BBVA Results Presentation 4Q17

- 2. 2017 Results February 1st 2018 / 1 2017 Results February, 1st 2018

- 3. 2017 Results February 1st 2018 / 2 Disclaimer This document is only provided for information purposes and does not constitute, nor should it be interpreted as, an offer to sell or exchange or acquire, or an invitation for offers to buy securities issued by any of the aforementioned companies. Any decision to buy or invest in securities in relation to a specific issue must be made solely and exclusively on the basis of the information set out in the pertinent prospectus filed by the company in relation to such specific issue. No one who becomes aware of the information contained in this report should regard it as definitive, because it is subject to changes and modifications. This document contains or may contain forward looking statements (in the usual meaning and within the meaning of the US Private Securities Litigation Reform Act of 1995) regarding intentions, expectations or projections of BBVA or of its management on the date thereof, that refer to or incorporate various assumptions and projections, including projections about the future earnings of the business. The statements contained herein are based on our current projections, but the actual results may be substantially modified in the future by various risks and other factors that may cause the results or final decisions to differ from such intentions, projections or estimates. These factors include, without limitation, (1) the market situation, macroeconomic factors, regulatory, political or government guidelines, (2) domestic and international stock market movements, exchange rates and interest rates, (3) competitive pressures, (4) technological changes, (5) alterations in the financial situation, creditworthiness or solvency of our customers, debtors or counterparts. These factors could cause or result in actual events differing from the information and intentions stated, projected or forecast in this document or in other past or future documents. BBVA does not undertake to publicly revise the contents of this or any other document, either if the events are not as described herein, or if such events lead to changes in the information contained in this document. This document may contain summarised information or information that has not been audited, and its recipients are invited to consult the documentation and public information filed by BBVA with stock market supervisory bodies, in particular, the prospectuses and periodical information filed with the Spanish Securities Exchange Commission (CNMV) and the Annual Report on Form 20-F and information on Form 6-K that are filed with the US Securities and Exchange Commission. Distribution of this document in other jurisdictions may be prohibited, and recipients into whose possession this document comes shall be solely responsible for informing themselves about, and observing any such restrictions. By accepting this document you agree to be bound by the foregoing restrictions.

- 4. 2017 Results February 1st 2018 / 3 Strong and Recurrent Results Quarter by Quarter Quarterly evolution (€m) 678 1,199 1,107 1,143 70 404 1,123 1,082 1,192 4Q16 1Q17 2Q17 3Q17 4Q17 12M17 vs. 12M16 (€m) 3,475 3,519 404 1,123 3,879 4,642 12M16 12M17 Ex-Telefónica impairment Ex-mortgage floor clauses provision Ex-Telefónica impairment Ex-mortgage floor clauses provision Net Attributable Profit

- 5. 2017 Results February 1st 2018 / 4 Mobile customers 17.7m +44% Dec-17 vs. Dec-16 2017 Highlights 01 Strong core revenue growth 02 Delivery in efficiency 03 Sound risk indicators 04 CET 1 FL above 11% 05 Focus on shareholder value 06 Accelerating our transformation Efficiency 49.5% -276 bps vs. 12M16 (constant) CoR 0.87% +3 bps vs. 2016 NPL ratio 4.4% -47 bps vs. 2016 CET 1 FL +11.1% +18 bps vs. 2016 NII + Fees (€ constant) +10.3% vs. 12M16 5.73 5.69 0.08 0.30 Dec-16 Dec-17 +3.2% YtD TBV/Share1 + Shareholders remuneration Digital Sales 28% Dec-172 (2) % of total sales YtD, # of transactions NPS #1 in 8 countries (1) Tangible Book Value per share

- 6. 2017 Results February 1st 2018 / 5 2017 Profit & Loss BBVA Group(€m) 2017 % % constant Net Interest Income 17,758 4.1 10.6 Net Fees and Commissions 4,921 4.3 9.4 Net Trading Income 1,968 -7.7 -6.0 Other Income & Expenses 622 -16.3 -19.1 Gross Income 25,270 2.5 7.9 Operating Expenses -12,500 -2.3 2.2 Operating Income 12,770 7.7 14.1 Impairment on Financial Assets (*) -3,680 -3.2 1.2 Provisions and Other Gains and Losses -1,036 -37.9 -38.5 Income Before Tax(*) 8,054 26.0 37.3 Income Tax -2,169 27.7 39.7 Net Income(*) 5,885 25.4 36.4 TEF Impairment -1,123 n.s. n.s. Non-controlling Interest -1,243 2.0 19.1 Net Attributable Profit 3,519 1.3 7.6 Net Attributable Profit (ex-Telefónica impairment in 2017 & mortgage floor provision in 2016) 4,642 19.7 26.3 2017/2016 Change (*) Ex- Telefónica impairment

- 7. 2017 Results February 1st 2018 / 6 4Q17 Profit & Loss BBVA Group(€m) 4Q17 % % constant Net Interest Income 4,557 3.9 14.3 Net Fees and Commissions 1,215 4.7 13.0 Net Trading Income 552 45.6 14.4 Other Income & Expenses 37 -87.4 -83.9 Gross Income 6,362 2.2 10.5 Operating Expenses -3,114 -4.0 4.1 Operating Income 3,248 9.0 17.4 Impairment on Financial Assets (*) -763 11.0 19.3 Provisions and Other Gains and Losses -447 -55.7 -54.9 Income Before Tax (*) 2,039 58.7 75.1 Income Tax -499 59.0 58.3 Net Income (*) 1,539 58.5 81.4 TEF Impairment -1,123 n.s. n.s. Non-controlling Interest -347 18.4 44.1 Net Attributable Profit 70 -89.7 -79.9 Net Attributable Profit (ex-Telefónica impairment in 2017 & mortgage floor provision in 2016) 1,192 10.2 20.2 Change 4Q17/4Q16 (*) Ex- Telefónica impairment

- 8. 2017 Results February 1st 2018 / 7 Strong Core Revenue Growth Net Interest Income (€m constant) Net Fees and Commissions (€m constant) Net Trading Income (€m constant) Gross Income (€m constant) 4,196 4,203 4,334 4,425 4,797 4Q16 1Q17 2Q17 3Q17 4Q17 1,125 1,194 1,199 1,257 1,271 4Q16 1Q17 2Q17 3Q17 4Q17 +1.1% +8.4% 491 683 370 353 562 4Q16 1Q17 2Q17 3Q17 4Q17 6,029 6,235 6,141 6,229 6,664 4Q16 1Q17 2Q17 3Q17 4Q17 +7.0% Excellent quarter +10.6% vs 12M16 Solid growth across the board +9.4% vs 12M16 +14.3% +13.0% Higher ALCO sales and results from FX hedges vs 3Q17 Supported by core revenues +7.9% vs 12M16 +10.5% +204 €m CNCB disposal

- 9. 2017 Results February 1st 2018 / 8 5.3% 6.6% 9.6% SPAIN* USA MEXICO TURKEY SOUTH AMERICA ex-Vz Delivery in Efficiency Delivering in efficiency Operating expenses 12M17 vs. 12M16 (€ constant) Group Operating Jaws YtD (%); (€ constant) Efficiency Ratio (€ constant) 7.1% 15.0% 7.6% 7.0% 7.9% 6.1% 1.3% 1.8% 1.5% 2.2% 6.2% 8.6% 8.4% 8.9% 9.2% 12M16 3M17 6M17 9M17 12M17 Gross Income Operating Expenses Gross Income ex NTI 52.2% 49.5% 64.3% 12M16 12M17 Av. European Peer Group** Developed Emerging 2.0% Inflation Average 12m 2.1% 6.0% 11.1% (*) Spain includes banking and non core real-estate activities (**) European Peer Group: BARC, BNPP, CASA, CS, CMZ, DB, HSBC, ISP, LBG, RBS, SAN, SG, UBS, UCI. Figures as of September 2017. -5.7% 3.2% -276 bps 9.5%

- 10. 2017 Results February 1st 2018 / 9 Operating Income Quarterly Evolution (€m constant) 2,906 3,184 3,050 3,124 3,412 4Q16 1Q17 2Q17 3Q17 4Q17 +9.2 % +17.4% +14.1% vs 12M16 12M17 vs. 12M16 (€m constant) BANKING ACTIVITY IN SPAIN -1.3% USA +26.1% MEXICO +9.5% TURKEY +27.8% SOUTH AMERICA +15.1%

- 11. 2017 Results February 1st 2018 / 10 Sound Risk Indicators NPL downward trend continues Total Impairments(*) (Financial Assets and RE) (€m constant) NPLs (€bn) 963 985 986 1,026 1,104 4Q16 1Q17 2Q17 3Q17 4Q17 +7.6% +14.6% 0.9% 0.9% 0.9% 0.9% 1.0% 0.8% 0.9% 0.9% 0.9% 0.9% 4Q16 1Q17 2Q17 3Q17 4Q17 Cost of risk & RE assets impairments Cost of risk Cost of risk YtD (%) NPL & Coverage ratios (%) 23.6 23.2 22.4 20.9 20.5 4Q16 1Q17 2Q17 3Q17 4Q17 -3.1€bn -0.4 €bn 70% 71% 71% 72% 65% 4.9% 4.8% 4.8% 4.5% 4.4% 4Q16 1Q17 2Q17 3Q17 4Q17 Coverage NPL (*) Ex- Telefónica impairment

- 12. 2017 Results February 1st 2018 / 11 10.90% 11.20% 11.08% 11.34% +33 bps -10 bps -24 bps -11 bps -31 bps +57 bps Dec.16 Sep.17 Net Earnings (ex-TEF imp.) Dividend accrual RWAs Others Dec.17 IFRS 9 Estimated Impact Corp. Op Dec.17 proforma CET 1 FL above 11% CET1 fully-loaded - BBVA Group Evolution (%, bps) +18 bps *Others includes negatives from the mark to market of AFS portfolio, FX impact and AT1 coupons, among others, and minor positive from the update of the calculation of Structural FX risk RWAs. * High quality capital Leverage ratio fully-loaded (%) European Peer Group: BARC, BNPP, CS, CMZ, DB, HSBC, ISP, LBG, RBS, SAN, SG, UBS, UCI. European Peer Group figures as of September 2017. BBVA figures of December 2017 6.6% 4.9% European Peer Group Average #1 AT1 and Tier 2 buckets already covered Dec-17, Fully loaded (%) AT1 Tier 2 1.73% 2.46%

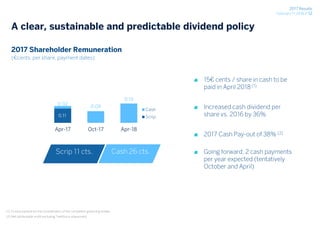

- 13. 2017 Results February 1st 2018 / 12 A clear, sustainable and predictable dividend policy 2017 Shareholder Remuneration (€cents. per share, payment dates) 0.11 0.02 0.09 0.15 Apr-17 Oct-17 Apr-18 Cash Scrip 2 payments per year (tentatively in October and April)Scrip 11 cts. Cash 26 cts. (1) To be proposed for the consideration of the competent governing bodies (2) Net attributable profit excluding Telefónica impairment 15€ cents / share in cash to be paid in April 2018(1) Increased cash dividend per share vs. 2016 by 36% 2017 Cash Pay-out of 38% (2) Going forward, 2 cash payments per year expected (tentatively October and April)

- 14. 2017 Results February 1st 2018 / 13 Accelerating our transformation

- 15. 2017 Results February 1st 2018 / 14 18.1 21.1 22.6 Dec-16 Sep-17 Dec-17 12.3 15.8 17.7 Dec-16 Sep-17 Dec-17 +25% PENETRATION 36% 40% 42% Digital Customers BBVA Group Digital Customers (Mn, % penetration) Mobile Customers (Mn, % penetration) 24% 30% 33% +44% PENETRATION 50% tipping point in digital customers achieved TURKEY USA CHILE SPAIN ARGENTINA VENEZUELA

- 16. 2017 Results February 1st 2018 / 15 Digital Sales (% of total sales YtD, # of transactions) 5 million units sold via mobile in 2017 SPAIN USA 17.1 28.6 Dec-16 Dec-17 MEXICO 11.9 21.7 Dec-16 Dec-17 15.4 36.9 Dec-16 Dec-17 19.4 22.8 Dec-16 Dec-17 TURKEY 25.2 32.8 Dec-16 Dec-17 SOUTH AMERICA 16.8 28.0 Dec-16 Dec-17 GROUP Exponential growth in all markets

- 17. 2017 Results February 1st 2018 / 16 Focused on customer satisfaction Peer Group: Spain: Santander, CaixaBank, Bankia, Sabadell, Popular// Turkey: AKbank, Isbank , YKB, Deniz, Finanz / / Mexico: Banamex, Santander, Banorte , HSBC/ Argentina: Galicia, HSBC, Santander Río // Venezuela: Banesco, Mercantil, Banco de Venezuela. // Uruguay: ITAU, Santander, Scotiabank // Paraguay: Continental, Itau, Regional. *Footprint average except n.a data in Turkey Spain Rnk BBVA NPS (Dec-17) Mexico Turkey Argentina Colombia Paraguay Peru Venezuela Increase in NPS by channel (footprint average*) Online Banking Branches +6.4 p.p. Dec-17 vs Dec-16 +5.8 p.p Dec-17 vs Dec-16 # 1 # 1 # 1 # 1 # 1 # 1 # 1 # 1

- 18. 2017 Results February 1st 2018 / 17 Digital sales & improved customer experience boost sales growth: Spain Digital sales driving total sales increase Turning customer experience into more sales Total sales (million units) New app design – Increasing Mobile sales (Average daily digital sales increase*) x 1.7 Credit cards x 1.5 Deposits x 2.5 Mutual funds x 1.3 Current accounts 2016 2017 Digital sales Non-Digital sales +120% +31% +13% BBVA #1 in 2017 Online Banking Functionality Benchmark in Europe BBVA Best Global Banking App 2017 (*) Average daily digital sales increase from Sep 16th- Dec-31st vs Jul 1st - Sep 15th Industry Recognition

- 19. 2017 Results February 1st 2018 / 18 Digitization generates higher revenues and engagement, improving efficiency: Mexico Digitization drives more revenues -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 Digitized Non-Digitized Months since digitization Digital sales are more efficient Gross margin per customer evolution* (%) Digital channel engagement enhances satisfaction +10% -1% NPS by channel** (Dec-17, %) Cost of opening checking accounts Non Digital Digital - 67% 1% 35% 99% 65% Dec16 Dec17 Branch Digital Branches Mobile +20p.p *Gross Margin analysis from a sample of customers before and after digitization ** Results from IRene 2.0 Bmobile survey to Bancomer customers Percentage of checking accounts opened by channel

- 20. 2017 Results February 1st 2018 / 19 Digital customers are more profitable and satisfied: Turkey Digital customers are more profitable and engaged than non digital * Profit per customer is provided for monthly year average profit for Retail Banking (Individual and SME banking). Includes only direct costs ** NPS Open market Bank DIY increases total sales Operating income per customer* (times) 1.5x NPS of digital customer vs non- digital Digital customers are more likely to recommend their bank NPS** (Dec-17, %) New equity investment accounts opened per week (#) Non Digital Digital 1.8x Non Digital Digital 1.5x Nov17 Jan18 Digital sales Non-Digital sales +153% TO FROM Paper based process, only in branch 4 documents, 47 pages 47 signatures Approximately 60 minutes Digital process Single document link Single digital signing Approximately 5 minutes

- 21. 2017 Results February 1st 2018 / 20 Business Areas

- 22. 2017 Results February 1st 2018 / 21 Spain Banking Activity – Profit & Loss NII evolution in line with our expectations Good trend in fees Lower NTI in 2017 due to higher ALCO sales and VISA capital gain in 2016 Significant cost reduction Cost and impairments reductions as the main P&L drivers Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 946 -2.7 2.1 3,738 -3.6 Net Fees and Commissions 388 10.1 -0.5 1,561 5.7 Net Trading Income 161 -7.8 112.9 555 -29.4 Other Income & Expenses -48 64.9 n.s. 327 17.9 of which: Insurance 106 17.4 2.0 438 9.6 Gross Income 1,447 -1.6 -5.5 6,180 -3.7 Operating Expenses -831 -6.3 -0.8 -3,378 -5.6 Operating Income 616 5.6 -11.2 2,802 -1.3 Impairment on Financial Assets (net) -138 224.2 9.8 -567 -25.7 Provisions (net) and other gains (losses) -79 -86.8 79.4 -369 -54.3 Income Before Tax 399 n.s. -23.9 1,866 47.2 Income Tax -78 n.s. -41.1 -482 33.9 Net Attributable Profit 320 n.s. -18.0 1,381 52.7 Net Attributable Profit (ex-mortgage floor provisionin2016) 320 -14.8 1,381 5.5 Change (%)Spain Banking Activity (€m)

- 23. 2017 Results February 1st 2018 / 22 119.0 47.6 62.1 6.7 Cust. Funds Spain Banking Activity – Activity & Spreads € bn 235.3 (1) Performing loans under management. (2) Includes mutual funds, pension funds and other off balance sheet funds. Note: Activity excludes repos Activity (Dec-17) 77.4 9.8 13.1 24.2 23.2 16.0 3.7 Lending € bn 167.3 Mortgages Consumer Corporates Other Commercial Public Sector Others Very small businesses Demand Deposits Time Deposits Others Off-balance Sheet Funds2 Customer Spread (%) 2.06 2.04 2.02 2.00 2.00 1.91 1.92 1.94 1.93 1.93 0.15 0.11 0.08 0.08 0.07 4Q16 1Q17 2Q17 3Q17 4Q17 Yield on loans Customer Spreads Cost of Deposits YoY -1.1% -5.3% +37.3% -0.5% +9.8% -12.7% -4.9% +2.7% +20.2% -32.7% +30.4% +10.5% YoY +1.9% Towards a more balanced and profitable loan portfolio. Growth in consumer and commercial loans offset by deleverage in mortgages and public sector A more profitable deposit mix and strong growth in mutual and pension funds Customer spread remains flat thanks to a decrease in the cost of deposits and changes in mix Well positioned for interest rate increases 1 2

- 24. 2017 Results February 1st 2018 / 23 53% 52% 50% 5.8% 5.6% 5.2% Spain Banking Activity - Key Ratios Cost reduction accelerates in the quarter: CX synergies and ongoing efficiency measures NPLs down by over 400 Mn € qoq and CoR better than expected Coverage ratio NPL ratio 0.32% 0.32% 0.31% 4Q16 3Q17 4Q17 Cost of Risk (YtD) 55.8 53.8 54.7 63.6 58.7 60.1 4.0 -5.4 -5.6 -13.0 -3.0 7.0 17.0 27.0 37.0 47.0 12M16 9M17 12M17 Efficiency (%, €) Risk Indicators Cost-to-income ex-NTI ratio Cost Evolution YoY Cost-to-income ratio 2017 guidance < 40 bps

- 25. 2017 Results February 1st 2018 / 24 Non Core Real Estate - Highlights Net exposure (€bn) 3.8 2.8 1.7 5.3 4.5 4.3 1.1 0.5 0.4 10.2 7.8 6.4 Dec-16 Sep-17 Dec-17 -37.2% -65.6% -18.7% -54.9% Net attributable profit (€m) Foreclosed Assets RE developer loans Other RE assets RE owned assets Cerberus JV to reduce almost entirely our exposure to REOs ahead of our initial expectations C. €0.8 Bn of performing developer loans transferred to Spain Banking activity in 4Q17 4Q17 P&L impacted by the update of RE assets provision model parameters -595 -501 12M16 12M17 -15.8%

- 26. 2017 Results February 1st 2018 / 25 USA – Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 559 10.3 2.3 2,158 13.0 Net Fees and Commissions 159 4.9 -3.3 647 4.1 Net Trading Income 34 45.8 42.4 111 -19.6 Other Income & Expenses 25 n.s. n.s. 2 n.s. Gross Income 777 17.0 5.7 2,919 10.5 Operating Expenses -490 7.9 5.8 -1,858 3.2 Operating Income 287 36.6 5.7 1,061 26.1 Impairment on Financial Assets (net) -47 148.3 -44.9 -241 10.8 Provisions (net) and other gains (losses) -18 n.s. 44.7 -36 23.1 Income Before Tax 222 9.5 27.6 784 31.8 Income Tax -128 154.0 205.1 -273 83.0 Net Attributable Profit 94 -38.2 -28.7 511 14.6 Change (%) USA (constant €m) Strong YoY revenue growth on the back of rate increases Negative one-off from the tax reform in 4Q17 (-78 Mn €). Pay back expected in 2018 Bottom line growing at double digits Positive earnings momentum

- 27. 2017 Results February 1st 2018 / 26 45.1 11.4 Cust. Funds USA – Activity & Spreads (1) Performing loans under management. Note: Activity excludes repos € bn 56.5 11.0 6.8 2.2 29.5 5.1 Lending € bn 54.7 Mortgages Consumer Other Commercial Public Sector SMEs Demand Deposits Time Deposits Activity (Dec-17) (constant €) 3.71 3.88 3.99 4.12 4.16 3.32 3.51 3.67 3.76 3.75 0.39 0.37 0.33 0.36 0.41 4Q16 1Q17 2Q17 3Q17 4Q17 YoY -0.1% -2.5% +5.0% +1.5% +27.1% -42.7% YoY 1.7% +3.8% -5.6% Yield on loans Customer Spreads Cost of Deposits Positive lending growth in the quarter (+1%) focus on high-margin retail loans Significant increase in customer spread vs. last year thanks to low deposit Betas Asset sensitive balance sheet Customer Spread (%) 1

- 28. 2017 Results February 1st 2018 / 27 USA - Key Ratios 68.2 63.9 63.7 71.9 66.3 66.2 1.8 1.6 3.2 -5.0 -3.0 -1.0 1.0 3.0 5.0 7.0 9.0 11.0 13.0 15.0 12M16 9M17 12M17 94% 119% 104% 1.5% 1.2% 1.2% 0.37% 0.45% 0.42% 4Q16 3Q17 4Q17 Coverage ratio NPL ratio Cost of Risk (YtD) Efficiency (%, constant €) Risk Indicators Cost evolution impacted by transformation efforts Efficiency improvement vs 2016 CoR better than expected despite hurricanes provisions Cost-to-income ex-NTI ratio Cost Evolution YoY Cost-to-income ratio 2017 guidance 50 bps

- 29. 2017 Results February 1st 2018 / 28 Mexico – Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 1,421 9.4 3.2 5,437 9.5 Net Fees and Commissions 325 8.3 6.4 1,217 9.3 Net Trading Income 72 -10.3 14.6 249 15.9 Other Income & Expenses 27 -80.0 -15.3 177 -32.2 Gross Income 1,845 1.7 3.8 7,080 8.0 Operating Expenses -642 6.7 3.4 -2,445 5.3 Operating Income 1,202 -0.7 4.1 4,635 9.5 Impairment on Financial Assets (net) -402 -6.0 -6.4 -1,652 4.9 Provisions (net) and other gains (losses) -26 -47.4 n.s. -35 -46.2 Income Before Tax 774 5.5 6.8 2,948 13.6 Income Tax -203 3.9 1.9 -786 16.4 Net Attributable Profit 571 6.1 8.6 2,162 12.7 Change (%) Mexico (constant €m) Outstanding growth of core revenues: NII + fees Continued positive operating jaws Impairments better than expected Double-digit bottom line growth Sustained growth in all P&L lines, meeting our expectations

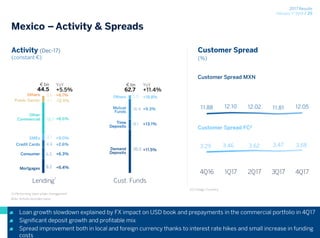

- 30. 2017 Results February 1st 2018 / 29 35.0 8.1 16.4 3.0 Cust. Funds Mexico – Activity & Spreads 8.2 6.5 4.4 3.1 18.7 3.1 0.5 Lending € bn 44.5 Mortgages Consumer SMEs Other Commercial Public Sector Others Credit Cards € bn 62.7 Demand Deposits Time Deposits Others Mutual Funds (1) Performing loans under management Note: Activity excludes repos YoY +5.5% +6.4% +6.3% +9.0% +8.6% -12.5% +6.1% +2.6% YoY +11.4% +11.5% +13.1% +18.8% +9.3% Activity (Dec-17) (constant €) Customer Spread (%) Loan growth slowdown explained by FX impact on USD book and prepayments in the commercial portfolio in 4Q17 Significant deposit growth and profitable mix Spread improvement both in local and foreign currency thanks to interest rate hikes and small increase in funding costs 1 11.88 12.10 12.02 11.81 12.05 3.29 3.46 3.62 3.47 3.68 4Q16 1Q17 2Q17 3Q17 4Q17 Customer Spread MXN Customer Spread FC2 (2) Foreign Currency

- 31. 2017 Results February 1st 2018 / 30 35.4 34.4 34.5 36.6 35.6 35.8 7.2 4.9 5.3 -2.0 3.0 8.0 13.0 18.0 23.0 12M16 9M17 12M17 39.7% 53.6% Bancomer System (ex Bancomer) Cost to income ratio (1) (1) System figures as of November 2017 according to local data (Source: CNBV) Mexico - Key Ratios 127% 126% 123% 2.3% 2.3% 2.3% Inflation 6.0% Average 12m 3.40% 3.36% 3.30% 4Q16 3Q17 4Q17 Coverage ratio NPL ratio Cost of Risk (YtD) Efficiency (%, constant €) Risk Indicators Positive operating jaws maintained with costs growing below inflation Best-in class efficiency Stability of risk indicators CoR better than expected Cost-to-income ex-NTI ratio Cost Evolution YoY Cost-to-income ratio 2017 guidance 350 bps

- 32. 2017 Results February 1st 2018 / 31 Strong core revenue growth Higher contribution from CPI linkers in 4Q17 due to inflation rate revision (+€141 Mn) Widening operating jaws Turkey – Profit & Loss Outstanding growth across the board Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 1,001 31.5 26.6 3,331 20.6 Net Fees and Commissions 181 35.4 -2.4 703 18.5 Net Trading Income -7 -82.2 n.s. 14 -76.8 Other Income & Expenses 19 160.0 -20.9 67 80.6 Gross Income 1,194 38.0 18.0 4,115 19.2 Operating Expenses -401 1.0 8.8 -1,503 6.6 Operating Income 793 69.3 23.3 2,612 27.8 Impairment on Financial Assets (net) -111 121.5 -1.8 -453 7.3 Provisions (net) and other gains (losses) -1 -98.5 -97.6 -12 -84.2 Income Before Tax 681 82.5 35.8 2,147 38.9 Income Tax -127 68.5 17.7 -426 34.7 Non-controlling Interest -280 54.7 40.6 -895 20.4 Net Attributable Profit 274 134.5 41.1 826 70.0 Net Attributable Profit change (ex 9,95%additional stake in Garanti) 87.3 41.2 40.1 Change (%) Turkey (constant €m)

- 33. 2017 Results February 1st 2018 / 32 11.8 32.7 3.9 Cust. Funds Turkey – Activity & Spreads (1) Performing loans under management. Note: Activity excludes repos 5.57 5.51 5.24 4.89 4.90 3.68 3.73 3.74 3.88 4.04 4Q16 1Q17 2Q17 3Q17 4Q17 Customer Spread TL Customer Spread FC2 16.2 4.8 31.0 Lending € bn 52.0 Retail Loans Credit cards Business Banking € bn 48.4 Demand Deposits Time Deposits Mutual & Pension Funds YoY +13.9% +19.9% +15.6% +10.7% YoY +15.8% +17.8% +13.8% +27.5% Activity (Dec-17) (constant €) Customer Spread (%) High TL loan growth despite slowdown in loans under the Credit Guarantee Fund scheme in 2H Improving funding mix TL customer spread flat qoq in a higher interest rate context 1 (2) Foreign Currency

- 34. 2017 Results February 1st 2018 / 33 40.8 37.7 36.5 41.6 38.0 36.7 7.7 8.8 6.6 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 12M16 9M17 12M17 124% 138% 85% Turkey - Key Ratios 2.7% 2.5% 3.9% Coverage ratio NPL ratio Cost of Risk (YtD) Efficiency (%, constant €) Inflation 11.1% Average 12m Risk Indicators Expenses increase well below inflation and significant efficiency improvement Large and highly collateralized tickets moving into NPLs in 4Q17 2017 CoR better than expected 0.87% 0.83% 0.82% 4Q16 3Q17 4Q17 Cost-to-income ex-NTI ratio Cost Evolution YoY Cost-to-income ratio 2017 guidance <100 bps

- 35. 2017 Results February 1st 2018 / 34 South America – Profit & Loss Top line growth translated into the bottom-line Mid-teens growth in core revenues due to higher lending activity Positive operating jaws achieved in 2017 Impairments evolution better than expected Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 892 25.8 11.2 3,200 15.1 Net Fees and Commissions 199 27.6 7.1 713 17.9 Net Trading Income 134 8.4 21.6 480 6.2 Other Income & Expenses -14 n.s. n.s. 59 -18.9 Gross Income 1,212 19.1 7.3 4,451 13.9 Operating Expenses -550 21.6 11.4 -2,008 12.4 Operating Income 661 17.0 4.1 2,444 15.1 Impairment on Financial Assets (net) -110 -20.4 -40.8 -650 26.1 Provisions (net) and other gains (losses) -42 -26.0 138.0 -103 -12.9 Income Before Tax 509 37.7 17.9 1,691 13.5 Income Tax -151 30.8 25.3 -486 10.1 Non-controlling Interest -102 37.8 11.4 -345 17.6 Net Attributable Profit 256 42.0 16.6 861 14.0 Change (%) South America (constant €m)

- 36. 2017 Results February 1st 2018 / 35 16.47 15.73 14.72 13.47 13.11 3.61 3.76 4.16 3.31 3.93 5.86 6.32 6.52 6.78 6.60 7.00 6.91 6.91 6.80 6.57 4Q16 1Q17 2Q17 3Q17 4Q17 8.0 11.0 13.4 13.6 11.9 Cust. Funds South America – Activity & Spreads (1) Performing loans under management Note: Activity excludes repos 5.5 14.8 11.8 13.0 3.0 Lending € bn 48.2 Argentina Chile Colombia Peru Others € bn 57.9 Argentina Chile Colombia Peru Others Argentina Chile Colombia Peru YoY +9.7% +65.8% +6.7% +8.5% +0.0% +7.7% YoY +10.5% +37.3% -0.6% +12.9% +0.2% +18.2% Activity (Dec-17) (constant €) Customer Spread (%) Double digit loan growth supported by Argentina and Colombia Higher spread yoy in Colombia and Chile offsetting decreases in Argentina and Peru 1

- 37. 2017 Results February 1st 2018 / 36 2.9% 3.5% 3.4% 1.15% 1.51% 1.32% 4Q16 3Q17 4Q17 South America – Key Ratios 45.7 45.0 45.1 51.7 50.4 50.6 14.2 9.3 12.4 13.9 8.5 9.6 0.0 5.0 10.0 15.0 20.0 25.0 30.0 12M16 9M17 12M17 103% 94% 89% Efficiency (%, constant €) Risk Indicators Coverage ratio NPL ratio Cost of Risk (YtD) Inflation 10.0% Average 12m Positive jaws and costs growing in line with inflation ex-Venezuela Asset quality and cost of risk better than expected Cost-to-income ex-NTI ratio Cost Evolution YoY Cost-to-income ratio 2017 guidance 140–150 bps Cost Evolution YoY ex- Venezuela Inflation ex-Vz 9.5% Average 12m

- 38. 2017 Results February 1st 2018 / 37 Accelerating profitable growth: Spain: Focus on fee growth, continued efficiency improvement and strong risk performance Non-core RE: Completing the run off USA: NII as the main P&L driver Mexico: solid growth to continue, in line with 2017 trends Turkey: solid TL loan growth and focus on cost control South America: strong growth, mainly driven by Argentina Capital above target in a clearer regulatory context Delivering on our transformation Maintain strong efforts to deliver best in class customer experience Target > 50% digital customers in 2018 and mobile in 2019 Digital sales exponential growth with more focus on non customers Enhance smart interaction with our customers leveraging data Faster developments through global technological platforms and agile organization Transformation of our operating model 2018 Outlook

- 39. 2017 Results February 1st 2018 / 38 Annex

- 40. 2017 Results February 1st 2018 / 39 24% 12% 16% 28% 18% 2% 12M17 Note: Spain includes Banking activity in Spain and Non Core Real Estate. Figures exclude Corporate Center Spain 6,163 €m USA 2,919 €m Turkey 4,115 €m Mexico 7,080 €m South America 4,451 €m Rest of Eurasia 468 €m Gross Income - Breakdown

- 41. 2017 Results February 1st 2018 / 40 Group – Net Attributable Profit (Ex-TEF impairment in 2017 and ex-mortgage floor clauses provision in 2016) (€m) 3,879 -204 73 94 65 243 340 -26 105 72 4,642 12M16 €m FX Effect Banking activity Spain Non core RE USA Mexico Turkey Rest of Eurasia South America Corp. Centre (ex-TEF imp) 12M17 €m YoY (%) (constant €) 5.5 -15.8 14.6 12.7 70.0 -17.3 14.0 -9.1 BUSINESSES +894 €m

- 42. 2017 Results February 1st 2018 / 41 Total Spain – Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 970 -1.9 2.8 3,809 -3.2 Net Fees and Commissions 388 9.8 -0.8 1,563 5.5 Net Trading Income 161 -6.5 113.1 555 -29.1 Other Income & Expenses -70 226.2 n.s. 235 12.9 Gross Income 1,449 -3.0 -4.7 6,163 -3.8 Operating Expenses -862 -6.3 -0.3 -3,493 -5.7 Operating Income 587 2.4 -10.4 2,670 -1.4 Impairment on Financial Assets (net) -151 173.7 -7.4 -705 -21.7 Provisions (net) and other gains (losses) -350 -59.9 305.1 -771 -39.8 Income Before Tax 86 n.s. -78.8 1,193 127.4 Income Tax 14 -69.7 n.s. -312 46.7 Net Attributable Profit 100 n.s. -66.9 880 184.5 Change (%) Total Spain (€m)

- 43. 2017 Results February 1st 2018 / 42 Non Core Real Estate - Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 23 43.6 38.8 71 19.5 Net Fees and Commissions 0 n.s. n.s. 3 -50.7 Net Trading Income 0 n.s. n.s. 0 n.s. Other Income & Expenses -22 n.s. -25.7 -91 33.2 Gross Income 1 -93.6 n.s. -17 157.8 Operating Expenses -31 -5.6 13.8 -115 -7.1 Operating Income -29 196.4 -24.8 -132 1.2 Impairment on Financial Assets (net) -12 -0.4 -66.4 -138 0.4 Provisions (net) and other gains (losses) -271 -2.1 536.8 -403 -15.2 Income Before Tax -313 4.6 164.6 -673 -9.4 Income Tax 93 381.7 223.1 170 15.4 Net Attributable Profit -220 -21.3 146.3 -501 -15.8 Change (%) Non Core Real Estate (€m)

- 44. 2017 Results February 1st 2018 / 43 South America (ex-Venezuela) – Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 820 16,3 3,9 3.106 12,2 Net Fees and Commissions 181 16,7 -1,2 691 14,5 Net Trading Income 137 3,2 23,4 483 6,9 Other Income & Expenses 19 -22,7 -41,5 97 22,1 Gross Income 1.157 13,7 3,6 4.377 12,1 Operating Expenses -507 12,5 4,1 -1.951 9,6 Operating Income 651 14,7 3,3 2.426 14,3 Impairment on Financial Assets (net) -99 -28,6 -46,5 -635 23,5 Provisions (net) and other gains (losses) -54 -8,1 211,7 -114 -7,0 Income Before Tax 498 34,4 16,3 1.677 12,9 Income Tax -134 14,2 13,0 -466 6,6 Non-controlling Interest -105 42,3 14,9 -347 18,3 Net Attributable Profit 259 44,5 18,6 864 14,4 South America (ex-Venezuela) (constant €m) Change (%)

- 45. 2017 Results February 1st 2018 / 44 Rest of Eurasia - Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income 36 -15,5 -26,0 180 8,7 Net Fees and Commissions 39 -34,4 -9,7 164 -15,2 Net Trading Income 24 34,5 27,6 123 40,4 Other Income & Expenses 0 -88,1 -65,1 1 -97,3 Gross Income 100 -19,3 -11,1 468 -4,8 Operating Expenses -81 -12,0 10,1 -308 -9,9 Operating Income 19 -40,5 -51,2 160 7,0 Impairment on Financial Assets (net) 13 -43,8 1930,9 23 -24,3 Provisions (net) and other gains (losses) 3 -75,9 n.s. -6 n.s. Income Before Tax 35 -47,7 -8,2 177 -12,9 Income Tax -11 -26,9 19,7 -52 0,3 Net Attributable Profit 23 -54,1 -17,6 125 -17,4 Change (%) Rest of Eurasia (€m)

- 46. 2017 Results February 1st 2018 / 45 Corporate Centre - Profit & Loss Change (%) 4Q17 4Q17 vs 4Q16 4Q17 vs 3Q17 2017 2017 vs 2016 Net Interest Income -83 -25.8 -1.8 -357 -21.6 Net Fees and Commissions -20 -29.1 10.8 -86 -21.2 Net Trading Income 143 29.8 188.0 436 22.2 Other Income & Expenses 46 -43.5 n.s. 80 -54.5 Gross Income 86 66.1 n.s. 73 n.s. Operating Expenses -224 8.8 1.5 -884 0.9 Operating Income -138 -10.5 -49.9 -811 -10.6 Impairment on Financial Assets (*) -1 -87.5 797.6 -2 -94.0 Provisions and other gains and Losses -16 n.s. 70.4 -73 -47.3 Income Before Tax (*) -155 -4.2 -45.6 -886 -18.2 Income Tax 74 8.1 139.1 166 -43.3 Net Income (*) -81 -13.2 -68.1 -720 -8.9 TEF Impairment -1,123 n.s. n.s. -1,123 n.s. Non-controlling Interest 13 n.s. 1979.5 -1 -60.0 Net Attributable Profit -1,190 1172.4 370.2 -1,844 132.3 n.s. Net Attributable Profit (ex-Telefonica Impairment) -68 -27.7 -73.3 -722 -9.1 Change (%) Corporate Center (€m) (*) Ex- Telefónica impairment

- 47. 2017 Results February 1st 2018 / 46 Evolution of phased-in capital ratios (%) 12.2 11.9 11.7 0.7 1.3 1.3 2.3 2.5 2.5 Dec-16 Sep-17 Dec-17 CET1 Tier 2 Additional Tier 1 15.7 15.5 10.9 11.2 11.1 1.6 1.7 1.7 2.2 2.5 2.5 Dec-16 Sep-17 Dec-17 Evolution of fully-loaded capital ratios (%) 15.4 15.3 Capital Base 15.1 14.7 CET1 Tier 2 Additional Tier 1 Total capital Ratio Total capital Ratio

- 48. 2017 Results February 1st 2018 / 47 10.90% 11.08% 122 bps -45 bps -21 bps -25 bps -13 bps % CET1 FL (Dec.16) Net Earnings (ex-TEF Impairment) Dividend accrual RWAs Others Garanti& CNCB Transactions % CET1 FL (Dec.17) Capital YtD Evolution CET1 fully-loaded – BBVA Group YtD Evolution (%, bps) +18bps (*) *Others includes negatives from the mark to market of AFS portfolio, FX impact and AT1 coupons, among others, and minor positive from the update of the calculation of Structural FX risk RWAs. +31 bps Ex-Garanti & CNCB transactions

- 49. 2017 Results February 1st 2018 / 48 Risk-Weighted Assets by Business Area Breakdown by business areas and main countries (€m) Dec-16 Sep-17 Dec-17 Banking activity in Spain 113,194 106,302 111,825 Non Core Real Estate 10,870 10,736 9,691 United States 65,492 58,236 58,682 Turkey 70,337 64,611 62,768 Mexico 47,863 46,478 43,715 South America 57,443 53,923 55,665 Argentina 8,717 8,540 9,364 Chile 14,300 13,652 14,300 Colombia 12,185 12,001 12,249 Peru 17,400 15,203 14,750 Venezuela 1,360 1,446 1,516 Rest of South America 3,480 3,080 3,485 Rest of Eurasia 15,637 13,525 12,916 Corporate Center 8,115 11,503 6,426 BBVA Group 388,951 365,314 361,686 Phased-in RWA

- 50. 2017 Results February 1st 2018 / 49 Shareholder’s Return: TBV per Share and Dividends 5.73 5.88 5.82 5.79 5.69 0.08 0.08 0.21 0.30 0.30 5.81 5.96 6.03 6.09 5.99 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Shareholder Remuneration TBV TBV per Share & Shareholder Remuneration (€ per Share)

- 51. 2017 Results February 1st 2018 / 50 26.5 10.7 10.6 4.8 3.2 Sep-17 55.8 ALCO Porfolio Euro (1) USA Turkey Mexico South America Euro (1) USA Turkey Mexico South America 30.8 10.5 11.4 5.9 2.9 Dec-16 61.5 ALCO Portfolio breakdown by region (€ bn) 54.9 Euro (1) USA Turkey Mexico South America (1) Figures excludes SAREB bonds (€5.2bn as of Dec-16 and Sep-17; €5bn as of Dec-17) 26.1 10.5 10.9 4.5 2.9 Dec-17

- 52. 2017 Results February 1st 2018 / 51 Liquidity Coverage Ratios (LCRs): Significantly above the 100% requirement BBVA Group and Subsidiaries LCR BBVA Group Euroz.(1) USA(2) Mexico Turkey S. Amer. LCR 128% 151% 144% 148% 134% well >100% (1) Perimeter: Spain + Portugal + Rest of Eurasia (2) Compass LCR calculated according to local regulation (Fed Modified LCR) Dec-17

- 53. 2017 Results February 1st 2018 / 52 Customer Spreads (1) Foreign currency Note 1: USA ex NY Business Activity Average 4Q16 1Q17 2Q17 3Q17 4Q17 Spain 1.91% 1.92% 1.94% 1.93% 1.93% Yield on Loans 2.06% 2.04% 2.02% 2.00% 2.00% Cost of Deposits -0.15% -0.11% -0.08% -0.08% -0.07% USA 3.32% 3.51% 3.67% 3.76% 3.75% Yield on Loans 3.71% 3.88% 3.99% 4.12% 4.16% Cost of Deposits -0.39% -0.37% -0.33% -0.36% -0.41% Mexico MXN 11.88% 12.10% 12.02% 11.81% 12.05% Yield on Loans 13.34% 13.70% 13.78% 13.68% 14.02% Cost of Deposits -1.46% -1.60% -1.77% -1.87% -1.98% Mexico FC1 3.29% 3.46% 3.62% 3.47% 3.68% Yield on Loans 3.32% 3.49% 3.66% 3.53% 3.76% Cost of Deposits -0.03% -0.04% -0.05% -0.07% -0.08% South America 6.34% 6.48% 6.57% 6.36% 6.55% Yield on Loans 9.93% 9.95% 9.92% 9.46% 9.73% Cost of Deposits -3.59% -3.47% -3.35% -3.10% -3.18% Argentina 16.47% 15.73% 14.72% 13.47% 13.11% Yield on Loans 22.77% 21.18% 19.97% 18.63% 18.77% Cost of Deposits -6.30% -5.46% -5.24% -5.16% -5.65% 4Q16 1Q17 2Q17 3Q17 4Q17 Chile 3.61% 3.76% 4.16% 3.31% 3.93% Yield on Loans 6.44% 6.42% 6.71% 5.47% 6.27% Cost of Deposits -2.83% -2.67% -2.55% -2.15% -2.34% Colombia 5.86% 6.32% 6.52% 6.78% 6.60% Yield on Loans 11.84% 12.08% 11.94% 11.62% 11.37% Cost of Deposits -5.98% -5.76% -5.42% -4.84% -4.77% Peru 7.00% 6.91% 6.91% 6.80% 6.57% Yield on Loans 8.26% 8.23% 8.32% 8.17% 7.90% Cost of Deposits -1.26% -1.32% -1.41% -1.37% -1.33% Venezuela 19.89% 20.17% 19.77% 19.95% 18.77% Yield on Loans 21.95% 21.72% 21.15% 21.24% 20.02% Cost of Deposits -2.06% -1.55% -1.38% -1.29% -1.25% Turkey TL 5.57% 5.51% 5.24% 4.89% 4.90% Yield on Loans 13.11% 13.15% 13.48% 13.75% 14.06% Cost of Deposits -7.55% -7.65% -8.25% -8.86% -9.16% Turkey FC1 3.68% 3.73% 3.74% 3.88% 4.04% Yield on Loans 5.52% 5.63% 5.76% 5.95% 6.14% Cost of Deposits -1.85% -1.90% -2.02% -2.07% -2.10%

- 54. 2017 Results February 1st 2018 / 53 2017 Results February, 1st 2018