Budget 2017

- 2. Union budget was presented before Parliament By Hon’ble Finance Minister Arun Jaitely on 1st Feb, 2017 The Budget size was 21.47 Lakh Crore The Agenda was “Transform, Energize and Clean India (TCE).” TRANSFORM the quality of governance and quality of life of our people; ENERGISE various sections of society, especially the youth and the vulnerable, and enable them to unleash their true potential; CLEAN the country from the evils of corruption, black money and non-transparent political funding

- 3. Major Changes in BudgetPresentation 3 • Provides for Integrated Planning and development of Infrastructure • Undoes the Colonial Legacy & political interference in Railway plans Railways Merged with Union Budget • This allows for timely approval and allocation of resources for the Fiscal • Government Expenditures and Plans can kick start from the beginning of the financial year • Expense categorization to be under Capital & Revenue Heads • Reduces Policy complexity in implementation and monitoring Budget Announcement Date Preponed to 1st Feb Plan & Non Plan Categorization Done away with

- 4. Farmers : committed to double the income in 5 years; Rural Population : providing employment & basic infrastructure; Youth : energising them through education, skills and jobs; The Poor and the Underprivileged : strengthening the systems of social security, health care and affordable housing; Infrastructure: for efficiency, productivity and quality of life; Financial Sector : growth & stability by stronger institutions; Digital Economy : for speed, accountability and transparency; Public Service : effective governance and efficient service delivery through people’s participation; Prudent Fiscal Management: to ensure optimal deployment of resources and preserve fiscal stability; Tax Administration: honouring the honest.

- 5. GDP Growth Rate 3.90% 5.60% 6.60% 7.20% 7.60% 7.10% 6.75% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2008-09 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 GDP Growth Rate

- 6. Particulars Actual 15-16 Budget Estimate 16-17 Budget Estimate 17-18 Receipts Revenue 1257992 1444156 1600203 Total Receipts 1257992 1444156 1600203 Expenditure Capital 253022 247032 309801 Revenue 1537761 1731037 1836934 Total Expenditure 1790783 1978069 2146735 Fiscal Deficit 532791 533904 546332 Fiscal Deficit (% of GDP) 3.90% 3.50% 3.20% Rs. In Crore

- 7. 2017-18 Tax Revenue- 87.66% Non- Tax Revenue- 12.34% (Includes Non-Debt Capital and Borrowings) 19.75% 23.45% 11.11% 17.28% 12.34% 12.34% 3.73% 2017-18 Income Tax Corporation Tax Customs Union Excise Duty Service Tax and Other Taxes Non-Tax Revenue Non-Debt Capital Receipt

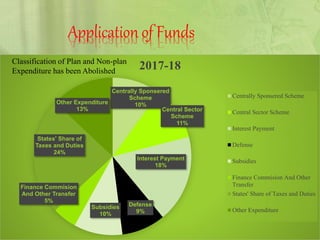

- 8. Application of Funds Centrally Sponsered Scheme 10% Central Sector Scheme 11% Interest Payment 18% Defense 9% Subsidies 10% Finance Commision And Other Transfer 5% States' Share of Taxes and Duties 24% Other Expenditure 13% 2017-18 Centrally Sponsered Scheme Central Sector Scheme Interest Payment Defense Subsidies Finance Commision And Other Transfer States' Share of Taxes and Duties Other Expenditure Classification of Plan and Non-plan Expenditure has been Abolished

- 9. 2010 2011 2012 2013 2014 2015 2016 2017 Fiscal deficit 4.18483 3.73591 5.16269 4.9019 5.02863 5.10817 5.32783 5.46532 As % of GDP 6.79% 4.87% 5.79% 4.85% 4.43% 4.04% 3.92% 3.20% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% AS%OFGDP RS.INLAKHCRORE Trajectory of Fiscal Deficit Fiscal deficit As % of GDP 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 Gross Tax Revenue6.217.898.8510.311.312.414.515.2 As % of GDP 10.010.29.9310.29.999.8110.68.87 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 0 2 4 6 8 10 12 14 16 AS%OFGDP RS.INLAKHCRORE Taxation Income Gross Tax Revenue As % of GDP 201 0 201 1 201 2 201 3 201 4 201 5 201 6 201 7 Total borrowings 4.16 3.7 4.36 4.67 4.75 4.9 4.8 3.5 4.16 3.7 4.36 4.67 4.75 4.9 4.8 3.5 0 1 2 3 4 5 6 Rs.inLakhCrore Government Borrowing Total borrowings

- 10. A sum of Rs. 10 lakh crore is allocated as credit to farmers, with 60 days interest waiver. NABARD fund will be increased to Rs. 40,000 crore. Government will set up mini labs in Krishi Vigyan Kendras for soil testing. A dedicated micro irrigation fund will be set up for NABARD with Rs 5,000 crore initial corpus. Irrigation corpus increased from Rs 20,000 crore to Rs 40,000 crore.

- 11. The government targets to bring 1 crore households out of poverty by 2019. During 2017-18, five lakh farm ponds will be taken up under the MGNREGA. Over Rs 3 lakh crore will be spent for rural India. MGNREGA to double farmers' income. Will take steps to ensure participation of women in MGNREGA up to 55%. Space technology will be used in a big way to ensure MGNREGA works. Will allocate Rs. 19,000 crore for Pradhan Mantri Gram Sadak Yojana in 2017-18. The country well on way to achieve 100% rural

- 12. Will introduce a system of measuring annual learning outcomes and come out with an innovation fund for secondary education. Focus will be on 3,479 educationally-backward blocks. Skill India mission was launched to maximise potential. Will set up 100 India International centres across the country. Courses on foreign languages will be introduced. Will take steps to create 5000 PG seats per annum.

- 13. For the poor and underprivileged health care Rs. 500 crore allocated for Mahila Shakthi Kendras. Under a nationwide scheme for pregnant women, Rs. 6000 will be transferred to each person. A sum of Rs. 1,84,632 crore allocated for women and children. Health sub centres, numbering 1.5 lakh, will be transformed into health wellness centres. Two AIIMS will be set up in Jharkhand and Gujarat. Will undertake structural transformation of the regulator framework for medical education. Allocation for Scheduled Castes is Rs. 52,393 crore

- 14. Infrastructure and railways A total allocation of Rs. 39,61,354 crore has been made for infrastructure. Total allocation for Railways is Rs. 1,31,000 crore. No service charge on tickets booked through IRCTC. Raksha coach with a corpus of Rs. 1 lakh crore for five years (for passenger safety). 3,500 km of railway lines to be commissioned this year up from 2,800 km last year. SMS-based ''clean my coach service'' is put in place. Rs. 64,000 crore allocated for highways. High speed Internet to be allocated to 1,50,000 gram panchayats.

- 15. Energy sector A strategic policy for crude reserves will be set up. Rs. 1.26,000 crore received as energy production based investments. Trade infra export scheme will be launched 2017- 18.

- 16. FDI policy reforms - more than 90% of FDI inflows are now automated. Shares of Railway PSE like IRCTC will be listed on stock exchanges. Pradhan Mantri Mudra Yojana lending target fixed at Rs 2.44 lakh crore for 2017-18. Digital India - BHIM app will unleash mobile phone revolution. The government will introduce two schemes to promote BHIM App - referral bonus for the users and cash back for the traders (promoted ).

- 17. Total expenditure is Rs. 21, 47,000 crore. Plan, non-plan expenditure to be abolished; focus will be on capital expenditure, which will be 25.4 %. Rs. 3,000 crore under the Department of Economic Affairs for implementing the Budget announcements. Expenditure for science and technology is Rs. 37,435 crore. Total resources transferred to States and Union Territories is Rs 4.11 lakh crore. Recommended 3% fiscal deficit for three years with a deviation of 0.5% of the GDP. Revenue deficit is 1.9 % Fiscal deficit of 2017-18 pegged at 3.2% of the GDP. Will remain committed to achieving 3% in the next year.

- 18. Funding of political parties The maximum amount of cash donation for a political party will be Rs. 2,000 from any one source. Political parties will be entitled to receive donations by cheque or digital mode from donors. Defence sector The defence sector gets an allocation of Rs. 2.74,114 crore(6%).

- 19. Tax proposals Out of 13.14 lakh registered companies, only 5.97 lakh firms have filed returns for 2016-17. Individuals numbering 1.95 crore showed an income between Rs. 2.5 lakh to Rs. 5 lakh. Out of 76 lakh individual assesses declaring income more than Rs. 5 lakh, 56 lakh are salaried. Only 1.72 lakh people showed income of more than Rs. 50 lakh a year. Between November 8 to December 30, deposits ranging from Rs. 2 lakh and Rs. 80 lakh were made in 1.09 crore accounts. Net tax revenue of 2013-14 was Rs. 11.38 lakh crore. Reduce basic customs duty for LNG to 2.5% from 5%.

- 20. Rate of growth of advance tax in Personal I-T is 34.8% in the last three quarters of this financial year. Under the corporate tax, in order to make MSME ( Micro, Small & Medium Enterprises)companies more viable, there is a proposal to reduce tax for small companies with a turnover of up to Rs 50 crore to 25%. About 67 lakh companies fall in this category. Ninety-six % of companies to get this benefit. The limit of cash donation by charitable trusts is reduced to Rs 2,000 from Rs 10,000. No more cash transactions above Rs. 3 lakh.

- 21. Personal income tax Existing rate of tax for individuals between Rs. 2.5- Rs 5 lakh is reduced to 5% from 10%. All other categories of tax payers in subsequent brackets will get a benefit of Rs 12,500. 10% surcharge on individual income above Rs. 50 lakh and up to Rs 1 crore to make up for Rs 15,000 crore loss due to(rebate Rs 12,500) cut in personal I-T rate. 15% surcharge on individual income above Rs. 1 crore to remain(rebate Rs 14,500). Net revenue loss in direct tax could be Rs. 20,000 crore.

- 22. Stock markets react positively to Budget 2017 BSE Sensex rises 485.68 points, or 1.76%, to 28,141.64 while the Nifty 50 rises 155.10 points, or 1.81%, to 8,716.40 after the Union budget speech. Rail stocks fell up to 6% as investors were unhappy on the proposed allocation to railways for 2017-18.

- 23. The following is a list of items that will turn costlier: Cigarettes, pan masala, cigar , bidis, chewing tobacco, LED lamp components ,Cashew nuts, Aluminium ores, Polymer coated MS tapes used in manufacturing of optical fibres, Silver coins ,Printed circuit board used in making mobile phones. Following is a list items that will turn cheaper: Booking railway tickets online, LNG(Liquefied natural gas) , Solar tempered glass used in solar panels, Fuel cell based power generating systems, Wind operated energy generator , POS machines card and fingerprint readers.