Years CDI 1 – Percentage of CDI 16

- 17. 2Q11 Results The statements contained in this document with regard to the business prospects, projected operating and financial results, and growth potential are merely forecasts based on the expectations of the Company’s Management in relation to its future performance. Such estimates are highly dependent on market behavior and on the conditions affecting Brazil’s macroeconomic performance as well as the electric sector and international market, and they are therefore subject to changes.