CBS Q4 06

- 1. CBS CORPORATION REPORTS FOURTH QUARTER AND FULL YEAR 2006 RESULTS Adjusted Results For the Fourth Quarter of 2006: Operating Income Up 14% to $759.3 Million, Net Earnings From Continuing Operations Up 44% to $464.0 Million, EPS From Continuing Operations Up 43% to $.60 Per Diluted Share Adjusted Results For the Full Year 2006: Operating Income Up 5%, Net Earnings From Continuing Operations Up 16%, EPS From Continuing Operations Up 19% Per Diluted Share Full Year 2006 Free Cash Flow Up 8% to $1.6 Billion New York, New York, February 27, 2007 – CBS Corporation (NYSE: CBS.A and CBS) today reported results for the fourth quarter and full year ended December 31, 2006. quot;CBS' first year out of the gate was a great one,quot; said Sumner Redstone, Executive Chairman, CBS Corporation. quot;Our strong performance in the fourth quarter and full year of 2006 is the result of strategic vision and operational excellence. Leslie and his team are building our existing businesses to capitalize on the digital revolution and to position CBS for continued success well into the future.quot; quot;CBS' fourth quarter results capped off a strong first year as a stand-alone company,quot; said Leslie Moonves, President and Chief Executive Officer, CBS Corporation. quot;Strong fourth quarter operating results at Television, Outdoor and Publishing helped us surpass our key financial targets for the year. Looking forward, we will continue to focus on running our core operations effectively; reshaping our portfolio into better-margin, higher- growth businesses; using the interactive opportunity to deepen and broaden our relationship with audiences; and receiving compensation for our content through retransmission consent agreements and new interactive platforms. I am confident that the Company is well positioned to deliver long-term growth, strong cash flow, and increased value for our shareholders.quot;

- 2. 2 Fourth Quarter 2006 Results For the fourth quarter of 2006, revenues of $3.9 billion increased 2% from the same quarter last year, as growth of 3% at Television, 10% at Outdoor and 7% at Publishing was partially offset by an 8% decline at Radio. Fourth quarter of 2006 operating income before depreciation and amortization (“OIBDA”) increased to $794.9 million and operating income increased to $681.5 million from losses of $8.7 billion and $8.8 billion, respectively, in 2005. Adjusted OIBDA before impairment charges for the fourth quarter of 2006 increased 11% to $872.7 million from $783.9 million and adjusted operating income increased 14% to $759.3 million from $667.5 million for the same prior-year period. These results reflected increases at Television, Outdoor and Publishing partially offset by a decline at Radio. Fourth quarter of 2006 net earnings from continuing operations increased to $335.0 million, or $.43 per diluted share, from a net loss of $9.2 billion, or a loss of $12.12 per diluted share, in 2005. Adjusted net earnings from continuing operations for the fourth quarter of 2006 increased 44% to $464.0 million from $321.5 million, and adjusted diluted earnings per share from continuing operations was up 43% to $.60 from $.42 for the same prior-year period. These results reflected higher operating results and interest income, lower interest expense and a lower effective income tax rate. Net earnings from discontinued operations of $95.6 million in the fourth quarter of 2005 reflected the operating results of Viacom Inc. prior to its separation from the Company and Paramount Parks, which was sold in June 2006. Net earnings were $335.0 million, or $.43 per diluted share, compared with a net loss of $9.1 billion, or a loss of $12.00 per diluted share, for the fourth quarter of 2005. Refer to page 4 for an explanation and a reconciliation of adjusted results to reported results. Fourth quarter free cash flow was $(14.7) million in 2006 compared to $121.6 million for the same prior-year period. In the fourth quarter of 2006, the Company’s free cash flow was reduced by a $200 million discretionary contribution to pre-fund one of its qualified pension plans.

- 3. 3 Full Year 2006 Results For the full year 2006, revenues of $14.3 billion increased 1% from the prior year, with increases of 2% at Television, 8% at Outdoor and 6% at Publishing, partially offset by a decline of 7% at Radio. Full year OIBDA and operating income of $3.0 billion and $2.6 billion, respectively, increased from losses of $6.4 billion and $6.9 billion, respectively, in 2005. Full year adjusted OIBDA before impairment charges and adjusted operating income increased 4% and 5%, respectively, from 2005, reflecting increases at Television, Outdoor and Publishing, partially offset by a decrease at Radio. Full year net earnings from continuing operations increased to $1.4 billion, or $1.79 per diluted share, in 2006 from a net loss of $8.4 billion, or a loss of $10.59 per diluted share, in 2005. Full year 2006 net earnings from continuing operations reflected tax benefits of $164.1 million primarily from the settlement of certain income tax audits. Adjusted net earnings from continuing operations increased 16% to $1.4 billion from $1.2 billion, and adjusted diluted earnings per share from continuing operations was up 19% to $1.85, compared with $1.55 for the prior year. These results reflected higher operating results and interest income, lower interest expense and a lower effective income tax rate. Net earnings from discontinued operations of $277.6 million in 2006 principally reflected the gain on the sale of Paramount Parks. Net earnings from discontinued operations of $1.3 billion in 2005 primarily reflected the operating results of Paramount Parks as well as Viacom Inc. prior to its separation from the Company. Net earnings were $1.7 billion, or $2.15 per diluted share, compared with a net loss of $7.1 billion, or a loss of $8.98 per diluted share, in 2005. Refer to page 4 for an explanation and a reconciliation of adjusted results to reported results. Full year 2006 free cash flow increased 8% to $1.6 billion from $1.5 billion in 2005, reflecting higher operating results and interest income, and lower interest expense. The Company’s free cash flow in 2006 was reduced by $250 million of discretionary contributions to pre-fund one of its qualified pension plans. Business Outlook When comparing 2007 to 2006 on an as reported basis, several factors ─ including higher expense for stock- based compensation, the sale of 39 radio stations and nine television stations, as well as the shutdown of UPN ─ will result in revenue and operating income that will be comparable to that of 2006. For the long term, the Company is poised to deliver rates of growth as follows: low single-digit growth in revenues, mid single-digit growth in operating income and high single-digit growth in earnings per share.

- 4. 4 Consolidated Adjusted Results The following table reconciles the Company’s consolidated fourth quarter and full year adjusted results to reported operating income (loss), net earnings (loss) from continuing operations and per share results included in this earnings release. Adjusted results exclude non-cash impairment charges, the impact of expensing stock- based compensation and the impact of dispositions and tax benefits primarily from the settlement of certain income tax audits. The Company believes that these adjusted results provide investors with a clearer perspective on the current underlying financial performance of the Company. Additional reconciliations of non-GAAP measures and adjusted results to reported results have been included on pages 16-20 of this earnings release. Three Months Ended Twelve Months Ended December 31, Better/ December 31, Better/ (Amounts in millions, except per share amounts) 2006 2005 (Worse)% 2006 2005 (Worse)% $ 794.9 $ (8,710.1) n/m $ 3,045.9 $ (6,429.4) n/m OIBDA Non-cash impairment charges 65.2 9,484.4 65.2 9,484.4 Stock-based compensation 12.6 4.5 64.3 17.6 UPN shutdown costs — — 24.0 — Adjustments for the separation of Former Viacom(a) — 5.1 — (10.5) $ 872.7 $ 783.9 11% $ 3,199.4 $ 3,062.1 4% Adjusted OIBDA before impairment charges $ 681.5 $ (8,826.5) n/m $ 2,606.4 $ (6,869.5) n/m Operating Income (Loss) Non-cash impairment charges 65.2 9,484.4 65.2 9,484.4 Stock-based compensation 12.6 4.5 64.3 17.6 UPN shutdown costs — — 24.0 — Adjustments for the separation of Former Viacom(a) — 5.1 — (10.5) $ 759.3 $ 667.5 14% $ 2,759.9 $ 2,622.0 5% Adjusted Operating Income Net Earnings (Loss) From Continuing $ 335.0 $ (9,232.0) n/m $ 1,382.9 $ (8,360.6) n/m Operations Non-cash impairment charges 165.6 9,546.5 165.6 9,508.4 Stock-based compensation 12.6 4.5 64.3 17.6 UPN shutdown costs — — 24.0 — Adjustments for the separation of Former Viacom(a) — 74.4 — 165.2 Net gain on sale of radio stations (24.6) — (24.6) — Tax benefits primarily from the settlement of certain income tax audits (31.2) — (164.1) — Tax impact of adjustments 6.6 (71.9) (23.5) (98.1) Adjusted Net Earnings From Continuing $ 464.0 $ 321.5 44% $ 1,424.6 $ 1,232.5 16% Operations $ .43 $ (12.12) n/m $ 1.79 $ (10.59) n/m Diluted EPS From Continuing Operations Adjusted Diluted EPS From Continuing $ .60 $ .42 43% $ 1.85 $ 1.55 19% Operations Diluted Weighted Average Number of Common 776.4 764.9 771.8 793.9 Shares Outstanding (a) Adjustments for the separation of Former Viacom reflect additional corporate expenses as a result of the separation and interest savings from a lower debt level resulting from the separation. n/m – not meaningful

- 5. 5 Segment Results The tables below present the Company’s revenues, OIBDA and operating income (loss) by segment for the three and twelve months ended December 31, 2006 and 2005 (dollars in millions). Three Months Ended Twelve Months Ended December 31, Better/ December 31, Better/ Revenues 2006 2005 (Worse)% 2006 2005 (Worse)% Television $ 2,561.0 $ 2,491.0 3% $ 9,487.1 $ 9,325.2 2% Radio 498.2 543.5 (8) 1,959.9 2,114.8 (7) Outdoor 580.6 527.4 10 2,103.4 1,949.3 8 Publishing 252.5 237.0 7 807.0 763.6 6 Eliminations (9.4) (10.0) 6 (37.2) (39.9) 7 $ 3,882.9 $ 3,788.9 2% $ 14,320.2 $14,113.0 1% Total Revenues Three Months Ended Twelve Months Ended December 31, Better/ December 31, Better/ OIBDA 2006 2005 (Worse)% 2006 2005 (Worse)% Television $ 531.5 $ 444.2 20% $ 1,947.7 $ 1,824.7 7% Radio 211.3 214.7 (2) 820.0 925.0 (11) Outdoor 166.8 147.5 13 568.0 469.9 21 Publishing 38.9 36.1 8 78.0 74.6 5 Corporate (54.2) (38.5) (41) (162.9) (120.5) (35) Residual costs (34.2) (29.7) (15) (139.7) (118.7) (18) $ 860.1 $ 774.3 11% $ 3,111.1 $ 3,055.0 2% OIBDA before impairment charges Impairment charges(a) (65.2) (9,484.4) n/m (65.2) (9,484.4) n/m $ 794.9 $ (8,710.1) n/m $ 3,045.9 $ (6,429.4) n/m Total OIBDA Three Months Ended Twelve Months Ended Better/ Better/ December 31, December 31, Operating Income (Loss) 2006 2005 (Worse)% 2006 2005 (Worse)% Television $ 487.1 $ 394.2 24% $ 1,776.2 $ 1,645.9 8% Radio 203.5 205.3 (1) 787.4 892.9 (12) Outdoor 110.9 96.4 15 351.8 260.5 35 Publishing 36.3 33.9 7 68.5 66.0 4 Corporate (56.9) (42.2) (35) (172.6) (131.7) (31) Residual costs (34.2) (29.7) (15) (139.7) (118.7) (18) $ 746.7 $ 657.9 13% $ 2,671.6 $ 2,614.9 2% OI before impairment charges Impairment charges(a) (65.2) (9,484.4) n/m (65.2) (9,484.4) n/m $ 681.5 $ (8,826.5) n/m $ 2,606.4 $ (6,869.5) n/m Total Operating Income (Loss) (a) Represents non-cash impairment charges to reduce goodwill of $65.2 million in Television for the three and twelve months ended December 31, 2006 and $9.5 billion in Television ($6.5 billion) and Radio ($3.0 billion) for the three and twelve months ended December 31, 2005. n/m – not meaningful

- 6. 6 Television (CBS Television Network and Stations, CBS Paramount Network Television, CBS Television Distribution, Showtime Networks Inc. and CSTV Networks, Inc.) For the quarter, Television revenues increased 3% to $2.6 billion from the prior year, primarily reflecting growth in television license fees and affiliate revenues partially offset by lower home entertainment revenues. Television license fees increased 45% principally due to the second-cycle cable sale of Star Trek: Voyager. Affiliate revenues increased 9% due to rate increases and subscriber growth at Showtime and the inclusion of CSTV Networks since its acquisition in January 2006. Advertising revenues increased slightly as higher political advertising sales at the television stations were primarily offset by lower revenues from the absence of UPN. Home entertainment revenues decreased 61% principally due to the switch from self-distribution in 2005 to third party distribution in 2006. Television OIBDA and operating income, in each case before impairment charges, increased 20% to $531.5 million and 24% to $487.1 million, respectively, reflecting the revenue increases noted above as well as higher profits from the mix of available titles for syndication, partially offset by higher programming costs and stock-based compensation. For the year, Television revenues increased 2% to $9.5 billion from 2005 primarily reflecting increases in television license fees and affiliate revenues partially offset by lower home entertainment and advertising revenues. Television license fees increased 26% primarily due to the 2006 availabilities of CSI: Miami, Frasier, Star Trek: Voyager and Without A Trace, partially offset by the absence of license fees from the prior year second-cycle cable renewal of Everybody Loves Raymond. Affiliate revenues increased 8% due to rate increases and subscriber growth at Showtime and the inclusion of the results of CSTV Networks since its acquisition in January 2006. Advertising revenues decreased 1% from 2005 as higher political advertising sales were more than offset by lower revenues from the absence of UPN and decreases at CBS Network. Home entertainment revenues decreased 68% principally due to the switch from self-distribution in 2005 to third party distribution in 2006. Television OIBDA and operating income, in each case before impairment charges, increased 7% to $1.9 billion and 8% to $1.8 billion, respectively, primarily reflecting the revenue increases. Television results included stock-based compensation of $31.1 million and $7.1 million for 2006 and 2005, respectively. On February 7, 2007, the Company announced that it entered into a definitive agreement to sell seven of its owned television stations in four markets for $185 million. In connection with the sale, the Company recorded a pre-tax impairment charge of $65.2 million in 2006. On February 13, 2007, the Company entered into an agreement with Liberty Media Corporation to exchange the stock of a subsidiary of the Company which holds CBS Corp.'s Green Bay television station and approximately $170 million cash, for 7.6 million shares of CBS

- 7. 7 Corp. Class B Common Stock held by Liberty Media Corporation. On February 26, 2007, the Company completed the previously announced sale of its television station in New Orleans. Radio (CBS Radio) For the quarter, Radio revenues decreased 8% to $498.2 million from $543.5 million, reflecting the impact of programming changes at 27 owned radio stations during 2006, coupled with challenges in the radio advertising marketplace. In connection with the sales of radio stations in ten of its smaller markets, Radio is currently operating under local management agreements (quot;LMAsquot;) in certain of these markets, resulting in lower revenues in the fourth quarter of 2006. On a quot;same stationquot; basis, excluding stations operating under LMA agreements as well as the stations that were sold during the fourth quarter, Radio revenues for the fourth quarter decreased 6% from the same prior-year period. OIBDA and operating income, in each case before the 2005 impairment charge of $3.0 billion, decreased 2% to $211.3 million and 1% to $203.5 million, respectively. The decreases in OIBDA and operating income were driven by the revenue decline, partially offset by lower expenses, primarily lower programming expenses, including sports programming, and lower employee-related and advertising and promotion costs. For the year, Radio revenues decreased 7% to $2.0 billion from $2.1 billion in 2005. OIBDA and operating income, in each case before the 2005 impairment charge, decreased 11% to $820.0 million and 12% to $787.4 million, respectively, reflecting the revenue decrease partially offset by lower expenses, primarily lower programming expenses, including sports programming, and lower professional fees and sales commissions. Radio results included stock-based compensation of $10.7 million and $2.3 million for 2006 and 2005, respectively. During 2006, the Company reached agreements to sell 39 radio stations in ten of its smaller markets for a total of $668 million. The sale of the five radio stations in the Buffalo market closed in December 2006, resulting in a pre-tax gain of approximately $25 million included in “Other items, net” for the fourth quarter and full year 2006. The sales of the seven radio stations in Kansas City and Columbus, and the three radio stations in Greensboro, closed in January 2007 and February 2007, respectively. Outdoor (CBS Outdoor) For the quarter, Outdoor revenues increased 10% to $580.6 million from $527.4 million primarily reflecting increases of 10% in both North America and Europe. North America delivered 11% growth in U.S. revenues, including a 12% increase in the U.S. billboards business, 4% growth in Canada and 8% growth in Mexico.

- 8. 8 European results were driven by the U.K., which reported a 17% increase in revenues. Canada and Europe benefited from favorable foreign exchange rates in the fourth quarter of 2006. In constant dollars, Outdoor revenues increased 7%, with Canada flat and Europe up 1% from the same quarter of 2005. OIBDA increased 13% to $166.8 million and operating income increased 15% to $110.9 million, reflecting the higher revenues noted above partially offset by higher transit lease costs as well as the unfavorable impact of foreign exchange on expenses. OIBDA in the fourth quarter of 2005 was reduced by approximately $16 million from the impact of hurricanes. For the year, Outdoor revenues increased 8% to $2.1 billion reflecting growth of 9% in North America, driven by U.S. billboards, and 4% in Europe. OIBDA increased 21% to $568.0 million and operating income increased 35% to $351.8 million, due to the revenue increase partially offset by higher expenses, primarily reflecting higher transit and billboard lease costs and employee-related costs as well as the unfavorable impact of foreign exchange on expenses. In addition, OIBDA in 2005 was reduced by approximately $28 million from the impact of hurricanes. Outdoor results included stock-based compensation of $3.2 million and $.6 million for 2006 and 2005, respectively. Publishing (Simon & Schuster) For the quarter, Publishing revenues increased 7% to $252.5 million from $237.0 million, reflecting sales from top-selling fourth quarter 2006 titles, including YOU: On a Diet by Michael F. Roizen and Mehmet C. Oz, Lisey’s Story by Stephen King and Joy of Cooking: 75th Anniversary Edition by Irma S. Rombauer, Marion Rombauer Becker and Ethan Becker. OIBDA increased 8% to $38.9 million from $36.1 million, and operating income increased 7% to $36.3 million from $33.9 million, reflecting the revenue increase partially offset by an increase in bad debt expense. For the year, Publishing revenues increased 6% to $807.0 million from $763.6 million in 2005 due to sales of top-selling titles as well as higher distribution fee income. OIBDA increased 5% to $78.0 million and operating income increased 4% to $68.5 million, reflecting the revenue increase partially offset by higher expenses, primarily resulting from an increase in bad debt expense and higher production, employee-related and selling and marketing costs. Publishing results included stock-based compensation of $1.9 million and $.5 million for 2006 and 2005, respectively.

- 9. 9 Corporate For the quarter, corporate expenses before depreciation increased to $54.2 million from $38.5 million and for the year, increased to $162.9 million in 2006 from $120.5 million in 2005. These increases were primarily due to higher employee-related costs, including stock-based compensation, as well as higher costs associated with operating as a stand-alone entity beginning in 2006. Corporate expenses included stock-based compensation of $17.4 million and $7.1 million for 2006 and 2005, respectively. Residual Costs Residual costs primarily include pension and postretirement benefit costs for benefit plans retained by the Company for previously divested businesses. For the quarter, residual costs increased to $34.2 million from $29.7 million for the same prior-year period and for the year, increased to $139.7 million from $118.7 million in 2005. These increases were primarily due to the recognition of higher actuarial losses which resulted from a change in the mortality rate assumption and lower than expected performance of plan assets in 2005. Interest Expense For the quarter, interest expense decreased to $140.3 million from $195.9 million for the same prior-year period and for the year, interest expense decreased to $565.5 million from $720.5 million, in each case as a result of lower debt balances in 2006. Interest Income For the quarter, interest income increased to $39.6 million from $9.7 million for the same prior-year period and for the year, interest income increased to $112.1 million from $21.3 million, in each case primarily resulting from an increase in cash and cash equivalents. Other Items, Net For the quarter, other items, net increased to $13.0 million in 2006 from a net loss of $26.7 million for the same prior-year period, primarily reflecting the 2006 net gain on the sale of radio stations and lower non-cash impairment charges to reflect other-than-temporary declines in the market values of certain of the Company’s investments. For the year, other items, net decreased to a net loss of $14.3 million from a net gain of $4.3 million, primarily due to the absence of a 2005 gain of $64.6 million on the sale of one of the Company’s investments partially offset by lower non-cash impairment charges to reflect the other-than-temporary declines in the market values of certain investments.

- 10. 10 Provision for Income Taxes For the quarter, the Company’s effective income tax rate was 27.7% versus (2.0)% for the comparable prior- year period and for the year, the effective income tax rate was 30.6% in 2006 versus (10.5)% in 2005. The effective income tax rates for the fourth quarter and full year 2006 were impacted by tax benefits primarily from the settlement of certain income tax audits of $31.2 million and $164.1 million, respectively. The effective income tax rates for the fourth quarter and full year 2005 were impacted by the non-cash impairment charge of $9.5 billion. Excluding the impact of the tax benefits primarily from the settlement of certain income tax audits and the non-cash impairment charges, the Company’s fourth quarter effective income tax rate decreased to 32.7% from 45.3% for the comparable prior-year period and for the year, the Company’s effective income tax rate decreased to 38.0% from 42.6% for the prior year, primarily reflecting lower tax amounts owed per the federal, state, local and foreign tax returns. Equity in Loss of Affiliated Companies, Net of Tax Equity in loss of affiliated companies, net of tax reflects the operating results of the Company’s equity investments and any impairment of such investments. For the fourth quarter, the Company recorded net losses of $93.9 million and $14.8 million in 2006 and 2005, respectively. For the year, the Company recorded net losses of $97.0 million and $1.5 million in 2006 and 2005, respectively. The net losses for the fourth quarter and full year 2006 principally reflected a non-cash impairment charge associated with an other-than-temporary decline in the market value of one of the Company’s investments. Discontinued Operations Net earnings from discontinued operations for the twelve months ended December 31, 2006 included the operating results and gain on the sale of Paramount Parks and losses on dispositions related to the Company’s aircraft leases. The sale of Paramount Parks was completed on June 30, 2006. Net earnings from discontinued operations for the three and twelve months ended December 31, 2005 included the operating results of Paramount Parks as well as Viacom Inc. prior to its separation from the Company. Other Matters During 2006, in connection with the separation agreement between CBS Corporation and Viacom Inc., Viacom Inc. paid to the Company the net undisputed amount of the special dividend adjustment of $172 million. In January 2007, CBS Corporation and Viacom Inc. resolved the remaining disputed items relating to the special dividend, resulting in an additional $170 million payment to the Company from Viacom Inc., for an aggregate adjustment to the special dividend of $342 million.

- 11. 11 About CBS Corporation CBS Corporation is a mass media company with constituent parts that reach back to the beginnings of the broadcast industry, as well as newer businesses that operate on the leading edge of the media industry. The Company, through its many and varied operations, combines broad reach with well- positioned local businesses, all of which provide it with an extensive distribution network by which it serves audiences and advertisers in all 50 states and key international markets. It has operations in virtually every field of media and entertainment, including broadcast television (CBS and The CW -- a joint venture between CBS Corporation and Warner Bros. Entertainment), cable television (Showtime and CSTV Networks), local television (CBS Television Stations), television production and syndication (CBS Paramount Network Television and CBS Television Distribution), radio (CBS Radio), advertising on out-of-home media (CBS Outdoor), publishing (Simon & Schuster), interactive media (CBS Interactive), music (CBS Records), licensing and merchandising (CBS Consumer Products) and video/ DVD (CBS Home Entertainment). For more information, log on to www.cbscorporation.com.

- 12. 12 Cautionary Statement Concerning Forward-looking Statements This news release contains both historical and forward-looking statements. All statements, including Business Outlook, other than statements of historical fact are, or may be deemed to be, forward- looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements are not based on historical facts, but rather reflect the Company’s current expectations concerning future results and events. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause the actual results, performance or achievements of the Company to be different from any future results, performance and achievements expressed or implied by these statements. These risks, uncertainties and other factors include, among others: advertising market conditions generally; changes in the public acceptance of the Company’s programming; changes in technology and its effect on competition in the Company’s markets; changes in the Federal Communications laws and regulations; the impact of piracy on the Company’s products; the impact of consolidation in the market for the Company’s programming; other domestic and global economic, business, competitive and/or regulatory factors affecting the Company’s businesses generally; and other factors described in the Company’s news releases and filings with the Securities and Exchange Commission including but not limited to the Company’s most recent Form 10-K. The forward-looking statements included in this document are made only as of the date of this document, and, under section 27A of the Securities Act and section 21E of the Exchange Act, we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. Contacts: Press: Investors: Gil Schwartz Martin Shea Executive Vice President, Corporate Communications Executive Vice President, Investor Relations (212) 975-2121 (212) 975-8571 gdschwartz@cbs.com marty.shea@cbs.com Dana McClintock Debra King Senior Vice President, Corporate Communications Vice President, Investor Relations (212) 975-1077 (212) 975-3718 dlmcclintock@cbs.com debra.king@cbs.com

- 13. 13 CBS CORPORATION AND SUBSIDIARIES CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS (Unaudited; all amounts, except per share amounts, are in millions) Three Months Ended Twelve Months Ended December 31, December 31, 2006 2005 2006 2005 $ 3,882.9 $ 3,788.9 $ 14,320.2 $ 14,113.0 Revenues Operating income (loss) 681.5 (8,826.5) 2,606.4 (6,869.5) Interest expense (140.3) (195.9) (565.5) (720.5) Interest income 39.6 9.7 112.1 21.3 — — — Loss on early extinguishment of debt (6.0) Other items, net 13.0 (26.7) (14.3) 4.3 593.8 (9,039.4) 2,132.7 (7,564.4) Earnings (loss) before income taxes Provision for income taxes (164.6) (177.6) (652.2) (794.2) Equity in loss of affiliated companies, net of tax (93.9) (14.8) (97.0) (1.5) Minority interest, net of tax (.3) (.2) (.5) (.6) 335.0 (9,232.0) 1,382.9 (8,360.6) Net earnings (loss) from continuing operations — Net earnings from discontinued operations 95.6 277.6 1,271.5 $ 335.0 $ (9,136.4) $ 1,660.5 $ (7,089.1) Net earnings (loss) Basic earnings (loss) per common share: Net earnings (loss) from continuing operations $ .44 $ (12.12) $ 1.81 $ (10.59) Net earnings from discontinued operations $ .13 $ .36 $ 1.61 $ — Net earnings (loss) $ .44 $ (12.00) $ 2.17 $ (8.98) Diluted earnings (loss) per common share: Net earnings (loss) from continuing operations $ .43 $ (12.12) $ 1.79 $ (10.59) Net earnings from discontinued operations $ .13 $ .36 $ 1.61 $ — Net earnings (loss) $ .43 $ (12.00) $ 2.15 $ (8.98) Weighted average number of common shares outstanding: Basic 767.4 761.6 765.2 789.7 Diluted 776.4 761.6 771.8 789.7 $ .20 $ .14 $ .74 $ .56 Dividends per common share

- 14. 14 CBS CORPORATION AND SUBSIDIARIES CONSOLIDATED CONDENSED BALANCE SHEETS (Unaudited; Dollars in millions) At At December 31, 2006 December 31, 2005 Assets Cash and cash equivalents $ 3,074.6 $ 1,655.3 Receivables, net 2,824.0 2,726.1 Programming and other inventory 982.9 970.0 Prepaid expenses and other current assets 1,262.6 1,444.1 Total current assets 8,144.1 6,795.5 Property and equipment 4,274.6 4,016.9 Less accumulated depreciation and amortization 1,460.8 1,280.5 Net property and equipment 2,813.8 2,736.4 Programming and other inventory 1,665.6 1,884.4 Goodwill 18,821.5 18,629.8 Intangible assets 10,425.0 10,514.2 Other assets 1,638.8 2,469.3 Total Assets $ 43,508.8 $ 43,029.6 Liabilities and Stockholders’ Equity Accounts payable $ 502.3 $ 588.6 Participants’ share and royalties payable 767.5 867.9 Program rights 906.9 862.4 Current portion of long-term debt 15.0 747.1 Accrued expenses and other current liabilities 2,207.8 2,312.6 Total current liabilities 4,399.5 5,378.6 Long-term debt 7,027.3 7,153.2 Other liabilities 8,558.5 8,759.1 Minority interest 1.0 1.7 Stockholders’ equity 23,522.5 21,737.0 Total Liabilities and Stockholders’ Equity $ 43,508.8 $ 43,029.6

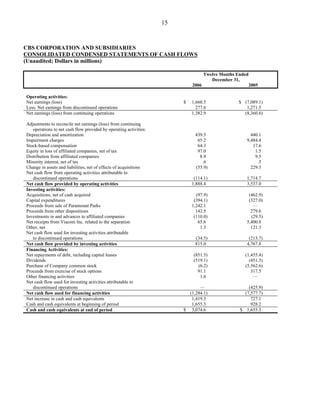

- 15. 15 CBS CORPORATION AND SUBSIDIARIES CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (Unaudited; Dollars in millions) Twelve Months Ended December 31, 2006 2005 Operating activities: Net earnings (loss) $ 1,660.5 $ (7,089.1) Less: Net earnings from discontinued operations 277.6 1,271.5 Net earnings (loss) from continuing operations 1,382.9 (8,360.6) Adjustments to reconcile net earnings (loss) from continuing operations to net cash flow provided by operating activities: Depreciation and amortization 439.5 440.1 Impairment charges 65.2 9,484.4 Stock-based compensation 64.3 17.6 Equity in loss of affiliated companies, net of tax 97.0 1.5 Distribution from affiliated companies 8.9 9.5 Minority interest, net of tax .6 .5 Change in assets and liabilities, net of effects of acquisitions (55.9) 229.3 Net cash flow from operating activities attributable to discontinued operations (114.1) 1,714.7 1,888.4 3,537.0 Net cash flow provided by operating activities Investing activities: Acquisitions, net of cash acquired (97.9) (462.9) Capital expenditures (394.1) (327.0) — Proceeds from sale of Paramount Parks 1,242.1 Proceeds from other dispositions 142.5 279.6 Investments in and advances to affiliated companies (110.0) (29.5) Net receipts from Viacom Inc. related to the separation 65.6 5,400.0 Other, net 1.3 121.3 Net cash flow used for investing activities attributable to discontinued operations (34.5) (213.7) 815.0 4,767.8 Net cash flow provided by investing activities Financing Activities: Net repayments of debt, including capital leases (851.5) (1,455.4) Dividends (519.1) (451.3) Purchase of Company common stock (6.2) (5,562.6) Proceeds from exercise of stock options 91.1 317.5 — Other financing activities 1.6 Net cash flow used for investing activities attributable to — discontinued operations (425.9) (1,284.1) (7,577.7) Net cash flow used for financing activities Net increase in cash and cash equivalents 1,419.3 727.1 Cash and cash equivalents at beginning of period 1,655.3 928.2 $ 3,074.6 $ 1,655.3 Cash and cash equivalents at end of period

- 16. 16 CBS CORPORATION AND SUBSIDIARIES SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION (Unaudited; Dollars in millions) Operating Income (Loss) Before Depreciation and Amortization The following tables set forth the Company’s Operating Income (Loss) before Depreciation and Amortization for the three and twelve months ended December 31, 2006 and 2005. The Company defines “Operating Income (Loss) before Depreciation and Amortization” (“OIBDA”) as net earnings (loss) adjusted to exclude the following line items presented in its Statements of Operations: Net earnings from discontinued operations; Minority interest, net of tax; Equity in loss of affiliated companies, net of tax; Provision for income taxes; Other items, net; Loss on early extinguishment of debt; Interest income; Interest expense; and Depreciation and amortization. The Company defines “OIBDA before impairment charges” as OIBDA less non-cash impairment charges. The Company defines “Adjusted OIBDA before impairment charges” as OIBDA adjusted to exclude non-cash impairment charges, the impact of expensing stock-based compensation and the impact of dispositions. The Company presents OIBDA before impairment charges on a segment basis as the primary measure of profit and loss for its operating segments in accordance with SFAS 131, quot;Disclosure about Segments of an Enterprise and Related Information.quot; The Company uses these OIBDA measures, among other things, to evaluate the Company’s operating performance, to value prospective acquisitions and as one of several components of incentive compensation targets for certain management personnel, and these measures are among the primary measures used by management for planning and forecasting of future periods. These measures are an important indicator of the Company’s operational strength and performance of its business because it provides a link between profitability and operating cash flow. The Company believes the presentation of these measures are relevant and useful for investors because they allow investors to view performance in a manner similar to the method used by the Company’s management, help improve their ability to understand the Company’s operating performance and make it easier to compare the Company’s results with other companies that have different financing and capital structures or tax rates. In addition, these measures are also among the primary measures used externally by the Company's investors, analysts and peers in its industry for purposes of valuation and comparing the operating performance of the Company to other companies in its industry. Since OIBDA is not a measure of performance calculated in accordance with generally accepted accounting principles (“GAAP”), it should not be considered in isolation of, or as a substitute for, net earnings (loss) as an indicator of operating performance. OIBDA, as the Company calculates it, may not be comparable to similarly titled measures employed by other companies. In addition, this measure does not necessarily represent funds available for discretionary use, and is not necessarily a measure of the Company’s ability to fund its cash needs. As OIBDA excludes certain financial information compared with net earnings (loss), the most directly comparable GAAP financial measure, users of this financial information should consider the types of events and transactions which are excluded. The Company provides the following reconciliations of Adjusted OIBDA before impairment charges to net earnings (loss) and OIBDA before impairment charges for each segment to such segment’s operating income (loss), the most directly comparable amounts reported under GAAP.

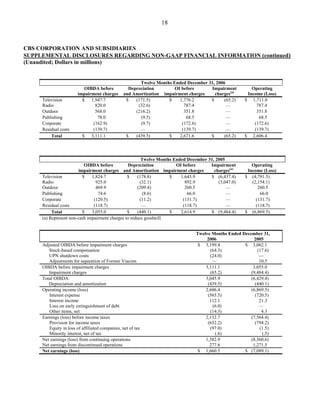

- 17. 17 CBS CORPORATION AND SUBSIDIARIES SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION (continued) (Unaudited; Dollars in millions) Three Months Ended December 31, 2006 OIBDA before Depreciation OI before Impairment Operating charges(a) impairment charges and Amortization impairment charges Income (Loss) Television $ 531.5 $ (44.4) $ 487.1 $ (65.2) $ 421.9 — Radio 211.3 (7.8) 203.5 203.5 — Outdoor 166.8 (55.9) 110.9 110.9 — Publishing 38.9 (2.6) 36.3 36.3 — Corporate (54.2) (2.7) (56.9) (56.9) — — Residual costs (34.2) (34.2) (34.2) $ 860.1 $ (113.4) $ 746.7 $ (65.2) $ 681.5 Total Three Months Ended December 31, 2005 OIBDA before Depreciation OI before Impairment Operating charges(a) impairment charges and Amortization impairment charges Income (Loss) Television $ 444.2 $ (50.0) $ 394.2 $ (6,437.4) $ (6,043.2) Radio 214.7 (9.4) 205.3 (3,047.0) (2,841.7) — Outdoor 147.5 (51.1) 96.4 96.4 — Publishing 36.1 (2.2) 33.9 33.9 — Corporate (38.5) (3.7) (42.2) (42.2) — — Residual costs (29.7) (29.7) (29.7) $ 774.3 $ (116.4) $ 657.9 $ (9,484.4) $ (8,826.5) Total (a) Represent non-cash impairment charges to reduce goodwill. Three Months Ended December 31, 2006 2005 Adjusted OIBDA before impairment charges $ 872.7 $ 783.9 Stock-based compensation (12.6) (4.5) — Adjustments for separation of Former Viacom (5.1) OIBDA before impairment charges 860.1 774.3 Impairment charges (65.2) (9,484.4) Total OIBDA 794.9 (8,710.1) Depreciation and amortization (113.4) (116.4) Operating income (loss) 681.5 (8,826.5) Interest expense (140.3) (195.9) Interest income 39.6 9.7 Other items, net 13.0 (26.7) Earnings (loss) before income taxes 593.8 (9,039.4) Provision for income taxes (164.6) (177.6) Equity in loss of affiliated companies, net of tax (93.9) (14.8) Minority interest, net of tax (.3) (.2) Net earnings (loss) from continuing operations 335.0 (9,232.0) Net earnings from discontinued operations 95.6 — $ 335.0 $ (9,136.4) Net earnings (loss)

- 18. 18 CBS CORPORATION AND SUBSIDIARIES SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION (continued) (Unaudited; Dollars in millions) Twelve Months Ended December 31, 2006 OIBDA before Depreciation OI before Impairment Operating charges(a) impairment charges and Amortization impairment charges Income (Loss) Television $ 1,947.7 $ (171.5) $ 1,776.2 $ (65.2) $ 1,711.0 — Radio 820.0 (32.6) 787.4 787.4 — Outdoor 568.0 (216.2) 351.8 351.8 — Publishing 78.0 (9.5) 68.5 68.5 — Corporate (162.9) (9.7) (172.6) (172.6) — — Residual costs (139.7) (139.7) (139.7) $ 3,111.1 $ (439.5) $ 2,671.6 $ (65.2) $ 2,606.4 Total Twelve Months Ended December 31, 2005 OIBDA before Depreciation OI before Impairment Operating charges(a) impairment charges and Amortization impairment charges Income (Loss) Television $ 1,824.7 $ (178.8) $ 1,645.9 $ (6,437.4) $ (4,791.5) Radio 925.0 (32.1) 892.9 (3,047.0) (2,154.1) — Outdoor 469.9 (209.4) 260.5 260.5 — Publishing 74.6 (8.6) 66.0 66.0 — Corporate (120.5) (11.2) (131.7) (131.7) — — Residual costs (118.7) (118.7) (118.7) $ 3,055.0 $ (440.1) $ 2,614.9 $ (9,484.4) $ (6,869.5) Total (a) Represent non-cash impairment charges to reduce goodwill. Twelve Months Ended December 31, 2006 2005 Adjusted OIBDA before impairment charges $ 3,199.4 $ 3,062.1 Stock-based compensation (64.3) (17.6) UPN shutdown costs (24.0) — — Adjustments for separation of Former Viacom 10.5 OIBDA before impairment charges 3,111.1 3,055.0 Impairment charges (65.2) (9,484.4) Total OIBDA 3,045.9 (6,429.4) Depreciation and amortization (439.5) (440.1) Operating income (loss) 2,606.4 (6,869.5) Interest expense (565.5) (720.5) Interest income 112.1 21.3 — Loss on early extinguishment of debt (6.0) Other items, net (14.3) 4.3 Earnings (loss) before income taxes 2,132.7 (7,564.4) Provision for income taxes (652.2) (794.2) Equity in loss of affiliated companies, net of tax (97.0) (1.5) Minority interest, net of tax (.6) (.5) Net earnings (loss) from continuing operations 1,382.9 (8,360.6) Net earnings from discontinued operations 277.6 1,271.5 $ 1,660.5 $ (7,089.1) Net earnings (loss)

- 19. 19 CBS CORPORATION AND SUBSIDIARIES SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION (continued) (Unaudited; Dollars in millions) Free Cash Flow Free cash flow reflects the Company’s net cash flow provided by operating activities less capital expenditures and operating cash flow of discontinued operations. The Company uses free cash flow, among other measures, to evaluate its operating performance. Management believes free cash flow provides investors with an important perspective on the cash available to service debt, make strategic acquisitions and investments, maintain its capital assets, satisfy its tax obligations and fund ongoing operations and working capital needs. As a result, free cash flow is a significant measure of the Company’s ability to generate long term value. It is useful for investors to know whether this ability is being enhanced or degraded as a result of the Company’s operating performance. The Company believes the presentation of free cash flow is relevant and useful for investors because it allows investors to view performance in a manner similar to the method used by management. In addition, free cash flow is also a primary measure used externally by the Company’s investors, analysts and peers in its industry for purposes of valuation and comparing the operating performance of the Company to other companies in its industry. As free cash flow is not a measure of performance calculated in accordance with GAAP, free cash flow should not be considered in isolation of, or as a substitute for, net earnings (loss) as an indicator of operating performance or net cash flow provided by operating activities as a measure of liquidity. Free cash flow, as the Company calculates it, may not be comparable to similarly titled measures employed by other companies. In addition, free cash flow does not necessarily represent funds available for discretionary use and is not necessarily a measure of the Company’s ability to fund its cash needs. As free cash flow deducts capital expenditures and operating cash flow of discontinued operations from net cash flow provided by operating activities, the most directly comparable GAAP financial measure, users of this financial information should consider the types of events and transactions which are not reflected. The Company provides below a reconciliation of free cash flow to the most directly comparable amount reported under GAAP, net cash flow provided by operating activities. The following table presents a reconciliation of the Company’s net cash flow provided by operating activities to free cash flow: Three Months Ended Twelve Months Ended December 31, December 31, 2006 2005 2006 2005 Net cash flow provided by operating activities $ 143.6 $ 577.4 $ 1,888.4 $ 3,537.0 Less capital expenditures 198.4 132.2 394.1 327.0 Less operating cash flow of discontinued operations (40.1) 323.6 (114.1) 1,714.7 Free cash flow $ (14.7) $ 121.6 $ 1,608.4 $ 1,495.3 The following table presents a summary of the Company’s cash flows: Three Months Ended Twelve Months Ended December 31, December 31, 2006 2005 2006 2005 Net cash flow provided by operating activities $ 143.6 $ 577.4 $ 1,888.4 $ 3,537.0 Net cash flow provided by (used for) investing activities $ (121.4) $ 5,025.1 $ 815.0 $ 4,767.8 Net cash flow used for financing activities $ (124.2) $ (4,758.0) $ (1,284.1) $ (7,577.7)

- 20. 20 CBS CORPORATION AND SUBSIDIARIES SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION (continued) (Unaudited; Dollars in millions) Radio Segment “Same Station” Reconciliation In connection with the sale of 39 radio stations in ten of its smaller markets, the Company entered into local management agreements (“LMAs”) in certain of these markets. Pursuant to these agreements, the Company receives a management fee and no longer records advertising revenues and operating expenses. These agreements have no impact on OIBDA and operating income. The following table presents the revenues for the Radio segment on a “same station” basis, which excludes all revenues for these stations for all periods presented. The Company believes that adjusting the revenues for the Radio segment for the impact of these LMAs and station sales provides investors with a clearer perspective on the current underlying financial performance of the Radio segment. Three Months Ended Twelve Months Ended December 31, Better/ December 31, Better/ 2006 2005 (Worse)% 2006 2005 (Worse)% Radio revenues, as reported $ 498.2 $ 543.5 (8)% $ 1,959.9 $ 2,114.8 (7)% Revenues for stations sold and stations operating (18.9) (32.2) n/m (117.1) (132.1) n/m under LMAs Radio revenues, “same station” basis $ 479.3 $ 511.3 (6)% $ 1,842.8 $ 1,982.7 (7)% n/m – not meaningful Effective Income Tax Rate Reconciliation The following table presents the Company’s effective income tax rate excluding the impact of non-cash impairment charges and tax benefits primarily from the settlement of certain income tax audits. This table also reconciles the Company’s earnings (loss) before income taxes and provision for income taxes excluding these one-time items to the reported measures included in this earnings release. The Company believes that adjusting its effective income tax rate for these one-time items provides investors with a clearer perspective on the underlying financial performance of the Company. Three Months Ended December 31, 2006 Twelve Months Ended December 31, 2006 2006 2006 excluding 2006 2006 excluding Adjustments(a) Adjustments(a) reported one-time items reported one-time items Earnings before income taxes $ 593.8 $ 65.2 $ 659.0 $ 2,132.7 $ 65.2 $ 2,197.9 Provision for income taxes $ (164.6) $ (50.8) $ (215.4) $ (652.2) $ (183.7) $ (835.9) Effective income tax rate 27.7% 32.7% 30.6% 38.0% Three Months Ended December 31, 2005 Twelve Months Ended December 31, 2005 2005 2005 excluding 2005 2005 excluding Adjustments(a) Adjustments(a) reported one-time items reported one-time items Earnings (loss) before income taxes $(9,039.4) $ 9,484.4 $ 445.0 $(7,564.4) $ 9,484.4 $ 1,920.0 Provision for income taxes $ (177.6) $ (23.9) $ (201.5) $ (794.2) $ (23.9) $ (818.1) Effective income tax rate (2.0)% 45.3% (10.5)% 42.6% (a) Adjustments for the three and twelve months ended December 31, 2006 include the non-cash impairment charge of $65.2 million and tax benefits primarily from the settlement of certain income tax audits of $31.2 million and $164.1 million, respectively. Adjustments for the three and twelve months ended December 31, 2005 include the non-cash impairment charge of $9.5 billion.