Businessasiapacrim

- 1. DOING BUSINESS IN THE ASIA/PACIFIC RIM REGION State Capital Group 1747 Pennsylvania Avenue, N.W. Suite 1200 Washington, D.C. 20006 (202) 659-6601 PHONE (202) 659-6641 FAX info@statecapitalgroup.org www.statecapitalgroup.org © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 2. STATE CAPITAL GROUP ASIA/PACIFIC RIM MEMBER FIRMS AUSTRALIA (MELBOURNE) AUSTRALIA (SYDNEY) Hall & Wilcox Holman Webb Level 30 Bourke Place Level 17 Angel Place 600 Bourke Street 123 Pitt Street, GPO Box 119 Melbourne, Victoria 3000 Sydney, New South Wales DX 233 Australia Australia +(61-3) 9603-3555 PHONE +(61-2) 9390-8000 PHONE +(61-3) 9670-9632 FAX +(61-2) 9390-8390 FAX www.hallandwilcox.com.au www.holmanwebb.com.au Contact Attorney: Contact Attorney: Mark Dunphy D’Arcy Kelly mark.dunphy@hallandwilcox.com.au dak@holmanwebb.com.au CHINA (HONG KONG) CHINA (SHANGHAI) Lily Fenn & Partners Martin Hun & Partners Room D, 32/F. 19/F, Yongda International Tower Lippo Centre, Tower 1 2277 Longyang Road Queensway 89, Hong Kong Shanghai 201204, P. R. China China +852-2522-9882 PHONE +86 21 5010-1666 PHONE +852-2522-3367 FAX +86 21 5010-1222 FAX www.lilyfennlawyers.com www.mhplawyer.com Contact Attorney: Contact Attorney: Lily K.B. Fenn Martin Hu lilyfenn@lilyfennlawyers.com martin.hu@mhplawyer.com INDIA NEW ZEALAND J. Sagar & Associates (JSA) Wynn Williams & Co. 84 E, C-6 Lane, Sainik Farms Level 7 BNZ House New Delhi 110 062 129 Hereford Street India Christchurch 8011 +91-11-2955-2714 PHONE New Zealand +91-11-2955-2717 FAX +(64‐3) 3797‐622 PHONE www.jsalaw.com +(64‐3) 792‐467 FAX www.wynnwilliams.co.nz Contact Attorneys: Jyoti Sagar jyoti@jsalaw.com Contact Attorney: Sajai Singh sajai@jsalaw.com Jonathan Gillard jonathan.gillard@wynnwilliams.co.nz Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 3. SINGAPORE SOUTH KOREA Wee, Ramayah & Partners Yoon Yang Kim Shin & Yu 22 Malacca Street #15-00 19th Floor, ASEM Tower 159-1 Royal Brothers Building Samsung-Dong, Gangnam-Gu Singapore 048980 Seoul 135-798 Singapore Korea +(65) 6534-5155 PHONE +(82-2) 6003-7000 PHONE +(65) 6534-2622 FAX +(82-2) 6003-7804 FAX www.wrp.com.sg www.hwawoo.com Contact Attorney: Contact Attorney: Rajaram Ramiah Jay K. Lee rr@wrp.com.sg jklee@hwawoo.com SRI LANKA THAILAND Nithya Partners Tilleke & Gibbins International Ltd. No. 51, Gregory’s Road Supalai Grand Tower, 26th Floor Colombo 7 1011 Rama 3 Road Sri Lanka Chongnonsi, Yannawa +94-11-4712-625 PHONE Bangkok 10120 +94-11-2695-223 FAX Thailand www.nithyapartners.com +(66‐2) 653-5555 PHONE +(66‐2) 653-5678 FAX Contact Attorney: www.tillekeandgibbins.com Chanaka de Silva cdes@wow.lk Contact Attorneys: Santhapat Periera santhapat.p@tillekeandgibbins.com Tiziana Sucharitkul tiziana.s@tillekeandgibbins.com Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 4. CONTENTS AUSTRALIA .................................................................................................................................................. Tab 1 CHINA (HONG KONG) ............................................................................................................................... Tab 2 CHINA (SHANGHAI) .................................................................................................................................... Tab 3 INDIA ........................................................................................................................................................... Tab 4 NEW ZEALAND ........................................................................................................................................... Tab 5 SINGAPORE ................................................................................................................................................ Tab 6 SOUTH KOREA ............................................................................................................................................ Tab 7 SRI LANKA ................................................................................................................................................... Tab 8 THAILAND ................................................................................................................................................... Tab 9 This publication is intended to provide general information for those interested in learning more about conducting business in various jurisdictions throughout the Asia/Pacific Rim region. The contents are intended to provide general information and not to apply to specific problems. Because the facts in each situation vary, the legal authorities discussed may not be applicable to specific circumstances. Readers of this publication are urged to consult their own attorneys concerning specific legal questions. No one should rely on the materials discussed without first determining whether the pertinent provisions have been amended, repealed or overruled. This article is intended for general informational purposes only and subject to updates from time to time. Any person should not rely upon the contents of this article as legal or professional advice. Further professional advices should be sought for any particular issues or cases. Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 5. TAB 1 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 6. AUSTRALIA Hall & Wilcox Holman Webb Level 30 Bourke Place Level 17 Angel Place 600 Bourke Street 123 Pitt Street, GPO Box 119 Melbourne, Victoria 3000 Sydney, New South Wales DX 233 Australia Australia +(61-3) 9603-3555 PHONE +(61-2) 9390-8000 PHONE +(61-3) 9670-9632 FAX +(61-2) 9390-8390 FAX www.hallandwilcox.com.au www.holmanwebb.com.au Contact Attorney: Contact Attorney: Mark Dunphy D’Arcy Kelly mark.dunphy@hallandwilcox.com.au dak@holmanwebb.com.au - 1. 1 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 7. I. INTRODUCTION TO AUSTRALIA The Land In the Asia/Pacific Rim Region, Australia occupies an entire continent of approximately 7.7 million square kilometers. The climate ranges from temperate in the South to tropical in the North. Average temperatures range from 4° to 28° Celsius. The People Australia has a population of approximately 21.64 million (as at December 31, 2008) that is mostly located in cities on the Eastern Seaboard, including Sydney (capital of the state of New South Wales- population: 6.98 million) and Melbourne (capital of the state of Victoria- population: 5.3 million). The nation’s capital is Canberra. With 11.25 million people in the workforce, Australia is ranked seventh in the world for overall competitiveness, (World Competitiveness Yearbook 2009). Australia is home to citizens from some 200 countries, making it the most multilingual workforce in the Asia Pacific region. More than 4.1 million Australians speak a second language (including 3 million who speak a language other than English at home). The Language Australia’s national language is English. Time Zone Greenwich Mean Time (GMT) +8 to +11 hours. Australia’s time zone offers a distinct advantage for global business, spanning the close of business in the United States and the opening of Europe’s trading day. 1. 2 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 8. II. GOVERNMENT STRUCTURE AND ECONOMIC CLIMATE Government Structure Australia is a federation of six States and two Territories and offers a stable democratic system of government at three levels. The Federal Government consists of a Senate (Upper House) and the House of Representatives (Lower House) and members are elected by popular vote. Its powers are set out in the Australian Constitution. The State and Territory Governments are responsible for providing education, health care and law enforcement. Local Government is the lower tier responsible for planning and development and works more closely with communities to provide local services. Financial System Australia’s banks provide a wide range of financial services to all sectors of the economy, including funds management and insurance services. Foreign banks authorized to operate as branches in Australia are required to confine their deposit-taking activities to wholesale markets. There are 51 separate banks in Australia. Currency Australia’s currency is the Australian dollar. As of June 2, 2009, the exchange rate was: A$1.0 = US$0.8101 A$1.0 = Euro$0.5697 Foreign Exchange Control There are no foreign exchange controls in Australia. Leading Industries Agribusiness, Manufacturing, Energy, Mining, Financial Services, Tourism, Research & Development. Australian Workplace Relations Australian corporations fall within the scope of the Fair Work Act of 2009, which comes into effect in stages throughout 2009 and 2010. The Fair Work Act establishes “Fair Work Australia” - a one-stop shop with broad jurisdiction to exercise functions and powers including agreement making, award setting / modernization and employment related disputes. Occupational health and safety laws are governed at the State and Federal level. Employers have a strict duty to ensure the safety, health and welfare of employees and others present at the workplace. Employers and individuals face monetary fines and potential jail terms for individuals. Workers compensation laws govern at the State level. Anti-discrimination laws at both State and Federal level prohibit discrimination in the workplace. 1. 3 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 9. III. INVESTMENT CLIMATE AND FOREIGN TRADE Australia maintains strong trade and investment links in the Asia-Pacific region. Unlike many countries in the region, there are no foreign exchange controls in Australia and the currency is fully internationalized. Capital flows, profit remittances, capital repatriation, transfer of royalties and trade related payments remain largely free from regulation. With regulatory procedures taking just two days, Australia has been assessed as one of the easiest place in the world to start a business. (World Bank 2007) Foreign Investment Policy The Government encourages foreign investment consistent with national and community interests. In the majority of industry sectors, smaller proposals are exempt from notification and larger proposals are approved unless judged contrary to the national interest. The screening process undertaken by the Foreign Investment Review Board (FIRB) enables comments to be obtained from relevant parties and other Government agencies in considering whether larger or more sensitive foreign investment proposals are contrary to the national interest. Foreign Investment Framework Australia’s foreign investment legislation applies to investment proposals by foreign interests. A foreign interest is an individual who is not ordinarily a resident in Australia and any corporation or trust in which there is a substantial (15% or more) foreign interest (even if it is not actually foreign controlled) or where several foreigners have a 40% or more interest in aggregate. Acquisitions and Establishment of New Businesses The types of proposals by foreign interests to invest in Australia that require prior approval include: • Acquisitions of substantial interests in existing Australian businesses, the value of whose gross assets exceed A$100 million, or where the proposal values the business at over A$100 million. For US investors a notification threshold of A$953 million instead applies, except for investments in prescribed sensitive sectors, or by an entity controlled by a US government, which are subject to a A$110 million threshold. The Foreign Acquisitions and Takeover Act (FATA) does not apply to investments by US investors in those financial sector entities which are subject to the operation of the Financial Sector (Shareholdings) Act 1998; • Proposals to establish new businesses involving a total investment of A$10 million or more. Proposals by US investors, except an entity controlled by a US government, do not require notification but remain subject to other relevant policy requirements; • Portfolio investments in the media of 5% or more and all non portfolio investments irrespective of size; • Takeovers of offshore companies whose Australian subsidiaries or gross assets exceed A$200 million and represent less than 50% of global assets, the applicable US investor threshold of either A$953 million or A$110 million, and for entities controlled by a US government a A$219 million threshold applies; • Direct investments by foreign governments and their agencies irrespective of size; • Acquisitions of interests in urban land (including interests that arise via leases, financing and profit sharing arrangements and the acquisition of interests in urban land corporations and trusts) that involve: - developed non residential commercial real estate, where the property is subject to heritage listing, valued at A$5 million or more and the acquirer is not a US investor; - developed non-residential commercial real estate, where the property is not subject to heritage listing, valued at A$50 million or more, or A$953 million for US investors; - accommodation facilities irrespective of value; - vacant real estate irrespective of value; 1. 4 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 10. - residential real estate irrespective of value; or - proposals where any doubt exists as to whether they are notifiable (funding arrangements that include debt instruments having quasi equity characteristics will be treated as direct foreign investment). Economic Policies & Incentives for Foreign Investment The Australian Government is keen to promote and develop investment in Australia. The Federal Government’s national investment agency, Invest Australia, assists in the growth of foreign investment in Australia. Some of Invest Australia’s services include: • Identifying potential investment opportunities in Australia; • Providing industry information and advice on establishment costs; • Collecting information on key operating costs overseas for comparison; • Arranging site visits and locating suitable commercial partners for joint venture project; • Providing information on foreign investment regulations in Australia; • Assisting with grants for feasibility studies for major investments and • Assisting qualifying large investors to efficiently pass their application through the government approval channels The Australian Trade Commission (commonly known as “Austrade”), the Federal Government’s export and investment facilitation agency, provides incentives on a case-by-case basis to encourage foreign investment. In broad terms, the Government will seek to give incentives to projects that are: • Not contrary to Australia’s national interest • Able to provide significant net economic benefits and employment to Australia in the future • Able to encourage sustainable investment • Likely to significantly boost Australia’s research and development capacity • Unlikely to proceed without some form of investment incentive • Viable in the long-term without subsidy • Complementary to Australia’s areas of competitive advantage • Consistent with Australia’s international obligations. Incentives can be in the form of taxable grants, tax relief, tax deduction or the provision of infrastructure services at discounted rates. Through Invest Australia’s Regional Headquarters (RHQ) program the Federal Government also offers special incentives to encourage foreign organizations to use Australia as their headquarters in the Asia-Pacific Region. Special incentives have also been created for projects that: • Will boost Australian industry innovation • Provide significant economic benefits to regional Australia • Have estimated expenditure of at least A$50 million The RHQ incentives include: • Immigration agreements granted by the Minister for Industry, Science and Resources whereby key expatriate employees of companies who are essential to the establishment and management of Australian-based regional operations, have permanent and long stay visas • The deductibility of business expenses including expenditure of a revenue or capital nature, incurred directly by the RHQ company within a two year period, commencing one year prior to the RHQ first deriving assessable income and finishing one year after this date. State Governments have also developed their own programs to generate growth of foreign investment in line with 1. 5 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 11. their Federal counterparts. However, there is no specific criterion, rather each case is determined on its own merits. Relevant Regulatory Bodies The Australian Competition and Consumer Commission (ACCC) www.accc.gov.au The Australian Prudential Regulatory Authority (APRA) www.apra.gov.au Australian Securities and Investment Commission (ASIC) www.asic.gov.au Australian Stock Exchange Limited (ASX) www.asx.com.au Australian Taxation Office (ATO) www.ato.gov.au Foreign Investment Review Board (FIRB) www.firb.gov.au Reserve Bank of Australia (RBA) www.rba.gov.au IP Australia www.ipaustralia.gov.au .au Domain Administration (auDA) www.auda.org.au State-Level Incentives Victoria “Invest Victoria” is a specialized branch of the Department of Innovation, Industry and Regional Development, which acts to smooth the path for investment projects, promote export culture and readiness and oversee State investments crucial to creating the infrastructure and lifestyle that make Victoria an easy place to do business. Invest Victoria offers a number of services to businesses including a variety of programs to help Victorian companies develop and implement world-class management practices and quality production techniques. They also assist businesses aiming to develop an export culture, seek new markets or expand existing overseas markets through a series of export related assistance programs. Invest Victoria also facilitates major investment projects in Victoria by coordinating all government and public utility negotiations within an agreed time frame. They can help with: site selection; natural gas supply; transport; waste disposal; electricity supply; environmental approvals; sewage; water supply; permits and approvals; and other regulatory controls. These services are made available to new projects and on an ongoing basis to existing clients making a major commitment to doing business in Victoria. New South Wales The New South Wales Department of State and Regional Development (DSRD) is the first point of contact within government for companies wishing to do business in Sydney and regional New South Wales (NSW.) The DSRD works with businesses to save them time and money when establishing or expanding in NSW by: • offering tailored assistance to help them set up and grow in NSW • providing a wide range of business and investment information for international and local companies • assisting business to find new markets for their products and services • attracting and sustaining investment projects • organizing trade missions for NSW business to help them establish themselves in the international economy • delivering enterprise improvement programs that enhance international competitiveness • driving policy change to improve the business climate in NSW. 1. 6 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 12. Regional Trade Agreements and Associations Singapore-Australia Free Trade Agreement (SAFTA) Thailand-Australia Free Trade Agreement (TAFTA) Australia-New Zealand Closer Economic Relations Australia-United States Free Trade Agreement (AUSFTA) Free Trade Agreements Under Consideration / Negotiation Australia-ASEAN-New Zealand FTA Negotiations Australia-China Free Trade Agreement Negotiations Australia-Malaysia FTA Negotiations Australia-UAE FTA Negotiations Australia-Japan FTA Feasibility Study Major Trading Partners and Leading Imports and Exports The level of foreign investment in Australia: $1.7 trillion (2008) Major Trading Partners: Australia’s main export destinations (2008 figures; $AUD) were: Japan (22.7%), China (14.6%), Republic of Korea (8.3%), India (6.1%) and the United States (5.5%). Major Investors: Australia's leading investors (2008 figures; $AUD) were: United Kingdom ($427.1 billion or 25%), United States of America ($418.4 billion or 24%), Japan ($89.5 billion or 5%), Hong Kong (SAR of China) ($56.3 billion or 3%), Singapore ($43.1 billion or 2%), Switzerland ($38.1 billion or 2%). Imports: (merchandise trade): AUD $225.8 billion (2008) Exports: (merchandise trade): AUD $222.5 billion (2008) The Current Account Deficit (CAD) has traditionally been a benchmark for foreign investors. Australia’s current account deficit in the March quarter 2009, seasonally adjusted, was at AUD $4.6 billion. 1. 7 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 13. IV. CORPORATE AND BUSINESS STRUCTURES A person may carry on business in Australia as a sole trader, a partnership, a joint venture, a trust, or a company. A foreign company may carry on business in Australia either as an Australian branch or through an Australian subsidiary company. To carry on business in Australia as a branch, the foreign company must register with the Australian Securities and Investment Commission (ASIC). A foreign company wishing to apply for registration should reserve the company’s name to ensure that it is available in Australia and must lodge with ASIC the application form, together with a certified copy of its certificate of registration and constituent documents. The foreign company must also have a registered office in Australia and appoint a local agent to represent the company in Australia. Once registered, the foreign company is required to lodge copies of its financial statements and comply with various notification obligations under the Corporations Act. A foreign company can establish a new Australian subsidiary by registering the company, or more commonly, acquiring an existing “shelf” company (a recently registered company which has not traded). If an entity carries on business in an Australian state (other than under its own individual or company name), the entity is required to register that business name with the relevant Australian State Government department. 1. 8 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 14. V. TAXATION The 30% company tax rate in Australia is competitive compared to other major economies. Non-resident companies and resident companies are taxed on their Australian-sourced income at the same rate. It is likely the withholding tax applying to dividends, interest and royalties will be reduced under one of Australia’s double taxation agreements that also deals with taxation of business profits, real property income and certain wages. Non-residents only incur withholding tax on unfranked dividends paid by Australian companies. Under double taxation agreements, which Australia has entered into with most major countries, the maximum rate of withholding tax payable on unfranked dividends is 15%, compared with 30% normally. Under a protocol with the United States relating to double taxation, which came into effect on 1 July 2003, certain US companies (generally only listed companies) with at least 80% ownership of an Australian company are exempt from withholding tax. For other US companies, with at least 10% ownership in the Australian company, the rate is 5%. This new protocol, along with the relaxation of foreign investment restrictions under the Australia- United States Free Trade Agreement, makes Australia an even more attractive proposition for United States investors. Similar concessions now apply to UK investors. The rate of withholding interest is generally 10%. The rate for royalties is generally 30%; however, it drops to 10% under most of Australia’s double tax agreements, and 5% under the US agreement. The Australian Government will consider the provision of investment incentives to strategic investment projects in limited and special circumstances where the project would generate significant net economic and employment benefits for Australia. Tax Incentives Incentives could include grants, tax relief or the provision of infrastructure services. Incentives are considered on a case-by-case basis, taking into account a published set of eligibility criteria. The criteria include a requirement that the investment would not be likely to occur in Australia without the incentive, is viable without subsidy, and provides significant net economic benefits for Australia. Other Significant Taxes Different forms of direct and indirect taxes are levied by both the Federal and State Governments, including: Australian Federal Government • Income tax, • Fringe benefits tax • Indirect taxes (on petrol, oil, tobacco and alcohol) • Goods and Services Tax • Capital Gains tax • Customs duty State Governments • Employers’ payroll tax • Land tax • Stamp duties • Gaming taxes • Motor vehicle taxes 1. 9 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

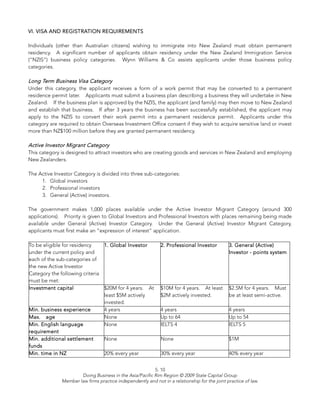

- 15. VI. VISA AND REGISTRATION REQUIREMENTS Non-Australian citizens travelling to Australia may only do so with a visa. People applying for Australian temporary or permanent residence or work visas must undergo health and character checks, as well as fulfilling a number of other criteria. There are numerous visa options for people who wish to live/work temporarily or permanently in Australia. The two general types of business visas addressing the labor needs of Australian employers are: i. A short-term visa for people who wish to come to Australia for genuine business purposes for periods of up to three months at any one time; and ii. A long-term stay visa generally used when companies wish to sponsor foreign executives, technical or specialist personnel for a specified period of employment in Australia, for periods of up to four years. 1. 10 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 16. VII. OTHER Useful Australian Websites Australian Industry Group ⇒ www.aigroup.asn.au Austrade ⇒ www.austrade.gov.au Australian Bureau of Statistics ⇒ www.abs.gov.au Australian Department of Immigration & Multicultural Affairs ⇒ www.immi.gov.au Australian Financial Review ⇒ www.afr.com.au Australian Newspaper ⇒ www.theaustralian.com.au Australian Open for Business ⇒ www.fed.gov.au Australian Tourist Commission ⇒ www.atc.net.au CSIRO (Commonwealth Scientific Industrial Research Organization) ⇒ www.csiro.au Export Finance & Insurance Corporation ⇒ www.efic.gov.au Invest Australia ⇒ www.investaustralia.gov.au New South Wales Department of State & Regional Development ⇒ www.business.nsw.gov.au NSW Government ⇒ www.nsw.gov.au Victoria Business Victoria ⇒ www.business.vic.gov.au Victorian Government ⇒ www.vic.gov.au Tasmanian State Government ⇒ www.tas.gov.au Queensland State Government ⇒ www.qld.gov.au Western Australian State Government ⇒ www.wa.gov.au South Australia State Government ⇒ www.sa.gov.au Northern Territory Government ⇒ www.nt.gov.au Australian Capital Territory Government ⇒ www.act.gov.au 1. 11 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 17. TAB 2 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 18. CHINA (HONG KONG) Lily Fenn & Partners Room D, 32/F. Lippo Centre, Tower 1 Queensway 89, Hong Kong China +852-2522-9882 PHONE +852-2522-3367 FAX www.lilyfennlawyers.com Contact Attorney: Lily K.B. Fenn lilyfenn@lilyfennlawyers.com 2. 1 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 19. I. INTRODUCTION TO HONG KONG, CHINA The Land Hong Kong is a Special Administrative Region of the People's Republic of China, which has enjoyed a high degree of autonomy since July 1, 1997. Hong Kong was a British colony up to June 30, 1997. Situated at the southeastern tip of China, it is ideally positioned at the center of rapidly developing East Asia. The People Hong Kong's population is about 7 million with a large foreign population of about half a million people. The Language Chinese and English are the official languages. English is widely used in the Government and by the legal, professional and business sectors; however, there are many well-educated professionals who speak fluent English, Cantonese and Putonghua (Mandarin Chinese). Time Zone Hong Kong’s time zone is GMT + 8 hours. 2. 2 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 20. II. GOVERNMENT STRUCTURE AND ECONOMIC CLIMATE Government Structure Hong Kong is a Special Administrative Region of the People's Republic of China, which has enjoyed a high degree of autonomy since July 1, 1997. Hong Kong was a British colony up to June 30, 1997. Hong Kong exercises executive, legislative and independent judicial powers, including the authority of final adjudication of disputes. The Chief Executive is the head of Hong Kong, which has a two-tier system of representative government. At the central level is the Legislative Council, which legislates, controls public expenditure and monitors the performance of the Administration. At the district level, 18 District Councils advise on the implementation of policies in their respective districts. Economic Aspects Hong Kong is one of the most open and externally oriented economies in the world. The city prospers as a trading, logistics and aviation hub and a service centre, where an understanding of international markets as well as the Mainland gives Hong Kong a unique and versatile economic role as the Mainland opens up. The economy is robust enough to have weathered the economic shockwaves, recovered and reached new heights. Over the past two decades, the economy of Hong Kong has more than doubled in size with Gross Domestic Product growing at an average annual rate of 5% in real terms. Hong Kong is the world's 11th largest trading economy, the world's sixth largest foreign exchange market, the world's 15th largest banking centre, and Asia's second biggest stock market. Hong Kong is one of the world's top exporters of garments, watches and clocks, toys, games, electronic products and certain light industrial products. Travel and tourism, trade-related services, transportation services, financial, banking and professional services are the main components of trade in services of different kinds. About 3,900 international corporations have established regional headquarters or offices in Hong Kong. The major types of business include wholesale/retail and import/export trades, other business services (e.g., accounting, advertising and legal services), finance and banking, manufacturing, transport and related services. Hong Kong advocates and practices free trade – a free and liberal investment regime, the absence of trade barriers, no discrimination against overseas investors, freedom of capital movement, well-established rule of law based on the British legal system, transparent regulations, low and predictable taxation. Monetary Policy The objective of Hong Kong's monetary policy is to maintain currency stability. Given the highly externally oriented nature of the economy, this objective is further defined as a stable external value for the Hong Kong dollar in terms of a linked exchange rate against the U.S. dollar at the rate of HK$7.80 to US$1. This objective is achieved through the Linked Exchange Rate System introduced in October 1983. The Financial System and Culture Hong Kong prides itself in the "little government, big market" approach, where the comparatively light hand of regulatory bodies ensures Hong Kong maintains its world-class standard while providing the pro-business framework and environment that create a just, fair and level playing field. The government lives by the mantra “market leads, government facilitates." 2. 3 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 21. The primary economic sector is negligible in terms of contribution to Gross Domestic Product (“GDP”) and employment. In the last 20 odd years, GDP constituents have changed from 69% services and 30% manufacturing to 90% services and around 10% manufacturing. Hong Kong and its inhabitants are widely renowned for their ability to adapt and re-invent. Now that manufacturing has largely moved over the border to the Mainland, Hong Kong is embracing the roles of the manager, financier, marketer, logistics organizer and trader. Coupled with tourism and other key industries, the same now comprise the majority of GDP and employment. Since the economic reforms introduced by the Mainland in 1978, business between Hong Kong and the Mainland has increased significantly, with Hong Kong handling more than 20% of the Mainland's foreign trade. 2. 4 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 22. III. INVESTMENT CLIMATE AND FOREIGN TRADE According to the “World Investment Report 2008” released by the United Nations Conference on Trade and Development, Hong Kong was the second largest Foreign Direct Investment (“FDI”) recipient in Asia after the mainland of China. Hong Kong was the world's seventh and Asia's second largest FDI recipient, attracting US$54.4 billion inward investment in 2007. Hong Kong was also ranked Number 1 globally in the report's Inward FDI Performance Index, which measures the amount of FDI relative to the size of the economy. Like trade and development, Hong Kong and Mainland China are the key to each other's success. Hong Kong is the largest investor on Mainland China, and Mainland investment in Hong Kong amounts to some 2,000 enterprises and over 25% of the total stock. Foreign Investment Incentives Hong Kong’s free-port status, low tax rates, good infrastructure, freedom from government interference and substantial available capital make her attractive to potential investors and thus competitive with other countries in the region and do offer specific incentives. The simplicity of procedures for investing, expanding and establishing a local company is a major attraction for foreign investment in Hong Kong. It is easy to start a company: ready-made companies, also known as shelf companies, are widely available and enable a businessperson to walk off a plane in the morning and start operating a company in the afternoon. The government's special industrial-land policies are a lot less demanding than the policies of many other Asian investment centers. Controls on new investments are minimal and there is no exchange control. However, new building construction requires permits, and polluting industries face increasingly strict controls. Moreover, pharmaceutical operations face strict rules on importation, manufacture, sale and distribution; the Department of Health oversees compliance. There is no investment-approval procedure directed specifically towards foreign investors. All businesses must comply with the registration requirements of the Business Registration Ordinance, Companies Ordinance and their respective subsequent amendments. Save for state-owned activities, there are almost no limits on foreign investors. An exception is broadcasting and cable operation: foreign ownership of local broadcasting stations or cable operators may not exceed 49% of shareholding. The handover of sovereignty in 1997 did not affect the free movement of foreign equity. The Basic Law safeguards "free movement of goods, intangible assets and capital", it is the mini constitution of Hong Kong. Hong Kong imposes no controls on foreign exchange, and no restrictions on entry and repatriation of capital or on conversion and remittance of profits and dividends derived from direct or indirect investments. Investors bring their capital into Hong Kong through the open exchange market and remit it the same way. Hong Kong has also signed investor-protection agreements with trading partners to guarantee free transfer of funds. Foreign Trade Hong Kong is a member of the World Trade Organization (“WTO”) and the Asia-Pacific Economic Co-operation (“APEC”) forum, which is moving to liberalize the region's import restrictions by 2020. Using competitive manufacturing bases in China, Hong Kong has become the world's leading re-exporter of garments, imitation jewelry, travel goods, handbags, umbrellas, artificial flowers, toys, watches and clocks. In recent years, however, there has been increasing use of direct shipments or trans-shipments of goods 2. 5 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 23. manufactured in Mainland China to overseas markets at the expense of re-exports through Hong Kong. This trend should increase in the future, given that China is now a member of the WTO. Apart from re-exports, Hong Kong's domestic exports consist mostly of the following: (1) textiles; (2) clothing apparel; (3) machinery, equipment, apparatus, parts and components; and (4) consumer electrical and electronic products. Its main imports include raw materials, consumer goods, capital goods, foodstuffs and fuels. Hong Kong's major export markets are Mainland China, the United States of America, Japan and the European Union. Its main sources of imports are Mainland China, Japan, Taiwan, the United States of America and the European Union. Hong Kong also had a clear interest in China's WTO entry, which occurred in December 2001. Whilst obliging China to respect multilateral rules and disciplines, membership curtails other countries' freedom to take unilateral trade sanctions against it and ensure that trade disputes are settled through binding international arbitration. Since more than half of Mainland China's exports pass through Hong Kong, liberalized trading rules for China will significantly benefit Hong Kong. In general, any person who imports or exports any goods must lodge an import/export declaration with the Customs and Excise Department within 14 days after the importation or exportation of goods. The declaration can be made on a prescribed form or via Electronic Data Interchange Service. At the time of lodging declarations, importers and exporters must pay a declaration charge and/or export clothing training levy. 2. 6 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 24. IV. CORPORATE AND BUSINESS STRUCTURES Representative Offices Representative offices are useful if a business wishes to explore the Hong Kong market before making a larger investment. However, a representative office can only fulfill limited functions, for example, promotion and liaison work, such as collecting information and contacts. Should a business wish to enter into any transaction that creates a legal obligation, the business will need to change the status of its business structure (see options below). For the following corporate structures, it is necessary to: i. incorporate the company at the Companies Registry; and ii. register the company with the Inland Revenue Department through the application for a Business Registration Certificate. Branch Offices of Parent Companies Where a company incorporated outside Hong Kong establishes a branch office in Hong Kong as an extension of the investing company; it is referred to as an “overseas company.” Unlike a subsidiary, a branch can leverage off the credit rating of the overseas owner. The key differences between a branch and a representative office are the operating scope and tax treatment. Limited Companies A Hong Kong Limited Company allows its shareholders to take advantage of all the tax benefits and concessions available to a fully incorporated business. Most notably, Hong Kong-based companies can benefit from the free trade agreement with Mainland China known as the Closer Economic Partnership Arrangement (“CEPA”), which provides preferential trading terms. In addition, CEPA-qualified companies are eligible for preferential access to Mainland China markets across a wide range of sectors. 2. 7 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 25. V. TAXATION Hong Kong taxes are among the lowest in the world, and the tax regime is simple and predictable. Profits Tax rate is the same for foreign and local companies - a low 16.5% for the Financial Year 2009/2010. The actual tax bill is often even less after various tax deductions and depreciation allowances. There is no capital gains tax in Hong Kong, no withholding tax on dividends and interest, or collection of social security benefits. Salaries Tax rate is at a maximum standard rate of 15%, imposed only on all salary income of individuals derived in or from Hong Kong. The Salaries Tax is demanded on a yearly basis and can be paid in two installments, usually between December and March. Property Tax applies to owners of land or buildings situated in Hong Kong. It is low by international standards: 15% for the Financial Year 2009/2010 of the rental income from land or buildings with an allowance of 20% on cost of repairs and maintenance. If a company is subject to Profits Tax, it is exempted from Property Tax. There is no Sales Tax or Value Added Tax in Hong Kong. The limited tax base, combined with exceptionally low tax rates, makes Hong Kong's tax incidence much lower than virtually all other developed economies. There is no estate duty imposed on the Hong Kong assets of any individuals who pass away. Hong Kong is considered a paradise for individuals with high personal net worth to pass on their wealth and fortunes to their next generation, and beyond. 2. 8 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 26. VI. VISA AND REGSITRATION REQUIREMENTS Hong Kong is a Special Administrative Region and thus a separate travel area from Mainland China. People from more than 170 countries and territories may come to Hong Kong visa-free for visits ranging from seven (7) to 180 days. In broad terms, short-term visitors may conduct business negotiations and sign contracts while entering Hong Kong on a visitor visa or entry permit. Generally, foreign nationals must obtain a visa before coming to Hong Kong to live, work or invest. There are three main ways you may obtain a long-term visa and entitlement to stay in Hong Kong: • Obtain a work visa as employee; • Obtain a visa through investment in the Capital Investment Entrant Scheme; or • Obtain a dependent visa. Work Visas/Permits for Employees If a company has established operations in Hong Kong and wishes to employ people from overseas, the company must demonstrate that the proposed employee has special skills, knowledge or experience that are not readily available in Hong Kong. The proposed employee will need a sponsor (the person or enterprise offering employment) and must complete a visa application form (available from the Immigration Department website). This form can then be sent directly to the Immigration Department in Hong Kong, or to the nearest Chinese Embassy or Consul-General in the applicant’s home country. Capital Investment Entrant Scheme (CIES) The CIES visa is designed for people who can make a capital investment of not less than HK$ 6.5 million (approximately US$833,000) in a legitimate and approved asset class in Hong Kong. Applicants must also demonstrate that they can support themselves and their dependents without public assistance. While CIES visas are designed for those who do not intend to work in Hong Kong, holders of this visa can work or take up directorate positions in companies subject to certain criteria. Dependent Visas Persons who are successful in receiving either an employment visa or a CIES visa may also bring their spouse and dependent children to Hong Kong, provided there are sufficient funds and suitable accommodation for them. The limit on their stay is the same as that of the applicant. A spouse may apply for a dependent visa, which allows the holder to undertake almost any type of lawful employment in Hong Kong. Effectively, dependent visas are issued as a matter of course as long as the requisite relationship exists, (a couple must be legally married) and suitable proof of: i) actual dependency; and ii) evidence of the sponsor’s ability and willingness to support the dependant. 2. 9 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 27. TAB 3 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 28. CHINA (SHANGHAI) Martin Hu & Partners 19/F, Yongda International Tower 2277 Longyang Road Shanghai 201204, P. R. China +86 21 5010-1666 PHONE +86 21 5010-1222 FAX www.mhplawyer.com Contact Attorney: Martin Hu martin.hu@mhplawyer.com 3. 1 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 29. I. INTRODUCTION TO CHINA The Land China is situated in the eastern part of Asia on the west coast of the Pacific Ocean. It is the third largest country in the world, only after Canada and Russia. The distance from east to west measures over 5,200 kilometers and from north to south over 5,500 kilometers. Besides a vast land area, there are also extensive neighboring seas and numerous islands. The coastline extends more than 14,500 kilometers. More than 5,000 islands are scattered over China's vast territorial seas – the largest being Taiwan and the second largest, Hainan. The People China has a dense population of more than 1.3 billion excluding that of Hong Kong, Macau and Taiwan, accounting for 21% of the whole world’s population. There are 95 cities with a population over 1 million, including Shanghai, Beijing, Wuhan, Guangzhou, Chongqing, Nanjing and Chengdu. Chongqing is the largest with a population over 31 million. China is a melting pot with 55 ethno-linguistic groups or minority groups, differing in language, habit, religion, etc. The Language Chinese is the official language yet orally diversified in a variety of dialects. Time Zone Greenwich Mean Time (GMT) +8 hours. Unlike other large countries, China, including Hong Kong, uses only one time zone that is Time Zone 8 hours ahead of Greenwich Mean Time. That is Beijing time. 3. 2 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 30. II. CHINA’S GOVERNMENT STRUCTURE AND ECONOMIC CLIMATE Government Structure The state administrative organs of China include the central and local administrative organs. The central administrative organ is the Central People's Government, better known as the State Council. Local administrative organs are local people's governments at four levels: the provinces (including autonomous regions and centrally administered municipalities), cities and prefectures, counties and townships. At present, China is divided into 23 provinces, 5 autonomous regions (for minority groups), 4 municipalities directly under the Central Government (namely Beijing, Shanghai, Tianjin and Chongqing) and 2 special administrative regions (Hong Kong and Macau). Financial System The present banking system includes state policy banks, state-owned commercial banks, joint stock commercial banks, private commercial banks and a range of provincial level financial institutions and leasing companies. People's Bank of China and China Banking Regulatory Commission As China's central bank, the People's Bank of China (PBC) has the power to adopt monetary policies and safeguard financial stability by regulating currency circulation and credit activities and managing state treasury. China Banking Regulatory Commission, which was established in 2003, plays the role of nation's banking watchdog. Commercial banks Chinese commercial bank system consists of three parts, namely exclusively state-owned commercial banks, commercial banks and foreign-funded commercial banks, among which the exclusively state-owned banks constitute the main body of Chinese commercial bank system. Policy banks Since 1994, China has established three policy banks directly under the State Council, namely China Development Bank, Agricultural Development Bank of China and Export-Import Bank of China. The government is reorganizing policy banks and China Development Bank (CDB) has been ratified to transfer into a commercial lender. Non-bank financial organizations Chinese non-bank financial organizations mainly include Trust & Investment Corporation, Securities Company, Insurance Company, Finance Company, Leasing Company and Credit Union. Currency China’s currency is the RMB. As of June 5, 2009, the exchange rate was US$1.0=RMB 6.8334.The RMB is not yet freely convertible to foreign currency (see below). Foreign Exchange Control The State Administration of Foreign Exchange (SAFE) plays a key role in the financial system in charge of foreign exchange control. Upon approval by the SAFE, foreign-invested enterprises (FIEs) may open foreign exchange special account and foreign exchange settlement account with the bank, located in the registration place and designated by the SAFE. The Chinese currency RMB is not yet freely convertible to foreign currency. However, it is convertible for ordinary international trading accounts settlement, post-tax net profit of the FIEs and post-tax legitimate income of foreign staff, upon application to the foreign exchange deposit bank. Foreign-invested enterprises (FIEs) may also settle 3. 3 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 31. and sell the foreign exchange to the designated bank for ordinary business expenses. Industries Infrastructure China has invested heavily in building infrastructure, covering railway, expressway, harbor and airway, and a comprehensive national transportation network has already been formed and is in progressive evolution. Leading Industries China has built up an independent, complete and technology-oriented industrial system with leading sectors in steel, machinery, energy, space & air, textile and light industry, well deserving the credit of “global manufacturing factory”. Market Economy Status Chinese economists point out that China acquired full market economy status in 2004, either by the economic principles of the Western countries or from national economic development conditions. So far, 97 WTO members have recognized China as a full market economy but the country's major trade partners including the USA, the EU and Japan - have yet to do so. Reform of State-Owned Enterprises (SOE) The state-owned sector plays a leading role in national economy despite the rapid development of private and overseas-funded economic entities since 1978 when China began to reform and open to the outside world. SOEs have transformed into companies with a formal legal business structure and many have been able to list on stock exchanges. Since 1998, a policy of “release the small and grasp the big” has been successfully executed with over half of SOEs closed down in the following five years. The consequent redundancy of some 14 million employees has been properly handled with unemployment and welfare programs, which shift the burden of compensation from enterprises to the government. The State-owned Assets Supervision and Administration Commission of the State Council (SASAC) were created in 2003 to exercise rights of ownership and supervise the operation of state assets. Restructuring of SOEs and property right transactions provide good opportunities for transnational companies to develop in China. Private Sector The private sector has been responsible for a considerable part of the value-added produced by the non-farm business sector and a major part of all export for the past few years. In addition to high productivity and profitability, the changes in government policies are accountable for the rapid growth of the private sector. First, the state export monopoly was removed and the small and medium sized enterprises were granted export license. Then fundamental changes were made as amendment to the Constitution in 2004, to re-identify the status of private entrepreneurs, encouraged the development of non-state sector and particularly protect private property from arbitrary seizure. In 2005, regulations that prevented privately owned companies from entry into a number of sectors of the economy such as infrastructure, public utilities and financial services were abolished. Finally, the revised Company Law, effective as of January 1, 2006, also provides more flexibilities and autonomy for individuals to run business. 3. 4 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 32. III. INVESTMENT CLIMATE AND FOREIGN TRADE Scale of Foreign Investment As of 2007, China had 632,348 foreign invested enterprises, with total actual use of foreign investment of US$ 790.75 billion. There are over 190 countries and regions investing in China and 480 transnational companies among top Fortune 500 Companies investing in China. The economy is expected to do relatively well in trying times and remain sustainable for the next decade due to a profound evolution of economic policies, particularly in the areas of allocation of capital, labor mobility, urbanization, reform of SOEs and creation of an upgraded framework for development of the private sector of the economy. Types of Foreign Investment There are two types of foreign investment: direct investment and indirect investment. Direct investment refers to the establishment of equity joint ventures (EJV), contractual joint ventures (CJV) or wholly foreign-owned enterprises (WFOE) and joint exploitation (for maritime and overland oil joint exploitation). Indirect foreign investment includes overseas loans and commodity credit. Overseas loans mainly consist of three forms: loans from foreign governments and international financial institutions; export credit of foreign countries or commercial loans; bonds or stocks issued abroad. Commodity credit includes compensation trade, processing of imported materials, assembling of imported parts and components as well as leasing trade. Some common investment vehicles include: Equity Joint Ventures (“EJV”) EJV has been the most common of the foreign investment vehicles in China. It is a limited liability legal entity and conforms substantially to international custom and practice. However, its utilization is declining due to the minority shareholders’ veto power over certain issues. Cooperative Joint Ventures (“CJV”) CJV takes two forms: a non-legal person CJV that defines the rights and obligations of each party in compliance with the contract entered into by the parties, and a legal person CJV that limits the liability of each party to their respective capital contribution, similar to EJV to certain extent. In general, CJV is more flexible than EJV. Wholly Foreign-Owned Enterprises (“WFOE”) WFOE used to have more restrictions in terms of the business fields where foreign investment can be made. After China’s entry into WTO, however, such restrictions have been gradually phased out and as such, WFOE is becoming popular among foreign investors. Qualified Foreign Institutional Investor (QFII) Scheme Since the enactment of certain rules and regulations in late 2002, China opened its US$ 460 billion of domestic stock market to selected overseas investors. The RMB-denominated A Shares, which are not tradable in foreign currency in contrast with B Shares, which are tradable in either US dollars or Hong Kong dollars, account for 99 percent of the stock traded on China’s two exchanges in Shanghai and Shenzhen. A Shares are now available for foreign investment without having to establish a PRC business vehicle, subject to certain restrictions on repatriating profits and principal. M&A Conversion of Domestic Enterprises Foreign investors may also acquire existing domestic enterprises in order to enter the Chinese market. Cross-border M&A is becoming more popular these days and can take forms of either share acquisition or asset acquisition. 3. 5 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 33. Foreign Investment Policy China currently classifies foreign investment fields into four categories: encouraged, permitted, restricted and prohibited categories. The government publishes foreign investment guidelines including a detailed list of encouraged, restricted and prohibited foreign investment categories. Those not listed in the published guidelines fall into permitted fields. Industries classified as encouraged categories enjoy certain import duty and tax preferential treatment, such as energy-saving technology and high-technology development. Industries classified as restricted category usually requires joint venture with Chinese partner or majority control by Chinese partner, such as the development and production of grains (including potatoes), cotton, and oil-seed (the Chinese party will be the controlling party), processing and export of the logs of precious varieties of trees (EJV and CJV only). 3. 6 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 34. IV. CORPORATE AND BUSINESS STRUCTURES Legal Framework The deepening of reform of SOEs and growing importance of the private sector in the economy, together with relevant economic and social factors, necessitate further modernization of the present legal framework for business. At present China is to an unprecedented extent endeavoring to prepare or has already enacted a series of laws including revised Company Law, Securities Law, revised Bankruptcy Law, Budget Law and Property’s Right Law together with relevant detailed measures. Company Law The Company Law is the primary piece of legislation governing companies established in China. The revised Company Law came into effect on January 1, 2006 and it gives primacy to corporate autonomy rather than government control. The revised Company Law represents a substantial move by the Chinese government towards inuring the corporate governance under regulation of the inherent rules of market economy and rising up to the standards of western counterparts. Foreign investors looking to incorporate in China should note that, although they are required to comply with the Chinese laws and regulations specific to foreign-invested companies, they will also be subject to the Company Law to the extent that there is no clear stipulation in the regulations specific to foreign-invested companies. Foreign Investment Laws and Regulations In addition to the Company Law, some other Chinese laws and regulations specifically apply to foreign-invested enterprises in China. These specific foreign investment laws and regulations mainly include equity joint venture law, co-operative joint venture law, wholly foreign-owned enterprise law and their detailed implementation regulations as well as M&A regulations and foreign investment tax law. Dispute Resolution Chinese court system has four levels, namely the Supreme Court, the High Court, the Intermediate Court and the Grassroots Court. Litigation is initiated at different levels of court according to certain criteria such as the amount of money of the subject matter and the nature of the case. Cases are usually adjudicated at two levels of court, which means cases can be appealed to only one higher level of court. A party in dispute may submit the dispute to an arbitration institution for resolution pursuant to a valid pre-existing arbitration agreement or arbitration clause contained in a contract. The China International Economic and Trade Arbitration Commission (CIETAC) is the most prestigious arbitration institution in China, which is headquartered in Beijing and has branches in Shanghai and Shenzhen. Parties to contracts related to foreign investment and trading shall have the right to choose the arbitration place and applicable arbitration rules. China signed the Convention on the Recognition and Enforcement of Foreign Arbitral Awards (New York Convention) in 1986. Therefore, as a general principle, the arbitral award made by a foreign arbitral tribunal the country of which is a Contracting State to the Convention will be recognized and enforced by Chinese courts. 3. 7 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 35. V. TAXATION Income Tax Income tax on enterprises with foreign investment and on foreign enterprises is levied on the income from production, business operations and other sources by EJVs, CJVs, and WFOEs and by foreign enterprises within the territory of the PRC. The Enterprise Income Tax Law (EIT Law) and Implementation Rules (Rules) were introduced in 2007. The unified tax rate levied by the EIT Law on all domestic and foreign enterprises is 25%. Meanwhile, the law provides tax exemptions and reductions. For example, income tax is levied on enterprises at a reduced rate on investment in state-appointed and state-fostered projects. Value-added Tax (VAT) Value-added tax is a type of circulation tax imposed on organizations and individuals engaging in sale of goods or provision of processing and repair labor services or importation of goods in China. The rate pattern of VAT is a basic rate (17%), with a lower rate (13%) applying to agricultural produce, energy products and etc., and a zero rate (0%)for export commodities. Business Tax All foreign invested enterprises shall pay business tax according to the Provisional Regulations of the People’s Republic of China on Business Tax. Business tax is a tax levied on the amount of sales revenue gained from sales, within the territory of China, of taxable services, real estate or transferred intangible assets. Business tax is applied to differently operated industries according to different tax categories and different rates of tax. Tax Audit Under current legislation, all foreign-invested enterprises and representative offices must be audited on an annual basis. This statutory requirement has to be met prior to business license renewal every year. 3. 8 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 36. VI. VISA AND REGISTRATION REQUIREMENTS Application The tourist should present his/her passport, a completed visa application form (The People's Republic of China Visa Application Form) and one recent passport photo (black and white or color) to the local Chinese embassy. The tourist should apply for his/her visa about one month in advance before departure, although it should only take a week for the visa to be processed. Visas may be obtained more quickly but additional fees may be charged. The cost of the visa will depend on each country and the valid period and type of visa for which the tourist is applying. Contact the local Chinese Embassy/Consulate for details. Types of Visas The most common types of visas include L for travel/family visit visa, F for business, D for resident, G for transit, X/F for student and Z for working. Extension of Visa The tourist can obtain an extension by applying to the Public Security Office in any Chinese town. Chinese visa officers usually demand evidence to support the application, including air ticket, or a letter from a Chinese company or relative or friend. Please note that a tourist visa is only extendable up to a maximum of 90 days, after which the tourist must leave the country. Other types of visa may also be extended with different requirements. 3. 9 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 37. TAB 4 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 38. INDIA J. Sagar Associates 84 E, C-6 Lane, Sainik Farms New Delhi 110 062 India +91-11-2955-2714 PHONE +91-11-2955-2717 FAX www.jsalaw.com Contacts: Jyoti Sagar jyoti@jsalaw.com Sajai Singh sajai@jsalaw.com 4. 1 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 39. I. INTRODUCTION TO INDIA The Land India is regarded as one of the most diverse countries in the world in terms of its topography. It is surrounded by the Himalayas in the north, the great Indian Plains in the central parts and the Deccan Plateau in the southern parts of the country. In terms of its size, India is the seventh largest country in the world, occupying 3.29 million square kilometers. The Indian peninsula is surrounded by the Arabian Sea, the Bay of Bengal and the Indian Ocean on the west, east and south, respectively. The national capital is situated in New Delhi. The climate of the country is primarily sub-tropical, although temperate climate is observed in some of the northern parts of the country. The People With a population of over 1 billion people, India is the second most populated country in the world after China, and is likely to become the most populated country in the world by 2030. The country has a high population density of 324 persons/square kilometer and a literacy rate of 64.84%. Agriculture remains as the single largest occupation of the people of India. Nearly 70% of the people depend on agriculture for their livelihood. Nevertheless, Indians have made great strides in the Information Technology sector and have obtained global recognition in this field. With increasing education levels, the number of people in the services and manufacturing sectors is increasing rapidly. The Language India is a multilingual society with 18 national languages spoken, each with a different script. Hindi is the language of the majority of people (38%). English is the preferred business language, as well as the language of the courts and for inter-State Government communication. The wide usage of the English language has been a boon for India in attracting offshore outsourcing. Time Zone Greenwich Mean Time (GMT) +5-1/2 hours. India has not adopted daylight saving time. Despite its size, India uses standard time countrywide throughout the year. 4. 2 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 40. II. GOVERNMENT STRUCTURE AND ECONOMIC CLIMATE Government Structure The tumultuous political times in South Asia have rattled the political systems of many countries of the region in the recent past. However, the strong political and administrative structure in India has helped the country in remaining stable even in difficult times. In accordance with its Constitution, India is a “sovereign, socialist, secular, democratic republic,” having a federal form of government divided into three distinct but interrelated branches: Legislature, Executive and Judiciary. Article 50 of the Constitution stipulates the separation of the Judiciary from the Executive. India has a fairly strong federal government that exercises national sovereignty – defense, foreign affairs, currency and communications – while State governments manage law and order, education and public health. The head of the Republic is the President, elected for a 5- year term by an electoral college consisting of lawmakers at the national and State levels. Each State is headed by a Governor appointed by the President on the advice of the Prime Minister. In addition to the 29 States, there are seven directly ruled Union Territories. The Executive backbone of the country is the Indian Administrative Service. As required by the Constitution, elections to Central and States legislatures are held regularly. The leader of the largest group in the legislature is invited by the Republic’s President or the State’s Governor to form the government, which is then required to secure the legislature’s vote of confidence. The head of a State government is the Chief Minister; that of the Federal government is the Prime Minister. The Legislature comprises the bicameral Federal Parliament (Sansad), which consists of a directly elected People’s Assembly (Lok Sabha) and the Council of States (Rajya Sabha) whose members are elected by State Legislative Assemblies. In the 543-member Lok Sabha, a typical deputy represents a constituency of over a million voters, a reflection of India’s overpopulation. India has an independent judicial system, with the Supreme Court being the apex judicial authority, having wide discretionary powers to hear special appeals on any matter from any court (other than those of the armed services) and discharges the function of a court of record and supervises every High Court. The High Court is the highest court in the State judicial system, and serves as a court of record exercising original and appellate jurisdiction and has original jurisdiction on revenue matters. Lower Courts include judicial districts, district courts, courts of civil jurisdiction, sub-district (munsif) courts, courts of subordinate judges and people’s courts (lok adalats). Financial System India’s financial system comprises banks (public, private and foreign) and financial institutions that have kept pace with the growing needs of corporate and other customers. The Reserve Bank of India (the “RBI”,) India’s Central Bank, essentially regulates and supervises the Indian financial system. In addition, it formulates, implements and monitors the Monetary Policy of India and prescribes Exchange Control norms to facilitate external trade and payment and promote orderly development and maintenance of the foreign exchange market in India. Commercial banks, co-operative banks and regional rural banks broadly make up the banking system in India. The financial capital of India, Mumbai, compliments other major financial centers of the region like Singapore and Hong Kong. The strong fundamentals and regulatory framework of the Indian banking industry have been instrumental in protecting the Indian banks from major financial disasters as have been seen in many western countries in the recent past. 4. 3 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 41. Type of Economy India stands as a vibrant and diverse country whose economy is rapidly integrating with the world economy. The business environment in India is considered conducive for achieving high levels of sustainable growth. A transition can be seen from an agrarian economy to one based on industry and commerce. General Economic Trends: GDP at current prices (2007-2008): Rs. US$ 1.16 trillion GDP growth rate (2007-2008): 9% Inflation rate measured by WPI: 4.5% (average during financial year 2007-2008) Forex Reserves: US$ 251.9 billion (March 2009) The Market The Indian economy is expected to continue growing at the rate of 5% or more until 2050, when it will become the world’s fourth largest economy as per a study conducted by Golman Sachs. The size and growth potential of the Indian market has attracted foreign investors to India. India is experiencing rapid urbanization, explosion of the electronic media, advancement in education, increasing domestic and foreign travel and changing nature and composition of expenditures. An increase in the number of households headed by salary earners, professionals and businesspersons and the emergence of a thriving consumer finance business are expected to continue the consumerism boom. Rural areas, where about 72% of Indians live, have witnessed rapid market growth in recent times, driven largely by enhanced agricultural productivity, income redistribution and the inroads made by the audio-visual media. Currency The Rupee is India’s monetary unit. RBI authorizes a person to deal in foreign exchange or foreign securities in the capacity of an authorized dealer (AD), moneychanger or offshore banking unit. A person purchasing foreign exchange from an AD is required to provide a declaration of intended use; if not used for the purpose specified or used for restricted activities, it would violate the Foreign Exchange Management Act, 1999 (FEMA). FEMA provides for full convertibility on capital and current account transactions for non-residents, while it subjects residents to non-convertibility on capital account transactions only. The objective of the Government is to promote an orderly development and maintenance of the foreign exchange market in India. Leading Industries Power The Government of India undertakes both generation and distribution activities. Involvement of State governments in the power industry is through state electricity boards (SEBs), originally established as integrated monopolies to carry out generation and interstate transmission and distribution. While most of the industry is under Government ownership, private sector’s participation is increasing in generation, distribution and transmission. The main sources of power generation in India are thermal power, hydroelectric power and power generated by renewable sources of energy. Nuclear power is presently the fourth largest source of power in India, and is likely to receive a great impetus in the near future after the recent signing of the Indo-U.S. civilian nuclear agreement. Mining The Government’s Department of Mines, Ministry of Mines and Minerals regulates and promotes the mining sector, other than coal, lignite, petroleum and natural gas and atomic minerals. The latter minerals come under the purview of independent government departments. 4. 4 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.

- 42. Information Technology The information technology (IT) industry in India comprises software services, manufacture and trading of computers and computer peripherals and IT enabled services (ITES). The Indian ITES sector has captive back office operations of large multinational companies, third party vendors and joint ventures. Telecommunications Telecommunications is one of the fastest growing industries in India and includes telecom services and equipment – including fixed line telephony, mobile telephony, national long-distance services, international long distance services, Internet and broadband services, Very Small Apparatus terminal (VSAT) services and other value-added services such as radio paging. India has the third largest network of telephone lines in the world, after China and U.S.A. The phenomenal growth rate of the telecommunications industry in India (at 45%) makes it the highest growth rate in the world. Entertainment The entertainment industry is broadly categorized into films, television, television software, music, radio and live entertainment and event management. The Indian film industry is the largest in the world, even larger than Hollywood! Financial Services This industry can be broadly divided into banking, capital markets (asset management/mutual funds and portfolio investors), insurance companies and non-banking financial intermediaries/institutions. Health Care & Life Sciences Drugs and Pharmaceuticals, Biotechnology, Healthcare institutions and Medical Equipment suppliers constitute this industry. Infrastructure Roads, Ports and Airports constitute the highest growth areas in this sector. India is a fast-growing market in both passenger and cargo traffic. 4. 5 Doing Business in the Asia/Pacific Rim Region © 2009 State Capital Group Member law firms practice independently and not in a relationship for the joint practice of law.