Banco ABC - 3rd Quarter 2008 Results Presentation

- 1. 3Q08 Earnings Presentation s October 30, 2008 Speak kers: Anis Chacur Neto Deputy CEO o – Sergio Lulia Jacob ‐ Exe ecutive VP & IR Officer Alexandre Yoshiaki Sin nzato – IR Manager 1

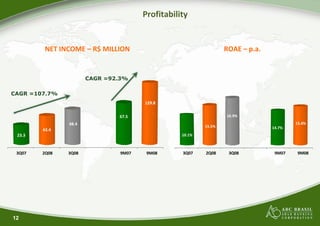

- 2. 3Q08 Hi ighlights Net Income of R$48.4 million in 3Q08, growing by 11.5% from R$43.4 million in 2Q08 and by 107.7% year over year. In 2008, Interest on Equity began to be paid on a quarterly basis, with the payment to shareholders in 3Q08 of gross IOE o R$17.6 million. of The Efficiency Ratio was 35.8% in 3Q08, from 35.1% in 2Q08 and 37.4% in 3Q07, one of the best efficiency ratios presented by the bank market. The Credit Portfolio, including guarantees, reached R$6,879.1 million, growing 5.9% in relation to 2Q08 and 61 8% year over year 61.8% year. The Loan Portfolio (Resolution 2,682) grew by 9 9.8% (3Q08 versus 2Q08). Portfolio quality remained high, with 99.4% of loan operations rated from AA to C (Central Bank f Resolution 2,682), compared with 99.3% in 2Q0 and 99.3% in 3Q07. 08 The Return on Equity (ROAE) reached 16.9% in 3Q08 versus 10.1% in 3Q07 and 15.5% in 2Q08. 2

- 3. Ownership p Structure Free Float Marsau Uruguay 32.7% (ABC) 56.4% Associates 1.4% Management 9.5% 3

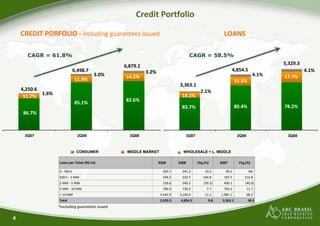

- 4. Credit Portfolio CREDIT PORFOLIO ‐ including guarantees issued LOANS CAGR = 61.8% CAGR = 58.5% 5,329.3 6,879.1 6,498.7 3.2% 4,854.5 4.1% 3.0% 14.2% 4.1% 17.7% 11.9% 15.5% 3,363.1 4,250.6 2.1% 1.6% 14.2% 11.7% 82.6% 85.1% 83.7% 80.4% 78.2% 86.7% 86 7% 3Q07 2Q08 3Q08 3Q07 2Q08 3Q08 CONSUMER MIDDLE MARKET WHOLESALE + L. MIDDLE Loans per Ticket (R$ mi) 3Q Q08 2Q08 Chg.(%) 3Q07 Chg.(%) 0 ‐ 500 k 265.7 241.2 10.2 90.2 NA 500 k ‐ 2 MM 594.2 242.7 144.8 187.5 216.8 2 MM ‐ 5 MM 236.6 540.2 (56.2) 400.1 (40.9) 5 MM ‐ 10 MM 786.9 730.5 7.7 704.2 11.7 > 10 MM 3,445.9 3,100.0 11.2 1,981.1 68.2 Total 5,329.3 4,854.5 9.8 3,363.1 58.5 *excluding guarantees issued 4

- 5. High‐quality C Credit Portfolio 3Q08 Segments Credit Past Due Write Off (R$ Portfolio (*) tfolio % Port PLL (R$ mi) % Portfolio (> 91dias) (R$ % Portfolio mi) (R$ mi) mi) Wholesale+L.Middle 4,165.8 1.1 0.0 30.7 0.7 4.3 0.1 Middle 942.7 1.4 0.1 21.1 2.2 13.1 1.4 Payroll 220.8 0.3 0.1 4.3 1.9 0.9 0.4 Total 5,329.3 2.8 0.1 56.1 1.1 18.3 0.3 *excluding guarantees issued Rating (R$ mi) * 3Q08 % Port tfolio D-H 0.6% AA 916.3 17.2 A 2,393.7 44.9 B 1,729.4 32.5 C 255.3 4.8 D 8.7 0.2 E 3.4 0.1 F 10.8 0.2 G 2.1 0.0 H 9.6 0.2 Total 5,329.3 100.0 AA-C 99.4% *excluding guarantees issued 5

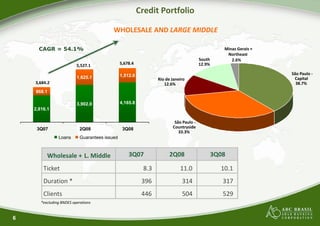

- 6. Credit Portfolio WHOLESALE AN ND LARGE MIDDLE CAGR = 54.1% Minas Gerais + Northeast South 2.6% 5,527.1 5,678.4 12.9% 1,512.6 São Paulo ‐ 1,625.1 Rio de Janeiro R Capital 3,684.2 12.6% 38.7% 868.1 3,902.0 4,165.8 2,816.1 São Paulo ‐ 3Q07 2Q08 3Q08 Countryside 33.3% Loans Guarantees issued Wholesale + L. Middle 3Q07 2Q08 3Q08 Ticket 8.3 11.0 10.1 Duration * 396 314 317 Clients 446 504 529 *excluding BNDES operations 6

- 7. Credit Portfolio MIDDLE MARKET Minas Gerais CAGR = 96.6% South 9.2% 979.9 4.3% 773.8 37.2 Rio de Janeiro 3.8% 19.1 498.5 São Paulo ‐ 19.4 Countryside C 942.7 754.7 11.0% 479.1 São Paulo ‐ Capital C i l 71.7% 3Q07 2Q08 3Q08 Loans Guarantees issued Middle Market 3Q07 2Q08 3Q08 Ticket 1.7 2.0 2.4 Duration * 166 197 193 Clients 297 389 409 * excluding BNDES operations 7

- 8. Credit Portfolio PAYROLL‐ ‐DEDUCTIBLE CAGR = 225.2% INSS 20.6% 220.8 197.8 67.9 67 9 3Q07 2Q08 3Q08 Others 79.4% Loans Payroll‐Deductible 3Q07 2Q08 3Q08 Average Term 580 751 752 Agreements 4 24 37 39 8

- 9. Other A Activities TREASURY AND D CAPITAL MARKET Capital Market (R$ mi) 3Q08 8 2Q08 Chg.(%) 3Q07 Chg.(%) Underwriting Fees and Structured Oper. 2.3 1.3 76.9 3.5 (34.3) Number of trades 5 5 NA 5 NA Treasury (R$ mi) 3Q08 8 2Q08 Chg.(%) 3Q07 Chg.(%) Income 4.5 9.8 (54.5) (0.8) (656.9) Average consolidated VaR 4.3 3.4 26.5 2.6 65.4 9

- 10. Fun nding 5,459.3 4,819.4 4,354.3 40.6% 3,841.3 36.3% 3,164.6 43 3.0% 44.0% 7.4% Retail International 35.4% 10.3% 2.7% 9.2% BNDES 2.5% 1.8% 2.4% 10 0.5% 13.4% 11.3% 22.4% 19.5% Institutional 19 9.0% 24.4% 20.2% Local 25 5.0% 28.3% 23.3% Corporate 25.0% 22.1% Sep 2007 Dec 2007 Ma 2008 ar Jun 2008 Sep 2008 Open Market Deposits and Funding (R$ mi) 3Q08 2Q08 Chg.(%) 3Q07 Chg.(%) Until 3 months 1,088.4 788.3 38 8.1 664.3 63.9 3 to 12 months 1,160.9 1,343.3 (13 3.6) 570.1 103.6 1 to 3 years 665.5 614.0 8.4 8 485.8 37.0 Above 3 years 20.8 36.5 (43 3.0) 26.4 (21.0) Total 2,935.6 2,782.1 5.5 1,746.4 68.1 Borrowing and on Lending Obligations 3Q08 2Q08 Chg.(%) 3Q07 Chg.(%) Until 3 months 952.1 487.2 95 5.4 341.9 178.5 3 to 12 months 1,113.6 1,111.0 0.2 0 621.6 79.1 1 to 3 years 384.3 360.8 6.5 6 370.9 3.6 Above 3 years 73.6 78.3 (6 6.0) 83.8 (12.2) Total 2,523.7 2,037.3 23.9 2 1,418.2 77.9 10

- 11. Profi itability NET INCOME – R$ MILLION Other Operating Net Interest Loan Expenses Income Tax and 88.8 Social Income Operations Contribution (27.8) (22.2) Profit NET Treasury Sharing INCOME 4.5 Impact of IO OE 7.0 (13.9) Services 12.1 48.4 (15.2) 105.4 05 Income Statement (R$ mi) 3Q08 Net Interest Income after PLL 70.1 Adjustment of exchange Gains/Losses effect on Offshore Inve estments (a) 16.6 Taxes adjustment of exchange effect on Offshore Investmentts (b) 6.6 Net Interest Income 93.3 Banking services fees 12.1 Personnel Expenses/Other Administrative/Tax (30.7) Other operating income/expenses 18.3 estments (a) Adjustment of exchange Gains/Losses effect on Offshore Inve (16.6) Non Operating Income 1.2 Earnings before tax Income 77.6 Taxes (8.6) ts (b) Taxes adjustment of exchange effect on Offshore Investment (6.6) Profit Sharing (13.9) Net Income 48.4 11

- 12. Profi itability NET INCOME – R$ MILLION ROAE – p.a. CAGR =92.3% CAGR =107.7% 129.8 67.5 16.9% 48.4 15.4% 15.5% 14.7% 43.4 23.3 10.1% 3Q07 2Q08 3Q08 9M07 9M08 3Q07 2Q08 3Q08 9M07 9M08 12

- 13. Ra atios NIM STOCKHOLDERS’ EQUITY (R$ mi) AND BASEL INDEX (%) 26.7% 1,158.8 6.6% 6.5% 1,131.8 6.4% 6.2% 1,082.9 19.2% 19,2% 5.5% 16.7% 16,1% 3Q07 2Q08 3Q08 9M07 9M08 3Q07 2Q08 3Q08 EFFICIENCY RATIO (%) – inc cluding profit sharing 37.4% 35.8% 35.1% 3Q07 2Q08 3Q08 13

- 14. Ra atings Ratings Agency Update LOC CAL GLOBAL * Aaa Br a.Br a Baa2 Baa2 09/15/2008 AA A‐ BB+ 05/16/2008 *Deposits in local currency 14

- 15. Cont tacts Investor Relations Sergio Lulia Jacob – Ex xecutive VP & IR Officer Alexandre Sinza – IR Manager ato Eduardo Randi – IR Analyst ich Web Site: www.abcbrasil.com.br/ir Email: ri@abc cbrasil.com.br Tel.: +55 (11 3170 2186 1) 15

- 16. Discla aimer The following material, on this date, is a presentation containing general information about the Banco ABC Brasil S.A. We offer no guarantee and make no d declaration, implicitly or explicitly, as to the accuracy, completeness or scope of this information. This presentation may include forward‐looking state ements of future events or results according to the regulations of the Brazilian and International securities and exchange commissions. These statements are based on certain assumptions and analyses by the Company that reflect its experience, the economic environment, future market conditions and expected events by the company, many of which are beyond d the control of the Company. Important factors that m lead to significant differences between the actual may results and the statements of expectations about future events or results include the company’s business strategy, strategy Brazilian and International economic condit tions, technology, tions technology financial strategy financial market strategy, conditions, uncertainty regarding the results of its fu uture operations, plans, objectives, expectations and intentions, among others. Considering these fac ctors, the actual results of the company may be significantly different from those shown or implicit in the statement of expectations about future events n or results. The information and opinions contained in this presentation should not be understood as a s recommendation to potential investors and no invest tment decision is to be based on the veracity, current events or completeness of this information or thes opinions. No advisors to the company or parties se related to them or their representatives should have any responsibility for any losses that may result from the use or contents of this presentation. 16