Apresentação institucional 3_q12_en_v11

- 2. AES Brasil Group •P Presence i B il since 1997 in Brazil i • Operational Figures: • Consumption units: 7.7 million 53.6 • Distributed Energy: 53 6 TWh • Installed Capacity: 2,658 MW • Generated Energy : 13.9 TWh • 7.4 thousand AES Brasil People • Investments 1998-2011: R$ 8.1 billion • Solid corporate governance and sustainable practices • Safety as value #1 Disco Genco Service Provider 2

- 3. AES Brasil widely recognized in 2009-2012 Management Excellence Quality and Safety Environmental Concern (AES Tietê) (AES Sul) (AES El Eletropaulo) l ) (AES Tietê) (AES Brasil) (AES Tietê) (AES El t Eletropaulo) l ) (AES Eletropaulo) (AES Tietê) (AES Brasil) (AES Eletropaulo) (AES Tietê) (AES Tietê) (AES Tietê) (AES Eletropaulo) (2011- AES Tietê; 2012 – AES Eletropaulo) (AES Eletropaulo) (AES Eletropaulo) 3

- 4. Mission & visions Mission • Improving lives and promoting development by providing safe safe, reliable and sustainable energy solutions Visions • Be a leader in operational and financial management in Brazilian energy generation sector and expand installed capacity • Be the best distributors in Brazil 4

- 5. Social responsability: annual investments of R$ 83 million Development and transformation of communities “Casa de Cultura e Cidadania” Project - Offers courses and activities in culture and sports. Directly benefits approximately 5 6 tho sand appro imatel 5.6 thousand children and teenagers and indirectl 292 tho sand people in 7 units located within indirectly thousand nits ithin AES Brazil companies’ areas of operation Children educational development “Centros Educacionais Luz e Lápis” Project - Two units in São Paulo attending 300 children from 1 to 6 years old in condition of social vulnerability Education on safety and efficiency in energy consumption “AES Eletropaulo nas Escolas” Project - Education about safe and efficient use of energy to 4.5 thousand teachers and 404 thousand students from 900 public schools. The actions include recreational activities offered in adapted trucks. Converting consumers to clients Developed for grid connection regularization. Since 2004, more than 500 thousand families in low income communities were benefited from better energy supply conditions and social inclusion. 5

- 6. Shareholding structure BNDES AES Corp C 50.00% + 1 share P 0.00% T 46.15% C 50.00% - 1 share P 100% T 53.85% Cia. Brasiliana de Energia T 99.70% AES Sul C 99.99% T 99.99% AES Serviços C 99.00% T 99.00% C 71.35% P 32.34% T 52.55% AES Uruguaiana AES Tietê C 76.45% P 7.38% T 34.87% AES Eletropaulo C = Common Shares P = Preferred Shares T = Total 6

- 7. AES Tietê and AES Eletropaulo are listed in i BM&F B Bovespa ¹ ¹ Free Float Others² Market Cap³ 16.1% 19.2% 56.2% 8.5% US$ 1.3 bi 24.2% 24 2% 28.3% 28 3% 39.5% 39 5% 8.0% 8 0% US$ 4 0 bi 4.0 1 - Parent companies, AES Corp and BNDES, have similar voting capital on each of the Companies: approx 35.9% on AES Eletropaulo and 32.9% on AES Tietê 2 - Includes Federal Government and Eletrobrás shares in AES Eletropaulo and AES Tietê, respectively 3 - Base: 11/07/2012. Considers preferred shares for AES Eletropaulo and preferred and common shares for AES Tietê 7

- 8. AES Brasil is the second largest group in the electric sector Ebitda1 – 2011 (R$ Billion) 5.4 4.9 3.8 2.9 2.9 2.0 1.9 1.5 1.2 0.7 07 CEMIG Net AES BRASIL income1 2 CPFL TRACTEBEL NEOENERGIA CESP COPEL EDP LIGHT 0.3 0.3 DUKE CESP DUKE – 2011 (R$ Billion) ( ) 3.0 2.4 1.6 1.6 1.4 1.2 0.5 AES BRASIL2 CEMIG CPFL NEOENERGIA TRACTEBEL COPEL 1 – excluding Eletrobrás 2 – includes AES Atimus sale (aprox. R$ 1 billion in EBITDA and aprox. R$ 700 million in net income) LIGHT 0.1 01 EDP Source: Companies’ financial reports 8

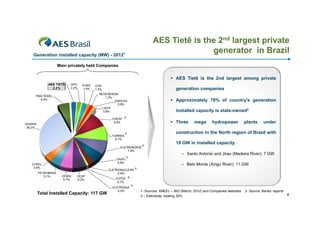

- 9. AES Tietê is the 2nd largest private generator in Brazil Generation installed capacity (MW) - 20121 Main privately held Companies AES Tietê is the 2nd largest among private AES TIETÊ 2,2% CPFL 2,2% DUKE 1,9% EDP 1,5% generation companies NEOENERGIA 1,2% ENDESA 0,8% LIGHT 0,8% TRACTEBEL 6,0% , CHESF 8,9% S DEMAIS 28,2% Approximately 78% of country’s generation country s installed capacity is state-owned2 ³ Three ELETRONORTE ³ 7,6% PETROBRÁS 5,1% ITAIPU ³ 5,8% CEMIG 5,7% CESP 6,2% Total Installed Capacity: 117 GW plants under 18 GW in installed capacity – Santo Antonio and Jirau (Madeira River): 7 GW – Belo Monte (Xingu River): 11 GW ELETRONUCLEAR 2,8% 2 8% CGTEE 0,7% hydropower construction in the North region of Brazil with FURNAS ³ 8,1% COPEL 3,8% mega ³ ³ ELETROSUL 0,5% ³ 1- Sources: ANEEL – BIG (March, 2012) and Companies websites 3 – Eletrobrás, totaling 35% 2- Source: Banks’ reports 9

- 10. AES is among the top 3 largest distribution players in Brazil Consumers – D /2011 C Dec/2011 16% 30% • 63 13% AES A Brasil Cemig 7% in Brazil • AES Brasil is one of the largest electricity distribution group in Brazil: – AES Eletropaulo: 45 TWh distributed, 12% 7% companies distributing 430 TWh CPFL Energia 5% distribution 12% 10.5% of the Brazilian market – AES Sul: 8.6 TWh distributed, 2.0% of the Consumption (GWh) - 2011 Neo Energia 13% Copel 12% Light Brazilian market AES Eletropaulo is the largest electricity distributor in Latin America in terms of revenue supply according to ABRAADE¹ supply, 52% EDP 11% Outros 7% 6% 6% 6% 1 – Brazilian Association of Electricity Distributors Distribution companies’ operations are restricted to their concession areas Acquisitions must only be performed by the holdings of economic groups 10 10

- 11. Energy Sector in Brazil

- 12. Energy sector in Brazil: business segments Free Clients Distribution Transmission • Consumption of 113 TWh • 63 companies • 68 companies (26% of Brazilian total market) • 430 TWh of energy • 68% private sector • Conventional sources: above 3,000 kW • Alternative sources: between 500 kW and 3,000 kW • Large consumers can purchase energy directly from generators • Free contracting environment distributed in 2011 • High voltage transmission • 70 million consumers • 67% private sector (>230 kV) • 98,648 km in extension • Annual tariff adjustment • Tariff reset every four or lines (SIN¹) • Regulated public service with free access five years • Regulated public service • Regulated contracting • Regulated tariff (annually adjusted by inflation) environment • 13 groups controlling 76% of total installed capacity • 22% private sector • 1,862 power plants • 117 GW of installed capacity • 73% hydroelectric • 17% thermoelectric • 5% biomass • 4% SHPP2 • 1% Wi d Wind • Contracting environment – ¹ Interconnected National System ² Small Hydro Power Plants Generation Sources: EPE, Aneel, ONS and Banks’ reports free and regulated markets 12

- 13. Energy sector in Brazil: contracting environment g Regulated market Free market Generators, Generators Independent Power Producers (IPPs), Trading companies and Auto producers Generators and Independent Power Producers (IPPs) Auctions: New Energy and Existing Energy Distribution companies • Bilateral contracts (PPAs1) Free clients Main auctions (reverse auctions): – New Energy (A-5): Delivery in 5 years, 15-30 years regulated PPA1 – New Energy (A-3): Delivery in 3 years, 15-30 years regulated PPA1 – Existing Energy (A-1): Delivery in 1 year, 5-15 years regulated PPA1 1 – Power Purchase Agreement 13

- 14. Electric sector in Brazil: demand and supply balance Static balance1 – Load x Supply2 (considering reserve energy3) Static balance - Load x Suppl (MW avg) e ly 100,000 100 000 90,000 • Brazilian electric system 80,000 presents a surplus in the 70,000 , 60,000 energy balance for the 50,000 years to come 40,000 30,000 • Low risk of rationing 20,000 • Expansion opportunities 10,000 - 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Balance (%) 5.9% 7.8% 11.2% 9.6% 8.4% 10.0% 10.6% 8.2% 5.4% 4.2% Balance 3,528 4,875 7,443 6,684 6,097 7,590 8,404 6,734 4,673 3,770 Reserve 439 1,007 1,509 1,743 1,746 2,959 2,959 2,959 2,959 since this capacity is not 2,959 Supply 62,912 66,355 72,585 74,492 76,823 80,320 84,428 85,886 87,601 90,409 Load 59,823 62,487 66,651 69,551 72,472 75,689 78,983 82,111 85,887 yet fully contracted 89,598 1 -Ten-year Energy Plan 2020, May/2011 – EPE 2- Supply based on physical guarantee 3- Energy destined to equalize the differences between the sum of power plants’ physical guarantees and the system’s physical guarantee. 14

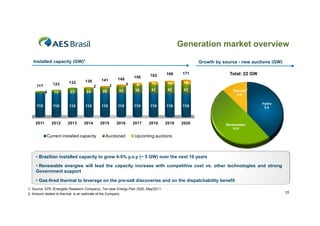

- 15. Generation market overview Installed capacity (GW)1 Growth by source - new auctions (GW) 141 136 162 166 171 156 148 11 14 19 41 42 42 123 133 13 23 24 28 33 8 38 110 110 110 110 110 110 110 110 110 110 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total: 22 GW 117 6 Current installed capacity 5 3 2 Auctioned Thermal2 2.6 Hydro 8.6 Renewables 10.6 Upcoming auctions • Brazilian installed capacity to grow 4-5% y.o.y (~ 5 GW) over the next 10 years • Renewable energies will lead the capacity increase with competitive cost vs. other technologies and strong Government support • Gas-fired thermal to leverage on the pre-salt discoveries and on the dispatchability benefit 1- Source: EPE (Energetic Research Company), Ten-year Energy Plan 2020, May/2011 2- Amount related to thermal is an estimate of the Company 15

- 17. Distribution Companies: Tariff methodology Tariff reset and readjustment • Tariff Reset is applied each 4 years for AES Eletropaulo − Base date: Jul/2011 • Parcel A Costs − Parcel A: costs are largely passed through to the tariff − Parcel B: costs are set by ANEEL • Tariff Readjustment: annually − Parcel A : costs are largely passed through to the tariff − Parcel B: cost are adjusted by IGPM +/- X(1) Factor X WACC Energy Purchase Transmission Sector Charges Regulatory Opex (PMSO) Investment Remuneration Remuneration R ti Asset Base X Depreciation Depreciation Regulatory Ebitda 1 – X Factor: index that captures productivity gains − Non-manageable costs that are largely passed through to the tariff − Incentives to reduces costs • Regulatory Opex: – Efficient operating cost determined by ANEEL (National Electricity Agency) • Remuneration Asset Base: – Prudent investments used to calculate the investment remuneration (applying WACC) and depreciation Parcel A - Non-Manageable Costs Parcel B - Manageable Costs 17

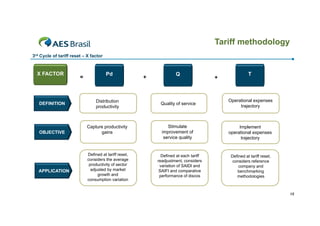

- 18. Tariff methodology 3rd Cycle of tariff reset – X factor X FACTOR DEFINITION OBJECTIVE APPLICATION = Pd Distribution productivity Capture productivity C t d ti it gains Defined at tariff reset, considers the average productivity of sector adjusted by market growth and consumption variation + Q + T Quality of service Operational expenses trajectory Stimulate Sti l t improvement of service quality Implement operational expenses trajectory Defined at each tariff readjustment, considers variation of SAIDI and SAIFI and comparative performance of discos Defined at tariff reset, considers reference company and benchmarking methodologies 18

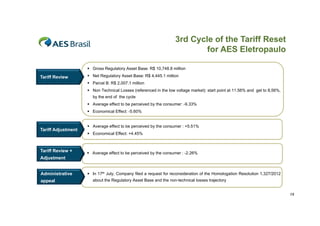

- 19. 3rd Cycle of the Tariff Reset for AES Eletropaulo Gross Regulatory Asset Base: R$ 10,748.8 million Tariff Review 4,445.1 Net Regulatory Asset Base: R$ 4 445 1 million Parcel B: R$ 2,007.1 million Non Technical Losses (referenced in the low voltage market): start point at 11.56% and get to 8,56%, by the end of the cycle Average effect to be perceived by the consumer: -9.33% Economical Effect: -5.60% Tariff Adjustment Tariff Review + T iff R i A Average effect t b perceived b th consumer : +5.51% ff t to be i d by the 5 51% Economical Effect: +4.45% Average effect to be perceived by the consumer : -2.26% Adjustment Administrative appeal In 17th July Company filed a request for reconsideration of the Homologation Resolution 1 327/2012 July, 1,327/2012 about the Regulatory Asset Base and the non-technical losses trajectory 19

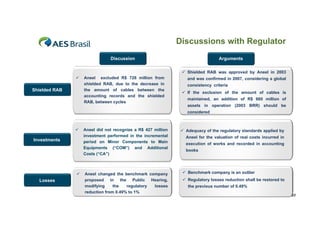

- 20. Discussions with Regulator Discussion Arguments Shielded RAB was approved by Aneel in 2003 Shielded RAB Aneel excluded R$ 728 million f A l l d d illi from shielded RAB, due to the decrease in the amount of cables between the accounting records and the shielded RAB, between cycles RAB b t l and was confirmed in 2007, considering a global consistency criteria If the exclusion of the amount of cables is maintained, an addition of R$ 660 million of , $ assets in operation (2003 BRR) should be considered Investments Losses Aneel did not recognize a R$ 427 million investment performed in the incremental period on Minor Components to Main Equipments (“COM”) and Additional q p ( ) Costs (“CA”) Aneel changed the benchmark company proposed in the Public Hearing, modifying the regulatory losses reduction from 0.49% to 1% Adequacy of the regulatory standards applied by Aneel for the valuation of real costs incurred in execution of works and recorded in accounting books Benchmark company is an outlier p y Regulatory losses reduction shall be restored to the previous number of 0.49% 20

- 21. Provisional Measure 579: energy cost reduction program p g Program created by Provisional Measure 579 (“PM 579”) in 09/12/2012; Law Decree 7805 was published on 09//17/2012 and regulates the terms of PM 579; Conversion of this provisional measure into law depends on the approval of the Brazilian Congress - More than 400 amendments were submitted to Congress It aims to reduce tariffs by an average of 20% (Residential: 16.2% and industrial 20% to 28%), as from February, 2013, through: - Reduction Sector Charges ( g (RGR, CCC and CDE): - 7% , ) % - Renewal Leases Generation and Transmission: - 13% New rules are only valid for the concessions granted before 1995 i e they are not valid for AES Eletropaulo 1995, i.e, (concession expires in 2028) nor for AES Tietê (concession expires in 2029). 21

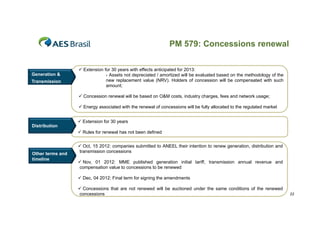

- 22. PM 579: Concessions renewal Generation & Transmission Extension for 30 years with effects anticipated for 2013: - Assets not depreciated / amortized will be evaluated based on the methodology of the new replacement value (NRV). Holders of concession will be compensated with such amount; Concession renewal will be based on O&M costs, industry charges, fees and network usage; Energy associated with the renewal of concessions will be fully allocated to the regulated market Extension for 30 years Distribution Rules for renewal has not been defined Other terms and timeline Oct, 15 2012: companies submitted to ANEEL their intention to renew generation, distribution and transmission concessions Nov, 01 2012: MME published generation initial tariff, transmission annual revenue and compensation value to concessions to be renewed Dec, 04 2012: Final term for signing the amendments Concessions that are not renewed will be auctioned under the same conditions of the renewed concessions 22

- 23. PM 579: Opportunities and risks AES Tietê Opportunities O t iti Competitive p p prices in the free market (~ R$ 100 – R$ 110/MWh) Possible pressure of higher prices at the free market in the short term Possible sale of electricity to generators whose concessions are expiring, to cover contracts set in the free market between 2015 and 2017 Risks Investments in modernization to be recognized by ANEEL at the end of the concession AES Eletropaulo Marginal benefits in collection and potential decrease in delinquency, since energy costs will be reduced Increase in energy consumption, as a potential result of the drop in tariffs Exchange rate variation of the energy price purchased from Itaipu will no longer be suportted by distribution companies, p y p , but by Eletrobras Cash impact between tariff adjustments of hydrological risks due to the allocation of energy quotas 23

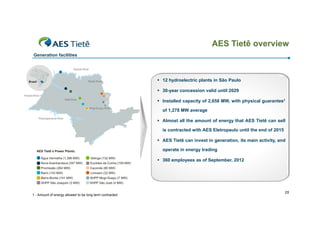

- 25. AES Tietê overview Generation facilities 12 hydroelectric plants in São Paulo 30-year concession valid until 2029 Installed capacity of 2 658 MW with physical guarantee1 2,658 MW, of 1,278 MW average Almost all the amount of energy that AES Tietê can sell is contracted with AES Eletropaulo until the end of 2015 AES Tietê can invest in generation, its main activity, and operate in energy trading 360 employees as of September, 2012 1 - Amount of energy allowed to be long term contracted 25

- 26. Generated energy shows high operational availability p y Generated energy (MW avarage1) 9M12 Generated energy by power plant (MW average1) 130% 125% 124% 126% 129% 4% Agua Vermelha 3% 3% Nova A N Avanhandava h d 5% Promissão 5% 1,665 1,599 1,582 1,551 1,689 Ibitinga 59% 9% Bariri Barra Bonita 11% Euclides da Cunha Other Power Plants 2009 2010 Generation - Mwavg 2011 9M11 9M12 Generation/Physical guarantee 1 – Generated energy divided by the amount of hours * Caconde, Limoeiro, Mogi and SHPPs 26

- 27. A significant amount of billed energy and net revenues comes from the bilateral contract with AES Eletropaulo Billed energy (GWh) Net revenues (%) 89% 15,112 112 15,112 15 14,729 14 729 14,706 301 117 13.032 13,032 554 1,150 1,340 1,980 1 980 421 1,519 2,331 2 331 11,118 1,942 1 942 346 1.192 1,083 1 083 2,970 1,535 3% 2% 6% 11,108 11 108 11,108 11 108 11,108 11 108 8,045 8,558 AES Eletropaulo 2009 AES Eletropaulo 2010 ERM1 MRE1 2011 Spot Market 1 – Energy Reallocation Mechanism 9M11 9M12 Other bilateral contracts Other bilateral contracts Other bilateral contracts Spot Market ERM MRE11 27

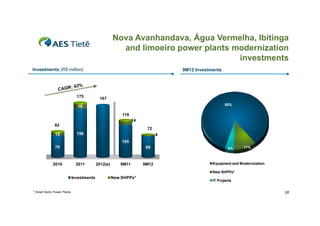

- 28. Nova Avanhandava, Água Vermelha, Ibitinga and limoeiro power plants modernization p p investments Investments (R$ million) 175 9M12 Investments 167 85% 19 119 14 82 12 72 156 4 105 70 2010 68 2011 2012(e) 9M11 9M12 4% 11% Equipment and Modernization New SHPPs* Investments * Small Hydro Power Plants New SHPPs* IT Projects 28

- 29. Growth opportunities “Thermal São Paulo” Project - Natural N t l gas combined cycle th bi d l thermal plant, with 550 MW of i t ll d capacity l l t ith f installed it - Project will not participate in 2012 auctions (A-3 and A-5) due to gas unavailability - Environmental License was restored after the decision of São Paulo State Court of Justice - Next steps: Obtainment of the installation license “Thermal A “Th l Araraquara” Project ”P j t - Natural gas combined cycle thermal plant, with 579 MW of installed capacity - Purchase option acquired in March, 2012 - Project ill t P j t will not participate i 2012 auctions (A 3 and A 5) d t gas unavailability ti i t in ti (A-3 d A-5) due to il bilit - Next steps: Obtainment of the installation license 29

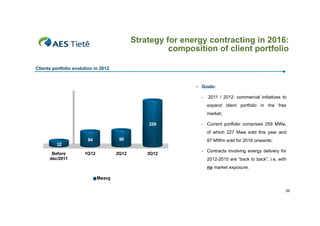

- 30. Strategy for energy contracting in 2016: p p composition of client portfolio Clients portfolio evolution in 2012 • Goals: - 2011 / 2012: commercial initiatives to expand client portfolio in the free market; 259 - Current portfolio comprises 259 MWa, of which 227 Mwa sold this year and 84 90 1Q12 2Q12 87 MWm sold for 2016 onwards; 32 Before dec/2011 3Q12 - C t Contracts i t involving energy d li l i delivery f for 2012-2015 are “back to back”, i.e, with no market exposure. Mwavg 30

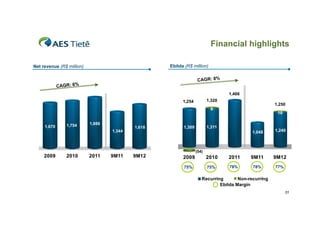

- 31. Financial highlights Ebitda (R$ million) Net revenue (R$ million) 1,466 1,320 1 320 1,254 1 254 1,250 9 1,670 1 670 1,754 1 754 1,886 , 1,344 1,618 10 1,311 1,309 1,048 1,240 (54) 2009 2010 2011 9M11 9M12 2009 2010 2011 9M11 9M12 75% 75% 78% 78% 77% Recurring Non-recurring Ebitda Margin 31

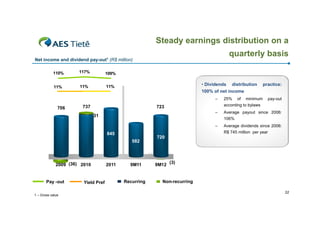

- 32. Steady earnings distribution on a quarterly q arterl basis Net income and dividend pay-out1 (R$ million) 110% 117% 109% 11% 11% 11% • Dividends distribution 100% of net income – 706 737 – 706 1 – Gross value Yield Pref p y pay-out Average payout since 2006: 582 2011 Average dividends since 2006: R$ 745 million per year 845 Pay -out minimum 106% – 2009 (36) 2010 of according to bylaws 723 31 742 25% practice: 9M11 Recurring 720 9M12 (3) Non-recurring 32

- 33. Debt profile Amortization schedule – principal (R$ million) Net debt (R$ billion) 0.7x 0.3x 0.7x 0.7x 0.6x 0.3x 0.3x 0.6x 0.4x 0.3x 300 0.4 4 2010 Net Debt 0.5 9M11 9M12 300 2013 2014 2015 0.5 2011 0.4 4 2009 0.4 300 Net Debt / Ebitda Gross Debt/Ebitda Ebitda/Financial expenses of 1.75x 1 – Brazilian Interbank Interest Rate Average Cost 3Q12 Average Cost (% CDI)1 115% 121% Average Term (years) 2.5 1.5 Effective Rate Covenants Gross debt/Ebitda of 2.5x 3Q11 12.7% 9.7% 33

- 34. Capital markets Daily avg volume (R$ thousand) AES Tietê X Ibovespa X IEE 12 months A 140 703 638 553 546 19,910 120 13,922 8% -1% -3% -6% -10% 100 80 Nov-11 10,187 4,239 IEE May-12 Ibovespa GETI4 Aug-12 TSR 3,397 9,683 9,537 2,101 14,885 8,086 2009 Feb-12 Nov-12 Preferred 5,025 12,584 2010 Common 2011 YTD Oct/12 Shares negotiated (thousand) GETI3 A 09/12/2012: The Brazilian Government announced the Energy Reduction Program, by b the PM 579 • Market Cap4: R$8.45 billion / US$ 4.02 billion • BM&FBovespa: GETI3 (common shares) and GETI4 (preferred shares) • ADRs ADR negotiated i US OTC M k t AESAY ( ti t d in Market: (common shares) and AESYY h ) d (preferred shares) 1 – Index: 11/07/2011 = 100 2 – Electric Energy Index 3 – Total Shareholders’ Return 4 – Index: 11/07/2012 34

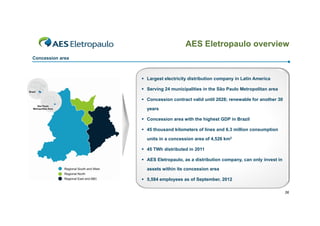

- 36. AES Eletropaulo overview Concession area Largest electricity distribution company in Latin America Serving 24 municipalities in the São Paulo Metropolitan area Concession contract valid until 2028; renewable for another 30 years Concession area with the highest GDP in Brazil 45 thousand kilometers of lines and 6.3 million consumption units in a concession area of 4,526 km2 45 TWh distributed in 2011 AES Eletropaulo, as a distribution company, can only invest in assets within its concession area 5,584 employees as of September, 2012 36

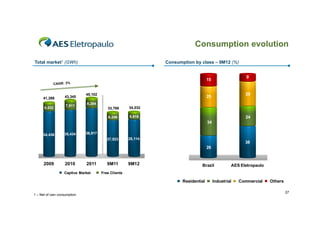

- 37. Consumption evolution Total market1 (GWh) Consumption by class – 9M12 (%) 9 15 41,269 6,832 43,345 7,911 45,102 29 25 8,284 33,769 34,032 6,246 5,918 24 34 34,436 35,434 36,817 27,523 28,114 38 26 2009 2010 2011 Captive Market 9M11 9M12 Brazil Free Clients Residential 1 – Net of own consumption AES Eletropaulo Industrial Commercial Others 37

- 38. Industrial class Industrial class X Industrial production in São Paulo State 15% 10% 5% 0% • -5% -10% Economic crisis -15% Jul-07 Feb-08 Sep-08 Apr-09 Nov-09 Jun-10 Jan-11 Aug-11 Mar-12 Oct-12 Industrial Production SP (% 12 months) by is manufacturing industry performance in São Paulo State Industrial (% 12 months) Consumption of industrial class by activity1 – AES Eletropaulo consumption influenced Economic recovery Industrial • Recent slowdown is influenced by y the decrease of industrial production in 2011 and 2012 Other industries 51% 1 – As of September 2012. Vehicles, Chemical, Rubber, Plastic and Metal Products 49% 38

- 39. Residential class Residential Consumption x Real Income ‐ São Paulo (Q‐2*) Avg Real Income R$ ‐ SP ( (Q ‐2*) 2,000 4,800 1,900 4,300 1,800 1,700 3,800 1,600 3,300 1,500 1,400 Residentia GWh al ‐ Residential class X A erage income in São Paulo Metropolitan Area Average Pa lo • by average income • 2,800 , • 2,300 2008 2009 2010 2011 Metropolitan Area will sustain growth of residential class 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2007 Income expansion trend in São Paulo 1,300 1,200 Residential consumption driven Average annual growth (2003- 2011): 2012 – total residential market: 5.5% y.o.y Consumption per consumer (i kWh) C ti (in – consumption per consumer: 2.1% y.o.y - 8.7% 258 Rationing 220 192 2000 2001 2002 199 2003 203 207 2004 2005 223 213 219 2006 2007 2008 228 229 234 237 Consumption per consumer is still 8.7% lower than in the period before the rationing 2009 2010 2011 Sep YTD 2012 1 - Two quarters of delay in relation to consumption 39

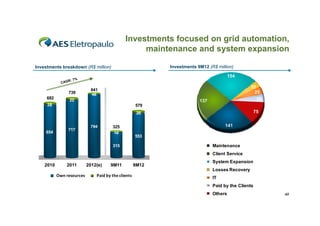

- 40. Investments focused on grid automation, maintenance and system expansion y p Investments 9M12 (R$ million) Investments breakdown (R$ million) 154 800 700 739 682 20 25 26 841 46 22 137 28 579 600 75 26 500 400 300 654 717 794 200 325 10 141 553 Maintenance 315 100 Client Service 0 2010 2011 2012(e) 9M11 9M12 System Expansion Losses Recovery Own resources Paid by the clients id b h li IT Paid by the Clients Others 40

- 41. Best SAIDI since 2006 and within regulatory limits SAIDI - System average interruption duration index 10.09 9.32 8.68 - 13% 11.86 10.60 10.62 10.36 8.62 4.48 2009 2010 2011 8th 7th 10M11 Jan-Oct 11 10M12 3.90 Jan-Oct 12 6th SAIDI (hours) SAIDI Aneel Reference ABRADEE ranking position among the 28 utilities with more than 500 thousand customers ► Sources: ANEEL, AES Eletropaulo and ABRADEE 2012 SAIDI ANEEL Reference: 8.67 hours 41

- 42. SAIFI remains below the regulatory limit and still decreasing SAIFI - System average interruption frequency index 7.87 6.17 7.39 5.46 6.93 - 18% 5.54 5.45 2009 2010 2011 7th 3rd 10M11 4.84 8.68 Jan-Oct 11 10M12 6.99 Jan-Oct 12 4th SAIFI (times) SAIFI Aneel Reference ABRADEE ranking position among the 28 utilities with more than 500 thousand customers ► Sources: ANEEL, AES Eletropaulo and ABRADEE 2012 SAIFI ANEEL Reference: 6.87 times 42

- 43. Losses level close to the regulatory reference for t e 3 d Cyc e o Tariff Reset e e e ce o the 3rd Cycle of a eset Losses (last 12 months) 11.8 10.9 10 9 Regulatory Reference² - Total Losses (last 12 months) 10.5 10.6 10 6 10.4 5.3 4.4 4.0 4.1 6.5 6.5 6.5 2010 2011 3Q11 3Q12 9.8 9.4 2013/2014 2014/2015 6.2 2009 10.3 10 3 4.2 6.5 10.7 10 7 Technical Losses ¹ 2011/2012 2012/2013 Non Technical Losses 1 – In January 2012, the Company improved the assessment of the technical losses, which were decreased to a level of 6.1%. The number for the last twelve months ended in 3Q12 is 6.2% 2 – Values estimated by the Company to make them comparable with the reference for non-technical losses determined by the Aneel 43

- 44. Financial highlights Net revenues (R$ million) Ebitda (R$ million) 2,413 9,697 9 697 426 9,836 , 8,786 2,848 933 1,775 7,371 7,383 87 197 339 1,491 1,648 1,716 442 1,473 324 670 1,392 439 231 2009 2010 2011 9M11 9M12 2009 2010 2011 9M11 9M12 Recurring Regulatory assets and liabilities 1 Non-recurring 1 – Non recurring 2011 : Includes sale of AES Eletropaulo Telecom with a R$ 707 million impact on Ebitda 44

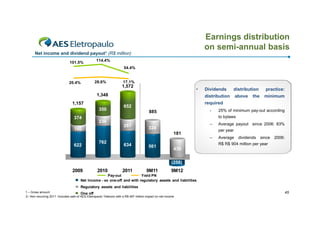

- 45. Earnings distribution on semi-annual basis Net income and di id d payout1 (R$ million) N ti d dividend t illi ) 101.5% 114.4% 54.4% 20.4% 28.6% 17.1% 1,572 • 1,348 1,157 350 374 practice: minimum required 652 - 885 25% of minimum pay-out according to bylaws 236 287 160 – 324 181 622 Dividends distribution distribution above the 762 634 561 Average payout since 2006: 83% per year – Average dividends since 2006: R$ R$ 904 million per year 439 (258) 2009 2010 2011 9M11 9M12 Pay-out Yield PN Net Income - ex one-off and with regulatory assets and liabilities Regulatory assets and liabilities 1 – Gross amount One off 2– Non recurring 2011 :Includes sale of AES Eletropaulo Telecom with a R$ 467 million impact on net income 45

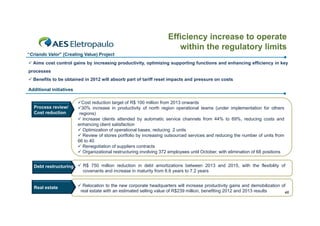

- 46. Efficiency increase to operate within the regulatory limits “Criando Valor” (Creating Value) Project Aims cost control gains by increasing productivity, optimizing supporting functions and enhancing efficiency in key processes Benefits to be obtained in 2012 will absorb part of tariff reset impacts and pressure on costs Additional initiatives Process review/ Cost reduction Cost reduction target of R$ 100 million from 2013 onwards $ 30% increase in productivity of north region operational teams (under implementation for others regions) Increase clients attended by automatic service channels from 44% to 69%, reducing costs and enhancing client satisfaction Optimization of operational bases, reducing 2 units Review of stores portfolio by increasing outsourced services and reducing the number of units from 66 to 40 Renegotiation of suppliers contracts Organizational restructuring involving 372 employees until October, with elimination of 68 positions Debt restructuring R$ 750 million reduction in debt amortizations between 2013 and 2015, with the flexibility of covenants and increase in maturity from 6.6 years to 7.2 years Real estate Relocation to the new corporate headquarters will increase productivity gains and demobilization of real estate with an estimated selling value of R$239 million, benefiting 2012 and 2013 results 46

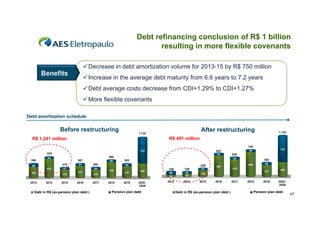

- 47. Debt refinancing conclusion of R$ 1 billion resulting in more flexible covenants Decrease in debt amortization volume for 2013-15 by R$ 750 million Benefits Increase in the a erage debt mat rit from 6 6 years to 7 2 years average maturity 6.6 ears 7.2 ears Debt average costs decrease from CDI+1.29% to CDI+1.27% More flexible covenants Debt amortization schedule Before restructuring After restructuring 1.133 1.133 R$ 491 million R$ 1,241 million 744 578 388 387 275 86 533 302 2013 51 494 44 47 228 2014 51 2015 58 280 54 337 2016 Debt in R$ (ex-pension plan debt ) 436 2017 2018 321 2019 530 54 383 62 226 732 58 637 732 225 400 2020 2028 Pension plan debt 138 128 86 52 44 83 2014 2015 62 686 476 178 2013 587 47 383 321 2016 Debt in R$ (ex-pension plan debt ) 2017 2018 2019 400 2020 2028 Pension plan debt 47

- 48. More flexible covenants and considering IFRS changes FROM TO Net d bt Adj t d Ebitda 3.5 N t debt / Adjusted Ebitd < 3 5 Financial Index Gross debt / Adjusted Ebitda < 3.5 Default If the limit is exceeded in any quarter Regulatory assets and liabilities Not considered in the calculation (equivalent to 4.5x Gross Debt / Adjusted Ebitda) If the limit is exceeded for two consecutive quarters Considered in the calculation (concept before IFRS adoption) Debt recognized in liabilities excluding the Pension plan debt Compulsory loans Total debt recognized in liabilities Considered in the calculation of debt “corridor” concept Out of debt calculation 48

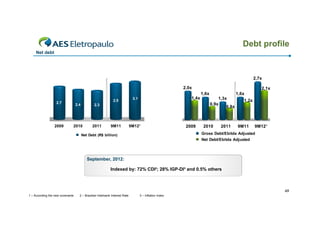

- 49. Debt profile Net debt 2,7x 2,0x 2,1x 1,6x 2.9 29 2.7 2009 2.4 2.3 2010 2011 1,4x 3.1 9M11 9M12¹ 2009 1,6x 1,3x 0,9x 0,8x 2010 2011 1,2x 1 2x 9M11 9M12¹ Gross Debt/Ebitda Adjusted Net Debt (R$ billion) Net Debt/Ebitda Adjusted September, 2012: Indexed by: 72% CDI²; 28% IGP-DI³ and 0.5% others 49 1 – According the new covenants 2 – Brazilian Interbank Interest Rate 3 – Inflation Index

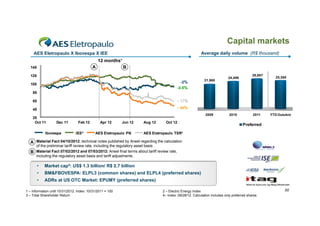

- 50. Capital markets Average d il volume (R$ th A daily l thousand) d) AES El t Eletropaulo X Ib l Ibovespa X IEE 12 months¹ A 145 B 125 -2% -0.5% 105 21,960 24,496 26,897 25,365 25 365 85 65 - 37% 45 - 40% 25 Oct 11 2009 Dec 11 Ibovespa Feb 12 IEE² Apr 12 Jun 12 AES Eletropaulo PN Aug 12 Oct 12 2010 2011 YTD Outubro Preferred AES Eletropaulo TSR³ A Material Fact 04/10/2012: technical notes published by Aneel regarding the calculation of the preliminar tariff review rate, including the regulatory asset basis . B Material Fact 07/02/2012 and 07/03/2012: Aneel final terms about tariff review rate, including the regulatory asset basis and tariff adjustments . • Market cap4: US$ 1.3 billion/ R$ 2.7 billion • BM&FBOVESPA: ELPL3 (common shares) and ELPL4 (preferred shares) • ADRs at US OTC Market: EPUMY (preferred shares) 1 – Information until 10/31/2012. Index: 10/31/2011 = 100 3 – Total Shareholder Return 2 – Electric Energy Index 4– Index: 09/28/12. Calculation includes only preferred shares 50

- 51. Attachments

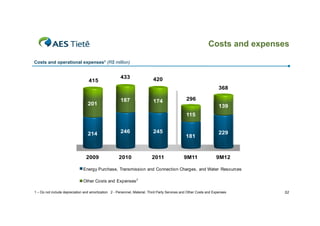

- 52. Costs and expenses Costs and operational expenses1 (R$ million) 415 433 420 368 201 187 174 96 296 139 115 214 246 245 2009 2010 2011 181 9M11 229 9M12 Energy Purchase, Transmission and Connection Charges, and Water Resources Other Costs and Expenses 2 1 – Do not include depreciation and amortization 2 - Personnel, Material, Third Party Services and Other Costs and Expenses 52

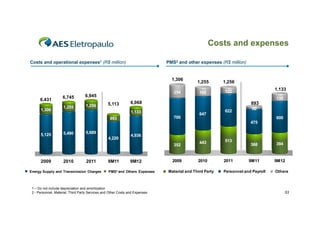

- 53. Costs and expenses Costs and operational expenses1 (R$ million) PMS2 and other expenses (R$ million) 1,306 6,431 1,306 6,745 1,255 254 6,945 1,256 1,255 1,256 165 122 1,133 138 5,113 6,068 893 1,133 700 893 647 622 50 600 475 5,125 5,490 5,689 4,220 4,936 352 2009 2010 2011 Energy Supply and Transmission Charges 9M11 9M12 PMS² and Others Expenses 1 – Do not include depreciation and amortization 2 - Personnel, Material, Third Party Services and Other Costs and Expenses 2009 443 513 2010 2011 Material and Third Party 368 394 9M11 9M12 Personnel and Payroll Others 53

- 54. AES Tiete's expansion obligation Efforts being made Privatization Notice established the obligation to expand the installed capacity in 15% (400 MW) until 2007, 2007 either in greenfield projects and/or through long term purchase agreements with new plants Judicial Notice: Aneel informed that the issue is not related to the concession agreement and must be addressed with the State of São Paulo The Company was notified by the State of São Paulo Attorney's Office to present its understanding on the matter, matter having filed its response on time, the proceedings were ended, since no other action was taken by the Attorney's Office AES Tietê was summoned to answer a Lawsuit filed by the State of São Paulo, which requested the fulfillment of the obligation in 24 months. An injunction was granted in order to have a project submitted within 60 days. 19th In March, the Company’s appeal was denied. Thus, on April, 26th AES Tietê presented “Thermo São Paulo” Thermo Paulo project as the plan to fullfill the obligation to expand the installed capacity. by the Company to meet the obligation : • Long-term energy contracts (biomass) totaling an average of 10 MW • SHPP São Joaquim - started operating in July, 2011, with 3 MW of installed capacity 1999 2007 Aug/08 Oct/08 Jul/09 Sep/10 Sep/11 Nov/11 Apr/12 Sep/12 • SHPP São José started operating in March, 2012, with 4 MW of installed Company faces restrictions until deadline: • Insufficiency of hydro resources • Environmental restrictions • Insufficiency of natural gas supply • New Model of Electric Sector (Law # 10,848/2004), hi h forbids bilateral 10 848/2004) which f bid bil t l agreements between generators and distributors In response to a p Popular Action (filed by individuals against the Federal Government, Aneel, AES Tietê and Duke), the Company p p y presents its defense before the first instance Popular Action: Due to the plaintiffs failure to specify the persons that should be named as Defendants, a favorable decision was rendered by the first Instance Court (an appeal has been filed) Lawsuit: The Company appealed to the State of Sao Paulo State Court of Appeals and the injunction was kept Decision in the first appeal level determined the state of São Paulo to express about AES Tietê’s Expansion program capacity • Thermal SP - Project of a 550MW gas fired thermo plant • Thermal Araraquara - Acquisition of a purchase option 54

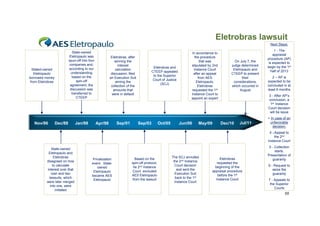

- 55. Eletrobras lawsuit Next Steps: State-owned State owned Eletropaulo was spun-off into four companies and, according to our understanding based on the spin-off agreement, the discussion was transferred to CTEEP Stated-owned Eletropaulo borrowed money from Eletrobras Nov/86 Dec/88 Jan/98 Eletrobras, after winning the interest calculation discussion, filed an Execution Suit aiming the collection of the amounts that were in default Apr/98 p Sep/01 p Eletrobras and CTEEP appealed to the Superior Court of Justice (SCJ) Sep/03 p Oct/05 In I accordance t d to the procedure that was stipulated by 2nd Instance Court after an appeal from AES Eletropaulo, Eletrobras requested the 1st Instance Court to appoint an expert Jun/06 May/09 y On July 7, the judge determined Eletropaulo and CTEEP to present their considerations, which occurred in August 1 - The appraisal procedure (AP) is expected to begin by the 1st half of 2013 2 – AP is i expected to be concluded in at least 6 months 3 - After AP’s conclusion, a 1st Instance Court decision will be issue Dec/10 Jul/11 > In case of an unfavorable decision: 4 –Appeal to the 2nd Instance Court State owned State-owned Eletropaulo and Eletrobras disagreed on how to calculate interest over that loan and two lawsuits, which were later merged into one, were initiated Privatization event . Stateowned Eletropaulo became AES Eletropaulo Based on the spin-off protocol, he 2nd Instance Court excluded AES Eletropaulo El l from the lawsuit The SCJ annulled the 2nd Instance Court decision and sent the Execution Suit back to the 1st Instance Court Eletrobras requested the beginning of the appraisal procedure before the 1stt b f th Instance Court 5 - Collection starts. Presentation of guaranty 6 - Request to seize the guaranty 7 - Appeals to the Superior Courts 55

- 56. Shareholders agreement On Dec 2003 AES and BNDES signed a Shareholders’ Agreement to regulate their relationship as shareholders of Brasiliana and its controlled companies. The Agreement is available at www.aeseletropaulo.com.br/ri Shareholders can dispose its share at any time, considering the following terms: time Right of 1st refusal Any party with an intention to dispose its shares should first provide the other party the right to buy Tag along rights In the case of change in Brasiliana’s control, tag along rights are triggered for the following Drag along rights g Once the offering party exercises the Drag Along clause, offered party is obligated to dispose of all that participation at the same price offered by a third party companies (only if AES is no longer controlling shareholder): – AES Eletropaulo: Tag along of 100% in its common and preferred shares – AES Tietê: Tag along of 80% in its common shares – AES Elpa: Tag along of 80% in its common shares its shares at the time, if the Right of 1st Refusal is not exercised by offered party time 56

- 57. Brazilian main taxes AES Eletropaulo AES Tietê • Income Tax / Social Contribution: – 34% over taxable income • ICMS (VAT tax) – deferred tax • PIS/Cofins (sales tax): – Eletropaulo´s PPA: 3.65% over Revenue – Other bilateral contracts: 9 25% over Revenue 9.25% minus Costs • Income Tax / Social Contribution: – 34% over taxable income • ICMS: 22% over Revenue (average rate) – Residential: 25% – Industrial and commercial: 18% – Public entities: free • PIS/Cofins: – 9.25% over revenue minus Costs 57

- 58. Contacts: ri.aeseletropaulo@aes.com ri.aestiete@aes.com + 55 11 2195 7048 The statements contained in this document with regard to the business prospects, projected operating and financial results, and growth potential are merely f lt d th t ti l l forecasts b t based on th expectations of th C d the t ti f the Company’s M ’ Management i t in relation to its future performance. Such estimates are highly dependent on market behavior and on the conditions affecting Brazil’s macroeconomic performance as well as the electric sector and international market, and they are therefore subject to changes.