clearchannel 298

- 1. CC Media Holdings, Inc. Reports Second Quarter 2008 Results ---------------- San Antonio, Texas August 11, 2008…CC Media Holdings, Inc. (OTCBB: CCMO) today reported results for its second quarter ended June 30, 2008. CC Media Holdings, Inc. is the new parent company of Clear Channel Communications, Inc. CC Media Holdings, Inc. was formed in May 2007 by private equity funds sponsored by Bain Capital Partners, LLC and Thomas H. Lee Partners, L.P. for the purpose of acquiring the business of Clear Channel Communications, Inc. The acquisition was completed on July 30, 2008, pursuant to the Agreement and Plan of Merger, dated November 16, 2006, as amended on April 18, 2007, May 17, 2007 and May 13, 2008. Prior to the consummation of its acquisition of Clear Channel on July 30, 2008, the Company had not conducted any activities, other than activities incident to its formation and in connection with the acquisition, and did not have any assets or liabilities, other than as related to the acquisition. Subsequent to the acquisition, Clear Channel became an indirect, wholly-owned subsidiary of the Company and the business of the Company became that of Clear Channel and its subsidiaries. The Company will account for its acquisition of Clear Channel as a purchase business combination in conformity with Statement of Financial Accounting Standards No. 141, Business Combinations, and Emerging Issues Task Force Issue 88-16, Basis in Leveraged Buyout Transactions. The Company expects to allocate a portion of the consideration paid to the assets and liabilities acquired at their respective fair values with the remaining portion recorded at the continuing shareholders basis. Any excess consideration after this allocation will be recorded as goodwill. The Company is currently in the process of obtaining third-party valuations of certain of the acquired assets and liabilities in order to allocate the purchase price. The Company will complete its purchase price allocation within one year of the closing of the acquisition. Certain information in this earnings report is presented using the results of operations and the historical basis of assets, liabilities and equity of Clear Channel as of June 30, 2008 and December 31, 2007. CC Media Holdings reported revenues of $1.83 billion in the second quarter of 2008, an increase of 2% from the $1.80 billion reported for the second quarter of 2007. Included in the Company‘s revenue is a $52.2 million increase due to movements in foreign exchange; strictly excluding the effects of these movements in foreign exchange, revenues would have declined 1%. See reconciliation of revenue excluding effects of foreign exchange to revenue at the end of this press release. The Company‘s operating expenses increased 6% to $1.19 billion during the second quarter of 2008 compared to 2007. Included in CC Media Holdings‘ 2008 expenses is a $41.1 million increase due to movements in foreign exchange. Strictly excluding the effects of these movements in foreign exchange in the 2008 expenses, expense growth would have been 2%. See reconciliation of expenses excluding effects of foreign exchange to expenses at the end of this press release. Also included in CC Media Holdings‘ 2008 operating expenses is approximately $8.0 million of non-cash compensation expense. This compares to non-cash compensation expense of $9.7 million in the second quarter of 2007. The Company‘s income before discontinued operations increased 28% to $277.3 million, as compared to $215.9 million for the same period in 2007. CC Media Holdings‘ diluted earnings before discontinued operations per share increased 27% to $0.56, compared to $0.44 for the same period in 2007. The Company‘s second quarter 2008 net income included an approximate $27.0 million nontaxable gain, or $0.05 per diluted share, on the termination of a forward exchange contract and the sale of the related shares. The gain was recorded in ―Gain on marketable securities‖. Excluding this one-time item, CC Media Holdings‘ second quarter 2008 income before discontinued operations would have been $250.3 1

- 2. million, or $0.51 per diluted share. See reconciliation of net income and diluted earnings per share at the end of this press release. CC Media Holdings‘ OIBDAN (defined as Operating Income before Depreciation & amortization, Non- cash compensation expense, Merger costs and Gain on disposition of assets – net) was $604.7 million in the second quarter of 2008, a 7% decrease from 2007. See reconciliation of OIBDAN to net income at the end of this press release. Mark P. Mays, Chief Executive Officer of CC Media Holdings, commented, ――Results for the first half and second quarter of 2008 were impressive in the context of this challenging economic and advertising climate. We reported higher revenue and earnings per share for the second quarter and continued to outperform many in the media arena. Strong relative performance in both Outdoor and Radio are a testament to the wisdom of continuing to do what we do best. We exert strict cost discipline and invest in the growth drivers of our core businesses. As we enter the second half of the year with our merger closed, we are hopeful that our streamlined operations coupled with a concentration on growth and execution will enable us to continue to perform well, despite a difficult economic environment.‖ Merger Update Clear Channel held a special meeting of its shareholders on July 24, 2008, at which the proposed merger, as amended, was approved. The merger closed on July 30, 2008. Under the terms of the Merger Agreement, as amended, Clear Channel‘s shareholders received $36.00 in cash for each share they own. As an alternative to receiving the $36.00 per share cash consideration, Clear Channel‘s shareholders were offered the opportunity on a purely voluntary basis to exchange some or all of their shares of Clear Channel common stock on a one-for-one basis for shares of Class A common stock in the Company. Approximately 23.6 million shares were exchanged. Radio Divestitures Adjusted number of radio stations being marketed for sale (―Non-core‖ radio stations) 275 Non-core radio stations sold through June 30, 2008 (238) Remaining non-core radio stations at June 30, 2008 classified as discontinued operations 37 Non-core radio stations under definitive asset purchase agreements (34) Non-core radio stations being marketed for sale 3 On November 16, 2006, the Company announced plans to sell 448 non-core radio stations. The total number of stations was revised from 448 to 275 during the first quarter of 2008. Clear Channel sold 238 non-core radio stations, had definitive asset purchase agreements for 34 non-core radio stations and continued to market 3 non-core radio stations at June 30, 2008. These stations were classified as assets from discontinued operations in the Company‘s consolidated balance sheet and as discontinued operations in the consolidated financial statements as of and for the period ended June 30, 2008, for the period ended June 30, 2007 and as of December 31, 2007. Twenty-four stations that were under definitive asset purchase agreements were sold subsequent to June 30, 2008. There can be no assurance that any of the pending divestitures contemplated in this release will actually be consummated. 2

- 3. Revenue, Direct Operating and SG&A Expenses, and OIBDAN by Division Three Months Ended % (In thousands) June 30, Change 2008 2007 Revenue Radio Broadcasting $ 891,483 $ 945,963 (6%) Outdoor Advertising 914,808 836,713 9% Other 52,381 52,514 (0%) Eliminations (27,594) (32,998) Consolidated revenue $1,831,078 $1,802,192 2% CC Media Holdings‘ second quarter 2008 revenue increased from foreign exchange movements of approximately $52.2 million as compared to the same period of 2007. Direct Operating and SG&A Expenses by Division Radio Broadcasting $ 531,291 $ 548,639 Less: Non-cash compensation expense (4,506) (6,676) 526,785 541,963 (3%) Outdoor Advertising 641,278 563,700 Less: Non-cash compensation expense (3,450) (2,995) 637,828 560,705 14% Other 44,244 44,104 — — Less: Non-cash compensation expense 44,244 44,104 0% Eliminations (27,594) (32,998) Plus: Non-cash compensation expense 7,956 9,671 Consolidated divisional operating expenses $1,189,219 $1,123,445 6% CC Media Holdings‘ second quarter 2008 direct operating and SG&A expenses increased from foreign exchange movements of approximately $41.1 million as compared to the same period of 2007. OIBDAN Radio Broadcasting $ 364,698 $ 404,000 (10%) Outdoor Advertising 276,980 276,008 0% Other 8,137 8,410 (3%) Corporate (45,138) (39,376) Consolidated OIBDAN $ 604,677 $ 649,042 (7%) See reconciliation of OIBDAN to net income at the end of this press release. Radio Broadcasting The Company‘s radio broadcasting revenue declined approximately $54.5 million in the second quarter of 2008 compared to the same period of the prior year. Decreases in local and national revenues were partially offset by increases in traffic and on-line revenues. Local and national revenues were down as a result of overall weakness in advertising. The Company‘s radio revenue experienced declines across all different sized markets and advertising categories including automotive, retail and consumer 3

- 4. services. During the second quarter of 2008, the Company‘s total prime minutes sold and its prime average minute rate decreased compared to the second quarter of 2007. The average minute rate for the 60 second spots declined more than the average minute rate of the shorter duration spots during this period. Overall there was a decrease in operating expenses across the Company‘s radio markets with a decrease of approximately $17.3 million primarily from reduced advertising and promotion expenses and a decline in commission expenses associated with the revenue decline. The decrease was partially offset by an increase in syndicated radio programming expenses attributable mostly to contract talent payments. Outdoor Advertising The Company‗s outdoor advertising revenue increased 9% during the second quarter of 2008 when compared to the same period in 2007. Included in the 2008 results is an approximate $52.2 million increase related to foreign exchange when compared to 2007. Outdoor advertising expenses increased 14% when compared to the same period in 2007. Included in the 2008 results is an approximate $41.1 million increase related to foreign exchange when compared to 2007. Americas Outdoor Revenue increased approximately $8.1 million during the second quarter of 2008 compared to the second quarter of 2007, primarily from increases in airport and street furniture revenues as well as digital display revenue. The increase in street furniture revenue was primarily the result of new contracts and increased rates while the increase in airport revenue was due to new contracts and increased rates and occupancy. Digital display revenue growth was primarily attributable to an increase in digital displays. Partially offsetting the revenue increase was a decline in bulletin and poster revenue. The decline in bulletin revenue was primarily attributable to decreased occupancy while the decline in poster revenue was primarily attributable to a decrease in rate. Leading advertising categories during the quarter were retail, amusements and financial services which all experienced revenue growth for the second quarter of 2008 when compared to the second quarter of 2007. Revenue growth was led by Los Angeles, Boston, Latin America and Canada. The Company‘s Americas operating expenses increased $20.1 million primarily from higher site lease expenses of $15.7 million mostly attributable to new taxi, airport and street furniture contracts. Administrative expenses associated with various legal expenses also increased during the quarter. o International Outdoor Revenue increased approximately $70.0 million, with roughly $50.1 million from movements in foreign exchange. The remainder of the revenue growth was primarily attributable to strong growth in China, Turkey and Australia and due to the Company‘s Romanian operations which were acquired at the end of the second quarter of 2007. Growth was partially offset by revenue declines in France, due to the loss of a contract for advertising on railways, and the United Kingdom. Operating expenses increased $57.5 million. Included in the increase is approximately $39.5 million related to movements in foreign exchange. The remaining increase in operating expenses was primarily attributable to an increase in site lease expenses and other operating and selling expenses associated with the increase in revenue. 4

- 5. FAS No. 123 (R): Share-Based Payment (“FAS 123(R)”) The following table details non-cash compensation expense, which represents employee compensation costs related to stock option grants and restricted stock awards, for the second quarter of 2008 and 2007: Three Months Ended (In thousands) June 30, 2008 2007 Direct operating expense $ 4,583 $ 5,172 SG&A 3,373 4,499 Corporate 2,836 3,668 Total non-cash compensation $ 10,792 $ 13,339 Current Information and Expectations The Company has previously provided information regarding its revenue pacings and certain expectations related to 2008 operating results. That information was last provided on May 9, 2008 and has not been updated. The Company is not providing such information in this release and does not anticipate providing this information in the future. The Company will not update or revise any previously disclosed information. Investors are cautioned to no longer rely on such prior information given the passage of time and other reasons discussed in the Company‘s reports filed with the SEC. Future results could differ materially than the forward-looking information previously disclosed. The Company periodically reviews its disclosure practices in the ordinary course of its business and management determined to cease providing this information after taking into consideration a number of factors. There should be nothing read into the timing of this change in policy, nor should any inferences be drawn relative to internal or external economic factors. 5

- 6. TABLE 1 - Financial Highlights of CC Media Holdings, Inc. and Subsidiaries - Unaudited Three Months Ended June 30, % (In thousands, except per share data) 2008 2007 Change Revenue $1,831,078 $1,802,192 2% Direct operating expenses 743,485 676,255 Selling, general and administrative expenses 445,734 447,190 Corporate expenses 47,974 43,044 Merger costs 7,456 2,684 Depreciation and amortization 142,188 141,309 Gain on disposition of assets – net 17,354 3,996 Operating Income 461,595 495,706 (7%) Interest expense 82,175 116,422 Gain (loss) on marketable securities 27,736 (410) Equity in earnings of nonconsolidated affiliates 8,990 11,435 Other income (expense) – net (6,086) 340 Income before income taxes, minority interest and discontinued operations 410,060 390,649 Income tax expense: Current 101,047 122,071 Deferred 24,090 37,715 Income tax expense 125,137 159,786 Minority interest expense, net of tax 7,628 14,970 Income before discontinued operations 277,295 215,893 28% Income from discontinued operations 5,032 20,097 Net income $ 282,327 $ 235,990 20% Diluted earnings per share: Diluted earnings before discontinued operations per share $ .56 $ .44 27% $ .57 $ .48 19% Diluted earnings per share Weighted average shares outstanding – Diluted 496,887 495,688 Income Taxes The Company‘s effective tax rate for the three months ended June 30, 2008 was 30.5% as compared to 40.9% for the same period of the prior year. The decline was primarily due to the release of the valuation allowance on the capital loss carryforwards that were used to offset the taxable gain from the disposition of the Company‘s America Tower Corporation shares. 6

- 7. TABLE 2 - Selected Balance Sheet Information - Unaudited Selected balance sheet information for 2008 and 2007 was: June 30, December 31, 2008 2007 (In millions) Cash $ 668.1 $ 145.1 Total Current Assets $ 2,908.9 $ 2,294.6 Net Property, Plant and Equipment $ 3,081.5 $ 3,050.4 Total Assets $ 19,078.4 $ 18,805.5 Current Liabilities (excluding current portion of long-term debt) $ 1,429.0 $ 1,453.1 Long-Term Debt (including current portion of long-term debt)* $ 5,772.3 $ 6,575.2 Shareholders‘ Equity $ 9,876.0 $ 8,797.5 * See Table 4 for a discussion of debt incurred in conjunction with the merger. TABLE 3 - Capital Expenditures - Unaudited Capital expenditures for the six months ended June 30, 2008 and 2007 were: June 30, 2008 June 30, 2007 (In millions) Non-revenue producing $ 81.8 $ 77.7 Revenue producing 129.9 75.3 Total capital expenditures $ 211.7 $ 153.0 The Company defines non-revenue producing capital expenditures as those expenditures that are required on a recurring basis. Revenue producing capital expenditures are discretionary capital investments for new revenue streams, similar to an acquisition. 7

- 8. TABLE 4 – Post Merger Capital Structure - Unaudited In connection with the merger, the Company terminated its $1.75 billion multi-currency revolving credit facility and incurred new amounts of debt, including amounts outstanding under the Company‘s new senior secured credit facilities, its new receivables based credit facility and the new senior cash pay and senior toggle notes. Additionally, the Company repurchased $639.2 million aggregate principal amount of the AMFM Operating, Inc. 8% Senior Notes due 2008 pursuant to a tender offer and consent solicitation. On August 7, 2008, the Company announced that it commenced a cash tender offer and consent solicitation for its outstanding $750.0 million principal amount of 7.65% senior notes due 2010 on the terms and conditions set forth in the Offer to Purchase and Consent Solicitation Statement dated August 7, 2008. Immediately following the closing of the transaction, the Company has aggregate principal amount of debt outstanding of approximately $20.8 billion (and available and undrawn facilities of approximately $1.7 billion), the components of which are: (In thousands) Amount Term Loan A $ 1,331,500 Term Loan B 10,700,000 Term Loan C 695,879 — Delayed Draw Facility Receivables Based Facility 533,500 Revolving Credit Facility 80,000 Senior Cash Pay Notes 980,000 Senior Toggle Notes 1,330,000 Existing Clear Channel Senior Notes 5,025,000 Existing Clear Channel Subsidiary Debt 111,929 Total Indebtedness $20,787,808 In connection with the merger, the Company issued approximately 23.6 million shares of Class A common stock, approximately 0.6 million shares of Class B common stock and approximately 59.0 million shares of Class C common stock for a total of approximately 83.2 million shares. Every holder of shares of Class A common stock is entitled to one vote for each share of Class A common stock. Every holder of shares of Class B common stock is entitled to a number of votes per share equal to the number obtained by dividing (a) the sum of the total number of shares of Class B common stock outstanding as of the record date for such vote and the number of Class C common stock outstanding as of the record date for such vote by (b) the number of shares of Class B common stock outstanding as of the record date for such vote. Except as otherwise required by law, the holders of outstanding shares of Class C common stock are not entitled to any votes upon any questions presented to its stockholders. Except with respect to voting as described above, and as otherwise required by law, all shares of Class A common stock, Class B common stock and Class C common stock have the same powers, privileges, preferences and relative participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, and will be identical to each other in all respects. Liquidity and Financial Position For the six months ended June 30, 2008, cash flow from operating activities was $686.0 million, cash flow used by investing activities was $178.1 million, cash flow used by financing activities was $998.7 million, and net cash provided by discontinued operations was $1.0 billion for a net increase in cash of $522.9 million. 8

- 9. As of August 8, 2008, the Company had approximately $1.7 billion available on its bank revolving credit facility. The Company may utilize existing capacity under its bank revolving credit facility and other available funds for general working capital purposes including funding capital expenditures, acquisitions and the refinancing of certain public debt securities. 9

- 10. Supplemental Disclosure Regarding Non-GAAP Financial Information Operating Income before Depreciation and Amortization (D&A), Non-cash Compensation Expense and Gain on Disposition of Assets – Net (OIBDAN) The following tables set forth the Company‘s OIBDAN for the three months ended June 30, 2008 and 2007. The Company defines OIBDAN as net income adjusted to exclude non-cash compensation expense and the following line items presented in its Statement of Operations: Discontinued operations; Minority interest, net of tax; Income tax benefit (expense); Other income (expense) - net; Equity in earnings of nonconsolidated affiliates; Gain (loss) on marketable securities; Interest expense; Gain on disposition of assets - net D&A; and merger costs. The Company uses OIBDAN, among other things, to evaluate the Company's operating performance. This measure is among the primary measures used by management for planning and forecasting of future periods, as well as for measuring performance for compensation of executives and other members of management. This measure is an important indicator of the Company's operational strength and performance of its business because it provides a link between profitability and cash flows from operating activities. It is also a primary measure used by management in evaluating companies as potential acquisition targets. The Company believes the presentation of this measure is relevant and useful for investors because it allows investors to view performance in a manner similar to the method used by the Company's management. It helps improve investors‘ ability to understand the Company's operating performance and makes it easier to compare the Company's results with other companies that have different capital structures, stock option structures or tax rates. In addition, this measure is also among the primary measures used externally by the Company's investors, analysts and peers in its industry for purposes of valuation and comparing the operating performance of the Company to other companies in its industry. Additionally, the Company‘s bank credit facilities use this measure for compliance with leverage covenants. Since OIBDAN is not a measure calculated in accordance with GAAP, it should not be considered in isolation of, or as a substitute for, net income as an indicator of operating performance and may not be comparable to similarly titled measures employed by other companies. OIBDAN is not necessarily a measure of the Company's ability to fund its cash needs. As it excludes certain financial information compared with operating income and net income (loss), the most directly comparable GAAP financial measures, users of this financial information should consider the types of events and transactions, which are excluded. In addition, because a significant portion of the Company‘s advertising operations are conducted in foreign markets, principally France and the United Kingdom, management reviews the operating results from its foreign operations on a constant dollar basis. A constant dollar basis (i.e. a foreign currency adjustment is made to the 2008 actual foreign revenues and expenses at average 2007 foreign exchange rates) allows for comparison of operations independent of foreign exchange movements. As required by the SEC, the Company provides reconciliations below to the most directly comparable amounts reported under GAAP, including (i) OIBDAN for each segment to consolidated operating income; (ii) Revenue excluding foreign exchange effects to revenue; (iii) Expense excluding foreign exchange effects to expenses; (iv) OIBDAN to net income; and (v) Net income and diluted earnings per share excluding certain items discussed earlier. 10

- 11. Gain on disposition of (In thousands) assets – net Non-cash Depreciation Operating compensation and and income (loss) expense amortization Merger costs OIBDAN Three Months Ended June 30, 2008 — Radio Broadcasting $ 339,177 $ 4,506 $ 21,015 $ $ 364,698 — Outdoor 168,766 3,450 104,764 276,980 — — Other (4,613) 12,750 8,137 Gain on disposition of assets – net — — — 17,354 (17,354) — — — Merger costs (7,456) 7,456 — Corporate (51,633) 2,836 3,659 (45,138) Consolidated $ 461,595 $ 10,792 $ 142,188 $ (9,898) $ 604,677 Three Months Ended June 30, 2007 — Radio Broadcasting $ 369,075 $ 6,676 $ 28,249 $ $ 404,000 — Outdoor 174,860 2,995 98,153 276,008 — — Other (2,407) 10,817 8,410 Gain on disposition of assets – net — — — 3,996 (3,996) — — — Merger costs (2,684) 2,684 — Corporate (47,134) 3,668 4,090 (39,376) Consolidated $ 495,706 $ 13,339 $ 141,309 $ (1,312) $ 649,042 11

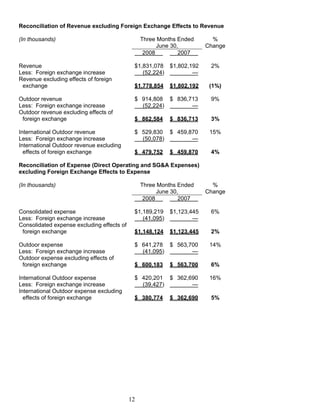

- 12. Reconciliation of Revenue excluding Foreign Exchange Effects to Revenue Three Months Ended % (In thousands) June 30, Change 2008 2007 Revenue $1,831,078 $1,802,192 2% — Less: Foreign exchange increase (52,224) Revenue excluding effects of foreign exchange $1,778,854 $1,802,192 (1%) Outdoor revenue $ 914,808 $ 836,713 9% — Less: Foreign exchange increase (52,224) Outdoor revenue excluding effects of foreign exchange $ 862,584 $ 836,713 3% International Outdoor revenue $ 529,830 $ 459,870 15% — Less: Foreign exchange increase (50,078) International Outdoor revenue excluding effects of foreign exchange $ 479,752 $ 459,870 4% Reconciliation of Expense (Direct Operating and SG&A Expenses) excluding Foreign Exchange Effects to Expense Three Months Ended % (In thousands) June 30, Change 2008 2007 Consolidated expense $1,189,219 $1,123,445 6% — Less: Foreign exchange increase (41,095) Consolidated expense excluding effects of foreign exchange $1,148,124 $1,123,445 2% Outdoor expense $ 641,278 $ 563,700 14% — Less: Foreign exchange increase (41,095) Outdoor expense excluding effects of foreign exchange $ 600,183 $ 563,700 6% International Outdoor expense $ 420,201 $ 362,690 16% — Less: Foreign exchange increase (39,427) International Outdoor expense excluding effects of foreign exchange $ 380,774 $ 362,690 5% 12

- 13. Reconciliation of OIBDAN to Net income Three Months Ended % (In thousands) June 30, Change 2008 2007 OIBDAN $ 604,677 $ 649,042 (7%) Non-cash compensation expense 10,792 13,339 Depreciation & amortization 142,188 141,309 Merger costs 7,456 2,684 Gain on disposition of assets – net 17,354 3,996 Operating Income 461,595 495,706 (7%) Interest expense 82,175 116,422 Gain (loss) on marketable securities 27,736 (410) Equity in earnings of nonconsolidated affiliates 8,990 11,435 Other income (expense) – net (6,086) 340 Income before income taxes, minority interest and discontinued operations 410,060 390,649 Income tax expense: Current 101,047 122,071 Deferred 24,090 37,715 Income tax expense 125,137 159,786 Minority interest expense, net of tax 7,628 14,970 Income before discontinued operations 277,295 215,893 Income from discontinued operations 5,032 20,097 Net income $ 282,327 $ 235,990 Reconciliation of Net Income and Diluted Earnings per Share (“EPS”) Three Months Ended Three Months Ended (In millions, except per share data) June 30, 2008 June 30, 2007 Net Income EPS Net Income EPS Reported Amounts $ 282.3 $ .57 $ 236.0 $ .48 Discontinued operations (5.0) (.01) (20.1) (.04) — — Less: Gain on sale of shares (27.0) (.05) Amounts excluding certain items $ 250.3 $ .51 $ 215.9 $ .44 2007 Quarterly Information On May 30, 2008, Clear Channel Communications filed on Form 8-K revised financial statements. The financial statements were revised to reflect, for each of the quarters for the year ended December 31, 2007, the reclassification of the revenues and operating expenses of certain radio markets from discontinued operations to continuing operations in accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-lived Assets (―Statement 144‖). The following table provides full year 2007 revenues, expenses and non-cash compensation by business segment and by quarter. 13

- 14. Fiscal Year 2007 (in $000s) Net Revenue 1Q 2007 2Q 2007 3Q 2007 4Q 2007 FY 2007 Radio $799,201 $945,963 $909,643 $903,727 $3,558,534 Outdoor 690,856 836,713 817,541 936,726 3,281,836 45,674 55,352 54,164 207,704 Other 52,514 (30,654) (32,998) (31,371) (31,849) (126,872) Eliminations $1,505,077 $1,802,192 $1,751,165 $1,862,768 $6,921,202 Consolidated Direct and SG&A Expenses (Includes Non-Cash Compensation) 1Q 2007 2Q 2007 3Q 2007 4Q 2007 FY 2007 Radio $511,211 $548,639 $542,729 $570,470 $2,173,049 Outdoor 521,738 563,700 565,700 621,701 2,272,839 41,903 44,104 43,989 45,931 175,927 Other (30,654) (32,998) (31,371) (31,849) (126,872) Eliminations $1,044,198 $1,123,445 $1,121,047 $1,206,253 $4,494,943 Consolidated Non-Cash Compensation (Included in Direct and SG&A Expenses) 1Q 2007 2Q 2007 3Q 2007 4Q 2007 FY 2007 Radio $4,464 $6,676 $5,610 $5,476 $22,226 Outdoor 1,367 2,995 2,257 3,014 9,633 ------ ------- ------- ------ -------- Other $5,831 $9,671 $7,867 $8,490 $31,859 Consolidated 14

- 15. About CC Media Holdings, Inc. CC Media Holdings, the new parent company of Clear Channel Communications, is a global media and entertainment company specializing in mobile and on-demand entertainment and information services for local communities and premiere opportunities for advertisers. The company's businesses include radio and outdoor displays. More information is available at www.clearchannel.com. For further information contact: Investors – Randy Palmer, Senior Vice President of Investor Relations, (210) 832-3315 or Media – Lisa Dollinger, Chief Communications Officer, (210) 832-3474 or visit the Company‘s web-site at http://www.clearchannel.com. Certain statements in this document constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Clear Channel Communications to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The words or phrases “guidance,” “believe,” “expect,” “anticipate,” “estimates” and “forecast” and similar words or expressions are intended to identify such forward-looking statements. In addition, any statements that refer to expectations or other characterizations of future events or circumstances are forward-looking statements. Various risks that could cause future results to differ from those expressed by the forward-looking statements included in this document include, but are not limited to: changes in business, political and economic conditions in the U.S. and in other countries in which Clear Channel Communications currently does business (both general and relative to the advertising industry); fluctuations in interest rates; changes in operating performance; shifts in population and other demographics; changes in the level of competition for advertising dollars; fluctuations in operating costs; technological changes and innovations; changes in labor conditions; changes in governmental regulations and policies and actions of regulatory bodies; fluctuations in exchange rates and currency values; changes in tax rates; and changes in capital expenditure requirements; access to capital markets and changes in credit ratings. Other unknown or unpredictable factors also could have material adverse effects on Clear Channel Communications’ future results, performance or achievements. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this document may not occur. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date of this document. Other key risks are described in Clear Channel Communications’ reports filed with the U.S. Securities and Exchange Commission, including in the section entitled “Item 1A. Risk Factors” of Clear Channel’s Annual Report on Form 10-K for the year ended December 31, 2007. Except as otherwise stated in this document, Clear Channel Communications does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise. 15