CIC Presentation - Equity Compensation 2014-12-17-c

- 1. Equity Compensation Using Stock and Options to Pay for Services 12.17.14 Benjamin M. Hron bhron@mccarter.com 617.449.6584 @HronEsq

- 2. OVERVIEW ♦ Pros/Cons of Equity Compensation ♦ Vesting ♦ Types of Equity Compensation ♦ Mechanics of Grants ♦ Taxation ♦ Other Common Terms ♦ Advanced Concepts ♦ Allocating Equity Compensation 2

- 3. PROS/CONS OF EQUITY COMPENSATION ♦ Pros – Reduces cash burn rate – Aligns incentives ♦ Cons – Complicate compensation & capitalization – Potential to overpay (ex. David Choe) NOTE: Equity is NOT a substitute for min. wage federal & state labor laws apply! 3

- 4. VESTING ♦ Vesting = lapsing of restrictions on ownership – over time (typically 4 years) – upon achievement of milestones ♦ Acceleration – On termination – On change of control (single v. double trigger) ♦ Critical for controlling capitalization ♦ Aligns incentives ♦ Aids in retention (golden handcuffs) 4

- 5. TYPES OF EQUITY COMPENSATION ♦ Stock (restricted v. unrestricted) ♦ Options – Incentive Stock Options (ISOs) – Nonqualified Options (NQOs) ♦ Others (not common for startups) – Stock Appreciation Rights – Phantom Stock – Restricted Stock Units 5

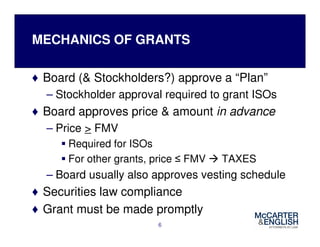

- 6. MECHANICS OF GRANTS ♦ Board (& Stockholders?) approve a “Plan” – Stockholder approval required to grant ISOs ♦ Board approves price & amount in advance – Price > FMV Required for ISOs For other grants, price ≤ FMV TAXES – Board usually also approves vesting schedule ♦ Securities law compliance ♦ Grant must be made promptly 6

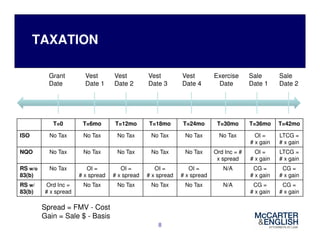

- 7. TAXATION ♦ Timing of income recognition – ISOs & NQOs – Stock – 83(b) election 30 days to file – NO EXCEPTIONS ♦ Ordinary Income v. Long Term Capital Gains ♦ 409A Excise Tax on Deferred Compensation 7

- 8. TAXATION 8 Grant Date Vest Date 1 Vest Date 2 Vest Date 3 Vest Date 4 Exercise Date Sale Date 1 Sale Date 2 T=0 T=6mo T=12mo T=18mo T=24mo T=30mo T=36mo T=42mo ISO No Tax No Tax No Tax No Tax No Tax No Tax OI = # x gain LTCG = # x gain NQO No Tax No Tax No Tax No Tax No Tax Ord Inc = # x spread OI = # x gain LTCG = # x gain RS w/o 83(b) No Tax OI = # x spread OI = # x spread OI = # x spread OI = # x spread N/A CG = # x gain CG = # x gain RS w/ 83(b) Ord Inc = # x spread No Tax No Tax No Tax No Tax N/A CG = # x gain CG = # x gain Spread = FMV - Cost Gain = Sale $ - Basis

- 9. OTHER COMMON TERMS ♦ Voting obligations ♦ Restrictions on transfer ♦ Company right of first refusal on transfer ♦ Co-sale (“Tag-along”) ♦ Drag-along 9

- 10. ADVANCED CONCEPTS ♦ Choosing appropriate type of incentive ♦ Quoting grant in # v. % – Outstanding Shares v. Fully-Diluted Capital ♦ Repurchase of vested shares – Termination for Cause or w/o Good Reason – Other ♦ Vesting v. Exercise (CA-style options) ♦ Refresh grants 10

- 11. ALLOCATING EQUITY COMPENSATION ♦ Setting option pool size ♦ Considerations in setting grants – Value add – Cash compensation – Competition – Precedent ♦ PLAN AHEAD – Hiring needs – Refresh grants 11

- 12. ALLOCATING EQUITY COMPENSATION Typical Numbers: 12

- 13. ALLOCATING EQUITY COMPENSATION Resources Fred Wilson: http://avc.com/2010/11/employee-equity-how-much/ Paul Graham: http://www.paulgraham.com/equity.html Venture Hacks: http://venturehacks.com/articles/option-pool-shuffle Angel List: https://angel.co/salaries Others: ♦http://www.socalcto.com/2011/09/equity-for-early-employees-in-early.html ♦http://www.businessinsider.com/how-to-allocate-ownership-fairly-when-forming- a-new-software-startup-2011-4 ♦http://www.andrew.cmu.edu/user/fd0n/35%20Founders%27%20Pie%20Calcula tor.htm ♦http://onstartups.com/tabid/3339/bid/146/Startup-Founders-Should-You-Divide- Equity-Equally.aspx 13

- 14. The End Benjamin M. Hron bhron@mccarter.com 617.449.6584 @HronEsq Questions? 14