aramark Presentation03.14.06

- 1. Managed Services, Managed Better 1

- 2. Special Note about Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect our current views as to future events and financial performance with respect to our operations. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “aim,” “anticipate,” “are confident,” “estimate,” “expect,” “will be,” “will continue,” “will likely result,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in conjunction with a discussion of future operating or financial performance. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Factors that might cause such a difference include: unfavorable economic conditions; ramifications of any future terrorist attacks or increased security alert levels; increased operating costs, including labor-related and energy costs; shortages of qualified personnel or increases in labor costs; costs and possible effects of further unionization of our workforce; currency risks and other risks associated with international markets; risks associated with acquisitions, including acquisition integration issues and costs; our ability to integrate and derive the expected benefits from our recent acquisitions; competition; decline in attendance at client facilities; unpredictability of sales and expenses due to contract terms and terminations; the impact of natural disasters on our sales and operating results; the risk that clients may become insolvent; the contract intensive nature of our business, which may lead to client disputes; high leverage; claims relating to the provision of food services; costs of compliance with governmental regulations and government investigations; liability associated with noncompliance with governmental regulations, including regulations pertaining to food services, the environment, the Federal school lunch program, Federal and state employment and wage and hour laws and import and export controls and customs laws; dram shop compliance and litigation; inability to retain current clients and renew existing client contracts; determination by customers to reduce their outsourcing and use of preferred vendors; seasonality; and other risks that are set forth in the “Risk Factors” sections of ARAMARK’s SEC filings. For further information regarding risks and uncertainties associated with ARAMARK's business, please refer to the quot;Management's Discussion and Analysis of Results of Operations and Financial Conditionquot; and quot;Risk Factors” and other sections of ARAMARK's SEC filings, including, but not limited to, our annual report on Form 10-K and quarterly reports on Form 10-Q, copies of which may be obtained by contacting ARAMARK's investor relations department via its web site www.aramark.com. Forward-looking statements speak only as of the date made. We undertake no obligation to update any forward-looking statements to reflect the events or circumstances arising after the date as of which they are made. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements included herein or that may be made elsewhere from time to time by, or on behalf of, us. Important Disclosure In this presentation, we mention certain financial measures that are considered non-GAAP. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes items different than those prepared or presented in accordance with generally accepted accounting principles. We have prepared disclosures and reconciliations of non-GAAP financial measures that were used in this presentation and may be used periodically by management when discussing the Company's financial results with investors and analysts, which are available on our website www.aramark.com. 2

- 3. ARAMARK: An Outsourced Services Leader Leading provider of food, facilities 2005 Sales: $11.0 billion and uniform services to Business, Education, Healthcare, Government Uniform & Career and Sports & Entertainment clients Apparel 14% Mid-teens average annual EPS growth since 2001 IPO with strong cash flow 240,000 employees in 19 countries Broad and deep management ownership that fosters Food & Support 86% entrepreneurial culture 3

- 4. Services Provided Food & Support Services Uniform Services Cafés, Executive Energy Management Uniform Rental / Lease Dining Rooms Groundskeeping Nationwide Service Catering Laundry & Linen Services National Account Retail and C-Stores Programs Plant Operations Conference Center Clean Rooms Central Transportation Management WearGuard & Crest Brands Building Commissioning Refreshment Direct Sale Offerings Services Clinical Equipment Services Managed & National Concessions Environmental Services Account Programs Event Planning QSR / Healthcare On-site Restaurants Leader Lodging Galls Brand Public Safety Catalog Business 4

- 5. Fiscal Year 2005 Highlights Total Sales Up 8% to $11.0B Net Income Up 10% to $288M Diluted Earnings Per Up 13% to $1.53 Share Cash Flow* Up 18% to $612M Dividend Up 27% to $0.28** Cash Returned to $215M*** Shareholders $200M Additional Repurchase Authorization * From operating activities. ** On an annualized basis (2006 vs. 2005). *** Open market share repurchases and cash dividends. 5

- 6. Entrepreneurial Culture Through Ownership Current Economic Ownership* Employee ownership reaches deep into the Management & Employees organization 34% Over 19,000 employee owners – direct and through benefit plans Critical advantage for a services company Public Investors 66% *As of 12/31/05. 6

- 7. Drivers of Outsourcing Client focus on core business “Customer” (end-user) satisfaction is critical to client Improved effectiveness often important to client’s success Client cost reduction About 40% of New ARAMARK Business in 2004-2005 Came From Previously Self-Operated Clients 7

- 8. Worldwide Food & Support Services 2005 Sales: $9.4 Billion Sector Analysis* Sports & International 24% Entertainment Business Healthcare U.S. 76% Education * Estimated. Significant Diversification Across Business Sectors 8

- 9. International Food & Support Services 2005 Sales: $2.3 billion 2005 Sales Including Minority JV’s*: $3.4 billion Belgium Other Korea Spain U.K. Japan Chile Majority Owned Subs Ireland** Canada Germany * Includes $2.3 billion of international sales as reported plus $1.1 billion of sales from minority-owned JV’s. ** Increased ownership to 90% in February 2005. 9

- 10. Business Model On-site service provider – Contract with client (Business, College, Hospital) – Service directly affects “customer” (Employee, Student, Patient, Fan) – “Embedded” in the client organization – mid 90% retention Focus to improve outcomes important to client Cost efficiencies through common practices and purchasing volume 10

- 11. How We Add Value Customer knowledge – Understand preferences through research and operational experience Tailor service offerings to increase customer satisfaction – Broad, retail-oriented food service offerings – Improved environment through facilities management Improve economics to client through: – Increased customer spend and participation – Higher quality / efficiency to support client’s mission – Standardized operation and volume to drive cost efficiencies Value is More Than Just Low Cost 11

- 12. Growth Opportunities Additional penetration into self-operated clients – Healthcare, Education are underpenetrated Higher usage at existing clients – Improved service offerings attract more customers from on-site population Additional services – Cross-selling food and facilities services International expansion – Grow from current 19 country base 12

- 13. Penetration into Self-Op Clients – Healthcare Opportunity: $36B Self-Op Conversion Strategy Enterprise sales force ARAMARK Other Share Thought leadership platform Share Client intimacy Non- Differentiation Strategy Target Self-op Comprehensive portfolio with Potential Self-Op best-in-class delivery Untapped $24BPotential Consumer Patient centered platform Spend Enabling environments Source Data: NRA;AHA 13

- 14. Higher Usage at Existing Clients – Higher Education Product Mix and Marketing Programs: Driving Higher Margin Base Business Growth through…. Earn Points Convenience Solutions Same store sales up 16% eCommerce and POS Solutions Check average up 27% Lifestyle Meal Plan Marketing and Customer Loyalty Programs Voluntary Plan enrollment up 15% Note: Percentages represent year-over-year increases in the account 14

- 15. Higher Usage at Existing Clients – Sports & Entertainment Per Capita Spending Concourse, Rt Field Restaurant At Fenway Park 14% CAGR Yawkee Way 2000 2001 2002 2003 2004 2005 15

- 16. Additional Services – Healthcare 1,000 Healthcare Facilities 2004 - 2005 New Business Facilities New single service to new 11% client New service to Food existing client New multiple 4% 10% service to new client 1% Clinical Technology We Provide Food, Facilities and CTS For Only 4% of Our Healthcare Clients 16

- 17. International Expansion Strategy Europe Healthcare Opportunity: $43B Achieve Top 3 presence in countries representing 80%+ of world’s GDP Self-Op Accelerate organic growth – Potential build B&I, diversify into Healthcare, Education and Europe Education Opportunity: $22B S&E Make selective acquisitions Focus on the end consumer Self-Op Potential Source: Gira 17

- 18. ARAMARK: Uniform & Career Apparel A leading U.S. provider with approximately $1.6 billion in sales in fiscal 2005 Rental: Uniform Services Direct Marketing: WearGuard/Crest and Galls WearGuard/ Uniform Galls Services Crest Uniform Rental / Lease/ Workwear, Image Apparel Public Safety Direct Purchase Mass Personalization / Design Equipment / Supplies Dust Control Managed Account Programs Apparel Clean Room Quick Service Restaurant Accessories Nationwide Network Leader Managed Account Programs Healthcare Sourcing, Manufacturing, Distribution 18

- 19. Business Model Broad line of rental and direct sale career apparel covering nearly all job categories A nationwide network of uniform rental service facilities covering 90% of the top 200 markets Broad, direct distribution through catalog, outbound telemarketing, sales force and internet Best-in-class global uniform manufacturing / sourcing to reduce costs and control quality 19

- 20. How We Add Value Important component of employer branding – Particularly service companies – Significant customizing capability Consistent employee image Increased employee satisfaction Improved employee protection 20

- 21. Growth Opportunities Penetration of “non-user” population – 26 million potential “first-time” users – Currently about 50% of new sales Ancillary sales to existing customers – Cross-sell allied, sanitation products Nationwide clients – Ability to standardize products, services and cost 21

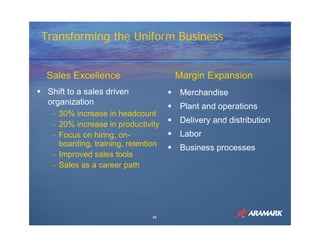

- 22. Transforming the Uniform Business Sales Excellence Margin Expansion Shift to a sales driven Merchandise organization Plant and operations – 30% increase in headcount Delivery and distribution – 20% increase in productivity Labor – Focus on hiring, on- boarding, training, retention Business processes – Improved sales tools – Sales as a career path 22

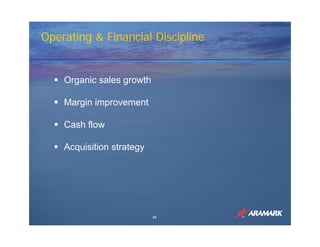

- 23. Operating & Financial Discipline Organic sales growth Margin improvement Cash flow Acquisition strategy 23

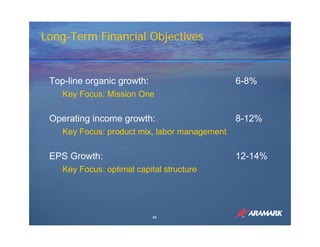

- 24. Long-Term Financial Objectives Top-line organic growth: 6-8% Key Focus: Mission One Operating income growth: 8-12% Key Focus: product mix, labor management EPS Growth: 12-14% Key Focus: optimal capital structure 24

- 25. Drivers of Margin Expansion Product costs – Supply chain driven – Production discipline and Costs as % of total operational efficiency – Product mix and marketing programs – Uniform sourcing and Other Product manufacturing initiatives Labor Labor and related costs – Labor management tools – Technology driven initiatives – Medical costs – Workers’ compensation 25

- 26. Strong Cash Flow Dynamics Working Capital Dynamics Significant cash sales component Low inventory requirements – 30%+ of total – Food approximately 2-3% of sales Scale drives attractive vendor terms – Facilities inventory is negligible Net Capex Trends as a % of Sales Cash Flow from Operating Activities* CAPEX DA % $ Million 700 3.0 600 2.5 500 2.0 400 1.5 300 1.0 200 0.5 100 0.0 0 2003 2004 2005 2001 2002 2003 2004 2005 * From continuing operations. 26

- 27. Acquisition Strategy Disciplined and Return-Focused Target: 15% after-tax IRR EPS accretive in 1-2 years Strategies Strengthen existing services and client portfolio – Fine Host, Harrison, CTS Add or strengthen key services – ServiceMaster Expand International reach – AIM Services (Japan); Campbell Catering (Ireland); Restauracion Colectiva & Rescot (Spain); Central Restaurantes (Chile); Catering Alliance (UK); Bright China Service Industries, Golden Collar (China) 27

- 28. History of Solid Performance Sales - billions Net Income - millions $12 $300 Sales $10 Net $250 Income $8 $200 $6 $150 $4 $100 $2 $50 $0 $0 '85 '86 '87 '88 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 Reflects actual amounts originally reported in Form 10K Annual Reports. Not restated for discontinued operations (Educational Resources business sold in FY 2003). Fiscal 2003 includes insurance proceeds of $19.7 million net of tax and income from discontinued operations of $35.7 million. Effective beginning FY 2002 goodwill is no longer amortized. 1985 is a 9 month period. 1986, 1992, 1997, 2003 are 53 week years. 28

- 29. Managed Services, Managed Better 29

- 30. Reconciliation of Non-GAAP Measures – Net Capital Expenditures as a Percentage of Sales ARAMARK CORPORATION AND SUBSIDIARIES RECONCILIATION OF NON-GAAP MEASURES NET CAPITAL EXPENDITURES AS A PERCENTAGE OF SALES (Unaudited) (In Thousands) Net capital expenditures, expressed as a percentage of sales, is a metric utilized by management to review cash flow dynamics, which long term investors may find useful. Fiscal Year Ended October 3, 2003 October 1, 2004 September 30, 2005 Reconciliation of net purchases of property and equipment and client contract investments: Purchases of property and equipment and client contract investments $ (298,606) $ (308,763) $ (315,560) Disposals of property and equipment 28,183 20,503 21,581 Net purchases of property and equipment and client contract investments $ (270,423) $ (288,260) $ (293,979) ARAMARK Corporation Consolidated Sales $ 9,447,815 $ 10,192,240 $ 10,963,360 Net purchases of property and equipment and client contract investments as a percentage of sales 2.9% 2.8% 2.7% 30