BMO Capital Markets 25th Annual Global Metals & Mining Conference

- 2. Forward Looking Information Both these slides and the accompanying oral presentations contain certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario). Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Teck to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements include statements relating to the long-life our assets and estimated resource life, estimated profit and estimated EBITDA, our expectation regarding market supply and demand in the commodities we produce, the effect of US dollar oil price changes on our Canadian dollar cost savings, our goal to maintain the core of our business at least free cash flow neutral, our expectation that we will end 2016 with at least $500 million in cash, the availability of options to strengthen our liquidity and our ability to take advantage of any of those options, the expectation that Fort Hills will generate cash flow in 2018, 2016 production and cost guidance, 2016 capital expenditure guidance including our expectation that capitalized stripping costs will be reduced by $120 million, our statements regarding the Fort Hills capital expenditures and our ability to fund those, our statements regarding our liquidity, 2016 total spending reduction expectations, capital and operating cost savings, our level of liquidity, statements regarding our credit rating, the availability of or credit facilities and other sources of liquidity, forecast 2016 steelmaking coal cash costs, statements regarding our coal growth potential, the potential benefits of LNG use in haul trucks, all projections for Project Corridor and statements made on the “Corridor Project Summary” slide, statements regarding the production and economic expectations for the Fort Hills project, including but not limited to operating and sustaining cost projections, sustaining capital projection, free cash flow projections, netback assumptions and calculations, operating margin, Alberta oil royalty, net margin, Teck’s share of go-forward capex, mine life, capital cost projections, transportation capacity and our ability to secure transport for our Fort Hills production, and management’s expectations with respect to production, demand and outlook in the markets for coal, copper, zinc and energy. These forward-looking statements involve numerous assumptions, risks and uncertainties and actual results may vary materially, which are described in Teck’s public filings available on SEDAR (www.sedar.com) and EDGAR (www.sec.gov). In addition, the forward-looking statements in these slides and accompanying oral presentation are also based on assumptions, including, but not limited to, regarding general business and economic conditions, the supply and demand for, deliveries of, and the level and volatility of prices of, zinc, copper and coal and other primary metals and minerals as well as oil, and related products, the timing of the receipt of regulatory and governmental approvals for our development projects and other operations, our costs of production and production and productivity levels, as well as those of our competitors, power prices, continuing availability of water and power resources for our operations, market competition, the accuracy of our reserve estimates (including with respect to size, grade and recoverability) and the geological, operational and price assumptions on which these are based, conditions in financial markets, the future financial performance of the company, our ability to attract and retain skilled staff, our ability to procure equipment and operating supplies, positive results from the studies on our expansion projects, our coal and other product inventories, our ability to secure adequate transportation for our products, our ability to obtain permits for our operations and expansions, our ongoing relations with our employees and business partners and joint venturers. Management’s expectations of mine life are based on the current planned production rates and assume that all resources described in this presentation are developed. Certain forward-looking statements are based on assumptions regarding the price for Fort Hills product and the expenses for the project, as disclosed in the slides. Our estimated profit and EBITDA statements are based on budgeted commodity prices and a 1.40 CAD/USD exchange rate. Our estimated year-end cash balance assumes current commodity prices and exchange rates, our 2016 guidance for production, costs and capital expenditures, existing US$ debt levels and no unusual transactions. Cost statements are based on assumptions noted in the relevant slide. Assumptions regarding liquidity are based on the assumption that Teck’s current credit facilities remain fully available. Assumptions regarding Fort Hills also include the assumption that project development and funding proceed as planned, as well as assumptions noted on the relevant slides discussing Fort Hills. Assumptions regarding our potential reserve and resource life assume that all resources are upgraded to reserves and that all reserves and resources could be mined. The foregoing list of assumptions is not exhaustive. Assumptions regarding the Corridor project include that the project is built and operated in accordance with the conceptual preliminary design from a preliminary economic assessment. 2

- 3. Forward Looking Information Factors that may cause actual results to vary materially include, but are not limited to, changes in commodity and power prices, changes in market demand for our products, changes in interest and currency exchange rates, acts of foreign governments and the outcome of legal proceedings, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, adverse weather conditions and unanticipated events related to health, safety and environmental matters), union labour disputes, political risk, social unrest, failure of customers or counterparties to perform their contractual obligations, changes in our credit ratings, unanticipated increases in costs to construct our development projects, difficulty in obtaining permits, inability to address concerns regarding permits of environmental impact assessments, and changes or further deterioration in general economic conditions. We will not achieve the maximum mine lives of our projects, or be able to mine all reserves at our projects, if we do not obtain relevant permits for our operations. Our Fort Hills project is not controlled by us and construction and production schedules may be adjusted by our partners. The Corridor project is jointly owned. The effect of the price of oil on operating costs will be affected by the exchange rate between Canadian and U.S. dollars. Statements concerning future production costs or volumes are based on numerous assumptions of management regarding operating matters and on assumptions that demand for products develops as anticipated, that customers and other counterparties perform their contractual obligations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labour disturbances, interruption in transportation or utilities, adverse weather conditions, and that there are no material unanticipated variations in the cost of energy or supplies. We assume no obligation to update forward-looking statements except as required under securities laws. Further information concerning assumptions, risks and uncertainties associated with these forward-looking statements and our business can be found in our most recent Annual Information Form, as well as subsequent filings of our management’s discussion and analysis of quarterly results, all filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov). 3

- 4. Agenda Teck Overview & Strategy Commodity Market Observations Teck Update 4

- 5. • Based in Vancouver, Canada, with operations in the Americas • Strategy focused on long life assets in stable jurisdictions • Sustainability: Key to managing risks and developing opportunities Strong Resource Position1 With Sustainable Long-Life Assets Coal Resources ~100 years Copper Resources ~30 years Zinc Resources ~15 years Energy Resources ~50 years Attractive Portfolio of Long-Life Assets 1. Reserve and resource life estimates refer to the mine life of the longest lived resource in the relevant commodity assuming production at planned rates and in some cases development of as yet undeveloped projects. See the reserve and resource disclosure in our most recent Annual Information Form, available on SEDAR and EDGAR, for additional detail regarding underlying assumptions. 5

- 6. Long-Term Strategy Diversification to expand opportunity set Long life assets Low half of the cost curve Appropriate scale Low risk jurisdictions 6

- 7. Teck has good leverage to stronger zinc and copper markets, and benefits from the weaker Canadian dollar The Value of Our Diversified Business Model Cash Operating Profit 2015 Production Guidance1 Unit of Change Estimated Profit 2 Estimated EBITDA2 $C/$US C$0.01 $22M /$.01∆ $34M /$.01∆ Coal 25.5 Mt US$1/tonne $23M /$1∆ $35M /$1∆ Copper 312 kt US$0.01/lb $6M /$.01∆ $9M /$.01∆ Zinc 940 kt US$0.01/lb $9M /$.01∆ $14M /$.01∆ 2016 Leverage to Commodities & FX 1. Based on mid-point of 2016 guidance ranges. Zinc includes 645 kt of zinc in concentrate and 295 kt of refined zinc. 2. Based on budgeted commodity prices and a 1.40 CAD/USD exchange rate. The effect on our profit and EBITDA will vary with commodity price and exchange rate movements, and sales volumes. Coal ~30% Copper 35% Zinc 35% Base Metals ~70% 7

- 8. Agenda Teck Overview & Strategy Commodity Market Observations Teck Update 8

- 9. Commodity Market Observations • Current cycle longest and deepest for decades • Coal market curtailments reaching point where global demand growth is a factor • ~Two years for oil market to correct prior to Fort Hills production ramp-up • Industry costs declining, but still higher than appreciated • Zinc market poised for change 9

- 10. Commodity Market Observations • Current cycle longest and deepest for decades 10

- 11. • Up cycles in green and down cycles in orange; plotted against duration in years on the right scale • Peak-to-trough price moves during the cycle in blue; plotted against the left axis • Up cycles tend to be longer, with higher percentage gains Copper Price Cycles – Current Cycle Deepest since 1920’s Years PeaktoTroughCycle%Change 72% -37% 132% -57% 45% -68% 284% -13% 115% -37% 121% -12% 50% -15% 54% -35% 98% -30% 51% -45% 333% -26% 68% 49% 6 4 6 4 8 3 16 1 7 2 12 2 2 4 2 6 3 4 2 4 8 2 2 5 0 5 10 15 20 25 30 35 40 -500.0% -400.0% -300.0% -200.0% -100.0% 0.0% 100.0% 200.0% 300.0% 400.0% Source: Wood Mackenzie, USGS, WBMS, Teck11

- 12. Commodity Market Observations • Current cycle longest and deepest for decades • Coal market curtailments reaching point where global demand growth is a factor 12

- 13. Steelmaking Coal Will Slowly Rebalance • Excess supply continues to pressure prices & margins • US exports declining but still >1.5 times above historical average levels • Reduced imports into China, although some evidence of destocking • Stronger fundamentals ex-China Tighter Market ex-ChinaUS Steelmaking Coal Exports (ex. Canada) -25 -20 -15 -10 -5 0 5 10 China EU Latin America India JKT Seabornemet.coalimportschange, 2019vs.2015,Mt Decline in China offset by growth in other Asian countries and Latin America 38 Mt 0 10 20 30 40 50 60 70 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Mt 2000-2009 average at 23Mt 2010-2014 average at 55Mt Source: GTIS, CRU13

- 14. Commodity Market Observations • Current cycle longest and deepest for decades • Coal market curtailments reaching point where global demand growth is a factor • Industry costs declining, but still higher than appreciated 14

- 15. 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 0 10 20 30 40 50 60 70 80 90 100 $/tonne Cumulative Production % 2013 Cash Costs 2013 Total Costs 2014 Cash Costs 2014 Total Costs Copper Costs Higher Than Understood GFMS Net Cash and Total Cost Curves 2013 Price 2014 Price 2015 Price Current Price (2/10/2016) Source: GFMS, Thomson Reuters15

- 16. Commodity Market Observations • Current cycle longest and deepest for decades • Coal market curtailments reaching point where global demand growth is a factor • ~Two years for oil market to correct prior to Fort Hills production ramp-up • Industry costs declining, but still higher than appreciated 16

- 17. Global Oil Market to Rebalance World Production & Consumption Balance Source: Consensus Economics, February 201617

- 18. Commodity Market Observations • Current cycle longest and deepest for decades • Coal market curtailments reaching point where global demand growth is a factor • ~Two years for oil market to correct prior to Fort Hills production ramp-up • Industry costs declining, but still higher than appreciated • Zinc market poised for change 18

- 19. $0 $100 $200 $300 $400 $500 $600 Spot Annual Spot TCs vs. Realized Annual TCs LME Zinc Stocks – Since Dec 2012 Zinc Market Changing Rapidly • Supply situation tightening in concentrates • Growth in zinc demand expected to outpace negative supply growth • Demand growth still positive, but weaker growth has slowed inventory drawdown • Terminal Market Stocks continue to decline, market tightness should draw out hidden stocks 400 500 600 700 800 900 1,000 1,100 1,200 50¢ 60¢ 70¢ 80¢ 90¢ 100¢ 110¢ 120¢ Stocks Price US¢/lb thousandtonnes plotted to Feb. 12, 2015 US$/dmt plotted to January 2016 Source: Teck, CRU19

- 20. Agenda Teck Overview & Strategy Commodity Market Observations Teck Update 20

- 21. Plan to Navigate an Extended Low Price Environment & Emerge Stronger • Continuing to deliver excellent operating execution − Reduced our cash unit costs at all operations in 20151 − All major operating mines cash flow positive after sustaining capex2 • Finish building Fort Hills − >50% complete; on schedule and on budget • Protecting our strong financial position − Evaluating options to further strengthen liquidity • Staying true to our core values − Recognized once again for sustainability 1. Compared with 2014. 2. In the fourth quarter and full year 2015. Major operating mines exclude Quebrada Blanca and Pend Oreille. 21

- 22. Guidance Results Steelmaking Coal Production1 25-26 Mt 25.3 Mt Site costs C$49-53/t C$45/t Transportation costs C$37-40/t C$36/t Combined costs2 C$86-93 /t C$83/t US$64/t Lower unit costs at all mines Copper Production 340-360 kt 358 kt Record mill throughput at Antamina Cash unit costs3 US$1.45-1.55 /lb US$1.45/lb Lower unit costs at all mines Zinc Metal in concentrate production4 635-665 kt 658 kt Refined production 280–290 kt 307 kt Record production at Trail Capital Expenditures5 $2.3B $2.2B Lower capex Solid Delivery Against 2015 Guidance 1. Reflects mid-year revision for temporary shutdowns. 2. Combined coal costs are site costs, inventory adjustments and transportation costs. 3. Net of by-product credits. 4. Including co-product zinc production from our copper business unit. 5. Including capitalized stripping. 22

- 23. 46 35 3 1 15 12 35 28 2014 20152014 2015 Significant Unit Cost Reductions Unit costs reduced at all of our operations1 1. In 2015 as compared with 2014. 2. Steelmaking coal unit cost of sales include site costs, inventory adjustments and transport costs. Total cash costs are unit cost of sales plus capitalized stripping. 3. Copper C1 unit costs are net of by-product margins. Total cash costs are C1 unit costs plus capitalized stripping. 23% Total Cash Costs (US$/tonne)2 76 99 Site Transport Inventory Total Cash Costs (US$/lb)3 xx% 14% Copper3 C1 Unit Costs down US$0.20/lb Total Cash Costs down US$0.27/lb Total Capitalized Stripping Site Total Capitalized Stripping 1.66 1.93 2014 2015 24% Unit Cost of Sales (US$/tonne)2 64 84 C1 Unit Costs (US$/lb)3 xx% 12% 1.45 1.65 Steelmaking Coal2 Unit Cost of Sales down US$20/t Total Cash Costs down US$23/t 1.65 1.45 0.28 0.21 2014 2015 23

- 24. Core Business Free Cash Flow vs. Development Project Cash Flow Cost management delivering improvements in Free Cash Flow2, despite weakening prices Target to be at least cash flow neutral Fort Hills capital expenditures are fully funded1 Development Project Core Business Potential future free cash flow Teck’s total share of capital $2.94B Remaining capital (as of February 10th, 2016) $1.2B Teck cash balance ~$1.8B (100) - 100 200 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 C$Millions Free Cash Flow, Before Fort Hills Capex 1. As of February 10, 2016. Based on Suncor’s planned project spending. Sanction capital is the go-forward amount from the date of the Fort Hills sanction decision (October 30, 2013), denominated in Canadian dollars and on a fully-escalated basis. 2. Free Cash Flow is Net Cash from Operations, before changes in Working Capital, less Investing activity excluding Fort Hills capital expenditures, not including proceeds from sales of investments, less interest paid and distributions to minority interests. 24

- 25. $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 $3,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 US$M 25 1. As at February 10, 2016. 2. Assumes current commodity prices and exchange rates ,Teck’s 2016 guidance for production, costs and capital expenditures., existing US$ debt levels and no unusual transactions. Strong Financial Position • Cash balance of ~$1.8B1 − Includes ~$1B in cash generated via two precious metal streaming agreements − Repaid US$300M of notes in Q4 2015 • No debt due until 2017 2017 Q1: US$300M Q3: US$300M Expect to achieve year-end cash balance of >$500M2

- 26. Options to Strengthen Liquidity • Further cost & capital reductions • Additional precious metal streaming transactions • Asset value realization opportunities − Infrastructure assets − Non-operating assets • Minority interests in assets • Royalties on future cash flows 26

- 27. Near-Term Priorities • Keeping operations cash flow positive • Funding Fort Hills from internal sources • Maintaining a strong financial position − Target for US$3B credit facility to remain undrawn in 2016 − Expect year-end cash balance of >$500M1 • Evaluating opportunities to further strengthen liquidity 27 1. Assumes current commodity prices and exchange rates, Teck’s 2016 guidance for production, costs and capital expenditures., existing US$ debt levels and no unusual transactions.

- 28. Plan to Navigate an Extended Low Price Environment & Emerge Stronger Attractive portfolio of long-life assets & resources Good leverage to base metals markets Fort Hills capital fully funded Target for core business to remain at least free cash flow neutral Solid liquidity & opportunities to strengthen further 28

- 30. • In 2011, we launched our formal sustainability strategy • Organized around 6 focus areas representing our most material sustainability challenges and opportunities • Set short-term (2015) and long-term (2030) goals and vision for each area • On track to achieve all of our 2015 goals Our Sustainability Strategy 30

- 31. Received the PDAC 2014 Environmental and Social Responsibility Award Best 50 Corporate Citizens in Canada 2015 On the Dow Jones Sustainability World Index six years in a row One of top 100 most sustainable companies in the world and one of Canada’s most sustainable companies Top 50 Socially Responsible Corporations in Canada Received the Globe Foundation Environment Award in 2014 31 External Recognition

- 32. Diversified Portfolio of Key Commodities North America ~23% Europe ~15% Latin America ~2% China ~20% Asia excl. China ~40% 32 Diversified Global Customer Base Coking coal CopperZinc LeadMoly SilverGermanium Indium Source: Teck; 2015 revenue

- 33. 2015 Results 2016 Guidance Steelmaking Coal Production 25.3 Mt 25-26 Mt Site costs $45/t $45-49/t Capitalized stripping $16/t $11/t1 Transportation costs $36/t $35-37/t Total cash costs2 $99/t US$76/t $91-97/t US$65-69/t Copper Production 358 kt 305-320 kt C1 unit costs3 US$1.45/lb US$1.50-1.60/lb Capitalized stripping US$0.21/lb US$0.21/lb1 Total cash costs4 US$1.66/lb US$1.71-1.81/lb Zinc Metal in concentrate production5 658 kt 630-665 kt Refined production 307 kt 290-300 kt 2016 Production & Site Cost Guidance 1. Approximate, based on capitalized stripping guidance and mid-point of production guidance range. 2. Steelmaking coal unit cost of sales include site costs, inventory adjustments and transport costs. Total cash costs are unit cost of sales plus capitalized stripping. 3. Net of by-product credits. 4. Copper total cash costs Include cash C1 unit costs (after by-product margins) and capitalized stripping. 5. Including co-product zinc production from our copper business unit. 33

- 34. ($M) Sustaining Major Enhancement New Mine Development Sub-total Capitalized Stripping Total Coal $50 $40 $ - $90 $290 $380 Copper 120 5 80 205 190 395 Zinc 130 10 - 140 60 200 Energy 5 - 1,000 1,005 - 1,005 TOTAL $305 $55 $1,080 $1,440 $540 $1,980 Total capex of ~$1.4B, plus capitalized stripping 2015A $397 $64 $1,120 $1,581 $663 $2,244 2016 Capital Expenditures Guidance 34

- 35. Operation Expiry Dates Coal Mountain In Negotiations - December 31, 2014 Elkview In Negotiations - October 31, 2015 Fording River April 30, 2016 Highland Valley Copper September 30, 2016 Trail May 31, 2017 Cardinal River June 30, 2017 Quebrada Blanca October 30, 2017 November 30, 2017 December 31, 2017 Quintette April 30, 2018 Antamina July 31, 2018 Line Creek May 31, 2019 Carmen de Andacollo September 30, 2019 December 31, 2019 Collective Agreements 35

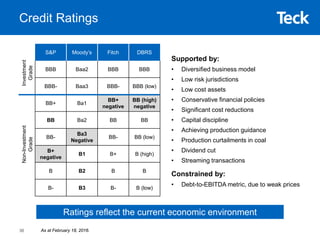

- 36. Credit Ratings S&P Moody’s Fitch DBRS BBB Baa2 BBB BBB BBB- Baa3 BBB- BBB (low) BB+ Ba1 BB+ negative BB (high) negative BB Ba2 BB BB BB- Ba3 Negative BB- BB (low) B+ negative B1 B+ B (high) B B2 B B B- B3 B- B (low) Investment Grade Non-Investment Grade Supported by: • Diversified business model • Low risk jurisdictions • Low cost assets • Conservative financial policies • Significant cost reductions • Capital discipline • Achieving production guidance • Production curtailments in coal • Dividend cut • Streaming transactions Constrained by: • Debt-to-EBITDA metric, due to weak prices Ratings reflect the current economic environment As at February 18, 2016.36

- 37. Teck Credit Ratings vs. London Metal Exchange Index Credit Ratings Reflect Commodity Prices 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Moody's S&P Fitch London Metal Exchange Index (Right Axis) BBB/Baa2 BBB-/Baa3 BB+/Ba1 BB/Ba2 BB-/Ba3 BBB+/Baa1 B+/B1 B/B2 B-/B3 A+/A1 A/A2 A-/A3 InvestmentGradeNon-InvestmentGrade 37

- 38. Substantial Credit Facilities1 Amount (M) Commitment Maturity Letters of Credit Limit ($M) Letters of Credit Drawn ($M) Total Available ($M) US$3,000 Committed July 2020 US$1,000 Undrawn US$3,000 US$1,200 Committed June 2017 None US$740 US$460 Expect to keep available for letter of credit requirements ~C$1,700 Uncommitted n/a n/a ~C$1,500 ~C$200 Total1 ~C$2,500 ~C$5,000 • Unsecured; any borrowings rank pari passu with outstanding public notes • Only financial covenant is debt to debt-plus-equity of <50%; excludes issued letters of credit • Availability not affected by commodity price changes or credit rating actions • Available for general corporate purposes 1. As of December 31, 2015. Assumes a 1.38 CAD/USD exchange rate. 2. Includes cash and US$3B credit facility. Excludes US$1.2B credit facility and uncommitted bilateral credit facilities. Ample liquidity for remaining Fort Hills capital expenditure of ~$1.2B 38

- 39. Relative Commodity Price Changes Relative Price Changes 0.00 0.20 0.40 0.60 0.80 1.00 1.20 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Zn Cu Ag Au GSCI WTI Hot Rolled Coil Plotted to Feb 2, 2016 Peak Since 2014 Since October 2015 Oil $108/bbl -71% -37% GSCI 5,185 -60% -23% Zinc $1.10/lb -33% -12% Copper $3.37/lb -39% -15% Gold $1,385/oz -19% -2% Silver $22/oz -35% -10% Steel $690/st -42% -2% Source: LME, GSCI, BEA, LBMA, Teck39

- 40. $0 $10 $20 $30 $40 $50 $60 $70 50 70 90 110 130 150 170 190 210 230 250 Bloomberg Commodity Index (Left Axis) Teck (Right Axis) Teck Stock Price vs. Bloomberg Commodity Price Index (2000-present) Commodity Prices Impact Stock Price Plotted to February 10, 2016 40

- 41. Steelmaking Coal Business Unit & Markets

- 42. • Up cycles in green and down cycles in orange; plotted against duration in years on the right scale • Peak-to-trough price moves during the cycle in blue; plotted against the left axis • Up cycles tend to be similar in duration but with higher percentage gains Source: CRU, Teck Steelmaking Coal Price Cycles - Current Cycle Long and Deep -2% 1% -26% 13% -12% 19% -25% 17% -0.1% 146% -13% 144% -31% 68% -72% 1 1 2 2 4 3 3 2 1 3 1 1 1 2 5 0 3 6 9 12 15 -250% -200% -150% -100% -50% 0% 50% 100% 150% 200% 250% PeaktoTroughCycle%Change Years 42

- 43. AUS$ Stronger US dollar favours producers outside of the US Source: Argus, Bank of Canada • >60 Mt cutbacks announced with over 55% implemented by the end of 2015 • Require additional cutbacks to achieve market balance • US coal production high end of cost curve and no currency benefit Coal Prices By Currency Argus FOB Australia CDN$ US$ Met Coal Market Slowly Rebalancing; FX Assisting Producers Outside USA plotted to February 10, 2016 70 80 90 100 110 120 130 140 150 $/tonne 43

- 44. Traditional Steel Markets • China slowing • JKT slowing • EU slowing Rest of the World • India good growth • Brazil stable • US slowing Monthly Hot Metal Production Source: WSA, based on data reported by countries monthly; NBS Mt Update to December 2015 Global Hot Metal Production JKT India Europe USA Brazil 0 3 6 9 12 15 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 45 55 65 75 China 44

- 45. Source: WSA, NBS, Wood Mackenzie, CRU 1. Europe includes 12 countries. Crude steel production to grow at 1.3% CAGR between 2015 and 2020 Ex-China seaborne demand for steelmaking coal is forecasted to increase by ~3% CAGR in the same period Crude Steel Production 2014-2020Crude Steel Production (Mt) 2015 Global 1,623 (-2.8% YoY) China 804 (-2.3% YoY) Global, ex-China 819 (-3.4% YoY) JKT 196 (-4.4% YoY) Europe 202 (-2.5% YoY) India 90 (+2.6% YoY) Crude Steel Production Continues to Grow 45

- 46. Relocation to China’s coastline facilitates access to seaborne raw materials Sources: NBS, CISA Chinese Steel Industry Moving to the Coast 46 Xinjiang Tibet Qinghai Sichuan InnerMongolia Henan Shanxi Guangxi Guangdong Fujian Zhejiang Jiangsu Shandong Liaoning Jilin Heilongjiang Guizhou Hunan Hubei Jiangxi Anhui Shaanxi Gansu Ningxia Qinghai Sichuan Yunnan Beijing Hebei WISCO Fangchenggang Project • Planned capacity: hot metal 8.5Mt, crude steel 9.2Mt, steel products 8.6Mt • Cold roll line (2.1Mt) commissioned in Jun 2015. • No timeline for BFs yet. Baosteel Zhanjiang Project • Capacity: hot metal 8.2Mt, crude steel 8.7Mt, steel products 8.2Mt, coke 3.2Mt. • BF #1 commissioned in Sep 2015 • BF #2 to be commissioned in Jun 2016 Ningde Steel Base • Proposed but no progress yet. Ansteel Bayuquan Project • Phase 1 (~ 5.4 Mt pig iron, 5.2 Mt crude steel and 5 Mt steel products) in 2013. • Phase 2 (5.4 Mt BF) planned but no progress yet. Capital Steel Caofeidian Project • Phase 1 (10 Mt) completed in 2010. • Phase 2, planned with the investment of ~ US$7 billion, kicked off in Aug 2015 and scheduled to be completed by 2018. Capacity: hot metal 8.9Mt, crude steel 9.4Mt, steel products 9.0Mt. Shandong Steel Rizhao Project • Capacity: hot metal 8.1 Mt (2 BFs), crude steel 8.5Mt, steel products 7.9Mt. • BF #1 started construction in Sep 2015. 50% 52% 54% 56% 58% 60% 62% 64% 66% 68% 0 100 200 300 400 500 600 700 800 900 2000 2003 2006 2009 2012 2015 Non-coastal (Mt, lhs) Coastal (Mt, lhs) Coastal share (%, rhs)

- 47. We Are a Leading Steelmaking Coal Supplier To Steel Producers Worldwide North America ~5% Europe ~20%China ~20% High quality, consistency, reliability, long-term supply Asia excl. China ~50% Source: Teck, based on 2015 sales volumes. Latin America ~5% Proactively realigning sales with changing market 47

- 48. 0 50 100 150 200 250 300 350 Q12010 Q22010 Q32010 Q42010 Q12011 Q22011 Q32011 Q42011 Q12012 Q22012 Q32012 Q42012 Q12013 Q22013 Q32013 Q42013 Q12014 Q22014 Q32014 Q42014 Q12015 Q22015 Q32015 Q42015 US$/tonne Teck Realized Price (US$) Benchmark Price Discount to the benchmark price is a function of: 1. Product mix: >90% hard coking coal 2. Direction of quarterly benchmark prices and spot prices - Q1 2016 benchmark for premium products is US$81/t Historical Average Realized Prices Average Realized Price in Steelmaking Coal Average realized price discount: ~8-9% Average realized % of benchmark: 91-92% (range: 88%-96%) 96% 88% 93% 94% 92% 91% 48

- 49. 46 35 34 3 1 35 28 26 15 12 8 2014 2015 2016 Total cash costs down 31% from 2014 to 2016F2 Total Cash Costs2 49 US$/t 2014 2015 20163 Change Site $46 $35 $34 -26% Inventory Adjustments $3 $1 $0 -100% Transportation $35 $28 $26 -25% Unit Cost of Sales (IFRS) $84 $64 $60 -28% Capitalized Stripping $15 $12 $84 -45% Total Cash Costs2 $99 $76 $68 -31% Sustaining Capital $6 $2 $14 -76% All In Sustaining Costs $105 $78 $69 -34% 1. In US dollars per tonne. Assumes a Canadian dollar to US dollar exchange rate of 1.10 in 2014, 1.28 in 2015 and 1.38 in 2016. 2. Steelmaking coal unit cost of sales include site costs, inventory adjustments and transport costs. Total cash costs are unit cost of sales plus capitalized stripping. All in sustaining costs are total cash costs plus sustaining capital. 3. Based on the mid-point of guidance ranges. 4. Approximate, based on capital expenditures guidance and mid-point of production guidance ranges. IFRS Steelmaking Coal Costs1 $99 $76 IFRS IFRS $68 Site Inventory Transport Capitalized Stripping

- 50. Significant Long-Term Coal Growth Potential Potential Production Increase Scenarios Teck’s large resource base supports several options for growth: • Quintette restart (up to 4 Mtpa) fully permitted • Brownfields expansions - Elkview expansion - Fording River expansion - Greenhills expansion • Capital efficiency and operating cost improvements will be key drivers - 10 20 30 40 50 Production(Mt) FRO GHO CMO EVO LCO CRO QCO 28 Mt 40 Mt Time Conceptual Potential to grow production when market conditions are favourable 50

- 51. >75 Mt of West Coast Port Capacity Planned Teck Portion at 40 Mt • Exclusive to Teck • Recently expanded to 12.5 Mt • Planned growth to 18.5 Mt Westshore Terminals Neptune Coal Terminal Ridley Terminals West Coast Port Capacity • Current capacity: 18 Mt • Expandable to 25 Mt • Teck contracted at 3 Mt • Teck is largest customer at 19 Mt • Large stockpile area • Recently expanded to 33 Mt • Planned growth to 36 Mt • Contract expires March 2021 MillionTonnes(Nominal) Teck’s share of capacity exceeds current production plans, including Quintette 12.5 18 33 6 7 3 0 5 10 15 20 25 30 35 40 Neptune Coal Terminal Ridley Terminals Westshore Terminals Current Capacity Planned Growth 51

- 52. 0% 20% 40% 60% 80% 100% CO2 NOx Particulate SOx Diesel Natural Gas LNG for Haul Trucks Project • Pilot project underway to evaluate running Teck haul trucks on a blend of diesel and LNG - Six haul trucks at Fording River - First use of LNG as a haul truck fuel at a Canadian mine site • Has the potential to eliminate ~35,000 tonnes of CO2 emissions annually at our steelmaking coal operations, and to reduce our fuel costs by >$20M per year across our operations Comparison of Fuel Cost $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 LNG / Diesel Liter Diesel / Liter Gas Cost Liquifaction Carbon Tax Delivery Diesel PriceperLiter Comparison of Emissions %ofDieselEmissions 52

- 53. Our Market: Seaborne Hard Coking Coal2 ~200 million tonnes Global Coal Production1 7.9 billion tonnes 1. Source: International Energy Agency 2014 data. 2. Source: CRU Seaborne Steelmaking Coal2 ~290 million tonnes Export Steelmaking Coal2 ~325 million tonnes Steelmaking Coal Production2 ~1,185 million tonnes Seaborne Hard Coking Coal Market 53

- 54. • Around the world, and especially in China, blast furnaces are getting larger and increasing PCI rates • Coke requirements for stable blast furnace operation are becoming increasingly higher • Teck coals with high hot and cold strength are ideally suited to ensure stable blast furnace operation • Produce some of the highest hot strengths in the world50 60 70 80 90 100 South Africa Japan (Sorachl) Japan (Yubarl) U.S.A. Canada Other Teck HCC Australia Japan South Africa Australia (hard coking) and Canada U.S.A. Australia (soft coking) 10 20 30 40 50 60 70 80 Drum Strength Dl 30 (%) CSR Teck HCC 54 Coking Coal Strength High Quality Hard Coking Coal

- 55. Copper Business Unit & Markets

- 56. 0 200 400 600 800 1000 1200 1400 0¢ 50¢ 100¢ 150¢ 200¢ 250¢ 300¢ 350¢ 400¢ 450¢ 500¢ 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 LME Stocks Comex SHFE Price Historic Copper Metal Prices & StocksUS¢/lb thousandtonnes plotted to Feb. 12, 2016 Daily Copper Prices & Stocks Source: LME, ICSG, ILZSG56

- 57. Copper Mine Production Forecasts Continue to Decline 57 Losses in 2016 already 72% of 2015 levels 16,000 16,500 17,000 17,500 18,000 18,500 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 5% Disruption net of Projects Market Adjustment 2017 Adjusted 15,000 15,500 16,000 16,500 17,000 17,500 Feb-13 Jun-13 Oct-13 Feb-14 Jun-14 Oct-14 Feb-15 Jun-15 Oct-15 2015 Adjusted Market Adjustment 5% Disruption thousandtonnescontainedcopper 2015 2016 15,000 15,500 16,000 16,500 17,000 17,500 18,000 18,500 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14 Feb-15 Apr-15 Jun-15 Aug-15 Oct-15 Dec-15 5% Disruption & Projects Market Adjustment 2016 Adjusted 2017 thousandtonnescontainedcopper thousandtonnescontainedcopper • Down 588 kmt from 2013 net estimates • Down 1.8 million tonnes from guidance Source: Wood Mackenzie • Down 1.3 million from 2014 estimates • Projects down by 72% • Net Mine Production Growth in 2016 now only 1.1%, less than 300 kmt • Down 829 kt from April 2015 estimates • Projects down by 50% or 426 kmt 57

- 58. Copper Costs Higher than Understood Source: Bernstein Research Bernstein Estimated Margin After Sustaining Capex (5,000) (4,000) (3,000) (2,000) (1,000) - 1,000 2,000 3,000 4,000 5,000 6,000 - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Margin(US$/tonne) Cumulative Copper Production (kt) At US$2.00 Copper At US$2.40 Copper At US$2.40 6,239kt 72nd Percentile At US$2.00 4,270kt 49th Percentile 58

- 59. (300) (250) (200) (150) (100) (50) 0 Thous.Mt -950 -859 -776 -851 -945 -584 -839 -973 -831 -968 -1,015-1,200 -1,000 -800 -600 -400 -200 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD Thousandtonnes Disruptions Continue in Copper Significant Copper Concentrate Disruptions Breakdown of Disruptions including SXEW plotted to December 2015 plotted to December 2015 Source: Teck, CRU59

- 60. Ore Grade Trends Ongoing decline will put upward pressure on unit costs Source: Wood Mackenzie 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2.2 2.4 2.6 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1980 1984 1988 1992 1996 2000 2004 2008 2012 2016 2020 2024 CopperGradeCu% All Operations Primary Mines Co-By Product Mines - (RH axis) Industry Head Grade Trends (Weighted by Paid Copper) 60

- 61. 0¢ 10¢ 20¢ 30¢ 40¢ 50¢ 60¢ 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Standard Spot High Grade Spot Realised TC/RC Copper Concentrate TC/RCs Copper Concentrate TC/RC plotted to January 2016 Source: Teck, CRU61

- 62. Wood Mac Still Forecasting Demand Growth Source: Wood Mackenzie62

- 63. 0 200 400 600 800 1,000 1,200 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Cathode Concs Scrap Blister/Semis 000’stonnes(content) Net Copper Imports up 4.6% in 2015 Source: NBS Chinese Copper Imports Switch from Cathode to Concentrates Updated to December 2015 63

- 64. Significant Chinese Copper Demand Remains …But Will Add Significantly in Additional Tonnage Terms Annual Growth Rate of Chinese Copper Consumption to Slow Dramatically… China expected to add almost as much to global demand in the next 15 years as the past 25 years Source: Wood Mackenzie, Teck - 200 400 600 800 1,000 1,200 1,400 1990 1994 1998 2002 2006 2010 2014 2018 2022 2026 2030 0% 5% 10% 15% 20% 25% 30% 1990 1994 1998 2002 2006 2010 2014 2018 2022 2026 2030 Annual Avg. 11.9% Annual Avg. 2.8% Annual Avg. Growth 356 Mt/yr Annual Avg. Growth 325 Mt/yr Thousandtonnes 64

- 65. Copper Scrap Supply vs. LME Price Copper Scrap Supply Source: Wood Mackenzie Copper scrap supply is strongly correlated with price 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Copper Price (USD/lb) Scrap as a % Consumption 65

- 66. -100 0 100 200 300 400 500 600 700 800 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 0 100 200 300 400 500 600 700 800 Feb-13 Jun-13 Oct-13 Feb-14 Jun-14 Oct-14 Feb-15 Jun-15 Oct-15 Since April 2014 • Despite a 725,000 tonne drop in demand • The surplus is down 750,000 tonnes Source: Wood Mackenzie thousandtonnescontainedcopper 2015 2016 0 100 200 300 400 500 600 700 800 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14 Feb-15 Apr-15 Jun-15 Aug-15 Oct-15 Dec-15 2017 thousandtonnescontainedcopper thousandtonnescontainedcopper Global Copper Cathode Balances Wood Mackenzie’s Outlook is Trending Down Since December 2014 • Despite a drop of 660,000 tonnes to Wood Mackenzie’s demand estimates • Their surplus is down 700,000 tonnes Since April 2015 • Down from a 510,000 tonnes surplus • Despite a 510,000 tonne drop in demand 66

- 67. • At 2% global demand growth, 400 kt of new supply needed annually • We have lowered our demand forecast to below all analysts for 2016 & 2017, • We still show structural deficit starts in 2018 • Project developments slowed due to lower prices, higher capex, corporate austerity, permitting & availability of financing Forecast Copper Refined Balance Long-Term Copper Mine Production Still Needed Source: WM, CRU, ICSG, Teck (2,000) (1,500) (1,000) (500) 0 500 2012 2013 2014 2015 2016 2017 2018 2019 2020 Thousandtonnes 67

- 68. Building Partnerships: Corridor Project Teck and Goldcorp have combined Relincho and El Morro projects and formed a 50/50 joint venture company • Committed to building strong, mutually beneficial relationships with stakeholders and communities Capital smart partnership • Shared capital, common infrastructure • Shared risk, shared rewards Benefits of combining projects include: • Longer mine life • Lower cost, improved capital efficiency • Reduced environmental footprint • Enhanced community benefits • Greater returns over either standalone project 68

- 69. Corridor Project Summary Initial Capital $3.0 - $3.5 billion Copper Production1 190,000 tonnes per year Gold Production1 315,000 ounces per year Mine Life 32+ years Copper in Reserves2 16.6 billion pounds Gold in Reserves2 8.9 million ounces Note: Conceptual based on preliminary design from the PEA 1. Average production rates are based on the first full ten years of operations 2. Total copper and gold contained in mineral reserves as reported separately by Teck and Goldcorp; refer to Appendix A in Additional Information. 3. Capital estimate for Phase 1a based on preliminary design shown in 2015 dollars on an unescalated basis69

- 70. Copper Development Projects in the Americas Corridor is one of the largest open pit copper development projects in the Americas on the basis of copper contained in Proven and Probable Reserves - 5,000 10,000 15,000 20,000 25,000 Radomiro Tomic Corridor ElArco Quebrada BlancaII Quellaveco AguaRica Relincho ElMorro Casino SchaftCreek GaloreCreek RioBlanco CopperEquivalentinReserves(Mlbs) Copper-equivalent contained in Reserves (Mlbs) (North & South American Copper Projects) Note: Copper equivalent reserves calculated using $3.25/lb Cu and $1,200/oz Au. Does not include copper resource projects that are currently in construction Source: SNL Metals & Mining, Thomson One Analytics, and company disclosures. 70

- 71. Zinc Business Unit & Markets

- 72. Historic Zinc Metal Prices & Stocks Daily Zinc Prices & Stocks 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 0¢ 50¢ 100¢ 150¢ 200¢ 250¢ 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 LME SHFE Price US¢/lb thousandtonnes plotted to February 12, 2016 Source: LME, SHFE72

- 73. 0 1,000 2,000 3,000 4,000 5,000 6,000 0 100 200 300 400 500 600 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 2014 2015 Monthly Chinese Zinc Mine Production LME Zinc Stocks Zinc Mine Production Undersupplied, Even With Lower Growth 400 500 600 700 800 900 1,000 1,100 1,200 50¢ 60¢ 70¢ 80¢ 90¢ 100¢ 110¢ 120¢ Stocks Price plotted to Feb 12, 2016 plotted to December, 2015 • Metal market in deficit • LME stocks down >776 kt over 27 months; sub-500 kt recently for the first time since 2010 • ‘Off-market’ inventory position to work down also • Large periodic increases indicate significant off-market inventories flowing through the LME to consumers • Chinese zinc mine production is down in the last 27 months US¢/lb thousandtonnes Source: LME, NBS, CNIA73

- 74. • Down 770 kt from January 2015 estimates • Down 1,150 kt from January 2015 estimates Zinc Mine Production Wood Mackenzie’s Outlook is Trending Down thousandtonnescontainedzinc 2015 2016 2017 • Down 600 kt from April 2015 estimates • New project production down by 22% thousandtonnescontainedzinc thousandtonnescontainedzinc 12,000 12,500 13,000 13,500 14,000 14,500 15,000 Feb-13 May-13 Aug-13 Nov-13 Feb-14 May-14 Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 12,000 12,500 13,000 13,500 14,000 14,500 15,000 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 12,000 12,500 13,000 13,500 14,000 14,500 15,000 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Source: Wood Mackenzie74

- 75. 2014-2020 2014-2020 Significant Zinc Mine Reductions Large Short-Term Losses, More Long Term -500 -400 -300 -200 -100 0 Century Lisheen Skorpion RedDog Rosebery Bracemac-McLeod RapuraAgucha Pomorzany-Olkusz(inclBulk) Jaguar Mid-Tennessee MaeSod Endeavor 0 100 200 300 400 500 Gamsberg Antamina DugaldRiver McArthurRiver Bisha GansuJinhui Kyzyl-Tashtygskoe ShalkiyaRestart SindesarKhurd AguasTenidas Changba ZawarMines ElBrocal Sanguikou CaribouReactivation SanCristobal Penasquito Source: ICSG, Wood Mackenzie Teck, Company Reports75

- 76. LME Zinc Stocks – Since Dec 2012LME Zinc Stocks - 11 Years Zinc Inventories Declining 400 500 600 700 800 900 1,000 1,100 1,200 50¢ 60¢ 70¢ 80¢ 90¢ 100¢ 110¢ 120¢ Stocks Price 0 200 400 600 800 1,000 1,200 1,400 0¢ 50¢ 100¢ 150¢ 200¢ 250¢ 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Stocks Price US¢/lb thousandtonnes plotted to Feb. 12, 2016 US¢/lb thousandtonnes • LME stocks down ~730 kt over 24 months • Large inventory position still to work down but we were recently under 500kt for the first time since early 2010 • Large, sudden increases indicate there are also significant off-market inventories flowing through the LME to consumers plotted to Jan . 12, 2016 Source: LME76

- 77. • Down 280 kt from December 2014 estimates, taking the market from surplus into a deficit of 119 kt • Down 442 kt from December 2014 estimates, taking the market further into deficit of 666 kt thousandtonnescontainedzinc 2015 2016 2017 • Up 259 kt from April 2015 estimates • Wood Mackenzie expects 300 kt of projects will come online in 2017 due to higher prices thousandtonnescontainedzinc thousandtonnescontainedzinc (300) (200) (100) 0 100 200 300 400 Feb-13 May-13 Aug-13 Nov-13 Feb-14 May-14 Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 (800) (600) (400) (200) 0 200 400 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 (500) (400) (300) (200) (100) 0 100 200 300 400 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Zinc Concentrate Balances Wood Mackenzie’s 2015 and 2015 Outlooks Trending Down Source: Wood Mackenzie77

- 78. Zinc Metal Market Mostly in Deficit Since 2013 -1000 -800 -600 -400 -200 0 200 400 600 2013 2014 2015 2016 2017 WoodMac CRU Market View – Wood Mackenzie & CRU • Zinc metal deficit forecasted for 2016 and 2017 • Mine production increases of -2.5% and 8.0% respectively expected for 2016 and 2017. The closure of Century and Lisheen, as well as production cuts due to low zinc prices will cause mine production to decrease in 2016. In 2017, higher prices are expected to bring a large amount of Chinese mine production online and it is expected that Glencore will bring production back in 2017 • Deficits of around 500kt/year in 2016 and 2017 will still result in large draw down of stocks Zinc Metal Balance Source: Wood Mackenzie, CRU78

- 79. China 6% USA 19% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Galvanized Steel as % Crude ProductionChina Zinc Demand Construction 15% Transportation 20% Other 5% Consumer Goods 30% Infrastructure 30% Chinese Zinc Demand to Outpace Supply Source: Teck If China were to galvanize crude steel at half the rate of the US using the same rate of zinc/tonne, a further 2.1 Mt would be added to global zinc consumption 79

- 80. • Deficit decreased by 206 kt from December 2014 estimates, to 178 kt • Deficit increased by 112 kt from December 2014 estimates, to 347 kt • Increase due to production cuts, resulting in insufficient concentrate available to smelters and less refined production in 2016. thousandtonnes 2015 2016 2017 • Deficit increased by 98 kt from April 2015 estimates, to 402 kt thousandtonnes thousandtonnescontainedzinc Refined Zinc Balances Wood Mackenzie’s Outlook is Trending Down (500) (450) (400) (350) (300) (250) (200) (150) (100) (50) 0 Feb-13 May-13 Aug-13 Nov-13 Feb-14 May-14 Aug-14 Nov-14 Feb-15 May-15 Aug-15 Nov-15 (450) (400) (350) (300) (250) (200) (150) (100) (50) 0 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 (500) (450) (400) (350) (300) (250) (200) (150) (100) (50) 0 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Source: Wood Mackenzie80

- 81. Committed Supply Insufficient for Demand Forecast Zinc Refined Balance Source: Teck • We expect insufficient mine supply to constrain refined production, allowing a refined metal supply increases of only 792 kt between 2014 and 2020 • Over this same period we expect refined demand to increase 2.8 Mt tonnes • Market in deficit in 2014 and starting in 2016 will be ongoing, large inventory has funded the deficit but this will only continue in 2016. • Metal market moving into significant deficit with further mine closures and inventories are depleting(2,500) (2,000) (1,500) (1,000) (500) 0 500 2013 2014 2015 2016 2017 2018 2019 2020 Thousandtonnes 81

- 82. Energy Business Unit & Markets

- 83. Source: PIRA Scenario Planning Annual Guidebook: February 2015 0 20 40 60 80 100 120 2000 2014 2020 2025 2030 2035 2040 Millionbpd Transport Petrochemicals Other** Buildings Other Industry Power Generation PIRA Forecasted World Oil Demand By Sector (2000-2040) World Oil Demand Expected to Grow 83

- 84. North American Rig Counts Down Sharply Source: Baker Hughes, EIA, National Bank of Canada, HIS, US Department Of Energy North American Rig Count & US Production 5000 6000 7000 8000 9000 10000 300 700 1,100 1,500 1,900 1/7/11 1/7/12 1/7/13 1/7/14 1/7/15 1/7/16 Thousandbpd RigcountUnits US Rig Count CAD Rig Count US 4-week Production Avg. 84

- 85. Building An Energy Business Strategic diversification Large truck & shovel mining projects World-class resources Long-life assets Mining-friendly jurisdiction Competitive margins Minimizing execution risk Tax effective 85 Mined bitumen is in Teck’s ‘sweet spot’

- 86. • Significant value created over long term • 60% of PV of cash flows beyond year 5 • IRR of 50-year project is only ~1% higher than a 20- year project • Options for debottlenecking and expansion 50-year assets provide for superior returns operating through many price cycles The Real Value of Long-Life Assets Fort Hills Project Indicative Rolling NPV1 1. Indicative NPV assumes US$95 WTI, $1.05 Canadian/US dollar exchange rate, and costs as disclosed with the Fort Hills sanction decision (October 30, 2013). 86

- 87. Minimizing Execution Risk In The Fort Hills Project • Cost-driven schedule - “Cheaper rather than sooner” • Disciplined engineering approach • “Shovel Ready” • Global sourcing of engineering and module fabrication • Balanced manpower profileSuncor has completed 4 projects of ~$20 billion over last 5 years, all at or under budget Benefiting from Suncor’s operational and project development experience 87

- 88. • Focusing on productivity improvements - Reduced pressure on skilled labour and contractors • Benefiting from availability of fabricators for major equipment • Seeking project cost reductions - Exploring performance improvements with contractors and suppliers - Building cost savings and improved productivity expectations into current contract negotiations - Reviewing all indirect costs Lower Oil Price Environment Provides Opportunities for the Fort Hills Project “Major projects in construction such as Fort Hills…will move forward as planned and take full advantage of the current economic environment. These are long-term growth projects that are expected to provide strong returns when they come online in late 2017.” - Suncor, January 13, 2015 Enhanced ability to deliver on time and on budget 88

- 89. >95% Engineering complete approximate as at December 2015 >50% Construction complete approximate as at December 2015 Project Progress construction has surpassed the midway point and the project continues to track positively within schedule expectations Fort Hills Project Status & Progress Capital Expenditures1 continues to track positively within project sanction cost Teck’s sanction capital$2.94B Global fabrication, module and logistics program performing well to date, delivering positive results All critical schedule milestones have been achieved to date supporting target 2017 first oil Remaining capital investment as of February 10, 2016 $1.2B 1. Based on Suncor’s planned project spending. Sanction capital is the go-forward amount from the date of the Fort Hills sanction decision (October 30, 2013), denominated in Canadian dollars and on a fully-escalated basis. 89

- 90. Teck’s Sanction Capital2 ~$2.94 billion Teck’s Estimated 2016 Spend $960 million Teck’s Remaining Capital3 ~$1.2 billion Operating & Sustaining Costs3 $25-28 per barrel of bitumen Sustaining Capital3 $3-5 per barrel of bitumen Teck’s Share of Production 13,000,000 bitumen barrels per year 1. All costs and capital are based on Suncor’s estimates. 2. Sanction capital is the go-forward amount from the date of the Fort Hills sanction decision (October 30, 2013), denominated in Canadian dollars and on a fully-escalated basis. Includes earn-in of $240M. 3. As of February 10, 2016. 4. Sustaining capital is included in operating & sustaining costs. Mine life: 50 years Fort Hills By The Numbers1 90

- 91. Royalties based on pre-capital payout. * WTI/WCS Differential based on forecast from Lee & Doma Energy Consulting: 2017/2018 Fort Hills Startup, Constrained Pipe/Excess Rail **Tidewater Premium based on average premium pricing for USGC market via Keystone and Flanagan South Pipelines Source: Alberta Energy bitumen valuation methodology (http://www.energy.alberta.ca/OilSands/1542.asp) 1. Estimates are based on C$/US$ exchange rates as shown, expected bitumen netbacks, operating costs of C$25 per barrel (including sustaining capital of C$3-5 per barrel) and Phase 1 (pre-capital payout) royalties. Cash Margin1 Calculation Example: Prior to Capital Recovery Teck seeks to secure dedicated transportation capacity for Fort Hills volumes to key markets to minimize WCS discount Fort Hills Bitumen Netback Calculation Model $60 $55.50 $37 $10-$11 $13 $- $10 $20 $30 $40 $50 $60 $70 $11 $10 $15.50 $7-9 $1.25 $22 $3 $1-2 $2-3 91

- 92. Source: Shorecan, Net Energy, Lee & Doma Western Canadian Select (WCS) Average Monthly WTI-WCS Differential Western Canadian Select (WCS) Is The Benchmark Price For Canadian Heavy Oil At Hardisty, Alberta WCS differential to West Texas Intermediate (WTI) • Contract settled monthly as differential to Nymex WTI • Long term differential of Nymex WTI minus $10-20 US/bbl • Based on heavy/light differential, supply/demand, alternate feedstock accessibility, refinery outages and export capability − Narrowed in 2014/2015 due to export capacity growth, rail capacity increases, and short term production outages • Recently improved export capability to mitigate volatility − Further export capacity subject to rigorous regulatory review; potential impact to WCS differentials.Plotted to Feb. 2016Long-term WCS Differential $15.69 2010-2011 $23.12 2012-2013 $16.45 2014-2015 WTI (US/bbl) $40 $50 $60 $70 $80 $90 $100 WCS Differential to Nymex WTI (US/bbl) -$13.00 -$14.50 -$15.50 -$17.00 -$18.00 -$19.50 -$20.50 *Forecast Assumptions: Fort Hills Startup 2017/2018 with supply/demand model exiting Western Canada in a constrained pipe/excess rail transportation model, per Lee & Doma Energy Consulting. FORECAST* $- $5 $10 $15 $20 $25 $30 $35 $40 $45 WCS Differential (US$/bbl) 92

- 93. Source: Shorecan, Net Energy, Lee & Doma Diluent (C5+) Pricing Average Monthly WTI/Diluent (C5+) Differential Diluent (C5+) at Edmonton, Alberta Is the benchmark contract for diluent supply for oil sands Diluent differential to West Texas Intermediate (WTI) • Contract settled monthly as differential to Nymex WTI • Based on supply/demand, seasonal demand (high in winter, low in summer), import outages • Long-term diluent (C5+) differential of Nymex WTI +/- $5 US/bbl Diluent (“Pool” in Edmonton is a common stream of a variety of qualities • Diluent pool comprised of local and imported natural gas liquids WTI (US/bbl) $40 $50 $60 $70 $80 $90 $100 Diluent (C5+) Differential to Nymex WTI (US/bbl) +$2.50 +$1.50 +$0.50 -$0.50 -$1.50 -$2.50 -$3.50 *Forecast Assumptions: Fort Hills Startup 2017/2018, using 2015 CAPP Western Canadian oil production forecast, Diluent (C5+) differentials per Lee & Doma Energy Consulting FORECAST* $(10) $(5) $- $5 $10 $15 $20 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14 Jan-15 May-15 Sep-15 Jan-16 US$/bbl WTI/C5+ Diff Long-term C5+ Diff Plotted to Feb 2016 93

- 94. Teck Marketing Plan for 50 kbpd Diluted Bitumen Blend Cushing Flanagan Houston Kitimat Hardisty Edmonton Saint John N.E. US US Gulf Coast Europe Asia TransCanada Energy East (Europe, Asia, US Gulf Coast, N.E. US) Teck can enter long-term commitments Enbridge Northern Gateway (Asia) Keystone, Keystone XL (US Gulf Coast) Enbridge Flanagan South (US Gulf Coast) Vancouver TransMountain Pipeline (Asia) Steele City Asia Europe Asia Superior * Acquired through Fort Hills participation Sufficient export capacity in place • Includes pipeline and rail capability • No shut in risk, but price risk likely Targeting long term market access • US Gulf Coast • Deep water ports Hardisty tankage & export pipeline capacity are key Non-committed barrels sold spot at Hardisty or nominated on common carriage pipeline Diversified Market Access Strategy 94

- 95. Sufficient Transportation Capacity In Western Canada 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 kbbls/day 2015 CAPP Supply Forecast 2014 CAPP Supply Forecast Total Pipeline & Local Refining Total Pipeline, Local Refin ing & Rail Constrained Pipe& BalancedRail Constrained Pipe & Excess Rail Excess Pipe Balanced Pipe 2 New Pipelines Enbridge Expansions Western Canadian Transport Supply & Demand Assumptions • Fort Hills first oil late 2017 • Enbridge mainline capacity expansions move forward • Two export pipelines enter service • TransMountain Expansion (2019-2020) • Energy East (2021-2022) • Providing incremental capacity of 1.0-1.6 MM bbls/day Source: CAPP (Canadian Association of Petroleum Producers), Lee& Doma, Teck Sufficient pipeline & rail capacity to accommodate all production Fort Hills’ First Oil Constrained Pipe& BalancedRail 95

- 96. East Tank Farm Blending w/Condensate Bitumen & Blend Logistics Operator Nominal Capacity (kbpd) Status Northern Courier Hot Bitumen TransCanada 202 Construction: ~40% complete East Tank Farm - Blending Suncor 292 Construction: ~40% complete Wood Buffalo Blend Pipeline Enbridge 550 Operating Wood Buffalo Extension Enbridge 550 Construction: ~55% complete Hardisty Blend Tankage Gibsons 450 Construction: ~60% complete Wood Buffalo Extension Norlite Diluent Pipeline Cheecham Terminal Hardisty Terminal Wood Buffalo Pipeline Athabasca Twin PipelineWaupisoo Pipeline Edmonton Terminal Fort Hills Mine Terminal Northern Courier Hot Bitumen Pipeline Teck Options Export Pipeline Rail Local Market Pipeline Legend Bitumen Blend Diluent Existing New Kirby Terminal Diluent Logistics Operator Nominal Capacity (kbpd) Status Norlite Diluent Pipeline Enbridge 130 Construction Committed Logistics Solutions in Alberta 96