Arex 1 q16 results presentation

- 1. First Quarter 2016 Results MAY 4, 2016

- 2. Forward-looking statements First Quarter 2016 Results – May 2016 2 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation specifically include the expectations of management regarding plans, strategies, objectives, anticipated financial and operating results of the Company, including as to the Company’s Wolfcamp shale resource play, estimated resource potential and recoverability of the oil and gas, estimated reserves and drilling locations, capital expenditures, typical well results and well profiles, type curve, and production and operating expenses guidance included in the presentation. These statements are based on certain assumptions made by the Company based on management's experience and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and believed to be reasonable by management. When used in this presentation, the words “will,” “potential,” “believe,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project,” “target,” “profile,” “model” or their negatives, other similar expressions or the statements that include those words, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. In particular, careful consideration should be given to the cautionary statements and risk factors described in the Company's most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. The Company uses the terms “estimated ultimate recovery” or “EUR,” reserve or resource “potential,” and other descriptions of volumes of reserves potentially recoverable through additional drilling or recovery techniques that the SEC’s rules may prohibit the Company from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized by the Company. EUR estimates, identified drilling locations and resource potential estimates have not been risked by the Company. Actual locations drilled and quantities that may be ultimately recovered from the Company’s interest may differ substantially from the Company’s estimates. There is no commitment by the Company to drill all of the drilling locations that have been attributed these quantities. Factors affecting ultimate recovery include the scope of the Company’s drilling project, which will be directly affected by the availability of capital, drilling and production costs, availability of drilling and completion services and equipment, drilling results, lease expirations, regulatory approval and actual drilling results, as well as geological and mechanical factors. Estimates of unproved reserves, type/decline curves, per well EUR and resource potential may change significantly as development of the Company’s oil and gas assets provides additional data. Type/decline curves, estimated EURs, resource potential, recovery factors and well costs represent Company estimates based on evaluation of petrophysical analysis, core data and well logs, well performance from limited drilling and recompletion results and seismic data, and have not been reviewed by independent engineers. These are presented as hypothetical recoveries if assumptions and estimates regarding recoverable hydrocarbons, recovery factors and costs prove correct. The Company has limited production experience with this project, and accordingly, such estimates may change significantly as results from more wells are evaluated. Estimates of resource potential and EURs do not constitute reserves, but constitute estimates of contingent resources which the SEC has determined are too speculative to include in SEC filings. Unless otherwise noted, IRR estimates are before taxes and assume NYMEX forward-curve oil and gas pricing and Company-generated EUR and decline curve estimates based on Company drilling and completion cost estimates that do not include land, seismic or G&A costs. Cautionary statements regarding oil & gas quantities

- 3. Company overview AREX OVERVIEW ASSET OVERVIEW Enterprise value $619MM High-quality reserve base 167 MMBoe proved reserves 63% Liquids, 33% oil $504 MM proved PV-10 (non-GAAP) Permian core operating area 139,000 gross (126,000 net) acres ~1+ BnBoe gross, unrisked resource potential ~1,800 Identified HZ drilling locations targeting Wolfcamp A/B/C 2016 Capital program focused on aligning capex with cash flow Stable leasehold that is largely HBP provides for flexible budget Improving commodity prices would allow us to seamlessly increase capital budget from ~$20 MM to ~$80 MM Note: Proved reserves as of 12/31/2015 and acreage as of 3/31/2016. All Boe and Mcfe calculations are based on a 6 to 1 conversion ratio. Enterprise value is equal to market capitalization using the closing share price of $2.99 per share on 4/27/2016, plus net debt as of 3/31/2016. See “PV-10 (unaudited)” slide for reconciliation to GAAP measure. 3First Quarter 2016 Results – May 2016

- 4. 1Q16 Operating highlights OPERATING HIGHLIGHTS Low cost, on time, and on budget • Drilled 4 HZ wells, no completions during the quarter • Wolfcamp A – 2 wells and Wolfcamp C – 2 wells • Wells drilled during the quarter coming in at or below $3.7 MM AFE • 3Q15 wells continue to track above 510 MBoe type curve Production decline management • No completions during the quarter given sustained low prices, production continued on natural PDP decline • Total 1Q16 production of 1,165 Mboe • Positioned for return to development with two completions planned for 2Q16 4First Quarter 2016 Results – May 2016

- 5. 1Q16 Financial highlights FINANCIAL HIGHLIGHTS Preserving cash flow • Quarterly EBITDAX (non-GAAP)1 of $8.7 MM, or $0.21 per diluted share • Quarterly cash flow from operations of $5.3 MM • Capital expenditures of $4.9 MM ($4.0 MM for D&C) • Remain well-hedged for the balance of 2016 Stable financial position • Continued to reduce debt and current liabilities during the quarter • Lenders set borrowing base and commitment amount at $325 MM following Spring 2016 redetermination, while providing flexibility to pursue balance sheet initiatives • Current liquidity position is more than adequate to execute on our 2016 plan Heightened focus on cutting costs • Revenues (pre-hedge) of $17.6 MM, adjusted net loss (non-GAAP)1 of $13.0 MM, or $0.32 per diluted share • Every per-unit cash cost metric has been improved since 1Q15 • 1Q16 Cash operating costs totaled $10.74/Boe, a 13% decrease compared to 1Q15 5 1. See “Adjusted net loss (unaudited)” and “EBITDAX (unaudited)” slides for reconciliation to GAAP measures. First Quarter 2016 Results – May 2016

- 6. First Quarter 2016 Results – May 2016 Balance sheet detail 6 AREX Liquidity and Capitalization• Following the Spring 2016 redetermination, our lenders set the borrowing base and commitment amount at $325 MM, while agreeing to a number of amendments designed to provide additional flexibility • Interest coverage covenant of 1.25x (or 1.00x following the issuance of junior secured debt) through 12/31/17, moving to 1.5x through 12/31/18 and 2.0x thereafter • $150 MM permitted debt basket allows for issuance of new junior secured debt • 2016 capital budget targeted to match operating cash flow • Pro forma liquidity2 of $54 MM provides additional flexibility • LTM EBITDAX / LTM Interest of 3.9x and current ratio of 6.7x, well above minimum covenant requirements • No near-term debt maturities AREX Debt Maturity Schedule ($ MM) AREX Capitalization as of 3/31/2016 ($ MM) Cash $0.8 Credit Facility 269.9 7.0% Senior Notes due 2021 226.1 Total Long-Term Debt 1 $496.0 Shareholders’ Equity 595.8 Total Book Capitalization $1,091.8 AREX Pro Forma Liquidity2 Borrowing Base $325.0 Cash and Cash Equivalents 0.8 Borrowings under Credit Facility (272.0) Undrawn Letters of Credit (0.3) Liquidity $53.5 $272.0 $230.3 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 2016 2017 2018 2019 2020 2021 7.0% Senior Notes 1. Long-term debt is net of debt issuance costs of $6.4 million as of March 31, 2016 Revolving Credit Facility 2. See “Liquidity (unaudited)” slide for pro forma reconciliation.

- 7. First Quarter 2016 Results – May 2016 7 $7.36 $6.18 $5.87 $6.65 $5.55 $4.97 $5.04 $5.44 $5.45 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 AREX LOE Historical Track Record ($/Boe) 2015 Permian Peer LOE ($/Boe) AREX D&C Historical Track Record ($ MM) Current Permian Peer D&C Cost ($ MM) $13.23 $9.51 $8.84 $7.83 $7.71 $7.46 $7.34 $6.92 $6.63 $6.39 $5.24 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 AREX $8.6 $7.0 $5.8 $5.5 $4.5 $3.7 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 2011 2012 2013 2014 2015 Current AFE $7.8 $6.8 $6.6 $6.5 $5.8 $5.5 $5.5 $5.3 $5.2 $5.0 $3.7 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 AREX Source: Latest available company presentations and public filings. Peers include CPE, CWEI, CXO, EGN, FANG, LPI, MTDR, PE, PXD, and RSPP. Lowest cost structure in the Permian Basin

- 8. First Quarter 2016 Results – May 2016 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 1 31 61 91 121 151 181 211 241 271 301 331 361 391 2015 Wolfcamp B&C bench completions Average completed lateral length = 6886' Enhanced completion design drives outperformance from 2015 wells 8 Note: Production data normalized for operational downtimeNote: Production data normalized for operational downtime CumulativeProduction(Boe) Time (Day)

- 9. Strong track record of reserve and production growth 9 RESERVE GROWTH 0 20 40 60 80 100 120 140 160 180 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Gas (MMBoe) Oil & NGLs (MMBbls) • YE15 reserves up 14% YoY • Replaced 603% of produced reserves at a drill- bit F&D cost (non-GAAP) of $4.32/Boe1 • 154.6 MMBoe proved reserves booked to HZ Wolfcamp play MMBoe PRODUCTION GROWTH 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Natural Gas (MBoe/d) Oil & NGLs (Mbbls/d) • 2015 Production increased 10% YoY to a record 15.2 MBoe/d • Anticipating production decline in 2016 with significantly reduced capital budget MBoe/d First Quarter 2016 Results – May 2016 1. Drill-bit F&D costs are calculated by dividing the sum of exploration costs and development costs for the year by the total of reserve extensions and discoveries for the year. See “F&D costs (unaudited)” slide for reconciliation to GAAP measure.

- 10. First Quarter 2016 Results – May 2016 The business is anchored by long-lived, low-cost proved reserve base 10 • 12/31/2015 reserve summary prepared by DeGolyer and MacNaughton (“D&M”) • Replaced 603% of produced reserves at a drill-bit F&D cost (non-GAAP) of $4.32 per Boe1 • Total proved reserves up 14% YoY, proved PV-10 (non-GAAP) of $504 million2 Oil (MBbls) NGLs (MBbls) Natural Gas (MMcf) 3 Total (MBoe) PV-10 ($ MM) 2 PDP 15,476 20,362 154,202 61,539 $390.8 PDNP 191 52 450 317 $1.1 PUD 38,829 29,072 221,336 104,790 $112.1 Total Proved 54,496 49,486 375,988 166,646 $504.0 Total Proved Reserves Reserves by Commodity Proved PV-10 33% 30% 37% Oil NGLs Natural Gas 37% <1% 63% PDP PDNP PUD 78% < 1% 22% PDP PDNP PUD 1. Drill-bit F&D costs are calculated by dividing the sum of exploration costs and development costs for the year by the total of reserve extensions and discoveries for the year. See “F&D costs (unaudited)” slide for reconciliation to GAAP measure. 2. PV-10 calculated based on the first-of-the-month, 12-month average prices for oil, NGLs and natural gas, of $50.16 per Bbl of oil, $15.13 per Bbl of NGLs and $2.64 per MMBtu of natural gas. See “PV-10 (unaudited)” slide for reconciliation to GAAP measure. 3. The gas reserves contain 42,617 MMcf of gas that will be produced and used as field fuel (primarily for compressors and artificial lifts) before the gas is delivered to a sales point.

- 11. Established infrastructure in place is critical to low cost structure 11 Benefits of water recycling • Reduce D&C cost • Reduce LOE • Increase project profit margin • Minimize fresh water use, truck traffic and surface disturbance First Quarter 2016 Results – May 2016

- 12. First Quarter 2016 Results – May 2016 Current hedge position 12 • Based on the midpoint of current 2016 guidance, approximately 48% of forecasted oil production and 75% of forecasted natural gas production are hedged at weighted average prices of $50.56/Bbl and $2.61/MMBtu, respectively. Commodity & Period Contract Type Volume Contract Price Crude Oil April 2016 – December 2016 Swap 750 Bbls/d $62.52/Bbl April 2016 – June 2016 Swap 1,000 Bbls/d $40.00/Bbl April 2016 – June 2016 Swap 500 Bbls/d $40.25/Bbl April 2016 – September 2016 Swap 750 Bbls/d $43.00/Bbl Natural Gas April 2016 – December 2016 Swap 200,000 MMBtu/month $2.93/MMBtu April 2016 – March 2017 Swap 400,000 MMBtu/month $2.45/MMBtu April 2017 – December 2017 Collar 200,000 MMBtu/month $2.30/MMBtu - $2.60/MMBtu

- 13. First Quarter 2016 Results – May 2016 Production and expense guidance 13 2016 Guidance Production Oil (MBbls) 1,300 – 1,400 NGLs (MBbls) 1,440 – 1,540 Natural Gas (MMcf) 9,600 – 10,100 Total (MBoe) 4,340 – 4,625 Cash operating costs (per Boe) Lease operating $5.00 - $6.00 Production and ad valorem taxes 8.0% of oil & gas revenues Cash general and administrative $3.50 - $4.00 Non-cash operating costs (per Boe) Non-cash general and administrative $1.00 - $1.50 Exploration (non-cash) $0.50 - $1.00 Depletion, depreciation and amortization $18.00 - $20.00 Capital expenditures (in millions) ~$20

- 14. Appendix

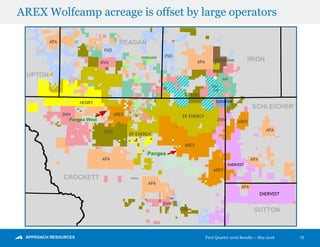

- 15. AREX Wolfcamp acreage is offset by large operators 15 Pangea West EOG HENRY ENERVEST EP ENERGY others APA PXD DVN AREX AREX AREX AREX APA APA DVN DVN ELEVATION PXD DVN APA APA APA EOG Pangea ENERVEST EOG / EAP EAP BROADOAK ENDEAVOR APA UPTON CROCKETT REAGAN IRION SCHLEICHER SUTTON EP ENERGY AREX AREX AREX AREX EOG First Quarter 2016 Results – May 2016

- 16. First Quarter 2016 Results – May 2016 Adjusted net loss (unaudited) 16 (in thousands, except per-share amounts) Three Months Ended March 31, 2016 2015 Net loss $ (13,660) $ (7,708) Adjustments for certain items: Unrealized loss on commodity derivatives 957 9,321 Rig termination fees - 498 Related income tax effect (335) (3,437) Adjusted net loss $ (13,038) $ (1,326) Adjusted net loss per diluted share $ (0.32) $ (0.03) The amounts included in the calculation of adjusted net loss and adjusted net loss per diluted share below were computed in accordance with GAAP. We believe adjusted net loss and adjusted net loss per diluted share are useful to investors because they provide readers with a meaningful measure of our profitability before recording certain items whose timing or amount cannot be reasonably determined. However, these measures are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The following table provides a reconciliation of adjusted net loss to net loss for the three months ended March 31, 2016 and 2015.

- 17. First Quarter 2016 Results – May 2016 EBITDAX (unaudited) 17 We define EBITDAX as net loss, plus (1) exploration expense, (2) depletion, depreciation and amortization expense, (3) share-based compensation expense, (4) unrealized loss on commodity derivatives, (5) interest expense, net, and (6) income tax benefit. EBITDAX is not a measure of net income or cash flow as determined by GAAP. The amounts included in the calculation of EBITDAX were computed in accordance with GAAP. EBITDAX is presented herein and reconciled to the GAAP measure of net loss because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund development and exploration activities. This measure is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The following table provides a reconciliation of EBITDAX to net loss for the three months ended March 31, 2016 and 2015. (in thousands, except per-share amounts) Three Months Ended March 31, 2016 2015 Net loss $ (13,660) $ (7,708) Exploration 569 1,090 Depletion, depreciation and amortization 20,229 26,520 Share-based compensation 1,550 2,217 Unrealized loss on commodity derivatives 957 9,321 Interest expense, net 6,298 5,922 Income tax benefit (7,245) (3,996) EBITDAX $ 8,698 $ 33,366 EBITDAX per diluted share $ 0.21 $ 0.83

- 18. First Quarter 2016 Results – May 2016 Cash operating expenses (unaudited) 18 We define cash operating expenses as operating expenses, excluding (1) exploration expense, (2) depletion, depreciation and amortization expense, and (3) share-based compensation expense. Cash operating expenses is not a measure of operating expenses as determined by GAAP. The amounts included in the calculation of cash operating expenses were computed in accordance with GAAP. Cash operating expenses is presented herein and reconciled to the GAAP measure of operating expenses. We use cash operating expenses as an indicator of the Company’s ability to manage its operating expenses and cash flows. This measure is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The following table provides a reconciliation of cash operating expenses to operating expenses for the three months ended March 31, 2016 and 2015. (in thousands, except per-Boe amounts) Three Months Ended March 31, 2016 2015 Operating expenses $ 34,869 $ 45,686 Exploration (569) (1,090) Depletion, depreciation and amortization (20,229) (26,520) Share-based compensation (1,550) (2,217) Cash operating expenses $ 12,521 $ 15,859 Cash operating expenses per Boe $ 10.74 $ 12.32

- 19. First Quarter 2016 Results – May 2016 Liquidity (unaudited) 19 Liquidity is calculated by adding the net funds available under our revolving credit facility and cash and cash equivalents. We use liquidity as an indicator of the Company’s ability to fund development and exploration activities. However, this measurement has limitations. This measurement can vary from year-to-year for the Company and can vary among companies based on what is or is not included in the measurement on a company’s financial statements. This measurement is provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on our website. The table below summarizes our liquidity at March 31, 2016, and pro forma for the third amendment to our revolving credit facility at March 31, 2016. (in thousands) Liquidity at March 31, 2016 Pro forma Borrowing base $ 450,000 $ 325,000 Cash and cash equivalents 840 840 Revolving credit facility – outstanding borrowings (272,000) (272,000) Outstanding letters of credit (325) (325) Liquidity $ 178,515 $ 53,515

- 20. First Quarter 2016 Results – May 2016 F&D costs (unaudited) 20 F&D Cost reconciliation Cost summary (in thousands) Property acquisition costs Unproved properties $ 653 Proved properties - Exploration costs 4,439 Development costs 146,237 Total costs incurred $ 151,329 Reserves summary (MBoe) Balance – 12/31/2014 146,248 Extensions & discoveries 34,895 Production (1) (5,787) Revisions to previous estimates (8,709) Balance – 12/31/2015 166,646 F&D cost ($/Boe) All-in F&D cost $ 5.78 Drill-bit F&D cost 4.32 Reserve replacement ratio Drill-bit 603% All-in finding and development (“F&D”) costs are calculated by dividing the sum of property acquisition costs, exploration costs and development costs for the year by the sum of reserve extensions and discoveries, purchases of minerals in place and total revisions for the year. Drill-bit F&D costs are calculated by dividing the sum of exploration costs and development costs for the year by the total of reserve extensions and discoveries for the year. We believe that providing F&D cost is useful to assist in an evaluation of how much it costs the Company, on a per Boe basis, to add proved reserves. However, these measures are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our previous SEC filings and included in our annual report on Form 10-K filed with the SEC on March 4, 2016. Due to various factors, including timing differences, F&D costs do not necessarily reflect precisely the costs associated with particular reserves. For example, exploration costs may be recorded in periods before the periods in which related increases in reserves are recorded, and development costs may be recorded in periods after the periods in which related increases in reserves are recorded. In addition, changes in commodity prices can affect the magnitude of recorded increases (or decreases) in reserves independent of the related costs of such increases. As a result of the above factors and various factors that could materially affect the timing and amounts of future increases in reserves and the timing and amounts of future costs, including factors disclosed in our filings with the SEC, we cannot assure you that the Company’s future F&D costs will not differ materially from those set forth above. Further, the methods used by us to calculate F&D costs may differ significantly from methods used by other companies to compute similar measures. As a result, our F&D costs may not be comparable to similar measures provided by other companies. The following table reconciles our estimated F&D costs for 2015 to the information required by paragraphs 11 and 21 of ASC 932-235. (1) Production includes 1,530 MMcf related to field fuel.

- 21. First Quarter 2016 Results – May 2016 PV-10 (unaudited) 21 The present value of our proved reserves, discounted at 10% (“PV-10”), was estimated at $504 million at December 31, 2015, and was calculated based on the first-of-the-month, twelve-month average prices for oil, NGLs and gas, of $50.16 per Bbl of oil, $15.13 per Bbl of NGLs and $2.64 per MMBtu of natural gas, adjusted for basis differentials, grade and quality. PV-10 is our estimate of the present value of future net revenues from proved oil and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of future income taxes. The estimated future net revenues are discounted at an annual rate of 10% to determine their “present value.” We believe PV-10 to be an important measure for evaluating the relative significance of our oil and gas properties and that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating the Company. We believe that PV-10 is a financial measure routinely used and calculated similarly by other companies in the oil and gas industry. The following table reconciles PV-10 to our standardized measure of discounted future net cash flows, the most directly comparable measure calculated and presented in accordance with GAAP. PV-10 should not be considered as an alternative to the standardized measure as computed under GAAP. (in millions) December 31, 2015 PV-10 $ 504 Less income taxes: Undiscounted future income taxes (307) 10% discount factor 263 Future discounted income taxes (44) Standardized measure of discounted future net cash flows $ 460

- 22. Contact information SERGEI KRYLOV Executive Vice President & Chief Financial Officer 817.989.9000 ir@approachresources.com www.approachresources.com