Birla sun life insurance

- 2. Birla Sun Life Insurance PROJECT REPORT ON STUDY OF PRODUCT PORTFOLIO OF SUBMITTED BY: A report submitted in partial fulfillment of BBA programme at 2

- 3. Birla Sun Life Insurance ACKNOWLEDGEMENT We would like to express our sincere gratitude and thanks to Mr. Rajesh Rao, Agency Manager, Birla sun life insurance ltd, Jaipur for giving us the guidance. We owe everything we have gained from the project in terms of knowledge and experience to them, as without their timely support and encouragement the project would not have been as fruitful as it has been. We also thank Mr. Ashwin saxena for his constant encouragement and guidance at every stage of this project, acting as my faculty guide. He has been kind enough to spare his valuable time and share his corporate experiences, which helped me to approach the project in the right way. We are grateful also to the entire staff of Birla sun life insurance ltd who helped us to collect the relevant data and get the real gist of current scenario. 3

- 4. Birla Sun Life Insurance We would also like to extend sincere thanks to few people who were not part of our project but without their help things would not have been as easy as they were. THANK YOU ALL Bhanwar lal kumawat (BBA 3ndYear) Parishkar college of Global Excellence. 4

- 5. Birla Sun Life Insurance CONTENTS 1. Introduction to insurance 5 2. Fundamental principles of insurance 6-8 3. Reasons for taking a life insurance policy 9-10 4. Vision, Mission, Values 11 5. Company Profile 12-16 6. Sales Procedure 17-19 7. Company’s Products 19-34 7.1 Flexi Plans 7.2Classic Life Premier 7.3 Gold plus II Plan 7.4 Supreme Life Plan 7.5 Platinum plus Plan 9. Funds by BSLI 34-39 11. Conclusion 40 5

- 6. Birla Sun Life Insurance 12. Recommendation 41 13. Bibliography 41 14. Annexure 42-44 “Insurance, in law and economics, is a form of risk management primarily used to hedge against the risk of a contingent loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for a premium. An insurer is a company selling the insurance. The insurance rate is a factor used to determine the amount, called the premium, to be charged for a certain amount of insurance coverage. Risk management, the practice of appraising and controlling risk, has evolved as a discrete field of study and practice.” The evolution of human beings from the primordial ‘wild’ stage to the ‘cave dwelling’ stage is nothing but their saga of search for security. Their quest for security is eternal. Life insurance is a device invented by them to seek security against the most important hazards against which they found themselves quite helpless. It will not be an exaggeration to say that progress of civilization is due to human beings’ unending pursuit for security. 6

- 7. Birla Sun Life Insurance Life insurance in its modern form is a western concept. Although it started taking shape since last 300 years, it came to India with the arrival of the Europeans .the first life insurance company was established in India in 1818 as oriental life insurance company mainly by Europeans to provide for widows of Europeans. The companies that followed mainly catered to Europeans and charge extra premium on Indians lives. The first Indian company, insuring Indian lives at standard rates, was Bombay mutual life insurance company, which was formed in 1870.this was the year also when the first Insurance Act was passed by the British parliament. The years subsequent to the Swedishi Movement saw the emerging of several insurance companies. The end of the year 1955, there were 245 insurance companies and provident societies out of which 16 were non-Indian companies. These companies were nationalized in 1956 and brought under one umbrella – the life insurance corporation of India, which enjoyed monopoly of life insurance business, till almost up to the end of year 2000.By enacting the IRDA Act 2000,the government of India effectively ended LIC’s monopoly and opened the doors for private insurance companies FUNDAMENTAL PRINCIPLES OF INSURANCE Some useful terms in Insurance: A) INDEMNITY 7

- 8. Birla Sun Life Insurance A contract of insurance contained in a fire, marine, burglary or any other policy excepting life assurance and personal accident and sickness insurance) is a contract of indemnity. This means that the insured, in case of loss against which the policy has been issued, shall be paid the actual amount of loss not exceeding the amount of the policy, i.e. he shall be fully indemnified. The object of every contract of insurance is to place the insured in the same financial position, as nearly as possible, after the loss, as if his loss had not taken place at all. It would be against public policy to allow an insured to make a profit out of his loss or damage. B) UTMOST GOOD FAITH Since insurance shifts risk from one party to another, it is essential that there must be utmost good faith and mutual confidence between the insured and the insurer. In a contract of insurance the insured knows more about the subject matter of the contract than the insurer. Consequently, he is duty bound to disclose accurately all material facts and nothing should be withheld or concealed. Any fact is material, which goes to the root of the contract of insurance and has a bearing on the risk involved. It is only when the insurer knows the whole truth that he is in a position to judge (a) Whether he should accept the risk and (b) What premium he should charge. If that were so, the insured might be tempted to bring about the event insured against in order to get money. 8

- 9. Birla Sun Life Insurance C) Insurable Interest - A contract of insurance affected without insurable interest is void. It means that the insured must have an actual pecuniary interest and not a mere anxiety or sentimental interest in the subject matter of the insurance. The insured must be so situated with regard to the thing insured that he would have benefit by its existence and loss from its destruction. The owner of a ship run a risk of losing his ship, the charterer of the ship runs a risk of losing his freight and the owner of the cargo incurs the risk of losing his goods and profit. So, all these persons have something at stake and all of them have insurable interest. It is the existence of insurable interest in a contract of insurance, which distinguishes it from a mere watering agreement. D) Causa Proxima - The rule of causa proxima means that the cause of the loss must be proximate or immediate and not remote. If the proximate cause of the loss is a peril insured against, the insured can recover. When a loss has been brought about by two or more causes, the question arises as to which is the causa proxima, although the result could not have happened without the remote cause. But if the loss is brought about by any cause attributable to the misconduct of the insured, the insurer is not liable. 9

- 10. Birla Sun Life Insurance E) Risk - In a contract of insurance the insurer undertakes to protect the insured from a specified loss and the insurer receive a premium for running the risk of such loss. Thus, risk must attach to a policy. F) Mitigation of Loss - In the event of some mishap to the insured property, the insured must take all necessary steps to mitigate or minimize the loss, just as any prudent person would do in those circumstances. If he does not do so, the insurer can avoid the payment of loss attributable to his negligence. But it must be remembered that though the insured is bound to do his best for his insurer, he is, not bound to do so at the risk of his life. G) Subrogation - The doctrine of subrogation is a corollary to the principle of indemnity and applies only to fire and marine insurance. According to it, when an insured has received full indemnity in respect of his loss, all rights and remedies which he has against Third person will pass on to the insurer and will be exercised for his benefit until he (the insurer) recoups the amount he has paid under the policy. It must be clarified here that the Insurer’s right of subrogation arises only when he has paid for the loss for which he is liable under the policy and this right extends only to the rights and remedies available to 10

- 11. Birla Sun Life Insurance the insured in respect of the thing to which the contract of insurance relates. H) Contribution - Where there are two or more insurance on one risk, the principle of contribution comes into play. The aim of contribution is to distribute the actual amount of loss among the different insurers who are liable for the same risk under different policies in respect of the same subject matter. Any one insurer may pay to the insured the full amount of the loss covered by the policy and then become entitled to contribution from his co-insurers in proportion to the amount which each has undertaken to pay in case of loss of the same subject-matter. In other words, the right of contribution arises when 1) There are different policies, which relate to the same subject matter 2) The policies cover the same peril which caused the loss, and 3) All the policies are in force at the time of the loss, and 4) One of the insurers has paid to the insured more than his share of the loss. 11

- 12. Birla Sun Life Insurance Life Insurance Policy is a form of security for the person who insures his life and his family. Life insurance policies have helped trade and other economic activities to flourish in a great manner. It has generated lots of job opportunities. It is looked upon as a lucrative career option. Life insurance companies have also entered the international business scenario. The following reasons substantiate why a life insurance policy should be taken: A) Early Deaths The mortality rate is experiencing a declining trend in many parts of the world. However it is also important to note that the age at which People die is also ever decreasing. Some reasons for this include unhealthy living style, stress, pollution, and some natural calamities. This necessitates people to make adequate measures to yield income for their family and dependents. This could be a serious concern if the insured happens to be the sole breadwinner. Some individuals see this as an option to plan their retirement. B) Advancements in Health Care The mortality rate has declined rapidly even though the fact remains that the number of people who die at an early age is on the increase. This is mainly due to the advancement in healthcare and the awareness on medical facilities. This results in an increased spending at an old age. This increased spending is also due to increase in the costs of 12

- 13. Birla Sun Life Insurance living apart from paying expensive medical bills. Unless they invest in Life insurance or other forms of insurance like health insurance it becomes next only too impossible to meet the financial demands especially during the old days. C) Increase in the Cost of Living and Spending Power The purchasing power of the consumers and the standard of living has experienced a steep rise over the years. The increase in National Income and gross domestic product are Partly responsible for this. Individuals incur many unexpected expenses due to the growing needs. Insurance comes in handy to meet such an unexpected expense. It also Makes sure that an individual is able to meticulously plan his finances. Insurance option is more or less an interest free loan. An individual can cancel his insurance policy and obtain a huge amount if it is imperative in meeting an urgent expenses and he does not have alternative sources for finance. Life insurance companies therefore do the needful to consumers. D) Tax Concessions 13

- 14. Birla Sun Life Insurance Income tax concessions are available to individuals and corporate houses that adopt insurance policies. Many have been making investments in Insurance with the sole aim of enjoying tax benefits. This naturally increases spending power. Since the investments increases the economic activities in the country automatically increases. VISION To be a world class provider of financial security to individuals and corporates and to be amongst the top three private sectors life insurance companies in India. MISSION 14

- 15. Birla Sun Life Insurance To be the first preference of our customers by providing innovative, need based life insurance and retirement solutions to individuals as well as corporates. These solutions will be made available by well-trained professionals through a multi channel distribution network and Superior technology. Our endeavor will be to provide constant value addition to customers throughout their relationship with us, within the regulatory framework. We will provide career development opportunities to our employees and The highest possible returns to our shareholders. VALUES Integrity: Honesty in every action. Commitment: Deliver on the promise Passion: Energized action Seamlessness: Boundary less in letter & spirit Speed: One step ahead always 15

- 16. Birla Sun Life Insurance COMPANY PROFILE Birla Sun Life – A Coming Together Of Values Birla Sun Life is a joint venture between The Aditya Birla Group, one of the largest business house in India and Sun Life Financial Inc., a leading International Financial Services Organization. The local knowledge of the Aditya Birla Group combined with the expertise of Sun Life Financial Inc. offers a formidable protection for our future. The Aditya Birla Group is led by its chairman- Mr. Kumar Manglam Birla. The Group has over 88000 employees across all its units worldwide. Some of the key organizations with the group are Hindalco, Grasim, Aditya Birla Nuvo, etc. The group is India's leading business house with a number of key organizations. These are as follows: 1. Grasim 2. UltraTech Cement Ltd 3. Hindalco 4. Indian Aluminium Company Ltd 5. Aditya Birla Nuvo 6. Idea Cellular Ltd. 7. Birla Sun Life Insurance Co.Ltd 8. Birla Sun Life Asset Mgmt. Co.Ltd 16

- 17. Birla Sun Life Insurance 9. Birla Sun Life Distribution Co. Ltd 10. PSI Data Systems 11. Indo Gulf Fertilizers Ltd. 12. Birla Global Finance Ltd Sun Life Financial Inc. and its partners today have operations in key markets worldwide, including Canada, the United States, the United Kingdom, Hong Kong, the Philippines, Japan, Indonesia, India, China and Bermuda. Sun Life Financial Inc. is a leading player in the life insurance market in Canada. Share Holding Pattern: In Birla-Sun Life, the two companies are having shareholding pattern as follows: 74 %--> Aditya Birla Group 26 %--> Sun Life Financial Inc. The group has 3 businesses: 1. Mutual Funds 2. Wealth Management 3. Life Insurance Birla Sun Life Insurance co ltd. is the Life-Insurance arm of Birla-Sun Life Birla Sun Life Insurance in its 7 successful years of operations has contributed significantly to the growth and 17

- 18. Birla Sun Life Insurance development of life insurance industry in India. It pioneered the launch of Unit Linked Life Insurance plans amongst the private players in India. It was the first player in the industry to sell its policies through the Bancassurance route and through the Internet. It was the first private sector player to introduce a Pure Term plan in the Indian market. This was supported by sales practices, which brought a degree of transparency that was entirely new to the market. The process of getting sales illustrations signed by customers, offering a free look period on all policies, which are now industry standards were introduced by BSLI. Being a customer centric company, BSLI has covered more than a million lives since inception and its customer base is spread across more than 1000 towns and cities in India. All this has assisted the company in cementing its place amongst the leaders in the industry in terms of new business premium income. The company has a capital base of more than Rs.672 crores. Many ONEs with Birla Sun Life Insurance: BSLI is a company that has a very unique contribution in the history of Insurance sector. The company not only has varying plans and funds, rather also is a pioneer in many aspects. These pioneering features of BSLI are as follows: 1. Free Look Period: BSLI offers its policyholders with a free look period of 15 days. Client gets freedom to have an in-depth look over all the terms 18

- 19. Birla Sun Life Insurance and conditions regarding his/her life-insurance policy. If he finds policy not worth opting for, he can also return the policy, but at BSLI, co. people ensures this not to happen. 2. Bancassurance: BSLI pioneered Bancassurance in India. Bancassurance means to include Banks as one of the distribution channels with the company. BSLI is the first company, which realized that banks, with their huge customer base and strong customer loyalty, are a readymade platform to acquire new business on a more cost effective and sustainable basis. 3. Unit Linked Life Insurance Plans: BSLI was the first in India to introduce Unit Linked Plans. A ULIP is an auspicious coming together of security from life 4. insurance and earnings from investment. Which means, apart from securing the future they offer efficient returns. These plans provide the customer with a certain number of units, in the same way as a mutual-fund holder gets units. ULIPs offer market- linked returns to policyholders. 5. Sales Illustrations: BSLI is the first company to introduce Sales Illustrations in the Insurance Industry. Sales people of BSLI give demonstrations of fund 19

- 20. Birla Sun Life Insurance 6. Performance on two points of projections i.e. on 6% and 10%. Now IRDA has also made it mandatory to have sales illustrations. BSLI’s has launched Century SIP, a unique systematic investment plan offering an opportunity to create wealth with as little as Rs 1000 per month plus a life insurance cover of up to 100 times the monthly installment. This plan comes along with free term insurance for an individual up to 55 years of age. The life insurance cover comes at no extra cost to the investor. The cover is hassle free. The investor need not go thru any medial test to avail of the life cover. All an investor needs to do is enroll for CSIP & sign a “Declaration of Good Health”. In case of unfortunate demise of investor the insurance claim will be directly paid to the nominee by the insurance company (Birla Sun Life Insurance Company). Announcing the launch of Century SIP, Anil Kumar, CEO, and Birla Sun Life MF said, “This offering touches all aspects of an investor’s financial planning needs. We wish to encourage the investment habit among investors by providing them life insurance cover.” Insurance cover to the investor would continue even after the SIP’s minimum maturity tenor of 3 years. Any individual between 18 to 46 years of age may invest in this plan. Investment in this plan may be made through 20

- 21. Birla Sun Life Insurance Electronic clearing system (ECS), direct debits or post dated cheques. 7. Others: Some other ONEs with BSLI are: 1st to issue daily NAVs of funds for better transparency. 1st to have a distinct CRISIL benchmark. 1st to disclose portfolio on a monthly basis. Policyholders can view their policy details online; they can be accessed from BSLI website using your unique password. Out of every 100 claims intimated to BSLI 98.28 stands cleared. Also the average Turn Around Time (TAT) : (i) From the receipt of the last requirement till dispatch of cheque is 5 days and 21

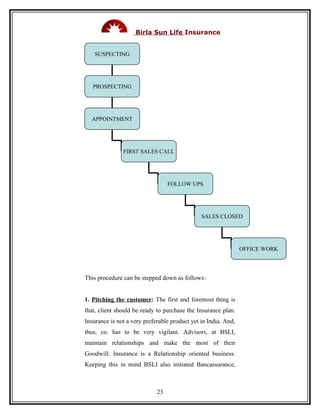

- 22. Birla Sun Life Insurance (ii) From intimation of claim till its decision & dispatch of cheque is 36 days. Sales Procedure of Insurance in BSLI: BSLI ensures that its policyholders get the best out of the policy offered to them by their Advisors. For this, BSLI follows a set procedure of selling Insurance to the clients. The sales procedure can be diagrammatically presented as follows: 22

- 23. Birla Sun Life Insurance SUSPECTING PROSPECTING APPOINTMENT FIRST SALES CALL FOLLOW UPS SALES CLOSED OFFICE WORK This procedure can be stepped down as follows: 1. Pitching the customer: The first and foremost thing is that, client should be ready to purchase the Insurance plan. Insurance is not a very preferable product yet in India. And, thus, co. has to be very vigilant. Advisors, at BSLI, maintain relationships and make the most of their Goodwill. Insurance is a Relationship oriented business. Keeping this in mind BSLI also initiated Bancassurance, 23

- 24. Birla Sun Life Insurance where Banks’ image of being loyal to the customers, plays a major role in pitching the customer to buy Insurance. BSLI uses following routes for distributing their Product to general public: a. Direct Personal Contacts (through Advisors) b. Bancassurance (through Banks) c. Personal Relations (through co. employees) d. Existing Policyholders. 2. Sales Illustration: BSLI is the first company to give demonstration of the fund performance i.e. how a certain policy will perform or will give returns. BSLI Advisors give sales illustration. Fund performance is shown on 6% and 10% projections. If client find these projected returns suitable to his/her risk profile, he go for purchasing the policy. 3. Proposal Form: Now as client is ready to get insured, advisor gives him the proposal form and asks for all the documents required. Proposal form is a 4 page document that contains all the necessary information related to the Insured and the Owner of the policy. Documents required along with the proposal form are: Date-Of-Birth Proof Address & ID Proof Income Certificate Medical Certificates (only if Insurer is a senior citizen) 24

- 25. Birla Sun Life Insurance 4. After Sales Service: Now after the Insurance is sold, follow-ups are required. Advisor needs to maintain good relations with the policyholder. Insurance co. can Generate further business, only if, existing policyholders are satisfied with the services being provided by the advisor of the co. Thus, BSLI keeps this in mind and Business Development Executives continuously track the needs of the policyholders. BSLI provides the policyholders with monthly updates of the fund performance and also discloses the asset portfolio of the fund. This assists the policyholders to manage their policy according to their risk profile. They can, thus, change their fund allocation as well as the asset allocation in any fund, chosen by them. COMPANY PRODUCTS / PLANS All the plans associated with BSLI are Unit Linked Plans. Flexi Plans Flexi Plans have three variants. These variants are: 1. Flexi Save Plus (Endowment Plan) 2. Flexi Cash Flow (Money Back Plan) 25

- 26. Birla Sun Life Insurance 3. Flexi Lifeline (Whole of Life Plan) Features: • This is a Unit Linked Plan with guaranteed returns. • Provides flexibility with Top-Up Facility. • For Quarterly modal premium less than Rs.5000, payment can be made through ECS. • Policyholder can attach riders to the plan according to his/her needs. • Liquidity in the form of Partial withdrawals. • Three Investment Fund options are available with the policy and policyholder is free to switch between funds anytime during the tenure of the policy. • The Sum Assured may be increased once in every 5 policy years, starting from the 6th policy year. • Premium can be paid annually, semi-annually, quarterly and monthly Premium Invested: Collected Premium is invested in three Investment Fund Options. These funds are: 1. Protector 2. Builder 3. Enhancer Benefits: 26

- 27. Birla Sun Life Insurance 1. Maturity Benefits: At maturity, Policyholder gets the higher of the guaranteed fund value (min. 3% on premium) or the Total Fund value. 2. Survival Benefits: (i) At the end of every 5th Coverage Benefit Period and the remainder on maturity, an amount equals to the minimum of (a) or (b) mentioned below will be reduced from the guaranteed fund value and transferred to the holding account for the purpose of partial withdrawals, where- (a) Guaranteed Fund Value (b) Sum Assured % as stated below: • 30% if the Coverage Benefit Period is 10 years. • 25% if the Coverage Benefit Period is 15 years. • 20% if the Coverage Benefit Period is 20 years. • 15% if the Coverage Benefit Period is 25 years. If survival benefits are not withdrawn, they will continue to be a part of the Fund Value. (ii) If the life insured is a minor, policyholder can withdraw the survival benefit payout within one month from 27

- 28. Birla Sun Life Insurance the scheduled payout date from the fund value. 3. Death Benefits: Age at time of Death Benefits Death 30 days to 1 year Fund Value Only Higher of Sum Assured less all partial withdrawals made in 24 Age 1 Year to 60 months preceeding the death of life insured or the fund value or Year the guaranteed fund value. On or After Higher of Sum Assured less all partial withdrawals made since attainment of 60 the life insured attained the age 58 or the fund value or the Years guaranteed fund value. Charges: 1. Mortality Charges: These charges are deducted by canceling units on a monthly basis at the prevailing NAV. The annual mortality charges per 1000 sum assured for sample ages are as follows: Age 20 30 40 50 60 Male 1.01 1.17 2.15 5.53 13.732 6 1 0 2 Female 0.89 1.16 1.65 4.03 10.660 6 3 7 0 2. Partial Withdrawal Charges: 2 withdrawals in a policy year are free of charge. Rs100 for every additional partial withdrawal are charged. 28

- 29. Birla Sun Life Insurance Classic Life Premier This is the plan that not only helps to save for the future but also helps to get rich benefits from the investments, especially at a time when the need for family protection reduces significantly. Features: • The plan is a unit linked, non-participating plan. • This plan has the option of seven-investment fund with the flexibility to allocate the premiums in varying proportions into the different Fund Option. • Top up facility is there. The minimum amount of top ups is 10000. • The plan offers further benefits in the form of additional units, which will be added to the Fund value at the end of the 10th policy year. • There is high liquidity in the form of Partial Withdrawals and Surrender Benefits. • Death Benefits, which will be higher of the Fund value or Sum Assured, reduced by the applicable partial withdrawals. Eligibility: • Entry Age: Minimum: 30 days for 20 & 30 term 8 years for 10 terms 30 years for whole life Maximum: For 10 years term- 60 years 29

- 30. Birla Sun Life Insurance For 20 years term- 50 years For 30 years term- 40 years For Whole Life- 60 years • Duration: Minimum: 10 years Maximum: 70 years (assuming whole life to be 100 years) • Maturity Age: 70 years for the term- 10,20,30 years 100 years for whole life • Premium Payment Term: For 10 years term- 3, 5yrs or regular coverage paying period. For 20 yrs, 30yrs term and Whole Life- 5yrs, 10 yrs or regular coverage paying period. Premium Investment: Premium collected is invested in Seven Investment Fund Options: 1. Assure 2. Protector 3. Builder 4. Enhancer 5. Creator 6. Magnifier 7. Maximiser Benefits: 30

- 31. Birla Sun Life Insurance 1. Guaranteed Addition: It is in the form of additional units, which is added to the fund value on the 10th policy anniversary and on every 5th policy anniversary thereafter, while policy is in effect. 2. Partial Withdrawal Options: Partial Withdrawals can be made after 3 policy years or when the life insured attains maturity, whichever is later. The minimum partial withdrawal amount is Rs.10000 3. Surrender Benefits: Policy offers the flexibility of surrendering the policy, if the need arises. There is no surrender charge after 6 completed policy years. However, if the policy is surrendered within 3 years from inception, the surrender value is paid after the completion of the third policy anniversary. 4. Death Benefits: • Below 5 years: If the death of the life insured take place before 5 years, only the fund value shall be payable to the policy owner. • Between 5 to 60 years: Higher of the fund value or the sum assured less all applicable partial withdrawals made in the last 24 months preceding the death of the life insured. 31

- 32. Birla Sun Life Insurance • 60 years and Above: Higher of the fund value or the sum assured less all applicable partial withdrawals made since the life insured attained the age of 58. 5. Maturity Benefits: On maturity of the policy, the fund value is payable. Under the whole life option, on maturity of the policy, when the life insured attains the age of 100, then fund value is payable and the policy will be terminated. 6. Tax Benefits: Tax benefits on premium payment are governed by section 80C of the Income Tax Act 1961. Tax Exemptions on the amount received on maturity in the unfortunate event of death and the withdrawals are governed by section 10(10D). 7. Addition of Riders: Policy holder can customize the plan by adding any of the following 6 riders: 1. Accidental Death & Dismemberment Rider 2. Term Rider 3. Critical Illness Rider 4. Critical Illness Plus Rider 5. Critical Illness Women Rider 6. Waiver of Premium Rider Charges: 1. Premium Allocation Charges: These charges during the premium paying term are as under: Policy Year 1 2 or 3 Thereafter 32

- 33. Birla Sun Life Insurance Charge 13% 4% 2% This charge on Top-up and underwriting extra is 2%. 2. Mortality Charge: This charge will be deducted by cancellation of units on a monthly basis at the prevailing NAV. The Annual Mortality charge per 1000 of the Sum at risk for sample ages are as follows: Age 25 35 45 55 65 Female 1.023 1.162 2.385 6.441 15.92 Male 1.083 1.363 3.110 8.571 21.06 3. Fund Management Charge: This is charged by adjustment of the daily NAVs. The charge is: • 1% p.a. for Assure, Protector, Builder and Enhancer Fund. • 1.25% p.a. for Creator, Magnifier and Maximiser Fund. 4. Policy administration Charge: The charge is deducted by canceling units on a monthly basis at the prevailing NAV. The annual charge differs according to the Life Insurance Coverage Sum Assured and Life Insurance Coverage Paying Period. The maximum charge is 6.10 and the minimum charge is 0.00 33

- 34. Birla Sun Life Insurance 5. Surrender Charge: These charges are levied as the percentage of the annual life insurance coverage Premium payable. Charges are as follows: Policy Year 1 2 3 4 5 6 7+ Surrender 30 20 15 10 8 6 NIL Charge % % % % % % 6. Rider Premium Charge: If the riders are attached, this charge will be realized by cancellation of units on a monthly basis based on the equivalent monthly rider coverage premium payable, when rider coverage payment period equals the rider coverage benefit period. Gold Plus II Plan The plan gives much more than a good insurance cover, an opportunity to grow investment for the medium term. It is worth more than Gold. Features: • It is a Unit Linked, Non-Participating, Insurance plan. 34

- 35. Birla Sun Life Insurance • Duration of plan is 8 years. • Premium paying term of 3 years with the flexibility to reduce premium up to Rs. 10000 from the second policy year. • Plan also has Top-up facility. • Liquidity in the form of Partial Withdrawals and Surrender Benefits. • Plan has 7 fund options. • Free unlimited fund switching and premium redirection Eligibility: • Entry Age: 18 to 70 years. • Minimum Premium: Rs.50000 • Minimum sum Assured: 5 x Annual Premium Premium Investment: Premium collected is allocated in varying proportions in seven investment fund options. Policyholder can switch between the fund options anytime during the tenure of the policy. The seven Investment Funds available are: 1. Assure 2. Protector 3. Builder 4. Enhancer 5. Creator 6. Magnifier 7. Maximiser 35

- 36. Birla Sun Life Insurance Benefits: 1. Maturity Benefits: On maturity fund value will be paid to the policyholder. 2. Death Benefits: In the Unfortunate event of the Death of the Life Insured prior to the maturity date of the policy, the nominee gets the greater of (a) Fund Value (b) Sum Assured reduced for partial withdrawal as follows: • Before the life insured attains the age of 60, the sum assured payable on death is reduced by partial withdrawals made in the preceeding years. • Once the Life Insured attains the age of 60, the Sum Assured payable on death is reduced by all partial withdrawals made from age 58 onwards. 3. Tax Benefits: Policyholder is eligible for tax benefits U/S 80C and U/S 10(10D) of the Income Tax Act 1961. • U/S 80C- Premium up to Rs.100000 is allowed as deduction from taxable income each year. • U/S 10(10D) - The Benefits received under plan are exempted from tax. 36

- 37. Birla Sun Life Insurance Charges: 1. Premium Allocation Charges: It is deducted from premium when received and before allocation of units. Policy Policy Years Charges 1 2 3 4+ On Policy Premium 8% 4% 4% On top-up Premium 2% 2% 2% 2% 2. Fund Management Charges: Fund Management charge not exceeding 1.5% per annum of the fund value will be charged by adjustments of the daily unit price. The charge is • 1% p.a.- Assure, Protector, Builder and Enhancer • 1.25% p.a. – Creator, Magnifier and Maximiser 3. Policy Administration Charges: These charges are recovered by canceling units on a monthly basis proportionately from each investment fund. The annual Rate per 1000 of Sum Assured is: Policy Policy Years Charges 1 2 3 4+ Policy 19.4 19.4 19.4 14.4 37

- 38. Birla Sun Life Insurance Administration Charge * * An additional 5 per 1000 will be charged in the first 3 policy years only on any excess Sum Assured over Rs. 50000 4. Mortality Charges: These charges are deducted on a monthly basis. These charges are taken by canceling units proportionately from each of the investment funds at that time. The annual rate per 1000 of Sum Assured less fund value for sample ages are: Age 25 35 45 55 65 Female 1.023 1.162 2.385 6.441 15.92 Male 1.083 1.363 3.110 8.571 21.06 5. Surrender Charges: These charges are applied when the policyholder surrender their policy in the first 3 policy years. The surrender charge as a percentage of the annual policy premium chosen at issue is Policy Policy Years Charges 1 2 3 4+ 38

- 39. Birla Sun Life Insurance Surrender 15% 12.5% 10% nil Charges Supreme Life Plan Features: • The plan is a Unit Linked Insurance Plan. • It provides the nominee with an increased sum assured and builds savings faster. • The plan offers more protection of money at supremely low cost. • Provides with Supreme Accidental TPD (Total Permanent Disability). • Policyholder gets freedom to choose premium amount as low as Rs.25000 • The plan provides with 6 Investment Fund Options. • The plan is flexible as it provides the policyholder with Top-Up Premium facility to ensure faster growth in the Fund Value. • Partial Withdrawals, are allowed, after 3 years to meet liquidity needs of the policyholder Duration: • Policy Term: 10, 15, 20, 25, 30, 35, 40 Years. • Premium Payment Term: Policyholder can choose to pay premium at short or regular intervals. Premium Investment: Premium Collected is investment in six investment fund options. These funds are: 39

- 40. Birla Sun Life Insurance 1. Assure 2. Protector 3. Builder 4. Enhancer 5. Creator 6. Magnifier Benefits: 1. Death Benefits: • Double Death Benefits i.e. Death Benefits= Sum Assured + Savings • Increasing Death benefits i.e. Death Benefit= Sum Assured + 25% every 5th year 2. Accidental TPD Benefit: • Policyholder immediately gets the original sum assured up to Rs.50 lac • Co. pays the future premiums up to age 60. 3. Switches & Redirection: • Policyholder gets flexibility to switch between the fund options. Two switches are free per annum. Charges: 1. Mortality Charges: Charges are deducted monthly by canceling units from the associated fund option. The charge is 95% 2. Policy Administration Charges: These charges are deducted monthly by canceling units from the investment fund. The annual charge is Rs. 720 on 40

- 41. Birla Sun Life Insurance the first 1000 Sum Assured in all years i.e. Rs.3.60 per 1000 Sum Assured p.a. The additional charges for years 1-5 are as follows: Term Band 1 Band 2 Band 3 10/15 4.75 4.25 4.00 20+ 3.75 3.25 3.00 3. Premium Allocation Charges: These charges are 5% for the 1st policy year and 2% for subsequent policy years. 4. Fund Management Charges: These charges are 1 – 1.25% p.a. for all associated funds. Platinum Plus Plan Features: • This plan is a Unit Linked, Non-Participating, Insurance plan. • A policy term of 10 years. • A premium paying term of 3 years. • One Innovative Investment fund, namely Platinum Plus Fund I. • Full Liquidity after three policy years to meet any cash needs. • Unique Guaranteed Maturity Unit Price representing the highest unit plus price of Platinum 41

- 42. Birla Sun Life Insurance Plus Fund I recorded on 88 reset dates starting on March 17, 2008 and ending on June 15, 2015. Eligibility: • Entry Age of Life Insured: 18 to 70 Years. • Minimum Annual Premium: Rs. 1,00,000 • Minimum Sum Assured: 5xAnnual Premium. Premium Collected is invested in the Equity & Debt Market according to the preset Asset Allocation of the Platinum Plus Fund I. Benefits: 1. Guaranteed Maturity Unit Price • Minimum of Rs. 10 on the first Reset Date • At maturity, is the highest Unit Price recorded on 88 Reset Dates 2. Maturity Benefits • Number of units multiplied by higher of Guaranteed Maturity Unit Price or prevailing Unit Price at maturity 3. Surrender Benefits • Full liquidity after 3 policy years –100% Fund Value* 4. Death Benefits • Higher of Fund Value (as per the then prevailing unit price) or Sum Assured (less applicable partial withdrawals) 5. Tax Benefits 42

- 43. Birla Sun Life Insurance • U/S 80C- Premium up to Rs.100000 is allowed as deduction from taxable income each year. • U/S 10(10D) - Benefits from the plan are exempted from tax. Charges: 1. Premium Allocation Charges: 10% of premium in the first year and 4% of premium in subsequent years. 2. Fund Management Charges: 1.00%-1.50% p.a. for Assure & 1.50%-2.00% p.a. for Platinum Plus Fund I. 3. Policy Administration Charges: These charges are deducted monthly by canceling units from the investment fund Assure first and then, from Platinum Plus I, if required. The annual charge is Rs. 720 on the first 1000 Sum Assured in all years plus Rs.6 per 1000 Sum Assured in years 1 to 3 only. 4. Mortality Charges: Charges are deducted monthly by canceling units from the associated investment funds. The Annual Charges for sample ages are as follows: Attained 25 35 45 55 65 Age 43

- 44. Birla Sun Life Insurance 1.02 1.16 2.38 6.44 Female 15.920 3 2 5 1 1.08 1.36 3.11 8.57 Male 21.060 3 3 0 1 5. Surrender Charges: This charge, as a percentage of the annual premium at issue, is 16%, 13% and 10% for policy year 1, 2 and 3 respectively. 6. Revival Charge: The charge for policy revival is Rs. 100-1000 per revival FUNDS BY BSLI Birla Sun Life Insurance, a leading Life Insurance company, offers its clients with a long range of Funds. These funds are designed to cater to a variety of needs of people who are from different life stages. BSLI offers a broad range of 12 funds, each having differing asset allocations. 12 funds offered are: 1. Individual Protector 2. Individual Assure 3. Individual Balancer 44

- 45. Birla Sun Life Insurance 4. Individual Builder 5. Individual Creator 6. Individual Enhancer 7. Individual Life Maximiser 8. Individual Magnifier 9. Individual Multiplier 10. Pension Nourish 11. Pension Enrich 12. Pension Growth A new fund named Platinum Plus Fund I is also added in this list of funds. Asset Allocation is decided by the Fund Managers of the company. These fund managers continuously tracks the movements of volatile market and combine this volatility with the fund requirements of the policyholders. Accordingly he decides allocation of assets in 5 major investment options: Government Securities Corporate Debt Securitized Debt Equity Money Market Instruments Proportion of allocating the fund in these options, vary according to the needs and fund requirements of policyholders. The most important thing to be noticed here is that this portfolio is decided, based on the regulations of IRDA. Performances of these funds are rated by the rating agency-CRISIL. 45

- 46. Birla Sun Life Insurance All the 12 funds by BSLI are described below along with their respective Asset Allocations. Individual Assure Objective: The primary objective of this fund is to provide Capital Protection, at a high level of safety and liquidity through judicious investments in high quality short-term debt. Strategy: Generate better return with low level of risk through investment into fixed interest securities having short-term maturity profile. Asset Allocation: SECURITIES HOLDING Corporate Debt 59.57% Money Market Instruments 17.97% TOTAL 100.00% 46

- 47. Birla Sun Life Insurance HOLDING 59.57% Corporate Debt Money Market Instruments 100.00% TOTAL 17.97% Individual Balancer Objective: The objective of this fund is to achieve value creation of the policyholder at an average risk level over medium to long-term period. Strategy: The strategy is to invest predominantly in debt securities with an additional exposure to equity, maintaining medium term duration profile of the portfolio. Asset Allocation: SECURITIES HOLDINGS Government Securities 10.67% Corporate Debt 39.04% Equity 23.44% Money Market Instruments 26.85% 47

- 48. Birla Sun Life Insurance TOTAL 100.00% HOLDINGS 10.67% 26.85% Government Securities Corporate Debt Equity 39.04% Money Market Instruments 23.44% Pension Growth Objective: This fund option is designed to build the capital and to generate better returns at moderate level of risk, over a medium or long-term period through a balance of investment in equity and debt. Strategy: Generate better return with moderate level of risk through active management of fixed income portfolio and focus on creating long term equity portfolio which will enhance yield of composite portfolio with low level of risk appetite. Asset Allocation: SECURITIES HOLDINGS 48

- 49. Birla Sun Life Insurance Government Securities 13.90% Corporate Debt 45.41% Equity 18.63% Money Market Instruments 22.06% TOTAL 100.00% HOLDINGS 22.06% 13.90% Government Securities Corporate Debt Equity 18.63% Money Market Instruments 45.41% Pension Enrich Objective: Helps to grow the capital through enhanced returns over a medium to long-term period through investments in equity and debt instruments, thereby providing a good balance between risk and return. Strategy: To earn capital appreciation by maintaining diversified equity portfolio and seek to earn regular return on fixed income portfolio by active management resulting in wealth creation for policyholders. Asset Allocation: 49

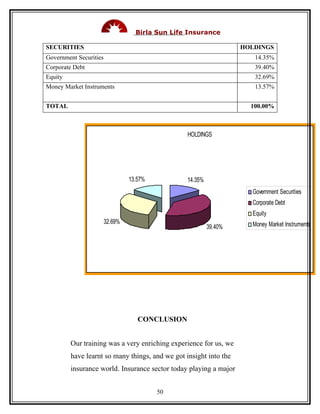

- 50. Birla Sun Life Insurance SECURITIES HOLDINGS Government Securities 14.35% Corporate Debt 39.40% Equity 32.69% Money Market Instruments 13.57% TOTAL 100.00% HOLDINGS 13.57% 14.35% Government Securities Corporate Debt Equity 32.69% Money Market Instruments 39.40% CONCLUSION Our training was a very enriching experience for us, we have learnt so many things, and we got insight into the insurance world. Insurance sector today playing a major 50

- 51. Birla Sun Life Insurance role in everyone’s life lot more than ever before life currently there is a comprehensive range of products covering each type of policy available in the market. We have studied various insurance plans covered under BSLI, and their features. BSLI also gives various Riders, which provides extra benefits to the customers. And we came to know about the pioneering features of BSLI, like sales procedure, SIP, etc. While most insurance plans block money for certain period of time, a BSLI plan gives the double benefit of life insurance along with easy liquidity through lump sum cash. Birla Sun Life Insurance (BSLI), one of the largest private life insurers, is gearing itself to take advantage of the vast rural opportunity that has opened up as a result of the revised definition of rural areas by the IRDA. Over the last four years, BSLI has painstakingly built its rural infrastructure to create a cost-effective distribution network across the country. Our training gave us corporate exposure, and helped in improving our communication skills. We learnt to deal with customers, we made them aware about various plans, and their respective features, even helped them to select the best plan as per their requirements. 51

- 52. Birla Sun Life Insurance RECOMMENDATIONS 1. Competition from public sector and foreign banks remains a key challenge for private sector banks. They need to reorient their staff and effectively utilize technology platforms to retain customers. 2. They have to update their portfolio timely. 3. Birla Sun Life Insurance Ltd should have proper division of departments under heads. 4. Birla Sun Life Insurance Ltd should have more pension plans. 5. Birla Sun Life Insurance Ltd should have more children plans, and more help line plans 6. They should provide more information to the customer so that they become more aware about insurance BIBLIOGRAPHY 1. www.birlasunlife.com Dated 13/6/08 Time 3:30 2. www.Paisawaisa.com/LifeInsurance Dated 13/6/08 Time 4:00 3. Company brochure 4. Company brochure/ GOLD- PLUSII PLAN/ Ver 01/12/07 52

- 53. Birla Sun Life Insurance 5. Company brochure/ Classic Life Premier/ Ver 8/9/07 53

- 54. Birla Sun Life Insurance ANNEXURE 1. Do you make investments? A.Yes B.No 2. How much you earn annually? A. Below 50,000 B. 50,000-100,000 C.100, 000-1, 50,000 D. Above 150000 3. Do you know about insurance? A. Yes B. No 4. Do you know about BSLI? A. Yes B.No 54

- 55. Birla Sun Life Insurance 5. How did you came to know about it? A Newspapers B. Online C. Personal Reference D. Other 6. What assets do you own? A. Personal house B.Car C.Credit card 7. Where would you like to invest? A. Mutual Fund B.Stocks C.Real estate D.Insurance 55

- 56. Birla Sun Life Insurance 8. What would u like to insure? A. Vehicle B.Life insurance 9. Which insurance plan of BSLI are you interested in? A.Saral Jeevan B.Gold Plus II C.Platinum Plus D.Classic Life Premier 10. How do you rate our plans? A. Average B. Good 56

- 57. Birla Sun Life Insurance C. Excellent 57

- 58. Birla Sun Life Insurance 58

- 59. Birla Sun Life Insurance 59

- 60. Birla Sun Life Insurance 60

- 61. Birla Sun Life Insurance 61

- 62. Birla Sun Life Insurance 62

- 63. Birla Sun Life Insurance 63

- 64. Birla Sun Life Insurance 64