ARC Resources - January 2013 Investor Presentation

- 2. FORWARD LOOKING STATEMENTS This presentation contains forward-looking information as to ARC’s internal projections, expectations or beliefs relating to future events or future performance and includes information as to our future well inventory in our core areas, our exploration and development drilling and other exploitation plans for 2012 and beyond, and related production expectations, the volume of ARC's oil and gas reserves and the volume of ARC's gas resources in the NE BC Montney (as defined herein), the recognition of additional reserves and the capital required to do so, the life of ARC's reserves, the volume and product mix of ARC's oil and gas production, future results from operations and operating metrics. These statements represent management’s expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of ARC Resources. The projections, estimates and beliefs contained in such forward-looking statements are based on management's assumptions relating to the production performance of ARC’s oil and gas assets, the cost and competition for services, the continuation of ARC’s historical experience with expenses and production, changes in the capital expenditure budgets, future commodity prices, continuing access to capital and the continuation of the current regulatory and tax regime in Canada and necessarily involve known and unknown risks and uncertainties, such as changes in oil and gas prices, infrastructure constraints in relation to the development of the Montney in British Columbia, risks associated with the degree of certainty in resource assessments and including the business risks discussed in the annual MD&A and related to management’s assumptions, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. Accordingly, readers are cautioned that events or circumstances could cause actual results to differ materially from those predicted. Other than the 2012 Guidance which is updated and discussed quarterly, ARC does not undertake to update any forward looking information in this document whether as to new information, future events or otherwise except as required by securities laws and regulations. We have adopted the standard of 6 mcf:1 bbl when converting natural gas to barrels of oil equivalent ("boes"). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf per barrel is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency of the 6:1 conversion ratio, utilizing the 6:1 conversion ratio may be misleading as an indication of value. Contained in the “Strategy” section is forward-looking information. The reader is cautioned that assumptions used in the preparations of such information, particularly those pertaining to dividends, production levels, operating costs and drilling results, although considered reasonable by the Company at the time of preparation, may prove to be incorrect. A number of factors, including, but not limited to: commodity prices, reservoir performance, weather, drilling performance and industry conditions, may cause the actual results achieved to vary from projections, anticipated results or other information provided herein and the variations may be material. Consequently, there is no representation by the Company that actual results achieved will be the same in whole or in part as those presented herein.

- 3. CORPORATE OVERVIEW Production (2012 YTD) 92,800 boed Liquids 36,000 boed Natural gas 341 mmcfd Crude Oil Reserves (2P Gross) 572 mmboe NE BC/ NW AB Liquids-rich Gas 17 year RLI (1) Dry Gas NORTH AB Current monthly dividend $0.10 Annualized total return 18% (2) REDWATER 11% (3) Enterprise value ~$8 billion (4) PEMBINA Shares outstanding ~309 MM (5) SE SASK/ MANITOBA Daily average trading volume 1.4 million shares S AB/ SW SASK Net debt (millions) $691 (1.0 X cash flow)(5) Member of S&P TSX 60 Index (1) Based on 2012 production guidance of 91,000-94,000 boe/d. (2) Annualized total return since inception to December 31, 2012, including December 2012 dividend, and assuming DRIP participation. (3) Annualized total return December 31, 2007 (last 5 years). (4) Market Capitalization as at December 31, 2012 and net debt as at September 30, 2012. (5) As at September 30, 2012 based on annualized YTD 2012 cash flow.

- 4. 2012 FOCUS ON OIL AND LIQUIDS • Oil and liquids comprised 40% of third quarter 2012 production while contributing 78% of third quarter revenue • Drilled 106 gross operated wells year-to-date (99% oil and liquids-rich) • Grew crude oil and liquids production 16% to >35,600 boe/d in Q3 2012 (relative to Q3 2011) with significant growth at Ante Creek, Pembina and Goodlands 3% Q4 Revenue 2% 22% 34% Q4 Production 6% Q3 Production Q3 Revenue 60% 3% 70% Crude Oil Condensate NGL’s Natural Gas

- 5. VALUE PROPOSITION • We believe that top performing companies all have the following attributes: – Great assets – Operational excellence – Capital discipline – Management that delivers results • At ARC our focus since inception has been on “Risk Managed Value Creation” • It is not a question of growth or income but of how best to create value for our owners • Current dividend of $0.10 per month

- 6. PRODUCTION GROWTH Production Growth - Montney and Non-Montney 100,000 Montney Gas (boe/d) Montney Oil/Liquids (bbls/d) Non-Montney Gas (boe/d) Non-Montney Liquids (boe/d) 80,000 Forecast Total Non-Montney production Production (Boe/d) 60,000 40,000 20,000 Forecast Forecast -

- 7. INCOME AND GROWTH ARC HAS DELIVERED BOTH • ARC has a 16 year history of risk managed value creation - Provided an 18% annual total return since inception - Paid out $4.6 billion in total dividends - $28.58/share - Grown absolute production from 9,500 boe/d to ~93,000 boe/d, – the Montney provides the opportunity for substantial future growth - Grown debt and dividend adjusted reserves & production by ~ 10% annually 100,000 Production History 15% CAGR* 75,000 Gas Liquids Boe/d 50,000 Proved 25,000 Undeveloped 20% 0 2012Q3 2002 2009 1996 1997 1998 1999 2000 2001 2003 2004 2005 2006 2007 2008 2010 2011 * Compound annual growth rate

- 8. STRATEGY RISK MANAGED VALUE CREATION Understand our Advantaged Position Leverage our Advantaged Position Make time to Think Strategically Financial Operational Flexibility Excellence RISK MANAGED VALUE CREATION High Quality, Top Talent Long Life and Strong Assets Leadership Culture Be Dynamic and Flexible to Changing Conditions

- 9. STRATEGIC OVERVIEW SUMMARY • ARC’s strategy has delivered exceptional results to date – We will continue to provide income and profitable growth to our investors • Where do we go from here? – Continued focus on meaningful oil and gas accumulations – Our strategic initiatives will focus on: • Operational excellence • Developing the Montney – near term growth is forecast as an outcome of the quality of our opportunities • Realization of the value embedded in our assets through the development of our large potential resources through advanced recovery methods or application of new technologies • Opportunistic acquisitions to add to our meaningful resource play presence • Maintaining balance sheet strength and financial flexibility

- 11. 2013 BUDGET STRATEGIC OBJECTIVES The 2013 Budget will: • Focus on oil and liquids opportunities • Invest in high rate of return natural gas opportunities to sustain current production • Leverage dominant presence and technical expertise in resource plays • Invest in infrastructure to set stage for growth in 2014 • Optimize capital efficiencies through active cost management and enhanced commercialization of development • Manage production decline rates by pacing growth • Preserve ARC’s strong financial position and balance sheet strength

- 12. 2013 CAPITAL PROGRAM SETTING THE STAGE FOR 2014 PRODUCTION GROWTH • $830 million capital program (~178 gross operated wells) with majority of spending in oil and liquids-rich gas plays and infrastructure. NE BC - $324MM(1) ~36 gross operated wells 2013 Capital Budget NE BC - $324MM* (2) ~44,500 boe/dgross operated wells ~36 Volumes ~$100MM42,099 boe/d directed towards NORTHERN AB - $211MM(1) Year ~37 NORTHERN AB - $211MM* facilities at Parkland/Tower towards gross gross operated wells operated wells Capital Average Gross Net ~$100MM directed ~37 ~15,000 boe/d(2) $MM (boe/d) Wells Wells facilities at Parkland/Tower 14,163 boe/d Operated* 774 84,500 178 160 Parkland/Tower, Dawson Non-Operated 56 10,600 103 10 REDWATER - $10MM(1) REDWATER - $10MM* 0 wells Total 830 95,000 281 170 0 wells ~3,600 boe/d(2) 3,539 boe/d *Corporate $22 MM PEMBINA - $131MM (1) ~54 gross operated - $131MM* PEMBINA wells ~54 gross operated wells ~11,000 boe/d(2) 9,220 boe/d S. AB/SW SASK - $6MM(1) SE SASK/MANITOBA - $126MM(1) 0 wells AB/SW SASK - $6MM* gross operated wells SE ~51 ~7,900 boe/d(2) 0 wells ~12,600 boe/d(2) 6,214 boe/d (1) Includes Operated and Non-operated. (2) 2013 annual average production.

- 13. 2013 BUDGET 2013/2014 Production Growth 2013 Budget - Volumes (BOED) All Properties PO DEV OPT EXPLORE 140,000 2014 base production, does not show 2014 CAPEX program 120,000 100,000 80,000 Base Decline ~22% Base Decline ~22% Base Decline ~22% 60,000 40,000 • Overall Corporate base decline of ~ 22%. • Oil and Liquids production increases ~ 5%. 20,000 • Gas production grows by ~2%. • Risks to the plan: commodity prices, timing issues and cost pressures related to service sector demand for equipment and personnel, regulatory approvals and liquids sales pipeline capacities. 0

- 14. 2013 BUDGET FOCUS ON OIL AND LIQUIDS • 91% of budget focused on oil/liquids drilling and infrastructure 2013 Capital by Commodity ($ millions) $22 NE BC/NW AB $56 NORTHERN AB $171 $581 ~85% spending on oil and ~100% spending on oil and liquids-rich gas liquids-rich gas Focus: Parkland/Tower, Focus: Ante Creek 2013 Drills by Dawson Commodity PEMBINA (# of Gross Operated Wells) 9 16 ~100% spending on oil and SE SASK/ MB 153 liquids-rich gas Focus: Cardium Oil ~100% spending on oil Liquids-rich Focus: Goodlands Gas Other

- 15. 2013 BUDGET ($ millions) 2011 (Actual) 2012 (Estimate) 2013 (Budget) Development 396 400 563 Development – Facilities 92 70 162 Maintenance 21 27 35 Optimization 14 9 13 Exploration & Seismic 94 52 11 Enhanced Oil Recovery 20 21 27 Land 75 4 - Other 14 17 19 Total Capital $726 $600 $830 (1) Other capital of $19 million comprises capitalized General and Administrative Expenses (“G&A”) including a portion of Long-Term Incentive Plan (“LTIP” or the “Whole Unit Plan”) expense, information technology and corporate office capital.

- 16. 2013 GUIDANCE 2012 Guidance 2012 YTD Actual 2013 Guidance Oil (bbls/d) 30,000 – 31,000 30,955 32,000 – 34,000 Condensate (bbls/d) 2,100 – 2,500 2,368 1,800 – 2,000 Gas (mmcf/d) 340 – 350 341 340 – 350 NGL’s (bbls/d) 2,100 – 2,600 2,644 2,400 – 2,800 Total (boe/d) 91,000 – 94,000 92,814 93,000 – 97,000 Operating costs 9.50 – 9.70 9.61 9.50 – 9.70 Transportation costs 1.30 – 1.40 1.30 1.40 – 1.50 G&A expenses (1) 2.45 – 2.60 2.78 2.50 – 2.70 Interest 1.20 – 1.30 1.33 1.20 – 1.30 Income Taxes (2) 0.90 – 1.05 1.03 1.05 – 1.15 Capital expenditures (millions) (3) 600 830 418 Land expenditures and minor net property acquisitions ($ millions) (4) 25 - 50 31 - Weighted average shares outstanding (millions) (5) 297 293 311 (1) The 2013 G&A expense before Long-Term Incentive Plan approximates $90 million ($1.75 - $1.90 per boe). (2) 2013 Corporate tax estimate will vary depending on level of commodity prices. (3) The $830 million 2013 capital budget does not include land and net property acquisitions as this amount is unbudgeted. (4) Based on weighted average shares plus the dilutive impact of share options outstanding during the period.

- 17. Asset Overview

- 18. ASSET OVERVIEW • ARC’s key assets with the greatest value creation opportunities and highest future reserves contributions are: • Ante Creek – oil resource play • Parkland/Tower/Attachie/Septimus – liquids-rich gas resource play • Pembina Cardium – oil resource play • Goodlands and SE Saskatchewan – oil resource play • Dawson – natural gas resource play • Sunrise/Sunset – natural gas resource play • ARC plans to develop these opportunities, subject to a supportive commodity price environment, over the next five years • Highlights from a few of these key areas will be covered in this presentation

- 19. Pembina Revitalizing a Mature Oil Field

- 20. PEMBINA ASSET DETAILS Net production (boe/d) – Q3 2012 11,300 Cardium production ~80% Production split % (liquids/gas) ~75%/25% Land (Cardium net sections) 132 Working Interest ~78% Reserves (2P mmboe) Cardium 41.6 Reserve Life Index 14.2 2012 Plans/Accomplishments • ARC is the second largest operator in the Pembina area • 29 Hz Cardium wells drilled year-to-date 2012 • Encouraging results on recent Buck Creek horizontals

- 21. PEMBINA OIL AND LIQUIDS GROWTH ARC HAS GROWN LIQUIDS PRODUCTION IN THIS MATURE FIELD Pembina ~19% Increase in Oil & Liquids Production since 2006 14,000 12,000 10,000 8,000 Boe/d Q3 2012 - 8,200 boe/d 6,000 Q1 2006 - 6,900 boe/d oil and liquids oil and liquids 4,000 Forecast 2,000 gas oil & liquids 0 Q1 2006 Q2 2006 Q3 2006 Q4 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012

- 22. PEMBINA CARDIUM DEVELOPMENT ECONOMICS 250 Key Metrics DCET Capex per well ($MM) 2.3 Reserves per well (Mboe) 171 200 IP (1 mo) (boe/d) 227 IP (12 mo) (boe/d) 90 Economics ($85/bbl) $4/GJ $3/GJ IRR (% AT) 52% 50% 150 Recycle Ratio 3.9 3.8 Rate (boepd) 100 50 0 0 6 12 18 24 30 36 Months On Production • All economics run at FLAT price forecasts with C$85/bbl and $3/GJ AECO

- 23. PEMBINA 2013 BUDGET – $131MM 2013 Budget - Volumes (BOED) Operated and Non-Operated PO DEV OPT 14,000 12,000 10,000 8,000 Base DeclineBase Decline ~23% ~23% Base Decline ~23% 6,000 4,000 • Drill 54 gross operated wells throughout the Pembina area. • Grow operated production to >10,000 boed and total production to over ~12,000 boed. 2,000 • Continue to optimize waterfloods throughout the area by spending $9 MM (gross) on drilling water injection wells, converting wells producers to injectors and injection stimulations. 0

- 24. Ante Creek A Montney Oil Success Story

- 25. ANTE CREEK ASSET DETAILS Net production (boe/d) – Q3 2012 10,500 Liquids (bbls/d) 5,400 Gas (mmcf/d) 31 Production split % (liquids/gas) ~50/50 Land (Montney net sections) 263 Working Interest ~99% Reserves (2P mmboe) 47.2 Liquids (mmbbls) 20.2 Gas (bcf) 162 Reserve Life Index 18.2 2012 Plans/Accomplishments • 30 mmcf/d gas plant commissioned in late February, alleviating capacity constraints • Growth in oil and liquids production in 2012 • Production to increase through 2013 as we “drill to fill” new gas plant

- 26. ANTE CREEK 2012 ACCOMPLISHMENTS Ante Creek Production 16,000 16,000 • 30 mmcf/d gas plant commissioned in 14,000 14,000 late February, alleviating capacity constraints 12,000 12,000 • Growth in oil and liquids production in 2012 10,000 10,000 • Production to increase through 2013 Sales (boe/d) 8,000 8,000 as we “drill to fill” new gas plant • Drill 21 Hz wells by year-end 2012 6,000 6,000 • Successful delineation step out 4,000 4,000 locations to extend pool boundaries • Added 12 sections of land year-to-date 2,000 2,000 through Crown land sales and asset acquisitions - - 2008 2009 2010 2011 2012 2013 • Transition to pad drilling to minimize Liquids (F) Gas (F) Liquids Gas environmental footprint and optimize operational efficiency

- 27. ANTE CREEK MONTNEY DEVELOPMENT ECONOMICS 450 Key Metrics DCET Capex per well ($MM) 4.0 400 Reserves per well (Mboe) 283 IP (1 mo) (boe/d) 400 350 IP (12 mo) (boe/d) 245 Economics ($85/bbl) $4/GJ $3/GJ 300 IRR (% AT) 45% 35% Recycle Ratio 2.1 2.0 250 BOE/D 200 150 100 50 0 0 6 12 18 24 30 36 Months • All economics run at FLAT price forecasts with C$85/bbl and $3 GJ AECO • Liquid yield assumptions – NGL 21 bbl/mmcf, COND 9.5 bbl/mmcf

- 28. ANTE CREEK 2013 BUDGET – $186MM OPERATED 2013 Budget - Volumes (BOED) Operated PO DEV OPT 16,000 14,000 12,000 10,000 8,000 Base Decline ~28% 6,000 4,000 • Drill 34 wells and grow production to 15,000 boed by the end of 2013. 2,000 • Drill 4 step-out wells to hold land (expiries) and prove up undeveloped land base. 0

- 29. British Columbia Montney Gas and Liquids

- 30. NE B.C. MONTNEY VAST RESOURCE BASE We engaged GLJ to provide a resources evaluation of our properties at Dawson, Parkland, Tower, Sunrise/Sunset, Attachie, Septimus, Sundown and Blueberry located in northeastern British Columbia and at Pouce Coupe located in northwestern Alberta (collectively, the "Evaluated Areas" or "NE BC Montney"). The evaluation procedures employed by GLJ are in compliance with standards contained in the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") and the evaluation is based on GLJ's January 1, 2012 pricing The estimates of Economic Contingent Resources (or ECR), DPIIP, TPIIP, UPIIP and Prospective Resources should not be confused with reserves and readers should review the definitions and notes set forth at the end of this presentation. Actual natural gas resources may be greater than or less than the estimates provided herein. There is no certainty that it will be commercially viable to produce any of the resources that are categorized as discovered resources. There is no certainty that any portion of ARC's resources that have been categorized as undiscovered resources will be discovered. Furthermore, if discovered, there is no certainty that it will be commercially viable to produce any portion of such undiscovered resources. Unless indicated otherwise in this presentation, all references to ECR volumes are Best Estimate ECR volumes. Continuous development through multi-year exploration and development programs and significant levels of future capital expenditures are required in order for additional resources to be recovered in the future. The principal risks that would inhibit the recovery of additional reserves relate to the potential for variations in the quality of the Montney formation where minimal well data currently exists, access to the capital which would be required to develop the resources, low gas prices that would curtail the economics of development and the future performance of wells, regulatory approvals, access to the required services at the appropriate cost, and the effectiveness of fraccing technology and applications. The contingencies that prevent the ECR from being classified as reserves are due to the early evaluation stage of these potential development opportunities. Additional drilling, completion, and test results are required before these contingent resources are converted to reserves and a larger component of DPIIP is converted to ECR. Projects have not been defined to develop the resources in the Evaluated Areas as at the evaluation date. Such projects, in the case of the Montney resource development, have historically been developed sequentially over a number of drilling seasons and are subject to annual budget constraints, ARC's policy of orderly development on a staged basis, the timing of the growth of third party infrastructure, the short and long-term view of ARC on gas prices, the results of exploration and development activities of ARC and others in the area and possible infrastructure capacity constraints. See “Definitions of Oil and Gas Reserves and Resources” in this presentation.

- 31. MONTNEY LANDS WORLD CLASS RESOURCE • NE BC Montney lands are a major growth engine. • Significant opportunity to grow liquids production. • Total BC Montney production of 240 mmcf/d with Dawson contributing approximately 160 mmcf/d. • New, 60 mmcf/d gas plant with 130 bbls/mmcf of liquids handling capacity planned for Parkland/Tower in early 2014. • Ideally positioned with access to west coast and other Alberta markets.

- 32. NE B.C. MONTNEY RESERVES AND RESOURCES • Very early stage in reserve booking cycle: • 2P Reserves (1.9 Tcf) plus Cum Prod only 5.3% of TPIIP at 3% cut-off (4.2% at 0% cut-off). • Best Estimate ECR estimated to be 4.1 Tcf resulting in total recovery including 2P reserves and Cum Prod to date of only 15.7% of TPIIP at 3% cut-off (12.3% at 0% cut-off). • ARC estimates the 2P Reserves plus ECR (6.0 Tcf) can support a peak production rate of 800 mmcf/d for 10 years. • Estimated Prospective Resources of 4.0 Tcf (“Best Estimate”) results in a total potential recovery factor of ~20% - 25% of the TPIIP. Recovery factors at that level could support a peak production rate of >1.3 Bcf/d for 10 years.

- 33. MONTNEY GROWTH ASSETS EXCEEDING EXPECTATIONS ARC’S MONTNEY GAS WELLS HAVE THE BEST INITIAL PRODUCTIVITY NE BC/NW AB Montney Gas Wells - P50 Peak Calendar Month Daily IP Source information: Accumap - NEBC NWAB Montney horizontals peak month IP July 2012.

- 34. Parkland/Tower Liquids Rich Gas

- 35. PARKLAND/TOWER EVALUATING POTENTIAL AND DEVELOPING EXISTING LANDS Parkland Tower Net production (boe/d) 7,200 800 Tower Liquids (bbls/d) 930 500 Gas (mmcf/d) 39 1.7 Land (net sections) 23 56 Working Interest ~84% ~90% Reserves (2P mmboe) 49.7 4.5 Liquids (mmbbls) 8.4 1.4 Gas (bcf) 247.0 19.2 Parkland Reserve Life Index 16 37 2012 Plans/Accomplishments • 11 wells drilled at Tower since late 2011 • 8 wells now tied-in at Tower, with restricted production rates as result of liquids handling facility limitations • Application submitted to construct two 60 mmcf/d gas plants with 130 bbls/mmcf liquids handling capacity. Pending approval, will commence construction in 2013 with commissioning of the first phase in early 2014.

- 36. PARKLAND LAYERED DEVELOPMENT • Producing Formation: Upper Montney Gross thickness 100m Net pay 90m Porosity 6% Permeability 0.01 to 0.1 mD • Large DGIP volumes in Parkland, currently have modest recoveries per well • 100 Bcf DGIP per section, ~100 meters of pay • EUR/well typically ~ 5 Bcf (20% Recovery factor) • Recovery factor low relative to developed areas

- 37. PARKLAND LAYERED WELL PERFORMANCE • Drilled and completed 2 wells in upper sand of the Upper Montney and 1 well offset in the lower sand in 2011 • All wells had similar IP, ranging from 4.7 – 5.1 MMcfd • No pressure response between the upper wells and the lower Montney well to date • Lack of vertical communication indicates potential of un-stimulated rock • Lower sand Montney performance to date in line with upper type well Layered Well Placement 7,000 Upper #1 Upper #2 6,000 400 m 5,000 Rate Mcfd 4,000 3,000 Lower Montney 50 m 2,000 1,000 200 m 200 m 0 Upper MTY Well #1 (10 Stage) Upper MTY Well #2 (9 Stage) Lower MTY Well (9 Stage)

- 38. PARKLAND MONTNEY DEVELOPMENT ECONOMICS Key Metrics 7,000 DCET Capex per well ($MM) 5.2 Reserves per well (Bcf) 5.8 6,000 IP (1 mo) (MMcf/d) 5.0 IP (12 mo) (MMcf/d) 4.0 Economics ($85/bbl) $4/GJ $3/GJ 5,000 IRR (% AT) 79% 54% Gas Rate (Mcf/d) Recycle Ratio 4.2 3.3 4,000 3,000 2,000 1,000 0 0 6 12 18 24 30 36 Months • All economics run at FLAT price forecasts with C$85/bbl and $3/GJ AECO • Liquid yield assumptions – 11 bbl/mmcf C5+, 13 bbl/mmcf NGL

- 39. TOWER 2012 ACCOMPLISHMENTS Tower Production 2,500 2,500 • Drilled 8 Hz wells Q3 YTD • 2012 Operated Program average 30 day IP rate: 375 boe/d per well 2,000 2,000 • Production volumes limited due to liquid handling restrictions • Granted a Royalty Infrastructure 1,500 1,500 Sales (boe/d) Credit Grant for gathering system • BC OGC reclassified all Tower 1,000 1,000 producing wells and upcoming well ARC purchased licenses to oil wells the Tower property in 2010 • Gas plant application submitted to 500 500 regulatory body OGC for 120 mmcfd gas plant and liquids handling facility - - 2010 2011 2012 2013 Liquids (F) Gas (F) Liquids Gas (1) ARC purchased the Tower property in August 2010.

- 40. TOWER OPERATIONAL EXCELLENCE - MINIMIZING FOOTPRINT • Pad drilling will substantially minimize surface land footprint • Expect 8 to 16 wells per pad depending on reservoir characteristics • Considerable cost savings related to pad development compared to single well leases, up to 20% • Numerous operational and capital efficiencies due to pad development: reduced rig moves; single lease to survey, acquire and build; consolidated facilities, electricity to one site, single trunk line • The cycle time from spud to on production is extended by 5 months for an 8 well pad. All wells are drilled and completed before production commences

- 41. TOWER MONTNEY DEVELOPMENT ECONOMICS 600 Key Metrics DCET Capex per well ($MM) 5.3 Reserves per well (Mboe) 400 500 IP (1 mo) (boe/d) 500 IP (12 mo) (boe/d) 260 Economics ($85/bbl) $4/GJ $3/GJ 400 IRR (% AT) 41% 37% Production Rate (boe/d) Recycle Ratio 3.3 3.1 300 200 100 0 0 6 12 18 24 30 36 Months • All economics run at FLAT price forecasts with C$85/bbl and $3/GJ AECO • Difference between EDM and quality & transport adjustments = +4.25 $/bbl • Liquid yield assumptions – 79.2 bbl/MMcf, shrinkage = 20.6%

- 42. TOWER/PARKLAND 2013 BUDGET – $249MM OPERATED 2013 Budget - Volumes (BOED) Operated PO DEV OPT 25,000 20,000 2014 base production, does not include 2014 CAPEX program 15,000 10,000 Base Decline ~21% 5,000 • Drill 24 horizontal wells. • Construct the oil handling, gas processing and pipeline infrastructure with a planned start-up in early 2014 • Significant capital being spent in 2013 with volumes coming on-stream in 2014. 0

- 43. Dawson World Class Asset

- 44. DAWSON ASSET DETAILS Net production (boe/d) – YTD 2012 25,300 Liquids (bbls/d) 700 Gas (mmcf/d) 160 45 mmcf/d Compressor Production split % (liquids/gas) ~97% gas Station 120 mmcf/d Land (Montney net sections) 130 Gas Plant Working Interest ~96% Reserves (2P mmboe) 174 Liquids (mmbbls) 5.0 Gas (bcf) 1,012 Reserve Life Index 16.8 2012 Plans/Accomplishments • Inventory of completed gas wells to be tied-in throughout remainder of 2012 and into 2013 • Maintain 2012 production flat at 165 mmcf/d

- 45. DAWSON RESERVE GROWTH • Reserve growth from 2008 – 2010 due to PUD assignment driven by repeated success of our drilling program and improved well confidence • Reserve growth from 2011 driven by modest PUD adds and overall improved performance expectations from individual wells • Higher confidence in production performance and repeatability is evident on assigned EUR/well and field recovery factor 50% 7.0 45% 6.0 40% Assigned EUR/Well (Bcf) Field Recovery Factor 35% 5.0 30% 4.0 25% 3.0 20% 15% 2.0 10% Field Recovery Factor 1.0 5% Assigned EUR/Well (Bcf) 0% 0.0 2008 2009 2010 2011

- 46. DAWSON TYPE CURVE GROWTH • 2008 type curve analysis was completed using initial production results and verified with a vertical well production multiplier • 2009-2011 Type curve used P90 IP’s with decline analysis and assigned decline exponent rate • 2012 Type curve realized the consistent flat production, coupled with a sharp decline exponent rate • 2013 type curve uses historical pressure and production data from 60+ wells to estimate existing remaining reserves and forecast future wells 6,000 2013 Type Curve 5,000 2012 Type Curve 2009-2011 Type Curve Gas Rate (Mcf/d) 4,000 2008 Type Curve 3,000 2,000 1,000 0 0 3 6 9 12 15 18 21 24 27 30 33 36 Months on Production

- 47. DAWSON MONTNEY DEVELOPMENT ECONOMICS 7,000 Key Metrics DCET Capex per well ($MM) 5.2 6,000 Reserves per well (Bcf) 7.1 IP (1 mo) (MMcf/d) 5.0 IP (12 mo) (MMcf/d) 4.8 5,000 $4/GJ $3/GJ Economics ($85/bbl) IRR (% AT) 72% 44% Gas Rate (Mcf/d) 4,000 Recycle Ratio 3.8 2.8 3,000 2,000 1,000 0 0 6 12 18 24 30 36 Months • All economics run at FLAT price forecasts with C$85/bbl and $3/GJ AECO • Liquid yield assumptions – 3.1bbl/mmcf C5, 0.7bbl/mmcf C4, 0.4bbl/mmcf C3

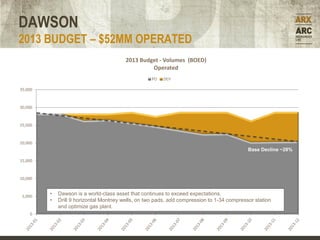

- 48. DAWSON 2013 BUDGET – $52MM OPERATED 2013 Budget - Volumes (BOED) Operated PO DEV 35,000 30,000 25,000 20,000 Base Decline ~28% 15,000 10,000 5,000 • Dawson is a world-class asset that continues to exceed expectations. • Drill 9 horizontal Montney wells, on two pads, add compression to 1-34 compressor station and optimize gas plant. 0

- 49. WEST MONTNEY Long-term Growth Opportunity

- 50. WEST MONTNEY ASSET DETAILS Net production (boe/d)- Q3 2012 3,450 Liquids (bbls/d) 30 Gas (mmcf/d) 20.5 Land (net Montney sections) 211 Working Interest ~93% Reserves (2P mmboe) 112 Liquids (mmbbls) 7 Gas (bcf) 628 Year # Hz Wells Drilled 2009 4 non-op 2010 4 operated 1 non-op 2011 5 operated 2012 Estimate 2 operated 1 non-op 2013 Budget 2 operated

- 51. WEST MONTNEY OPERATIONAL EXCELLENCE – DEVELOPMENT PLANNING

- 52. WEST MONTNEY SUNRISE PRODUCTION – OUTPERFORMING EXPECTATIONS • Expect positive technical revisions in Sunrise based on 2-25 Hz well pad performance Montney A Sunrise A2-25 Hz Cum to date: 2 Bcf EUR Forecast: 11 – 14 Bcf GLJ 2011 (2P) EUR: 7 Bcf Montney B Sunrise B2-25 Hz Cum to date: 2 Bcf EUR Forecast: 10 – 13 Bcf GLJ 2011 (2P) EUR: 6 Bcf

- 53. SUNRISE MONTNEY SUNRISE DEVELOPMENT ECONOMICS Key Metrics DCET Capex per well ($MM) 5.5 Reserves per well (Bcf) 9.7 6,000 IP (1 mo) (MMcf/d) 5.2 IP (12 mo) (MMcf/d) 4.5 5,000 Economics ($85/bbl) $4/GJ $3/GJ Gas Rate mcf/d IRR (% AT) 51% 32% 4,000 Recycle Ratio 4.5 3.2 3,000 2,000 1,000 0 0 6 12 18 24 30 36 Months • All economics run at FLAT price forecasts with C$85/bbl; $3/GJ AECO • Liquid yield: Condensate 1 bbls/MMcf, Propane 3 bbls/MMcf, Butane 1 bbls/MMcf (assume ARC Plant scenario)

- 54. Summary

- 55. WHY INVEST IN ARC RESOURCES • ARC is a top-tier oil and natural gas producer focused on “Risk Managed Value Creation” • Extensive land position in top quality resource plays provides significant growth opportunity. • Significant near-term oil and liquids growth opportunities • Significant long-term natural gas growth opportunity in B.C. Montney • Diverse inventory of high quality oil, liquids-rich gas and natural gas development opportunities provides optionality through commodity price cycles • History of proven performance • Grown absolute production from 9,500 boe/d to ~93,000 boe/d to date • Grown P+P reserves from 47 mmboe to 572 mmboe to date • Progressive approach of applying new technologies to “unlock” value • Proven track record of “Operational Excellence” in both cost management and safety • Solid balance sheet with protective hedging program • Experienced management team with track record of delivering results

- 56. PRODUCTION GROWTH Production Growth - Montney and Non-Montney 100,000 Montney Gas (boe/d) Montney Oil/Liquids (bbls/d) Non-Montney Gas (boe/d) Non-Montney Liquids (boe/d) 80,000 Forecast Total Non-Montney production Production (Boe/d) 60,000 40,000 20,000 Forecast Forecast -

- 57. Appendix

- 58. 2012 FINANCIAL AND OPERATIONAL PERFORMANCE Q3 2012 YTD Q3 2012 (CDN$ millions, except per share and per boe amounts) 2012 2011 2012 2011 Production (boe/d) 89,511 85,178 92,814 80,517 Gas 60% 64% 61% 61% Liquids 40% 36% 39% 39% Revenue 329.4 351.3 1,012.6 1,049.7 Gas 72.9 116.9 223.0 321.8 Liquids 256.5 234.4 789.6 727.9 Funds from operations 164.9 213.5 511.4 617.6 Per share 0.55 0.74 1.74 2.15 Operating Income 26.6 68.0 104.1 217.4 Per share 0.09 0.24 0.35 0.76 Dividends 90.6 86.2 264.9 257.5 Per share 0.30 0.30 0.90 0.90 Capital expenditures 133.1 229.3 417.8 531.0 Net debt outstanding 691.0 870.1 691.0 870.1 Weighted average number of shares outstanding (millions) 299.7 287.1 293.4 286.0 Netback (pre-hedging) 23.04 26.62 23.25 29.77

- 59. ACCESS TO CAPITAL DEBT Debt raised from three different sources: 1. Bank Credit Facility - $1.9 billion plus $25 million overdraft facility, 12 banks under facility • $nil drawn under credit facility as at September 30, 2012 • The credit facility was extended to August 3, 2016 • Pre-approval for an additional $250 million (Accordion) 2. Long-term notes • Private Placement market • Currently have US$631MM and CDN$63MM drawn (Q3 2012) 3. Prudential Master Shelf • Direct long-term relationship with major insurance company • Currently have US$106.3 MM drawn out of capacity of US$225MM (Q3 2012) • Term extended to April 14, 2015

- 60. DEBT MATURITIES SPREAD OVER TIME • ARC’s long-term notes are structured so that they mature over a number of years; this reduces refinancing risk • ARC’s undrawn credit facility of $1.2 billion (after debt and equity proceeds) allows for significant flexibility to repay debt Long-term Principal Note Repayment Schedule 120 100 80 C$ Millions 60 40 20 0 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 61. HEDGE POSITIONS AS OF NOVEMBER 7, 2012 Summary of Hedge Positions as at November 7, 2012 (1) Nov – Dec 2012 2013 2014 2015 - 2017 Crude Oil – WTI (2): (US$/bbl) US$/bbl bbl/d US$/bbl bbl/d US$/bbl bbl/d US$/bbl bbl/d Ceiling $ 91.11 18,000 $ 104.01 14,992 - - - - Floor $ 90.00 18,000 $ 95.01 14,992 - - - - Sold Floor $ 63.44 16,000 $ 64.17 11,984 - - - - Crude Oil Floors as % of 2012 Guidance (3) 55% 43% - Natural Gas – Nymex (3): US$/mmbtu mmbtu/d US$/mmbtu mmbtu/d US$/mmbtu mmbtu/d US$/mmbtu mmbtu/d $ 3.48 Ceiling 175,000 3.93 157,041 $ 4.83 90,000 $ 5.00 60,000 $ 3.48 Floor 175,000 3.39 157,041 $ 4.00 90,000 $ 4.00 60,000 Natural Gas Floors as % of 2012 Guidance (3) 50% 46% 26% 17% Total Floors as % of 2012 Guidance (3) 51% 43% 16% 11% (1) The prices and volumes noted above represent averages for several contracts representing different periods and the average price for the portfolio of options listed above does not have the same payoff profile as the individual option contracts. Viewing the average price of a group of options is purely for indicative purposes. (2) For 2012 and 2013, all floor positions settle against the monthly average WTI price, providing protection against monthly volatility. Positions establishing the “Ceiling” have been sold against either the monthly average or the annual average WTI price. In the case of settlements on annual positions, ARC will only have a negative settlement if prices average above the strike price for an entire year, providing ARC with greater potential upside price participation for individual months. (3) Based on 2012 guidance of 92,500 boe/d for 2012 hedge positions and based on 2013 guidance midpoint of 95,000 boe/d for 2013, 2014 and 2015-2017 hedge positions. Crude oil floors as a % of production are based on guidance volumes for crude oil and condensate production for the respective period.

- 62. RESERVES AND RESOURCES The discussion in this presentation in respect of reserves and resources is subject to a number of cautionary statements, assumptions and risks as set forth below and elsewhere in this presentation. See also the definitions of oil and gas reserves and resources found at the end of this presentation. The reserves data set forth in this presentation is based upon an evaluation by GLJ Petroleum Consultants Ltd. ("GLJ") with an effective date of December 31, 2011 using forecast prices and costs. The reserves evaluation was prepared in accordance with National Instrument 51-101 ("NI 51-101"). Crude oil, natural gas and natural gas liquids benchmark reference pricing, as at December 31, 2011, inflation and exchange rates used in the evaluation are based on GLJ's January 1, 2012 pricing. Reserves included herein are stated on a company gross basis (working interest before deduction of royalties without including any royalty interests) unless noted otherwise. There is no assurance that the forecast prices and costs assumptions will be attained and variances could be material. The recovery and reserves estimates of crude oil, natural gas liquids and natural gas reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Actual crude oil, natural gas and natural gas liquid reserves may be greater than or less than the estimates provided herein. See also ”NE B.C. Montney Vast Resource Base”, for further discussion regarding reserves and resources. See “Definitions of Oil and Gas Reserves and Resources” in this presentation.

- 63. KEY RESERVE INFORMATION 19% COMPOUND ANNUAL GROWTH • Reserves as of December 31, 2011* (mmboe) - Proved Producing 209 (98 mmboe liquids, 655 bcf gas) - Total Proved 360 (123 mmboe liquids, 1,419 bcf gas) - Proved Plus Probable 572 (170 mmboe liquids, 2,413 bcf gas) 700 19% CAGR 600 Probable Proved Producing Gas 37% 36% 500 Liquids Proved mmboe 400 Undeveloped 25% Proved 300 Non-Producing 2% 2P Reserves 200 NGL's 6% Crude 100 oil 24% 0 Natural Gas 70% INTERNAL DEVELOPMENT MONTNEY

- 64. 385 PER CENT RESERVE REPLACEMENT IN 2011 • Fourth consecutive year of greater than 200% reserve replacement through the drill bit • Proved plus probable reserves increased 18% to 572 mmboe after divest of non-core assets with 14.6 mmboe of 2P reserves 700% Acquisitions 600% Development 500% 400% 300% 200% 100% 0% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

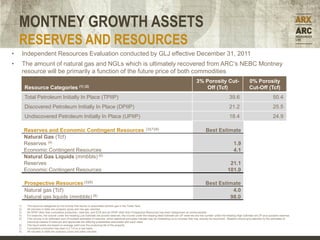

- 65. MONTNEY GROWTH ASSETS RESERVES AND RESOURCES • Independent Resources Evaluation conducted by GLJ effective December 31, 2011 • The amount of natural gas and NGLs which is ultimately recovered from ARC’s NEBC Montney resource will be primarily a function of the future price of both commodities 3% Porosity Cut- 0% Porosity Resource Categories (1) (2) Off (Tcf) Cut-Off (Tcf) Total Petroleum Initially In Place (TPIIP) 39.6 50.4 Discovered Petroleum Initially In Place (DPIIP) 21.2 25.5 Undiscovered Petroleum Initially In Place (UPIIP) 18.4 24.9 Reserves and Economic Contingent Resources (3)(7)(8) Best Estimate Natural Gas (Tcf) Reserves (4) 1.9 Economic Contingent Resources 4.1 Natural Gas Liquids (mmbbls) (6) Reserves 21.1 Economic Contingent Resources 101.0 Prospective Resources (3)(8) Best Estimate Natural gas (Tcf) 4.0 Natural gas liquids (mmbbls) (6) 98.0 1) The resource categories do not include free liquids or associated solution gas in the Tower field. 2) All volumes in table are company gross and raw gas volumes. 3) All DPIIP other than cumulative production, reserves, and ECR and all UPIIP other than Prospective Resources has been categorized as unrecoverable. 4) For reserves, the volume under the heading Low Estimate are proved reserves, the volume under the heading Best Estimate are 2P reserves and the number under the heading High Estimate are 2P plus possible reserves. 5) This volume is an arithmetic sum of multiple estimates of reserves, which statistical principles indicate may be misleading as to volumes that may actually be recovered. Readers should give attention to the estimates of individual classes of reserves and appreciate the differing probabilities associated with each class. 6) The liquid yields are based on average yield over the producing life of the property. 7) Cumulative production has been 0.2 Tcf on a raw basis. 8) All volumes in table are company gross and sales volumes.

- 66. MONTNEY HORIZONTAL WELLS 30 DAY HZ IP RATES GLACIER - TOWN ARC’S DAWSON/PARKLAND WELLS HAVE EXCEEDED EXPECTATIONS 14,000 12,000 10,000 Production Rate (mcf/d) ARC Others 8,000 ARC P50 5.2 Mmcf/d 6,000 Other Wells P50 3.3 Mmcf/d 4,000 2,000 0 1 101 201 301 401 501 601 701 801 901 1001 (1) Graph represents peak calendar day IP rates for the first month of production to July 2012. (2) Region includes all horizontal wells from NE BC and NW AB Montney.

- 67. SE SASKATCHEWAN OIL Solid Long-life Assets

- 68. SE SASKATCHEWAN OIL ASSET DETAILS R28 R27 R26 R25 R24 R23 R22 R21 R20 R19 R18 R17 R16 R15 R14 R13 R12 R11 R10 R9 R8 R7 R6 R5 R4 R3 R2 R1W2 R34 R33 R32 R31 R30 R29 R28 R27 R26 R25 R24 R23 R22W1 T14 T14 T13 T13 T12 T12 T11 T11 T10 Parkman T10 T9 T9 T8 T8 T7 Lougheed Midale T7 T6 North Browning T6 T5 Landscape T5 T4 Radville Weir Hill T4 T3 Bromhead Glen Ewen T3 T2 T2 T1 Oungre Elmore T1 File: IR Annual Presentation SESKMB. Datum: NAD27 Projection: Stereographic Center: N49.54139 W103.04696 Created in AccuMap™, a product of IH Net production (boe/d) – Q3 2012 9,300 Year # Hz Wells Drilled Production split 99% liquids 2009 11 Land (net sections) 232 2010 17 2011 21 Working Interest ~77% 2012 Estimate 35 Reserves (2P mmboe) 42 2013 Budget 29

- 69. SE SASKATCHEWAN OIL 2012 ACCOMPLISHMENTS SE SK Production 14,000 14,000 • Increased total production in area by 11% to 9,300 boe/d, relative to 12,000 12,000 Q3 2011 10,000 10,000 • Drilled 29 wells to the end of Q3 and plan to drill 35 wells to year-end • Continued to drill horizontally in a Sales (boe/d) 8,000 8,000 number of properties that were 6,000 6,000 previously only vertically exploited • Facility upgrades continue to be a 4,000 4,000 priority to support development volumes 2,000 2,000 • Continued work on waterfloods in Lougheed, Oungre, Skinner Lake - - 2008 2009 2010 2011 2012 2013 Liquids (F) Gas (F) Liquids Gas