Business intelligence prof nikhat fatma mumtaz husain shaikh

- 1. Guest Lecture on Business Intelligence By Prof .Nikhat Fatma Mumtaz Husain Shaikh Wednesday, March 10, 2021 Department of Computer Engineering Sinhgad Institute of Technology and Science, Narhe

- 2. Nikhat Fatma Mumtaz Husain Shaikh • Assistant Professor at K C College of Engineering and Management Studies and Research, Thane • Certified Microsoft Innovative Educator • Life Member of ISTE , CSI , IETE • Certified Neuro Linguistic Programmer by ABNLP twitter.com/ShaikhNik instagram.com/nikshaikh786/

- 3. Disclaimers These slides presented here are obtained from the authors of various books and from various other contributors and websites. I hereby acknowledge all the contributors for their material and inputs. I have tailored the contents to suit the requirements of this webinar.

- 5. 5 Goals for Today’s Session • Know how Analytics builds on Business Intelligence • Know why you’d build an analytic model: business payoffs • Know what kinds of results you can get from analytic models • Know how you’d build your own analytic model, and how to get data into your model • Know what to do next, if you want to learn

- 6. Business Intelligence • Business intelligence (BI) is a technology-driven process for analyzing data and delivering actionable information that helps executives, managers and workers make informed business decisions. • Business intelligence (BI) comprises the strategies and technologies used by enterprises for the data analysis of Business information • They aim to allow for the easy interpretation of these big data. Identifying new opportunities and implementing an effective strategy based on insights can provide businesses with a competitive market advantage and long-term stability.

- 7. 7 How Analytics Builds on Business Intelligence “Analytics are a subset of … business intelligence: a set of technologies and processes that use data to understand business performance … The questions that analytics can answer represent the higher-value and more proactive end of this spectrum.” – Tom Davenport, Competing on Analytics

- 8. 8 Analytics: The Three Levels • Descriptive Analytics: Classic BI • Quantitative Assessment of Past Business Results • Statistics, Exploratory Data Analysis, Visualization • Predictive Analytics • Quantitative Methods to Predict New Outcomes • Forecasting, Prediction, Classification, Association • Prescriptive Analytics • Quantitative Methods to Make Better Decisions • Decision Trees, Monte Carlo Simulation, Optimization

- 9. 9 Why Build Analytic Models: Example Payoffs • Two Frontline Systems Customer Examples • Excel model to optimally deploy 83 employees with different skill sets across 24 stations saved $1.9 million per year in overtime. • Excel simulation model showed major chemical company why a plant was missing goals, and how to solve the problem without any new investment. • U.S. Air Force Air Logistics Center • C-5 Galaxy transport maintenance hub reduced turnaround time from 360 to 160 days, saving taxpayers $50 million and saving soldiers’ lives. • Memorial Sloan-Kettering Cancer Center • Optimizing radiation beams reduced side-effects of treating cancer – improving quality of life and saving $459 million per year on prostate cancer alone.

- 10. 10 Can This Help in Your Work or Career? • Optimization models can deliver huge cost savings • Simulation/risk analysis models can help avoid disaster • But very few business analysts have the skills to do this • If you can do this, your value to your company will rise • Some analytic models address operations, others address strategic decisions • Ex. whether to build a new plant, and where to locate it • Be prepared to present your work to senior management

- 11. 11 Descriptive Analytics: Excel & Power BI • Key task: Data access / shaping – Power Query does this • Excel + Power Pivot data model holds Past Business Results • Pivot charts, Power View, Power BI for data visualization • Formulas: Sum, Count, Average, Min, Max, Var, StdDev

- 12. 12 Predictive Analytics: Data Mining • Key tasks: Data shaping, applying predictive models • Data mining algorithms “fit” analytic model to past data • Trained/fitted models are applied to newly arriving data • Classify: ex. Good/Poor credit risk, Likely/Unlikely to churn • Predict: ex. stock price, house price, exchange rate • Forecast a time series: ex. next sales from past sales history • Associate: ex. People who bought this item also bought... • Tools: Azure ML, XLMiner, Predixion, SAS, SPSS, R, others

- 13. 13 Prescriptive Analytics: Optimization, Simulation • Key task: Create a model – A person (you) must do this • Model must capture essential features of the business situation • Larger models often get their data from BI / Descriptive Analytics • A “What If” model is the starting point – Excel is a natural tool! • Given an appropriate model, we can: • Ask “What are all the possible outcomes?” – simulation/risk analysis • Ask “What’s the best outcome we can achieve?” – optimization • Tools: Solver, Risk Solver, @RISK, Crystal Ball, IBM, SAS, others

- 14. 14 Results from an Analytic Model • Results from a data mining model: • Tool to classify or predict outcomes for new cases • Assessment of accuracy / predictive power • Results from a simulation model: • Full range of outcomes and their likelihood • Sensitivity analysis of input parameters vs. outcomes • Results from an optimization model: • Best attainable objective, values for decision variables • Sensitivity analysis of decision variables & constraints

- 15. 15 Data Mining: What You Need, How You Do It • What You Need: Tools to • Access / shape data, explore / visualize data • Train / “fit” models to data: machine learning • Validate model results: statistics, Lift / ROC curves • How You Do It • Data “wrangling” / cleaning is usually the first step • Use feature selection to identify variables that matter • Try multiple algorithms: Regression, trees, neural nets • Assess and think about results: Avoid over-fitting

- 16. 16 Simulation: What You Need, How You Do It • What You Need: Tools to • Create a “what if” model, calculating results of interest • Define probability distributions for uncertain inputs • Run Monte Carlo simulation, create statistics and charts • How You Do It • Define distributions by fitting data, or industry practice • Define dependence among inputs: corr. matrices, copulas • Run simulation, or multiple simulations with parameters • Assess and think about results: stats, histograms, scatterplots

- 17. 17 Optimization: What You Need, How You Do It • What You Need: Tools to • Create a “what if” model, calculating results of interest • Define decision variables for inputs under your control • Define constraints and an objective to max / minimize • Run an optimization for optimal values, sensitivity analysis • How You Do It • Define constraints for limited resources, physical conditions, policies • Understand dependence between outputs and inputs: linear / nonlinear • Run optimization, or multiple optimizations with parameters you vary • Assess and think about results: understand “dual values,” sensitivity

- 18. 18 Can This Help in Your Work or Career? • Optimization models can deliver huge cost savings • Simulation/risk analysis models can help avoid disaster • But very few business analysts have the skills to do this • If you can do this, your value to your company will rise • Some analytic models address operations, others address strategic decisions • Ex. whether to build a new plant, and where to locate it • Be prepared to present your work to senior management

- 19. 19 Where to Learn More: Textbooks on Amazon • Cliff Ragsdale Spreadsheet Modeling 7th Ed • Powell & Baker Management Science 4th Ed • Camm et al Essentials of Business Analytics • James Evans Business Analytics

- 20. 20 Where to Learn More: Online Courses and Tools • www.edx.org • www.coursera.org • www.solver.com • www.xlminer.com

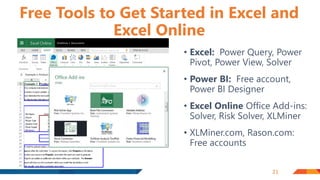

- 21. 21 Free Tools to Get Started in Excel and Excel Online • Excel: Power Query, Power Pivot, Power View, Solver • Power BI: Free account, Power BI Designer • Excel Online Office Add-ins: Solver, Risk Solver, XLMiner • XLMiner.com, Rason.com: Free accounts

- 22. Demonstration of SPSS • SPSS Statistics 25

- 24. Thank You- See You Again!!!!!! Prof. Nikhat Fatma Mumtaz Husain Shaikh nikhat.shaikh@kccemsr.edu.in

Editor's Notes

- If you like what you hear in these webinars, make sure to attend the PASS Business Analytics Conference taking place May 2-4 in San Jose, California. With hands-on learning opportunities from data and business analytics experts and a variety of networking opportunities, the PASS Business Analytics Conference is a great opportunity to gain valuable skills and advance your career. All webinar registrants get $100 off the two-day pass. Just use discount code BAMARA during registration. Visit passbaconference.com to register today!

- If you like what you hear in these webinars, make sure to attend the PASS Business Analytics Conference taking place May 2-4 in San Jose, California. With hands-on learning opportunities from data and business analytics experts and a variety of networking opportunities, the PASS Business Analytics Conference is a great opportunity to gain valuable skills and advance your career. All webinar registrants get $100 off the two-day pass. Just use discount code BAMARA during registration. Visit passbaconference.com to register today!