Customer Acquisition Cost and Lifetime Value (CAC & LTV)

- 1. Customer Acquisition Cost and Lifetime Value (CAC & LTV) June 24, 2014

- 2. Who’s Red Granite? (…and why should you listen to us?) 1. Founded in 2011 by Chris Arndt 2. The Entrepreneur’s Finance Team 3. Focus on financials AND key metrics that affect the financials 4. Proud Associate Members of 1871!

- 3. What’s CAC?

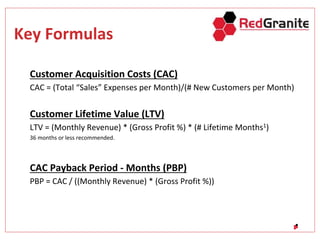

- 4. Key Formulas Customer Acquisition Costs (CAC) CAC = (Total “Sales” Expenses per Month)/(# New Customers per Month) Customer Lifetime Value (LTV) LTV = (Monthly Revenue) * (Gross Profit %) * (# Lifetime Months1) 36 months or less recommended. CAC Payback Period - Months (PBP) PBP = CAC / ((Monthly Revenue) * (Gross Profit %))

- 5. Key Ratios LTV/CAC >= 3x CAC Payback <= 12 months

- 6. Time to Quit ☹ Image Source: forentrepreneurs.com

- 7. Happy Dance! ☺ Image Source: forentrepreneurs.com

- 8. CAC & LTV Illustrated Image Source: blog.asmartbear.com

- 9. Which PBP is Better?

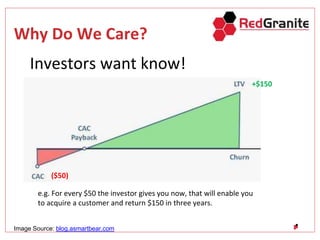

- 10. Why Do We Care?

- 11. Why Do We Care? Investors want know! ($50) +$150 e.g. For every $50 the investor gives you now, that will enable you to acquire a customer and return $150 in three years. Image Source: blog.asmartbear.com

- 12. Why Do We Care? Bootstrapped? Save yourself from ramen noodles! Working Capital Cycle A faster PBP means more profit cycles in a shorter time period. CAC CAC Payback $ Profit

- 13. Why Do We Care? A faster CAC Payback let’s you keep more equity Less money will be needed from investors so your ownership won’t be as diluted.

- 14. FAQ’s

- 15. FAQ: What’s in CAC? A: More than you think! ▪ Paid advertising ▪ PR ▪ Sales people base & commission ▪ Sales manager ▪ Free trial support and hosting ▪ On-boarding costs

- 16. FAQ: Customer lifetime? Q: How can I guess the number of months of my customers’ lifetime when my site has only been live for two months? A: In month two, start looking at the churn of the customers that signed-up in month one (i.e. Month 1 Cohort). Keep track of the churn for the Month 1 Cohort in the third and subsequent months as well. Then use this formula… # Months Lifetime = 1 / (Avg. Monthly % Customer Churn)

- 17. FAQ: Shorten PBP? Q: I now understand that the shorter the CAC Payback period the better, but how can I actually improve upon my current PBP? A: Two options: either reduce the CAC or increase the monthly profit margin for the customer. Continued on next slide…

- 18. FAQ: Shorten PBP? (cont.) Image Source: forentrepreneurs.com

- 19. Other

- 20. Advanced Topics 1. Cohort analysis to see improvements over time 1. Customer segmenting to identify most profitable segments

- 21. Questions? Chris Arndt, Founder ▪ Email: carndt@redgranitellc.com ▪ LinkedIn: http://www.linkedin.com/in/chrisarndt Web: www.redgranitellc.com