BANK OF AMERICA 2000 Annual Report

- 1. 2000 Summary Annual Report grow

- 2. Financial Highlights Bank of America Corporation and Subsidiaries Year Ended December 31 (Dollars in millions, except per share information) 2000 1999 For the Year – Operating Results(1) 2000 Revenue* Revenue(2) $ 33,253 $ 32,521 ($ in millions) Net income 7,863 8,240 Equity Investments Shareholder value added 3,081 3,544 $864 Asset Earnings per common share 4.77 4.77 Management $2,284 Diluted earnings per common share 4.72 4.68 Dividends paid per common share 2.06 1.85 Return on average assets 1.17% 1.34% $20,621 $8,965 Return on average common shareholders’ equity 16.70 17.70 Efficiency ratio 54.38 55.30 Average common shares issued and Consumer and Commercial Global Corporate and outstanding (in millions) 1,646 1,726 Banking Investment Banking For the Year – Cash Basis Financial Data(1) (3) Earnings per common share $ 5.30 $ 5.28 Diluted earnings per common share 5.24 5.19 Return on average tangible assets 1.33% 1.52% Return on average tangible common 2000 Net Income* ($ in millions) shareholders’ equity 26.06 28.46 Equity Investments Efficiency ratio 51.78 52.57 $460 Consumer and Asset Commercial At Year End Management Banking $601 Total assets $ 642,191 $ 632,574 Total loans and leases 392,193 370,662 $4,643 $2,052 Total deposits 364,244 347,273 Total shareholders’ equity 47,628 44,432 Common shareholders’ equity 47,556 44,355 Book value per common share 29.47 26.44 Global Corporate and Market price per share of common stock 45.88 50.19 Investment Banking Common shares issued and outstanding (in millions) 1,614 1,677 (1) Excludes after-tax merger and restructuring charges of $346 million for 2000 and $358 million for 1999. *Excludes Corporate Other. (2) Includes net interest income on a taxable-equivalent basis and noninterest income. (3) Cash basis calculations exclude goodwill and other intangible assets and their related amortization expense. Contents 2. Letter from Chairman 24. Internet and e-Commerce 7. Summary of Financial Performance 25. Investment Banking 8. Letter from President 28. Serving Large Corporations and the Institutional Market 12. Serving Consumers 30. Consolidated Statement of Income 14. Asset Management 31. Consolidated Balance Sheet 15. Card and Payment Services 32. Report of Independent Accountants / 18. Serving Small Businesses Principal Officers and Board of Directors 22. Serving the Middle Market Corporate Information (inside back cover)

- 3. In advertisements appearing nationwide, Bank of America asks: why not? grow. The phrase is intended to inspire people to think about the endless opportunities life presents and how we can help them turn those opportunities into reality. We are committed to growing our relationships with customers and clients, to expanding our share of market, to increasing revenue and earnings and to building shareholder value. To do that, we must add value, take away obstacles to doing business with us, multiply the choices we offer customers and clients and divide resources appropriately to improve the customer experience. That’s why we say grow . 1

- 4. Looking Back, Forging Ahead TO O U R S H A R E H O L D E R S : This will be my final letter to you as chairman and chief executive officer of your company. In the fall of 1998, when we created the new Bank of America, the board of directors asked me to remain as CEO past the normal retirement age. I agreed to stay on long enough to see us through the merger transition and set the company on a strong course for the future. While we clearly have many challenges still to face, it is my judgment that we have largely reached these milestones. As such, I have decided the time is right to hand the reins of your company to a new generation of leadership. To this end, I have informed our board of directors that I will retire from the company on April 25, 2001 at our annual shareholders meeting. The board, in turn, has named Kenneth D. Lewis, currently president and chief operating officer of your company, chairman-elect and CEO-elect. Mr. Lewis will assume those offices immediately upon my retirement. A Ye a r o f Pr o g r e s s a n d Ch a l l e n g e s In 2000, our company had operating earnings of $7.86 billion on revenues of more than $33 billion and a return on common equity of 16.7%. In the 18 months ended December 31, we repurchased 146 million shares of our common stock at an investment of $8.1 billion, reducing our shares out- standing by 8%. A more complete description of the year’s financial results can be found on page 7. Grow a Reputation Bank of America continues Received NAACP Corporate Ranked by Working to achieve industry prominence and earn Excellence Award and scored Mother magazine as one awards and citations from a broad range of highest rank in NAACP’s first of the nation’s top 10 organizations for its business successes, work- consumer report card on the companies for working place innovations and contributions to its com- banking industry. mothers. munities. Following are highlights from 2000: 2

- 5. We made significant progress in executing our corporate strategy, which, as I wrote last year, calls for us to integrate the delivery of our products and services on behalf of our customers; reward customers for bringing us more of their business; and align our financial and intellectual resources with revenue opportunities and customer solutions. I’ve asked Ken, as the chief architect of this growth strategy and the leader responsible for tactical execution, to report on this progress in a separate President’s Letter to Shareholders. You will find Ken’s letter on page 8. Strategic and tactical progress notwithstanding, our financial performance in 2000 was disappointing, as we missed our annual financial goals for growth in revenue, net income and earnings-per-share by significant margins. The weakness in these financial results – and the resulting weakness in our stock price – was due to several factors. First, along with the rest of our industry, our earnings and our stock came under pressure from higher interest rates, as we predicted last year. Prior to this month’s cuts in short-term interest rates, the Federal Open Market Committee of the Federal Reserve Board raised short-term interest rates six times dating back to June of 1999 for a total of 175 basis points, increasing the cost of capital and narrowing margins. Second, in the fall, strong earnings gains in core businesses began to be offset by weakening credit quality in the corporate sector. It is becoming increasingly clear that the credit quality situation is more than an anomaly; rather, we appear to be on the front end of an overall weakening in the credit cycle that will more than likely continue to impact earnings well into 2001. That said, we believe that Bank of America is better-positioned than most other banks to withstand an economic slowdown and accompanying decline in credit quality. In fact, with more than $50 billion in capital and reserves and pre-tax operating income of more than $3 billion per quarter, we are well-prepared to weather the inevitable ups and downs in the credit cycle. We have taken a number of specific actions to attempt to mitigate this increase in credit risk, including rigorous reviews of our portfolio, lowering limits, tightening underwriting and hedging where possible. We also believe that we will benefit in relation to our competitors in the months to come from our size, geographic reach and the diversity in our loan portfolio. Third, while we are seeing strong initial results of strategy execution in many areas of the bank, overall progress has not been as rapid as we projected. We took several aggressive steps last year to speed the transformation of the company, including our decision in July to reduce middle-management positions dramatically, which is stream- lining the organization, moving decision-making closer to the customer and freeing up funds for investment in growth opportunities. Other initiatives include a company-wide effort to bring performance measurements and incentive plans into alignment with new strategic and tactical goals, and customer service improvements that have resulted in consistently better rates of customer satisfaction. Although I am as disappointed as any other shareholder in the performance of our stock, I must reiterate what I wrote last year in this regard. Our company is undergoing a transformation from top to bottom that is predicated on a long-term, customer-focused strategy for internal growth. The evidence, as discussed briefly below and in more detail Nations Funds mutual Received the United Received the Distinguished funds topped $100 Way of America Spirit Corporate Award from the billion in assets. of America Award. U.S. Department of Com- merce Minority Business Development Agency. 3

- 6. throughout this report, shows that our strategy is working and that our primary growth engines are gaining momentum in the marketplace. The stock market, appropriately, continues to take a wait-and-see approach, even as issues such as interest rates, credit quality and the slowing growth of the overall economy present new challenges to strategic execution and make judgments about our long-term earnings potential difficult. Despite these factors, I believe that our core businesses will continue to grow and improve, and that, ultimately, the value they create will be recognized by investors. Th e Co m pa ny We’ ve B u i lt In the midst of unmistakably difficult times, I remain confident. There are good reasons for this confidence. We are building this company with a clear vision of what we want to be for our customers and clients. In short, we are building an organization that will provide greater value, convenience, capability and expertise to more customers and clients than any other company in the U.S. financial services industry. We may not want to be all things to all people, but we do want to be the primary source of financial services to more people and organizations than anyone else. The major components necessary to turn this vision into reality are all in place. We have the largest geographic retail banking franchise in the nation, with a leading presence in all the country’s highest-growth markets. We do business with more than one in three households within our franchise and more than 2 million U.S. businesses. Our delivery network is unmatched, with more banking centers and ATMs than any competi- tor, the busiest telephone banking call centers in the country and the largest Internet banking customer base in the world. We offer a broad array of products and services, enabling all our customers and clients – from individuals to corporations – to manage their finances as a whole, easily and confidently. We have capital strength, visionary leadership and more than 140,000 talented, dedicated associates working hard to accom- plish shared goals. With these pieces in place, we began the difficult task of pulling it all together and making the machine run the way it was designed to run: not as a disjointed collection of individual businesses, but as a unified whole that creates value for customers and clients. This idea has everything to do with the articulation of our corporate strategy, which is to integrate businesses, reward broad relationships and align resources effectively. Despite the financial “noise” created by the factors cited above, the underlying evidence is that the strategy is working. For example, in our retail bank, a critical component of strategic execution is broad- ening and deepening existing customer relationships. To reward customers for bringing us more of their business, we are creating value packages that encourage customers to expand their relationships with us from a single product up through several identified multi-product service levels. The value proposition is quite simple: customers who hold very few, basic Bank of America products – say, a checking account or a credit card – are encouraged to consolidate their business with the bank, including savings and invest- ments, brokerage services, auto or other consumer loans, mortgages or home equity Recognized by Global Named one of America’s top CEO Hugh McColl received Finance magazine as one companies for women’s Excelente Award for being of the “Best Retail Internet businesses by the Women’s the “Most Supportive Banks” in North America. Business Enterprise Person of the Latin National Council. American Community.” 4

- 7. loans, and other products and services. In return for bringing us more of their business, these customers qualify for reduced fees, enhanced services and other benefits. The results are positive, measurable and dramatic. Since the beginning of 1999, customers in two of these service levels – Plus and Premier – each have increased by more than 25%, even as our total number of retail customers has remained relatively unchanged. The benefits for customers is clear. And so is the benefit to the bank: when non-relationship households become Plus or Premier households, relationship-net-income more than doubles. Progress is evident in other high-growth businesses as well, including Asset Management, where mutual fund assets grew 35% during the year, topping the $100 bil- lion mark in August. Balances in Money Manager, our combined investing and banking account, increased 65% to more than $20 billion. And while we expect that Global Corporate and Investment Banking growth will slow this year due to weakened condi- tions in the capital markets, this group continues to gain market share, breaking into the top 10 in league table rankings in almost every significant product category, and will be in a very strong position when the markets regain momentum. At the same time our front line businesses are strengthening and expanding cus- tomer relationships, our associates in technology and R&D continue to work toward building the “digi-brick” institution we wrote about last year, combining the best of the physical and virtual worlds to deliver a 21st-century financial services experience to our customers. These associates are accomplishing this goal by implementing innovative technology solutions, and by forming strategic partnerships with myriad new corporate partners to give our customers access to all the newest capabilities they need. You can read more about how we’re making good on this part of our vision on page 24. Our associates are keeping their eyes on the ball and building this company for the future. My judgment – which is supported by positive trends in customer service and growth in our key businesses – is that we have the right business strategy and a sound long-term plan. I continue to believe that when the dust settles and the clouds lift, Bank of America will emerge as the best financial services company in the country, with a stock price to match its fundamentally solid financial performance. Lo o k i n g A h e a d Today, the company we have built during the 17 years of my tenure as CEO is positioned for great success. Our current challenges may delay that success. But the potential, the plan, the resources and the leadership are all here in abundance, and the combination of these assets gives me great confidence. In my judgment, it also is important to remember that our company continues to be a strong leader and a driving force for good in all the communities where we do busi- ness. Business challenges have not caused us to diminish our community development activities, as we announced last May that we exceeded our first-year target in our unprece- dented $350 billion, ten-year commitment to investing in low-to moderate-income American neighborhoods. The Bank of America Foundation also remains strong, as we topped the list of U.S. corporate foundations measured by cash contributions, and won the Winner of National Real Received Business Committee Certified as top-quality Estate Investor’s 2000 for the Arts and Forbes maga- provider of trade and cash Leadership Award for Top zine Founder’s Award for management services in Financial Firm. exceptional long-term leader- Asia by the International ship and commitment to Standards Organization. alliances with the arts. 5

- 8. coveted United Way Spirit of America Award, having excelled in all four major award cate- gories: corporate contributions, employee campaigns, major gifts and volunteer programs. I often have said that while a company’s highest priority must be achieving financial results, its reason for being must be something quite different. People, after all, deter- mine the ultimate success or failure of any organization, and people are seldom inspired to greatness solely by means of material reward. Rather, we inspire hard work, determi- nation, innovation and loyalty by building a company people believe in and care about. And that means building a company that takes care of all its stakeholders: shareholders, customers, associates and communities. In other words, while companies are frequently described in terms of the numbers they generate – assets, revenue, net income or market capitalization – these numbers fail to paint the full picture of the people who come together in an enterprise, day-in and day-out, to work toward shared goals. In this regard, we view community development activities, associate programs and philanthropy as part of the cultural foundation upon which the company and its future success must be built. This is the legacy our past lead- ers left to my stewardship, and it’s a legacy I am proud to pass on to my successors. At the January 2001 meeting of the board, our directors unanimously chose Ken Lewis to lead our company. Ken is a proven leader with tremendous management skill and a strong vision for what Bank of America can become in the future. He inspires the trust of his teammates, and will undoubtedly lead this company to overcome great challenges and achieve great successes. Ken is supported by an outstanding executive management team, which will work directly with him to lead our company. I would like to congratulate Ken, and express the confidence I have in all our leaders and their ability to fulfill our vision for Bank of America. I also would like to thank the members of our board – in particular, Sol Trujillo, who retired from the board last year – for their service and guidance. You all have my sincere gratitude. As I prepare to bring my 41-year career here to a close, our company faces a new beginning, even as the challenges to success have never been greater. However, with a clear vision, plentiful resources, strong leadership and the best people in the industry, I know the future will be bright. In closing, I would like to thank all of you for your support over the many years I have had the privilege to occupy this position. And, as always, I welcome your thoughts and suggestions. Hugh L. McColl, Jr. Chairman and Chief Executive Officer January 25, 2001 Honored by Minority MBA Named best supplier of Named Large Employer magazine as one of the banking services to small of the Year by Goodwill nation's top 10 companies business by Small Business Industries. for corporate diversity and Computing magazine. opportunities for MBA professionals of color. ® 6

- 9. Summary of Financial Performance Operating earnings per share (diluted) for Bank of America rose 1% in 2000 to $4.72. Lower earnings in the fourth quarter, driven by higher credit costs and sluggish revenue growth occurring in a slowing economy, significantly moderated what had been a 12% increase in per-share earnings for the first nine months. Operating earnings totaled $7.9 billion, compared to $8.2 billion in 1999. Average shares outstanding declined by 5%, as the company repurchased 67.6 million of its shares, representing an investment of $3.3 billion during the year. The return on equity was 16.70% while the return on average assets was 1.17%. Total revenues for the year rose 2%, while noninterest expense was virtually unchanged. The provision for credit losses rose substantially, to $2.5 billion, compared to $1.8 billion in 1999. N e t I n c o m e Including after-tax charges associated with growth initiatives and mergers, net income was $7.5 bil- lion, or $4.52 per share (diluted), compared to $7.9 billion, or $4.48 per share, a year ago. R eve n u e Revenues continued to grow due to broad-based increases in new business from the company’s diverse customer base. The year-to-year comparison was negatively impacted by the absence of a number of one-time gains recorded in 1999 and by higher auto lease residual charges in 2000. Managed loans and leases rose 9% for the year, while deposit growth was 3%. Net interest income growth was 2%, as loan growth and higher trading-related revenues more than offset margin compression, caused in part by a change in mix, and the significant cost of share repurchases. Noninterest income rose 3%, as the result of double-digit increases in card fee revenue, investment and broker- age service fees, equity investment gains and trading revenue. Noninterest income was negatively impacted by the absence of sales and securitizations, which boosted the year-ago results, and the impact of a $278 million increase in auto lease residual charges. Ex pe n s e s Noninterest expense was virtually unchanged, reflecting the second year of merger-related savings as well as benefits from other productivity initiatives. The efficiency ratio was 54%, an improvement from 55% in 1999. C r e d i t Q ua l i t y The provision for credit losses totaled $2.5 billion, up from $1.8 billion the previous year. While the economy remained strong for the first half of 2000, rising interest rates took their toll in the second half, lead- ing to higher problem loans and higher loan losses. Net charge-offs totaled $2.4 billion, or .61% of loans and leases, compared to $2.0 billion, or .55%, a year earlier, with the increase occurring primarily in the domestic corporate portfolio. Nonperforming assets stood at $5.5 billion at the end of 2000, up from $3.2 billion a year earlier. The increase was largely due to increasing problem loans in the domestic corporate and consumer finance portfolios. C a pi ta l Bank of America’s capital position remained strong in 2000. Total shareholders’ equity rose to $47.6 bil- lion at December 31, 2000, representing 7.42% of period-end assets, up from 7.02%. The Tier 1 capital ratio also rose to 7.50% from 7.35% at the end of 1999. B u s i n e s s Se g m e n ts Two of the company’s four primary business segments – Asset Management and Equity Investments – increased earnings in 2000. Consumer and Commercial Banking earnings of $4.64 billion were 2% lower than a year earlier, reflecting the impact of a significant increase in auto lease residual charges and the absence of one-time gains recorded in the previous year. The card businesses all achieved double-digit growth and service charge revenue was up 4% in the Banking Regions. Average managed loans grew 12%. Expenses fell by 4%. Asset Management earnings rose 18% to $601 million, as assets under management increased by $30 billion to $277 billion at year-end, despite falling market prices. Mutual fund fees grew 30%. The company made significant investments in new private banking offices and in sales personnel throughout the asset management businesses during the year. Global Corporate and Investment Banking earnings were 10% lower than a year earlier, reflecting higher loan losses and slower capital markets activity at the end of the year. Higher credit costs more than offset revenue growth of 9%, driven by the buildout of the investment banking and trading platforms. For the year, Bank of America ranked in the top 10 in all key product areas. Equity Investments earnings increased 39% to $460 million, driven by strong gains in strategic investments and alliances as well as in principal investing. 7

- 10. Building a Growth Company In 2000, despite a difficult economic environment for banking that hampered our financial performance as the year advanced, we made significant tactical progress toward our goal of becoming the top financial services company in the country. With the task of transitioning to the new Bank of America nearly complete, we took measures to identify and to capitalize on the massive potential of the company we have built. In 2001, as we continue to execute our strategy, we believe those measures will increasingly reveal their ability to fuel our profitability, growth and overall success. In 2000, we: • largely completed the merger transition; • continued our transformation from a company that grows by acquisition to a customer-focused, internal growth company; • eliminated unnecessary layers of management and ensured we had the right people in key posts; • identified and invested in businesses with the highest potential for growth; and • accelerated the reengineering of company-wide processes to improve customer satisfaction. Tr a n s f o r m i n g O u r Co m pa ny It has become clear that revenue growth is the benchmark of our company’s value in the marketplace. In 2000, we took action to accelerate the rate of revenue growth. Our goal is to produce consis- tent annual revenue growth of 7% to 9% and improve earnings-per-share growth. As Mr. McColl said in his letter, we are generating revenue growth from within our own franchise by working to retain, broaden and deepen existing customer relationships, even as we work to gain new customers. Associates throughout the company are working on projects and initiatives to drive this part of our strategy. These include improvements to our technology infrastructure that give associates access to more complete information regarding customers’ relationships with the bank, and the creation of different value packages based on the amount of busi- ness customers choose to bring to the bank. These initiatives already are resulting in accelerated growth in our enhanced service levels – Plus, Premier and Private Banking – and that growth has begun to show commensurate increases in relationship-net-income and overall profitability. Banc of America Securities is Recognized by Smart Received the Dalbar number 1 in dollar volume for Money magazine as “best Mutual Fund Service merger and acquisition trans- in customer service” for Award for achieving the actions in real estate, lodg- online banking. highest standard of service ing and gaming industries. to shareholders in the mutual fund industry. 8

- 11. Executing this strategy requires a company-wide shift away from a focus on merger transitions toward a disci- plined focus on improving customer service and reengineering our work processes. This transformation has not been easy, but we are confident that it is producing the right organizational model for the future growth of our company. I n ve st i n g i n G r ow t h Our greatest challenge in 2000 came in the form of a question: How could we make needed investments in high-growth businesses while at the same time work to deliver on the earnings goals to which we had committed? Our decision – to eliminate 9,000-10,000 positions, mostly in the middle management ranks – was a difficult one for many reasons, most importantly the loss of many talented, loyal associates. Nevertheless, this was the right decision for the long-term strength of the company. This action has flattened our management structure so that senior managers are more directly responsible for customer satisfaction. In addition, it enables us to respond to changes in the business more quickly. Finally, the cost savings realized can be invested in high-growth areas of the company. As we assessed our company post-transition, we identified and addressed several areas of significant opportunity, including: Consumer Products, including Cards: accelerating the application of Web technology in call centers and in payments processes and promoting cards and card usage as a core relationship product; Consumer Banking: increasing the number of consumer bankers in key urban markets and accelerating the application of Web technology in banking centers; Asset Management: adding 10 Private Bank offices in high-potential markets and expanding investment products and sales forces nationwide; e-Commerce: investing in new technologies and capabilities to create financial portals, Web-enabling businesses and implementing more Internet payment options; Investment Banking: adding people, heightening capabilities and expanding our presence in Europe; and Brand: conducting a $100 million major national campaign to promote the Bank of America brand. Executives in the first three areas – Consumer Products, Consumer Banking and Asset Management – have been charged with working together to broaden and deepen all their customers’ relationships with the bank. Processes and technology solutions are being designed and implemented to integrate business practices across all product groups so that broad, deep relationships are formed not as heroic exceptions to the rule, but as a matter of course. Corresponding performance measurements and incentives are being put into place to reinforce this initiative. A cc e l e r at i n g Pr o d u c t i v i t y Process improvements will enable us to achieve productivity gains with the goal of creating greater revenue wherever they are deployed. Teams throughout the company have been empowered by our leadership to reexamine every aspect of how and why we perform our work – from the customer’s point of view. Some teams already have produced impressive results: one group reduced processing time for a consumer real estate loan by 24%, on top of previous improvements that had produced similar reductions the year before. And we expect similar improvements in performance from many other areas. While we expect to realize productivity gains as a result of process improvement, cost savings is a secondary concern if we can increase revenues by improving customer satisfaction. The reason is obvious: there’s more than one way to generate higher earnings, and the best way is through increasing revenue and operating leverage, which is a hallmark of a growing business, rather than through expense cuts, which is the hallmark of a consolidating business. We believe that if our customer satisfaction improvements result in the kind of revenue increases we seek, we will be able to increase efficiency without cutting costs. Lo o k i n g to 2 0 0 1 We will continue to aggressively execute the tactical initiatives that will drive our corporate strategy forward in 2001. We also will continue to create innovative new products, services and financial solutions for all of our customers and clients, some of which are covered in detail on the pages that follow. I hope you’ll take the time to read about how we’re working to make Bank of America a growth company – and please let us know how you think we’re doing. Kenneth D. Lewis President and Chief Operating Officer 9

- 12. My investment add counselor really listens to me. strengthen Plus, he calls me when he thinks it’s time to move some assets. I’m willing augment to take risks and together we’ve increase made decisions rise that have kept my portfolio steadily growing.

- 13. grow a relationship Janet Hill in her living room in Danville, California

- 14. Serving Consumers Unparalleled Customer Convenience 4,500 banking centers 13,000 ATMs 1,500,000 daily phone inquiries 3,000,000 online customers 7,000,000 customer touches per day Our franchise is the envy of the industry and our relationship strategy rewards customers for allowing us to do more for them and grow revenue when they bring us more of their business. Suppose you could have unlimited access to the entire global payments system, enabling you to move funds anywhere you needed them, day or night, to or from anybody, through any channel you want: in person, at a machine on a street corner, on the phone, even sitting at a PC in your kitchen. We would maintain those access channels at our expense. We would also keep your money safe. You could get to it whenever you wanted, but nobody else could touch it without your consent. And we’d do all the bookkeeping; you would only have to check your balance periodically. Sound like a useful service? Actually, it’s a simple checking account. It comes in different shapes and sizes to fit different needs, with flexible pricing, depending on how you choose to use it. That’s where it all starts. Where it goes from there is up to the customer. We are integrating the products and services we provide – checking and savings accounts, investment products, loans, across our various delivery channels, including banking centers, ATMs, relationship managers, telephones, personal computers and hand-held devices – to make it easy and convenient for customers to expand their relationships with us. When customers bring us more of their business, we earn more revenue, which enables us to provide them with a value package that might include such benefits as pre- ferred pricing, reduced fees, higher interest rates on deposits, flexible credit terms and dedicated phone lines staffed by specially trained associates. At the same time, we are investing heavily in improving the quality of our baseline service. For example, we have shortened the hold time on deposited checks and reduced the volume of holds on non-cash deposits at ATMs. We have also simplified our phone systems, making it quicker and easier for customers to get their questions answered and problems solved. In fact, in a survey of 18 banks, three of our Contact Centers placed first, second and third in service quality. As a result, our customer satisfaction scores have improved in most of our markets over the past year. We have clearly defined levels of relationship service for individuals and families, including our Private Bank, whose very affluent customers require top-quality advice in managing their relatively complex financial affairs. Premier clients are consumers who qualify, on the basis of income and the size of their relationship, for customized personal service. 12

- 15. But the largest and fastest grow- Another area with strong rela- ing group of relationship customers tionship potential is consumer real are those we call Plus. These indi- estate, where we have made huge viduals qualify for enhanced service strides in improving our quality of simply because of the volume of busi- service. As the nation’s largest ser- ness they bring to the bank, not by vicer and third-largest originator of income level or any other demo- home mortgages, Bank of America graphic measure. Almost anyone can helps more than 400,000 families qualify by simply maintaining an fulfill their dreams of home owner- account such as Advantage or the ship each year. This is a business in Money Manager Account, which which razor-thin margins and heavy combine investment and banking, competition make it essential to main- or by combining a checking account tain a low-cost, high-quality environ- with a home loan. We are able to ment. By redesigning the application, provide an attractive value package approval and delivery process for to Plus customers because we receive telephone lending, we have shaved considerable value in return. The rate several days off the time it takes us Janet Hill of Danville, California, is a of customer retention increases to move from a loan application to savvy investor whose portfolio repre- 12% when customers move to Plus. a booking, increased our mortgage Deposit, investment and credit bal- approval rate by 15% and raised our sents a significant portion of her income. ances all tend to grow rapidly. And booking rate nearly 30%. Actively involved in her family’s finan- the net income we derive from the We view our nationwide con- cial decision-making since her two relationship increases significantly. sumer franchise as the envy of the daughters were young, she and her Imagine how revenue and prof- industry and the most convenient husband took many investment its would grow if the millions of for customers. The states in which customers who qualify for Plus or Bank of America offers full-service courses over the years and belonged Premier service, or for the Private banking account for 80% of the to an investment club. Bank, would sign up for one of nation’s projected population growth Widowed four years ago, Hill those service levels. over the next five years, and we have looked for an investment counselor And we have additional oppor- the leading market share in the four tunities to grow our revenue, simply fastest growing states. who respected her experience and by doing more for our customers Achieving our growth goals is input. She found the person she was who already enjoy relationship serv- easier said than done. But we know looking for at Bank of America. “We ice. For example, Plus customers we can succeed because we are talk regularly – either he calls me or I average 10 financial relationships already doing it in some key busi- per household, although typically nesses, such as Asset Management call him – and we meet three or four only four of those are with Bank of and Card and Payment Services and times a year,” she said. Hill’s relation- America. They have nearly three times in some markets. In California, our ship with the bank also includes check- the appetite for credit as the general largest market by far, we grew rev- ing and savings accounts, credit cards population, and they save and invest enues 8% in 2000. Deposits grew and an IRA. A volunteer for the Red at five times the average rate. Yet they 7.4% and consumer assets grew more take much of their credit and invest- than 12%. Those growth rates are Cross and programs for disadvantaged ment business to other financial insti- significantly higher than the year children, she and her daughter recently tutions, most of which we believe before. We intend to continue to bought a horse, and she intends to cannot match our convenience or improve the integration of our prod- take riding lessons. Confident her provide the broad complement of ucts and services across all delivery financial services we can. channels with the goal of getting portfolio is in capable hands, Hill Two of our biggest growth the rest of the consumer franchise makes the most of her very full life. engines, Asset Management and to perform at least at that level. Card and Payment Services, also When we do that, we will have have tremendous potential for transformed Bank of America into a advancing our relationship strategy truly great growth company. (see pages 14-15). 13

- 16. Asset Management The Asset Management Group serves the which focuses on developing and managing investing needs of all clients, with a wide products for retail investors, high-net-worth range of world-class investment products and clients and institutions with both cash manage- services. It’s a rapidly growing business for ment and long-term asset management needs. us, as we add customers who have tradition- At present, BACAP manages $277 billion in ally looked elsewhere when thinking about assets for individuals and institutions and pro- investing their assets. vides advisory services to the $107 billion Asset Management revenue, adjusted for Nations Funds family of mutual funds. We divestitures, is currently growing at an annual plan to double our equity research coverage $277 Billion of Assets Under Management rate of about 12%, while net income is grow- and continue to expand our investment man- Fixed Income ing at about a 40% annual rate. With results agement discipline in a number of ways, Cash $44.3 Other $8.3 like that, we want to grow the Asset Management including the completion of our acquisition of $110.8 business so that it contributes more than the Marsico Capital Management early in 2001. Equity current 7.6% of total company earnings. We We also plan to increase our sales force $113.6 have an excellent opportunity to do that, as the to serve the investing needs of our diverse financial needs of individual and institutional institutional client base as well as expand our ($ in billions) clients, including significant demand for product array to offer retirement programs to investment products, have become increas- small business and middle market clients. As we continue to grow our asset ingly complex. In addition, high-net-worth And to better serve retail investors seeking management business, includ- households are among the fastest growing advice and solutions, we will add sales per- ing the Private Bank, into the nation’s premier provider of segments in the country. sonnel to work with investment professionals investment products and serv- To capitalize on that growth potential, in our Private Bank, retail brokerage affiliate ices, we reach signposts along we are increasing our investment in the Asset and external broker-dealers. the way that tell us we are suc- Management business, beginning with the Our retail brokerage affiliate, Banc of ceeding in our efforts to pro- Private Bank. A leader in providing innovative, America Investment Services, Inc., is a criti- vide value for large numbers of customized investment management, trust, cal channel through which we meet a wide customers and clients. Some recent achievements include: financial and estate planning and credit prod- array of investing needs. One key to our suc- At midyear 2000, Bank of ucts to the high-net-worth market, the Private cess has been the spectacular growth of the America ranked first in mutual Bank has a physical presence in most of the Money Manager Account, which combines funds and annuities sales among wealthiest areas of the United States. We are investments and banking. Balances have a nationwide list of 100 holding adding offices in high-potential California mar- increased 65% to more than $20 billion companies, banks and savings kets, going into Massachusetts and Connecticut within the past year. We expect to continue and loans. We were also one of the fastest growing, with sales and expanding the New York office. growing that customer base as we pursue our more than doubling over the first We will add more professionals across relationship banking strategy. six months of the previous year. the country to provide advisory services, tax To enhance customer awareness of our Assets under management strategies and investing and wealth transfer investment capabilities, we expect to expand have grown by more than 30% expertise. Access to products will expand to the number of investment sales officers in in the last three years to $277 billion. include derivatives, private equity placements banking centers to more than 3,500 by year In addition, the Bank of and other alternative investments. Our com- end 2001, up from 2,500. We also plan to America Private Bank is the pany’s ongoing investment in e-commerce continue to grow our team of full-service world’s largest corporate will provide clients with both information investment consultants by 25% per year over trustee for individuals, with and advice through online, real-time access the next three years. We are enhancing our $129 billion in trust assets to their entire Bank of America relationship. product array, as well, to include financial under management and approximately 82,000 trust In particular, we expect strong growth in planning capabilities that enable us to pro- accounts on our books. our investment management business, Banc vide a broad spectrum of advice to clients. of America Capital Management (BACAP), 14

- 17. C ard and Payment Services Bank of America is investing in its card and overall loss rates. The bank’s mailing “uni- payments business to build upon already- verse” has been increased 50%, and the cost impressive growth across all card-related of acquiring a new account is down by businesses and customer segments. For 2000, more than 30%. consumer credit and debit card sales volumes Customer relationship information is were up 17%, and commercial card volume also a key to improving customer satisfaction was up more than 30%. and operational performance. For example, Card’s strong growth is being fueled by lower-risk relationship customers don’t need several factors. First, cards have become the to be called when their payments are only a preferred way to pay. For businesses, purchas- few days overdue. Attention can be focused ing cards are a far more efficient way to pay on higher-risk accounts, thereby increasing suppliers. For consumers, cards are the domi- collections effectiveness and improving cus- nant form of payment on the Internet, and tomer satisfaction. nothing matches the convenience and control Customers are also getting an enhanced that cards offer both online and at physical Check Card experience as the bank’s ability points of sale. By 2005, cards are projected to to use relationship information grows. Lower- overtake checks as the most used form of risk customers are now identified and their payments for consumers. transactions approved, allowing them to use Bank of America is leading this paper- their cards to fund purchases directly from The Bank of America Check CardTM is becoming increasingly popu- to-plastic payments revolution, primarily by their accounts, even when their balances run lar with customers, and it's leveraging and deepening customer relation- low. Revenue is projected to increase easy to see why. Check Cards ships across all lines of business. sharply as a result, and customer satisfaction offer the point-of-sale conven- Like many card companies, the bank is will benefit from fewer declined transactions. ience of a credit card, but reduce making significant investments in marketing Card products can also be a good way to the need to write checks or carry and new products. Direct mail solicitations have create new banking relationships. Thousands cash for everyday purchases. This popularity is reflected doubled, as have new accounts from that source. of single-service credit card customers are in our large increase in Check Bank of America has launched “Photo Security” expanding their relationships with the bank, Card purchase volume, which credit cards, upgraded Check Cards and intro- and when single-service customers become was up 28% in 2000. Per-card duced the new Visa BuxxTM card for teenagers, relationship customers, their relationship net transactions are also rising, enabling parents to program value into the card income increases more than 600 percent. another sign that customers like the convenience of the Bank of and monitor purchases. A newly integrated Harnessing customer information that America Check Card. national sales force is selling unique bundled no other card company possesses, the bank Higher transaction volumes products to meet the needs of small business is leveraging the value of relationships to mean higher revenue for Bank and middle market customers. improve both the customer experience and of America, as well as lower Unlike many other card companies, financial performance. processing and servicing costs Bank of America can leverage its huge base than we incur when customers write checks or withdraw cash of banking relationships to produce a higher from ATMs. From 1998 through return on its investment. For example, the 2000, debit card revenue has bank is soliciting twice as many relationship more than doubled, from $225 customers as in the past because these cus- million to $520 million. tomers have almost 30% higher response As more of our products migrate from paper to electronic rates to card solicitations and 25% lower channels, we will continue to grow revenues and reduce costs, while providing better service and convenience for customers. 15

- 18. Before the bank decrease helped us finance lower our new building, we had equipment lessen all over the place. Now our opera- shrink tions are consoli- dated under one roof, improving effi- ciency and helping us keep our prom- ise of perfection to our clients. minimize

- 19. grow a business Wilson Alers in his new studio near Ft. Lauderdale, Florida

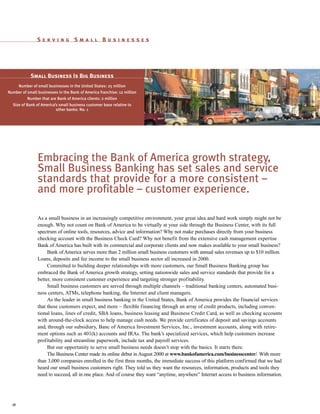

- 20. Serving Small Businesses Small Business Is Big Business Number of small businesses in the United States: 25 million Number of small businesses in the Bank of America franchise: 12 million Number that are Bank of America clients: 2 million Size of Bank of America’s small business customer base relative to other banks: No. 1 Embracing the Bank of America growth strategy, Small Business Banking has set sales and service standards that provide for a more consistent – and more profitable – customer experience. As a small business in an increasingly competitive environment, your great idea and hard work simply might not be enough. Why not count on Bank of America to be virtually at your side through the Business Center, with its full spectrum of online tools, resources, advice and information? Why not make purchases directly from your business checking account with the Business Check Card? Why not benefit from the extensive cash management expertise Bank of America has built with its commercial and corporate clients and now makes available to your small business? Bank of America serves more than 2 million small business customers with annual sales revenues up to $10 million. Loans, deposits and fee income to the small business sector all increased in 2000. Committed to building deeper relationships with more customers, our Small Business Banking group has embraced the Bank of America growth strategy, setting nationwide sales and service standards that provide for a better, more consistent customer experience and targeting stronger profitability. Small business customers are served through multiple channels – traditional banking centers, automated busi- ness centers, ATMs, telephone banking, the Internet and client managers. As the leader in small business banking in the United States, Bank of America provides the financial services that these customers expect, and more – flexible financing through an array of credit products, including conven- tional loans, lines of credit, SBA loans, business leasing and Business Credit Card, as well as checking accounts with around-the-clock access to help manage cash needs. We provide certificates of deposit and savings accounts and, through our subsidiary, Banc of America Investment Services, Inc., investment accounts, along with retire- ment options such as 401(k) accounts and IRAs. The bank’s specialized services, which help customers increase profitability and streamline paperwork, include tax and payroll services. But our opportunity to serve small business needs doesn’t stop with the basics. It starts there. The Business Center made its online debut in August 2000 at www.bankofamerica.com/businesscenter/. With more than 3,000 companies enrolled in the first three months, the immediate success of this platform confirmed that we had heard our small business customers right. They told us they want the resources, information, products and tools they need to succeed, all in one place. And of course they want “anytime, anywhere” Internet access to business information. 18

- 21. That’s what we delivered. We business customers seeking the believe the Business Center is by far financial discipline that it offers. the most robust online offering for Nationwide, Bank of America is the small businesses today. It gives our largest issuer of these cards, with customers professional capabilities more than 400,000 issued. that were once available only to much A leader in cash management for larger corporations. An interactive corporate clients, Bank of America is and customer-friendly portal, the broadening the reach of its expertise Business Center enables users to save to small and mid-sized companies. money and operate more efficiently We offer solutions that enable cus- and effectively with applications tomers to maximize their cashflows such as: by collecting payments more expe- diently, making payments more pre- Banc of America Marketplace™ , cisely and managing information product of a powerful alliance with and account balances more effec- Ariba, Inc. to benefit all of the bank’s tively. The teamwork between small 2 million-plus business customers, business bankers and Global Treasury is key to our small business rela- Wilson Alers (page 17) had a dream. Services has resulted in higher cus- tionship strategy. Customers with a After building his audiovisual skills first tomer satisfaction and retention rates business checking account or Business and an opportunity to make new sales. in Puerto Rico, then in Miami, the Check Card use it for convenient By including equipment leasing Bronx native teamed up in 1990 with access to online suppliers. It auto- and financing expertise in its suite of two lifelong friends, Oscar Colom and mates the purchasing and procure- small business services, the bank is ment process, giving users access to James Pabon, to launch a state-of-the- able to help customers understand and competitive pricing on a range of art audio, video, lighting and computer compare the relative benefits of lease business goods. and loan options as they consider graphics staging company. Today, My Desk, the Business Center’s their financing needs. The market for Media Stage claims many Fortune 500 hub, gives managers and employees equipment and vehicle leasing is large corporations as clients. Its teams desktop help in communicating and growing. Small business client travel to such diverse locations as Rio internally and managing projects. managers partner with the bank’s leasing specialists to aggressively de Janeiro, Rome and Singapore to Financial Services offers cus- expand our presence in this market. stage events. Media Stage recently tomers one-stop financial shopping, In addition to serving companies, built an 18,500-square-foot building with descriptions of the breadth of our Small Business Banking group products and services available from seeks to build more and broader near Ft. Lauderdale, Florida with a real Bank of America to help small relationships with individual business estate and construction financing pack- companies succeed. owners by helping them pursue their age Bank of America arranged with Resources is an online business personal financial goals. Our client the Small Business Administration. partner, providing customers with managers are increasingly teaming The company also opened a second access to business forms, templates, up with Banc of America Investment office in Puerto Rico to better serve tools and more. Services, Inc. to assist clients with their investment needs. clients in South and Central America Administration houses payroll The combination of superior and the Caribbean. Media Stage was and other personnel tools. client management and cross-selling recently named one of the top 100 will continue to keep Small Business We also have completed rollout Hispanic businesses in Florida. “We’ve Banking centered on its most impor- of our Business Check Card across tant goal – offering customers the been with the bank from the begin- the franchise. The card enables cus- convenience and the power of one- ning,” Alers said. “As our needs have tomers to make purchases directly stop financial shopping. from their business checking accounts. grown, so has our relationship. It’s It has proven popular with small been smooth from the start.” 19

- 22. As the Northwest grows more diverse expand and cosmopolitan, the demand for multiply Asian products is increasing expo- nentially. With the bank’s help, we doubled the size of our store and expan- ded our product lines to keep up with demand. compound

- 23. grow a community Tomio Moriguchi, President of the Uwajimaya specialty markets, flanked by (from left) his niece Amy Maeda, brother Akira Moriguchi, sister Suwako Maeda, nephew Michael Moriguchi and sister Tomoko Moriguchi in the new Uwajimaya store in Seattle’s International District

- 24. Serving the Middle Market Topping the Charts Among institutions providing financial services to middle market companies in the United States, Bank of America ranks No. 1 in: Number of banking relationships Secured and unsecured credit Investment banking Leasing Treasury management International services Syndications Short-term investments Comprehensive product and service offerings, cou- pled with cutting-edge technology and the ability to customize solutions, are enabling us to expand our client base while deepening existing relationships. What would it mean to your company if you only had to make one phone call or access one corporate portal for advice on all of your financial needs – to raise capital, manage your cash, compete globally or gain a foothold in the electronic marketplace? What would it mean to have the benefits of a local financial institution that knows you, plus the expertise and experience of Wall Street? What would it mean to know that someone was helping you ensure the future health of your company? Serving more than 30,000 companies throughout the United States with annual sales between $10 million and $500 million, Bank of America creates powerful solutions every day to help these middle market firms grow and thrive. For nearly 70% of middle market clients in our 21-state franchise, we serve as lead bank and we are working to grow that number significantly. The potential in lead bank status is tremendous. For example, the average number of products we provide to clients when we do not serve as lead bank is four. Establishing a lead bank relationship more than doubles the number of products a client uses. The opportunity in this marketplace continues to swell – with Bank of America serving more than 30% of middle market companies within our franchise and holding a leadership position in lending, treasury management, foreign exchange, syndications, derivatives, trade finance, leasing and private debt placement. Our strategy is to expand our client base further while deepening existing relationships. Clients’ needs vary greatly. They might require solutions to complex issues or the simple execution of transac- tions. They might need the sophistication of an entire team or one-on-one advice. Or they might need help taking their domestic business global. With a proven track record combining the right people, technology and solutions to create an unbeatable value proposition, Bank of America can meet all these needs. We know from listening to our clients that time is money. That’s why our client-centered team approach to relationship management is critical to achieving results – for our clients and ourselves. Our teams provide middle market companies with localized, integrated access to all the bank’s resources, including treasury management, investment banking, personal wealth management, credit products, asset management and consumer banking serv- ices for their employees. As a result, more than two-thirds of our middle market clients rate their satisfaction with us as excellent or above average. 22

- 25. Technology continues to enhance comprehensive capabilities. At the our capabilities, enabling us to offer same time, we continue to develop new opportunities online. Bank of new solutions to meet our clients’ America was one of the first banks to everyday needs. For example, Banc offer Web-based commercial banking. of America Marketplace,™ initially Bank of America Direct™ provides focusing on small and medium-sized an Internet-based transaction and businesses, offers a way to stream- information network designed to line a company’s procurement meet all of our clients’ treasury, pay- needs in an online environment. ments and receipts needs by enabling The marketplace provides businesses them to gather information and ini- with competitive pricing on the diverse tiate transactions anytime and any- range of products and services they where in the world, over the Internet. routinely purchase, while the online Through Bank of America Direct, delivery allows purchases to be made middle market clients can be assured quickly and reduces the need for paper- of rapid access to cash management based record-keeping. reports, stop payment capabilities, Bank of America was one of the Tomio Moriguchi took over his father’s the ability to review paid checks and first banks to offer middle market fish market in 1962 and expanded it research exceptions, or to access on- clients a single source for managing line customer receivables records – purchase, travel and fleet spending into Uwajimaya, a sprawling produce all in a secure environment. Bank through the Bank of America Visa and Japanese specialty market in of America was one of the first Commercial Card. Realizing that one Seattle (page 21). Although the oper- banks to complete large-scale deploy- size doesn’t fit all, we introduced an ation is extensive enough to be ment of digital certificates to assist enhanced card last fall with greater regarded as the cornerstone of that clients in the secure execution of customization. Now middle market their transactions. Today, more than clients can use a card with the flexibil- city’s bustling International District, 2,000 middle market and 1,200 cor- ity to change as their company grows. the family-owned business is having to porate clients are using the service. In 21 states and the District of expand further to keep up with the To ensure that we are able to Columbia, local client teams led by ever-increasing demand for Asian provide solutions for the breadth of nearly 700 client managers have one- our clients’ complex needs, we have on-one contact with clients every day. goods. Building on a banking relation- local teams of dedicated profession- They represent decades of experience, ship spanning more than five decades, als who provide comprehensive many of them in highly specialized Bank of America provided financing investment banking services. For fields. Collectively, we believe they for a new $35 million development our middle market and private bank- possess unmatched knowledge cap- ing clients, we completed approxi- ital that our clients have come to that enabled Uwajimaya to double the mately 12,000 transactions during respect and value. They serve as size of its store and include apart- the past year, ranging from strategic trusted advisors who actively listen to ments, other retail outlets and park- advisory assignments to equity and their clients, seeking to truly under- ing. The success of Uwajimaya earned debt capital raising and risk man- stand and appreciate their businesses Mr. Moriguchi the William D. Bradford agement services. Because of our and marshaling all the resources of understanding of our clients’ indus- the bank to develop customized Award from the University of Washington tries, their unique business issues solutions that will help our clients for playing a vital role in the health of and our demonstrated ability to meet specific growth objectives. the region’s economy and a cover assist them in driving shareholder We look forward in the future story in Washington CEO magazine. value, we grew investment banking to offering middle market clients a revenues in the middle market by fully integrated Web portal (see page 47% in 2000, over the previous year. 24) that will get them anywhere they Bank of America Direct and need to go in cyberspace to find what Middle Market Investment Banking they need to make their businesses represent some of our more more successful. 23

- 26. Internet and e-Commerce With the knowledge that customers are integrating their back office administrative becoming more sophisticated and discrimi- processes. The Business Center provides self- nating about their financial choices and more service tools that help employees manage inclined to seek online access to financial tasks and projects, as well as human resources services, Bank of America continues its tar- tools for updating personnel records and geted investment in Internet and e-commerce managing benefits and payroll information. solutions tailored to a range of different cus- Businesses can also enhance their purchasing tomer needs. Infrastructure investments con- power and find special products and services tinue, as well, to ensure that online customers through an online marketplace. Online Banking Taking Off can have confidence in the bank’s security, 3 The middle market and corporate portal reliability and responsiveness. We continue to will provide clients a full range of integrated grow and improve service to an online cus- product solutions and network hubs, including 2 tomer base that currently numbers more than risk management capabilities; capital-raising 3 million customers and clients – more than capabilities; strategic advisory services and any other financial institution. 1 working capital capabilities, which include Dec Mar 98 99 Jun 99 Sep Dec Mar 99 99 00 Jun 00 Sep 00 Dec 00 To expand our capabilities and provide credit, short-term investments, real estate and (number of subscribers in millions) solutions to as many customers and clients as a business-to-business marketplace. quickly as possible, we have formed strategic The number of customers who alliances with a number of “best of breed” The employee-to-business solutions use online banking is increasing companies that help to keep us ahead of the portal will provide Bank of America asso- exponentially. The trend is going to con- competitive curve. ciates self-service tools to manage finances, tinue, as we complete the Our portal approach to online delivery including online banking and bill payment, nationwide introduction of our ensures that the full complement of informa- investments and financial planning help. increasingly popular electronic tion, advice, products and business resources Associates also can select content matched billing and payment service. In is available to those using new technologies to personal interests, and get up-to-the-minute addition to accessing their Bank to bank with us. These portals serve as points news about the company. They’ll have access of America accounts through the Internet, customers who of entry for consumers, small businesses, to task management tools, customer contact enroll for the service can view middle market and corporate and institutional databases and interactive learning capabilities. electronic versions of bills from clients, as well as the bank’s own associates. In addition, the bank plans to market these participating payees, schedule capabilities to companies looking to bring inte- one-time or recurring payments The consumer portal at www.bankof- grated Web solutions to their employees. for virtually any bill, whether or america.com will fully integrate banking and not it has been delivered to them investment accounts, including Private Bank The portals will also deliver a comprehen- electronically, and pay other and Banc of America Investment Services, sive payments capability, integrating invoicing, individuals – even a child at col- Inc. portfolios; provide customers with elec- payment and information reporting services for lege – by going online, rather than writing and mailing checks. tronic bill presentment and payment capa- companies that access the bank online. Bank For customers, online bill bilities allowing them to receive and pay bills of America will leverage this infrastructure paying saves time and money online; give customers the ability to make by marketing it to e-commerce service providers and turns a tedious chore into a checking, ATM, debit and credit card pay- few simple mouse clicks. For who need the capabilities. In addition, a next ments to businesses; and deliver information, generation payments platform will enable con- the bank, it means broader, deeper and longer-lasting rela- products and tools for making life decisions sumers and businesses to pay everyone for tionships, since customers who such as a home purchase, college education everything electronically, combining elec- use the service tend to stay or retirement. tronic billing and payment, person-to-person with the bank longer and sign The small business portal, the Business payments and retail payments. up for more products and serv- ices than customers whose Center (see page 19), is a single Internet To Bank of America, the Internet is more relationship is limited to a resource that helps small businesses gain effi- than just another distribution channel. It’s a traditional checking account. ciency and productivity by providing one-stop way to offer customers and clients more value, financial shopping and automating and more access and better choices. 24