CALSTART Electric Utility Fleet Managers Conference

- 1. Climate Change, Carbon Footprint How Fleets Can Prepare for and Prosper from Change Clean Transportation Solutions SM Advanced Transportation Technologies Bill Van Amburg Senior Vice President EUFMC Conference – Williamsburg, VA June 23, 2009

- 2. Don’t Blink: the World is Rapidly Changing Same challenges, different conclusions “… the first car driven by a child born today could be powered by hydrogen, and pollution-free.” President Bush, 2003 "We asked ourselves, 'Is it likely in the next 10 or 15, 20 years that we will covert to a hydrogen car economy?' The answer, we felt, was 'no.'" Energy Secty Chu, 2009

- 3. Plan Beyond the Roller Coaster Fuel prices are increasing over time and it is unlikely we will “go back” $2.70

- 4. Start with the Basics Keep these thoughts in your mind: Burning one gallon of diesel releases more than 22 pounds of CO2 into the atmosphere Burning one gallon of gasoline releases nearly 20 pounds of CO2 into the atmosphere

- 5. Find Combination Strategies Air Quality Climate Change Energy Security We must find solutions that address all three competing needs Integrated Solutions Needed There is no one “Silver Bullet” solution

- 6. Agenda Recent Activities and Opportunities in Transportation Trends & Drivers of Change in Transportation The Fuel, Emissions and Climate Challenge – and Opportunity Your “Fuel” Footprint is Your Carbon Footprint – Addressing Your Fleet The Four Steps Biofuel Questions and Status Technology & Fuel Options Summary

- 7. Mission Statement CALSTART is a unique national, non-profit, member-supported organization dedicated to the growth of an advanced transportation technologies industry that will: Create high-quality jobs; Clean the air; Reduce dependence on foreign oil; and Prevent global warming

- 8. CALSTART: A Strategic Broker for Advanced Transportation National and International in Project Areas 2009 130+ Worldwide Member Network 4 Offices in US Four focus areas: Tech Commercialization Fleet, Port Consulting Industry Services Policy Development

- 9. Unified Hybrid Industry in DC CALSTART, HTUF and 9 major companies – including all truck makers - outline status, benefits and needs of hybrid trucks Joint call for federal assistance for: Purchase incentives Broader fleet demonstrations and Long term R&D investment

- 10. Briefing on Status, Benefits and Needs of Industry Rep. Roscoe Bartlett (MD) Rep. Charlie Dent (PA) from left: Bill Van Amburg, CALSTART Paul Skalny, US Army-NAC Victoria Mills, Environmental Defense Fund John Formisano, FedEx Express Marcy Lowe, Duke University CGGC

- 11. Duke Study Finds “Strategic US Opportunity” in Hybrid Tech Hybrid technology represents a competitive advantage to the US Other countries have worked on the technology – the pace of change and momentum is currently highest in US The hybrid truck supply chain now represents a growing national industry – touching jobs in more than 30 states Duke study shows there are regional “hot spots” for technology manufacturers and their suppliers – can benefit regions hurt by economy Industry shows great promise for creating green energy jobs Further commercialization requires government support, partnership to assist truck purchase and develop next technologies

- 12. Duke Hybrid Industry Map

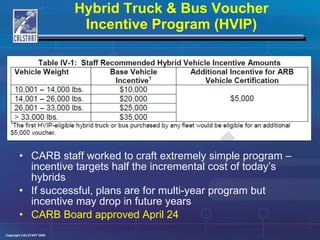

- 13. Hybrid Truck & Bus Voucher Incentive Program (HVIP) Under AQIP 09/10 funds, CARB proposing a simplified purchase voucher for hybrids $25M in funds Fleets would qualify for voucher via purchase order; paid on delivery of and payment for truck(s) Voucher reduces purchase price of hybrid (no waiting) Reduces incremental cost by ~50%

- 14. CARB staff worked to craft extremely simple program – incentive targets half the incremental cost of today’s hybrids If successful, plans are for multi-year program but incentive may drop in future years CARB Board approved April 24 Hybrid Truck & Bus Voucher Incentive Program (HVIP)

- 15. Federal Hybrid Truck Tax Credit Extension Proposal - DRAFT * Tax Credit capped at 20,000 per Original Equipment Manufacturer over life of the credit More valuable credits offered to less vehicles to drive early adoption Larger amounts at heaviest weights because of great difficulty of reaching these efficiency levels; fuel efficiency beyond aerodynamics and tires Amounts correspond to roughly half the incremental cost of current tech Provisional: Recommended by Incentives WG – being discussed with policy makers $30,000 $20,000 50% $25,000 $15,000 40% $35,000 $20,000 $10,000 30% $30,000 $25,000 33,000 – 66,000 lb 14,001 – 33,000 lb $45,000 $40,000 $35,000 >66,001 lb truck 10,001 – 14,000 lb 20% 15% 10% Demonstrated Fuel Economy Gain Vehicle Weight

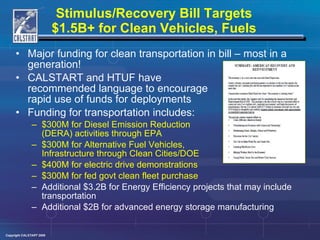

- 16. Stimulus/Recovery Bill Targets $1.5B+ for Clean Vehicles, Fuels Major funding for clean transportation in bill – most in a generation! CALSTART and HTUF have recommended language to encourage rapid use of funds for deployments Funding for transportation includes: $300M for Diesel Emission Reduction (DERA) activities through EPA $300M for Alternative Fuel Vehicles, Infrastructure through Clean Cities/DOE $400M for electric drive demonstrations $300M for fed govt clean fleet purchase Additional $3.2B for Energy Efficiency projects that may include transportation Additional $2B for advanced energy storage manufacturing

- 17. Trends & Drivers of Change ENERGY SECURITY: FUEL SUPPLY AND COSTS – Traditional fuel supplies/refining capacity barely meeting current demand The need for biofuels is increasing but so are questions about their impacts/benefits RFS2 rules at federal level – Biofuels grow as fuel blends; 2nd gen biofuels emerging Rise of non-traditional hydrocarbons possible – but have serious impacts Regional fuel variation and choice becoming more prevalent Alternatives becoming economically competitive with petroleum but have own costs GLOBAL WARMING – Push to reduce GHGs intensifying and pushing fuel economy – focus and urgency increasing in 2009 EPA now says GHG is a health danger – can regulate under clean air act California CO2 tailpipe rules likely to be approved by new EPA CAFÉ revised to match CA CO2 rules: CAFÉ for med & heavy trucks under study States/communities remain GHG leaders – Calif AB 32 increases momentum Several climate change bills now in Congress (Summer 2009) – law in 2010? Energy efficiency reduces GHG impact; Fuel switching and blending reduces GHG impact; Modal split (transit and rail) has long term role EMISSIONS REDUCTIONS – World population increasingly urban and world emission standards increasingly move to CA/Euro standards EU and US may align in 2012-2015 timeline Fine particulates (nano particles) will be of increasing concern from combustion Diesel fuel still challenged in dirtiest regions (ports, Southern California)

- 18. Peak Oil Advocates : ‘Cheap Gas Won’t Last’ Despite declining prices and rising inventories, peak oil advocates warn the relief is temporary EIA predicted a 4% drop in US consumption for 2008 Energy experts* suggest a substantial run up in prices around 2015 Demand in growing economies threatens to exceed the location of new reserves Some experts think non-OPEC production is peaking now Excess production capability has dropped from 10 million bbl/day in the 1980s to around 2 million bbl/day in 2008-2009 Graphic: Energy Tribune * Including Peter Wells (who consults with Toyota) and Charley Maxwell (senior energy analyist at Weeden & Co.) Energy Tribune, 11/26/08 http://www.energytribune.com/articles.cfm?aid=1032

- 19. Sources of GHG Transportation is biggest GHG source in CA, but it is also one third of all US emissions

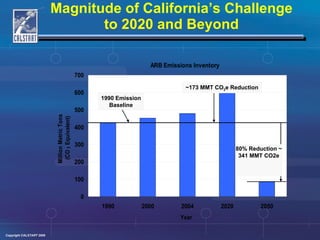

- 20. Magnitude of California’s Challenge to 2020 and Beyond 80% Reduction ~ 341 MMT CO2e 1990 Emission Baseline ~173 MMT CO 2 e Reduction 80% Reduction ~341 MMT CO 2 e

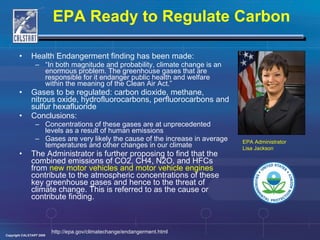

- 21. EPA Ready to Regulate Carbon Health Endangerment finding has been made: “ In both magnitude and probability, climate change is an enormous problem. The greenhouse gases that are responsible for it endanger public health and welfare within the meaning of the Clean Air Act.” Gases to be regulated: carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons and sulfur hexafluoride Conclusions: Concentrations of these gases are at unprecedented levels as a result of human emissions Gases are very likely the cause of the increase in average temperatures and other changes in our climate The Administrator is further proposing to find that the combined emissions of CO2, CH4, N2O, and HFCs from new motor vehicles and motor vehicle engines contribute to the atmospheric concentrations of these key greenhouse gases and hence to the threat of climate change. This is referred to as the cause or contribute finding. http://epa.gov/climatechange/endangerment.html EPA Administrator Lisa Jackson

- 22. Federal Auto Standards May 19, 2009: President Obama announces national fuel efficiency policy modeled after CA Pavley standards Photo: New York Times Light duty standards for MY 2012-2016: 250 gCO2/mile by 2016 (roughly 35.5 mpg) Win for the environment: national standard will lead to greater emission reductions than CA waiver Win for industry: single standard preferable to patchwork of standards

- 23. EPA’s Light Duty GHG Standard Average of 250 g CO2/mile by 2016 Standards have same endpoint as CA Pavley standards. 5% annual rate of improvement Still higher than limits in many other developed countries.

- 24. EU to Cut Auto Emissions 18% by 2015 In December, EU representatives agreed to require cutting auto GHG emissions Change from voluntary compliance to EU-wide mandate is very significant Target is reduction of 18% by 2015 New maximum standard = 130g CO2/km by 2012 Fines for non-compliance considered stiff, up to $119 per vehicle Environmentalists disappointed by automaker influence, affecting timeline, emission requirements Plan must pass Euro Parliament vote Returers, 12/02/08

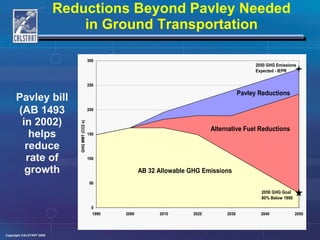

- 25. Reductions Beyond Pavley Needed in Ground Transportation Pavley bill (AB 1493 in 2002) helps reduce rate of growth

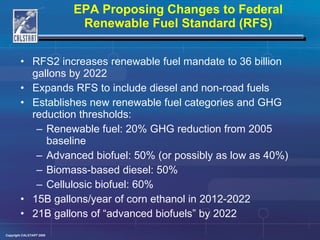

- 26. EPA Proposing Changes to Federal Renewable Fuel Standard (RFS) RFS2 increases renewable fuel mandate to 36 billion gallons by 2022 Expands RFS to include diesel and non-road fuels Establishes new renewable fuel categories and GHG reduction thresholds: Renewable fuel: 20% GHG reduction from 2005 baseline Advanced biofuel: 50% (or possibly as low as 40%) Biomass-based diesel: 50% Cellulosic biofuel: 60% 15B gallons/year of corn ethanol in 2012-2022 21B gallons of “advanced biofuels” by 2022

- 27. Low Carbon Fuel Standard California approves measure that will require reduction in “carbon intensity” of fuels Requires reduction in carbon levels in fuel by 10% over next decade Reduce levels in fuel by blending, formulation, selling other fuels 16 other states may follow rule; federal government considering similar measure First generation biofuels (biodiesel, ethanol) have raised big questions due to “indirect” emissions – emissions from changes in land cover world wide to produce them Regulators expect new generation of fuels to come from feedstocks such as algae, wood, agricultural waste, switchgrass, and even from municipal solid waste

- 28. Where Are Biofuels Headed? Still very much an active debate Today’s biofuels are stepping stones to next generation fuels and feedstocks – we believe you must start somewhere to make progress! Biofuels in future that do not compete with food and wilderness for fertile land can avoid indirect GHG emissions (Alex Farrell, UC Berkeley Energy & Resources Group) Wastes and residues, agriculture seasonal mix, wastelands crops – more R&D

- 29. The Fuel Landscape is Changing Broader look at full impacts on well-to-wheels basis underway, including indirect, food competition and land use impacts Renewable and Appropriate Energy Lab, UC Berkeley

- 30. Graphical Depiction of Indirect Emissions Source: Alex Farrell, UC Berkeley

- 31. Adjusted Carbon Intensity Values for Gasoline & Substitutes Carbon intensity values are measured in grams CO2e/MJ 21 pathways completed 33.09 – 61.83 2.3 0 76.10 – 142.20 Hydrogen (4 pathways – liquid & compressed, various feedstocks) 3 1 1 1 EER 34.90 - 41.37 0 104.70 – 124.10 Electricity (2 pathways – CA average and renewable mix) 73.40 47 27.40 Ethanol from Sugarcane (1 pathway – Brazilian) 77.40 – 105.10 30 47.44 – 75.10 Ethanol from corn (11 pathways, both midwest and CA) 95.86 -96.09 0 95.86 – 96.09 Gasoline (3 pathways) Total ILUC Direct Fuel Pathway

- 32. Adjusted Carbon Intensity Values for Diesel & Substitutes Carbon intensity values are measured in grams CO2e/MJ 10 pathways completed 40.05 – 70.84 1.9 0 76.10 – 142.20 Hydrogen (4 pathways – liquid & compressed, various feedstocks) 2.7 0.9 0.9 1 EER 38.78 – 45.96 0 104.70 - 124.10 Electricity (2 pathways – CA average and renewable mix) 12.51 0 11.26 Compressed Natural Gas (landfill gas, or biomethane) 75.22 – 75.56 0 67.70 – 68.0 Compressed Natural Gas (CA and N. American, compressed in CA) 94.71 0 94.71 Diesel (1 pathway: average ULSD) Total ILUC Direct Fuel Pathway

- 33. Energy Economy Ratios from CARB’s Proposed Regulation Source: California Air Resources Board 2.7

- 34. Climate Change Bills are Moving Ahead Climate Change and Energy bills moving – though Senate signals a desire to slow pace Bills moving in committee House Energy Chair Henry Waxman targets Memorial Day for energy, GHG bills Barbara Boxer is leading climate change legislation on the Senate side Speaker Pelosi advocates an ‘all-in-one’ approach that handles energy issues and global warming concerns in comprehensive legislation – Senate so far separates issues Photo: Syracuse.com US News & World Report, 03/11/09, http://www.usnews.com/articles/news/energy/2009/03/11/on-climate-change-henry-waxman-wants-congress-to-act-now.html

- 35. Reducing Your Footprint for Independence, Carbon and Savings Step 1: Baseline your fleet Step 2: Learn your options for reduction Step 3: Compare your options to your fleet mix, fleet geography, operational profile Step 4: Outline your reduction plan pathways – your shift in fleet technology, fuel and operations over several years

- 36. Your Fuel and Carbon Footprint Step 1: Baseline your fleet You need to know your starting point Keep it simple: Easiest way to do that is to measure your yearly fuel burn 22 pounds of CO2 for every gallon of diesel burned; 20 pounds for every gallon of gasoline; do the math! Consider joining a climate registry to document your progress

- 37. Your Fuel and Carbon Footprint Step 2: Know your options for reduction Reduce your fuel burn Increased efficiency: hybrids; cylinder on demand Eliminate idling Downsize vehicle platform sizes where possible Reduce your fuel carbon intensity Fuel switching: biofuel blends; natural gas Fuel world is changing and feedstock and process for the fuel matter Change your operations Take vehicles off the road (electronic meter reading) Dispatch best-suited vehicles to job Reduce vehicle miles traveled (VMT)

- 38. Your Fuel and Carbon Footprint Step 3: Compare your options to your fleet mix, fleet geography, operational profile E85 may be a great option in Midwest, propane better in Texas, natural gas in California – look for match with growing infrastructure and production Place the correct technology and fuel into the best use in your fleet; fine tune your fleet Be aware of regional air quality needs – not all fuels work everywhere Look for funding that can support your strategy in your different regions EPA; air districts; DERA; Clean Cities; state and regional incentives

- 39. Your Fuel and Carbon Footprint Step 4: Outline your reduction plan pathways – your shift in fleet technology, fuel and operations over several years Look for solutions where expansion of capacity and/or improvements will take place Vehicle fuel economy, hybrids just at beginning of improvements Despite shake up in biofuels today, indicators are that present-day ethanol – while imperfect – will be a stepping stone to more efficient alcohol production Biodiesel production will broaden to renewable diesel blends, broader feedstocks Direct fuel replacement also possible (bio-derived gasoline) but it is still in infancy

- 40. Options Landscape Examples Fuels Technologies Ethanol : avail now; regional; process and feedstock improving; small CO2 gain now but growing Propane : vehicle models available; special fueling; small CO2 gains Biodiesel : production growing; feedstock concerns; CO2 gains; NOx issue Renewable diesel : emerging option Plug-in hybrid : retrofit in LD; first LD products 09/10; first pilot products in M/HD now; business case still uncertain based on fuel prices; strong policy support Hydrogen : longer term option; transit; blending Electric : small vehicle niche; LD products possible 10/11; MD products emerging for delivery/ urban niche Fuel Cell : still early demos; limited testing 09-11; time to products? Hybrid : models expanding in LD; first OEM production in MD/HD; 20-50% carbon/fuel reduction Strategies Platform/engine size reduction: “right-sizing” Dispatch changes, work changes to reduce vehicle use Routing efficiencies: VMT reduction Natural gas : limited infrastructure but building around niches; CO2 benefits up to 21%; Biomethane for green NG; HCNG blending Adv. Engine : cylinder on demand; improved combustion; start-stop; turbocharging

- 41. Ethanol Significant growth in production slowing due to fuel price, economy – but can off set oil today Clear limits seen on corn-based production Questions growing: land impact; energy use; limits Other feedstocks and advanced production (such as cellulosic) are in active development – second generation production methods have already started Lower in energy than gasoline but can be priced competitively – though its cost rising too Lower GHG impact than gasoline; lower for most emissions – low % blends a concern in some areas Infrastructure growing quickly but still limited; most flex fuel vehicles still do not use E-85!

- 42. Natural Gas Re-emergence of natural gas – port locations big promoters for clean air Increasing production in medium and heavy-duty (Kenworth, Freightliner, Mack), new and advanced engines out Mostly domestic and a lower carbon alternative – particularly biomethane Also increasing in cost; may become increasingly imported Niches remain strong: transit, refuse, now ports Infrastructure still key barrier for many, though fuel partners available; strongest growth in regions with good infrastructure Light-duty OEM: Honda Civic GX in US; Can get natural gas upfits for several light and medium duty vehicles; low volume manufacturers still producing vehicles and kits

- 43. VW Shows Turbo/Super Charged CNG Concept Vehicle Touran TSI EcoFuel debuts at Geneva Motor Show Features dual charging via turbocharger and supercharger When paired with a standard 6-speed transmission, fuel consumption is 4.8 kilograms of natural gas per 100 kilometers CO2 is approximately 129g/km Meets Euro-5 standards Has four natural gas tanks and an auxiliary gasoline tank Range of 370 kms using natural gas fuel only, and a maximum range of 520 kms Photo: Media.Photobucket.com CALSTART NewsNotes, 03/03/09

- 44. New NG Engines, Trucks Available California Air Resources Board (CARB) and U.S. Environmental Protection Agency (EPA) certified Westport’s High Pressure Direct Injection (HPDI) technology adapted to the 2007 Cummins ISX heavy-duty engine Kenworth expands to LNG vehicles with T800 LBG trucks Mfg at Renton WA in 2009 Trucks to feature Cummins ISX, Westport’s HPDI fuel systems Freightliner producing CNG version of its Business Class M2 106 truck To contain Cummins Westport 8.9 -liter L Gas Plus engine Mack bring natural gas refuse truck back to market Use Cummins Westport ISL G natural gas engine

- 45. AT&T’s Push Has Big Impact for CNG As part of AT&T’s ambitious plan to expand the company’s alt fuel fleet, CNG vehicles will be a big part of that expansion Out of $565 million, $350 million is estimated for CNG vehicles Out of 15,000 alt fuel vehicles, 8,000 are anticipated to be CNG vehicles AT&T’s alt fuel fleet is expected to include more than 15,000 vehicles by 2019 The alternative-fuel vehicles are expected to offer Up to nearly 40% improvement in fuel economy and Up to 29% in greenhouse gas emission reductions Photo: Examiner.com http://www.att.com/gen/press-room?pid =4800&cdvn= news&newsarticleid =26598

- 46. UPS Expands CNG Fleet with 300 New Trucks With the addition of 300 new CNG trucks, UPS has the largest private fleet of alternative fuel vehicles 1,819 alt fuel fleet covers 1,100 CNG fueled vehicles, including 800 trucks Alt fuel trucks reduce petroleum consumption, reduce fuel costs Newest CNG trucks expected to reduce emissions by 20 percent compared to cleanest diesel engines currently available CALSTART NewsNotes, 03/02/09 Photo: UPS

- 47. First Trucks to Run on Biomethane In California In 2009 Hilarides Dairy powers trucks on renewable biomethane from dairy operation Has potential to generate 650 diesel gallon equivalents (DGEs) from farm CALSTART prepared a federal stimulus and AB 118 proposal to jump-start the biomethane industry CBG Truck In Tulare Tulare Covered Lagoon Producing CBG

- 48. Biodiesel and Renewable Diesel Volumes still low but growing – some impact from feedstock switching to produce ethanol Unintended consequences: feedstock matters – some bio-oil production is damaging, raises questions about benefits Most OEMs accepting increased biodiesel use – fuel spec has now been developed for B1-B20 levels Fuel quality improving but varies greatly – about 90% of biodiesel meets specs (diversity of feedstock & processes) Little or no performance drop off from conventional diesel; some operating concerns (such as cold weather) Reduced greenhouse gases and particulates from diesel, but questions over increased NOx for biodiesel; more research needed

- 49. Solazyme, Chevron Work on Biofuels from Algae Chevron announces partnership with company that extracts oils from algae, San Francisco-based Solazyme Solazyme also unveils what it says is first-of-its-kind algae-derived biodiesel, “Soladiesel” Says Soladiesel has successfully been roadtested in “factory standard automobile for long distances” Solazyme has developed an industrial scale fermentation process currently capable of producing thousands of gallons of algal oil using standard industrial equipment Solazyme plans to dramatically expand production in 2008 Mercedes Benz C320 runs on algae-derived biodiesel Source: Solazyme

- 50. Electric Technology Possible re-emergence of Electric Vehicles! No US OEM passenger car product YET – though Nissan and Mitsubishi say 2010 for EV, Daimler may produce and now GM and Chrysler announce products Also: medium-duty all-electric trucks becoming available in North America from two UK companies: Smith Trucks and Modec; others entering space for light/medium duty trucks Improving battery technology partly thanks to hybrids (NiMH, lithium ion) Still expensive, range limited: but energy storage costs dropping steadily Increased petroleum prices makes an improving business case Criteria and GHG emissions very low; varies depending on fuel source of power plants, but very good in California

- 51. EVs: Several Possible GM Volt EREV: Extended Range Electric Vehicle - Pre-production model unveiled Sept 16, 2008 On track to late 2010 first sales? Combines battery-electric drive system (goal: 40 mile EV range) with a small gasoline engine generator that runs when batteries get low to power car Chrysler surprises industry, announces will produce electric vehicle(s) by 2010 Showcases several potential models using current and new platforms Nissan looking at 2010 EVs using lithium-ion Mitsubishi Motors working on an EV with PSA Peugeot Citroen; plans for iMEV by 2010

- 52. VW, Toshiba Team on EV Volkswagen AG signs with Toshiba to develop new EV technology High-density battery systems will be the focus of the partnership VW and Toshiba also have relationships with Sanyo focusing on nickel- metal hydride New partnership focused on lithium-ion path VW’s drive train experience will be complemented by Toshiba’s battery and system expertise 02/18/09 Environmental Leader http://www.environmentalleader.com/2009/02/18/volkswagen-teams-with-toshiba-to-sell-electric-car-by-2012/ Photo: FuelEfficientVehicles.org

- 53. Smith to Build More Electric Vans, Trucks in US Smith Electric Vehicles launches new production facility in US in Kansas City region Smith also unveils the US version of the Newton, which has a top speed of 50, range of over 100 miles and a payload capacity of up to 16,280 lbs and is available in US truck Classes 5 through 7 Unveils first all-electric utility bucket truck based on Newton at EUFMC 2009 in partnership with Altec, testing with PG&E Will also build electric Ford Transit Connect vehicle in Kansas City

- 54. Electric Delivery Vans Deployed by FedEx in UK Electric propulsion systems can work in selected niches in truck market Cost of batteries remains a challenge

- 55. E-Trucks Headed to Port of LA Delivery of heavy-duty all-electric trucks begins at Los Angeles port Partnership with the Port of Los Angeles, South Coast Air Quality Management District and a small manufacturer, Balqon Corp. Nautilus E30 all-battery electric vehicle for work within the port, and for short hauls outside Range of 40-60 miles per charge, depending on load Charging time of three hours on 230v/480v chargers Unique partnership involved R&D funding from the port, and future royalty arrangement paid to port Photo: Los Angeles Times 02/25/09 Los Angeles Times, http://www.latimes.com/business/la-fi-electric-truck25-2009feb25,0,6411132.story

- 56. Hybrid Technology Perfect storm for hybrids? Incremental cost in cars dropping as fuel price rises – but fuel cost roller coaster, economy slowing market 10-years experience in cars: decent and now accelerating market penetration (3%) but still dominated by two automakers (Toyota and Honda); GM presence growing First products entering market for medium- and heavy-duty vehicles First focus is urban work trucks: Class 4-8 refuse, utility, delivery Class 8 drayage, line-haul and construction equipment are in prototype or near pre-production Hybrids can multiply benefits when combined with low carbon fuels (biofuels, NG, electricity – plug-in)

- 57. Small Hybrids: Heating Up With Honda expanding its activity in hybrids, Toyota announces new models Honda’s new entry, the small Insight hybrid, is tallying up brisk sales in Japan with a $20,000 price point A hybrid version of the smaller Fit compact is planned Toyota announces a small hybrid based on the Yaris, to expand its’ hybrid range downward into smaller, more affordable vehicles Technology from the company’s flagship Prius vehicle has been migrating upline, into larger and more expensive vehicles Market date for new Yaris hybrid uncertain, possibly for the 2011 lineup Automotive News, 03/25/09, http://www.autonews.com/article/20090325/ANA02/903259986 Honda Insight Photo: Jalopnik.com Toyota Yaris Photo: AutoChannel.com

- 58. What is the status of medium and heavy duty hybrids? Hybrid Truck Technology is Here

- 59. Hybrid Truck Technology is Critical to the U.S. Hybridization provides significant immediate benefits ENERGY SECURITY : Reduced fuel consumption (30-50%) EMISSIONS/CLIMATE : Reduced criteria (NOx) and GHG emissions (10-60%) One of few strategies to improve on 2010 emissions reductions ECONOMY : North American leadership in technology, manufacturing Fuel consumption reduction from HTUF field testing data Reductions come just from hybrid system, no additional after-treatment CO2 reductions closely tracked fuel reduction percentages Emissions/fuel reduction from HTUF dyno testing data performed at SwRI

- 60. Hybrid Truck Users Forum (HTUF) Successful CALSTART program with U.S. Army, DOE, fleet users, truck makers and industry partners has spurred rapid, early demonstration and production of truck hybrids User driven process involving > 80 fleets with > 1 million trucks Highly unique model has focused on developing user demand (market pull) All Major Truck Makers and System Suppliers involved (partial list)

- 61. HTUF National Conference 2008 World’s biggest hybrid truck and bus ride and drive Vehicles from Navistar, Freightliner, FCCC, Kenworth, Peterbilt, Azure Dynamics, Bosch Rexroth, Eaton, Dueco-Odyne, Hino, E-One, Arvin Meritor, Crane Carrier, NABI, JAMMA vehicle

- 62. Timeline to Commercialization: Hybrid Trucks Now Entering Market Test prototypes and systems Field pilot assessments (10-50 vehicles) Assembly line builds up to 100+ Initial commercial volumes – still high incremental cost TOOLS: R&D Support Pre-Production Deployment Support (HTUF) Purchase Incentives Hybrid introduction 10 years behind cars but industry is real, momentum growing Development Pre-Production Production Intent Early Production

- 63. Hybrid Medium Duty Trucks Expand to Both New & Heavier Applications Navistar extends weight class from 23,500 to 37,000 lbs (into Class 8 range) 6 engine horsepower/ torque combinations Showcases hybrids for tree-trimming, wrecker, dump, crane and beverage Peterbilt adds dump truck variant to cargo and utility body Freightliner shows M2 delivery and beverage bodies, new bus and RV platforms Posi Plus shows tandem axle utility truck to 40,000 lbs

- 64. Hybrid Tractors Emerging for Regional Heavy Applications Kenworth unveils Class 7/8 hybrid tractor: 54,500 lbs GCVW Peterbilt has similar model – also continuing to test larger Class 8 heavy-duty OTR tractor Navistar unveils Class 7/8 hybrid tractor targeting beverage trailer applications Freightliner announces will pilot build a hybrid tractor Dec 08 Above: Kenworth Class 8 tractor; Below: Navistar Class 7/8 tractor Left: Freightliner Class 7/8 tractor pilot; right, Peterbilt Class 7/8 tractor

- 65. Wal-Mart Class 8 Demo ArvinMeritor – Navistar deliver unique dual-mode hybrid design for testing Electric drive at lower speeds (up to 48 mph), blended mode at higher speeds Can greatly reduce fuel use, cut idle and give zero emission at ports, urban driving Wal-Mart testing this truck and several Peterbilt-Eaton trucks in line-haul and regional heavy haul applications Wal-Mart committed to doubling its fleet fuel efficiency by 2015

- 66. Electric “Reefer” Units Emerging with Hybrid Systems Navistar, Freightliner and Azure show electric refrigeration units – “reefers” and cold plates - combined with hybrids or energy storage Further reduces fuel burn, eliminates additional engine, cuts criteria and carbon emissions

- 67. Class 4/5 Offerings Expanding Azure Dynamics expands to multiple body offerings from base Ford E-Series hybrid chassis Adds relationships with nine truck body companies for shuttle bus, panel van and other applications Adding “LEEP” Lift system to Class 4/5 pick-up chassis Engine off lift operation via stored energy Can charge while driving Electric AC optional

- 68. Hydraulic Hybrid Vehicles Extremely promising technology Benefits: possible lower cost than electric technology; excellent at high power, demanding duty cycles; robust component base Weight, system integration and control are key issues; farther behind in development curve Most focus is on medium and heavy-duty vehicles Major US manufacturers are leaders in this technology

- 69. Freightliner CC, Parker Hannifin Show Hydraulic Hybrid Team of Freightliner and Parker Hannifin introduce a new hydraulic hybrid platform Features Cummins ISB 2007 engine, a Parker hydraulic- propulsion system, no transmission needed Available in limited volume for now Power recovery is critical Hydraulic hybrid recovers and reuses up to 70% of energy during the braking process Photo: Freightliner Custom Chassis CALSTART NewsNote 03/05/09 For more information, visit www.freightlinerchassis.com

- 70. Pre-Production – Hydraulic Refuse Truck Peterbilt - Eaton in final stages of field pilot testing of hydraulic hybrid refuse truck (63,000 pound GVWR) Pre-production in 2007/2008 – Production in 2009 Eaton to use same pump/accumulator design for hydraulic shuttle bus Fuel savings in 10-30% range – carbon reductions track fuel reductions closely Peterbilt Hybrid Refuse Chassis

- 71. Hydraulic Competition Expands Crane Carrier shows refuse collection truck with Bosch Rexroth HRB parallel hydraulic hybrid system Will enter testing with NY City Sanitation as part of HTUF Refuse Working Group deployment May 2009 Bosch also shows “series” hydraulic hybrid system in advanced military prototype now entering testing Left: Bosch Rexroth Hydrostatic Regenerative Braking (HRB) system for refuse and heavy applications Right: Bosch Rexroth series hydraulic military truck prototype

- 72. Hybrid Trucks: at “Tipping Point” but Need Help to Speed Early Market Hybrid truck production volumes are still too low in early market to realize price reductions Current payback period too long even with big fuel/maintenance savings However: modest volumes can move prices to within business cases needs: Need 3,000 - 5,000 unit sales/year Incentives can provide big kick-start to this number by helping drive volume up in targeted effort Federal, state level Need correct incentives to bridge gap between today’s price and prices at higher volumes Federal tax credits well-intentioned but not best tool for commercial fleets: too low, doesn’t help most fleets Hybrids moving from development to production

- 73. Plug-in Hybrid Electric Vehicles Lots of attention and interest in PHEVs among policy makers, environmentalists All current PHEVs are conversions from small firms – very few on road No OEM production dates set – though increasingly “hinted at”: GM 2009 for Saturn, 2010 for Volt? Benefits: increased fuel economy, GHG reductions, possible zero emission driving Cost and life cycle of energy storage (batteries) are prime limiter, along with infrastructure network (can plug at home) Most focus is on passenger cars – however while trucks offer additional challenges, there may be possible business case benefits before cars

- 74. Toyota vs. GM vs. Ford: Working on Plug-In Hybrid Electric Vehicles Toyota Motor Company is testing plug-in hybrid electric vehicles, first Japanese automaker to research and road test the technology General Motors has taken the lead in developing rechargeable vehicles – “Volt” pre-production car unveiled Sept 08; possible for 2010 GM may have Saturn Vue PHEV by late 2009 Ford in PHEV testing partnership with Southern California Edison Ford continues to study a PHEV concept “Extend,” seeks trademark Ford PHEV Escape

- 75. Bright Plug-in Van Prototype Shown “ IDEA” prototype from Bright Automotive brings together light-weight body/chassis with hybrid driveline, plug in battery pack 30 miles possible all-electric; blended mode can see 100 mpg in urban delivery duty Front conventional engine, rear electric drive axle; 10 kwh Li-ion batteries in proof of concept unit

- 76. Plug in Hybrid Trucks Emerge: Several Utility Industry Variants Commercial work trucks show potential for PHEV functionality before cars Extra energy storage boosts idle reduction/work site engine-off ops Diesel fuel costs cause rapid review of potential business case Energy Storage costs still high Dueco-Odyne first into market Plug-in hybrid utility bucket trucks PHEV “digger-derrick” version 6/08, a higher power-demand work truck Trucks carry 35 kwh of energy storage (lead-acid, 3000 pounds) for long work site ops PHEV underground compressor truck Eaton has two prototypes Class 6/7 variant based on production truck, system Class 5 “Superduty” prototype with EPRI Dueco-Odyne plug-in “material handler” (above), “digger-derrick” (middle), compressor truck (bottom). Plug-in port Eaton PHEV utility trucks

- 77. Plug-in Energy Storage Bodies New variant of an older idea – uses stored energy to operate lift, tools at work site Separate from and does not change conventional driveline Fuel savings and idle reduction benefits

- 78. Hydrogen / Fuel Cell Technology Longer term technology development effort US DOE halts all vehicle-based fuel cell development funding – focuses on stationary applications California legislature proposing to eliminate funding for hydrogen refueling infrastructure A few hundred vehicles worldwide for technical assessment to date Original launch dates (2010) no longer on table Will likely see in heavy transit buses before passenger cars Costs still extremely high, though significant technical advancement has occurred Significant benefit in near term from blending with natural gas (NOx reductions) In medium term, stationary/distributed generation; fork lifts; Auxiliary power units (APUs) for system power, idle reduction, range extension on some vehicles/equipment Longer term, possible primary power for centrally refueled vehicles/equipment

- 79. Nissan Testing Next-Gen FCV New Nissan FC stack is smaller, more powerful than previous technology 25% smaller 1.4 times power output – 130kw from 90kw Fuel cell vehicle began cold-weather testing in Feb. Smaller fuel cell will use 50 percent less platinum, cutting manufacturing costs significantly Previous generation (announced August 2008) touted 35 percent reduction in platinum CALSTART NewsNotes, 02/26/09

- 80. Develop a Reduction Plan Technology/ Fuel/ Operational Application/ Region LD Urban Support LD Regional Vehicle Reduce vehicle count through process improvement Right size platforms to job needs NEVs for on-site transport Mix of natural gas or propane vehicles in regions with infrastructure Hybrids for urban driving Some hybrids for stop and go driving E85/Flexfuel for longer distance if fuel available Right size platforms to job needs MD Work Vehicle - Urban Mix of hybrids for urban, stop-go or high idle work Right size platforms dispatched for job needs Natural gas or propane vehicles in cities with infrastructure Biodiesel blends (check spec and source) MD Work Vehicle - Rural Right size platforms dispatched for job needs Biodiesel blends (check spec and source) Chassis energy storage for work site idle Natural gas or propane vehicles in cities with infrastructure

- 81. Summary: Fleets, Climate Change Don’t Blink Plan Beyond the Roller Coaster Start with the Basics Find Combination Strategies No more “one size fits all” answers Should establish multi-year reduction plans Best simple metric is petroleum use – how much do you use now, and how can you reduce it? Tools: Low carbon fuels – this is a moving target More efficient vehicles (many ways to achieve) More efficient operations and systems LOOK FOR COMBINATION STRATEGIES (efficiency+fuels+operations)

- 82. Clean Transportation Solutions SM www.calstart.org For info contact: Bill Van Amburg (626) 744-5600 [email_address] www.htuf.org Advanced Transportation Technologies SM

Editor's Notes

- Gasoline’s Cheap Again, But Peak Oil Still Looms Large Energy Tribune November 26, 2008 http://www.energytribune.com/articles.cfm?aid=1032 Given the news from the past few months, it borders on the foolhardy to preach about the looming dangers of peak oil. Doing so seems a bit like warning about the possibility of drought while standing without an umbrella in the midst of a torrential downpour. Indeed, the price of oil has plummeted from its July peak of $145 per barrel (for West Texas Intermediate at Cushing, Oklahoma) to under $80 by early October. The price collapse coincides with a big drop in oil demand. The Energy Information Administration now expects that U.S. consumption will fall by 4 percent this year. And credit-card issuer MasterCard estimates that gasoline demand during the first week in October fell by 9.5 percent compared to the year-earlier period. Indeed, it appears that the demand destruction associated with the rapid run-up in oil prices has for the moment obliterated all talk of oil going to $200 in the next year or two, or three. Over the longer term, the key question appears obvious: will demand destruction take the “peak” out of peak oil? (I’ll come back to that in a moment.) The prospect of $50 oil looms. OPEC is in disarray. The Saudis have made it clear that they will defend the price that suits them, not the prices that Hugo Chávez wants. After all, they are spending tens of billions of dollars to bring on new spare capacity while the Venezuelans have essentially decided to sit on their hands and plunder PDVSA for as much cash as they can. Further, according to the latest projections from the International Energy Agency, Saudi Arabia will add 1.78 million barrels per day of new capacity by 2013. The Saudis are eager to get a return on their multi-billion dollar investments in the fields at Shaybah, Nuayyim, and Khurais. All of these factors have led to a stock price collapse for essentially all oil and natural gas companies. Between mid-September and early October, shares in Chesapeake Energy, one of the biggest U.S. independents, fell to less than $17, from $40. During that same time, Exxon Mobil fell to just over $62, from $75. And yet – and yet – some of the best minds in the energy business insist that this latest bear market is only baiting the trap for a huge price run-up that will likely come around 2015. And – despite all of the current turmoil – they may end up being right. Before going further, I readily admit that I have, for several years, had a rather flippant attitude toward peak oil. When asked my opinion, I would generally respond: so what? My rationale being, we will only know that we’ve hit peak oil when the event has actually passed. And second, regardless of prices or supplies, we will only move away from oil when something else comes along that is cheaper/cleaner/more convenient, or all of the above. Thus, I’ve long felt that all the fretting about peak oil has been largely misplaced and that even if the peak were imminent, there would be little that the U.S. or any other country could do to avoid the difficult energy transitions that are looming. That said, I’ve spent a good bit of time over the past couple of months talking to two of the sharpest analysts in the oil business: Peter Wells and Charley Maxwell. And both are convinced that peak oil is real, it’s coming, and the pain that will accompany its arrival will be severe. Who are these guys? Wells has a Ph.D. in geology and three decades of experience in the global oil industry. He has worked extensively in the Middle East, Russia, West Africa, and Europe, and is an expert on the oil politics and geology of Iran and Iraq. He spent 12 years with Shell International, 4 with BP, and 6 with LASMO, the British oil and gas independent, where he led the company’s business development efforts in the Mideast, including Iran. In 2001, he helped start Neftex, a British oil consulting firm. Since 2005, he has been a consultant to Toyota, developing world oil supply and price forecasting models. I have known Wells since 2005 and heard him speak several times. His presentation on September 23 during a “sustainable mobility” seminar sponsored by Toyota in Portland, Oregon motivated me to write this piece. Maxwell has been in the oil business for more than 50 years, beginning with a stint at Mobil Oil in 1957. In 1968 he began working as an energy securities analyst. Since 1999, he has been a senior energy analyst at Weeden & Co., a brokerage in Greenwich, Connecticut. Now 76 and showing no signs of slowing down, Maxwell has become one of the most quoted analysts in the business. In the September 8 issue of Barron’s, Maxwell predicted that due to ongoing demand growth, and lackluster supply additions that include the new Saudi fields at Khurais, Shaybah, and Nuayyim, the price of oil will reach about $300 per barrel by 2015. I have heard Maxwell speak several times since 2002, and talked to him at length on September 25, when he summarized his view of the future by saying, “We have gone on an unsustainable energy course.” Of course, there is a multitude of other analysts who’ve been studying peak oil and making dire predictions, including Colin Campbell and Kenneth Deffeyes. What sets Wells apart from the pack of alarmists is that he has done the deep and dirty analysis of individual field production data. In fact, Wells utilized field output info supplied by Denver-based consulting firm I.H.S., which owns one of the world’s most extensive oilfield databases. This same field-by-field data was utilized in 2006 by an I.H.S. subsidiary, Cambridge Energy Research Associates (CERA), to come up with their study on future global oil production, which claimed that global output could reach an “undulating plateau” of 130 million barrels per day by 2030. The study concluded that the peak oil argument “is based on faulty analysis which could, if accepted, distort critical policy and investment decisions and cloud the debate over the energy future.” The study also claimed that the remaining global oil resource base is about 3.74 trillion barrels. Wells took the same data and came up with a far different conclusion. He estimates that global liquids output will peak in about 2015 at no more than 100 million barrels per day. And that’s when things will get very interesting for automakers like Toyota and, of course, for the rest of us. Wells’s work on peak oil began in 2003, which led him to publish a piece in the Oil and Gas Journal in 2004. Looking back at that initial work, Wells says that his prediction at the time was that the peak in global liquids output would likely come at a level of about 95 to 110 million barrels per day, somewhere between 2020 and 2035, “depending on OPEC reserves and OPEC’s willingness/ability to invest in new capacity.” When he began his consulting work for Toyota in 2005, Wells decided on a “bottom up” approach using the I.H.S. database and Neftex’s own data for the U.S. He then disaggregated all of the potential sources of oil – conventional crude, NGLs, tar sands, shale oil, biofuels, coal-to-liquids, etc. – so that he could look at their growth potential on a segment-by-segment basis. The I.H.S. data included field-by-field information as well as production information for the former Soviet Union, the U.S., all of the OPEC members, and all non-OPEC producers. Among his most important conclusions is that non-OPEC production is peaking this year. That is in line with analyses done by the E.I.A. and by John S. Herold Inc., on the non-OPEC producers and the major international oil companies. During his presentation in Portland, Wells said that the world is near the halfway point with regard to oil reserves. That is, we have produced about 1 trillion barrels of oil and there’s about 1 trillion barrels left to produce. But the problem is that new discoveries are not keeping pace with demand. “World peak exploration success was hit in 1960,” said Wells. Today, as countries like China, India and others grow their economies, demand is outstripping the oil industry’s ability to find new reserves to feed that demand. And that can be seen by looking at spare capacity. In the mid-1980s, the world had a peak in spare capacity, with some 10 million barrels per day of excess production capability. Predictably, that spare capacity led to a price collapse that persisted until the first years of this century, a period during which, according to Wells, the floor price of oil was largely set by the spending needs of the Saudi government. Today, and for the foreseeable future, supply and demand will be in much tighter alignment, with Wells seeing excess capacity growing slightly this year and next to about 2 MMbbl/d. The tight spare capacity exacerbates several other factors. The peak in non-OPEC production means that future production must come from OPEC members. That’s a problem. Saudi Arabia stands alone as the player with the resources, technical skill, and desire to increase production in a meaningful way in the near term. The other major OPEC members with big resources – Iran, Iraq, Venezuela, Kuwait, and Nigeria – all face political constraints that will limit their ability to add large increments of new production. Of course, if those political constraints were removed, the issue of peak oil would probably be forgotten for another 20 years or so. Wells believes that Iraq could eventually produce 7 MMbbl/d, but that level won’t be reached until at least 2020, due to the obvious obstacles: political wrangling, violence, and the lack of technically savvy personnel who can manage large new exploration and production projects. Iran, Venezuela, and Nigeria could likewise ramp up production, but all are beset by political regimes that have little interest (or ability) to dramatically increase output for the export market. Wells predicts that Iran may be able to increase its output to about 5.5 MMbbl/d, but not much beyond that. There are other impediments that go beyond the OPEC/non-OPEC divide. And readers of ET will find them familiar: lack of manpower, increasing prices of steel, and increasing costs for fabrication, purchase, and maintenance of all types of oilfield machinery and installations. Of course, none of these factors will matter if oil demand continues to fall. That doesn’t appear to be likely. Destruction Demand History shows that sharp increases in oil prices are often followed by recessions. Those recessions typically lead to sharp decreases in oil demand and therefore, prices. The most obvious example of that slackening demand occurred after the sharp price increases of the late ’70s and early ’80s. Those prices reached about $98 per barrel (in 2008 inflation-adjusted dollars) in January 1981. In 1978, U.S. oil consumption averaged 18.8 MMbbl/d. It stayed below that level until 1998, when it hit 18.9 MMbbl/d. That period of slack demand was accompanied by a sustained period of low prices. From the mid-’80s through the early ’00s, prices largely stayed under $20 and even fell as low as $9.39 per barrel ($12.57 in 2008 dollars) in December 1998. Today, we have similar slackening of demand due to higher prices. For instance, in July 2008, consumption was 19.4 MMbbl/d, substantially below the all-time high of 21.6 MMbbl/d in August 2005. Furthermore, U.S. oil demand has been falling nearly every month since December 2007. So will demand destruction take the peak out of peak oil? While it’s tempting to answer in the affirmative, several factors appear to show that it will not. Before going to those factors, let’s look at the forces that could lead to slower demand growth. They include, most obviously, a sustained recession. If world economic growth stalls for a sustained time, oil demand will continue to be slack. Second, automakers are working hard on hybrid vehicles and electric cars that could slow gasoline demand. Third, new tougher efficiency standards for U.S. automakers, combined with ongoing additions of billions of gallons of corn ethanol into the gasoline pool, will likely further dampen U.S. gasoline demand. (Note, however, that decreasing gasoline demand will not necessarily mean lower overall oil consumption, as refiners will still have to refine crude in order to produce diesel, jet fuel, and other products.) Even so, there are major differences between the current situation and the conditions that existed in the ’80s and ’90s. First and foremost is the paucity of spare production capacity to be had. Further, there are far fewer oil producers with big reserves remaining to be tapped. As shown in Table 2, 10 different oil-producing nations peaked between 1996 and 2004. Those producers will not be able to add significant amounts of new crude production to the global market. Perhaps most crucially, in decades past China and India were largely still on the sidelines. That’s no longer the case. According to an October 7 report from the E.I.A., China’s August crude oil imports jumped by 12 percent, while its oil products imports increased by 32 percent, over the year-earlier period. Of course, it’s not just China. Other developing countries, like India, Vietnam, Malaysia, and Indonesia, are also rapidly increasing their energy consumption. And much of that is focused on transportation. In July, the I.E.A. estimated that the total number of motor vehicles could increase to as many as 1.2 billion by 2013, from the current 800 million. While a very small percentage will run on electricity, natural gas, or other alternatives, the overwhelming majority will be fueled by refined petroleum products. Additionally, any future increases in OPEC output, particularly among the Persian Gulf members of the cartel, could be directed toward internal use. Energy demand in the Persian Gulf is soaring. According to the latest BP Statistical Review, in 2007, oil consumption in the Middle East grew at the same rate – 4.3 percent – as did demand in China. That increasing oil demand is a reflection, in part, of the region’s growing electricity demand. In 2007, power generation jumped by 4.7 percent in the Middle East. For comparison, power use in North America grew by 2.4 percent. And as the Middle East continues to industrialize, it’s reasonable to assume that its energy demand will continue rising apace. In 2006, Dermot Gately, an economist at New York University, analyzed the energy consumption patterns within OPEC. Last year in The Energy Journal, Gately concluded that growing demand within OPEC members could mean that 40 percent to 50 percent of the cartel’s total output could be consumed internally by 2030, thereby “constraining OPEC’s ability to increase oil exports.” Gately wrote the rest of the world “should not rely upon OPEC’s export-share of non-OPEC demand remaining constant. We might not even be able to count upon OPEC being able to maintain its level of oil exports.” Data from Saudi Arabia, the world’s biggest oil producer, backs up Gately’s thinking. According to the E.I.A., Saudi oil production increased by 8.9 percent between 1997 and 2007, growing to 10.2 MMbbl/d from 9.4 MMbbl/d. But during that same time, internal consumption jumped by 67.3 percent, to 2.31 MMbbl/d from 1.38 MMbbl/d. The result: net Saudi oil exports during that decade fell, albeit slightly, about 80,000 bbl/d. So what does all this mean? Perhaps the best single point was made by Maxwell, who said that peak oil will not be as damaging to the U.S. and other developed countries as it will to the less-developed world. Why? Because higher oil prices will mean “rationing by price.” That is, the wealthier countries and consumers will be more able to afford motor fuel that costs $5, $10, or even $15 per gallon. Consumers in poor countries will be unable to compete for fuel at those prices. And that could create serious social problems. Wells largely agrees with this outlook, saying, “Rising prices will drive demand destruction and the development of new technologies to make much better use of supply.” He goes on, explaining in a recent e-mail, “This will be painful and potentially fatal in the really poor countries of the world where access to fuel for generators, fertilizers, transport, etc., will mean risk of famine/starvation/reduction of the capacity of nations to provide basic services.” Of course, consumers have long had rationing by price for other commodities, such as Rolex watches and Mercedes cars. But the rationing of a commodity that is so crucial to modern society could have dramatic negative effects on billions of people around the world. After all, some 2.5 billion still use biomass – dung, wood, straw, etc. – for their home cooking needs. If they are completely priced out of the market for hydrocarbons, they will be destined to continue living in dire poverty. But Wells and Maxwell, and the many other analysts who have been predicting peak oil, could still be proven wrong. Given the cyclical nature of the commodities sector and the recent slump in oil prices, it is foolish to make huge bets on oil prices. Furthermore, as the ongoing financial crisis seems to prove, no one knows anything. Forecasts and models are handy, but markets – and of course, prices – are inherently chaotic. A prolonged recession or a depression could choke world oil demand to the point where a peak in production matters little. And of course, other technologies could come along that could allow significant substitution for oil. But inventors and investors have been searching for an alternative to oil for decades, and they have yet to find anything that approaches the flexibility and versatility of crude. The sudden oil price drop may result in a corresponding investment decline in alternative energy technologies. The punch line seems obvious: consumers around the globe will be relying on oil for decades to come. The unanswerable question is equally obvious: how much will that oil cost in 2015, 2020, or 2030? If Wells and Maxwell are right, and I’m increasingly inclined to believe that they are, the U.S. and the rest of the world would be well served if they began taking steps to ameliorate the potential disruptions that will come from the oil price shocks that are looming large on the horizon.

- Read some of the quotes from the whitehouse website here http://epa.gov/otaq/climate/regulations/420f09028.htm#3

- 2008-12-02 : EU To Cut Car Emissions by 18% Before 2015? DESCRIPTION - Provisional deal reached disappoints environmentalists... CONTENT - Brussels, Belgium, December 2, 2008 - European Union representatives today provisionally agreed to a compromise plan to require carmakers to cut greenhouse gas emissions by 18 percent by 2015, reports Reuters. The new requirements equate to a standard rate of no more than 130 grams of carbon dioxide per km. Environmentalists expressed concern that the automakers had too much influence on the process, thereby weakening the regulations and pushing back the timeline. "The car industry has been driving negotiations all along and EU politicians have been happy to sit in the passenger seat," Greenpeace campaigner Franziska Achterberg said. The original plan called for compliance by 2012. Even with a few more years to meet the requirements, the fees are steep for non-compliance, according to Reuters, 'Monday's deal sees tough fines of 95 euros ($119.80) per gram per car sold for automakers that miss their target by a long way, but those that overshoot by less than three grams face modest sanctions of between 5 and 25 euros.' The new rules must pass the European Parliament and all 27 nations to become law. EU adopts 10 percent mandate http://www.biodieselmagazine.com/article.jsp?article_id=3140 Feb 09, Biodiesel Magazine By Susanne Retka Schill The European Union turned voluntary goals into mandatory requirements when it adopted the Renewable Energy Directive issued by the European Parliament on Dec. 17. A 10 percent mandate for renewable content in transportation fuels is part of the new 20-20-20 plan that calls for a 20 percent cut in greenhouse gas (GHG) emissions for all energy compared with 1990 levels, a 20 percent increase in the use of renewable energy and a 20 percent cut in energy consumption through improved energy efficiency, all by 2020. Transportation fuels, including biofuels, electricity and hydrogen, are included in the 20 percent increase in renewable energy usage. The 10 percent mandate for renewable content in transportation fuels was set after much discussion over lowering the target. It replaces the voluntary targets of 5.75 percent by 2010 and 10 percent by 2020, which were adopted in a 2003 policy. In a separate Fuel Quality Directive adopted on the same day, the European Union increased its B5 standard to B7. While the Renewable Energy Directive will phase in climate change reduction goals over the next decade, the new blending standard can be implemented within the next two years by member states. The European Committee for Standardization (CEN) will publish the revised standard by June. The European Biodiesel Board said the 10 percent requirement for 2020 sends a stronger signal to Europes biodiesel industry. In times of economic recession when different sectors are hit by declining investment, the [requirement] is essential in order to pave the way for even more ambitious developments of renewable energy in the transport sector, the EBB stated. The board is projecting the requirement to create a demand for 34 million metric tons of both biodiesel and ethanol. Current European biodiesel production capacity is 16 million metric tons (4.8 billion gallons). The specific GHG reduction target for biofuels is 35 percent, compared with fossil fuels, and will be enforced in 2011. For biofuels producers that began operation in January 2008, the requirement will take effect April 1, 2013. In 2017, the requirement increases to a 50 percent reduction, and for new producers after 2017, the target will be 60 percent. Targets for GHG emission reductions include not only fossil fuels, but also biofuels, electricity and hydrogen. The new directive requires fuel suppliers to reduce GHG emissions caused by extraction or cultivation, including land-use changes, transport and distribution, processing, and the combustion of transport fuels. A separate European initiative focusing on sustainability criteria is expected to be complete by the end of 2009, giving the European Commission time to review the language for inclusion in the climate change directive. The Renewable Energy Directive offers incentives for more sustainable biofuels by allowing second-generation biofuels to be double-credited in the 10 percent target. The directive calls for the European Commission to develop a methodology to measure GHG emissions from indirect land use by 2010. http://www.biodieselmagazine.com/article.jsp?article_id=3140

- Expand this using EPA webinar slides. Look into current process. 3-5 more slides

- On Climate Change, Henry Waxman Wants Congress to Act Now The House Energy Committee chair says his panel should pass a bill to curb emissions by Memorial Day By Katherine Skiba , Amanda Ruggeri Posted March 11, 2009 US News & World Rpt http://www.usnews.com/articles/news/energy/2009/03/11/on-climate-change-henry-waxman-wants-congress-to-act-now.html He battled Big Tobacco and fought for the "nutrition facts" label now carried on food products. And he became a household name after leading hard-hitting congressional probes into tough subjects: from waste and fraud in Iraq reconstruction and steroids in baseball to the coverup of the friendly-fire death of Army Ranger Pat Tillman and the outing of CIA agent Valerie Plame. Henry Arnold Waxman, 69, is a Democrat from California who has called Congress home for half his life. He has long inspired strong views on Capitol Hill, where some regard him as one of his generation's great lawmakers and a relentless champion for the common good, even as others dismiss him as a partisan pit bull with an insatiable appetite for headlines. Either way, one thing is certain: One of his top concerns has long been global warming , and after dethroning a fellow Democrat to win the chairmanship of the House Energy and Commerce Committee, he's vowing quick action on comprehensive energy legislation containing provisions to reduce greenhouse gas emissions. If America doesn't act, Waxman warns, the country will pay a hefty price in terms of health, the environment, national security, and global instability. "We're more and more suffering the consequences of global warming and climate change, which scientists tell us could be irreversible if we don't take very serious action now," he says. Waxman wants his new committee to have a bill to curb carbon emissions prepared by April so that it can be approved by the panel before Memorial Day. President Barack Obama, he says, "has called upon us to move forward in this area. It's something that we can no longer neglect." Opponents, starting with the top Republican on the committee, argue that the science isn't proved and the timing, with countries around the world mired in recession, isn't right. House Republican Joe Barton of Texas, a former chair of the panel and now its ranking member, says a sure way to turn a severe economic downturn into a depression is to pass a "cockamamie climate change bill" that includes mandatory cap-and-trade provisions. A cap-and-trade system would involve the federal government setting yearly limits on total greenhouse gas emissions such as carbon dioxide. Washington would then allocate emission credits that could be traded, banked, or sold to meet the cap. Each credit would allow a factory or coal-fueled power plant to emit 1 ton of greenhouse gases. Advocates believe the provisions would spur private-sector innovations, keeping the United States at the cutting edge of new energy technology and energy efficiency. Opponents envision industrial jobs going overseas. Waxman, addressing critics who warn about the risk of outsourcing, says doing nothing about global warning would result in an economy worse off than it is now, with damage to public health, the environment, "even our cities, our agriculture, our forests, and our national security." As draft legislation is hammered out and congressional hearings are underway, Waxman is showing few of his cards, careful to avoid being pinned down on exactly what he'd like in a bill or how much he'd concede. Whether the full House and Senate would approve climate legislation is also unclear, particularly in an area where Democrats, some from manufacturing bases or coal-producing regions, tend to be divided by regional interests. One environmentalist tracking the debate says Waxman "is making a gamble that he can get this done quickly while Obama's popularity is high." Copenhagen. Looming next December are international climate talks in Copenhagen under the auspices of the United Nations. That's another impetus behind the Democrats' bid for swift congressional action. Environmentalists point out that a hard-fought debate in Congress that forces agreement between pro-environment and pro-business legislators could be a useful preview for the Obama administration of what kinds of proposals it might be able to offer in Denmark. Long before he was one of Congress's more ambitious environmentalists, Waxman grew up above his father's grocery store in the Watts section of Los Angeles. He went to UCLA both for college and law school and, in short order, entered the California Assembly. He won election to Congress at age 35 in 1974, when a wave of Democratic reformers won seats in the aftermath of the Watergate scandal. It was in 1992 that he first introduced global warming legislation. He is, according to loyalists, a smart and strategic thinker, dogged in his pursuit of his goals. They say his private persona is a world apart from the public man on display when questioning witnesses, as he famously did in 1994 when he (an ex-smoker, aides say) confronted tobacco executives who, under oath, denied that smoking is addictive. A longtime close friend, congressional expert Norm Ornstein, says the public may best know Waxman from the House Oversight and Government Reform Committee hearings he led. There, Ornstein says, Waxman was "this stern guy wielding the gavel, trying to see justice done," with "people quaking in their boots sitting opposite him." Fewer know the private Waxman—a "real mensch," Ornstein says, and "a gentle, warm, nice guy." Ornstein, a resident scholar at the American Enterprise Institute, salutes Waxman as not only the best lawmaker on oversight in memory but as "one of the great legislators of the 20th century." Republicans, of course, strongly disagree. "Henry is very pugnacious in his beliefs," says House Republican Steve Buyer of Indiana, who sits on the Energy and Commerce Committee. "And he has been known to rub people the wrong way because of it." Barton says Waxman has promised bipartisanship within the committee, where Democrats have 36 seats to the Republicans' 23, but has not yet delivered. Barton says GOP input would ensure a bipartisan bill that would stand the test of time, not a "political victory for the radical environmental left." Short, bald, mustachioed, Waxman looks like someone who could have been a character actor if he'd chosen that path. His L.A. district, so reliably Democratic that he coasts to re-election , takes in Beverly Hills, Malibu, Santa Monica, and other star-studded hamlets. But he shuns local galas such as the Academy Awards ceremony. "He likes to watch from home," says aide Karen Lightfoot. "He's very down to earth." It was late last year, after the elections, that Waxman successfully challenged House Democrat John Dingell of Michigan, an advocate for the automotive industry, for the chairmanship of the energy committee. The panel has sweeping jurisdiction, taking in health-care reform (another top Waxman aim), interstate and foreign commerce, nuclear regulation, consumer safety, and even the Internet. Though seniority tends to rule for chairmanships, Waxman prevailed on a 137-to-122 vote of House Democrats. Though bold, Waxman's ascension doesn't mean advancing mandatory carbon reductions through Congress will be a slam-dunk. A measure failed in the Senate last year, and recent House proposals haven't gotten traction. Waxman, though, has friends in high places: Obama in the White House and fellow Californian Nancy Pelosi in the speaker's chair in the House. Pelosi, who calls global warming the "greatest challenge of our time," hopes to hold a House vote on cap-and-trade this year. Not inconsequentially, Waxman's former chief of staff, Phil Schiliro, a savvy Hill player, was tapped by Obama to be his top congressional liaison. Whether Waxman and his allies succeed in passing climate change legislation is not a sure thing. But if past is prologue, he'll give it all he's got. And he won't give up easily. Energy Bill Should Do It All March 3, 2009 Huffington Post Speaker of the House Nancy Pelosi on Tuesday called for efforts to create energy independence and to combat climate change to be wrapped into one large energy package. It's a position she had not previously adopted, but one which has been advocated by Energy and Commerce Committee Chairman Henry Waxman, also a California Democrat. "I would like to see one bill, which is the energy bill, with the cap and trade and the grid piece," Pelosi told a gathering of reporters and liberal writers in the Capitol building. A House bill from last session, backed by Pelosi, called for 15 percent of U.S. energy production to come from renewable sources by 2020. A Pelosi spokesman said that she is calling for the establishment of a renewable energy standard in the new legislation. The cap-and-trade bill would also set a limit on carbon emissions and create a regime in which companies can trade credits that would allow emission of a certain amount of carbon. Pelosi also referenced investment in a "smart grid" that would be able to transport renewable energy back and forth from generation to use. "I think having it as one bill shows the -- I don't want to say the integrity -- the oneness of it all, how it all relates to each other," said Pelosi. Waxman spokesperson Karen Lightfoot did not return a call requesting comment.

- 2009-03-03 : VW Unveils CNG Concept at Geneva Auto Show DESCRIPTION - Says Touran TSI EcoFuel with dual charging via turbocharger and supercharger... CONTENT - Geneva, Switzerland, March 3, 2009 - Volkswagen this week unveiled five of its newest concepts, touting fuel efficiency across the company brand, reports Automotive News. Fuel efficient diesels include the Polo BlueMotion Concept (3.3 liters/100Km), the Golf BlueMotion (3.8 liters/100Km) and the Passat CC BlueTDI, which the company calls the world's cleanest diesel sedan with an SCR catalytic converter. Also making its world debut, the Touran TSI EcoFuel, a compressed natural gas-powered van which features consumption of just '4.8 kilograms of natural gas per 100 kilometers when paired with a standard 6-speed transmission (129 g/km CO2; 7-speed-DSG: 4.7 kilograms and 126 g/km CO2).'

- Source: Westport Innovations Press Release, December 4, 2007

- T&T to Deploy More Than 15,000 Alternative-Fuel Vehicles Makes Largest Commitment to Compressed Natural Gas to Date by a U.S. Company; Part of 10-Year Commitment to Spend up to $565 Million on Alternative-Fuel Vehicles Dallas, Texas, March 11, 2009 newsrelease ShareThis Through an initiative that highlights the growing demand for cleaner domestic vehicles, AT&T* today announced plans to invest up to $565 million as part of a long-term strategy to deploy more than 15,000 alternative-fuel vehicles over the next 10 years. AT&T expects to spend an estimated $350 million to purchase about 8,000 Compressed Natural Gas (CNG) vehicles and approximately $215 million to begin replacing its passenger cars with alternative-fuel models. AT&T's investment represents the largest U.S. corporate commitment to CNG vehicles to date. The new deployments will bring AT&T's alternative-fuel fleet to more than 15,000 vehicles by 2019. "AT&T and other U.S. corporations have a unique opportunity to partner with the new administration as it works to lead the country out of this economic downturn," said Randall Stephenson, chairman and chief executive officer of AT&T Inc. "While there are no easy solutions to the challenges facing our nation, this investment is a first step on our part to help boost other industries while at the same time encouraging wider use and production of efficient vehicles and domestic fuel alternatives." The Center for Automotive Research (CAR) in Ann Arbor, Mich., estimates that the new vehicles will save 49 million gallons of gasoline and reduce carbon emissions by 211,000 metric tons over the 10-year deployment period. That is equivalent to removing the emissions from more than 38,600 traditional passenger vehicles for a year. Over the next five years, AT&T will replace about 8,000 gasoline-powered service vehicles with vehicles powered by domestically available CNG. CNG vehicles are expected to emit approximately 25 percent less greenhouse gas emissions than those traditionally powered by gasoline. The vehicle chassis will be built domestically by a U.S. automotive manufacturer. AT&T will then work with domestic suppliers to convert the chassis to run on CNG. AT&T will also work with natural gas service providers to build up to 40 new CNG fueling stations across its operating region to provide the fueling infrastructure needed for the new vehicles. This investment will have a positive impact on job creation and preservation. CAR estimates that nearly 1,000 jobs will be created or saved each year for five years. As it begins to retire gasoline-powered passenger vehicles in its fleet, AT&T has committed to replacing them with alternative-fuel models. AT&T expects to replace 7,100 passenger cars over the next 10 years. The alternative-fuel vehicles, which will be used by employees in a variety of diverse work functions across AT&T's operations, are expected to offer up to a 39 percent improvement in fuel economy and to reduce greenhouse gas emissions by up to 29 percent. During the initial phase of the deployment, gasoline-powered passenger vehicles will be replaced with hybrid models. As technologies evolve, additional alternative-fuel vehicle types will be considered for inclusion. "Economic times are tough, but tough times make it even more important to look for efficient solutions," said Stephenson. "This is part of a long-term strategy that will help us continue to cut operating costs, reduce emissions in the communities we serve and make our business even more sustainable." In 2009, AT&T will deploy nearly 800 of the CNG and hybrid electric vehicles. A Green Technology insignia will make the vehicles easy to identify on the road. The new CNG/passenger vehicle commitment follows AT&T's deployment of 105 alternative-fuel vehicles in more than 30 U.S. cities in June 2008. In addition, AT&T piloted four Ford Escape hybrids, which were deployed in late 2007 in California. Through these successful pilot programs, AT&T has learned that a mix of solutions is right for its fleet and that multiple technologies can help reduce its operating costs over time, while effectively reducing its fuel consumption and impact on the environment. In addition to taking steps to make its fleet more efficient, AT&T is committed to helping its customers make their commercial fleets more efficient via a portfolio of fleet management products and services. Using AT&T's nationwide mobile broadband network and GPS partner solutions, AT&T provides fleet managers with the ability to actively manage their vehicles, increase efficiency and reduce fuel and insurance costs. Nearly all of AT&T's own technician vehicles are equipped with similar GPS capabilities, which have provided increased visibility into business operations and allowed AT&T to uncover opportunities to improve efficiency and reduce costs. To view this announcement live, please visit www.att.com /public-policy . For more information about AT&T's sustainability efforts, please visit www.att.com /sustainability . *AT&T products and services are provided or offered by subsidiaries and affiliates of AT&T Inc. under the AT&T brand and not by AT&T Inc. About AT&T AT&T Inc. (NYSE:T) is a premier communications holding company. Its subsidiaries and affiliates, AT&T operating companies, are the providers of AT&T services in the United States and around the world. Among their offerings are the world's most advanced IP-based business communications services, the nation's fastest 3G network and the best wireless coverage worldwide, and the nation's leading high speed Internet access and voice services. In domestic markets, AT&T is known for the directory publishing and advertising sales leadership of its Yellow Pages and YELLOWPAGES.COM organizations, and the AT&T brand is licensed to innovators in such fields as communications equipment. As part of their three-screen integration strategy, AT&T operating companies are expanding their TV entertainment offerings. In 2009, AT&T again ranked No. 1 in the telecommunications industry on FORTUNE® magazine's list of the World's Most Admired Companies. Additional information about AT&T Inc. and the products and services provided by AT&T subsidiaries and affiliates is available at http:// www.att.com . © 2009 AT&T Intellectual Property. All rights reserved. AT&T, the AT&T logo and all other marks contained herein are trademarks of AT&T Intellectual Property and/or AT&T affiliated companies. All other marks contained herein are the property of their respective owners. http://www.att.com/gen/press-room?pid =4800&cdvn= news&newsarticleid =26598